Investors are thirsting for shiny sectoral funds!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here: Spotify and Apple Podcasts

And the video here:

Today, we look at 4 big stories:

The craziness in thematic and sectoral mutual funds

RBI’s guidelines on interest payments will hurt banks and NBFCs.

The confusion over the classification of gaming companies

Currency volumes migrate to the Singapore Stock Exchange

The craziness in thematic and sectoral mutual funds

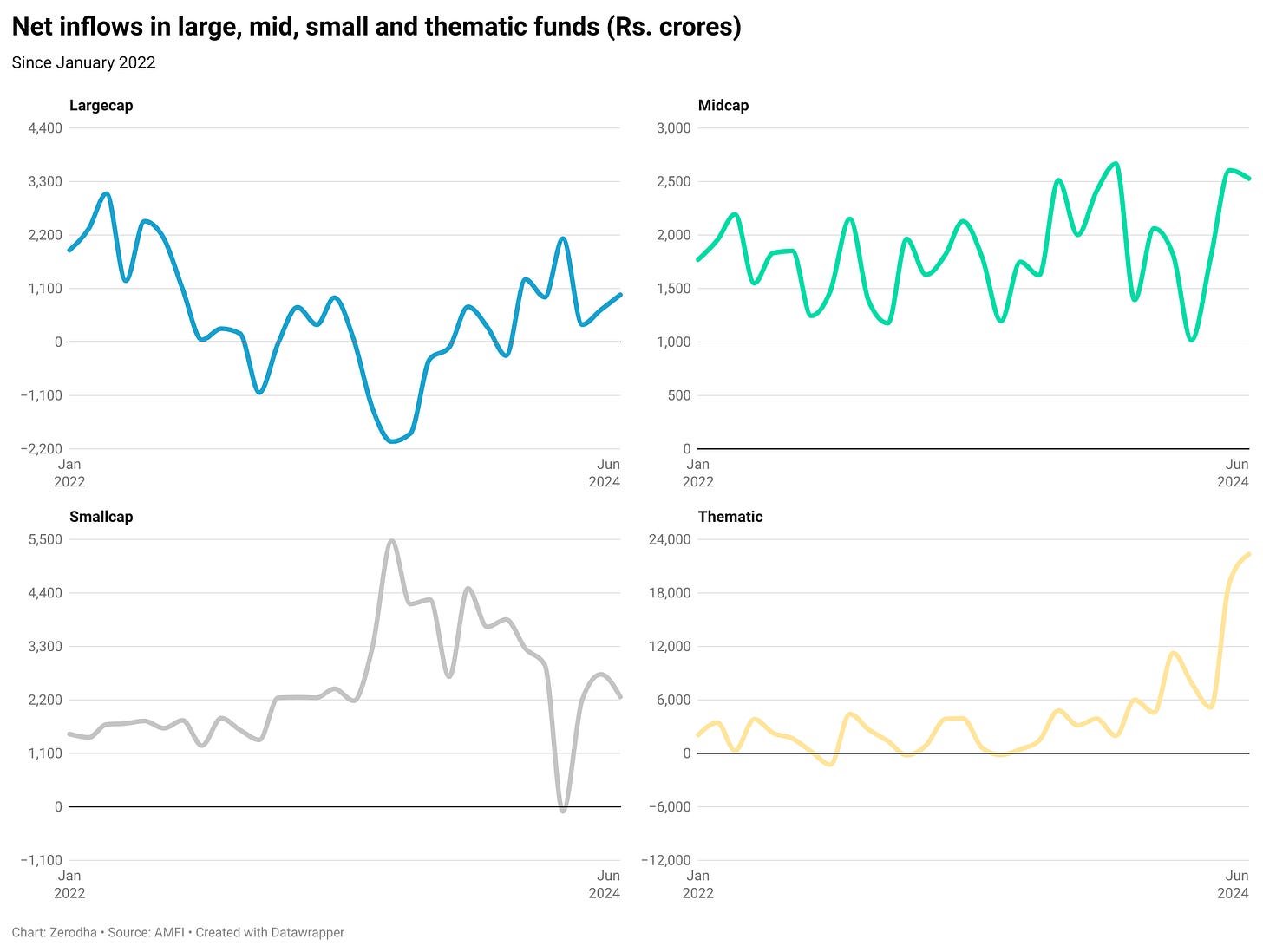

Thematic and sectoral mutual funds have seen a significant rise in popularity since the second half of 2020, coinciding with a raging bull market. While bull markets often lead to exciting and sometimes irrational behavior in the market, the surge in inflows to thematic mutual funds and ETFs stands out as both fascinating and concerning. Thematic funds focus on specific market segments such as defense, healthcare, and auto, making them highly volatile.

Bull Market Behavior and Inflows

The ongoing bull market has driven investors toward high-risk, high-reward opportunities. From January 2022 to June 2024, thematic funds have attracted massive investments.

Sectors like real estate, infrastructure, and commodities have historically underperformed the Nifty since 2008. Despite this, the allure of high returns during bull markets leads to increased inflows.

Thematic Fund Mania

The number of thematic schemes increased by nearly 50% between January 2022 and June 2024. This surge is reminiscent of the closed-ended fund craze of 2006-07.

Motilal Oswal's Defense Index Fund: Launched in June 2024, it collected Rs 1,676 crore during its NFO period, showcasing the intense interest in thematic funds.

