India’s biggest state telecom operator tries a comeback

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

BSNL lives to fight another day — or does it?

The race to mine the ocean floor

BSNL lives to fight another day — or does it?

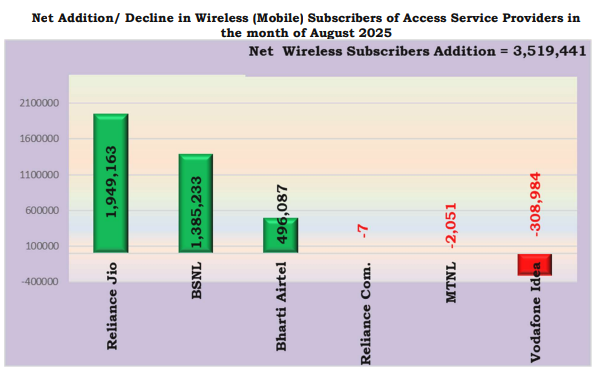

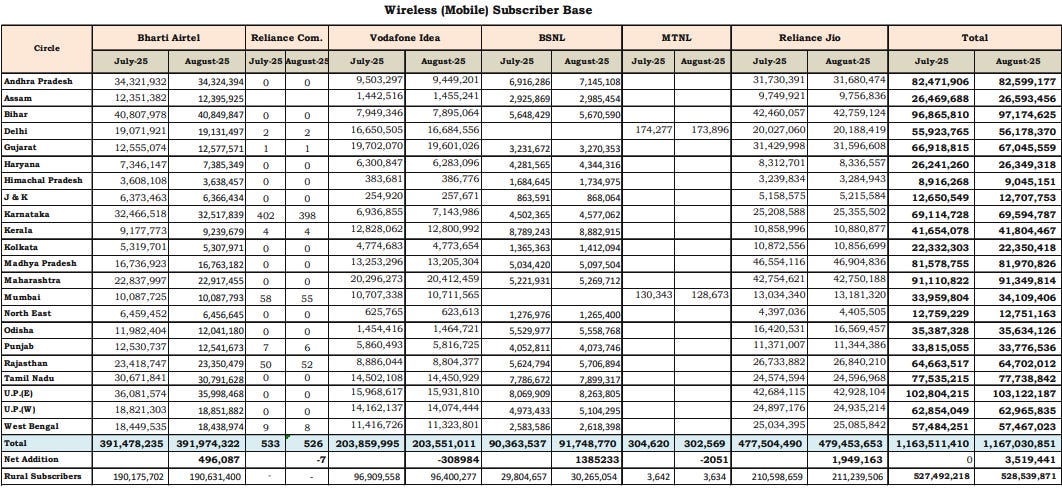

In August 2025, something interesting happened in Indian telecom. BSNL, the state-owned operator that most had written off — added 1.4 million new mobile subscribers in a single month. That might not sound dramatic until you realize it beat Airtel, India’s second-largest private telco, in net customer additions.

And there’s more: last week, BSNL completed its 5G pilot and will launch nationwide 5G services soon.

For a company that spent most of its life bleeding money, this was remarkable. One might even ask: is BSNL actually turning itself around? And if so, how?

Let’s dive into how India’s largest state-backed telecom operator is playing the game.

A lumbering — and failing — giant

For years, BSNL was the telecom backbone of India — the operator that reached every corner of the country when private players focused on cities. As a separate entity incorporated only in 2000, it inherited India’s entire landline infrastructure and a vast rural network.

