Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

For all the sources mentioned in this video, don’t forget to check out our newsletter; the link is in the description.

With that out of the way, let me get started.

A look at India’s value retail space

If you put Vishal Mega Mart, Baazar Style, and V2 Retail next to each other, the overlap in how they talk about their consumer becomes obvious. Let’s take this quarter’s commentary. Vishal Mega Mart’s management said this:

“...We got the benefit of Durga Puja Festival, which is, as you know, a very popular festival in eastern India. And also, to a lesser extent, the benefit of Chhath Puja, which is again a popular festival in Bihar”

So for Vishal, Q2 looked stronger simply because Puja moved into September this year.

Baazar Style said the same thing, with more nuance:

“so the fluctuation in Durga Puja leads to a variation in the sales in both Q2 and Q3. So, if a sale of Puja is in Q3 only, so that time you will see the numbers matching with all the national retailers, Q2 will have a lower margin because of July and August being the end-of-season sale, but because the Puja shifted to September and September then becomes a festival month for us, as a result, festival buying happens, and as a result, the gross margin on the festival buying is more compared to non-festival”

This is very specific to them because they’re heavily concentrated in Bengal and Assam and Puja timing literally decides which quarter looks good.

And V2 Retail observed something too apart from just the benefit of the festivals:

“So we have seen our winter contribution increase from about 40% on the last year same day to almost 55%.”

So apart from the festival bump, they also got an early winter, which pushes up the average selling price and margins a bit.

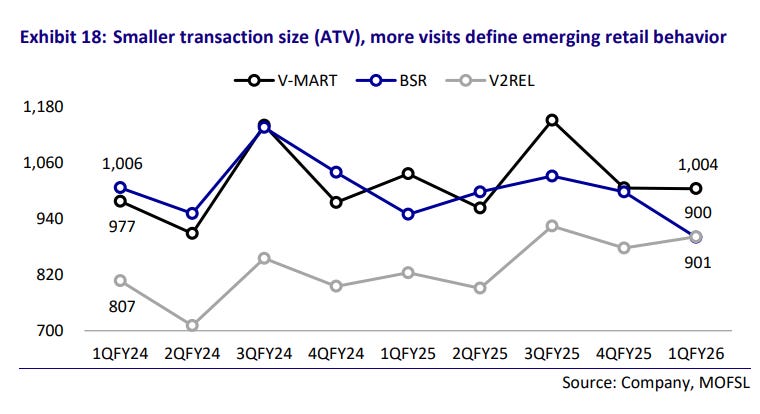

But the more interesting overlap shows up when they talk about their customer. All three end up describing a shopper who walks in with a very fixed budget, roughly ₹1000, and almost everything they say fits inside that frame.

Baazar Style is the one that says it the most directly:

“We believe India’s consumption story will be value retailer-driven and our proposition style for the entire day is INR 1,000 captures that essence perfectly”

Their average bill this quarter is ₹1,005, which basically tells you the whole story. Vishal sits slightly lower on that range, around ₹800–₹900 a bill, but the behaviour is identical. When someone asked whether the GST cut reduced how much people spend, the management said:

“So, we anticipate one of the two scenarios. And most likely, both will play out with different customers. One is folks who are going to buy more things from the store. So, earlier, if they were buying eight items per bill, they could buy nine, for example. The second thing also, which will inevitably happen is that folks who are desirous of buying a more aspirational, higher price point product may find that it’s become somewhat more affordable right now.”

That’s the customer: add one more item, upgrade a little bit, but stay inside the same comfort zone. And then he added this line, which just nails it:

“In apparel, only 1% of our revenue is impacted because, as you know, all products which are more than INR 1,000 earlier were paying higher GST”

Where it does show up is in the non-apparel stuff:

“That number is significantly higher for general merchandise, where almost 34% of our revenue is positively impacted by GST reduction…And lastly, the largest impact would be on FMCG, where 50% of our FMCG revenue would be positively impacted by the GST reduction.“

