Is the RBI worried about bank runs?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

Spotify:

Apple Podcasts:

And the video is here:

In today’s episode, we look at 5 big stories:

- Is the RBI worried about bank runs due to online banking and UPI?

- Govt asks PE and VCs to cough up tax on money they made.

- Finally, some positive news for Paytm.

- Is the US economy entering a recession?

- Crypto is slowly becoming mainstream

RBI is scared

The Reserve Bank of India (RBI) is proposing new liquidity rules for banks due to the rise of digital banking. Here's a breakdown of what's going on:

Why is the RBI doing this?

With everyone using online and mobile banking these days, the RBI wants to ensure banks have enough cash to meet sudden withdrawal demands. They're trying to manage the new risks that come with the convenience and speed of digital banking, risks that didn’t exist with older banking methods.

What are the changes?

The RBI is suggesting that banks set aside more funds for deposits accessible through internet and mobile banking. Specifically:

5% more cash for standard deposits

10% more cash for stable retail deposits (the ones less likely to be suddenly withdrawn)

15% more cash for less stable deposits

The RBI also wants banks to treat unsecured wholesale funding from small businesses the same way they treat retail deposits. This means banks will need to keep more cash or liquid assets available to cover any sudden withdrawals from these small business accounts.

Additionally, the RBI wants banks to be more conservative when valuing the government securities they hold as high-quality liquid assets (HQLAs). Currently, banks value these securities at market price. The RBI is proposing that banks still use the market price but slightly reduce this value.

Why is this happening?

Banking has evolved significantly with technology, allowing people to transfer and withdraw money instantly. Today, 70-80% of retail deposits have digital facilities. Given this scale, new rules and security provisions are needed. A classic example of the potential risks is the Silicon Valley Bank collapse in March 2023, where $42 billion was withdrawn in just one day, largely due to the speed and convenience of online banking. The RBI wants to prevent such a scenario in India.

The Impact on Banks

While these rules are positive for stability, they could make life tougher for banks. They'll need to hold more government securities to meet liquidity demands and maintain more high-quality liquid assets. According to ICRA, banks may need to hold an additional 4 lakh crore rupees in safe assets. This could hurt banks' profits, as they're already struggling with tight margins due to competition from stocks, mutual funds, and other players.

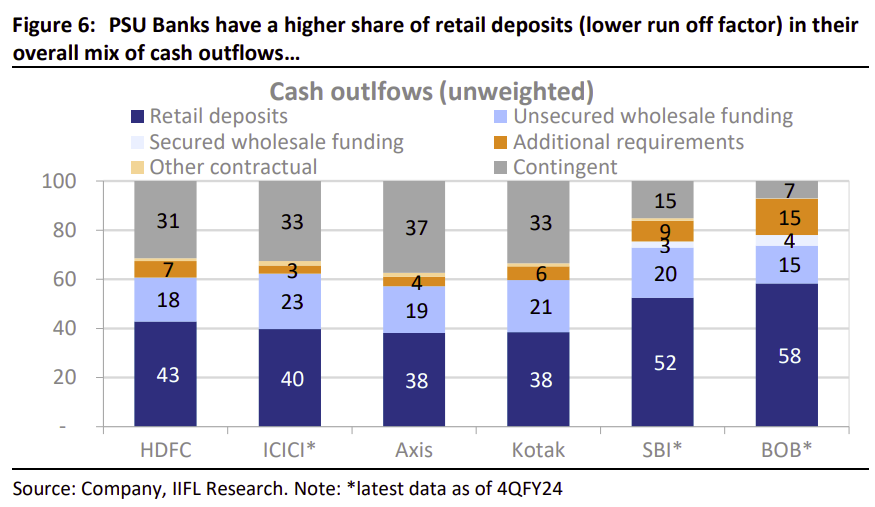

What happens to Indian banks after this change?

Banks will have to compete for stable deposits, leading to potentially lower deposit growth and, by extension, lower credit growth. So, while banks will have better balance sheets with more liquidity, they might face challenges in maintaining their profitability.

Private equity is sad!

For the past four years, the IPO market has been on fire. Companies have been cashing in on the bull market to go public. Over the last four financial years, companies that have IPO’d have raised over 2 lakh crores. Out of this, more than 40,000 crores went to private equity (PE) and venture capital (VC) investors who had backed these companies long ago.

When PE and VC investors put money into startups, they have two ways to make a return: sell their stake to someone else or hope the company goes public with an IPO. When an IPO happens, they can sell their shares through an Offer for Sale (OFS).

Everything was looking great for these PE and VC folks because they finally had a chance to cash out through these IPOs. But then, they got hit with some bad news in the recently announced budget.