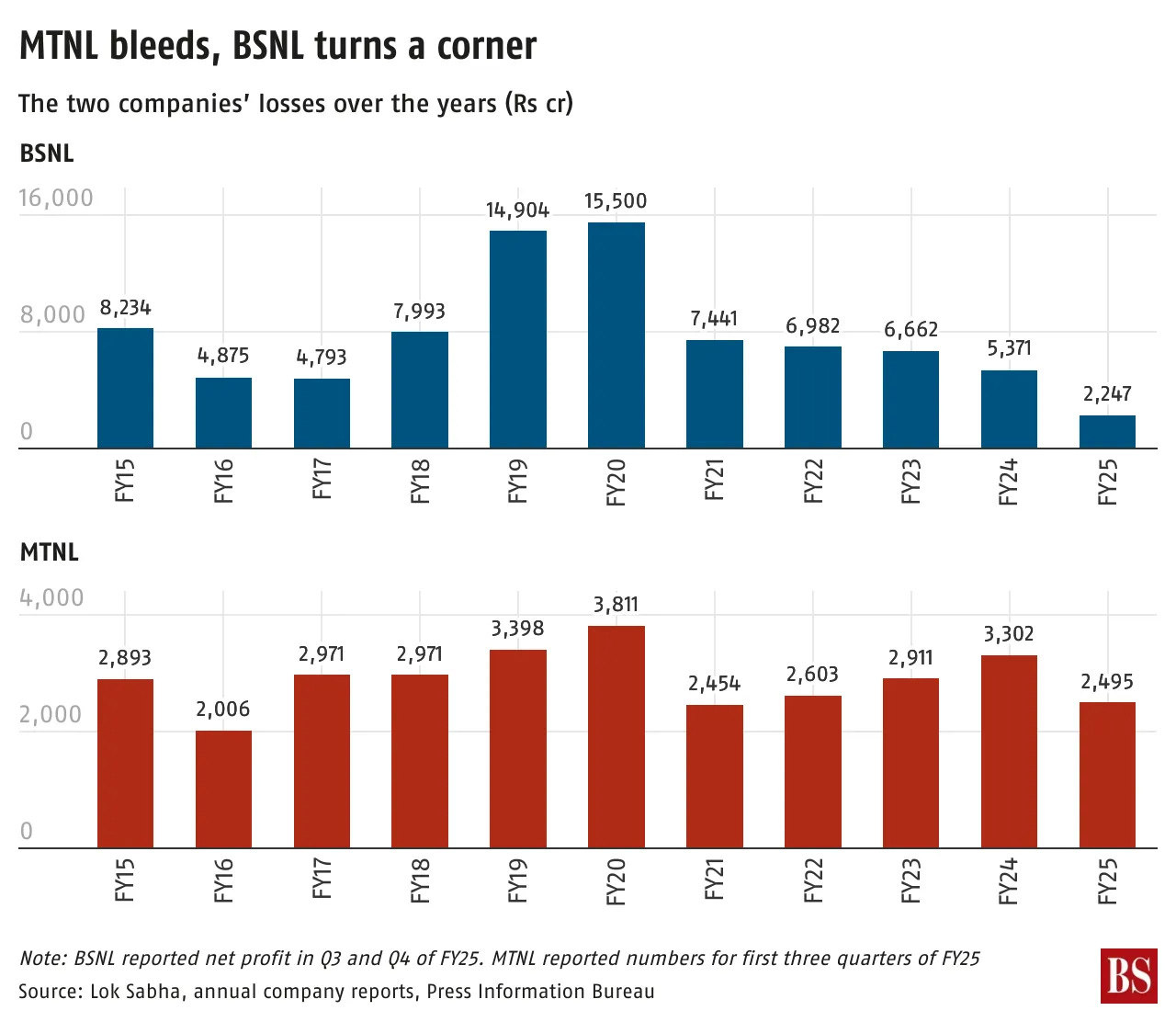

But the decline started within 10 years. BSNL posted its first-ever loss of ₹1,823 crore in FY 2009-10, and the bleeding never stopped. By 2015, losses had ballooned to ₹36,000 crore — after five back-to-back loss-making years.

The rot in the business was systemic. Bureaucratic delays killed crucial efforts to expand the network. A forced spectrum payment in 2010 drained BSNL’s cash reserves from ₹29,300 crore to just ₹1,700 crore. Overstaffed workforce consumed 54% of operating revenue in salaries alone. BSNL admitted it had been “unable to invest in expansion of its network over the period 2009-2013”. That reflected in customers confidence as its market share collapsed from around 16% in 2010 to just 10% by 2016.

Then came 2016, and everything changed. Reliance Jio entered the market with an offer that seemed too good to be true: free voice calls and dirt-cheap data. Suddenly, telecom became a price war. Airtel slashed its rates to compete. Vodafone and Idea, struggling to keep up, decided to merge just to survive. Within a couple of years, the market had reshaped itself — a handful of well-funded giants racing to blanket the country with 4G networks.

Since BSNL wasn’t able to invest because of mounting losses, it didn’t have 4G. Resultantly, while private operators deployed high-speed mobile internet everywhere, BSNL remained stuck on 3G. The result was predictable. By 2020, BSNL’s subscriber base had crumbled, its market share had collapsed to single digits, and the company was drowning in debt of over ₹32,000 crore, recording its highest ever losses.

It looked terminal. Yet, the Indian government had other plans.

The rescue mission

Between 2019 and 2025, the Indian government approved not one, not two, but three massive revival packages for BSNL, totaling over ₹3.22 lakh crore. To put that in perspective, India’s defense budget for 2019-20 was ₹3.18 lakh crore — BSNL’s total bailout package (spread over six years) exceeds a full year’s defense allocation.

Why? Because backing out would mean handing the telecom industry over to a two-player game. If BSNL disappeared, Jio and Airtel would effectively control the market and with that, all the pricing power. This logic also drove its efforts to keep Vodafone Idea Limited afloat. The government sees telecom as too important a sector to let just 2 players run the show. BSNL, for all its flaws, is the market balancer that keeps competition alive and ensures connectivity reaches places private operators might ignore.

The money came in three waves, each addressing a different crisis.

The first package in 2019 brought ₹69,000 crore to stop the bleeding. A massive voluntary retirement scheme slashed BSNL’s workforce nearly in half, cutting costs dramatically. It was painful, but necessary.

