India’s Credit Crunch, The AI Talent War & China’s Engineering State | Who said What? S2E11

Hi folks, welcome to another episode of Who Said What? I’m Krishna. For those of you who are new here, let me quickly set the context for what this newsletter is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

Neelkanth Mishra on India’s economy

If you’ve been watching this show for a while, you’ll know we closely listen to what Neelkanth Mishra, Chief Economist at Axis Bank, has to say. His readings of India’s macroeconomy are really insightful. This week, he gave an interview to CNBC TV18, and we tuned in.

Here was his blunt take on the economic slowdown:

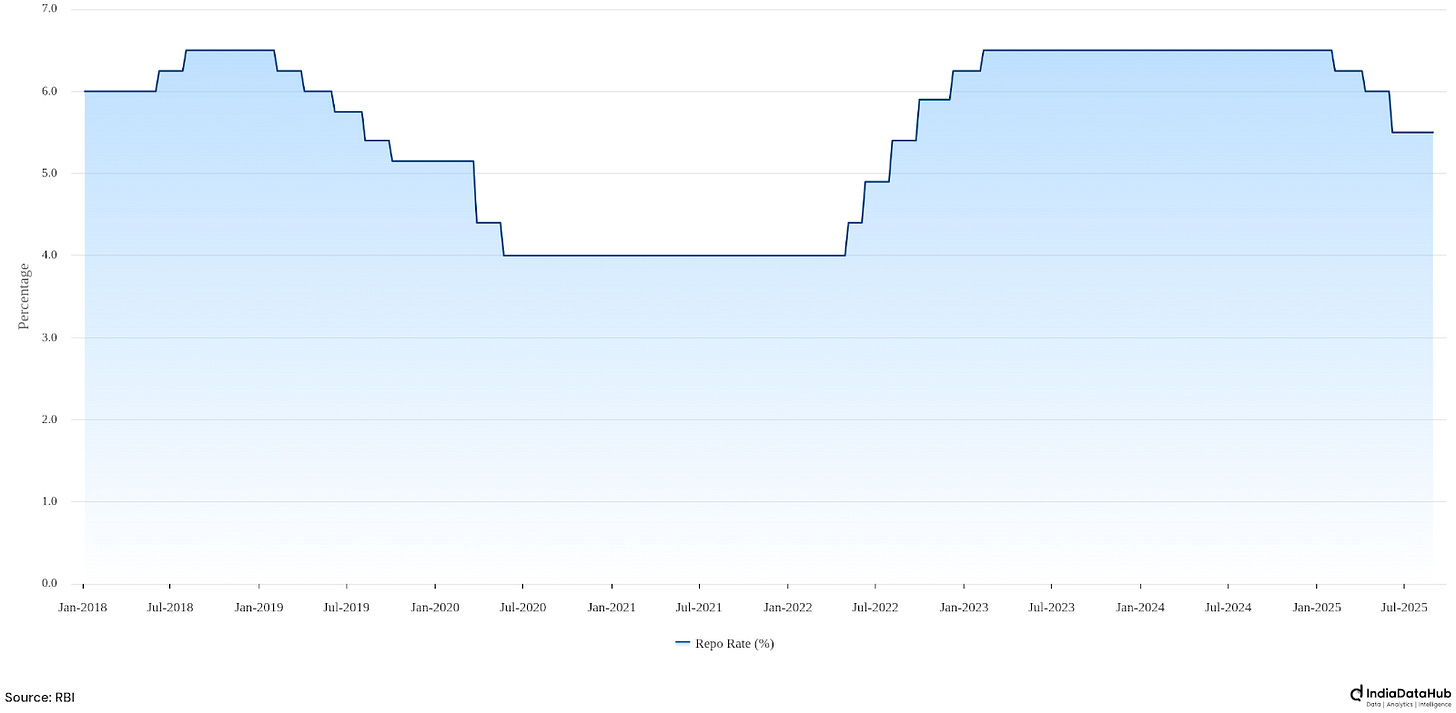

“The main reason the economy slowed over FY25 was not just the fiscal consolidation that was scheduled but it was mostly because of the inadvertent monetary tightening so so if you're if you're uh uh credit growth goes from 16.3% in March 24 to 9.8% in May 25. That's a 6.5% point of slowdown. And given that the system is about 56% of GDP, banking system credit um we're talking about more than a 3% point drag in credit growth. Now there is birectional causality. So slowing economy also drives this that's a slower credit.”