Here’s the scoop: Until recently, when PE and VCs sold stakes through OFS, they weren’t paying any taxes on the profits. The regulations were unclear on whether they had to. Many promoters and investors claimed zero capital gains tax, arguing there was no clear rule on calculating these gains.

But that’s changed. The government has closed this loophole in the budget. And not only did they close it, but they made the change retroactive.

This means PE and VC investors now have to pay taxes on all the money they’ve made through OFS sales in the past as well.

If you’ve been in the markets for a while, you might remember the retrospective taxation nightmares of Vodafone and Cairn India. The government had asked these companies to pay taxes on past acquisitions, which sent the wrong signal to foreign investors that the government could change the rules anytime.

You may be able to pay using Paytm again!

You’ve probably heard about Paytm's recent struggles. The company has had a rough few months:

The RBI held back Paytm Payment Services' application to become a payment aggregator.

They were barred from onboarding new online merchants in 2022.

Paytm Payments Bank was ordered by the RBI to stop accepting deposits into accounts or their digital wallet.

But finally, there’s a silver lining. The government has approved Paytm’s proposal to accept foreign investments for their payment aggregator business. Let me break this down for you.

Thanks to this approval, Paytm can now invest 50 crore rupees in their Payment Services, which is a crucial part of their business.

This approval had been stuck for months because China’s Ant Group holds a 9.88% stake in Paytm, and the Indian Government has been cautious about Chinese involvement since the 2020 border clash. However, Ant Group is slowly reducing its stake in Paytm, which likely made the government more comfortable with this decision.

For Paytm, this approval is a big deal because their Payment Services business accounts for about one-fourth of the company’s revenue.

With this green light, Paytm can now approach the RBI for a payment aggregator license. The RBI will still need to evaluate their application, but this is a huge positive step for the company and its investors.

In case you’re wondering what a payment aggregator does, think of it like a post office. Just like how a post office collects letters from people and delivers them to the correct receiver, a payment aggregator collects payments from senders and credits the money to receivers.

The news of Paytm being able to invest in this business has gotten investors really excited. The company’s shares immediately jumped up by 10% and hit an upper circuit after the news went public.

Is the US doing okay?

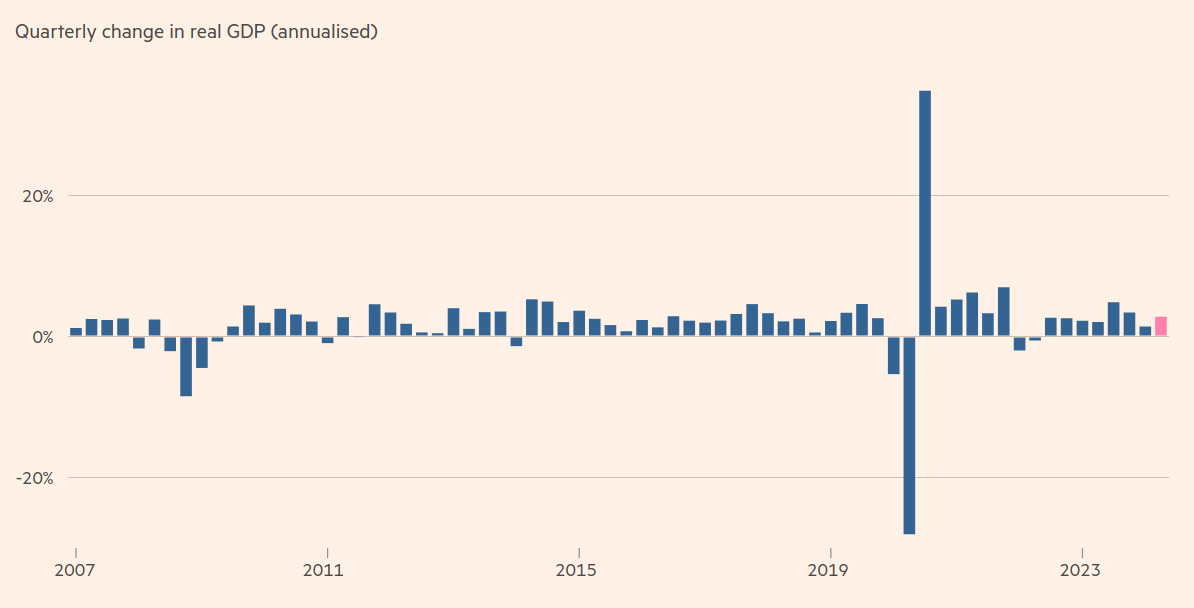

Recently, the data for the US economy's Q2 performance was released, and it surprised everyone. The growth numbers are much better than what analysts expected.