The second package in July 2022 was more ambitious — ₹1.64 lakh crore for comprehensive restructuring. This included fresh capital for network upgrades, 4G spectrum allocation, and 4G capex using an indigenous technology. The funding also helped keep rural landline operations running. Large sums of statutory dues were also converted into equity and a sovereign guarantee was given in bonds to restructure debt.

The third package in June 2023 brought ₹89,047 crore specifically for 5G spectrum. BSNL received pan-India spectrum in the most popular bands through this package.

In August 2025, the government topped it up with another ₹6,982 crore to accelerate 4G rollout.

Thanks to these interventions, BSNL’s debt fell by a third in 2023. Its authorized capital expanded five times to absorb all the new equity infusions. The government had essentially recapitalized the company from scratch.

Building the network

But, money alone doesn’t fix telecom. You need towers, spectrum, fiber, and technology. That’s where BSNL’s real transformation has been happening — on the ground.

The core of BSNL’s revival is its 4G rollout, part of a government project to achieve “4G saturation“ — meaning blanket 4G coverage across the country. Unlike Jio and Airtel, which rolled out 4G years ago using equipment from Nokia, Ericsson, or Samsung, BSNL was told to use a homegrown 4G/5G technology stack built by TCS in partnership with Center for Development of Telematics (C-DOT). It was a gamble, as indigenous tech would take longer to develop, but if it worked, India would have its own end-to-end telecom manufacturing capability.

This isn’t just urban coverage, though. Under the “4G Saturation Project,” BSNL aims to install thousands of new towers in villages lacking coverage. The network expansion shows up in BSNL’s subscriber data. After years of decline, BSNL’s wireless base has stabilized at around 9 crore subscribers as of August 2025. That’s still far behind Jio’s ~48 crore and Airtel’s ~39 crore, but the trend seems to be reversing. BSNL is no longer losing customers; it is retaining them and even trying to win them back.

Moreover, while BSNL missed the 4G bus, it’s determined not to miss 5G.

With the June 2023 spectrum package, BSNL received prime 5G spectrum — effectively putting it on par with Jio and Airtel spectrum-wise. But BSNL’s 5G rollout timeline is about 2-3 years behind private competitors.

The good news is that BSNL’s 4G equipment is 5G-ready. The indigenous technology stack can be upgraded to 5G via software updates, meaning BSNL can switch on 5G on these sites without a hardware change. BSNL is targeting 5G launches in Delhi and Mumbai by December 2025. According to a senior official, the indigenous equipment is “working fine without any issues“ in tests, paving the way for a commercial 5G launch.

If BSNL can successfully launch 5G by late 2025 and expand 4G/5G coverage deeper into its rural strongholds, it may carve out a sustainable niche for itself, especially with government and low-end users.

Is BSNL performing?

It’s no secret that Jio and Airtel together take up over 70% of the market, while being financially healthy. And BSNL won’t be toppling that anytime soon, despite having basically unlimited government backing. Telecom Regulatory Authority data shows BSNL had about 92 million wireless users by August 2025, which is about 7.9% market share.

In terms of active data users, though, the gap is even starker. BSNL’s mobile broadband (3G/4G data) market share is only ~3.2%, whereas Jio commands over 51% of India’s wireless data subscribers and Airtel about 32%. This indicates that a large portion of BSNL’s users are low-paying customers, and it is yet to attract many data-hungry customers, especially in urban areas.

However, this also plays into BSNL’s strategy. It’s not built to maximize profits — after all, it’s a public telecom operator. Their strategy can be distilled to having low prices that can reach people living in the most remote of areas.

On price, BSNL offers some of the lowest tariffs in the industry. In 2025, when Jio and Airtel hiked prices, BSNL announced a ₹225 Plan with comparatively more data availability. On rural reach, by mid-2025, BSNL saw a recovery in rural mobile users, adding ~1 million rural subscribers in August 2025 alone. With its new 4G network, it can finally offer competitive data speeds in villages. While starting from a low base does boost growth numbers, this strategy is also what’s helped BSNL grow fast recently.

Obviously, the bigger question is whether this performance is translating to profit.

For years, BSNL has been synonymous with losses. But it seems like that isn’t the case right now, as it earned a net profit of ₹262 crore in Q3 FY25, and ₹280 crore Q4 FY25. This is the first time in over a decade that BSNL posted quarterly net profits, let alone back-to-back.

What could have led to this? Multiple directions to look at.

Recent measures in workforce reduction and general efficiency increases could definitely have cut costs substantially. The revival packages that addressed the debt burden also would have brought the finance cost down for them. This bottom-line improvement, driven by rising broadband revenue and stabilized mobile revenues, suggests BSNL may be on track toward the government’s goal of full profitability by FY 2026-27.

But, if we dig a little deeper, we’ll find that the story is not all sunshine and roses.

