India’s Real Estate Boom: What’s Driving the Comeback?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

India’s Real Estate Boom: What’s Driving the Comeback?

SEBI removes Embassy REIT CEO

SEBI pushes mutual funds to invest NFO money faster

India’s Real Estate Boom: What’s Driving the Comeback?

In our first story of the day, let’s dive into the surprising comeback of India’s residential real estate sector. Just a few years ago, this sector was facing big challenges: there were too many unsold homes, people were hesitant to buy, and lenders weren’t keen on giving out loans. The industry seemed to be in a rough spot.

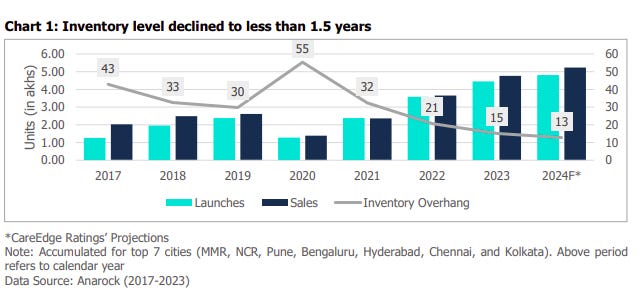

Then, things took a sharp turn after the pandemic. To see how much has changed, let’s look at inventory levels—a key measure in real estate that shows how long it would take to sell all the unsold homes at the current sales pace. Previously, this figure was over 30 months, meaning it would take more than two years to clear out all available homes. Now, it’s dropped to under 18 months, and experts believe it could fall to 15 months within the next two years. This shift shows homes are selling faster, indicating strong demand and a much healthier market.

This recovery is even more interesting when we consider the global landscape. Despite economic challenges, like inflation, rising prices, and geopolitical tensions in areas like Ukraine and the Middle East, India’s real estate market remains resilient. The Reserve Bank of India (RBI) has held the repo rate steady at 6.5%—essentially, the rate at which it lends money to commercial banks. They’ve kept this rate the same for ten rounds, hinting they might consider lowering it by the second half of 2025. If rates go down, borrowing costs decrease, potentially encouraging even more home buying.

A major factor behind this revival is the Real Estate Regulatory Authority (RERA), a regulation introduced to make the market more transparent. RERA brought in stricter rules, pushing out many smaller, less stable players and leading to market consolidation. Now, large developers dominate, with over 70% of their bookings happening in the early construction stages. In contrast, smaller developers need to wait until their projects are nearly complete to get half of their bookings. This shift is creating a more stable and reliable industry, making customers feel more secure in their purchases.

Another notable change is in what homebuyers are looking for. A few years ago, affordable housing led the market, accounting for more than 40% of new projects in 2017. Today, that figure has dropped to below 20%, as more people are leaning toward premium and luxury homes. In fact, premium and luxury projects have doubled from 10% to over 20% of new launches.

Why the shift? Consumers today are looking for more than just basic shelter. Buyers want larger spaces, dedicated work areas, smart home technology, and eco-friendly features, reflecting a willingness to pay more for comfort, convenience, and sustainability. In 2023, property prices rose by around 8% across the country, with Hyderabad, Bengaluru, and Gurgaon seeing the highest increases. Analysts expect this trend to continue, projecting a 7-10% rise in 2024.

Now, let’s take a look at the financial health of major players in the sector. In the financial year 2024 (FY24), the top listed real estate companies achieved impressive pre-sales—bookings that happen before a property is fully constructed—totaling over ₹1 lakh crore, marking a 36% growth compared to the previous year. Collections, or the money developers received from these pre-sales, doubled from ₹30,000 crore in FY19 to over ₹67,000 crore in FY24.

Another positive trend is the reduction of debt among real estate companies. Their collective debt has dropped from around ₹50,000 crore in FY19 to about ₹44,000 crore in FY24. Many developers are adopting an "asset-light" model, which focuses on projects that require fewer resources and avoids taking on excessive loans. This approach is helping them maintain stronger, more stable balance sheets.

Looking ahead, several factors suggest continued growth. For instance, India is heavily investing in infrastructure. Public capital spending has increased from 1.7% of GDP in FY14 to 3.4% in FY24, with over ₹11 lakh crore allocated in the FY24 budget—triple the amount spent in 2019. This funding is going toward expressways, airports, metro systems, and other large projects, which create new areas for real estate development and boost property values.

