IMF Report Reveals Something Big!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

IMF's take on Indian's Economy

SEBI's specialized funds explained

IMF's take on Indian's Economy

The International Monetary Fund just released its Article IV Consultation report on India – think of it as a comprehensive check-up where IMF economists meet with government officials, central bankers, and business leaders to take the country's economic pulse. This report is particularly interesting because it comes right after the IMF completed a detailed Financial System Stability Assessment of India, meaning we're getting an unusually thorough look at both economic health and financial stability. Whether you agree or disagree with the IMF’s view, it’s worth listening to what they are saying.

The Big Picture

So, what's the verdict? Despite some moderation in growth over recent quarters, India remains remarkably resilient. The IMF projects GDP growth of 6.5% for both 2024/25 and 2025/26 – dramatically outpacing global growth of around 3.2%. To put this in perspective, the U.S. is expected to grow at 2.1% in 2025, while China's growth is projected at 4.5%.

Inflation in India has broadly declined within the RBI's tolerance band of 2-6%, though food prices continue to create volatility. The financial sector remains solid, with non-performing loans at multi-year lows of just 2.6% as of September 2024. The government continues to make progress on fiscal consolidation, with the deficit narrowing to 5.6% of GDP in 2023/24, while the current account deficit remains well contained at just 0.7% of GDP, supported by strong growth in service exports.

What's particularly encouraging is that India's digital public infrastructure, strengthened corporate balance sheets, and overall financial health position the country well for continued growth and social welfare gains.

Risks And Challenges

However, looking deeper reveals some significant challenges that could derail this positive trajectory.

