Hello and welcome back to Beyond The Charts. This series is where we break down what's happening in the world of finance and the economy through charts in a way that's easy to understand.

In this edition, we track the pulse of the Indian economy through fresh, high-frequency indicators and some other data points, from inflation and factory output to jobs, corporate earnings, and more.

Prices & inflation

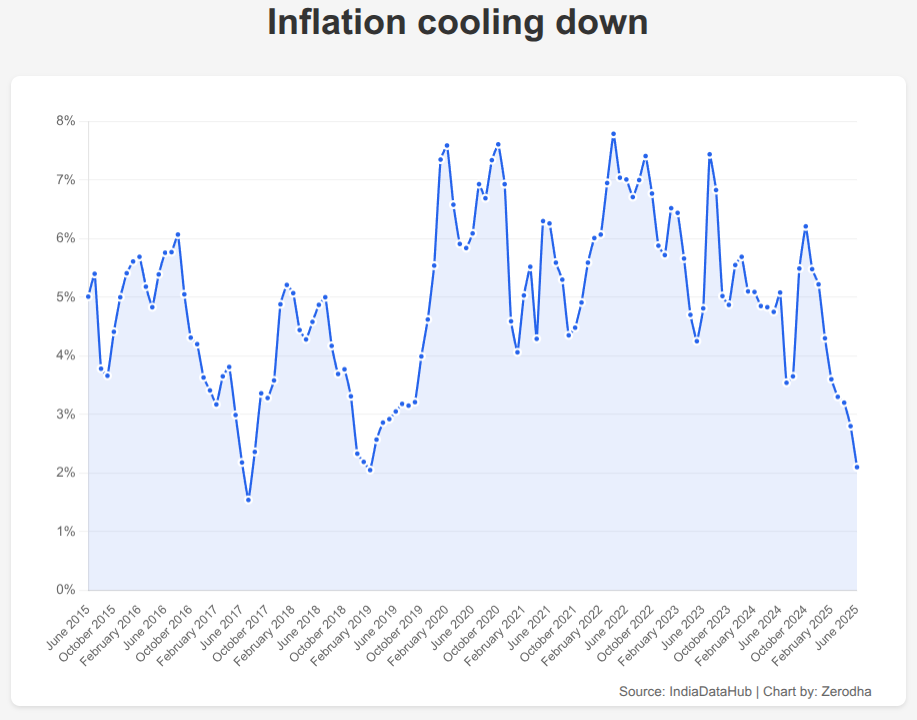

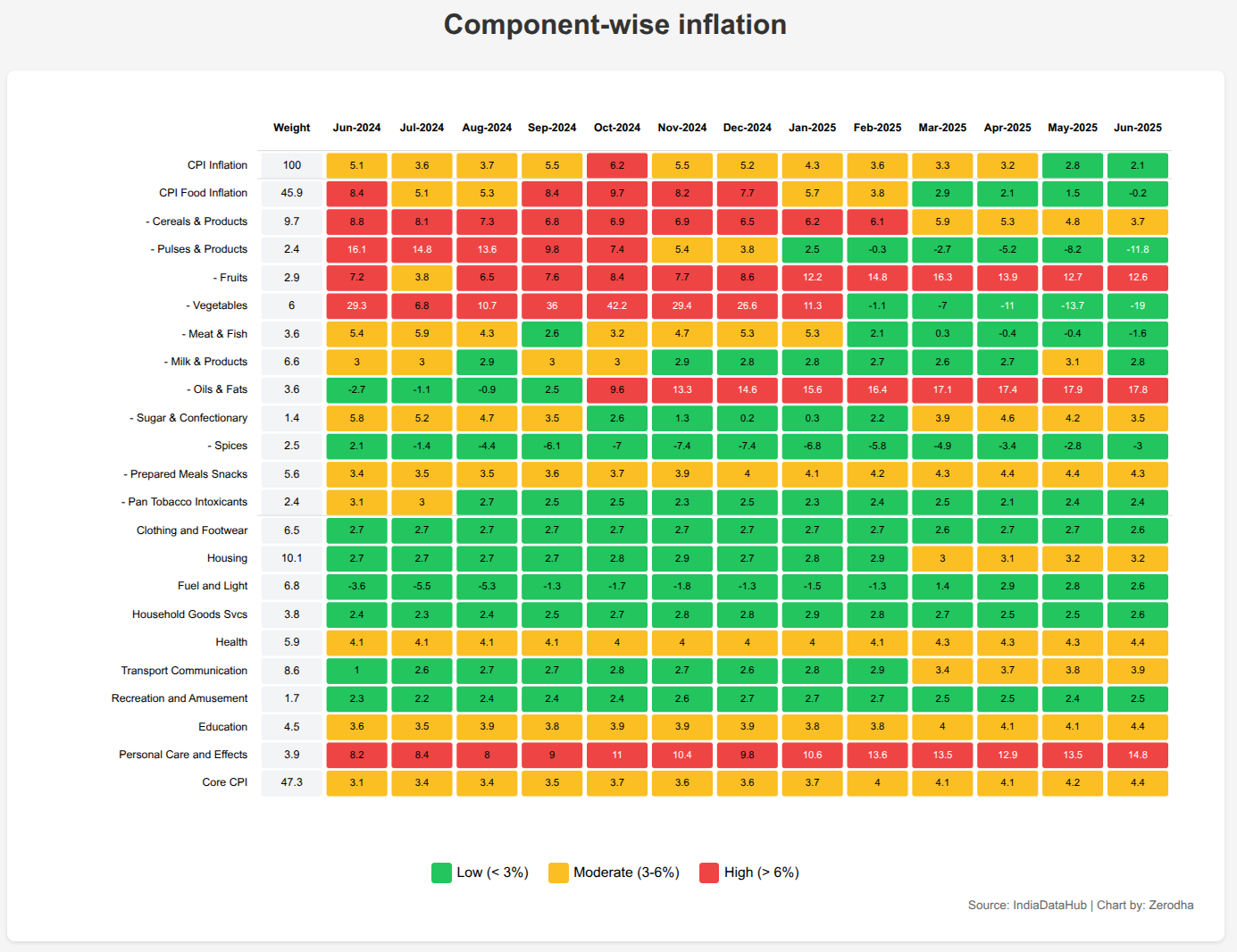

Retail inflation cooled to 2.1% in June 2025—the lowest in six years. The big driver was food prices, which slipped 0.2% year-on-year. Vegetables, last year’s main inflation villain thanks to supply shocks and erratic weather, fell nearly 19% as conditions improved.

Part of this drop is a base effect—prices had spiked in mid-2024, so the year-on-year comparison now makes inflation look lower. Core inflation, which strips out volatile food and fuel, tells a different story. It rose to 4.4% in June, showing that underlying price pressures remain.

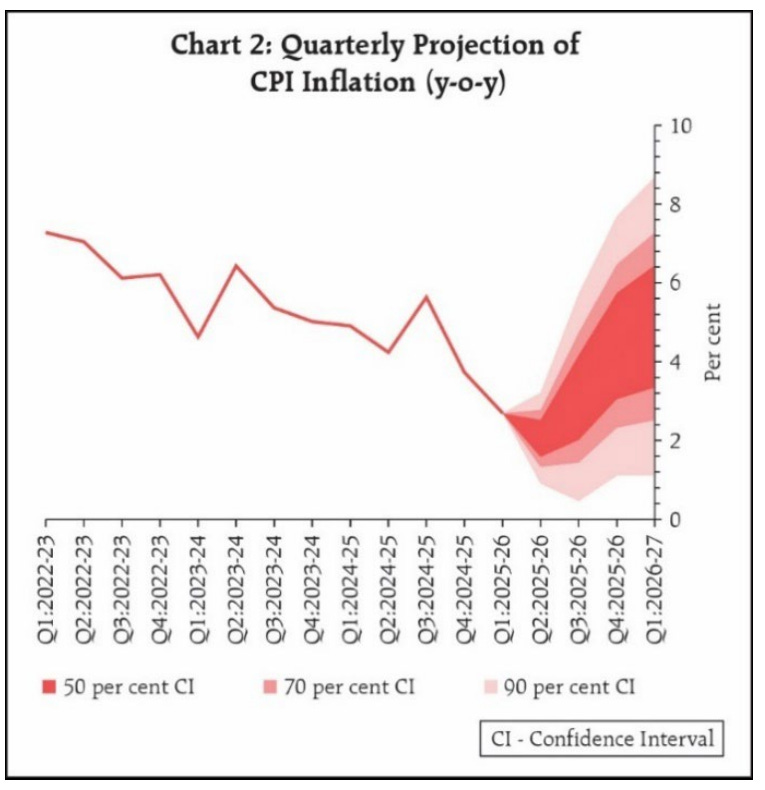

RBI, in its monetary policy statement released on Wednesday, said that inflation could climb back to around 4% by the end of this financial year as the base effect fades and demand picks up.