The GDP growth rate was at 2.8% in Q2, which is double the growth of 1.4% in the previous quarter. This growth comes despite the high interest rates and inflation concerns we’ve discussed in previous episodes. Everyone expected an economic slowdown, but the opposite happened!

Let me break it down for you:

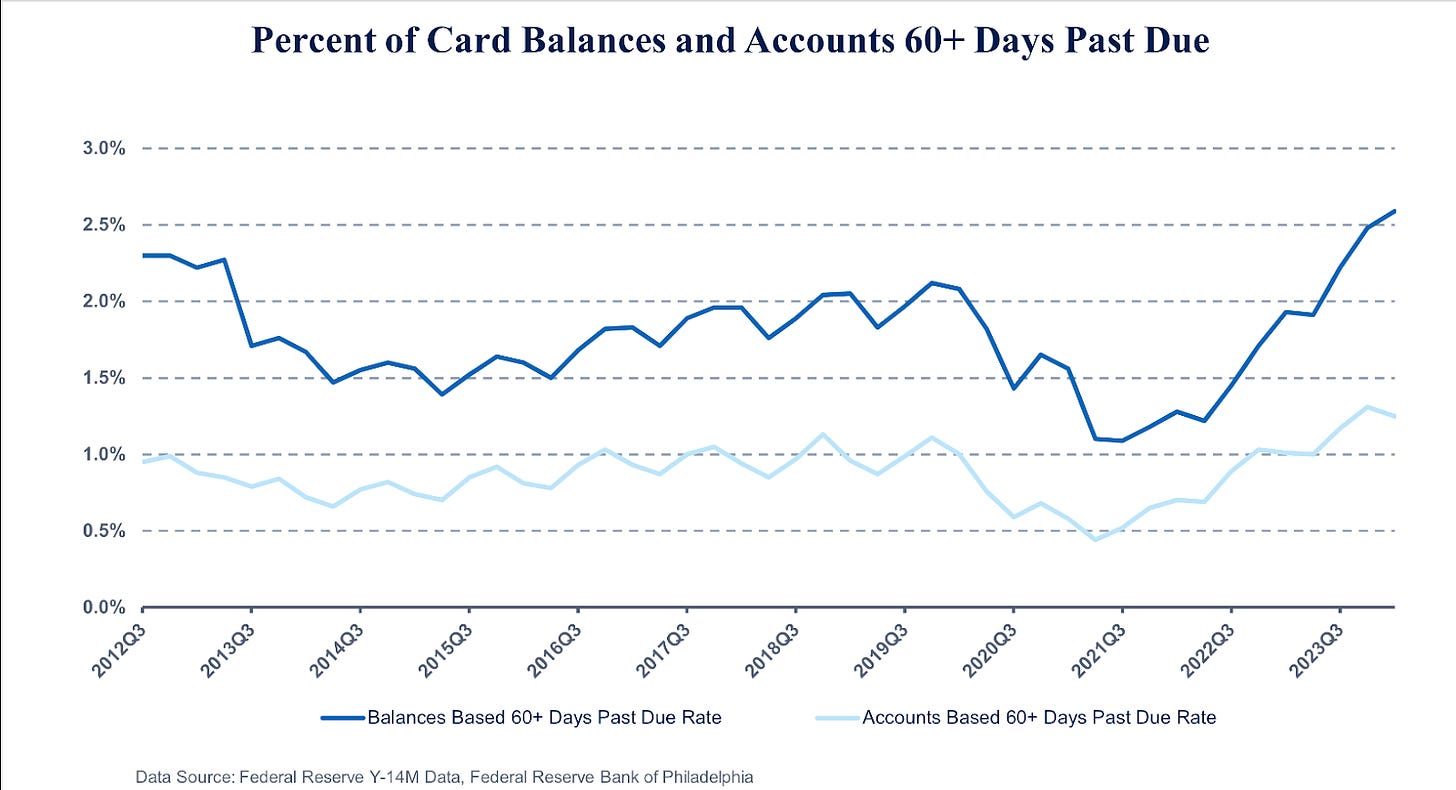

Consumer Spending: This accounts for about 70% of the US economy and grew by 2.3% this quarter, up from 1.5% in the previous quarter. That’s good news. However, US consumers have pretty much spent all the money they got from the government during the pandemic. Plus, there are early signs of increasing bad loans on credit cards, with defaults hitting a 12-year high. This doesn’t mean US consumers are in terrible shape, but all signs point toward a slowdown.