Think of it this way: credit is like the water pipes under the city. More than half of India’s economy runs through those pipes. If the flow suddenly slows down, the whole city starts to feel it. That’s what happened. It wasn’t that people or businesses lost interest in borrowing. It was that policy that tightened the taps.

And because it was policy-driven, it can also be reversed by policy. That’s why he thinks that the recent rate cuts and liquidity moves can flip the loop i.e., turning a cycle of low credit and weak growth into one where easier credit boosts demand, which in turn makes more people borrow and spend.

But don’t mistake this for a shift in the government’s priorities. Mishra is clear that GST cuts are not a big switch towards consumption. As he put it:

“See remember that the fundamental drivers of um of the economy have not shifted… you don’t believe you’re going from capex to consumption. 0% probability of that, right? … The priority remains to build infrastructure. It will all be from the government side. It will be primarily supply side interventions.”

He was pointing out that this is the point many in the market miss. GST simplification was bound to happen because the compensation cess was ending. The extra money it leaves in the system may boost demand in the short term, but the real story remains the same: this is an investment-led recovery, anchored in roads, railways, ports, and power.

So where should investors look in this kind of set-up? Mishra has a clear pecking order.

“I would look at uh credit providers because when credit growth starts to pick up it kind of feeds on itself. Um I would look at uh construction proxies. I would look at uh high value discretionary items. So I would any day prefer cars over FMCG for example if I have to play the consumption theme.”

The logic is simple. When money starts to flow more freely, lenders benefit first. As government capex rolls out, construction-linked businesses gain. And when households finally feel freer to spend, it shows up in cars and other big-ticket purchases, not soaps or packaged food. In other words, the early action is in credit, cement, steel, and autos — not in FMCG shelves.

Finally, Mishra points to what needs to change on the policy front. Here he doesn’t mince words:

“The government has so far through its fiscal discipline brought down the cost of capital for entrepreneurs. Now I think the need is to improve ease of doing business. TeamLease keeps pointing out that India has more than 65,000 regulations, so many filings, and so many with criminal penalties. All of those need to be brought down. Because when you’ve created this environment with low corporate tax rates and cheaper capital, the larger firms still don’t take risks — history shows incumbents generally try to protect their turf. The challengers will come from the small and midcaps, and they will only be able to grow if this regulatory burden is eased. Deregulation has to be among the most important priorities.”

In his telling, India has already fixed a lot of the big macro pieces: lower corporate taxes, cheaper capital, stable inflation. But all that can only take you so far if the regulatory cholesterol keeps clogging the arteries. Simplifying compliance, cutting needless filings, and easing the way for small and mid-sized firms to take risks is what will turn this cycle into something more durable.

Mishra sees the slowdown as a policy-made accident, not a structural fault. The revival will be driven by investment, not consumption.

Who’s winning AI?

When it comes to the AI race, the only thing anyone can say for sure is that the winners of this race are hardly decided.

Wang Jian is the founder of the AI and Cloud unit of Chinese internet giant Alibaba.

Recently, he gave Bloomberg his two cents on how the race is being run, especially in Silicon Valley:

“The only thing you need to do is to get the right person. Not really the expensive person because if it's a new business, if it's true innovation, that basically means talent and nobody cares about them. What happened in Silicon Valley is not the winning formula.”

If you’ve been seeing the news, US tech companies have been paying through their noses for AI talent. There’s a war going for the best AI engineers, with packages crossing even hundreds of millions for single employees.

Jian doesn’t agree with this strategy, though. He says that it’s typical of every new wave of technology and it will fade away. In his opinion, what really matters is getting the right person who can learn things on the go, instead of the most expensive person who has lots of experience.

“It’s a typical way of doing things, they’ll get out of that.”