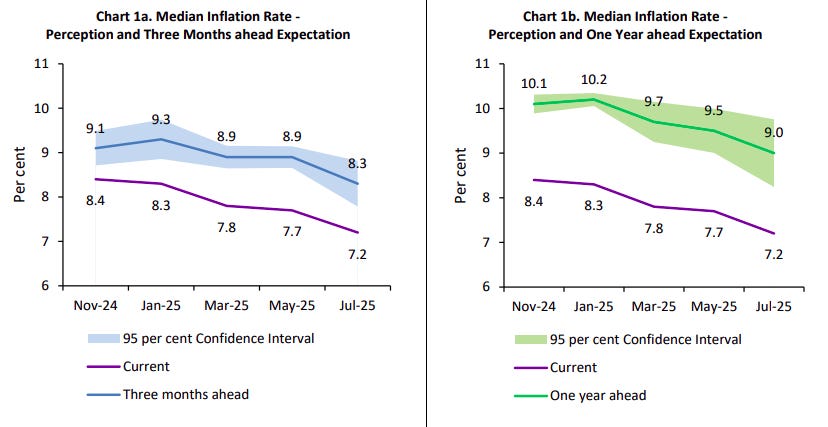

Interestingly, while actual inflation is low, people still expect prices to rise sharply. The RBI’s July survey shows households foresee about 9% inflation over the next year—down slightly from May but still far above reality. So even if prices are stable in reality, people’s worries about inflation haven’t gone away.

Auto sales

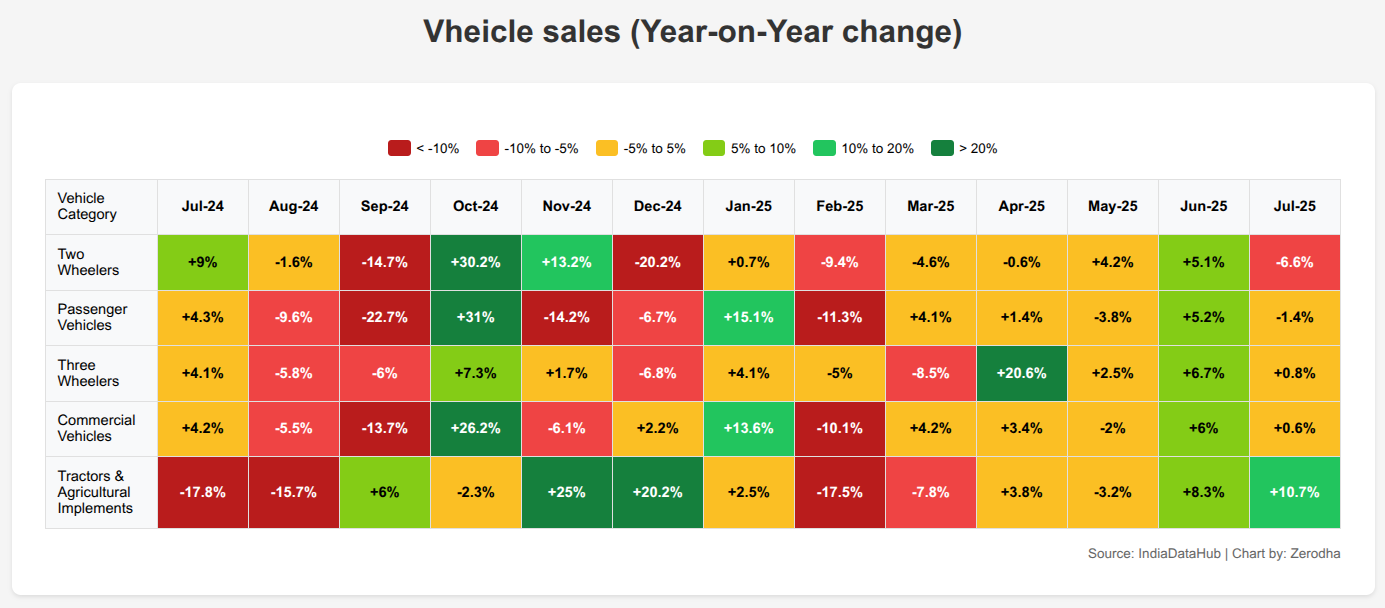

Car sales slipped 1.4% year-on-year in July after growing 5.2% in June. The bigger worry is in two-wheelers—closely linked to rural demand—which fell 6.6% after two months of growth. Three-wheeler and commercial vehicle sales were up only slightly, by 0.8% and 0.6%.

The one bright spot was tractors and farm equipment, with sales jumping 10.7% year-on-year, hinting at healthy farm incomes ahead of the harvest season.

Agriculture

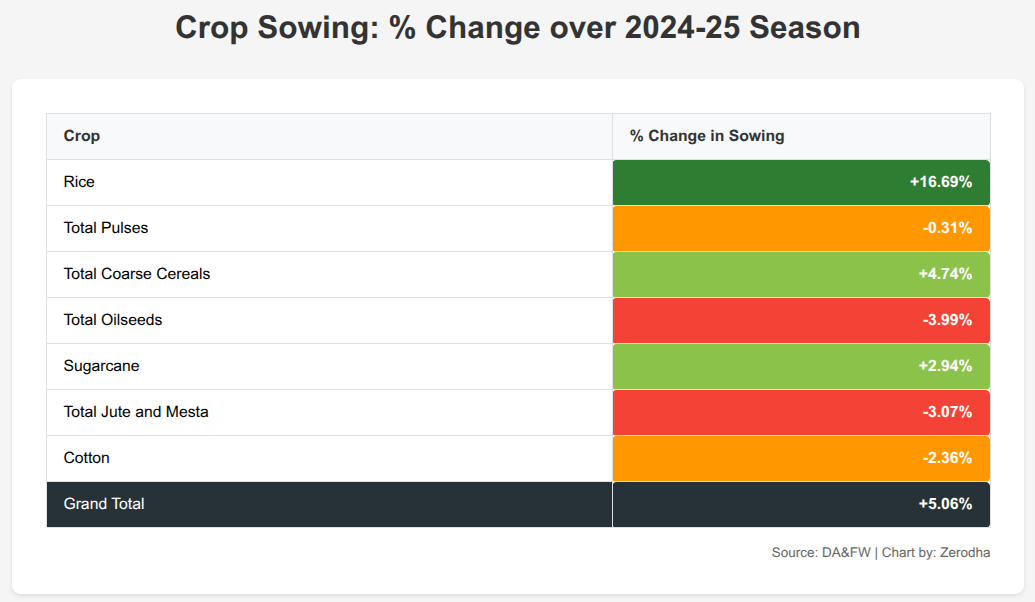

The 2025 monsoon has been a boon so far. By the end of July, rainfall was 7% above normal, helping farmers plant 83 million hectares of kharif crops—over 5% more than last year.

Rice sowing surged 16.69% year-on-year, while coarse cereals like jowar, bajra, ragi, and maize rose 4.74%. These gains could help keep food inflation in check later in the year.

Not all crops are doing well. Oilseeds are down 3.99%, and cotton is lower by 2.36%, partly due to uneven rains in central and western India and weaker crop prices that discouraged planting.

Rural employment & wages

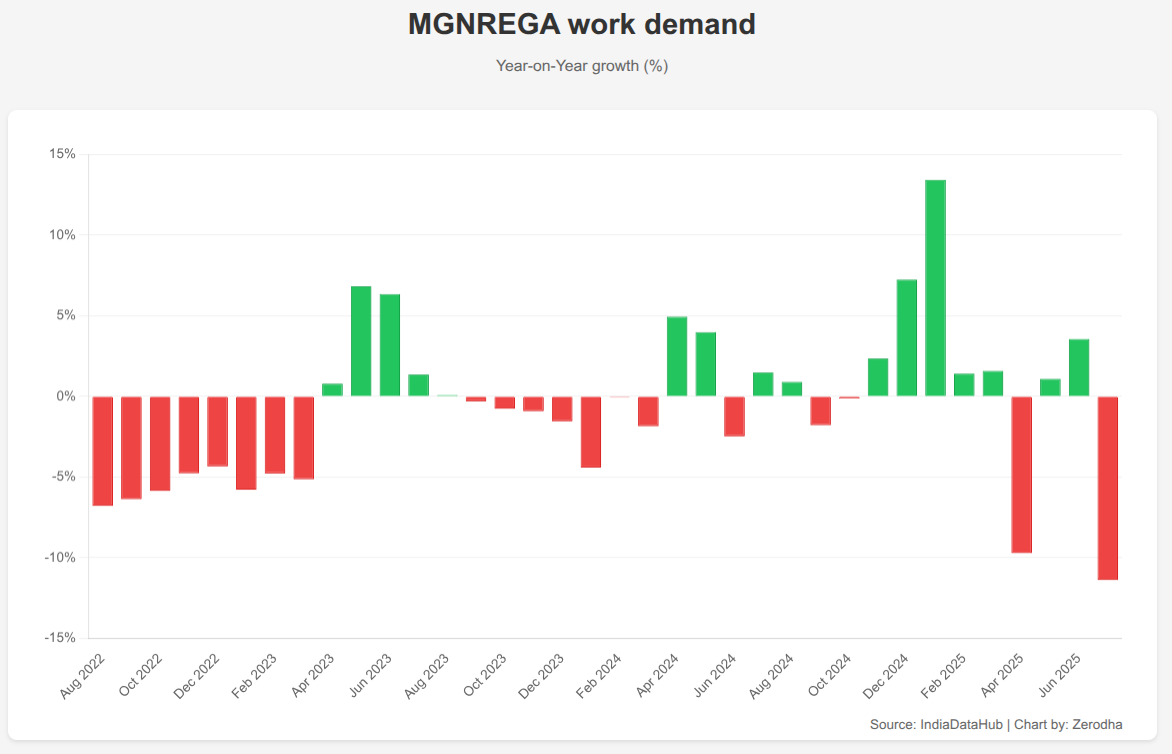

After spiking earlier this year, demand for work under the MGNREGA scheme has cooled. In July, 2.6 million fewer people sought jobs under the programme—a drop of 11.4% from last year—suggesting better job availability.