Business Investment: Companies are investing in their businesses. Nonresidential fixed investment climbed to 5.2% in Q2 from 4.4% in Q1. This shows that US businesses see opportunities that outweigh the cost of borrowing.

Inflation: With the US economy growing, inflation is also cooling off. The core personal consumption expenditure index, which measures inflation by removing food and energy, came in a bit higher than expected but is still lower than its peak, so it’s not all that bad.

Interest Rates: With inflation getting closer to the Fed's 2% target, there's talk that the central bank might ease up on interest rates. The first rate cut is expected in September. Right now, US interest rates are at a 23-year high.

Overall, the Federal Reserve might just nail the soft landing – balancing growth and keeping inflation under control without causing a recession. If you had asked economists last year, most would have predicted a recession.

Concerns: There are still a couple of issues:

Job Market: The unemployment rate in the US climbed to 4.1% in June 2024, the highest it’s been since November 2021.

High Interest Rates: These are hurting consumers. Some people are borrowing money to spend on essentials like food and shelter.

If the Fed waits too long to cut rates, it might miss its chance for a soft landing, and a recession could be on the horizon.

Crypto is slowly becoming mainstream

let's talk about how crypto is slowly becoming more legal in the US. This year alone, the Securities Exchange Commission (SEC), which is like the US version of SEBI, approved Bitcoin ETFs and Ethereum ETFs. This is a historic moment for the US markets because the SEC had been rejecting applications for Bitcoin ETFs since 2013.

Why does this matter?

What happens in the US often influences regulations in other markets, including India, one way or another.

A Quick Historical Context of Crypto:

For about 400 years, we've had pretty much the same asset classes—stocks, bonds, real estate, and commodities. In the last 50 years or so, things like mutual funds and ETFs have made investing in real estate and gold easier. But we haven't seen any major new asset classes until cryptocurrency came along. Crypto is probably the first true mainstream asset class to emerge in the last four centuries. In just one decade, it has grown to a market cap of about 2.4 trillion dollars, which is huge!

Why is Crypto Unique?

Crypto is a strange asset class. It's not backed by anything except people's belief that it'll go up. Despite all the hype about revolution, its main use case seems to be speculation.

Different Countries, Different Approaches:

India: The government and the RBI have made it costly to trade in crypto by imposing a TDS and asking banks to be strict. This has led to a 90% drop in crypto volumes from the peak.

