Is this the start of a new trade era?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Will Trump Shake Global Trade Again?

Patent Expiry Hits Dr. Reddy's

Will Trump Shake Global Trade Again?

Today, we’re diving into what might be one of the most important economic stories ahead: Trump’s new and very different take on trade policy and how it could reshape the global economy.

Now, we’re not the type to jump on every single headline coming out of the U.S. The news cycle can be overwhelming, and honestly, not everything deserves our attention. But in the years ahead, there’s going to be a lot of noise—and some of it will really matter. Trade policy is one of those big topics that could change the way the global economy works.

Before we get into it, let’s make one thing clear: no one can predict the future perfectly. But having a way to think through what’s ahead is still useful. Even if some predictions miss the mark, understanding the big trends can help us make smarter decisions. And that’s especially true now because we’re likely stepping into one of the most disruptive economic periods we’ve seen in a long time.

Recently, Mitsubishi UFJ—one of Japan’s biggest financial institutions—put out a report called “Trade War 2.0 Will Be Different.” What makes it stand out is how deeply it dives into how the next wave of trade conflicts could play out.

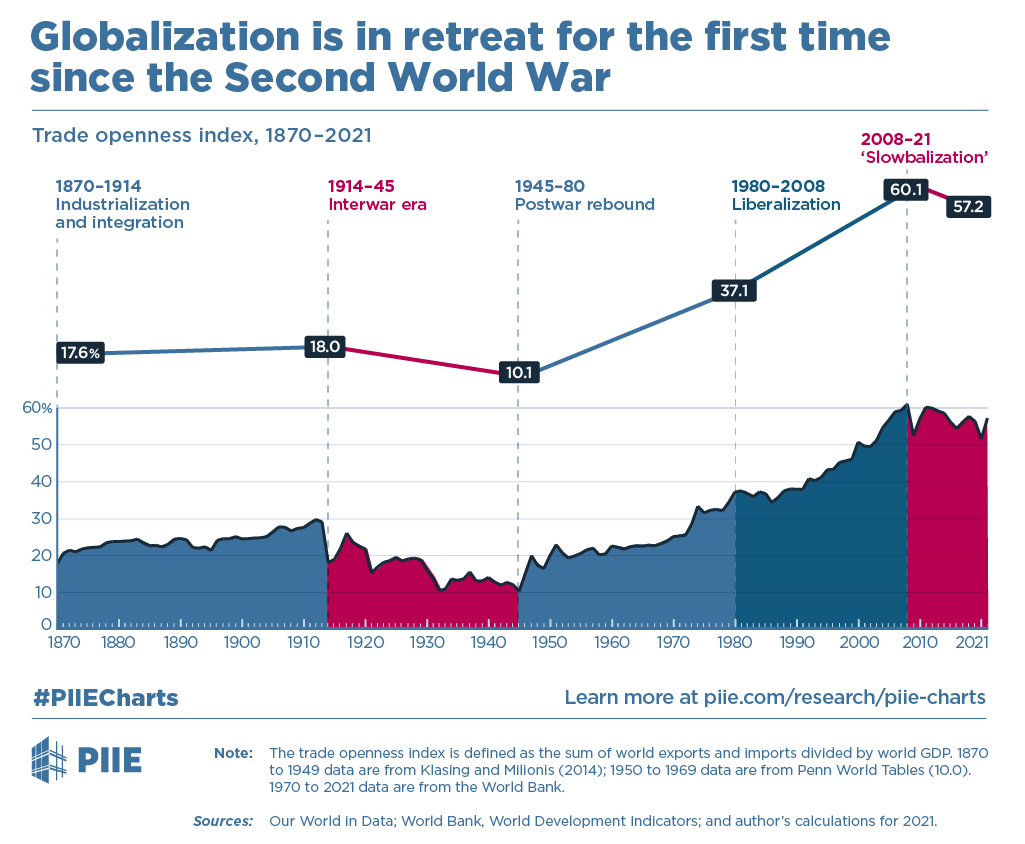

Let’s start with the big picture because this context is key. Since the 2008 financial crisis, we’ve been watching what MUFG calls “fragmented globalization.” Here’s what that means: global trade openness (basically, the total of exports and imports compared to global GDP) hit its peak at around 50% after decades of growth. But since then, it’s been going down. That post-World War II era of steadily increasing trade? It’s done. We’re now moving into a whole new phase.

