Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

People don’t eat out anymore?

We listen to a bunch of con-calls because we run an initiative called The Chatter, where we pull out the sharpest quotes from the management.

Devyani International, which operates major quick-service restaurant (QSR) brands like KFC and Pizza Hut, during their recent earnings call made a telling observation about how their business has fundamentally changed:

Dawar further explained the drivers behind this shift:

This represents a huge shift that we observed in our Daily Brief piece on QSRs. This is no temporary change in consumer behavior — it's a fundamental transformation in how people consume food from QSR chains. The fact that they've cut their KFC store formats by more than half, from 3,000 square feet to 1,400, shows how dramatic this shift has been.

Westlife Foodworld, the McDonald's franchisee for West and South India, is also betting heavily on these changing consumption patterns. During their earnings call, Managing Director Saurabh Kalra revealed an interesting strategic shift in how they're thinking about store locations:

"We are experimenting on metro stations, stores, etc. I do not think that is strategy yet. But our goal is very simple, we have got to be where consumers are spending. And whether it is long-distance transit in some of the areas like all the access-controlled highways. We would like to be a part of all access-controlled highways, we would like to be a part of all airports. We would definitely look at short-term transit like metro as opportunities for the future, but that does not mean that we are compromising on other areas like high street or a mall opportunity."

Westlife is pointing out that more and more people are eating while they’re on the move. Instead of going to a restaurant as a separate activity, food stops are happening at airports, highways, and even metro stations. Eating has become part of people’s travel and daily commutes, not just something they do after reaching a destination.

All of this shows how fast food in India is being reshaped. It’s no longer about big outlets and long meals, but about fitting into people’s everyday routines—whether that means smaller kitchens delivering to their homes or quick stops while they’re on the move.

Tata Power wants to capture the rooftop solar explosion

Another thing we came across through The Chatter was a comment from Dr. Praveer Sinha, the CEO of Tata Power.

Here’s what he said:

Now if a CEO says this, it’s worth asking: how does he plan to do this? Why is he so confident? And what’s behind these numbers?

On the concall, he explained that Tata Power has been streamlining its supply chain. The rooftop business, he said, is now almost entirely built on their own manufactured cells and modules, which helps with margins and reliability.

They’ve expanded channel partners, targeted new customer segments, and are leaning on the government’s Domestic Content Requirement (DCR), which makes it mandatory for rooftop projects to use India-made modules.

He even noted that from June 2026 onwards, DCR will apply to all projects, not just rooftops.

The scheme driving it all

But the comment also points to something bigger: the PM Surya Ghar: Muft Bijli Yojana. This is the government’s flagship rooftop solar program, launched at the end of February 2024. The pitch is simple: if you put solar panels on your roof, you can generate roughly 300 units of power a month — and that’s about what an average middle-class household consumes. In other words, the government is promising you can wipe out most of your electricity bill.

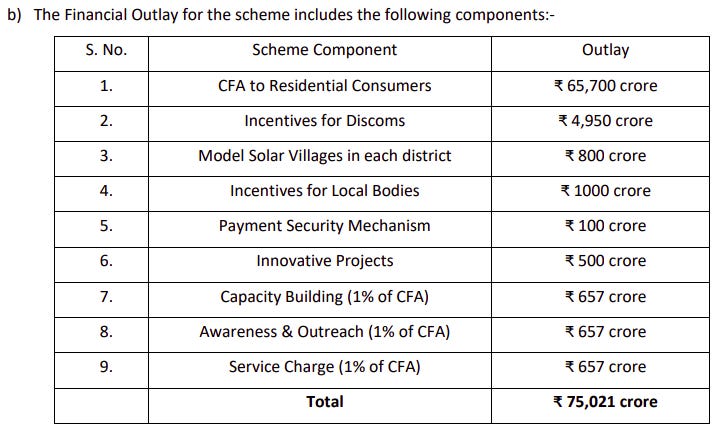

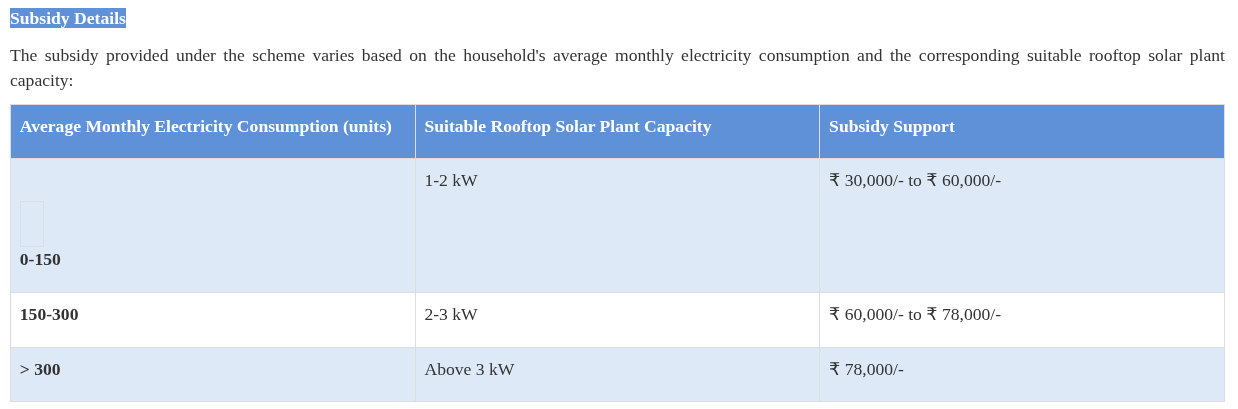

Now, to make this work, they’ve set aside a massive budget of about ₹75,000 crore and structured the scheme so households get a direct subsidy.

