Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

A new bubble?

Sam Altman thinks we’re repeating the “dot com bubble”.

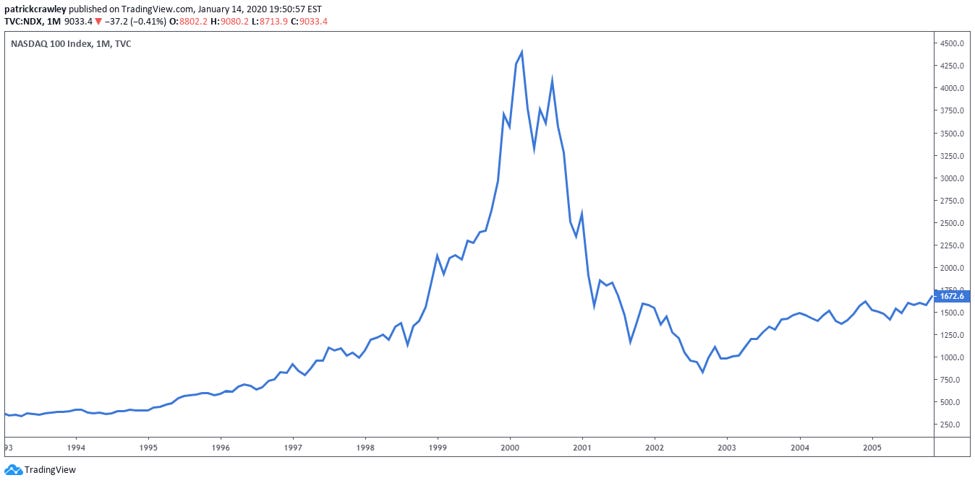

The dot com bubble scarred the psyche of an entire generation of investors, and for good reason. It was perhaps the most remarkable example of a pattern you see with practically every impressive piece of technology — a mass investor hysteria around an unbelievably good promise, which ends in a sudden and tragic correction.

In a recent interview to The Verge, Altman indicated that he had seen the same thing brewing in AI. In his words:

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.”

The internet, as it so often does, went and had itself a collective meltdown over that.

What people seemed to miss, though, was the second part of that statement:

“Is AI the most important thing to happen in a very long time? My opinion is also yes.”

That duality is important. The way he says it, such bubbles are just a way of life — a feature of anything that shows this sort of promise. It feels, almost, like he’s talking about a psychological phenomenon, not that he’s giving market commentary.

To him, “When bubbles happen, smart people get overexcited about a kernel of truth. If you look at most of the bubbles in history, like the tech bubble, there was a real thing. Tech was really important. The internet was a really big deal. People got overexcited.”

The dot com bubble was an odd beast. It came at the birth of something we now know to be world-changing — the internet — which coincided with a period of very low interest rates, and historically high liquidity. Companies were being spun out of nowhere, while investors had lots of money, but few places to get good returns. That meant all sorts of companies would get funded at multi-million dollar evaluations.

A lot of that money was then spent foolishly — on advertisements and promotions that were trying to dominate people’s mindshare. At its peak, for instance, one-fifth of all Superbowl (think IPL final, but for Americans) advertisements were paid for by internet companies.

Once the money dried up, of course, the party had to stop. And then, it became clear that underneath all the flashy advertising, they hadn’t really created much value. Investors panicked. The market seized up. Many of those companies died a quick, painful death.

But it’s important to take the right lessons away from this.

Back then, many people took the dramatic crash as proof that the internet has no use, or that e-commerce was a dumb idea. And who could blame them? A company like Amazon, for instance, fell from a share price of over $4.75 to $0.30. That is, in less than two years, it had lost ~93% of its value. It would only gain that value back years later, after the Global Financial Crisis had come and gone.

With the benefit of hindsight, though, we know how dumb those takes were. Over the long term, it became clear that both the internet and e-commerce made for some of the best business propositions in the world. The fundamental bet that so many people had taken on the internet as a technology was sound. And that terrible crash in Amazon’s value barely registers now:

The smarter lesson from that bubble was much more boring: it’s that you need to spend money wisely, and create businesses around solving actual problems that people have.

