India’s hidden oil treasure: The race against renewables

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

India's cautious FDI balancing act

Energy transition

India’s growth story

Tidbits

Ratan Tata - A tribute from team Daily Brief

India's cautious FDI balancing act

Recently, India has taken a careful, step-by-step approach to adjusting its Foreign Direct Investment (FDI) policy. Instead of making sweeping changes, the government is focusing on smaller, targeted updates in areas like defense, insurance, and banking.

A full policy overhaul would have meant rethinking the rules that let foreign companies invest in India. But right now, the focus is on making gradual improvements where they matter most.

Oh, and in case you're wondering, FDI is basically when foreign businesses invest money into Indian companies. This investment can bring in funds that boost industries, create jobs, and help the overall economy grow. Over the years, India has been opening up more sectors to foreign investment, but now it seems that targeted changes are the preferred route.

At the beginning of 2024, the Economic Survey even suggested that India might want to allow more Chinese FDI. The idea was that Chinese investments, especially in electronics manufacturing, could help India boost its exports.

This fits into a global trend called the "China Plus One" strategy, where companies look to set up manufacturing outside of China, in countries like India. The thought was that Chinese investments could bring more factories and jobs to India, instead of India just importing Chinese products with little added value locally.

But India's Commerce Minister, Piyush Goyal, quickly shot down this idea. He made it clear that while the Economic Survey can make suggestions, those ideas aren’t binding. The government isn't planning to change its stance on Chinese investments. This reflects India's overall cautious approach when it comes to foreign influence, especially in key areas. Even though China plays a big role in global manufacturing, India’s relationship with China has been sensitive, especially after the 2020 clashes in the Galwan Valley.

A good example of this cautious approach is what happened with BYD, the Chinese EV giant. BYD wanted to invest $1 billion to build a manufacturing plant in India, but the government turned down the proposal. Now, instead of making cars locally, BYD has to focus on importing them into India, which costs more. For a country aiming to lead in EVs, this could have been a big opportunity, but national security concerns outweighed the potential economic benefits.

It’s clear that India is hesitant to welcome more Chinese investments, especially in sensitive areas like EVs. The government is trying to balance the need for foreign money with concerns about security and strategic interests.

Alongside these sector-specific changes, India is also thinking about setting up a new regulatory body to keep a closer watch on FDI. This would act as a sort of watchdog, tracking foreign investments to ensure they align with India's broader goals. The goal is to make sure that foreign investment supports the country’s interests without bringing in unwanted risks. This extra layer of oversight would help make FDI safer and more beneficial over time.

So, while India remains open to foreign investment, it's clear that the government is taking a careful approach—encouraging investments where they make sense but being mindful about which countries get to invest, especially in areas that might affect national security. By considering this new regulatory body, India is adding an extra layer of protection to ensure that foreign money truly benefits the country without compromising its strategic interests.