The growth of Global Capability Centers (GCCs) is also driving demand, particularly in southern cities like Bengaluru and Chennai. These are large corporate setups established by global companies in places with a skilled workforce, creating jobs that, in turn, drive up demand for housing in those areas.

However, it’s not all smooth sailing. Rising property prices and high interest rates could make homes less affordable, especially for first-time buyers. Additionally, if the IT sector—an essential driver of demand in tech-focused cities—slows down its hiring, it could impact housing demand in those areas.

Looking forward to FY25, experts anticipate further growth, with pre-sales and collections projected to reach ₹1,30,000 crore and ₹80,000 crore, respectively—a 15-20% increase over FY24. But for this momentum to continue, developers will need to stay attuned to real demand and avoid oversupplying the market.

In summary, India’s real estate sector is experiencing a strong comeback post-pandemic, thanks to faster inventory turnover, regulatory improvements, and shifting consumer preferences. Although there are economic challenges to watch, the combination of financial discipline by developers and government infrastructure investments presents a promising outlook. The next few years will be crucial as the sector seeks to balance growth with affordability, navigating both opportunities and potential obstacles.

SEBI removes Embassy REIT CEO

Recently, SEBI directed Embassy Office Parks REIT, one of India’s largest Real Estate Investment Trusts (REITs), to suspend its CEO, Aravind Maiya. The reason? SEBI is unsure if Maiya meets the “fit and proper” standard required to lead a public company that manages investor funds.

The background involves the National Financial Reporting Authority (NFRA), India’s accounting regulator, which recently banned Maiya from audit work for 10 years. This ban stems from alleged lapses in his role as the audit partner for Coffee Day Enterprises (CDEL) in 2019, during which major financial issues weren’t flagged. NFRA fined Maiya ₹50 lakhs, claiming he overlooked key warnings about undisclosed fund transfers at CDEL.

SEBI is now questioning if someone with this regulatory history should be allowed to manage public funds. For SEBI, the “fit and proper” standard means a spotless record, especially in high-stakes roles like REIT leadership. Embassy argues that auditing and management are separate fields; they believe Maiya has done well since joining and that the “fit and proper” standard applies to the REIT, not specifically to its CEO.

Under pressure from SEBI, Embassy announced that Maiya will move from CEO to Head of Strategy, with other board members stepping in to handle operations. Embassy now faces a choice: either replace Maiya as SEBI advises or challenge SEBI’s decision—though pushing back could lead to even closer scrutiny. SEBI’s firm stance suggests they won’t compromise on leadership standards, especially for roles managing public money.

SEBI pushes mutual funds to invest NFO money faster

SEBI, India’s market regulator, is proposing a new rule for mutual funds to tackle delays in handling New Fund Offerings (NFOs).

First, for those unfamiliar, let’s clarify what an NFO is. When a mutual fund company wants to launch a new fund, they announce what’s called a New Fund Offering, or NFO. This is similar to an Initial Public Offering (IPO), where companies offer new shares to the public to raise money. With an NFO, the Asset Management Company (AMC) collects money from investors with the promise to invest it according to a specific strategy, like in large-cap stocks, mid-cap stocks, or government bonds.

Investors in these NFOs expect their money to be invested quickly according to the fund’s stated plan. However, SEBI is concerned that some AMCs are taking too long to deploy or actually invest this money. SEBI has noticed that, in some cases, it’s taking months for the funds to be fully invested as per the fund’s strategy.

To understand why this matters, let’s look at an example. Imagine a mutual fund company, say, XYZ AMC launches a new fund focused on large-cap stocks. The NFO goes well, raising ₹5,000 crore from investors. But instead of investing this money in large-cap stocks right away, they park it in safer, low-return instruments like government bonds or treasury bills, waiting for what they believe might be a better time to enter the stock market.

The problem here is that this delay means investors miss out on potential stock market gains while their money sits in safer, low-yield investments. If the fund’s strategy is to invest in large-cap stocks, then keeping funds in low-risk government securities means investors aren’t getting the returns they expected. In short, this lag could hurt investors who invested expecting higher returns from stocks.