A lot of the capital investments that seemed like “wasteful expenditure”, back then, were actually genuinely helpful. For instance, telecom companies spent hundreds of billions of dollars — often fuelled by debt — in laying out the infrastructure for the internet: things like cables, switches and the like. Many of those companies went bankrupt when the bubble burst. But the infrastructure they created stayed on, and arguably went a long way in making the internet affordable for regular people.

That’s the kind of spending Altman is also interested in. “You should expect OpenAI to spend trillions of dollars on data center construction in the not very distant future,” he said. “And you should expect a bunch of economists wringing their hands, saying, ‘This is so crazy, it’s so reckless,’ and we’ll just be like, ‘You know what? Let us do our thing.’”

Will OpenAI survive the bubble? We have no clue. But while the good times last, if they spend more on creating good things, and less on promoting themselves, that might not be too bad a thing.

What’s happening with Indian hospitals?

Hospital chains are expanding again, but they've learned from expensive mistakes. This time, they're building where demand already exists instead of hoping it will come.

For the past decade, they got it backward. They built massive new hospitals in empty fields, then waited years for patients to show up. This turned out to be expensive.

Now they're trying something different. When Apollo's Suneeta Reddy says she's adding 4,400 beds, she's not just talking expansion, she's talking about a completely different way to grow.

Here's what Apollo learned: instead of building from scratch, buy what already works and make it better.

"We'll add about 4,400 beds over the next three to four years — a mix of acquisitions, brownfield and greenfield," Suneeta Reddy, MD of Apollo Hospitals told NDTV Profit.

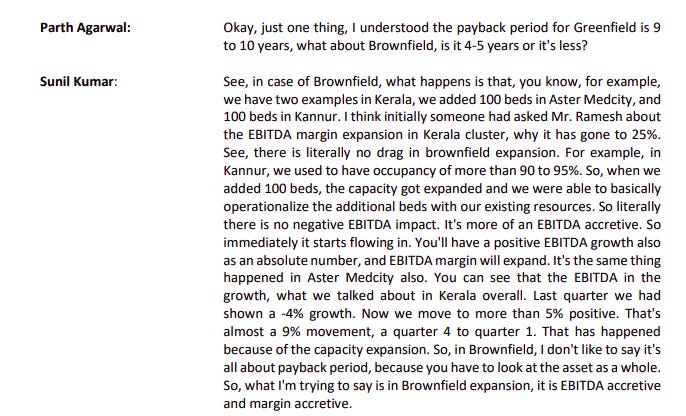

When Aster DM added 100 beds to an existing facility in Kannur, the impact was instant profit.

“...in Kannur. I think initially someone had asked Mr. Ramesh about the EBITDA margin expansion in Kerala cluster, why it has gone to 25%. See, there is literally no drag in brownfield expansion. For example, in Kannur, we used to have occupancy of more than 90 to 95%. So, when we added 100 beds, the capacity got expanded and we were able to basically operationalize the additional beds with our existing resources. So literally there is no negative EBITDA impact. It's more of an EBITDA accretive. So immediately it starts flowing in. You'll have a positive EBITDA growth also as an absolute number, and EBITDA margin will expand.”

No waiting period. No ramp-up losses. Just immediate returns.

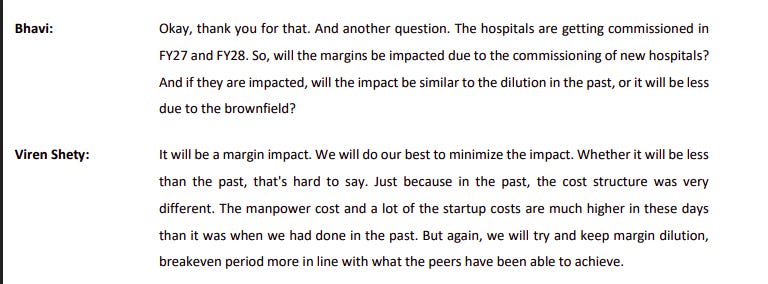

Compare that to building from scratch. New hospitals need time to build trust, attract doctors, and fill beds. Meanwhile, they're paying full overhead on empty capacity. Narayana's Viren Shetty admits the economics have gotten worse:

“The manpower cost and a lot of the startup costs are much higher in these days than it was when we had done in the past. “/

So why build new when you can buy proven?