Energy transition

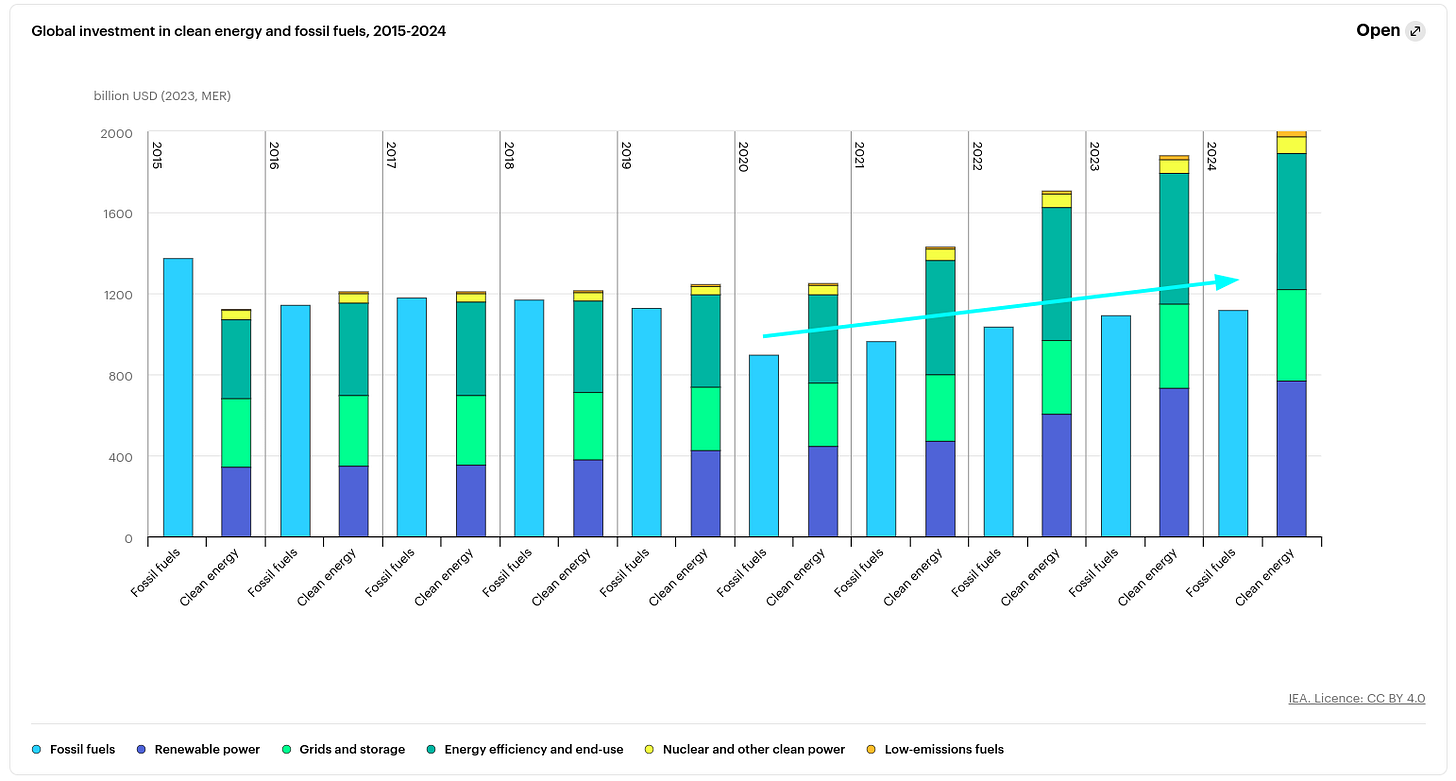

You’ve probably noticed a lot of buzz about the energy transition lately—and for a good reason. In FY24, global investments in clean energy hit a whopping $2 trillion. That’s a 60% jump since FY20, and it's now more than double what’s being spent on fossil fuels. Makes sense, right? Everyone’s aiming for a greener, cleaner world.

And India’s not missing out either. Just last year, we poured $82 billion into clean energy projects, all part of our goal to generate 50% of our power from renewable sources by 2030.

But here’s a question: with all this cash flowing into clean energy, does that mean traditional oil and gas are getting left behind? You’d think fossil fuels would be on their way out, especially with the “sunset industry” label they often get. The idea of “peak oil”—the point where oil production peaks and then starts to decline—seems to back that up. So, is oil as good as dead?

Well, not quite. The reality is a bit more complicated. While it’s true that clean energy investments have skyrocketed, fossil fuel investments haven’t exactly come to a halt either. Since 2020, investments in fossil fuels have grown too—going from $900 billion to $1.1 trillion. Sure, it’s not growing as fast as clean energy, but it’s still a pretty big number.

What’s interesting is that most of this push for more fossil fuel investment is coming from companies in the Middle East and Asia.

So, what does this mean? There’s no doubt that clean energy is leading the charge, but the global landscape is still mixed. Emerging markets and developing economies (EMDEs), excluding China, only account for about 15% of global clean energy investment. Instead, these countries are still focusing more on fossil fuels, trying to follow the same path that developed nations and China took not too long ago.

And today, we’re going to take a closer look at one key player in the EMDE group: India.

But before diving into what India’s doing, let’s zoom out a bit to understand the bigger picture of fossil fuels here.