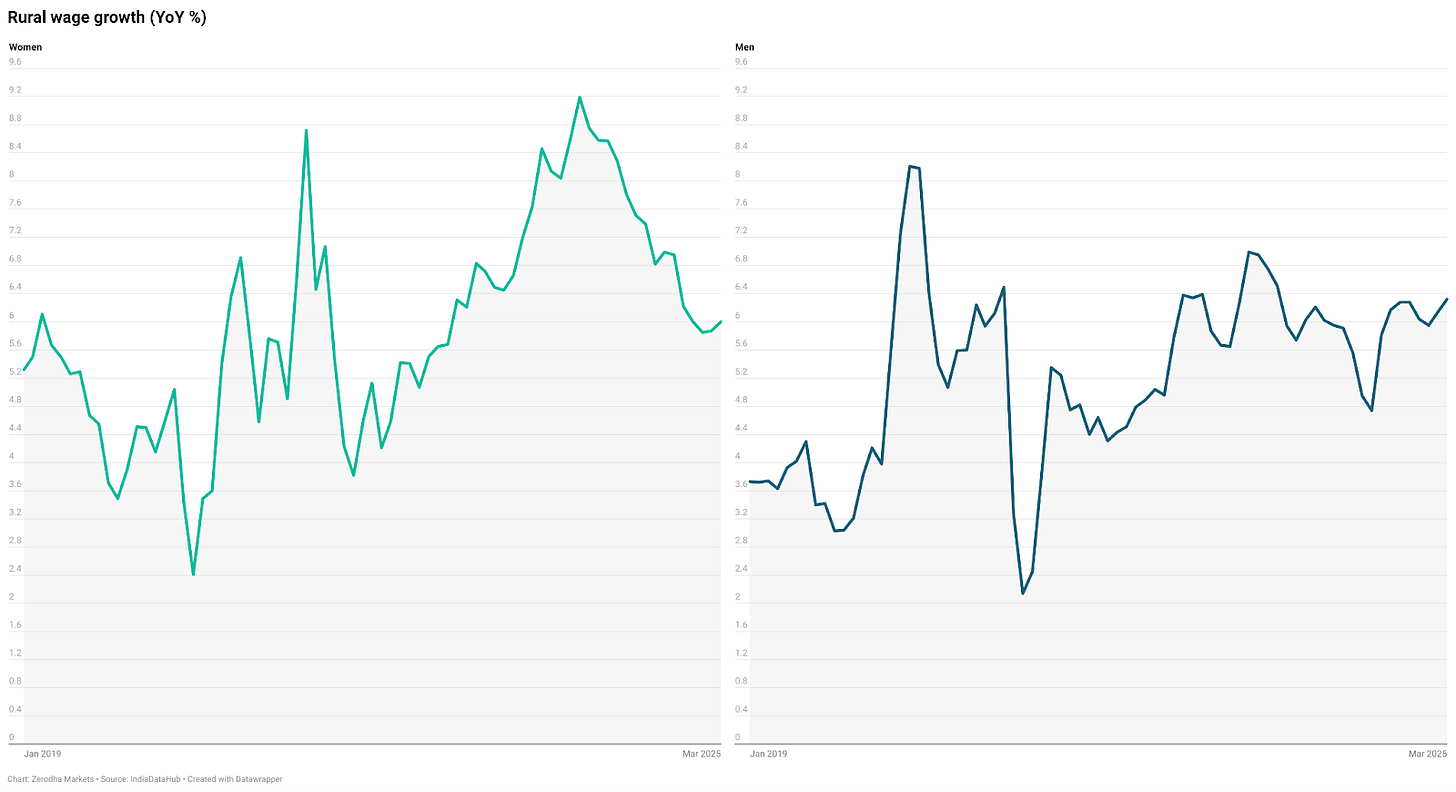

But wages tell a mixed story. Nominal rural wages have risen, but the pace has slowed. Men’s wages have been flat at 5–6% annual growth since mid-2023, while women’s wage growth has dropped from over 8% in 2023 to about 5.5% by March 2025.

Industry & infrastructure

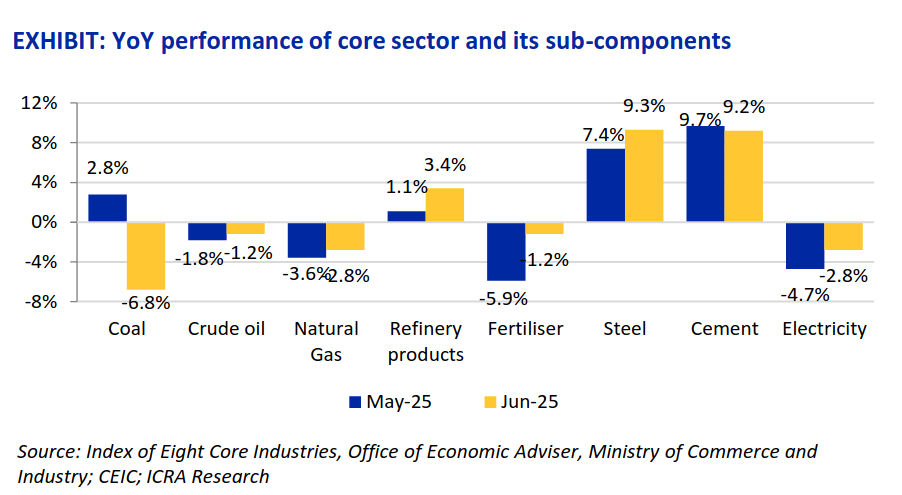

India’s eight core industries grew 1.7% in June 2025—slightly better than May’s 0.7% but far below the 5–6% growth seen in early 2024. Weakness came from coal and electricity output, partly due to last year’s high base. Steel and cement bucked the trend, up over 9%, reflecting strong construction and infrastructure activity.