Analysts have highlighted that this profitability could have been achieved by writing back provisions and changing accounting practices around depreciation. Even the company auditor issued a qualified opinion on the quarterly results leading people to speculate that this performance was largely driven by accounting adjustments.

In other words, profits might have been partly driven by a mere change in how accounting was done.

Can it last?

BSNL’s turnaround might look real, but is fragile.

The ₹3.2 lakh crore in government support is humongous, but it comes with expectations. Taxpayers are effectively funding a telecom competitor to keep the market competitive. If BSNL can’t sustain its momentum, all that capital could be wasted. And it is entirely possible that it repeats the mistakes of the past.

The execution risks are significant. BSNL is rolling out 100,000+ towers, launching 5G, competing on price, and trying to win back customers — all at once. Its network quality needs to match private players, its customer service needs to improve, and its offerings to enterprises need to scale.

Then, there’s the competitive reality. The next couple of years will tell us if the turnaround plays out well. BSNL is no longer dying — but can it truly compete? Can it sustain profitability? Can it win customers not just through price, but through quality?

India’s telecom story has always been dramatic, with multiple inflection points that changed the landscape of the sector. Success or failure, BSNL’s comeback attempt will not be an exception.

The race to mine the ocean floor

Last Friday, we covered the race for critical minerals, and how India is playing the race.

But we found another really interesting angle here. Turns out, some of the richest mineral deposits on Earth aren’t on land at all. They’re sitting on the ocean floor, thousands of meters below the surface. And countries around the world (including India) are already investing hundreds of millions in the technology needed to harvest them.

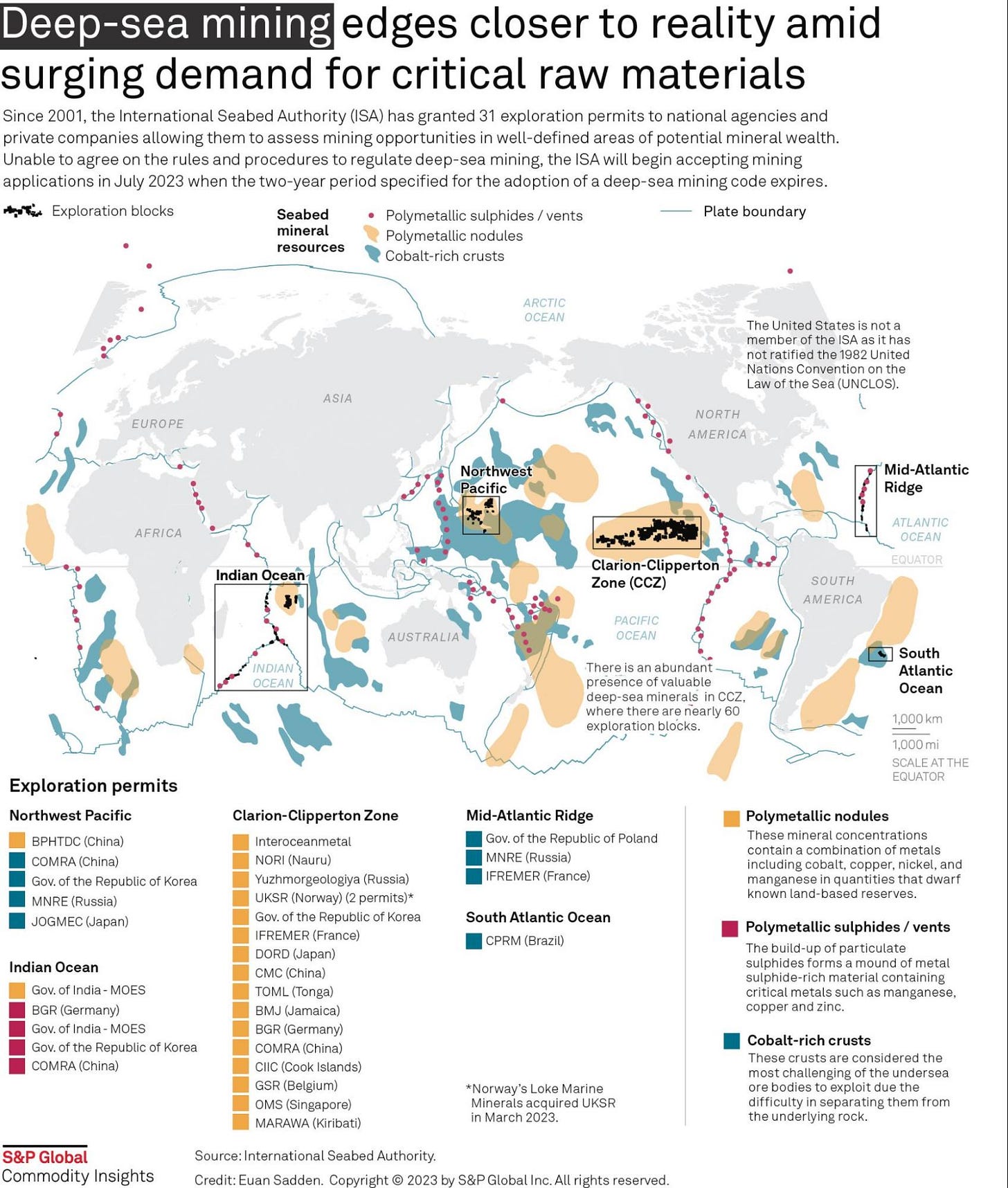

There’s just one catch: it’s not legal. At all. No commercial deep-sea mining is currently permitted in international waters. The International Seabed Authority (ISA) — the body governing these resources — hasn’t finalized the rules.