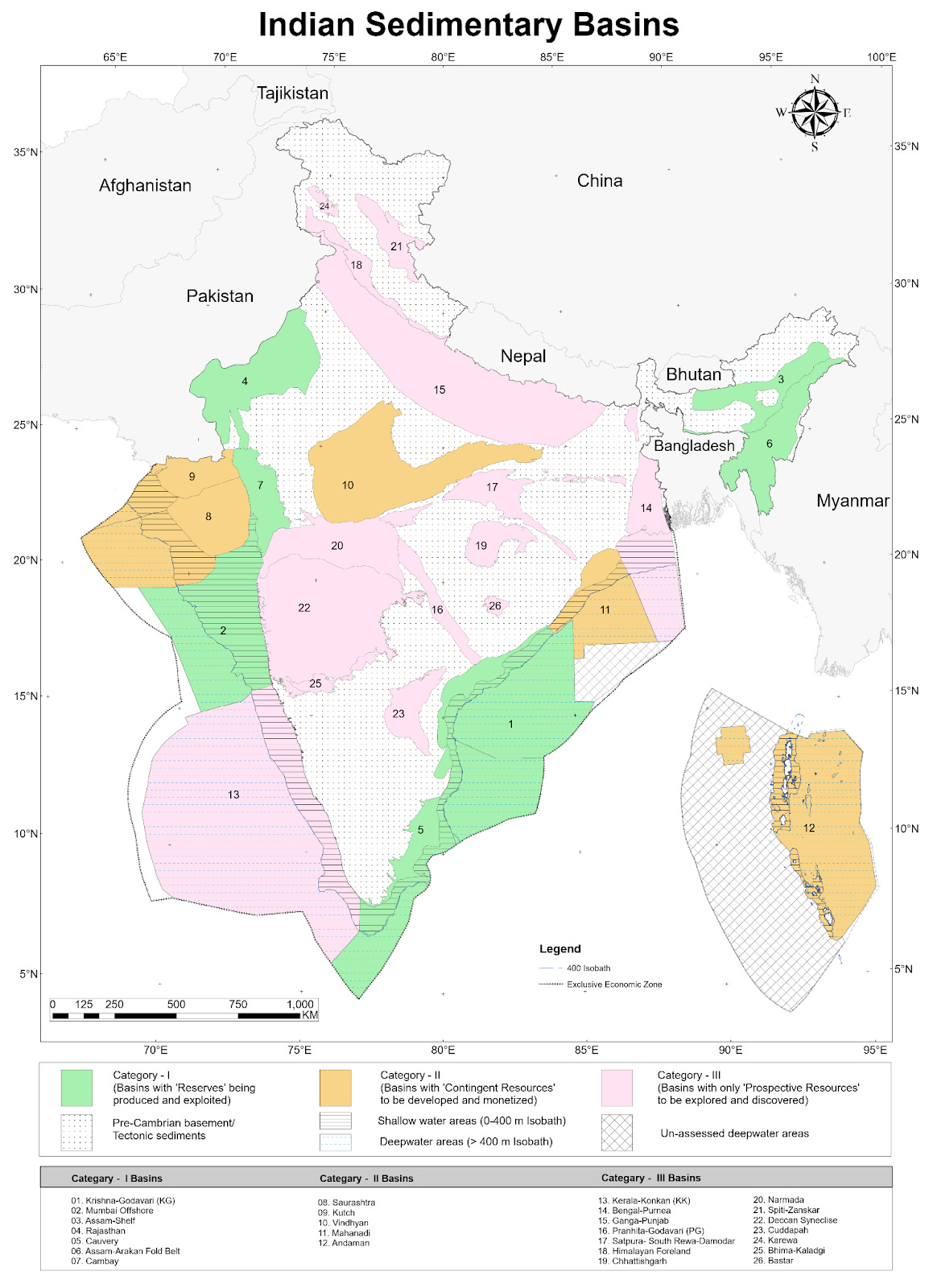

Fossil fuels, as you probably know, come from sedimentary rocks formed over millions of years from decayed plants and animals buried under layers of sediment. With enough heat and pressure, that organic matter transforms into coal, oil, or natural gas. India has 26 sedimentary basins, covering about 3.4 million square kilometers. These basins are divided into three categories, depending on how mature the resources are.

Under the Open Acreage Licensing Policy (OALP), these basins are broken down into smaller blocks that oil and gas companies can bid on. Winning a bid gives a company the right to explore and extract oil or gas from that area.

But here’s the twist: only about 10% of India’s sedimentary basin area is being explored right now. The rest is either locked away as “no-go” zones or considered not profitable enough to attract investment. And that’s a pretty big deal when you think about the estimated 22 billion barrels of untapped potential in India’s lesser-explored basins (according to S&P Global Commodity Insights). To put that into perspective, India has only discovered around 2 billion barrels of oil in the last two decades, while countries like Angola, Norway, and Guyana have each found 10 billion, and Brazil, an incredible 40 billion.

India’s Petroleum Minister, Hardeep Singh Puri, wants to change that. He’s made it clear that we’re sitting on untapped resources and is pushing to open them up. Recently, the government has cleared 1 million square kilometers of previously restricted land for exploration. And the response has been promising. In the latest OALP round, 38% of the bids were for these newly opened areas.