In the first half of 2024 alone, thematic funds raised Rs 33,670 crore.

HDFC Defence fund, which launched in 2023, stopped accepting fresh SIPs due to a significant rise in defense stocks, which surged between 100% to 700% in one year.

For defense stocks to justify their current prices, they would need to achieve implausibly high earnings growth.

Risks and Warnings

Thematic funds can experience rapid gains but often do nothing for extended periods.

Investing based on historical performance is like driving while only looking in the rearview mirror.

RBI’s guidelines on interest payments will hurt banks and NBFCs.

The Reserve Bank of India (RBI) has introduced new guidelines that are set to impact banks and Non-Banking Financial Companies (NBFCs) significantly. These changes focus on when interest payments should begin, aiming to make the process fairer for borrowers but potentially reducing profitability for lenders.

Understanding Loan Interest Payments

When you take out a loan, the process generally follows these steps:

You apply for a loan.

The bank reviews your documents and sanctions the loan, providing a sanction letter detailing the loan amount, repayment period, and interest rate.

You review, sign the sanction letter, and return it to the bank.

Additional paperwork and the signing of the loan agreement take place.

Finally, the bank disburses the loan amount to you. For loans like home loans, this can happen a few months after the initial sanction.

Traditionally, you would expect interest to be charged only after the loan disbursement. However, some lenders began charging interest at earlier stages, such as right after the loan sanction or when a check was signed, not when the funds were given to the borrower. This practice allowed banks to collect extra interest, which the RBI deemed unfair.

RBI's New Circular

In April, the RBI issued a circular instructing banks and lenders to charge interest only once the funds are released to the borrower. This change is excellent news for borrowers, as it prevents them from paying interest on money they haven't received yet.

Impact on Banks and NBFCs

With interest starting later, lenders will see a dip in their profitability in the June results.

The difference between the interest they pay for funds and what they charge borrowers will likely decrease, putting further pressure on their margins.

As we discussed last week, banks are already in fierce competition for funds, and this new rule adds another layer of challenge.

RBI’s Broader Regulatory Crackdown

This change is part of a broader effort by the RBI to maintain monetary stability and address concerns over new financial risks. Over the past few years, the RBI has tightened regulations on various aspects of banking and financial services, including:

Stricter know-your-customer requirements.

Regulations on how and when interest is charged.

Rules on the timing and transparency of loan disbursements.

Oversight on collaborations between banks and fintech companies.

Since the beginning of this year, the RBI has taken action against 161 entities, highlighting its rigorous approach. For instance, it banned Kotak Mahindra Bank from adding new customers due to IT issues and imposed severe restrictions on Paytm Payments Bank.

The confusion over the classification of gaming companies

The Indian gaming industry is in some confusion over how gaming companies are classified and the taxes applicable to them. This lack of clarity is causing operational difficulties and legal issues, which are stifling growth and investment in the sector.

Classification Conundrum

Proper classification of gaming companies is crucial because currently, both online gaming companies and real money games are treated similarly. This ambiguity has led to tax notices and other complications for the industry.

In India, games are traditionally categorized into two types:

Skill-Based Games: These include games like chess, rummy, and fantasy sports, where winning requires strategy and knowledge.

Chance-Based Games: These rely more on luck and include lotteries and slot machines. They often face stricter regulations.

However, this categorization has led to numerous legal challenges and inconsistencies:

The Supreme Court of India has ruled that games like rummy and fantasy sports are primarily skill-based.

States like Karnataka and Tamil Nadu have attempted to ban online gaming, including skill-based games, citing social concerns.

The Punjab and Haryana High Court ruled in 2017 that Dream11's fantasy sports game is skill-based.

Taxation Turmoil

The Indian government has imposed a 28% Goods and Services Tax (GST) on the full value of bets placed in online gaming, horse racing, and casinos. Previously, GST was only applicable to the platform fee, which was a fraction of the full bet amount. This significant increase in taxation had sparked backlash from the gaming industry, which argues that it will:

Impact the Ecosystem

Hurt Smaller Companies

Despite the pessimism, since October 1, 2023, GST collections from online gaming have risen substantially, from Rs 200 crore per month to Rs 1,100 crore per month.

Industry Plea for Clarity

Around 70 online video gaming companies have urged the Indian government to create separate categorization and clear policies to distinguish them from real money games. They argue that the confusion over taxation and regulatory issues is negatively impacting their operations and leading to a slowdown in investment deals.

Currency volumes migrate to the Singapore Stock Exchange

In one of our recent episodes, we've covered the significant shift in the trading landscape for exchanged traded currency derivatives. The Reserve Bank of India's (RBI) new regulations have dramatically reshaped this market by requiring traders to have exposure to the underlying currency. This policy change has led to a striking migration of rupee-dollar futures volumes from India's National Stock Exchange (NSE) to the Singapore Exchange (SGX). Since these restrictions were put in place, the volumes of rupee-dollar futures on SGX have surged by 28%, while those on NSE have plummeted by nearly 90%.

NSE previously held a dominant 94% share of India's currency derivatives market.

This new rule has pushed FIIs to shift their trading activities to SGX, as they are no longer able to trade currency derivatives on NSE without underlying currency exposure.

Listen to the full episode to be smarter than you are after reading these bullet points.

Continue elucidating complex economics of our country