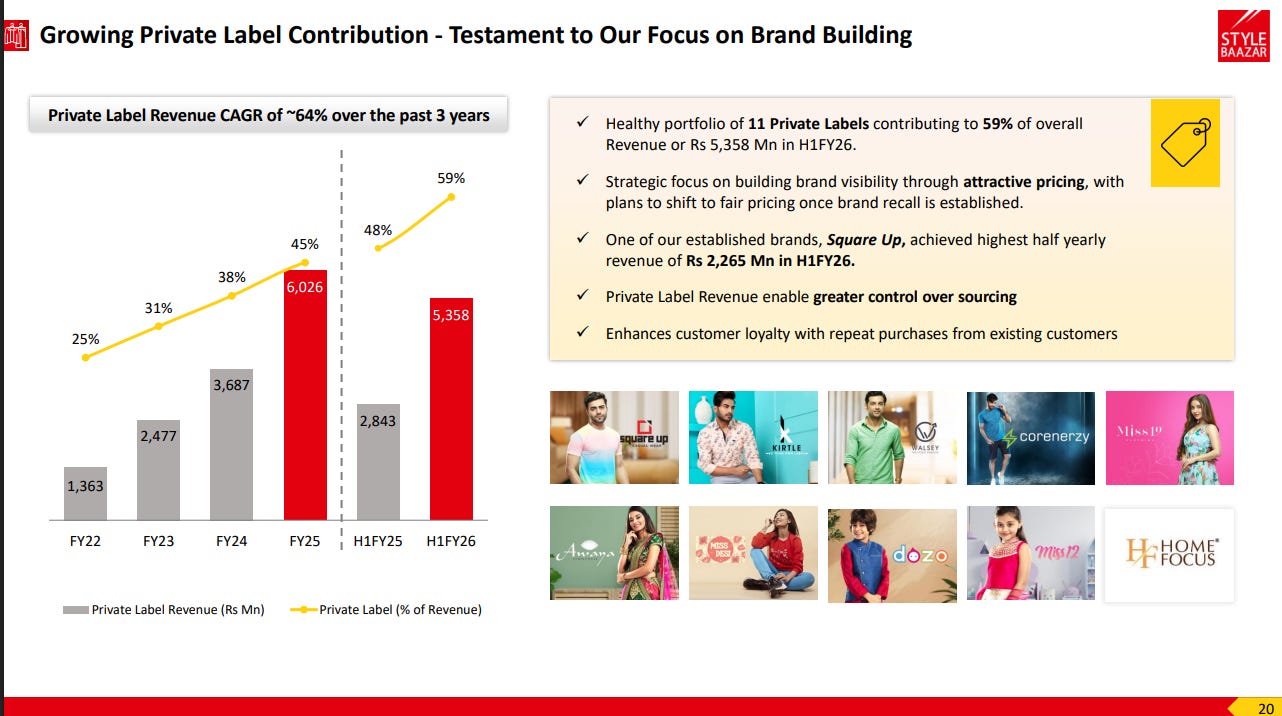

The other thing all three keep circling back to is private labels. Baazar’s management is the most blunt about it:

“Every person who is coming, we want one article or two articles of private label in his or her hand so that they can understand the quality that we are working on”

And their aspiration is to reach 65% of the sales coming from private label by FY27.

V2’s version of the same idea sounds different, but the logic is identical. They’re less worried about brand-building and more worried about what happens if bad designs sit too long on the shelves. Their CEO said:

“...No other retailer puts their slow movers on discount within 2 weeks of introduction. So we have been able to get our more than 1-year old inventory from about 24% to less than 4% now.”

That’s their way of managing the inventory. And Vishal is already well ahead on this with roughly three-fourths of their business today is their own brands.

And because of all this, it’s not surprising that value retailers are putting up a strong set of numbers again. The festive shift clearly helped footfalls in Q2, private labels are getting picked up much faster than before, and the rural and semi-urban belts continue to pull their weight as more shoppers move from unorganised stores to these organised chains. None of the companies dress it up as anything big or dramatic—they’re just responding to what the customer wants, and the customer hasn’t really changed all that much.

The AC makers are a little worried

Think about when your family last bought an AC. It was probably March or April, the summer months. That’s the core problem of being in the AC business in India. Your product only exists in people’s heads when they’re sweating. The moment the weather cools, you disappear. But your costs don’t. Factories, workers, rent, electricity, loans – those run twelve months a year, whether anyone buys an AC or not.