But it’s not just about opening up more land. The government is also encouraging foreign companies to join India’s exploration efforts by offering perks like compensation for helping with seismic surveys. They’re also updating the legal framework to protect companies from unexpected taxes and making it easier to resolve disputes outside of India.

All of this points to one clear goal: reducing India’s dependence on oil imports, which costs us over $150 billion a year in foreign exchange.

But will this strategy pay off? Especially as the rest of the world shifts toward renewable energy? That’s the big question India is facing right now.

India’s growth story

In our next story, let’s dive into the latest economic update from the World Bank, which has a few big insights for South Asia, especially India. There’s a lot here that matters for us as investors—like upgraded growth forecasts and the ongoing impact of climate change on this region. We’ll also see how shifting global dynamics are creating both challenges and opportunities for economic stability in South Asia.

We’ll break this down into three parts:

First, the World Bank’s upgraded growth forecast for India. We’ll explore what’s driving this and what it means for the country’s future.

Second, how extreme weather is affecting South Asia, especially India, and the potential economic and social impacts.

Third, the effects of global geopolitical shifts and how South Asia is navigating an increasingly divided world economy.

Part 1: India’s growth prospects

Let’s start with some good news: the World Bank has raised India’s growth outlook. They now expect the economy to grow 7% in FY 2024-25, up from an earlier estimate of 6.6%. While growth might slow slightly to 6.7% in FY 2025-26, India remains one of the fastest-growing economies in the world. South Asia as a whole is doing well, but India’s strong domestic demand is leading the way.

So, what’s behind this upgraded forecast?

Stronger Private Consumption: A rebound in agriculture and policies that are boosting employment have pushed consumer spending higher. Rural areas are seeing better incomes thanks to strong agricultural output, creating a positive ripple effect across the economy.

Agricultural Boost: A solid year of productivity in agriculture has lifted income levels, especially in rural areas. Better harvests mean more spending power, which in turn supports the broader economy.

Manufacturing and Services: Both these sectors are holding up well. India’s manufacturing sector is expanding faster than many other emerging economies, and the services sector has been growing for over 30 months. While exports of goods have been a bit slow, the services sector—particularly in IT and finance—remains strong.

Rising Portfolio Investments: Foreign portfolio investments (FPIs) have been on an upswing, nearly reaching pre-pandemic levels. They’ve grown for eight straight quarters, unlike in other South Asian countries where such investments have stalled. A major boost came from India’s inclusion of rupee-denominated government bonds in global bond indices, which has improved investor confidence.

Quick note: FPIs, unlike longer-term foreign direct investment (FDI), are typically shorter-term investments in financial assets like stocks and bonds, and can be more volatile. However, this inflow of capital shows strong confidence in India's markets.

Stable Inflation: Inflation in India is under control, staying within the Reserve Bank of India’s target range of 2-6%. This stability boosts consumer confidence, encouraging more spending, which supports overall economic growth.

Part 2: Climate change hits South Asia hard

Now, let’s shift gears to a more pressing concern: climate change. South Asia, and India in particular, is feeling the impact of extreme weather more than ever. Heatwaves and floods are becoming more frequent, and the effects are both humanitarian and economic.

Heatwaves on the Rise: Intense heat is becoming more common in India, and it’s hitting the poorest households hardest. Many don’t have access to cooling systems, making them especially vulnerable. This results in lower productivity and a greater risk to their overall well-being.

But it’s not just households that are struggling. Small businesses are also feeling the heat. Many don’t have the funds to adapt to rising temperatures or deal with flood risks, making them less productive. This is especially true in industries like garment manufacturing, where manual labor is crucial.

This highlights a growing gap in how climate change affects different parts of society. Poorer households and smaller businesses bear the brunt, while larger companies often have the resources to adapt. There’s a real need for targeted measures like better social protections and stronger infrastructure to help those most at risk.

If these issues aren’t tackled, they could seriously slow down economic progress. Building climate resilience is becoming a critical part of the policy agenda—not just to protect the vulnerable but to ensure sustainable growth across the region.

Part 3: Geopolitical shifts and South Asia

Finally, let’s talk about how South Asia is dealing with the shifting global economy. As the world divides into economic blocs, countries have to adjust to new challenges. For South Asia, this brings both risks and opportunities.

Less integrated, less exposed: South Asia hasn’t been as tightly connected to global trade networks as regions like East Asia. This means it’s less vulnerable to global trade disruptions, but it also means missing out on some benefits of deeper integration into global value chains.