So why are nations racing to develop mining technology for something they can’t actually use yet? And what’s stopping them from becoming reality?

Let’s take a nice little scuba dive into this world.

The ocean’s the limit

To understand the appeal of deep-sea mining, you might want to get down to earth first. And we mean literally.

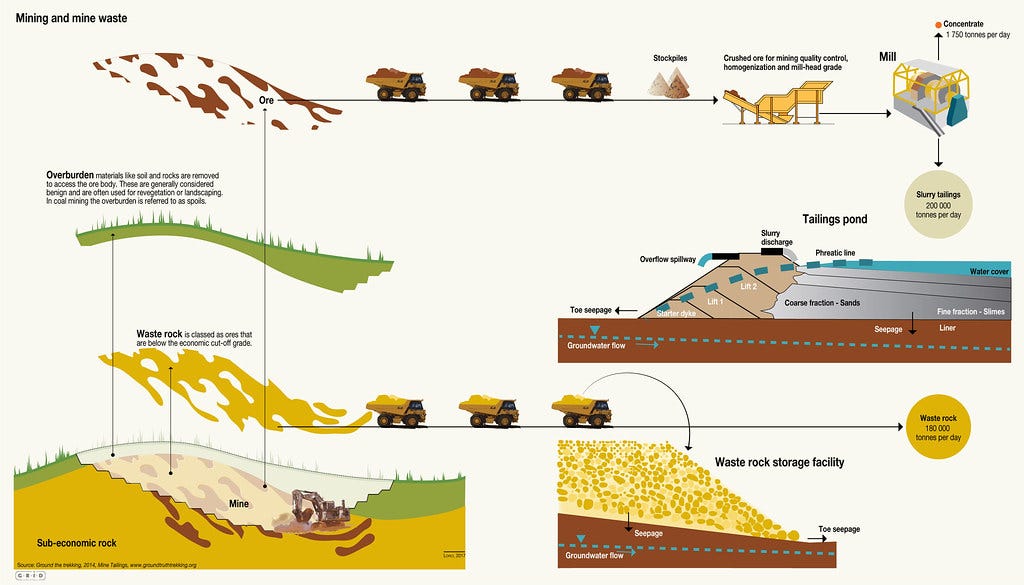

Traditional open-pit mining on land is brutal. To remove the ore from the earth, companies must drill, blast, clear forests, and remove enormous amounts of rock and soil. For every ton of valuable metal extracted, you might generate hundreds of tons of waste rock and soil (or overburden), as well as tailings — the crushed rock and chemicals left after processing.

Mining waste is such a problematic issue that it can lead to environmental disasters that can kill. That’s what happened in Brazil in 2019, when a tailings dam collapsed and killed 270 people. Even if you remove the human cost, waste can permanently scar landscapes and contaminate water sources.

The struggles hardly end there. If you got the ore, the actual valuable metal you might extract from it might be too little. Most open-pit mining barely extracts 1% of valuable metal, while the rest 99% is all waste. Modern-day mining on land is incredibly inefficient and wasteful.