Here’s a quote from the report that really stayed with us. Back in 2018, Henry Paulson, the former U.S. Treasury Secretary, said: “After 30 years of globalization, we now face the very real prospect that an economic iron curtain may descend.” That’s not just dramatic language – we’re seeing it happen in real time.

So, why does MUFG think Trade War 2.0 will look different? There are a few big reasons, and they’re all connected.

First, the speed. During Trump’s first term, it took about three years for the trade war to really hit its peak. This time, MUFG expects major moves within weeks of inauguration. Why so fast? Trump’s team is stacked with well-known trade hawks and already has the legal frameworks and tools ready to go. They’ve been through this before and They know exactly which levers to pull.

Let’s talk about those levers because this is where things get really interesting. While the U.S. Constitution technically gives Congress control over trade policy (under Article 1), over the years, they’ve handed over a lot of power to the president. Trump’s team can use tools like Section 338 of the Tariff Act or the International Emergency Economic Powers Act to slap tariffs into place almost immediately. No long investigations. No public comment periods. Just executive action and implementation.

This time, the approach is likely to be much broader. Instead of targeting specific products like washing machines or steel, we could see wide-ranging tariffs across multiple countries and industries. Think universal tariffs of 5-10% on many products from many countries, with higher rates aimed at specific targets. And for China? The proposals suggest even more aggressive tariffs—an extra 25-30% on top of what’s already there, potentially bringing the total to 40-60%.

Let’s talk about which countries are most vulnerable because this part gets really interesting. The data shows that countries that have increased their trade with both China and the U.S. since 2017 are in particularly risky positions. According to MUFG’s analysis, Vietnam, Mexico, Malaysia, Thailand, and India are all walking a tightrope. The EU isn’t off the hook either—especially Germany, where goods trade makes up 71% of its GDP. That level of exposure leaves them highly vulnerable.

Now, let’s focus on China because this is where things get especially complicated. Right now, about two-thirds of U.S.-China trade is already covered by tariffs. Under Trade War 2.0, it could get much worse. But here’s the key difference this time around: China is prepared.

MUFG says China has a “formidable policy toolkit” ready to deploy. Let’s break it down:

First, there’s currency devaluation. During the 2018-2019 trade war, China let the yuan drop by more than 10% to counter the impact of U.S. tariffs. They could pull that move again. MUFG even forecasts the USD/CNY exchange rate could reach 7.40 in Q1 and 7.50 in Q2 if average tariffs double to 40%.