As Blue Star’s management says very plainly on the call:

“You cannot stop a factory, correct?”

If you shut it, workers leave, machines sulk, suppliers drift away. So you keep manufacturing year-round, stacking boxes in warehouses, betting that next summer will bail you out. Your bet is that the weather will be as bad next year.

Last year, that trade worked beautifully because summer in 2024 was brutal. Heatwaves everywhere, people who had postponed buying for years finally gave in. So when Blue Star and Voltas sat down to plan 2025, the logic was simple: last year was massive, this year should be at least as good.

They ramped up production, filled warehouses, and pushed stock aggressively to dealers. But things didn’t go according to plan, and it rained a little early. This meant that the temperature stayed tolerable, and the need to buy an AC didn’t creep in as much.

“It was a tough quarter. You are aware of the impacted summer season that continued through July.”

But here’s an important thing to understand. Q2 is always the weakest quarter of the year for ACs because it’s monsoon season. Historically, the AC business has two real seasons: Q4, when dealers stock up before summer, and Q,1 when there’s actual summer, and customers rush to buy.

So, Q2 is usually slow. This Q2, though, wasn’t slow. It was lifeless. Because the government threw in a second curveball, i.e. GST.

“On August 15th, we had the GST announcement. So, practically from 15th of August till September 22nd, not only the Room Air-Conditioner business but also some segments of Commercial Air-Conditioning business were also impacted.”

And, ofcourse, that impacted the sales of ACs because people who wanted to buy delayed their purchase. Meanwhile, inventory kept piling up. And this is where the real pain sits.

Blue Star’s mangement lays out the number in the bluntest way possible:

“Our inventory level, based on the latest estimate, as on date is around 65 days of sale. Ideally it should be only 45 days of sale. I do not know the industry inventory levels, but I know that the industry inventory days are much higher than 65 days.”

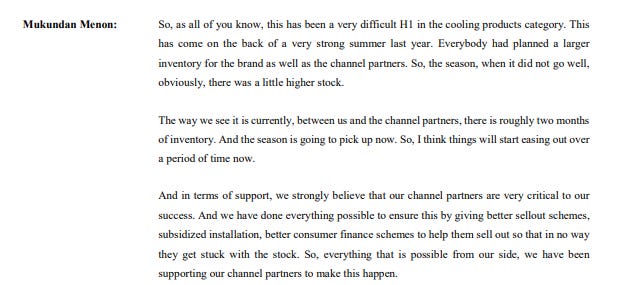

Voltas’ MD says almost the same thing:

“Between us and the channel partners, there is roughly two months of inventory.”

Now, this is crores of rupees stuck in boxes lying in company godowns and dealer shops — especially dealer shops. And dealers are small businessmen. Many buy stock using bank finance. They were counting on a hot summer to clear it. Instead, they’re sitting on EMIs and cartons.

Voltas’s MD actually says this out loud by describing that they tried to help the dealers sell the stock:

“And we have done everything possible to ensure this by giving better sellout schemes, subsidized installation, better consumer finance schemes to help them sell out so that in no way they get stuck with the stock.”

So they’re sitting on unsold stock from a failed summer, their dealers are choked, Q2 was wiped out by GST timing, and they still have to start producing for next year.