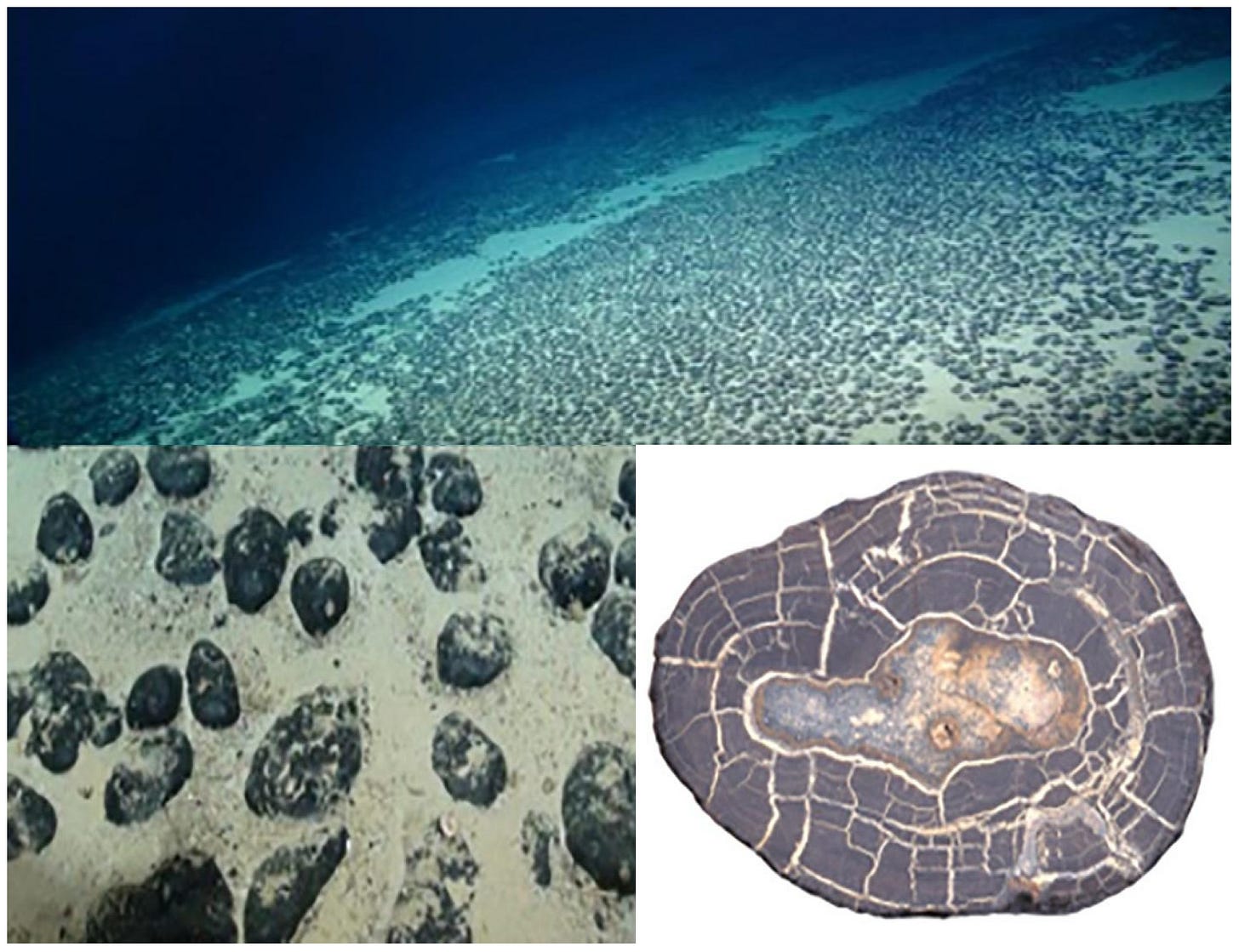

The ocean floor, however, offers a viable alternative to these issues. It doesn’t have open pits like on land, but something called polymetallic nodules. These modules are mineral concretions formed over millions of years, lying loose on the seabed at depths of 4 to 6 km. They’re packed with valuable metals: manganese, nickel, copper—all in concentrations that are often higher than many land-based ores.

But there’s more advantages. These nodules ideally don’t need drilling or blasting. The nodule is the ore. Ideally, you can just send down a machine that vacuums up the nodule and pumps it to a surface vessel. No forests to clear, no communities to relocate, and little overburden.

And that’s the promise that deep-sea nodules hold. Right now, they represent a completely untapped, potentially more-efficient source of critical minerals.

The value chain

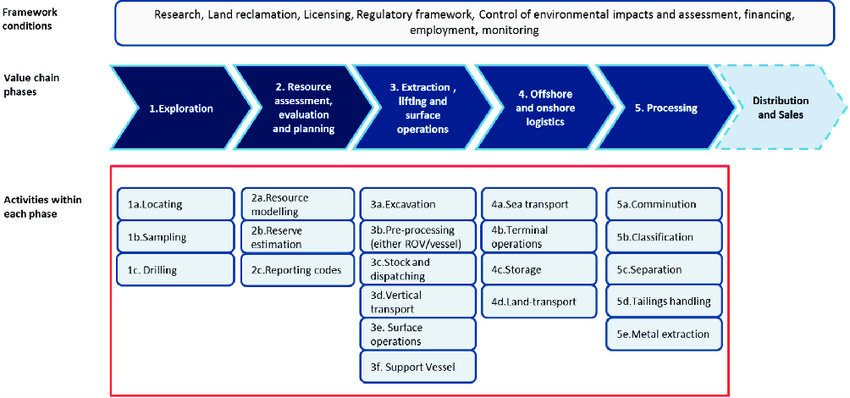

Now, the value chain of deep-sea mining is largely similar in basic structure to land-based mining. However, within each step of the chain, the processes couldn’t be more different.

The first stage is exploration and licensing. Before anyone can mine anything, they need permission and need to know what’s down there. In international waters, the ISA grants 15-year exploration contracts giving countries or companies exclusive rights to survey specific areas. Over 30 contracts have been issued to entities sponsored by 20 different countries.