Take India, for example. It’s been relying more on exports and investment from countries like the U.S. and the U.K. This has helped the economy grow but also brings risks—especially when tensions with other countries, like China, increase. Interestingly, China is a smaller player in terms of investment in India compared to other emerging markets, which gives India some buffer from broader geopolitical shifts.

Proactive steps: India isn’t standing still. The government has introduced the National Logistics Policy to improve infrastructure, reduce logistics costs, and make exports more competitive globally. The goal is to ensure India can benefit from global supply chains while staying protected from the risks of economic fragmentation.

On the services front, India is doing well. Even as global trade in goods faces challenges, India’s IT and financial services sectors are thriving, offering some cushion against the uncertainties in trade.

Challenges remain: Still, foreign investment into South Asia hasn’t fully bounced back to pre-pandemic levels. There’s more to be done in improving infrastructure, reducing red tape, and creating a predictable business environment to attract global capital.

In short, while global fragmentation brings challenges, it also opens up opportunities. By strengthening its manufacturing sector, building new trade partnerships, and making it easier to do business, India and the broader South Asian region can turn these challenges into long-term growth opportunities.

So, while there’s a lot to keep an eye on, the takeaway here is that with the right strategies, South Asia—especially India—has a solid chance of navigating these global shifts successfully.

Tidbits

The Reserve Bank of India (RBI) has sent a word of caution to NBFCs (Non-Banking Financial Companies), urging them to focus on responsible lending rather than chasing rapid growth. The worry is that aggressive lending, especially with high-interest loans, could threaten financial stability and bring back the credit risks that regulators have been trying to keep under control.

India is on track to meet its entire mobile phone demand through local production by the end of this fiscal year. This is a big deal, as it means less reliance on imports and a stronger position for India as a global electronics manufacturing hub. Companies like Apple and Samsung, with their local production units, have been driving this shift.

Infosys and Microsoft have also deepened their partnership, focusing on integrating generative AI into Infosys' solutions. This collaboration aims to boost cloud services and improve productivity for clients around the world, leveraging both companies' strengths in tech innovation.

Vedanta Resources has taken a major step to cut down its debt. The company recently made an early repayment of $869 million in bonds. By reducing its high-interest debt, Vedanta aims to better manage its liquidity, which should help improve its overall financial stability.

Ratan Tata - A tribute from team Daily Brief

In the end, we wanted to reflect on how Ratan Tata’s passing on October 9, 2024, feels like the end of an era. Mr. Tata wasn’t just another business leader—he was a symbol of integrity, quiet strength, and genuine compassion. Even though most of us never met him, his loss feels deeply personal.

But as we mourn today, we should also celebrate the incredible legacy he leaves behind—one that’s truly rare and hard to match.

Ratan Tata led the Tata Group as Chairman from 1991 to 2012, guiding it through a period of global expansion and high-profile acquisitions like Jaguar Land Rover and Corus Steel. He also launched the Tata Nano, a car designed to make the dream of owning a four-wheeler possible for millions of Indians. And let’s not forget his role in making TCS one of the world’s largest IT services companies, contributing greatly to India’s rise as a technology powerhouse. Today, TCS alone employs over 600,000 people.

But Mr. Tata’s vision went far beyond business or profit. His work with Tata Trusts showed his belief that true success is measured by the positive impact left on society. Through his philanthropic initiatives, he uplifted countless lives.

When we think of powerful figures, we often focus on their influence or wealth. But Ratan Tata’s legacy was different. It’s not just about the companies he built—it’s about the quiet, meaningful ways he touched lives.

Even though most of us never met him, his passing feels close to home. Rest in peace, Mr. Ratan Tata, and thank you for showing us what true greatness and leadership look like.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

समय के साथ आबादी बढ़ती जा रही है आबादी बढ़ने के साथ सभी का मानसिक तनाव भी बढ़ता जा रहा है और हमारा भविष्य खराब होते जा रहा है इस क्षेत्र में बहुत कुछ करना जरूरी है और बगैर देरी किए । सभी जरूरी चीजों की मांग बढ़ती जा रही है और आपूर्ति कम होती जा रही है और मांग आपूर्ति के बीच बढ़ता अंतर हमारी जिंदगी को बद से बदतर बनाते जा रहा है

My mom had a cancer, so I had to often visit to Tata Cancer hospital, first of all that hospital is in prime location any business man would have thought about real estate n minting money on it. Second, medicines made it available in cheap prices so common man can have little hope of surviving from that devil illnesses. Food used to come from Taj Sats n given free to poor people who could not afford daily expenses along with treatment. Many many more…

Great man 🙏🏻