With one of the world’s largest working populations and a lack of a good social security system, there should be hundreds of millions of workers contributing a significant part of their earnings to fund their retirement to India’s pension system. But that doesn’t appear to be the case.

The latest episode of Investing in India explores some aspects of the maze that is India’s pension system. We invited two guests to help us figure out where things are at. Sriram Iyer is the MD and CEO of HDFC Pension while Amit Gopal was the business leader for Mercer’s investment business at the time of the recording.

While the conversation does attempt to give some background, it’s worth summarising some facts here with links to further reading.

Background - India’s pension system is a collection of different schemes

Three classes of workers…

It’s worthwhile understanding how India classifies its workers based on ‘job security’ into -

Government employees - of both federal and state governments, public sector undertakings and any autonomous organisations set up the government; (Not only do government employees get generous health and retirement benefits, I learnt recently that they are also generally overpaid compared to similar roles in the private sector and other emerging markets - check out our episode with Karthik Muralidharan)

Organised sector employees - of companies that had at least 20 employees on their payroll, usually covered by a formal employment contract

Unorganised sector workers - employees of small businesses, self-employed professionals (including doctors, lawyers etc), non-professional workers; this sector, also called ‘all citizens’ in some reports makes up about 90 per cent of the working population

…with three different systems …

India’s pension system is made of broadly three distinct offerings aimed at the different classes of workers -

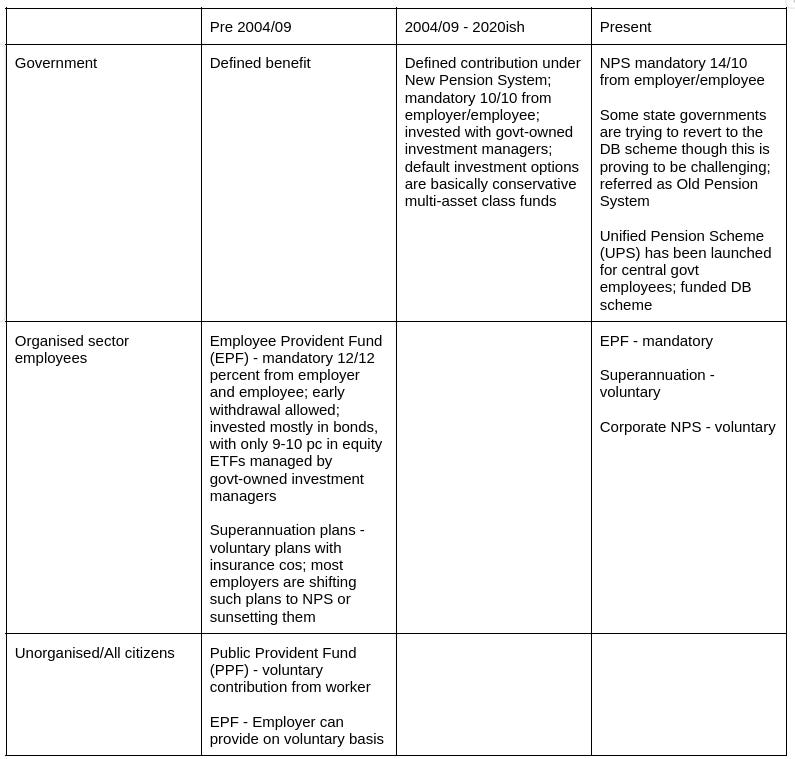

Defined benefit (now called Old Pension System) - non-contributing pension of about 50 percent of last drawn salary for government employees and surviving spouses and dependent children; funded pay-as-you-go from government budgets; in the past 2-3 years, some state governments have promised to revert to versions of this DB scheme