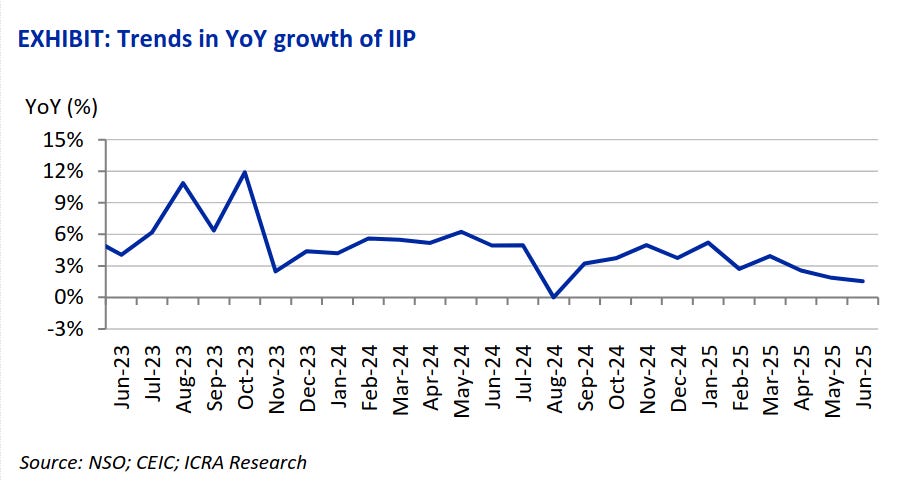

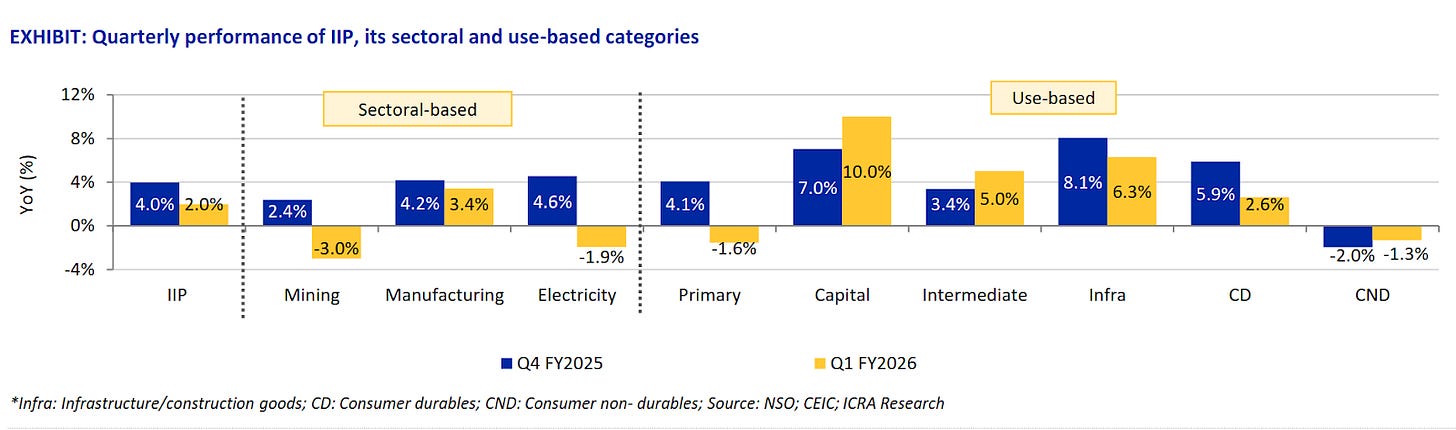

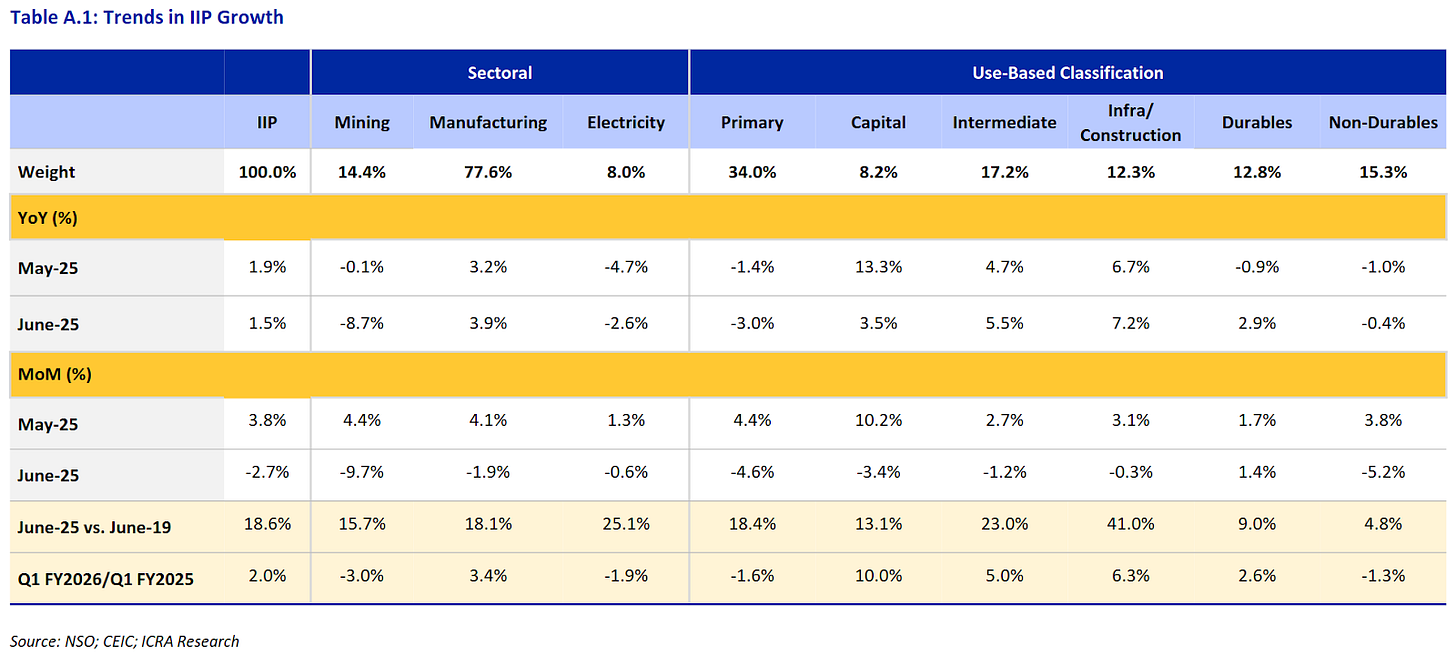

The broader industrial output (IIP) rose 1.5% in June, down from 1.9% in May. For April–June, growth averaged 2%, half the pace of the previous quarter. Manufacturing grew 3.9% in June, but mining fell 8.7% and electricity slipped 2.6%.

Infrastructure-linked goods rose over 7%, but consumer goods were mixed—non-durables like food and personal care fell 0.4%, while durables like electronics and appliances grew 2.9%.

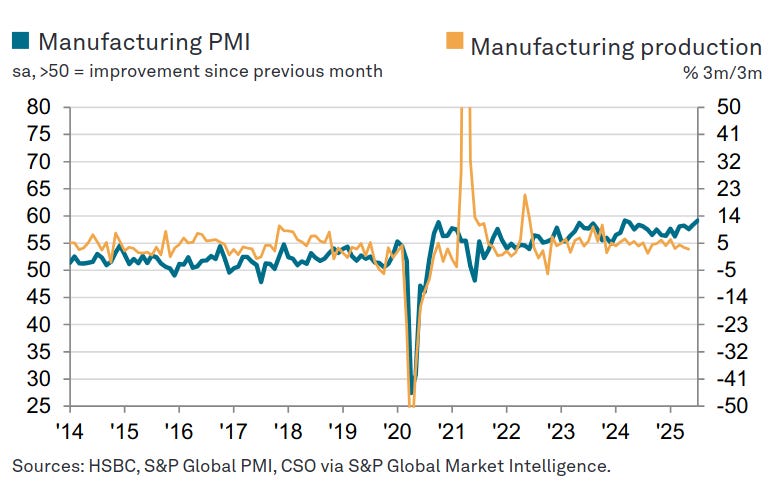

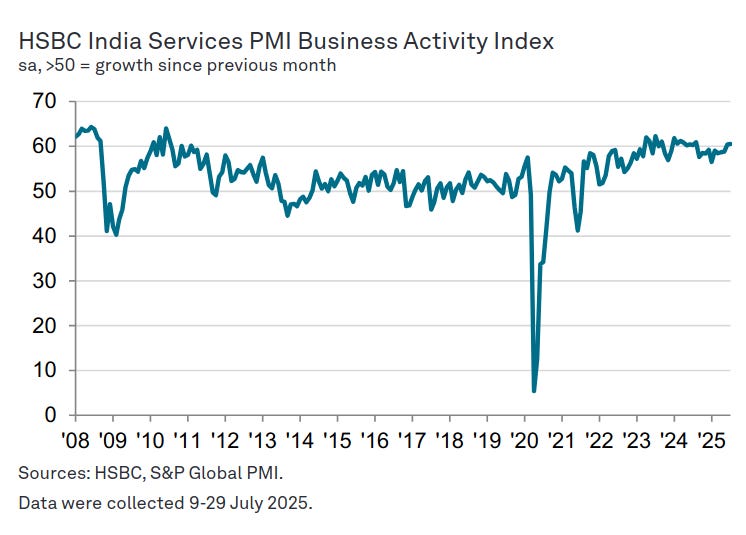

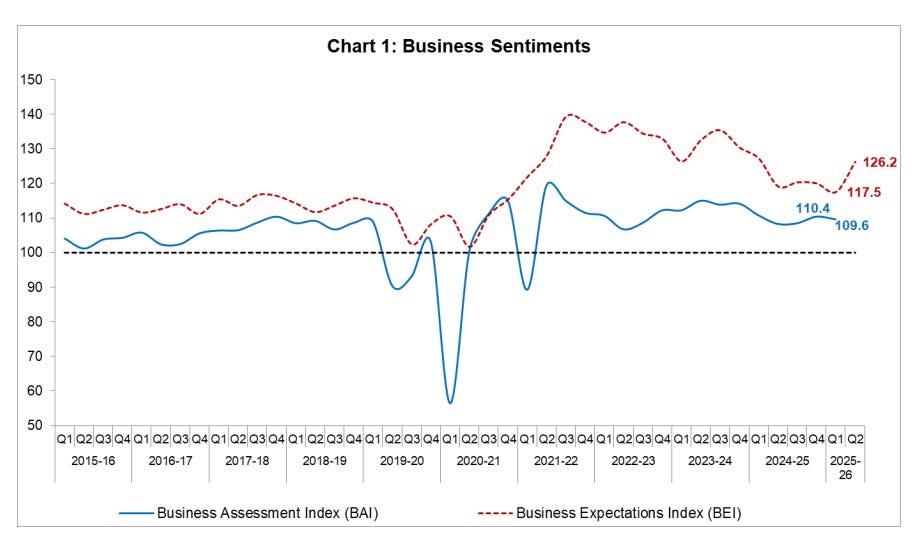

While official output data looks sluggish, business surveys paint a rosier picture.

The HSBC India Manufacturing PMI rose to 59.1 in July, the highest in over a year, driven by more domestic and export orders. Services PMI stayed strong at 60.5, with finance and insurance especially busy. But both sectors saw hiring slow, and business confidence hit a three-year low as firms worried about rising competition and costs.