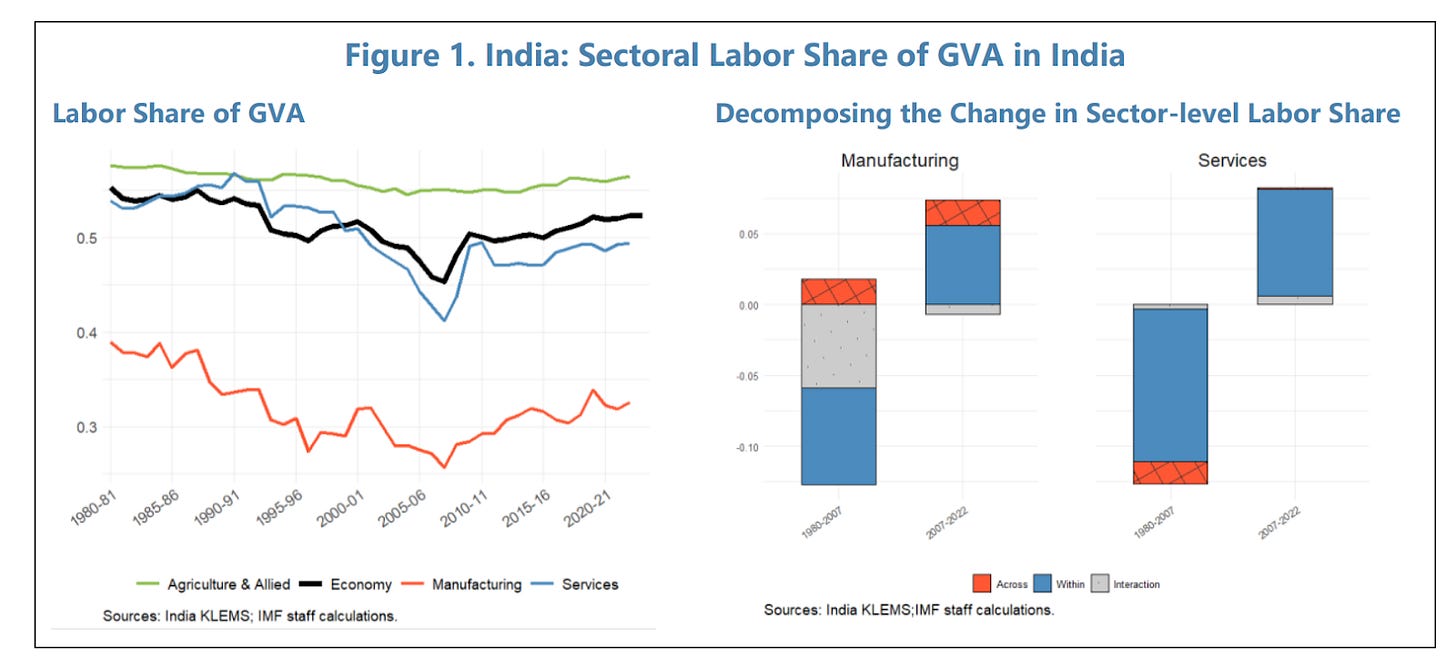

On the employment front, while headline numbers look impressive – with the labor force participation rate rising to 56.4% in 2023/24 from 48.4% in 2017/18 – the quality of jobs created tells a more nuanced story. Much of this increase has been driven by own-account and unpaid family workers. There's been an unusual post-pandemic increase in agricultural employment – a reversal of India's historical development path where workers typically shift from agriculture to higher-productivity sectors like manufacturing and services.

This matters for ordinary Indians because quality jobs are essential for raising living standards. While employment rose by 27 million in 2023/24 (compared to an increase of 14 million in the working-age population), the high degree of informality means millions lack the job security, benefits, and social protections that come with formal employment.

Private investment – critical for sustainable growth – hasn't accelerated as much as hoped. Private corporate investment in machinery and equipment reached just 4.3% of GDP in 2022/23, significantly below the 5.9% average between 2011/12 and 2015/16. This matters because without robust private investment, job creation and productivity growth will likely fall short of what's needed to achieve India's ambition of becoming an advanced economy by 2047.

Indian Authorities' Perspective

It's worth noting that Indian authorities have pushed back on some of the IMF's assessments. In their official response to the report, they highlighted that formal employment is expanding significantly – with net additions to the employees' provident fund subscriptions more than doubling from 6.1 million in 2018/19 to 13.1 million in 2023/24. They also emphasized that 61% of these additions came from workers under 29, indicating that new formal jobs are indeed going to India's youth.

The authorities also pointed to their successful poverty reduction efforts, with the multidimensional poverty headcount ratio falling to below 1% in 2023/24 from 12.2% in 2011-12. They highlighted that inequality has declined too, with the Gini coefficient of consumption expenditure falling in both rural and urban areas.

Economic Outlook And Downside Risks

Looking ahead, the IMF believes risks to India's economic outlook tilt to the downside, with both external and domestic challenges on the horizon.

On the external front, deepening geoeconomic fragmentation presents a significant risk. The report includes a specific analysis showing that if the world divides into separate economic blocs with restrictions on high-tech and energy trade, India could face a cumulative GDP loss of 1.5%. If tensions escalate further with increased non-tariff barriers and reduced FDI flows between blocs, this loss could reach 3.3% of the GDP.

Oil price volatility – particularly from regional conflicts – could impact both India's external balance and fiscal position. The IMF estimates that a $10 per barrel increase in oil prices, sustained for a year, adds about 0.4% of GDP to India's current account deficit. While India has diversified its oil import sources – with Russian oil now accounting for up to 40% of imports at discounted prices – saving approximately 0.2% of GDP annually – oil dependency remains a vulnerability.

Domestically, risks include potentially weaker private consumption and investment if real incomes don't recover sufficiently. Weather shocks could adversely impact agricultural output, driving food prices higher and stalling recovery in rural consumption. Recent volatility in financial markets amid rising household stock market participation could also impact wealth and consumer sentiment – particularly noteworthy given that India's domestic market capitalization has grown to over $4 trillion, exceeding 100% of GDP.

The Reform Agenda

To address these challenges, the IMF recommends a comprehensive reform agenda that cuts across sectors rather than relying on narrowly targeted interventions.

