How Trump is Shaking Up H1-B Visas

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Trump vs Birthright Citizenship

Foreign Borrowing: A Cause for Concern?

Mutual Funds for ₹250?

Trump vs Birthright Citizenship

Donald Trump has recently announced that he wants to end birthright citizenship in the United States. This means that children born on American soil to parents who are not US citizens or on temporary visas, like the H-1B visa, would no longer get automatic citizenship like before.

And this has huge implications for thousands of families on H-1B visas, especially those who rely on their US-born children’s citizenship as part of their longer-term plans to stay in America.

To understand why this is such a big deal, let’s first clearly understand exactly what the H-1B visa is.

See, back in 1990, the US government created the H-1B program to allow American companies to hire workers with specialized skills from around the world. These workers are usually in the fields of technology, engineering, and healthcare. Every year, the government makes a limited number of these visas available—65,000 for all applicants, plus an extra 20,000 for those who have advanced degrees from US universities.

However, the demand for these visas is so high that they are usually awarded through a lottery system. And to give you some numbers, in 2023 alone, there were around 3,86,000 approvals across different channels for this visa!

But recently, Donald Trump’s stand on H-1B visas has completely shifted. During his previous term as president, he was quite vocally strict about it. He followed a “Buy American, Hire American” approach that made it harder for companies to sponsor immigrants.

But, in some of his latest remarks, he has talked about letting more competent people come to America, even if they train and help others.

Listen to what he said:

“I also like very competent people coming into our country, even if that involves them training and helping other people... I'm not just talking about engineers, I'm talking about people at all levels…”

And in contrast, during Joe Biden’s term as president, his administration introduced changes that made the program more modern and added oversight to reduce abuse.

And by abuse in this context, We are talking about how some large IT consulting firms have been accused of “gaming” the lottery system. They do this by sending in far more applications than the number of workers they truly need. If a consulting firm thinks it needs 2,000 new staff members and the chance of winning a visa in the lottery is only one in three, it might put in 6,000 applications, hoping that around a third of those will be picked. This might be good for these big firms, but it can crowd out smaller companies that genuinely need niche skills or specific specialists. Over ten years, firms like Cognizant, Infosys, and Tata Consultancy Services managed to get about 350,000 H-1B approvals by using this tactic.

When we look at usage trends in the H-1B program, we see two different stories unfolding:

American tech companies like Amazon, Meta (previously Facebook), and Google have been asking for more H-1B workers for several years. Amazon alone saw its visa applications increase by 478% after 2016. However, in 2024, things changed a bit: companies like Amazon, Google, and Microsoft saw their approvals go down. For instance, Amazon’s approvals dropped from over 11,000 in 2023 to around 9,265 in 2024.

On the other hand, Indian firms that used to depend heavily on H-1B visas have slowed down their use of the program quite a lot. Infosys, TCS, and Wipro have all seen big drops, with TCS reducing its visa usage by 75% and Wipro by 69% over the past decade. One reason is that these companies are now hiring more people locally in the United States or finding other ways to run their projects.

Despite these changing trends, the share of Indian nationals in the H-1B program is still huge. In 2023, about 72% of H-1B visas went to people from India, which meant around 279,000 approvals. For people unable to get a visa, many ended up using their skills at home in India. In fact, some studies show that those who stayed in India helped their country’s tech sector grow to the point that India eventually surpassed the United States in software exports by 2005. This is sometimes referred to as a “brain gain,” because while the US did gain skilled workers, India also benefited when large numbers of talented individuals stayed back or later returned with new skills and networks.

There is also an important link between H-1B visas and innovation:

In the US, immigrants make up only about 14% of the workforce, yet they account for nearly a quarter of all patents.

In Silicon Valley, you’ll find that 56% of STEM workers are foreign-born, and among software engineers, that figure is as high as 70%.

A fascinating statistic is that almost half of America’s billion-dollar startups, such as SpaceX, Palantir, and Uber, have at least one immigrant founder. This shows that foreign talent does a lot to drive new ideas and industries forward.

In terms of innovation, between 2000-2016, the share of foreign-born investors who received grants in the US rose from 24% to 35%.

Research on the programme’s impact suggests that the H-1B system generally helps the US economy:

Studies show it has boosted overall incomes by hundreds of millions of dollars. One piece of research by Gaurav Khanna at the Center for Global Development found that every additional migrant in the H-1B programme increased U.S. worker incomes by about $1,345, leading to a large combined rise in GDP across both the US and India.