Trade & transport activity

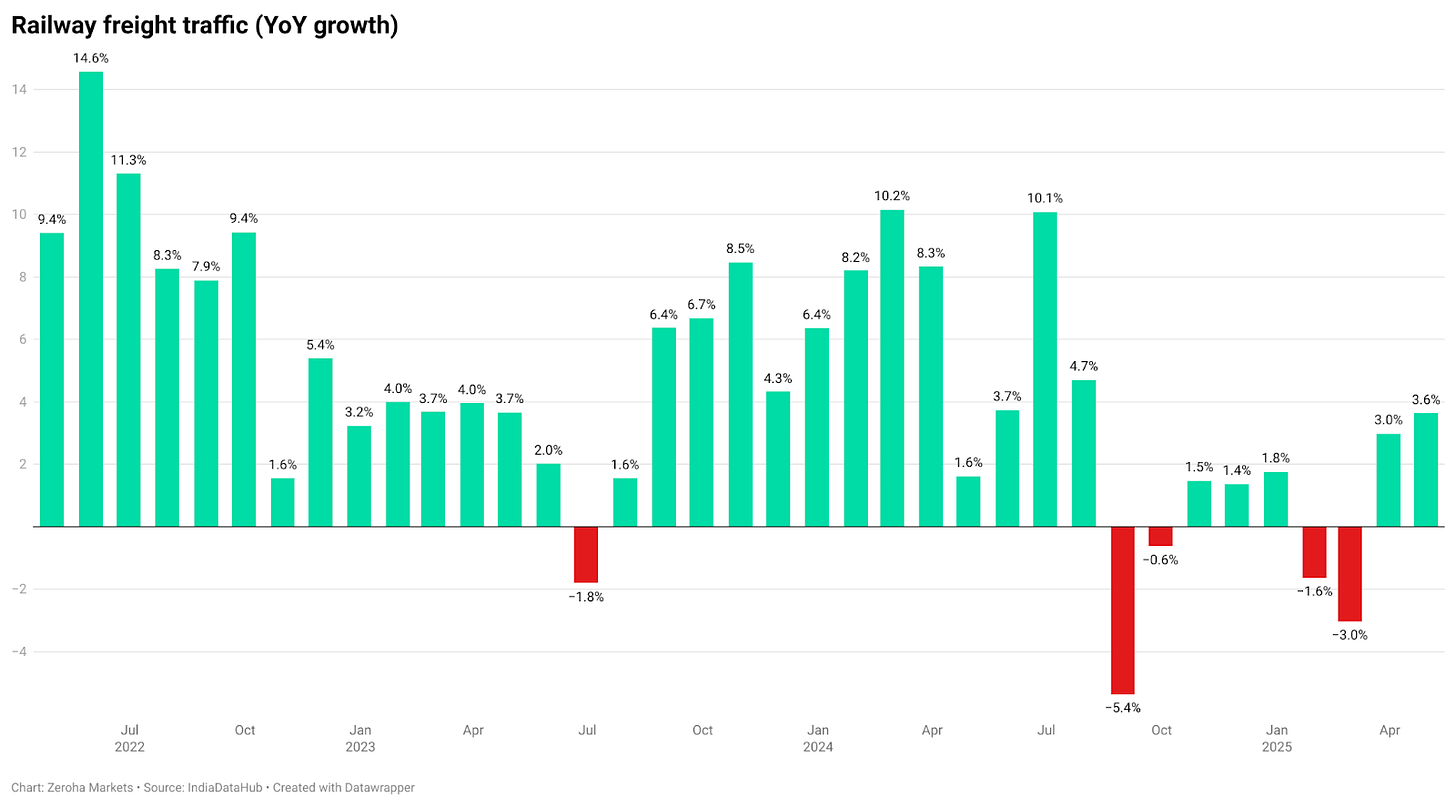

Rail freight grew just 3.6% year-on-year in April, showing muted demand for coal, cement, and food grains. More goods may be shifting to road transport.

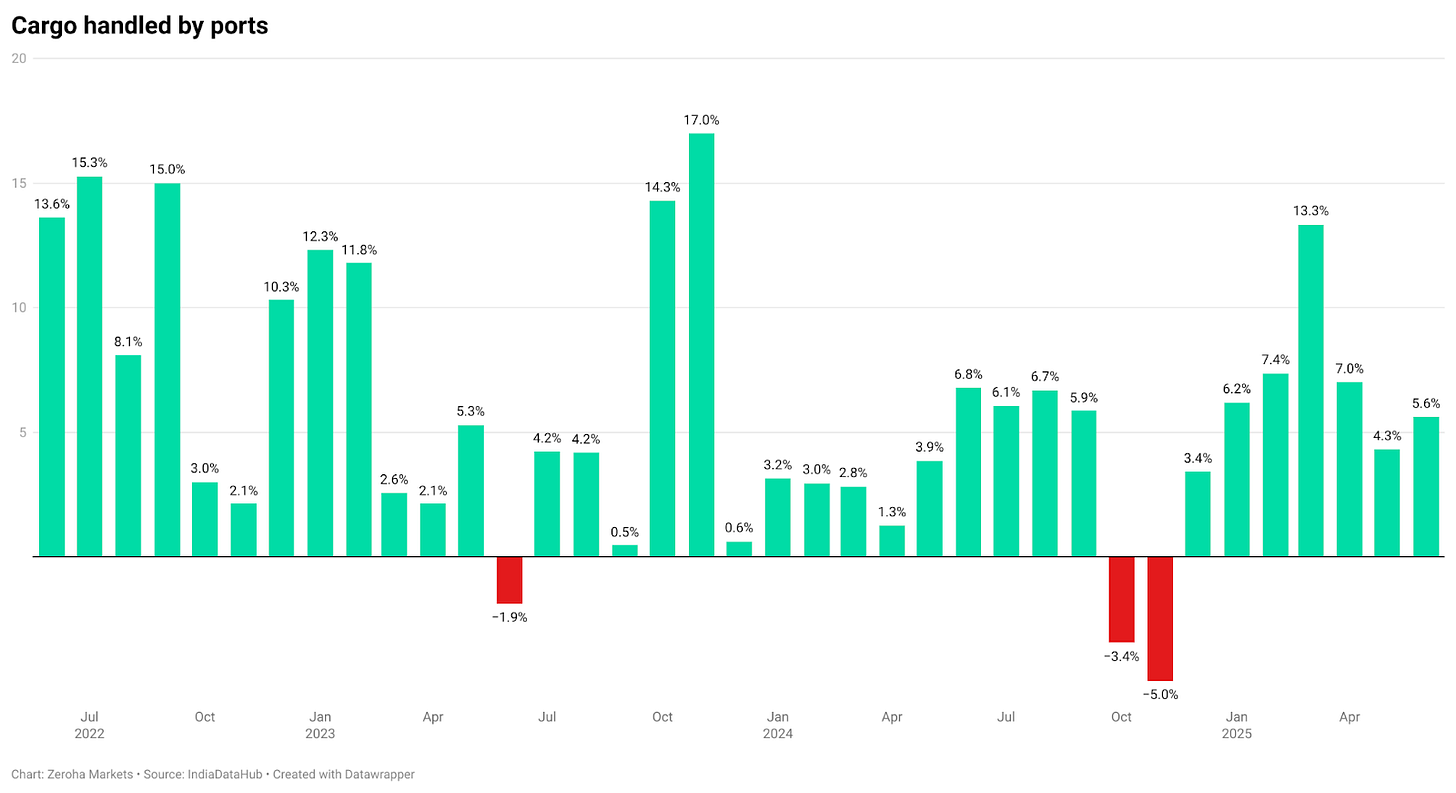

Ports are faring better—cargo handled at major ports rose 5.6% in June from a year earlier, continuing the recovery after last year’s global trade slowdown.