The report emphasizes that "holistic horizontal reforms" are needed to stimulate private investment, raise potential growth, and create quality jobs. In practical terms, this means:

Implementing labor codes to enhance market flexibility while providing adequate social protection for workers

Deepening economic integration through trade and foreign direct investment

Continuing public investment in infrastructure while improving its efficiency

Streamlining business regulations to reduce bureaucratic hurdles

Providing stable policy frameworks, particularly in taxation and regulation

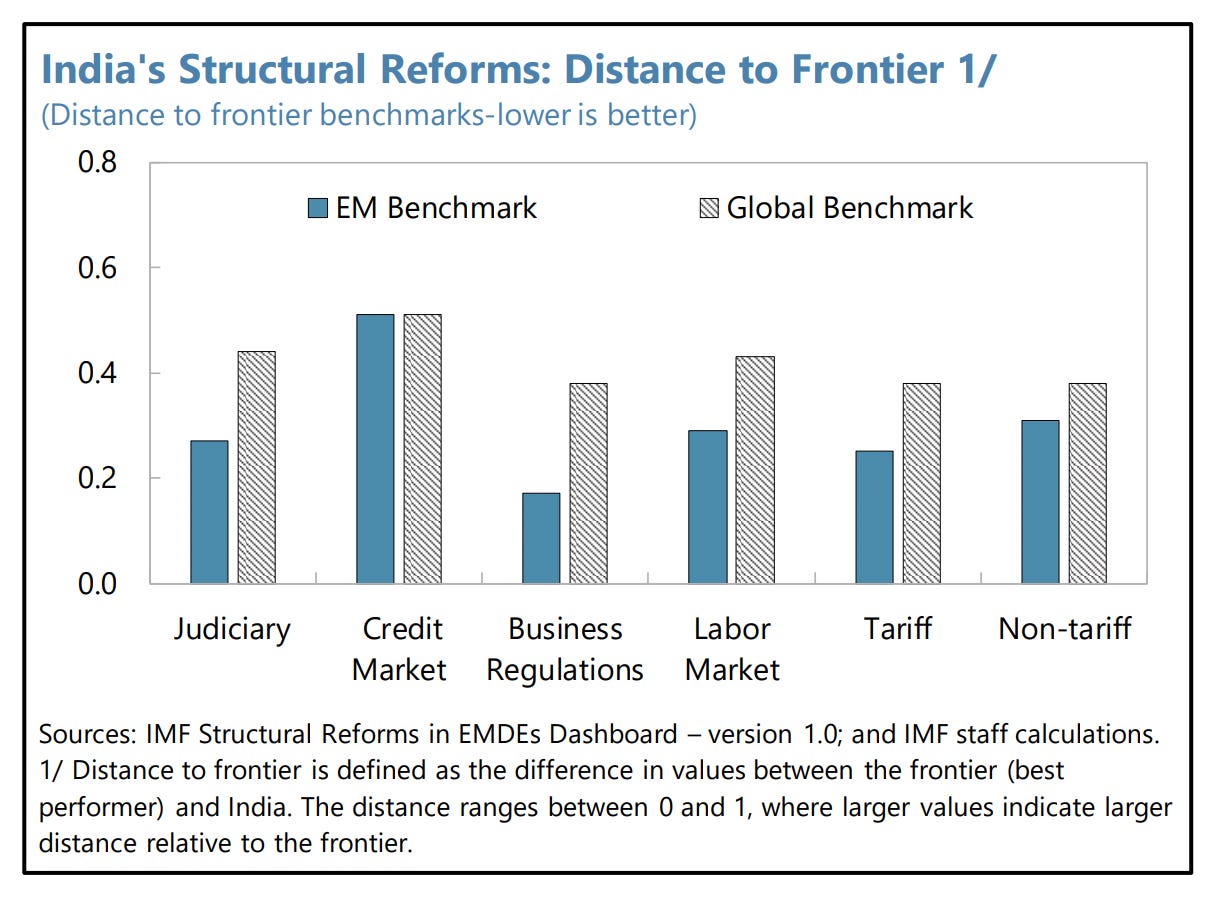

The IMF's analysis suggests these reforms could deliver significant gains. For instance, their cross-country analysis shows that major judicial reforms could boost private investment by up to 3% in two years, while credit market reforms could raise investment by up to 6%. For India specifically, narrowing the distance to the emerging market frontier in judiciary and credit markets by just 25% could boost private investment by 5%.