Another study found that if American companies are turned down for an H-1B visa, they don’t usually just hire more Americans. Instead, they move some of their operations or research overseas. This means visa restrictions can end up hurting America’s job market in the long run because it might encourage companies to shift even more work abroad.

Critics, however, worry that too many foreign workers might replace or lower wages for American workers. Interestingly, the research does not strongly support these fears. In some cases, wages for US computer scientists might have been slightly higher without foreign competition, but overall, the tech sector’s expansion seems to have helped workers in related fields and kept the American economy more competitive. There have also been studies of places with large immigration surges showing that local wages generally do not suffer, and per-capita income can rise in areas where there is more immigration.

The research by Britta Glennon, a Professor of Management at the Wharton School revealed another crucial pattern: when companies respond to visa restrictions by moving jobs abroad, the effects are concentrated in three countries: China, India, and Canada. This suggests companies are either going where the talent is (China and India) or where immigration policies are less restrictive (Canada).

Another area researchers look at is entrepreneurship. It turns out that immigrants start new businesses at an even higher rate than people born in the US, and they create both small and large companies that often pay slightly higher wages. This further fuels the country’s economic growth. Meanwhile, when immigrants from places like India come to America to study or work, they can return home eventually and bring valuable knowledge and connections back with them, boosting India’s tech scene.

Now, with Donald Trump’s renewed plan to end birthright citizenship, H-1B families fear losing a key route to creating permanent lives in the United States. Many are stuck in extremely long waiting lines for green cards—up to 100 years in some cases—and having a child who is automatically a citizen has always been part of the plan for stability. Removing this right could make the H-1B pathway less appealing or manageable for thousands of skilled workers, especially when combined with tighter visa rules.

All this shows how complicated the H-1B story has become. On the one hand, there is a clear link between welcoming foreign talent and maintaining America’s role as a global leader in technology and innovation. On the other, there is a growing concern among some people that more immigration might come at a cost to American workers or could be abused by big outsourcing firms. The truth seems to be more nuanced, with much research suggesting that the programme has been a net positive for the United States, while also bringing benefits to India and other countries that supply workers.

At the end of the day, the debate over H-1B visas has become even more heated because Donald Trump announced the ending of birthright citizenship. That is why many experts think the conversation about who gets to come to America, who gets to stay, and how that impacts the economy will only get louder in the months and years ahead. The H-1B programme sits right at the centre of this debate, balancing America’s hunger for talent with the concerns some people have about jobs, wages, and immigration. For now, the story continues to unfold, and whichever direction it takes, it is bound to shape the future of the technology industry, the fortunes of many immigrant families, and the American economy as a whole.

Foreign Borrowing: A Cause for Concern?

A few days ago, we’d written about a weird trend.

The economists Subramanian, Felman, and Anand, in a recent column for the Business Standard, pointed to how the RBI was controlling the Rupee-Dollar exchange rate too tightly. This, they argued, could backfire.

Their case was this: the choices a business faces depend greatly on the exchange rate. If American banks offer cheaper loans than Indian ones, and if the RBI keeps the Rupee artificially high against the Dollar, suddenly, American loans look very cheap. It makes complete sense for an Indian company to turn abroad for financing, through what are called “external commercial borrowings” or “ECBs”.

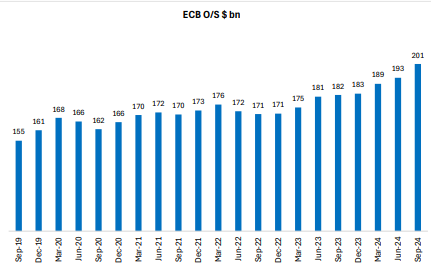

And then, in a “gotcha!‘ moment, they presented a chart:

The consequences of the RBI’s actions were obvious. According to the chart, the stock of foreign borrowings by Indian companies seemed to shoot up rapidly in the last year and a half. In 18 months, the total amount that Indian companies owed abroad had gone up by one-third.

This could cause all sorts of problems down the line — including putting massive downward pressure on the Rupee when all those companies paid back their loans.