With collections in new mutual fund schemes hitting record highs recently, SEBI has stepped in to address the issue. In 2023 alone, new schemes raised an impressive ₹63,800 crore. And in 2024, that total has already crossed ₹94,000 crore, with a few months still left in the year. That’s a massive amount of money, and SEBI wants to ensure it’s invested promptly so that investors don’t lose out.

To address this issue, SEBI has proposed a strict timeline for Asset Management Companies (AMCs). SEBI suggests that AMCs must invest all funds collected during a New Fund Offering (NFO) within 30 days from the date they allot fund units to investors. In exceptional situations—such as unusual market conditions—SEBI could grant a 30-day extension, giving AMCs a maximum of 60 days to deploy the funds. But that’s the limit—no more than 60 days, no matter the circumstances.

Currently, the rules for NFOs mainly focus on how long these offerings can remain open. An NFO can’t stay open for more than 15 days, meaning AMCs have just two weeks to gather investments before the offering must close. However, there is no specific rule about how soon these collected funds must be deployed according to the fund’s investment strategy.

The only existing rule allows AMCs to temporarily park these funds in low-risk government securities during the NFO period. However, SEBI’s data indicates that most AMCs are already able to deploy their funds fairly quickly. In fact, SEBI reviewed NFOs over the last three years and found that out of 647 NFOs, 603 were able to invest the funds within 30 days of allotment. Extending this to 60 days covers nearly all cases, as 633 of these NFOs deployed the funds within that time, accounting for 98% of all cases.

Based on these numbers, SEBI argues that AMCs don’t really need more than 30 or 60 days. Delays not only reduce investor returns but also suggest that AMCs may not be prioritizing investors’ best interests.

So, what happens if AMCs don’t stick to this timeline? SEBI isn’t just making a suggestion here—they’re proposing strong consequences for non-compliance. For one, AMCs could lose the ability to launch new schemes if they repeatedly fail to deploy funds on time. This is significant, as new fund launches are a key part of their business model.

Additionally, SEBI might require AMCs to waive exit loads (fees investors pay when they leave a fund) if they don’t invest on time. By waiving these fees, SEBI is giving investors the option to exit without penalties if they feel their money isn’t being used as promised. This could impact the AMC’s business and reputation, as investors may steer clear of funds with a history of deployment delays.

Through this proposal, SEBI is essentially urging AMCs to be more responsible with investor funds. If market conditions aren’t ideal, SEBI suggests that AMCs should consider moderating how much they raise during the NFO rather than holding onto funds for extended periods. In short, SEBI wants AMCs to recognize that holding onto cash for too long is unfair to investors.

Ultimately, SEBI’s proposal is about ensuring that AMCs put investors’ money to work promptly, delivering the returns they were promised according to the fund’s strategy. This move aligns with SEBI’s broader push for transparency and fairness in India’s growing mutual fund industry, especially as fund collections hit record highs each year.

If SEBI’s proposal goes through, investors can expect their money to be put to work faster when they invest in a new fund offering, aligning with the fund’s stated goals and potential returns.

Tidbits

JSW is in discussions with Haier for a joint venture in consumer electronics, which could give a significant boost to local manufacturing in India. Facing regulatory restrictions, Haier may consider giving up majority control—a strategic move to enter the Indian market amid increasing competition.

Meanwhile, Hero Electronix plans to sell a 25-30% stake in its semiconductor firm, Tessolve, aiming to raise between $120-150 million. This aligns with India’s growing semiconductor industry, as Tessolve currently serves 80% of the top global semiconductor clients and is expected to expand further with additional investor support.

Diesel sales in India are slowing down, with October sales remaining flat and year-to-date growth at just 1.8%. Shifting consumer preferences and seasonal factors are driving a shift toward gasoline, indicating changing energy consumption trends in the country.

Vanguard recently cut Ola Cabs valuation to $2 billion, down from a peak of $7.3 billion, raising caution among investors as the company prepares for an IPO. With rising competition and financial challenges, Ola Cabs IPO journey is expected to face close scrutiny.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

Vanguard recently cut Ola’s valuation to $2 billion, down from a peak of $7.3 billion, raising caution among investors as the company prepares for an IPO. With rising competition and financial challenges, Ola’s IPO journey is expected to face close scrutiny.

This event already completed right