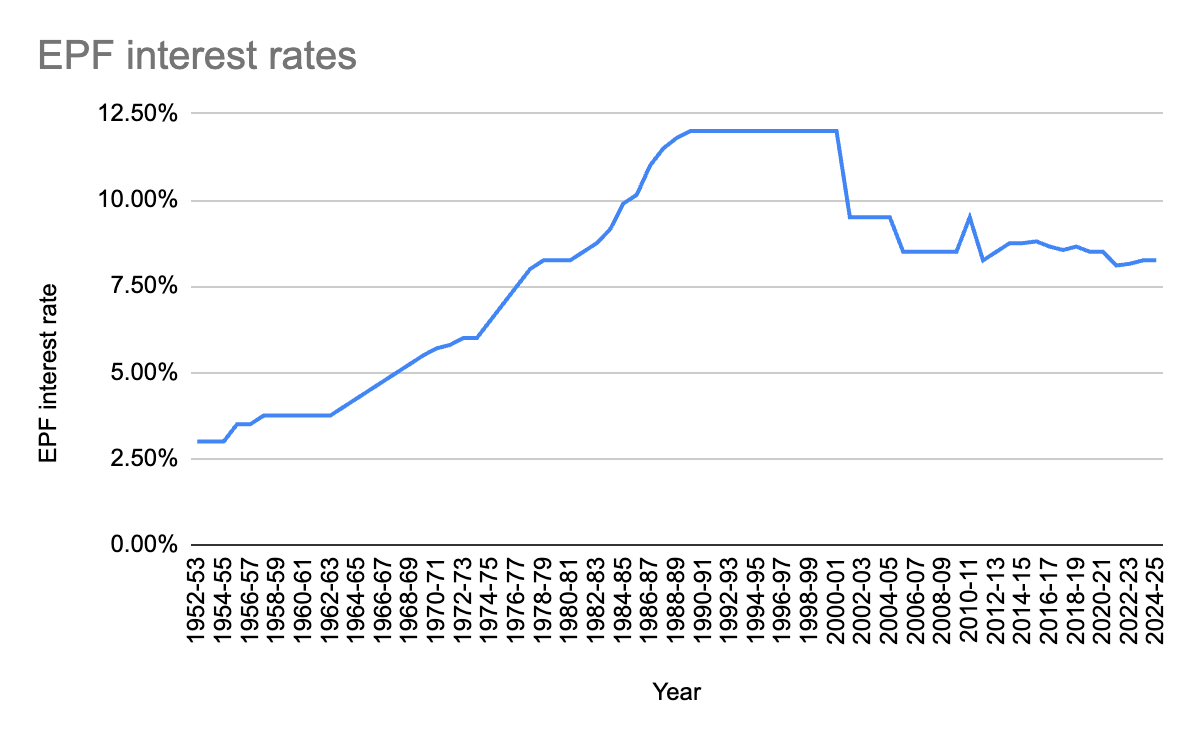

Employee Provident Fund (EPF) - mandatory defined contribution for the organised sector into a non-unitised government-sponsored trust that credits an interest of around 8-8.5 percent annually; can be withdrawn early; large corporates that can demonstrate that they can match the government-run scheme in terms of service and returns (but with the same investment restrictions) can opt to run a private trust called ‘exempt provident fund’

New Pension System, later called National Pension Scheme - defined contribution into an unbundled system with three layers - administration platform, distribution points and wholesale investment management; unitised with investment choice at both asset class and manager levels; has to be preserved until retirement age, then can be taken as a combination of lump sum up to 60 percent and an annuity from a private insurance company bought with remaining 40 percent

…in three different eras

They say India lives in three different centuries; in 2009, the government made efforts to bring everyone into the twentyfirst century…giving them a stake in India’s growth story through the stock market…basically passing the investment risk to the worker.