What's particularly interesting is the IMF's finding that targeted industrial policies – such as Production Linked Incentives, which have successfully attracted investments in electronics manufacturing – cannot substitute for these horizontal reforms, especially given the sheer number of new entrants into India's labor market each year.

Public Investment Efficiency

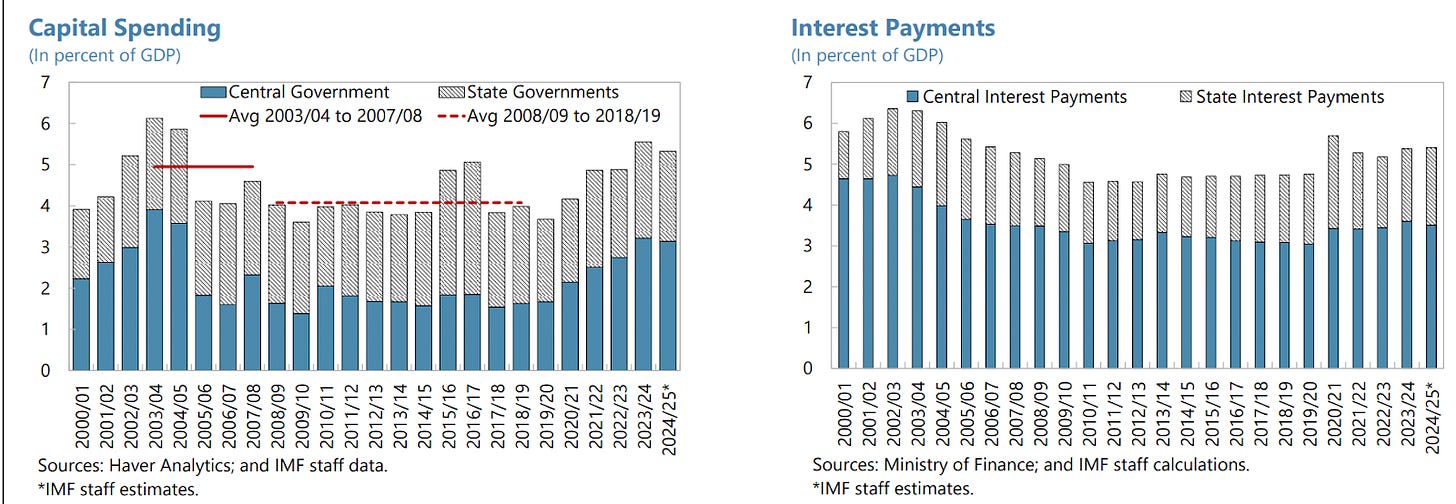

A key focus of the report is how India can get more bang for its buck from public investment. While the country has made substantial infrastructure investments – averaging 6.7% of GDP between 2018/19 and 2022/23 – the IMF's analysis reveals significant room for improvement in efficiency.

Using frontier analysis, the IMF estimates that the gap between India and the most efficient countries is about 29%. With improved public investment management, India could narrow about half of this efficiency gap and see greater access and quality improvements from its spending.

This matters because, despite significant investment, India still lags behind its peers on several infrastructure access indicators. While perceptions of infrastructure quality have improved in recent years – driven by better roads and electricity supply – the public capital stock per capita in India remains the lowest among large emerging markets.

The National Infrastructure Pipeline Taskforce estimates that India needs to spend over 10% of its GDP annually between 2020 and 2030 to reach its economic goals – making efficiency improvements all the more critical.