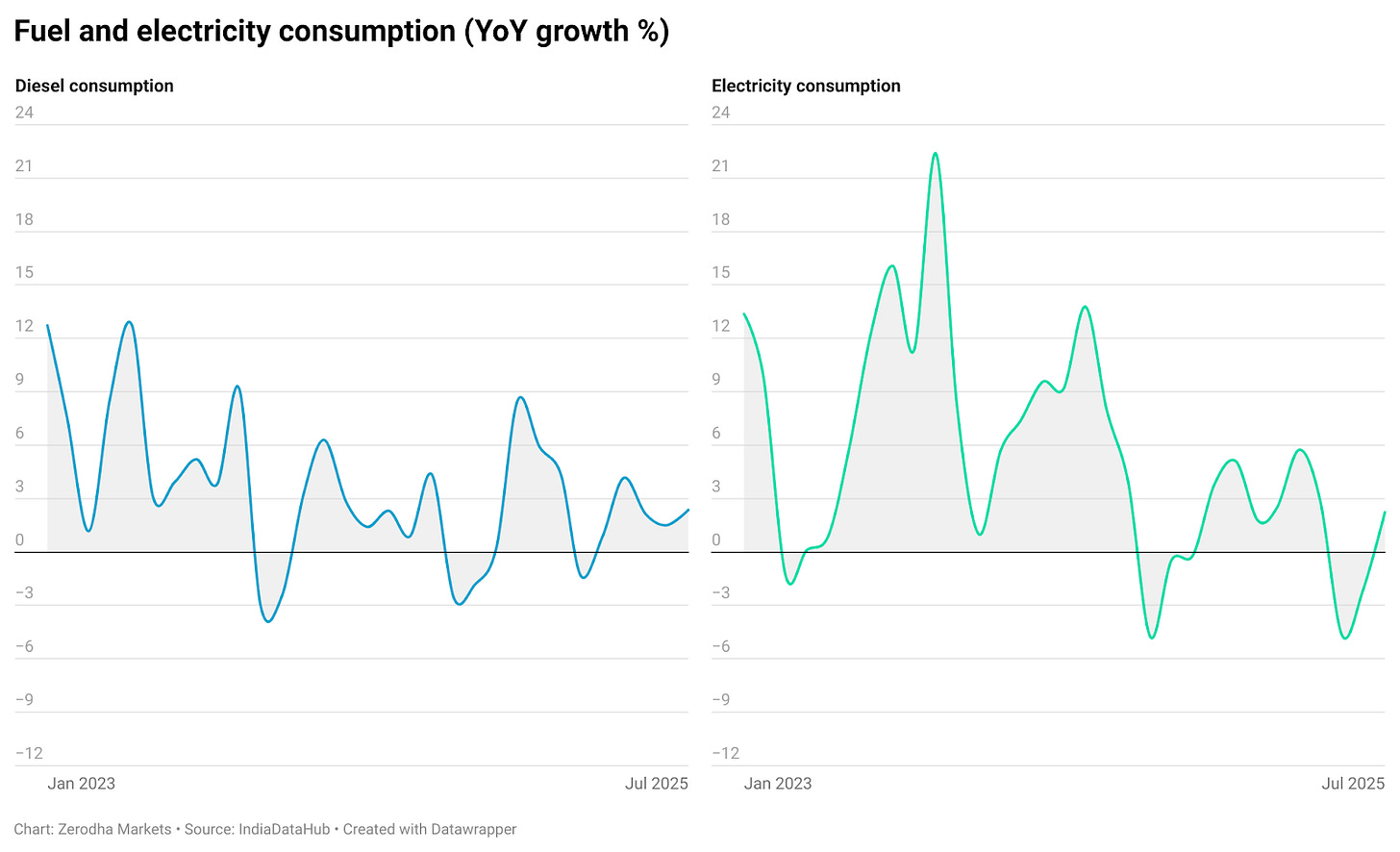

Looking at how much electricity and diesel we’re using can also give us insights into economic activity. Factories, construction sites, trucks, and trains closely depend on power and fuel, not just homes and cars.

Electricity use has been weak. After falling –4.7% in May and –2.1% in June, it rose just 2.2% in July. This dip is partly due to cooler weather and a high base from last summer, but it also reflects muted activity in factories and infrastructure.

Diesel consumption, on the other hand, has been steadier. It grew by around 2–2.4% year-on-year between May and July. That suggests freight and transport are holding up, even if the broader economy isn’t running at full speed.

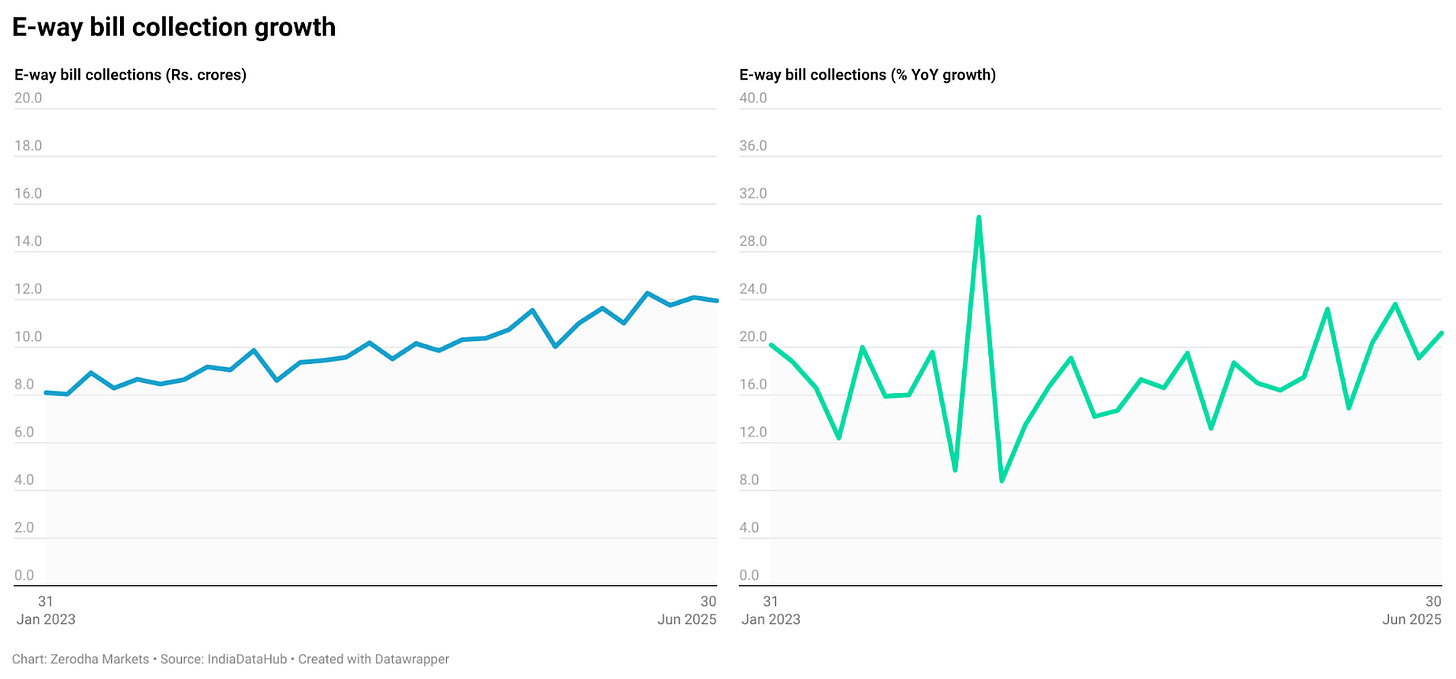

Another way to track goods movement in India is through GST e-way bills, which are required whenever goods are transported. In June 2025, e-way bill generation was about 20% higher than a year earlier. This means more goods are moving across the country, pointing to busy activity in trade and logistics.

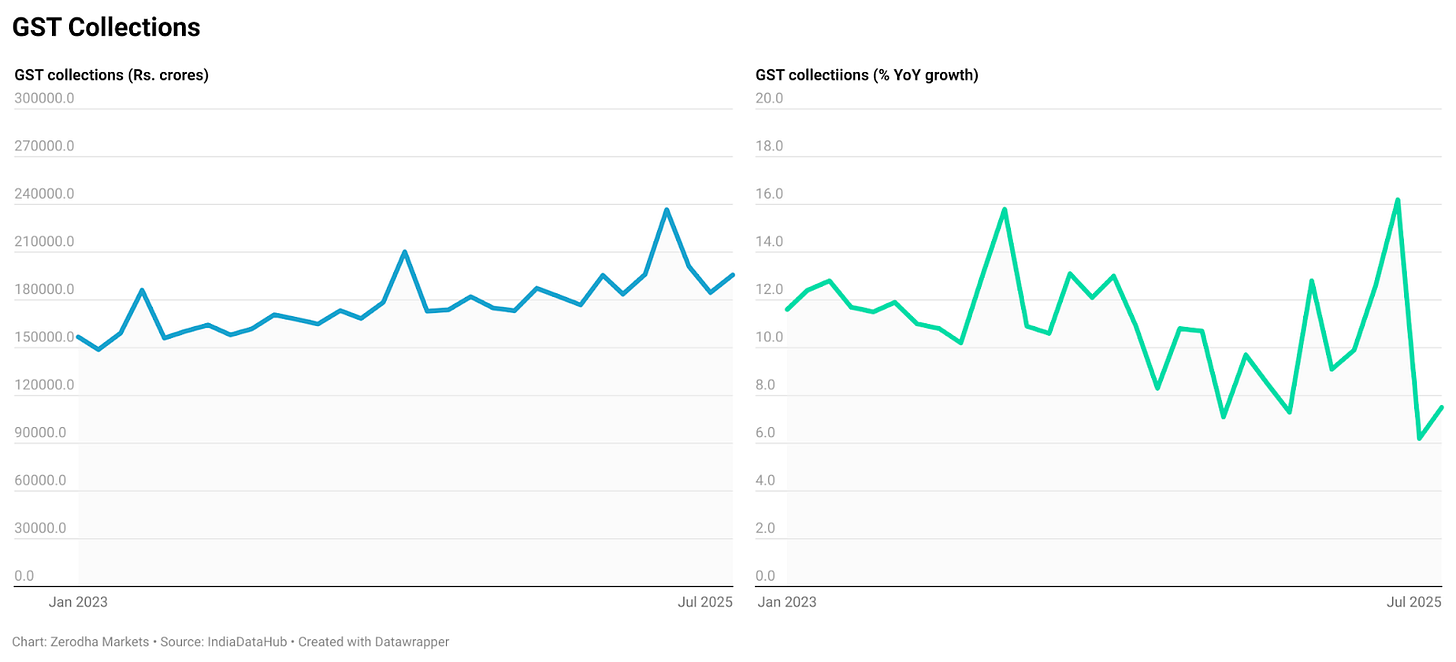

GST collections, however, have slowed in recent months. July’s collections were ₹1.95 lakh crore, up just over 7.5% from a year ago, still strong in absolute terms but softer in growth.