A recent report by SBI research, however, pushes back against this narrative. Here’s what they say:

That graph is wrong

There are actually two possible numbers you can use for corporate India’s outstanding ECBs. There’s an RBI estimate of $190 billion. And there’s a far larger estimate — $ 273 billion — that the authors probably took from Ministry of Finance (MoF) data. The difference between the two is over $80 billion Dollars. That, funnily enough, is almost exactly as much as SBI’s market capitalization.

Think about that: the confusion surrounding how much we borrow from abroad is bigger than the size of India’s largest bank!

Which number should you trust?

SBI Research goes for RBI’s smaller number. Why? Well, MoF’s numbers include investments of $73 billion that foreign investors made in Indian sovereign and corporate bonds. That, SBI Research says, has no place in India’s ECB data! Those are usually temporary investments by foreign portfolio investors who are just hoping to make a good return. That’s hardly the sort of calculated, exchange rate-based loan arbitrage that Anand, Felman, and Subramanian were pointing to.

When you ignore bond investments, the difference between the two numbers disappears. It no longer looks like India’s foreign borrowings are skyrocketing. Instead, they go up by a mere $16 billion over 30 months. That’s far more normal.

Is this just a reversion to the mean?

While exchange rate dynamics may make external borrowing look attractive, there’s an invisible cost that can even things out. Because borrowers know that exchange rates can change overnight, they have to hedge their foreign borrowings. Almost two-thirds of all external borrowings by Indian companies are hedged. This hedging activity adds extra costs to anything they borrow. That can narrow the supposed benefit you get from controlling the exchange rate.

SBI Research does agree, for the record, that the cost of external borrowing has come down slightly over the last couple of financial years:

It also believes that there was a lot more external borrowing in Fiscal 2024 than in Fiscal 2023.

But the fact is: that India borrowed a lot more from abroad before the COVID-19 pandemic than it does today. In Fiscal 2020, ECBs made up 1.9% of our GDP. That number fell to 1.2% in Fiscal 2024.

This could all be a simple matter of things returning to the pre-pandemic trend.

Is this part of a broader investment story?

There’s another way of looking at things: Indian corporates may be borrowing more from abroad because they’re finally investing more in India.

For many years, India’s private sector held back from investing in the country. This has worried economists and policy-makers for many years. Finance Minister Nirmala Sitharaman once even compared India’s private sector to the monkey God, Hanuman, asking out loud if they had forgotten their true powers.

But there are hints that this investment drought might be receding. According to SBI Research, there’s been a noticeable increase in the investments announced over the last few years. Much of this investment is led by the private sector, rather than the government. The first nine months of this year, for instance, saw investment proposals of Rs. 32 lakh crore — over 70% of which were private. This is well above pre-pandemic levels.

The RBI, too, has noticed this upsurge:

In Fiscal 2023, private gross capital formation reached its highest point since Fiscal 2016 — at 11.6% of our GDP. While data for Fiscal 2024 isn’t yet available, chances are, it’s increased even further.

It’s not just SBI Research, by the way. Late last year, Care Edge Ratings pointed to how capital goods companies have seen a large surge in orders in Fiscal 2024, which might be another positive signal.

When you look at the ECB data for the last Fiscal year, you find that around half of it is earmarked for capital goods, modernization, and capital expenditure. That seems to fit this very different narrative — that India’s rising external borrowings come from its higher appetite for business.

The lesson? Avoid macro-tourism.

So, which narrative should you trust? We can’t tell you for sure. India’s economy is a puzzle, and nobody knows how the pieces fit together.

If there’s something this episode goes to show, it’s that statistics are messy. To paraphrase the famous quote:

“Statistics are like lungis. What they reveal is suggestive, what they hide is vital”.

A number only has meaning when you attach a narrative to it. That narrative distorts the insight a number gives you. Economists at the pinnacle of their careers, too, have long, heated battles on individual numbers and what they mean. This is just one such battle. Lay people should expect to be confused by the mess of it all.

Many investors are drawn to macro-tourism. They make investment decisions by looking at high-level economic statistics and trends and using them to create hypotheses about an entire economy. Unfortunately, this is a terrible strategy — especially if you’re not used to digging deeper. All numbers have layers of context. If you don’t look for context, you’ll probably miss it. If you’re not aware of how exactly the nuances play out, you can end up going very, very wrong.

Mutual Funds for ₹250?