We can say with some certainty that Jian is right. For instance, on The Daily Brief, we’ve covered Apple in two contexts: their attempt to build their own GenAI, and their failure to make a car. In both situations, they hired the best of the talent who were paid lots of money. Yet, they have not had a mass-consumer product to show for it.

But this focuses primarily on Silicon Valley. In the same interview, Jian was very appreciative of the Chinese AI ecosystem. When asked why DeepSeek hasn’t released their second reasoning model and what that means for Chinese AI, Jian said:

“You can have very fast iteration of technology because of competition. You work fast this time, but then the other guy will get very fast. And if you’re good enough, you can catch them again. And I don’t think it’s brutal, but it’s healthy.”

This is a dynamic we’ve seen time and again with many industries in different countries — more so with AI because it’s really hard to say who is winning, or whether it will have a monopoly or many competing players. And the Chinese AI landscape seems to have understood this fact well.

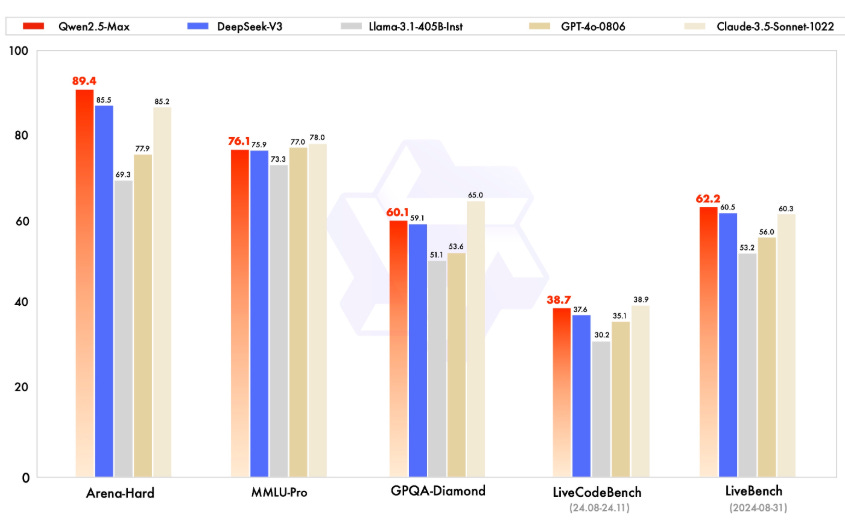

But within that landscape, Alibaba itself has turned out to be an incredibly strong player. Its own LLM, Qwen has already surpassed DeepSeek in various performance benchmarks. Alibaba has also built its own alternative to NVIDIA’s AI chips. They’re complementing this with a push into robotics, announcing a $100 million investment into a Chinese humanoid robot startup just recently. The e-commerce giant is making a strong statement in the industry.

Now, we’ve covered the chip race in China before — including AI chips. And we could figure that China still has lots of ground to cover to match the US.

However, it seems like they’re inching closer pretty fast day by day. And don’t buy our word on this, it’s NVIDIA founder Jensen Huang who’s been most impressed by China:

“Our competition in China is really intense. China is right behind us. We're very, very close.”

It is far too premature to make blanket statements about AI. The race is hardly over.

China the Engineer, America the Lawyer

We, at Markets, are huge fans of Dan Wang. (Almost) every year, for the last many years, he has been writing an annual letter that describes China, as it appears from within China. These letters are deeply insightful, helping you understand what China is actually like, shorn off propaganda from either direction.

Over the last couple of years, he seemed to break that streak — but only because this time around, he was writing a whole book. We’re still waiting to get our hands on it. But in the meanwhile, we’re digging through a couple of interviews he gave — one to Ross Douthat for the New York Times, and one for Bloomberg’s Odd Lots podcast.

Both are fascinating if you want to understand China, and not just project your own fears and hopes on the country.

To us, one of his key insights into Chinese culture is that it’s an “engineering state”. Starting with Deng Xiaoping, its first leader after Mao, China promoted engineers to the highest ranks of the Communist Party. He contrasts it with the United States, which he considers a “lawyerly society”.

As he says, “what’s really striking about the U.S. is that the founding documents of the Declaration of Independence read almost like a legal argument. Most of the founding fathers were lawyers. And… China is an engineering state trying to build its way out of every problem.”