Apollo isn't alone in this shift. The entire industry is expanding again, but smarter. Fortis is adding 1,400 beds, mostly through brownfield projects. Max is targeting nearly 3,000, again focusing on existing sites.

Rainbow Children's has taken the strategy furthest. Instead of chasing national scale, they're doubling down on pediatric care in specific markets. Different approach, same logic: own your space completely before expanding elsewhere.

The math behind this strategy is beautiful in its simplicity. Once a hospital crosses its breakeven point, every additional patient flows almost entirely to profit. Apollo's hospital margins are already at 24.3%, up from last year.

"As volumes build, operating leverage kicks in and EBITDA margins improve," Reddy explains. More patients using the same fixed infrastructure means exponentially better returns.

Aster DM just proved this works. They crossed ₹50,000 revenue per bed for the first time, driven by high-margin specialties like oncology and neurosciences. Their response? Double down on Bengaluru with more capacity.

Because here's what these companies really understand now: healthcare isn't a national business. It's a neighborhood business.

That's why Apollo is putting 700 of those 4,400 beds in Bengaluru alone — across two existing sites and a new Sarjapur location. In the west and north, they're targeting Navi Mumbai, Pune, and Gurgaon. The pattern is clear: own the local market completely.

The goal isn't to be everywhere. It's to be the obvious choice in specific places. But this expansion is happening under pressure. Costs keep rising while revenue growth faces limits.

Here’s what Narayana’s management said on this:

“On a margin basis, that will depend a lot more on the cost structure as it looks because as much as Bangalore, Kolkata, Delhi, Raipur places are high realization, they are also very high-cost markets. And the cost drivers of this industry are relentless. Meanwhile the pricing pressures what we face from various payors, both insurers and the government, are also equally relentless."

Wages, equipment, and real estate all cost more. Insurance reimbursements don't.

This squeeze makes the smart expansion strategy even more critical. Hospitals can't afford empty beds anymore. They need capacity that pays for itself immediately.

And yet demand signals keep strengthening. Medical tourism is recovering — Kerala's medical value travel revenue jumped 12% in just one quarter. Oncology revenue is climbing across every major chain. Narayana thinks cancer care could reach 25% of their revenue within five years.

So the industry is making a calculated bet: build more capacity, but only where demand is proven and profits are immediate.

Apollo's 4,400-bed expansion isn't just corporate news. It's the signal that Indian healthcare has matured. The wild growth phase is over. Now comes the consolidation phase, where smart operators grab local monopolies while weaker players get squeezed out.

The last cycle was about scale at any cost. This cycle is about profitable scale. The companies that survive will be the ones that can expand without bleeding cash, serve more patients without sacrificing margins, and dominate their local markets without overreaching nationally.

In hospitals, beds are the scoreboard. But the real game is filling them profitably from day one.

If you’ve made it this far, please let me know if you have any feedback for me 🙂

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Fascinating discussion. Enjoyed reading these.

The Daiy Brief by ZERODHA(TDZ) always picks up the most interesting and juiciest comments from business leaders,and has today contextualised things around Sam Altman who now is known as Defacto AI inventor. (TDZ) rightly discusses— “Is AI the New Dot-Com”?—and as usual concludes unbiased:Will OpenAI survive the bubble? We have no clue. But while the good times last, if they spend more on creating good things, and less on promoting themselves, that might not be too bad a thing.

I may be wrong,it appears to me as of now that,just as IT reshaped firms but the impact was seen in decades, AI impact will also be seen in coming decades,

simply because AI capabilities are becoming a competitive necessities moving up from competitive advantages.

The analysis of Smarter growth in Indian Hospitals rightly drives home the point that It's the signal that Indian healthcare has matured.