SEBI just put out a consultation paper that’s basically saying, “Hey, let’s make mutual funds accessible to everyone through micro-SIPs of ₹250.” It’s kind of like sachets for investments—just like those ₹2 shampoo sachets but for your investments.

Now, here’s where the industry stands today: Mutual funds have come a long way. The AUM (assets under management) has grown from ₹10 trillion in 2014 to ₹68 trillion as of November 2024. And the number of unique investors? That’s shot up from 1.7 crores in March 2018 to 5.18 crores in November 2024. Pretty incredible growth, right?

But here’s the thing—this growth isn’t spread out evenly. Let’s break it down with some city-wise numbers. Mumbai alone holds 27% of India’s mutual fund assets, which is about ₹18 lakh crore. Add Delhi with its 12% share and Bengaluru with 5%, and just these three cities make up 44% of all mutual fund assets in India. Now, throw in Pune and Kolkata, and the top 5 cities together account for over 50% of the country’s mutual fund AUM.

This is exactly why SEBI is pushing for this sachetization idea. Some mutual fund companies already offer small-ticket SIPs, but it’s not consistent across the board. SEBI wants to change that and make it a standard across all fund houses. The goal? To bring more people—especially those from smaller towns and lower-income groups—into the formal investment space.

Here’s where it gets interesting—and Deepak Shenoy explained this really well on Twitter. Running these small SIPs isn’t as simple as it sounds. Every time someone invests ₹250, there are costs involved—payment gateway fees, RTA processing charges, and all that backend stuff. It adds up to about ₹2 per transaction, which is nearly 0.8% of the investment amount. That’s actually higher than some direct mutual fund expense ratios!

Now, let’s talk about the numbers from smaller towns and cities (what the industry calls B30 or ‘Beyond 30 cities’). As of December 2024, only 19% of mutual fund assets come from these locations. But there’s a bright side—B30 assets grew by 41% in the last year. And here’s another interesting thing: 86% of investments from B30 areas are in equity schemes, compared to just 55% in the top 30 cities. It’s clear that smaller towns and cities have a strong appetite for equity investments.

SEBI is trying to make this work by getting everyone in the ecosystem to pitch in. They’re asking intermediaries to offer discounted rates, and they’re even planning to cover some of the costs using the Investor Education Fund. On top of that, they’re offering a ₹500 incentive to distributors who can get new investors to stick with these micro-SIPs for at least two years.

It’s definitely an ambitious plan. Will it work? That’s what this consultation paper is aiming to figure out. SEBI is taking feedback until February 6, 2025, and it’ll be interesting to see how the industry responds.

Tidbits

Smartphones have become India’s second-largest export category, with exports reaching $13.1 billion between April and November of FY25—a 46% jump from $8.9 billion during the same period last year. This growth has significantly narrowed the gap with automotive diesel fuel exports to just $400 million, compared to a $10 billion difference in FY24. Exports have skyrocketed from $1.6 billion in FY19 to $15.6 billion in FY24, marking a 10-fold increase in just six years. Apple, through its vendors Foxconn, Pegatron, and Wistron, accounted for two-thirds of these exports.

Tata Communications is preparing to launch AIStudio, a Platform-as-a-Service (PaaS), by March 2025. Built on its AICloud infrastructure and powered by Nvidia’s Hopper and Blackwell GPUs, the platform will offer AI tools like data management, multimodal search, and machine learning operations. These tools will be available to enterprises, startups, and government projects on a subscription basis. The company is also aiming to grow its presence in the U.S., targeting $1 billion in revenue by 2026, despite challenges like recent executive orders.

Paras Defence & Space Technologies has announced a ₹12,000 crore investment to set up India’s first optics park in Maharashtra. The park is expected to start operations in 2028 and will be developed in phases, with completion planned by 2035. Supported by the Maharashtra government through land allocation, incentives, and approvals, the project is set to create over 2,000 direct jobs.

- This edition of the newsletter was written by Pranav and Bhuvan

🌱One thing we learned today

Every day, each team member shares something they've learned, not limited to finance. It's our way of trying to be a little less dumb every day. Check it out here

This website won't have a newsletter. However, if you want to be notified about new posts, you can subscribe to the site's RSS feed and read it on apps like Feedly. Even the Substack app supports external RSS feeds and you can read One Thing We Learned Today along with all your other newsletters.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

January is coming to end, but still no update on the book club, i was very excited for it