Exploration requires deep-sea expeditions with specialized equipment: towed cameras, sampling devices, and even human-occupied submersibles. Companies spend years mapping nodule fields and conducting environmental baseline studies to avoid damaging the biodiversity around the mining area. This is expensive, risky work with no guaranteed payoff. Yet, governments see it as strategic positioning for first-mover advantage.

The second stage is the mining itself. Engineering a system to mine at 4-6 kilometer depths is extraordinarily challenging. At those depths, pressure exceeds 400 atmospheres. Temperatures hover near freezing, and saltwater corrodes everything. Naturally, this requires specialized technology.

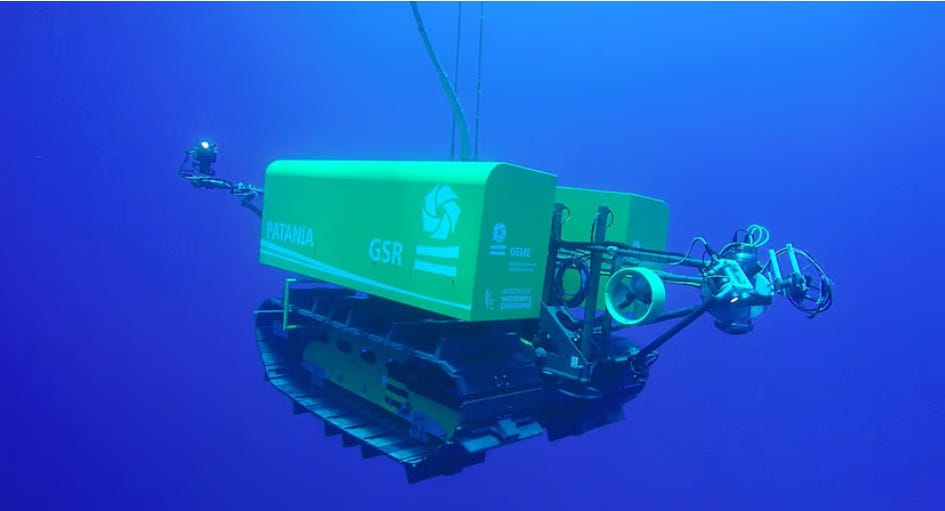

At the very basic, mining involves a robotic crawler that drives along the seafloor, gathering nodules through suction or mechanical arms. The nodules get pumped up a long vertical pipeline (called a riser pipe) to a surface ship. The mining ship itself is a massive platform over 200 meters long, with ore processing equipment, storage tanks, and crew accommodations.

Some countries have built basic prototypes already. Japan, for instance, successfully mined 649 kilograms of cobalt and nickel-based crust with a crawler-based system in 2020. In 2022, Canada-based The Metals Company (TMC) and Allseas picked up 14 tons worth of nodules from a seafloor that was 4.3 km deep.

The last stage is processing and refining. Much like ores, nodules also need to be refined. And they’re a whole different challenge.

Why? Because nodules are chemically distinct from typical land ores. They’re oxide concretions formed in seawater — meaning metals are bound in layers of manganese-oxide and iron-oxide. Nodules can’t be thrown into conventional smelters that are designed for ores. This is because melting nodules releases volatile chemicals that damage the furnace lining itself.

There is another layer of complexity. Most nodules are made up of multiple metals — the same nodule might be 30% manganese, 1% nickel, 1% copper, and 0.2% cobalt. Manganese is a low-value bulk product while cobalt is high-value but scarce. Optimizing a process that profitably recovers everything is genuinely hard.

So, instead of general smelting, most schemes for nodules favor hydrometallurgy—dissolving nodules in acids at high temperature and pressure, and then using chemical processes to separate metals. However, nobody has built a full-scale nodule processing plant yet. Additionally, while hydrometallurgy doesn’t generate tailings, it does generate chemical residues that are chemically reactive and can damage the plant.

As of 2025, nodules have only been processed in laboratory or pilot-plant experiments.

The value chain for deep-sea mining does exist, but it’s not as mature as for land mining. But as long as it’s illegal, it’s likely there’s not going to be much demand for everything that goes into its value chain.

Why deep-sea mining remains stuck

Why is deep-sea mining illegal? It’s because we haven’t even come to a consensus on all the legal questions it entails.

Here’s the thing: sea is a whole different realm than land. How does one decide property rights here? How do you price and fairly share the benefits of deep-sea mining, while also incentivizing players to take its risks? How do you ensure marine environment protection? What liability should companies bear for ecological damage appearing decades later?

The ISA has been negotiating rules for years, but member states can’t agree. In 2021, Nauru tried forcing the issue by triggering a clause requiring the ISA to consider mining applications within two years. However, due to a lack of consensus among countries, the deadline passed in July 2023 with no mining code, and no further clarity on when it’ll be passed. This regulatory limbo obviously poisoned investor confidence.