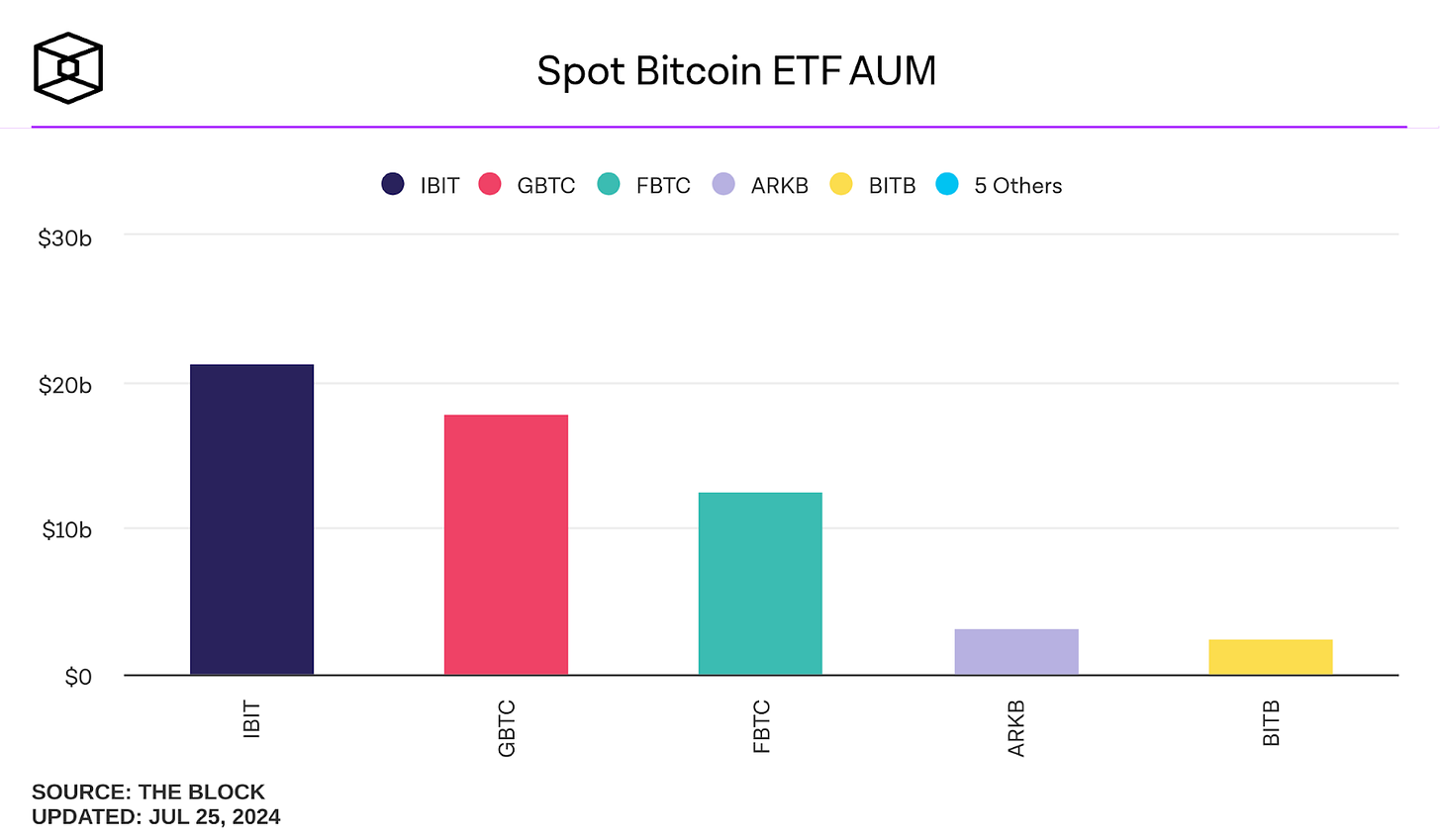

US: The SEC has taken a strict stance. Apart from Bitcoin, which is considered a commodity, other crypto tokens are seen as securities and don’t need new regulations. They're hesitant to allow crypto to be widely accessible to retail investors and have been suing crypto platforms and imposing fines on them. But the SEC was forced to approve Bitcoin ETFs in January 2024 after losing a court case. These ETFs have now gathered about 70 billion dollars in just 5 months.

Europe and Japan: They are bringing in regulations to clear up the crypto confusion.

Big News:

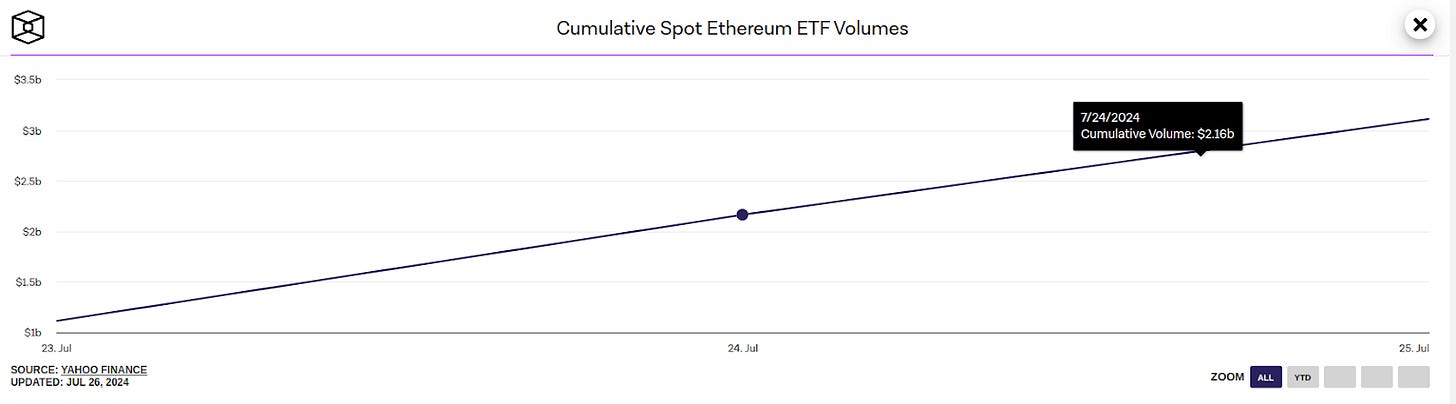

A week ago, the SEC approved Ethereum ETFs too. So far, Ethereum ETFs have seen over $3 billion worth of trades. This is big because crypto has never been more legal in the US than it is now!

Closer to Home:

In India, crypto is neither legal nor illegal. Our regulators don't seem to be in the mood to clarify things at the moment, but the RBI has been vocally against crypto.

Certainly these information are very important. Thanks for this post