Up to ₹78,000 is credited into your account once your system is installed and approved.

On top of that, you can take small, collateral-free loans at around 7% interest from public sector banks.

And this scheme is only for residential rooftops. That’s important because this was always the missing piece in India’s solar journey. We’ve built huge solar parks in Rajasthan and Gujarat, no doubt, but when it came to putting panels on people’s homes, India was lagging badly.

Why was it lagging?

Because the earlier attempt called Rooftop Solar Phase II didn’t really work out well. The target back then was 40 GW of rooftop by 2022. By the deadline, India had barely managed 7 or 8 GW, and less than 3 GW in the residential segment.

The reasons weren’t complicated. Subsidies had to move through state agencies, so paperwork dragged for months. Discoms didn’t like rooftop solar because it meant they’d lose their best-paying customers, so they slowed down approvals. And households, dealing with small, local vendors, weren’t sure if they could trust the quality or the promises.

So when Phase II flopped, the government reset the playbook. Surya Ghar centralised everything: one national portal, one set of rules, one direct benefit transfer. And most importantly, it reframed the pitch from “capacity in gigawatts” — which means nothing to most people — to “free units on your bill.”

What’s happened so far

In the first year alone, around 10 lakh homes have already installed rooftop solar under this program. Nearly 50 lakh households have applied. That’s translated into more than 3 GW of new rooftop capacity in a single year which is a huge jump compared to the sluggish growth earlier. For context, India’s total rooftop capacity is around 20 GW today.

The target is one crore households by 2027, which would add about 30 GW more. And remember, India has 25 crore households in total. That’s what Sinha meant when he said, even if we reach a crore homes, the opportunity is still massive.

Of course, the ground reality isn’t always as neat. In Madhya Pradesh, people found their “free” 300 units weren’t really free once minimum charges were added. In Tamil Nadu, delays in getting meters meant panels sat on rooftops without actually working. And in rural areas, not every house has the kind of roof that can take a solar setup.

Plus, scaling from 10 lakh to 1 crore homes in just the next 2 years is going to be a serious execution challenge. The slope of the curve is steep, and state utilities still hold a lot of power in how fast or slow approvals move.

It will be interesting to see how things unfold over the next few years.

How will AI affect our jobs?

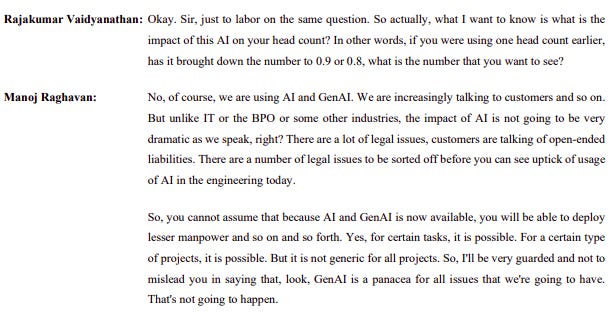

There’s another thing we came across i.e. Manoj Raghavan, MD & CEO of Tata Elxsi when asked about AI’s impact on hiring on the recent concall he said, this:

So why does this matter?

Well, here’s what’s happening: large language models, for all their faults, already have practical uses in companies. We’ve seen them in customer service, transcription, summarization, and a host of process-heavy jobs. The data so far doesn’t point to sweeping layoffs, but early studies—mainly from the U.S.—show that entry-level opportunities for fresh graduates are shrinking.

And AI’s potential impacts have become hard to ignore — no matter how true they will actually be. On one end, people warn of mass layoffs, automation wiping out entire sectors, even the end of human superiority. On the optimistic side, though, people predict immense prosperity.

And then you have the middle ground, where people see AI as another major but gradual technological shift—big, yes, but unfolding more slowly than the extremes suggest.

That’s where Raghavan’s point is crucial. He’s saying: hold on, adoption isn’t going to look the same everywhere. In industries like engineering, the barriers are higher. Customers are wary of open-ended liabilities. If an AI system fails in a safety-critical project, who takes the blame? Until those legal and contractual questions are resolved, adoption in certain industries will remain limited.

And even where AI can help, it doesn’t instantly translate to job cuts. As Raghavan put it, just because you have AI doesn’t mean you can deploy it on day one and replace manpower. For some tasks, yes. But for many projects, not yet.

This ties in with a bigger point made by Princeton professor Arvind Narayanan and researcher Sayash Kapoor in their essay “AI as Normal Technology”. Their argument: in high-stakes domains, diffusion will always be slow. The risk of error is too high, and the cost of getting it wrong is devastating.

Take crime, for instance. Predicting whether someone will (re)offend depends on a messy web of social and environmental factors — also the plot of the movie Minority Report. Today’s models simply can’t deal with that uncertainty, because it could result in convicting someone wrongly.

Or take healthcare. A misdiagnosis by an AI system could potentially be fatal—leading to regulatory crackdowns and even bankrupt institutions. When the downside risk is this high, organizations move cautiously. Moreover, what would an AI-powered healthcare product look like? What should it allow the user to do? How different would it be from the GPTs we use at scale today?

That’s the nuance missing from a lot of the AI hype. Yes, AI will reshape industries. Yes, it’s already changing the entry-level job market. But no, it’s not a panacea that you can drop in everywhere overnight.

The reality is going to be patchy. In some industries, adoption will be fast and disruptive. In others, it will be slow, painstaking, and heavily constrained by liability and trust. And the form of consumption that AI will take in one industry will be quite different from another.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.