Environmental concerns

One crucial question that hasn’t reached a consensus on the environmental effects of deep-sea mining. Many scientists and NGOs have mobilized against deep-sea mining. Their argument is that we don’t know enough about deep-ocean ecosystems to responsibly mine them.

Exploration studies have discovered thousands of new species in potential mining areas. We’re only beginning to understand reproduction, feeding patterns, and ecological connectivity in the ocean abyss. We can’t say for sure how deep-sea mining might impact these things — even if we know they offer a less wasteful way of mining.

Countries like Germany, France, Spain, Chile, and New Zealand support a precautionary pause to deep-sea mining, while Portugal has outright banned it. Major companies like Google, BMW, and Samsung have pledged to not use minerals mined from the ocean floor. This corporate cold shoulder makes raising capital nearly impossible.

But even if environmental concerns are alleviated, there’s another crucial reason why raising capital will be hard for deep-sea mining — investors don’t see profits.

Whither profits?

Things like robotic crawlers, vessels, and the special scientific know-how required to refine nodules make deep-sea mining extremely capital-intensive.

The crawlers that exist are merely prototypes. They are far from scaling to continuous industrial operations to processing millions of tons per year. The riser and pumping system is critical: you’re running a 4-kilometer pump 24/7 through ocean currents. If it fails, your entire operation stops. Plus, as we mentioned before, there are no refiners working at a commercial scale — everything is still in demo mode.

Countries Are Preparing Anyway

Despite everything, numerous countries are pushing forward. Different countries are positioning themselves in different parts of the value chain. They’re all preparing for the day deep-sea mining becomes legal.

In exploration and licensing, China, Russia, Japan, Korea, France, Germany, the UK, and Belgium all sponsor contracts. Smaller states surrounded by oceans, like Nauru, Tonga, and Kiribati have partnered with private companies to sponsor exploration contracts.

But technology is the hard part. Developing mining technology is completely different from exploration. Exploration companies conduct surveys and collect data, while tech firms build actual mining systems—robots, ships, processing equipment. These skillsets rarely overlap.

As we’ve highlighted before, Japan (through its state body JOGMEC) is arguably the leader in the tech segment. China has invested heavily in both exploration and indigenous technology development — its advantage in general industrial robotics might prove to be extremely useful in making crawlers. Norway opened Arctic seabed areas for exploration in 2023, aiming for commercial mining in its own waters as early as 2025, leveraging its expertise in oil.

Processing and refining is the weakest link. Almost no one has operational processing facilities. The Metals Company has preliminary agreements with Japan’s PAMCO to process nodules at a commercial scale, but nothing is operational yet. Most countries would likely need to export raw nodules for processing initially, or build entirely new refineries.

India’s Position

India is hardly sitting silently — in fact, it’s a major player in exploration. In 2025, India became the first nation to obtain a second sulfides contract—giving it the largest combined exploration area assigned by the ISA. Earlier, through its Deep Ocean Mission, India secured contracts in 2002 for polymetallic nodules (which extended 75,000 square km) and in 2016 for polymetallic sulfides.

However, there is lots of work to do in the later parts of the value chain. India is trying to back this with technology development, including a deep-sea mining system for depths as low as 6 km. However, India faces the gaps of having no processing ability and no finalized legal framework of our own, either. We would likely need international partnerships for processing and commercialization.

The bottom (line) of the ocean

Deep-sea mining sits at a fascinating intersection of resource geopolitics, engineering ambition, and environmental uncertainty. The seafloor holds enormous mineral wealth that could help meet surging demand for critical metals.

But formidable barriers remain. The legal regime is incomplete. Technology is unproven at commercial scale and requires massive capital. The environmental risks are not entirely well understood.

For now, deep-sea mining remains aspirational—high-reward but higher-risk. The coming years will see intensified research, continued technology development, and ongoing diplomatic negotiations.

Tidbits

Meta’s undersea cable picks Vizag and Mumbai

Meta has selected Mumbai and Visakhapatnam as landing sites for its $10 billion “Waterworth” undersea cable connecting the US, India, Brazil, and South Africa. Spanning 50,000 km, it will be the world’s longest subsea system and aims to avoid the Red Sea route. The cable is expected to land in India by 2030.

Source: Economic Times

Andhra clears ₹1 lakh cr BPCL refinery

The Andhra Pradesh government has allotted 6,000 acres near Ramayyapatnam Port to BPCL for a ₹1 lakh crore greenfield refinery and petrochemical complex. The state will refund 75% of the capex over 20 years as incentives. The plant is slated to start operations by January 2029.

Source: Economic TimesReliance revives Velvette brand

Reliance Consumer Products has relaunched the iconic Velvette personal-care brand in Tamil Nadu, offering soaps, shampoos, and lotions under the RCPL label. The brand, revived with the CK Rajkumar family, will expand across South India by year-end and nationwide within a year.

Source: The Hindu BusinessLine

- This edition of the newsletter was written by Vignesh and Manie

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