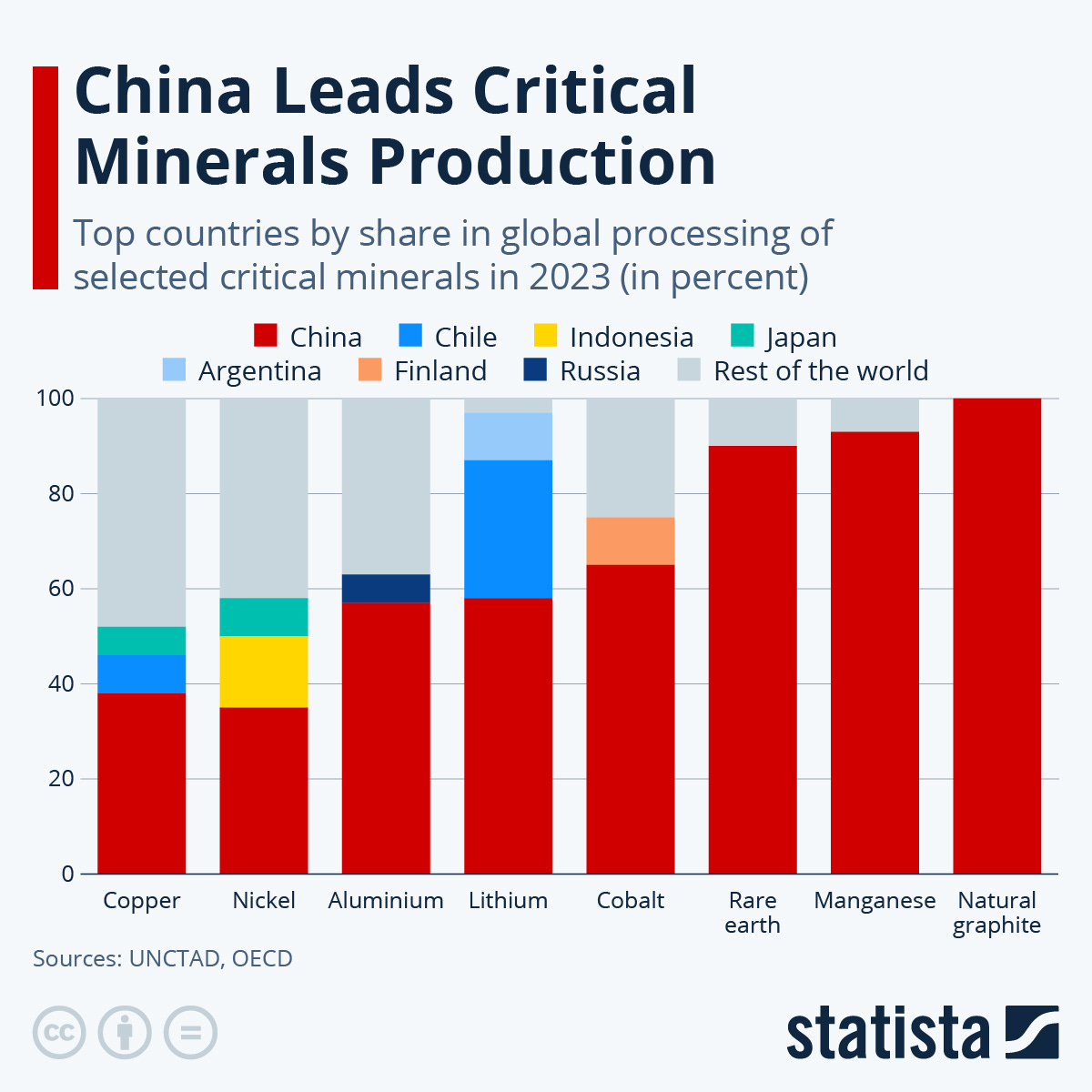

Then there’s the strategic minerals card. China has a firm grip on the supply of critical materials needed for high-tech manufacturing. For instance, they supply 54% of the U.S.’s germanium imports and are a major provider of gallium—both essential for making semiconductors.

On the financial side, China also holds about $760 billion in U.S. Treasury bonds, making them the second-largest foreign holder of U.S. debt. While that’s down from their peak of $1.3 trillion in 2013, it’s still a significant amount. If China decides to sell a chunk of that debt, it could send shockwaves through the bond market.

China has also been building up its corporate sanctions playbook. They’ve started adding U.S. entities to their export control list and their "unreliable entity list." Companies that end up on these lists face restrictions on things like imports, exports, investments, and even travel rights.

The non-tariff side of this trade war is just as important as the tariffs themselves. For example, the U.S. Commerce Department’s Entity List has grown to include over 3,000 entities and sub-entities since 1997. Just recently, in January 2025, the Department of Homeland Security added 37 more entities to its Uyghur Forced Labor Prevention Act Entity List, bringing the total to 144.

Now, let’s talk about the economic implications because they’re huge. According to Oxford Economics, in a worst-case scenario—where we see 45% tariffs on China, 15% on the rest of the world, and retaliatory tariffs—global trade could drop by 10% below its baseline in the long run. The impact on GDP would vary a lot by country. Canada and Mexico, for example, could see their GDP fall 3.6% and 3.1% below baseline, which might even push them into a recession.