Reigniting Private Investment

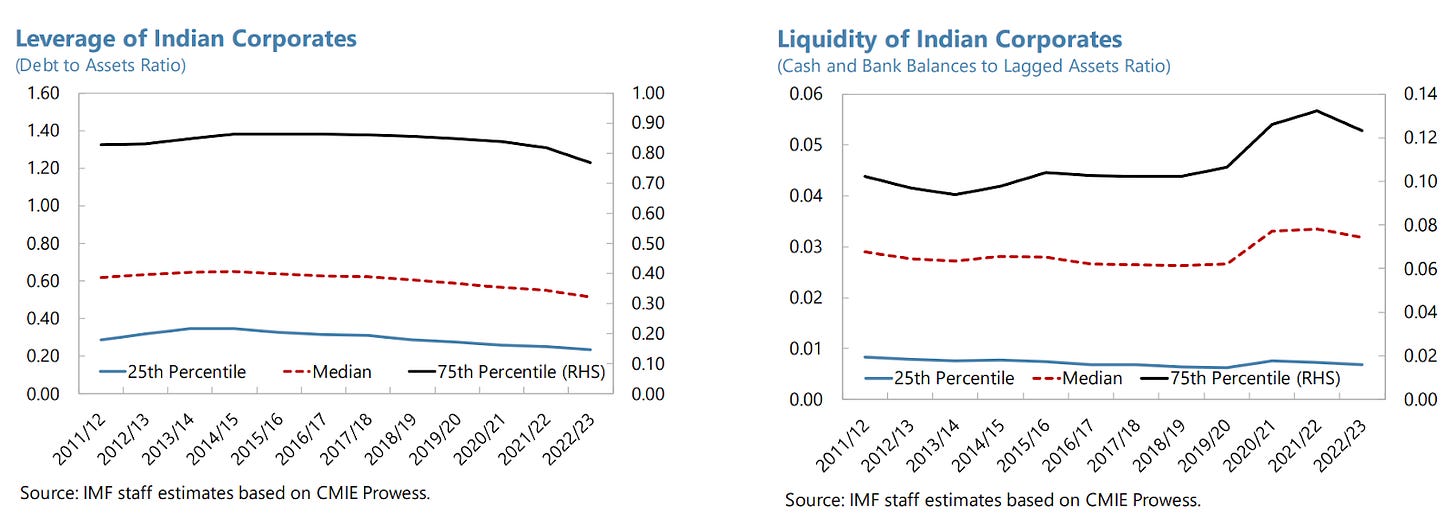

Private investment is crucial for India's development aspirations, and the report provides fascinating insights into what's holding it back and how to address it.

Corporate financial health has improved significantly, with median profitability rising to 8.3% of sales in 2022/23 from 6.8% in 2018/19, while leverage has declined, and interest coverage ratios have continued to trend higher. Yet investment hasn't taken off as expected.

One factor appears to be economic policy uncertainty, which the IMF shows has been somewhat elevated recently. Their analysis demonstrates that a one-standard deviation increase in uncertainty (about 40 points in their index) is associated with 11% fewer new project announcements – equivalent to about 66 fewer projects per quarter.

Another factor is India's approach to Bilateral Investment Treaties (BITs). Between 2013 and 2023, India issued termination notices to 68 countries for existing BITs and began negotiations under a new model agreement. While BITs' impact on investment is debated in economic literature, the IMF cites research showing that countries experiencing BIT terminations saw FDI inflows reduced by more than 30% compared to countries without terminations.

The report also highlights the importance of state-level factors. Using data from Indian states, the IMF found that manufacturing investment is positively correlated with education attainment, labor force participation, and ease-of-doing-business reforms. Their analysis shows that a 10-percentage point increase in reform implementation is associated with higher manufacturing investment by around 0.1% of GDP.

Enhancing Labor's Contribution

Perhaps most important for ordinary Indians is the report's analysis of how to enhance the contribution of labor to the economy and create better jobs.

The IMF's estimates of returns to education and training are particularly striking. An additional year of formal schooling in India increases earnings by 6-7% on average. Formal training boosts earnings by 18.5%, and on-the-job learning increases earnings by 7.3%. What's more, formal training raises the probability of being employed by 16 percentage points and the probability of having a regular-wage job by 18 percentage points.

Labor market reforms could yield enormous benefits. The IMF estimates that by reducing India's labor market reform gap by 25% relative to more flexible emerging markets, India could potentially create an additional 44 million jobs by 2029/30.

The report acknowledges India's progress in improving access to education but emphasizes the need to focus on quality. It highlights the importance of Early Childhood Care and Education (ECCE), noting that 85% of cognitive development is complete by age six. It also points to the success of tech-based, data-enabled programs like Gujarat's Education Command and Control Center, which increased student attendance by 26% in its first year.