Jobs

Formal hiring is picking up. Naukri’s JobSpeak Index shows July hiring up 8% year-on-year, led by AI/ML roles (+41%), hospitality (+26%), insurance (+22%), real estate (+15%), and BPO/customer service (+14%). Though job growth in the IT sector declined by 1%.

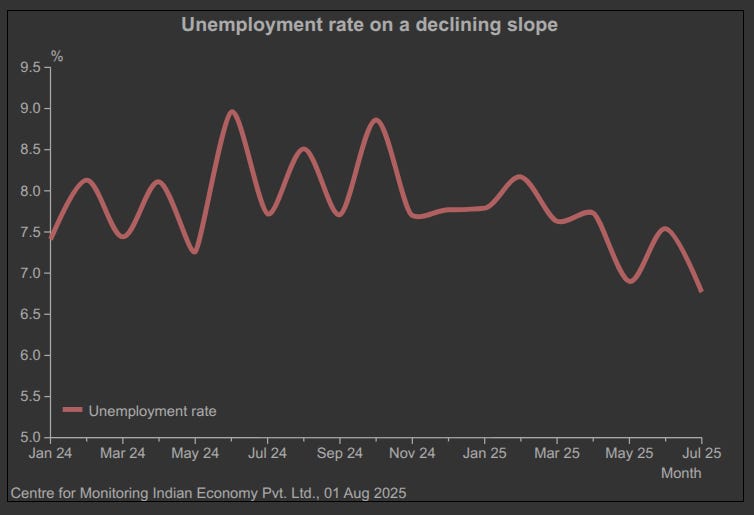

The CMIE unemployment rate fell to around 6.5% in July, from over 8.5% in mid-2024, indicating an improving job market.

RBI’s Business Expectations Index jumped to 126.2 for the July–September quarter, the highest in six quarters. About one in four companies plan to hire, and very few expect to cut jobs.

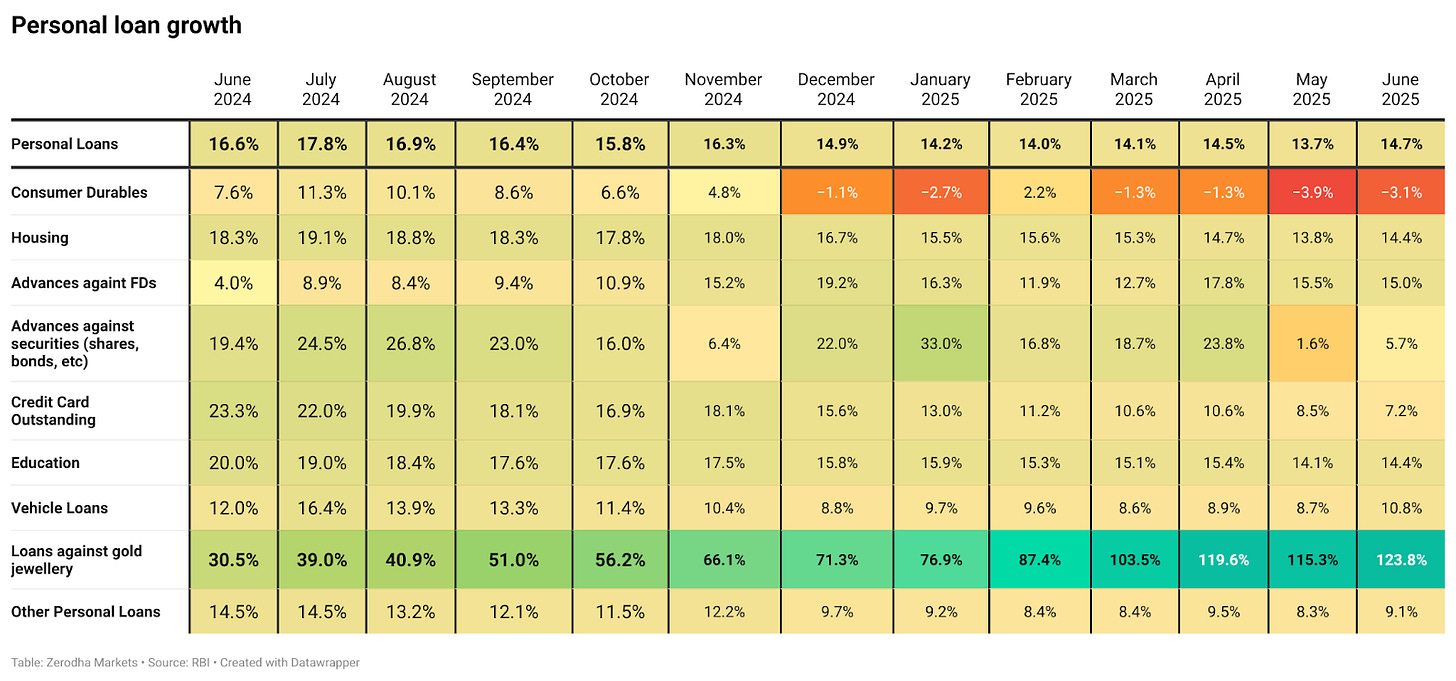

Sectoral credit

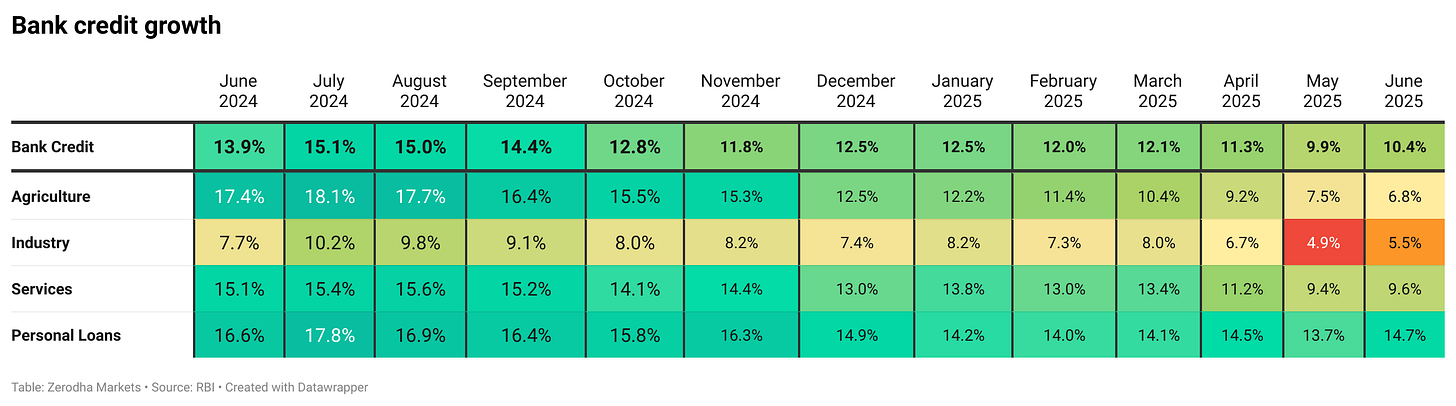

Bank lending is growing at a steady pace, but the kind of borrowers driving that growth has changed. As of June 2025, the overall bank credit was up by about 10.4% compared to the same time last year. That figure is healthy, although it is slower than the growth observed in the last couple of years.

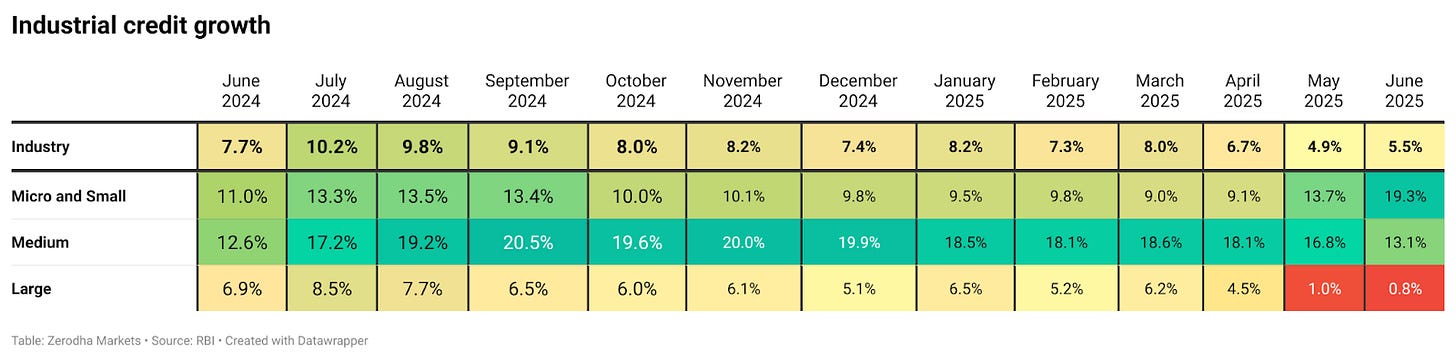

The biggest push is coming from small and medium businesses (MSMEs). Loans to MSMEs grew by around 13%, and those to micro and small by 19% over the past year, as banks continue to focus on this segment. Government support and loan guarantees have helped, and small businesses are actively borrowing to grow.