This is a fantastic approach to have if you’re building infrastructure. “

I was living in Hong Kong, Beijing, and Shanghai, where you can see that these cities get better and better every year. You have new subway stations. Shanghai this year will have a thousand parks, up from five hundred in twenty twenty. All of these cities are really highly functional.”

This makes China a great place to live for the average person. And that’s not just the case with a megalopolis like Shanghai. “China’s fourth-poorest province, I was surprised to see, had much better levels of infrastructure than one could find in much wealthier places in the United States, like New York State or California.”

But this does backfire — because this is an approach that is not just limited to physical infrastructure. Every problem, no matter what it looks like, or what its underlying causes might be, is treated like an engineering project. According to Dan, “they treat the megaproject as the solution to every problem.”

These could be economic problems, like overcapacity in a sector, or social problems, like overpopulation. In his words:

“...the fundamental problem of China — the most fundamental problem with the engineering state — is that they cannot restrain themselves from being only physical engineers.”

That is why, for instance, they tore large parts of their economy down by cracking down on their property and tech sectors. To him:

“I think part of that was trying to funnel China’s best and brightest — the people graduating from the top universities — away from building cryptocurrencies or consumer tech and hedge funds into building industries that are more critical to strategic needs, something like semiconductors, aviation or chemistry instead.”

But that also means China has many successes — from its mastery over everything from electronics to rare earths. This is, at least to some extent, a matter of how its economy is engineered — though it also owes itself to China’s incredible enterprises. “I would situate China’s success mostly on the level of its fiercely dynamic entrepreneurs,” he says.

These entrepreneurs go through a constant trial-by-fire, in a system that we’ve previously called “hunger games capitalism”. China doesn’t have the same sorts of unicorns that the United States has — billion-dollar businesses born out of a rare stroke of genius. Instead, thousands of Chinese companies go after a single industry, in a terrible business brawl, until there are just a handful of companies left standing. These victors have “process knowledge” — after fighting over every single inch of market share, they know how to optimise every bit of their business.

As he says:

“Let’s say, Ross, we give someone who’s never cooked a day in his life the most well-equipped kitchen, as well as the most exquisitely detailed recipe. Are we sure that this person will be able to do something as simple as frying an egg for breakfast? I’m not sure if that person will burn the kitchen down in some big way.”

China, on the other hand, behaves like a really experienced chef. It’s that sort of implicit understanding of how to make difficult things that really sets China apart. And that translates into more production, and cheaper goods for everyone.

To others, though, it’s rough. To Dan, “...this is what socialism with Chinese characteristics means: The state wins; consumers win. But it is actually pretty rough for any of these companies out there.”

And that might, ultimately, be the downfall of the Chinese system. It’s a country that is terrible for investors, terrible for those who own a business, and terrible for its elite overall.

“I think this goes to a broader point about authoritarian systems: no one feels very safe. You can be an elite in Beijing — but what is your life going to be? If you’re in finance, Beijing announced a salary cap of ~$300,000 at state-owned banks. If you made more, you might have to give money back. If you’re in tech, you think online education is safe (Chinese love education). Then the government declares it must be nonprofit. If you’re in military or government, your life can be wrecked by a corruption crackdown or your patron losing power.”

Chinese elites are incentivised to flee the country, because things can go wrong at any moment, and if they do, you won’t find anywhere to turn to.

But this is no guarantee. Political ideology, Dan warns, is a terrible basis for making predictions about the future.

“I think what is ultimately going to be most important is delivering well for its people. …the country that is going to be able to meet the needs of its own people is going to be the more triumphant power.”

And this is a game that China bets it can win. “...what the Chinese want to do is to just keep things really, really stable and just wait for the Western countries to collapse.”

There’s a lot more that we haven’t even touched on. From what Dan thinks about a US-China military confrontation, to his thoughts on AI, to Shanghai’s noodle cafes and cocktail bars. We strongly recommend going through both interviews for more.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Very interesting perspective regarding China vs US. Thank you

Facing an issue in viewing the YouTube recording of this episode. It says that the video has been uploaded as private.