Is Jio ready to be a grown-up?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

Today, we look at 4 big stories:

Why are potatoes getting expensive?

Ambani wedding, Jio divorce

SME IPO Frenzy

Is the economic treadmill too fast for China?

Why are potatoes getting expensive?

India's latest inflation data reveals a slight uptick, reflecting concerns that have been echoed by the Reserve Bank of India (RBI) Governor. The headline Consumer Price Index (CPI) inflation rose from 4.8% in May to 5.1% in June year-over-year, driven primarily by a significant increase in food and beverage prices. Here's a detailed breakdown of what's happening and why staple items like potatoes are getting more expensive.

Key Points:

Increased from 4.8% in May to 5.1% in June, exceeding the RBI's target of 4%.

Jumped from 7.9% to 8.4%, mainly due to a spike in the prices of staple vegetables like potatoes, onions, and tomatoes caused by severe heatwaves.

Prices of other essentials like rice, wheat, mangoes, and coffee have also been climbing.

Core Inflation:

Excluding volatile items like food, beverages, and fuel, core inflation remained steady at 3.1%, the same as in May.

Wholesale Price Index (WPI):

Rose to 3.4% in June from 2.6% in May, again driven by higher vegetable prices.

Implications:

Expect continued complaints about the high prices of fruits, vegetables, and coffee.

With inflation above 5%, the RBI is unlikely to cut interest rates soon. Rate cuts may begin in December, but significant reductions are unlikely, potentially keeping the repo rate above pre-pandemic levels.

If you're betting on falling bond yields, the outlook isn't very promising. The expected rally in bonds might be minimal based on current inflation trends.

Ambani wedding, Jio divorce?

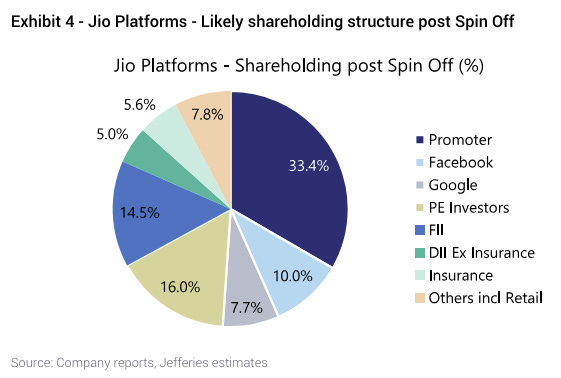

Investment Bank Jefferies recently released a report suggesting that Reliance might consider an IPO or spin-off for its telecom arm, Jio Platforms. This move could significantly impact both Reliance Industries and its investors by unlocking value and addressing the holding company discount. Here's a breakdown of what this means and the potential outcomes.

A spin-off involves creating a separate company from one of the divisions of a larger company. This helps the parent company focus on its core business and can unlock value for both entities. Similar to when Reliance spun off Jio Financial Services last year.

This occurs when the total value of a conglomerate's subsidiaries is greater than the market value of the parent company. Investors often apply this discount because they believe managing diverse businesses under one umbrella is challenging.

Jefferies' Report Insights:

For an IPO, Reliance would retain majority control of Jio. However, regulatory requirements would mandate that 35% of the IPO be offered to retail investors, making it a massive offering that might be hard to fully subscribe.

A spin-off would make Jio Platforms an independent entity, clarifying its value and potentially eliminating the holding company discount. This separation could make Jio more attractive to investors by clearly delineating its worth from the broader conglomerate.

Jefferies analysts estimate that a public listing could value Jio at $112 billion, highlighting the significant potential of this move.

SME IPO frenzy

In FY2024, about 130 SME IPOs went live on NSE, collectively raising a record-breaking 4622 crore rupees. This growth is significant compared to the 2455 crores raised in FY 2018. While SME IPOs have become popular due to their relatively fewer regulatory requirements, this has also led to instances of fraud and scams in the segment. To address these issues, recent measures and proposals aim to curb speculation and enhance transparency.

Key Points:

FY2024 saw 130 SME IPOs raising 4622 crore rupees, a record high, compared to 2455 crores in FY 2018.

SME IPOs have fewer regulatory requirements, leading to some fraud and scams.

NSE imposed a 90% cap on the listing price above the issue price in the pre-open session to reduce speculation. This means a Rs 100 stock at IPO can’t list at more than Rs 190.

Proposed Changes from The Hindu Business Line Editorial:

Raise the minimum subscription amount from 1 lakh rupees to 5 lakh to discourage retail investors who may not handle the risks associated with SMEs. The 1 lakh rule from 2012 is no longer a significant constraint.

Further reduce the 90% limit on listing day gains in the pre-open session to minimize speculative activities, even though many SME stocks have delivered over 90% returns on the listing day.

Apply these rules simultaneously on both BSE and NSE. With each exchange hosting around 300 SME stocks, inconsistent rules could simply shift speculation from one platform to another.

Is the economic treadmill too fast for China?

China's economy recently reported a growth rate of 4.7% for the quarter ending June 2024, falling short of the expected 5.1%. This shortfall highlights significant underlying issues in China's economic strategy and its broader implications. Unlike most countries, China sets explicit growth targets and shapes its economic policy around achieving them. While this method has historically driven remarkable economic performance, it now reveals deep-seated problems.

Key Points:

China aimed for a 5.1% growth rate but only achieved 4.7% in the June quarter of 2024.