The IMF also praises India's ongoing efforts to foster female labor force participation, which has increased from 23.3% in 2017/18 to 41.7% in 2023/24. Recent initiatives include increasing paid maternity leave, removing restrictions on female employment in night shifts, providing safe accommodation for working women, and mandating crèche facilities in establishments with 50 or more employees.

AI And India's Future

The report includes a particularly timely assessment of how artificial intelligence could impact India's economy. Unlike previous waves of automation, generative AI has the potential to displace high-skilled and non-routine jobs.

The IMF estimates that about 26% of Indian workers are in occupations with high AI exposure – with 14% in jobs where AI may be largely complementary, potentially raising productivity and earnings, while 12% are in occupations at higher risk of displacement. India's service sector, a robust source of growth and exports, is particularly exposed to AI disruption.

On the positive side, India scores slightly higher than the average emerging market on the IMF's AI Preparedness Index, particularly in regulatory areas. The report recommends strengthening human capital through enhanced STEM education and digital literacy programs, improving social safety nets, accelerating economic integration, and enhancing digital infrastructure to ensure India can capitalize on AI opportunities while mitigating risks.

Closing

The IMF's assessment presents a nuanced picture of an economy with tremendous potential but facing significant challenges. India's post-pandemic growth of 7.8% demonstrates remarkable resilience, but realizing the country's ambition of becoming an advanced economy by 2047 will require addressing structural constraints on private investment and job creation.

What's clear is that India stands at a critical juncture. With the right reforms – particularly in labor markets, judicial systems, and credit markets – it has the opportunity to create millions of quality jobs and sustain its position as the world's fastest-growing major economy. But in an increasingly fragmented global economy with rising geopolitical tensions, the window for action may be narrowing.

SEBI's specialized funds explained

This is big news from SEBI, folks. After months of anticipation, the Securities and Exchange Board of India has finally issued a circular on Specialized Investment Funds, or SIFs. This was previously called the "new asset class" in their consultation paper last year.

So what exactly is a Specialized Investment Fund? Think of it as SEBI's attempt to bridge the gap between regular mutual funds and Portfolio Management Services. These SIFs will operate under the mutual fund umbrella but with more flexibility in how they build portfolios and take risks.

Let's break down why SEBI is launching this. If you look at India's investment landscape, there's a pretty big jump in minimum investment amounts - from just a few hundred rupees for mutual funds to a whopping 50 lakhs for PMS. This gap has created an opportunity for a middle-ground product. In fact, SEBI noticed that many investors with 10-50 lakhs were turning to unregistered and unauthorized investment schemes in search of better returns. SIFs are designed to give these investors a regulated alternative.

Now, who can offer these funds? Any registered mutual fund can launch SIFs, provided they meet one of two eligibility routes. Under the first route, the mutual fund needs to have been in operation for at least 3 years with an average AUM of not less than 10,000 crores in the preceding 3 years. Alternatively, under the second route, AMCs can still offer SIFs if they appoint experienced professionals - specifically a Chief Investment Officer with 10 years of experience managing at least 5,000 crores and an additional fund manager with 3 years of experience managing at least 500 crores.

Let's talk about some key features. The minimum investment threshold is 10 lakhs per investor across all SIF strategies offered by an AMC. That's a significant jump from regular mutual funds. Interestingly, AMCs must ensure that the SIF has a distinct brand name and logo to clearly differentiate it from their mutual fund business.

One of the most exciting aspects of SIFs is their ability to use derivatives more aggressively. Unlike traditional mutual funds, which can only use derivatives for hedging and portfolio rebalancing, SIFs can take unhedged short positions through derivatives up to 25% of net assets. This opens the door to more sophisticated investment strategies.

Speaking of strategies, SEBI has specified what kinds of investment approaches AMCs can offer under SIFs. These include Equity Long-Short Funds, which can have up to 25% short exposure in equity through derivatives, Sector Rotation Long-Short Funds focused on a maximum of four sectors, and Debt Long-Short Funds. There are also hybrid options like Active Asset Allocator Funds that can dynamically invest across equity, debt, REITs, InvITs, and commodity derivatives.