For markets, this sets up some fascinating dynamics. During the 2018-19 trade wars, the S&P 500 dropped 6% in 2018—a significant decline for a year without a recession. But here’s the interesting part: this time, U.S. stocks are actually likely to outperform global markets, at least at first. Why? The U.S. economy is less dependent on exports, which make up only 11% of GDP. That makes it more resilient to trade shocks compared to economies that rely heavily on exports.

We’re already starting to see this trend in the data. Companies that benefit from inflation have been outperforming the broader market since September. At the same time, the dollar is strengthening sharply against most major currencies. According to MUFG’s analysis, emerging market currencies like the Brazilian Real and the Mexican Peso are especially vulnerable in this environment.

One aspect we find particularly fascinating is how Trump plans to use tariffs as a broader foreign policy tool. The report highlights how tariffs could be strategically applied to pressure other nations on various issues, making them more than just an economic lever.

Here’s another point from the report that deserves more attention: Xi Jinping has outlined China’s "four red lines"—boundaries that must not be crossed. These include any attempts to weaken the Chinese Communist Party’s power, push China toward democracy, contain its economic rise, or support Taiwan’s independence. This framework is crucial for understanding how China might respond to different U.S. actions.

The big takeaway here is that we’re not just watching a replay of the 2018-19 trade wars. What’s happening now is a much faster and more fundamental reshaping of the global trade system. The report describes it as a "more complete US-China decoupling," not just in trade but across investment, technology, and capital markets.

Here’s one final thought: While all of this may sound dramatic, it’s important to remember that the global economy is incredibly resilient. Companies will adjust, and new trade patterns will emerge. The question isn’t whether these changes will happen—it’s how we navigate through them.

Patent Expiry Hits Dr. Reddy's

Dr. Reddy’s Labs has been making headlines recently because the exclusive rights for its leading cancer drug, Revlimid, are set to expire in January 2026.

For some context, Revlimid has been one of Dr. Reddy’s biggest revenue earners over the past few years, contributing up to 40% of the company’s EBITDA. However, with these exclusive rights ending, a significant source of revenue is expected to take a sharp hit, leaving the company with the challenge of filling this gap through new products or strategies.

This uncertainty has already started to weigh on Dr. Reddy’s stock. The share price dropped nearly 7% right after the company released its Q3 earnings a few days ago and has fallen even further since then.

One potential bright spot in this scenario is Dr. Reddy’s bet on the anti-diabetic drug Semaglutide, which is expected to launch in some markets, including Canada, in early 2026.

But since the market has reacted so sharply to the fear of losing Revlimid’s exclusivity, it’s important to break this down step by step and understand what’s really going on here.

Let’s start with why the loss of exclusivity for Revlimid matters so much and how the pharma industry operates when it comes to patents.

When a pharmaceutical company develops a new drug, it’s a really big deal. The process usually takes years of research, development, and clinical trials—and often costs billions of dollars. To make all this effort worthwhile, pharma companies are granted patents that give them exclusive rights to manufacture and sell the drug for a certain period, usually around 20 years.

This exclusivity allows companies to recover their investments and turn a profit. During this period, no other company can legally sell the same drug, which means prices can be kept high.

Now, Revlimid has been one of those star drugs for Dr. Reddy’s, helping treat various types of cancers. But here’s an important detail: Dr. Reddy’s didn’t actually invent this drug. It was originally developed by an American biotechnology company called Celgene Corporation, which held the original patent rights for the drug—not Dr. Reddy’s.

Dr. Reddy’s challenged the patents for Revlimid in various jurisdictions, and after a series of legal battles, they reached a settlement agreement. This allowed them to sell a limited quantity of the drug starting in 2022.

The problem is that this settlement—and the exclusivity it provided—will end in January 2026. After that, any company can manufacture and sell generic versions of the drug, which will likely cause its price and revenues to drop sharply.

In the pharma world, this situation is called the “patent cliff.” It refers to the steep drop in revenue that happens when a patent or exclusive right expires, allowing competitors to enter the market with cheaper generics.

Now, the big hope for Dr. Reddy’s to offset this revenue loss lies in a drug called Semaglutide. You might know it better by its brand name, Ozempic. This drug has been making headlines globally, not just as a treatment for Type 2 diabetes but also because of its almost magical ability to help with weight loss.