China's unique approach of setting growth targets and structuring policies around them has historically worked but can lead to forced and unsustainable growth.

Structural Problems:

Property Market Crisis:

Local governments in China are heavily funded by real estate sales, which have suffered dramatically.

This crisis has led to a severe impact on net worth and spending behavior among Chinese citizens.

Foreign Direct Investment (FDI):

FDI into China has hit a 30-year low, reflecting waning global investor confidence.

Global Sentiment:

There is a growing effort among overseas markets to reduce dependence on Chinese goods, impacting exports.

Consumer Demand:

Long-suppressed consumer demand means Chinese people aren’t buying enough to sustain robust GDP growth.

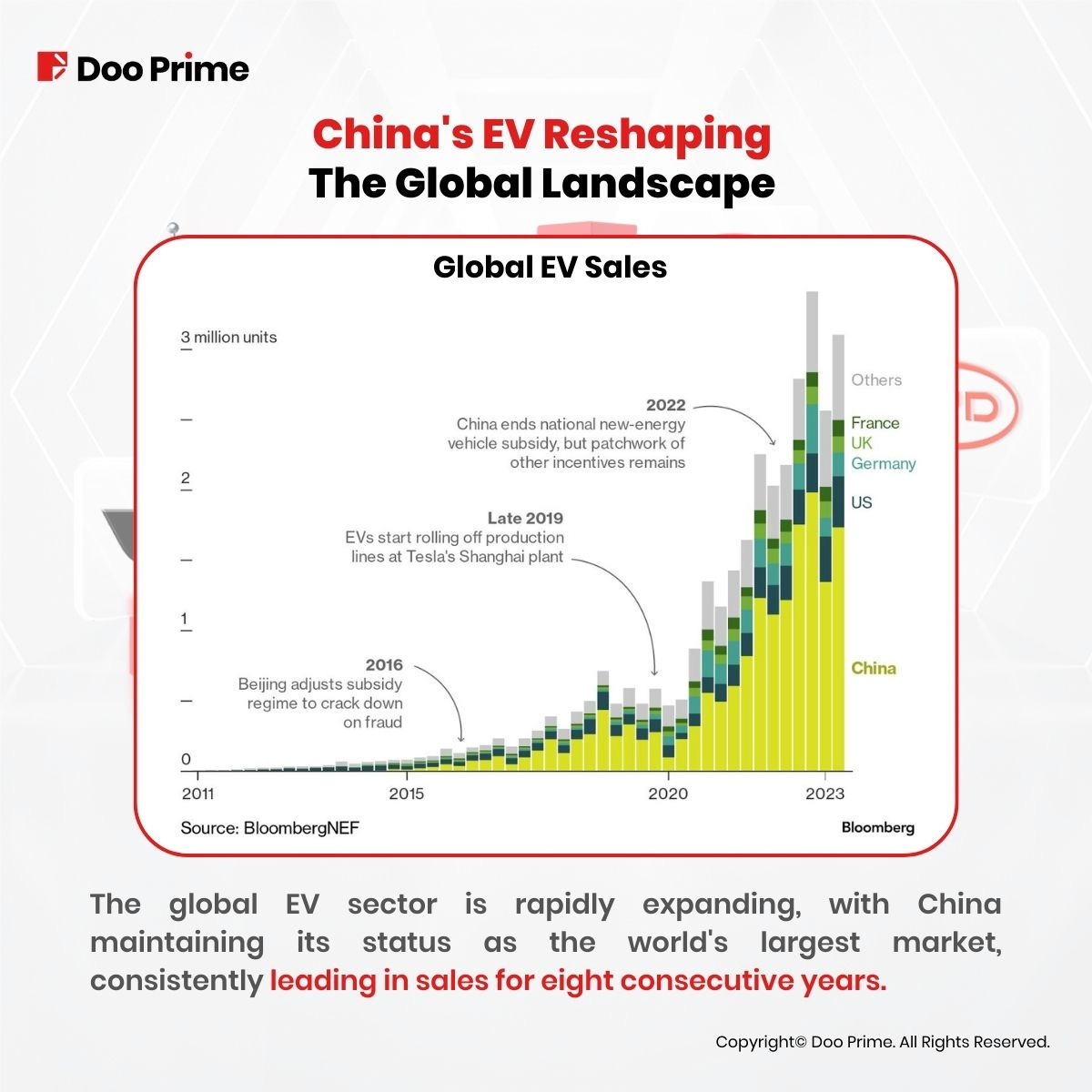

That said, it wasn’t all that bad either. EV sales, for instance, grew exponentially, but it didn’t quite make a difference to the economy.

Artificial Economic Boosts:

Approval of a $140 billion government bond issue to support debt-ridden local governments.

Boosting bank lending to the manufacturing sector to stimulate economic activity.

Providing financial support to struggling companies, allowing them to delay loan repayments.

Ground Realities:

Despite artificial boosts, the average Chinese citizen is facing financial strain, high youth unemployment, and salary cuts, leading to reduced spending.

Retail sales grew at an 18-month low of 2% year-on-year.

Businesses slashed prices across various sectors, including groceries and cars.

Home prices fell at their fastest pace in nine years, with sales declining 19% in the first half of the year.

Implications and Outlook:

While short-term growth figures may appear positive, they conceal deeper, long-term economic issues.

The Chinese Communist Party's third Economic Planning Meeting is crucial for addressing these challenges. Major changes are necessary to navigate the economic predicament.