What's particularly interesting about these funds is the flexibility in redemption frequency. While mutual funds typically offer daily redemptions, SIFs can tailor their redemption frequency based on the nature of investments - daily, weekly, or at other intervals. They can even implement notice periods for redemptions up to 15 working days.

SEBI has also put in place specific investment restrictions for SIFs. For debt securities, there are concentration limits that allow SIFs to invest no more than 20% of NAV in securities from a single AAA-rated issuer, 16% in securities rated AA, and 12% in securities rated A and below. There's also a cap of investing no more than 25% in debt securities of a particular sector. On the equity side, SIFs are permitted to own up to 15% of the paid-up capital carrying voting rights of a company, compared to just 10% for regular mutual funds. They can also invest up to 15% of their NAV in equity and equity-related instruments of any single company. These relaxed limits give fund managers more room to make concentrated bets while still maintaining some guardrails.

SEBI is clearly trying to prevent retail investors from jumping into these higher-risk products by setting that 10 lakh minimum. They're also requiring AMCs to monitor this threshold daily and ensure there are no breaches. If your total investment value falls below 10 lakhs due to a decline in NAV, that's okay - it's considered a passive breach. But in that case, you can only redeem your entire remaining investment.

Another interesting aspect is the risk disclosure framework. Similar to mutual funds' risk-o-meter, SIFs will feature something called a "Risk-band" with five levels from lowest to highest risk. This is designed to help investors understand what they're getting into. AMFI will be issuing the detailed standards for this risk band by March 31, 2025.

For those curious about transparency, SIFs will disclose their portfolios, including derivative instruments, on a bi-monthly basis - specifically at the end of May, July, September, November, January, and March. These disclosures will be available on both the AMC's website and AMFI's website within 10 days from the close of the month.

Something worth noting is the distribution requirements. If you're a mutual fund distributor looking to sell SIF products, you'll need to pass the NISM Series-XIII: Common Derivatives Certification Examination. This ensures that only qualified advisors can guide investors through these more complex products.

The circular also mandates that all advertisements and promotional materials for SIFs must carry a standard warning stating: "Investments in Specialized Investment Fund involves relatively higher risk including potential loss of capital, liquidity risk and market volatility. Please read all investment strategy related documents carefully before making the investment decision."

The circular comes into effect from April 1, 2025, so we've got some time before these products hit the market. But it's definitely something to keep an eye on if you're in that 10-50 lakh investment bracket.

Tidbits

The Indian government has appointed Finance Secretary Tuhin Kanta Pandey as the new chairman of the Securities and Exchange Board of India (SEBI) for a three-year term, succeeding Madhabi Puri Buch, whose tenure ends on February 28, 2025. Buch, who led SEBI for three years, introduced tighter derivative market regulations and promoted safer small investments. Pandey, a 1987-batch IAS officer, previously served as Finance Secretary and Secretary of the Department of Revenue.

The government has unveiled Bharat Ports Global, a consortium of India Ports Global (IPGL), Sagarmala Development Corporation (SDCL), and Indian Port Rail and Ropeway Corp (IPRCL), to expand India’s footprint in global port operations. The initiative focuses on key trade corridors, including the 7,200 km-long International North-South Transport Corridor (INSTC) and the India-Middle East-Europe Economic Corridor (IMEC).

India’s real GDP grew 6.2% in Q3FY25, recovering from a seven-quarter low of 5.4% in Q2FY25, according to data from the National Statistics Office (NSO). The rebound was driven by 8.6% growth in the construction sector, followed by 7.2% in financial, real estate, and professional services, and 6.4% in trade, hotels, transport, and communication. Private final consumption expenditure (PFCE) rose 7.6%, indicating improved consumer demand. The government revised its FY25 GDP growth projection to 6.5% from 6.4%. GDP growth had previously slowed from 8.6% in Q3FY24 to 7.6% in Q4FY24, 6.7% in Q1FY25, and 5.4% in Q2FY25 before showing signs of stabilization in the latest quarter.

- This edition of the newsletter was written by Bhuvan and Anurag

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

The charts are not explained enough, is was complicated to read and comprehend. Poor work here.

Why, No update on one thing we learned since Feb 21st?