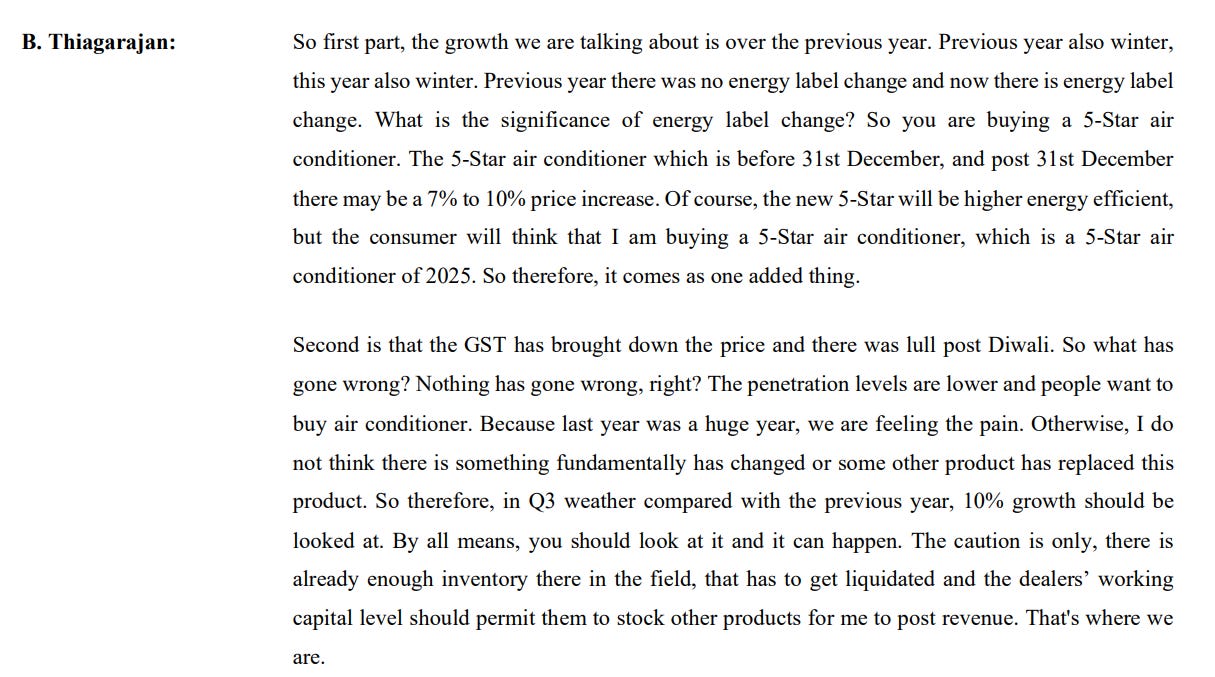

Then there’s one more complication: the BEE energy label change coming on January 1, 2026. The threshold for what counts as “5-Star” is going up. Current 5-Star models may no longer qualify. New 5-Star designs will be pricier.

Blue Star’s management explains this customer-side confusion beautifully:

“The 5-Star air conditioner which is before 31st December, and post 31st December there may be a 7% to 10% price increase. Of course, the new 5-Star will be higher energy efficient, but the consumer will think that I am buying a 5-Star air conditioner, which is a 5-Star air conditioner of 2025”

There’s a grace period, though, where dealers can sell old-label stock even after January. This creates a weird mini-season in December: dealers buy old 5-Star units now and sell them in January–March at a price advantage.

On the year ahead, Blue Star is brutally honest:

“...If we close the year with industry being flat, we being flat, we should be very happy….It is also probable that the industry ends up with (-15%) over last year”

Voltas takes a softer line:

“Whenever we see that the first half of the year, the purchases have not been made, we see that the demand is not destroyed or destructed. We believe that the demand is deferred.”

But the best line in all of this is Blue Star’s management:

“...it is all Duckworth-Lewis method. We do not know how many overs are left or what is the asking rate, so rain keeps interrupting on one side.”

Tired of trying to predict the next miracle? Just track the market cheaply instead.

It isn’t our style to use this newsletter to sell you on something, but we’re going to make an exception; this just makes sense.

Many people ask us how to start their investment journey. Perhaps the easiest, most sensible way of doing so is to invest in low-cost index mutual funds. These aren’t meant to perform magic, but that’s the point. They just follow the market’s trajectory as cheaply and cleanly as possible. You get to partake in the market’s growth without paying through your nose in fees. That’s as good a deal as you’ll get.

Curious? Head on over to Coin by Zerodha to start investing. And if you don’t know where to put your money, we’re making it easy with simple-to-understand index funds from our own AMC.

Hey Krishna!

Firstly thankyou, a very avid reader of these blogs. Could you please do one on the business of dating apps too ?

The prices I see on hinge for boosts / roses is crazy. I wish to start one in this space too, insights like these would help a lot :)