A summary table is in order to ensure we get the complete picture -

Concerns with different parts of the pension system

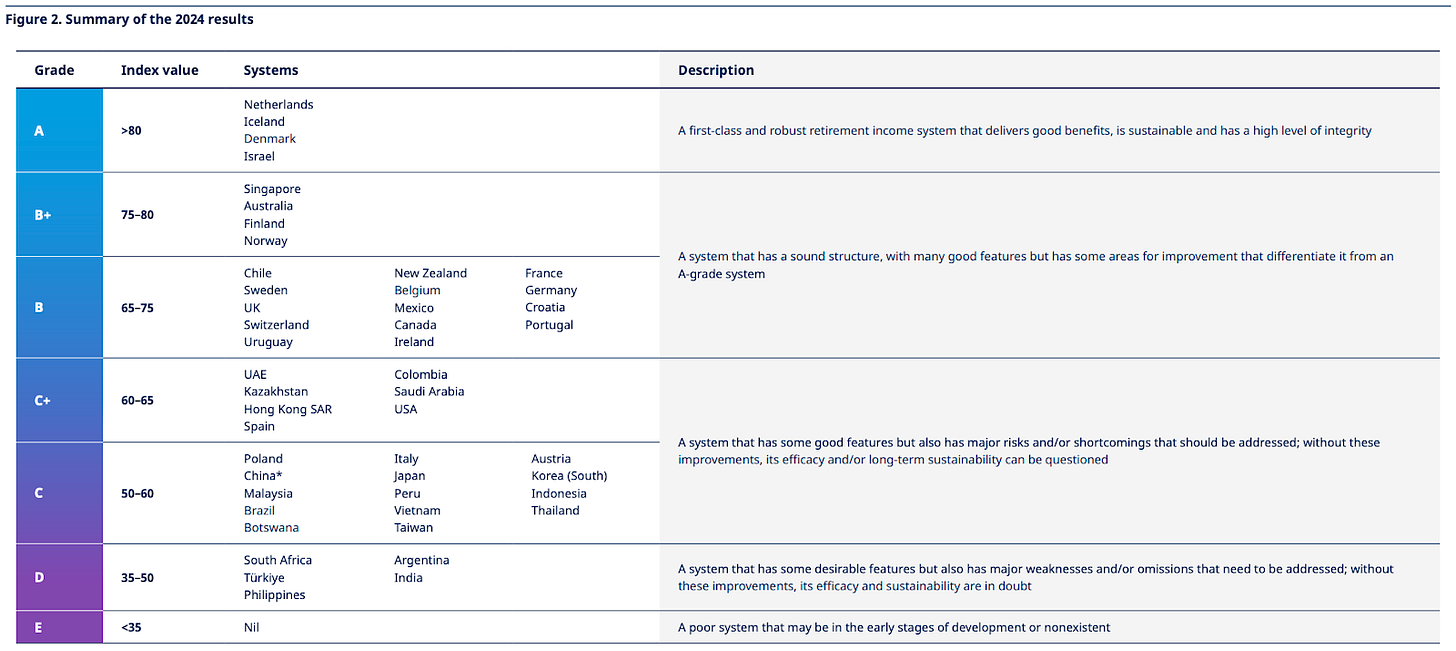

India’s pension system ranks quite low on the Mercer Global Pension Index in terms of adequacy (how much), sustainability (can it keep delivering) and integrity (can it be trusted).

With this context, the conversation discussed some aspects of the system -

Defined benefit Old Pension System (OPS) could ‘pauperise’ nation

The Oasis report laid out the reasons why the government had to change from the defined benefit pension promise - it was simply costing too much. Since it was a pay-as-you-go system, there was only a line item of ‘pensions’ in the national accounts.

The episode discusses that the recent decisions in some state governments to revert to the OPS were politically motivated. Iyer was emphatic that the DB schemes could pauperise the nation’s finances. While the size of the unfunded liability is not disclosed in the budgets, pension experts estimate it to be as high as a quarter of the GDP!

Employee Provident Fund (EPF) is a monopoly and regulator to the corporate exempt schemes

Gopal explained how the EPF was set up in the 1950s under labour laws. The EPF is a trust structure that invests in securities but is non-unitised and is not marked-to-market. While the accrual accounting works for the 90 percent invested in bonds, the trust has to churn the equity ETFs regularly to be able to book realised gains.

The EPFO is quite significant in size. It has 77 million members from 780,000 establishments. Members make up two-thirds of the beneficiaries while surviving spouses and children make up the rest.

The assets under management are at about US$ 251 billion in 2023. About 90 percent of the AUM is invested in debt, through two asset management companies - SBI Funds Management and UTI Asset Management. The fund can invest between 5 and 15 percent in equity ETFs.

The 1200-odd exempt provident funds have to invest in similar asset allocation to get a similar return.

Gopal explained that many of the exempt provident funds are winding up and transferring assets back to the EPFO, partly because the service levels differentiator is hard to justify against the risk of not being able to match returns post the IIFL-triggered credit crisis. He also mentioned the difficulties of dealing with an organisation that is both a competitor and regulator. And it’s not cheap at 0.5 percent of wages (not contribution!), charged to the employer. Note the following table from page 73 of the annual report.

National Pension Scheme’s unbundled architecture is slowly getting better

Set up under a new separate regulator, the Pension Fund Regulatory and Development Authority (PFRDA), the National Pension Scheme has three different layers -

Central Recordkeeping Agencies (CRAs) - administration platforms that function as depositaries,

Points of Presence (POPs) - distribution points that interface with customers physically through branches and now online

Pension Fund Managers (PFMs) - wholesale investment management, each offering the same 4 investment options of pure government bonds (G), corporate bonds (C ), equities (E) and alternatives (A) as well as four risk-based multi-asset class options of conservative, moderate, balanced and aggressive

The USP of the NPS was meant to be the low fees. The investment management fees work on a sliding scale based on total AUM across asset classes - a pretty unusual arrangement. The CRA and POP flat fees are also capped. The total expense ratio, taking into account all three layers, is no more than 0.3 percent, making it one of the cheapest pension systems in the world according to Iyer.

The returns from the equity funds have been competitive over the past 10 years since they were meant to track the large cap index.

The more recent decision to allow active management has led to some variability in the equity returns.

Iyer believes that the returns would be more of a function of the AUM, hence liquidity, than the alpha that the manager would like to offer relative to the ultra low fees that it’s charging.

Iyer also believed that the low allocation to equities within the composite schemes offered to government employees led to the modest 9 percent returns - only slightly higher than the 8.5-odd EPF returns.

Iyer highlighted that the PFRDA had picked up marketing efforts in the past couple of years. Given the ultra low fees, the PFMs were not meant to be involved, but since being allowed to hold the POP license, many PFMs were now marketing to the corporate sector. He admitted that the NPS was far away from the original goal of reaching the unorganized sector, such as taxi drivers (who are the actual middle class earning around INR 30,000 per month in Mumbai).

In closing, while Gopal was a bit more sanguine about the prospects of startups being able to help the pension system becoming better in the short term, Iyer was optimistic that the NPS was at least moving in the right direction.

We hope you are enjoying our “Investing in India” series and would love to hear your thoughts and your suggestions. Feel free to drop us a comment anytime!

See you next time!

I listened to this in audio format. I think the content here can be improved with more user engagement. It felt boring as compared to other podcasts in heard in the substack.

👏👏👏