We’ve talked about Semaglutide/Ozempic before on this show, so if you’re interested, check out the links in the description for more details.

Because of its incredible effects, this drug has become one of the most sought-after in the world.

If Dr. Reddy’s manages to successfully launch a generic version of Semaglutide, it could help offset some of the revenue losses from Revlimid—and maybe even surpass those losses over time.

But, of course, it’s not as simple as launching the drug and raking in the profits.

First, there are countless regulatory hurdles. Dr. Reddy’s is planning to launch Semaglutide in Canada in early 2026 and expand to other markets after that. However, there’s always a risk of delays in getting approvals, which could push back timelines.

Then there’s the competition. The patent for Semaglutide is currently held by Novo Nordisk. Once it expires in India in 2026, it won’t just be Dr. Reddy’s entering the market—many other pharma companies will jump at the opportunity too. In the highly competitive generic space, the profitability window tends to be short-lived as other players quickly catch up.

That said, there’s another angle to consider: the shifting dynamics of the pharma business. As patents expire, companies are increasingly focusing on biosimilars and complex generics—products that are harder to develop and, therefore, face less competition.

Dr. Reddy’s management has already highlighted that biosimilars and innovative drugs are key to their future growth. They’re aiming to launch a portfolio of 15-20 new products in the U.S. over the next few years. But the reality is that these strategies take time to play out, and success is never guaranteed.

So, in the short term, opinions on Dr. Reddy’s future remain divided. Some analysts, like those at Nuvama, are optimistic. They believe the company can hold on to a significant portion of its earnings through launches like Semaglutide and other new products. Others, like Emkay Global, are less confident, pointing to pricing pressures and limited visibility on key launches as reasons for concern.

As we mentioned earlier, Dr. Reddy’s stock price has already felt the pressure, dropping nearly 7% after its Q3 earnings report.

For investors or market watchers, the story of Dr. Reddy’s is a classic example of the challenges and opportunities in the pharma industry. The expiration of a major patent poses a huge risk but also pushes companies to innovate and diversify. Whether Semaglutide will help Dr. Reddy’s bounce back remains to be seen, but it’s a development worth following closely.

Tidbits

The Central Consumer Protection Authority (CCPA) has sent notices to Ola and Uber following complaints that iPhone users are being charged more than Android users for the same routes. The investigation is also looking into similar pricing practices in other industries, like food delivery and ticket booking apps. In a related development, Apple has been served a notice over user complaints about faster battery drain, overheating, and app glitches after installing the iOS 18+ update. Union Minister Pralhad Joshi has called both issues “unfair trade practices” and reiterated the government’s “zero tolerance” for consumer exploitation.

Reliance Industries is planning to build the world’s largest data center in Jamnagar, Gujarat, in partnership with NVIDIA. The facility will use NVIDIA’s Blackwell AI processors to boost India’s AI capabilities, including supercomputers and language models for regional languages. The government has allocated ₹10,000 crore to accelerate AI projects, signaling its aim for India to become a global AI hub. However, challenges like limited semiconductor manufacturing remain. With a strong focus on keeping data within India and leveraging the country’s digital networks, this project underscores India’s commitment to advancing its AI infrastructure.

The Indian government plans to increase its agriculture budget by 15%, bringing it to ₹1.75 lakh crore in 2025. This would be the largest hike in six years and aims to tackle stagnant rural incomes and rising food inflation. The agriculture ministry’s allocation will rise from ₹1.23 lakh crore, with funds directed toward better seed varieties, improved storage facilities, and boosting the production of pulses, oilseeds, and vegetables.

- This edition of the newsletter was written by Bhuvan and Anurag

🌱One thing we learned today

Every day, each team member shares something they've learned, not limited to finance. It's our way of trying to be a little less dumb every day. Check it out here

This website won't have a newsletter. However, if you want to be notified about new posts, you can subscribe to the site's RSS feed and read it on apps like Feedly. Even the Substack app supports external RSS feeds and you can read One Thing We Learned Today along with all your other newsletters.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.