On the other hand, big companies are borrowing much less. Loans to large industries grew by less than a percent. Overall industry credit grew around 5.5%, mainly because small businesses were still borrowing.

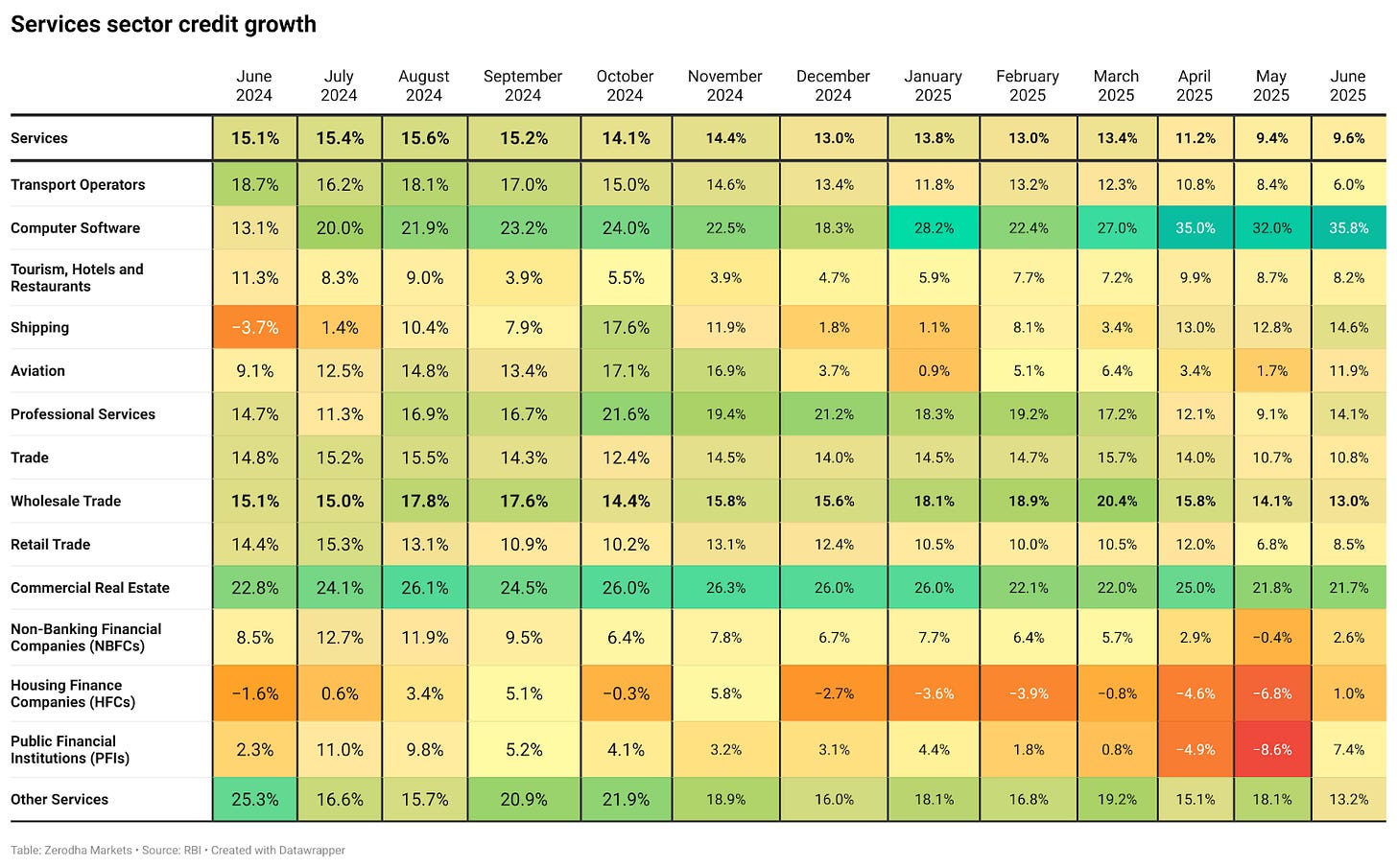

Credit to the services sector has slowed to 9.6% growth. Some sub-sectors like computer software and shipping are doing well, but others, such as NBFCs and housing finance, have cooled.

Personal loans are also growing well, up 11.8% from a year ago. People are still taking out loans to buy homes and vehicles, and gold loans have gone up sharply—over 124%, boosted by high gold prices and the ease of borrowing against jewelry.

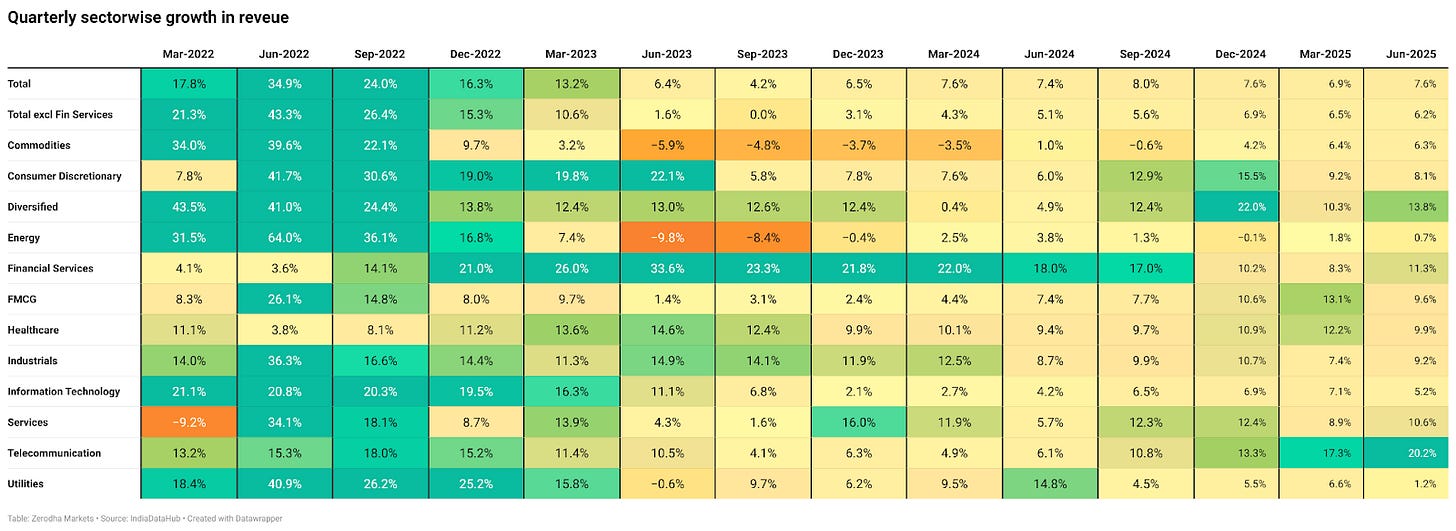

Corporate profit growth

India Inc.’s April–June 2025 (Q1 FY26) results so far show the economy is still growing, but at a slower pace than last year.

Let’s start with the big picture. Company revenues were up 7.6% from a year ago, and profits grew 7.5%. Growth is still there, but it’s slower than last year, and there’s also a gap between which sectors are doing well and which aren’t. Domestically focused industries are doing better than those hit by weak global demand or high costs.

In the financial sector, banks and other lenders reported revenue growth of 11.3% and profit growth of 3.2%, supported by steady loan growth and fewer bad loans.

Energy companies saw sales edge up 0.7% as lower crude prices reduced sales values, but profits rose 36% on improved refining margins.

In industrials, revenues grew 9.2% and profits 16.2%, helped by construction activity and higher government spending on infrastructure.

In consumer goods, FMCG companies increased sales by 9.6%, while profits were up 3.7%

Consumer discretionary companies—including carmakers and leisure brands—grew sales by 8.1%, but profits fell 1.8%.

IT services companies posted revenue growth of 5.2% and profit growth of 6.7%, reflecting the slower pace of global technology spending.

Telecom companies reported revenues up 20.2% and profits up 32.6%.

And finally, healthcare revenues grew 9.9%, but profits plunged 30.3% due to higher costs and softer export demand.

To sum it up, the economy is still growing, but momentum has cooled. Agriculture and infrastructure are keeping things moving, inflation is at a six-year low, and jobs are improving. But consumer demand is patchy, industrial growth is uneven, and businesses are cautious.

That’s it for this edition. If you have any feedback, do let us know in the comments.

Loved it.

Hi, these are great reads. One suggestion - yoy monthly tables of data can be put into charts to make it much more easy to absorb.