How to Lose Friends and Alienate Supply Chains

What the hell is happening? #1

Hi👋, my name is Bhuvan and welcome to the first experimental edition of What the hell is happening?

To say that there are monumental changes afoot in the world right now would be like saying water is wet. Since we are all geeks and nerds here, we obsessively track these shifts and read and listen to a wide array of other experts, geeks and nerds. Though some of what we learn makes its way into The Daily Brief, Who Said What, and the other shows we do, a lot of it stays with us.

We are only able to do what we do at Markets by Zerodha because we rely on other people generously sharing their knowledge to learn. It's only fair that we do the same. Creating a curated newsletter with the interesting things that we discover had long been on our to-do list but we couldn't do it because of resource constraints. We are just a small team of 5-odd people, so this took a backseat.

However, considering all the utterly crazy and once-in-a-generation events that are unfolding, a lot of us might have more questions than ever—we know we do for sure. So we are starting this newsletter to curate some of the best articles, podcasts, videos, tweets, and research papers that we come across in our quest to understand the maddening worlds of finance and economics.

The idea is to handpick things that help you understand the biggest trends that are shaping our world like trade, climate change, geopolitics, demographics, artificial intelligence, de-globalization, the future of the dollar-based financial system, debt, resource battles, inequality among others.

Please do read the newsletter and let us know if we should keep going or retire in shame.

The stupid trade war

The only thing that matters to the global economy right now is how Donald Trump's stupid trade war plays out from here. The sheer stupidity and capriciousness of Trump's shambolic tariffs are the greatest self-goal in the history of all self-goals. Never before has such a grave act of economic self-harm been committed on such flimsy and illiterate pretext.

Prior to Liberation Day, which should, in my view, be renamed as Full Retard Day, the US was the fastest growing advanced economy and the envy of the world. Growth was solid, inflation was falling, wage growth was decent and productivity growth was solid. By the way, the words "full retard" are not my choice. Those were the exact words used by the famous historian Niall Ferguson:

Noting that conservative historian Niall Ferguson labeled Trump's trade policy going "full retard," he contributed, "I go with 'neurotic' for the word’s wider applicability to any leader who, lacking a clear bead on his times, fabricates a gratuitously ambitious mission to meet his misguided sense of importance."

Trump took a look at the growing US economy and went "Hmm, our economy is doing too well, I better fix it." With the grace and nuance of a drunk elephant on roller skates, he launched his idiotic, self-sabotaging trade war. If his goal was to stop the fastest growing advanced economy from growing, he couldn't have done a better job, he f****ing nailed it!

The covers of The Economist magazine capture this dramatic change in sentiment perfectly.

Pretty much all sane people both on the right, middle, and the left are united on the view that tariffs are bad, yet Trump hasn't fully backed off. He's just been flip-flopping, keeping everybody on their toes. Trump is probably the best thing to have happened to therapists and psychiatrists since social media.

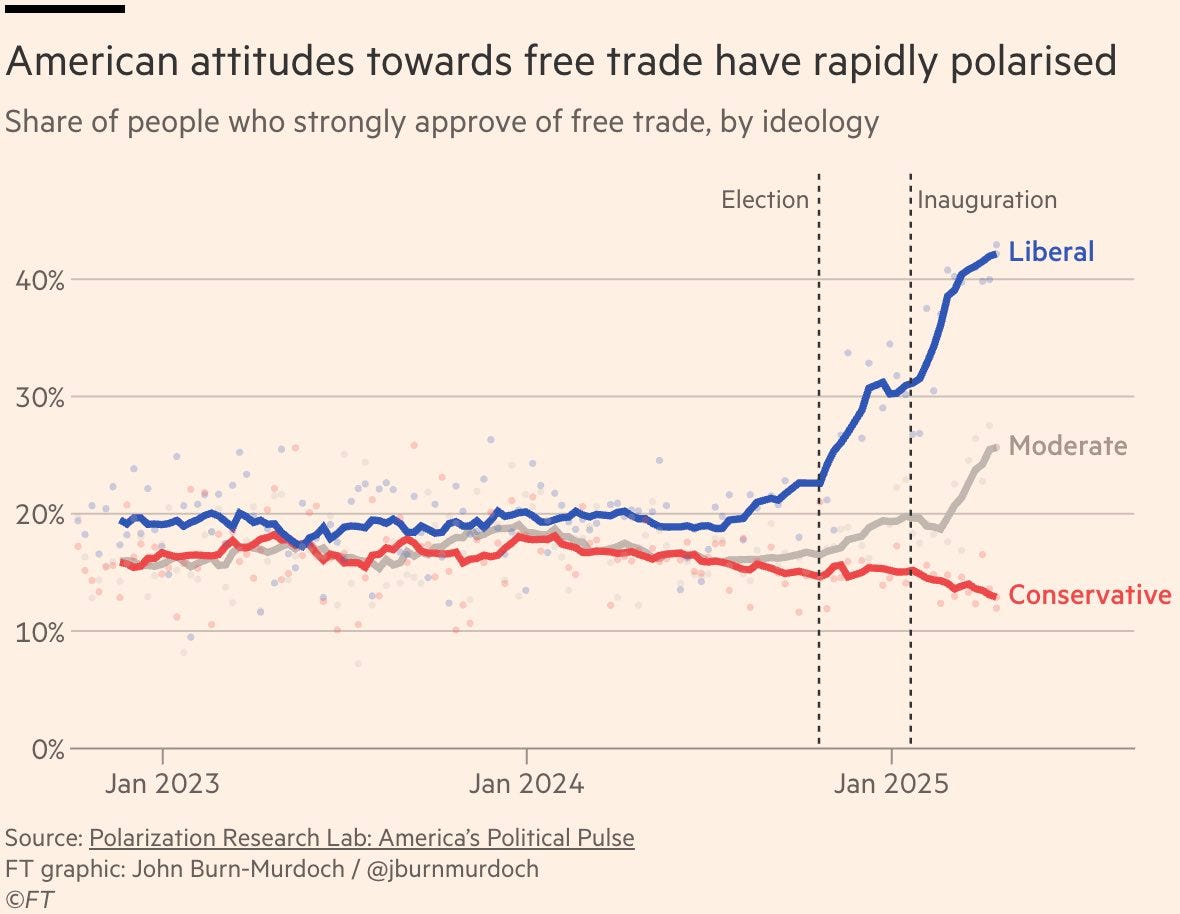

Perhaps one of the funniest side-effects of Trump's reckless tariffs is that he's single-handedly managed to improve the image of free trade among Americans.

Excluding the most diehard MAGA people, pretty much all Americans—progressives, moderates, and reasonable conservatives are all now pro free trade and pro-globalization. The weirdest moment for me in all this is when I saw progressives quote tweeting content from the Cato Institute. That's like Darth Vader retweeting the Pope.

Janan Ganesh of the Financial Times summed it up best in his article titled "Donald Trump's gift to globalisation":

For the first time since the crash of 2008, globalisation has the high ground. It is those striving to undo it who are on the moral and intellectual defensive. Protectionism has turned out to be something of a fair-weather cause: popular as long as no one has to make a material sacrifice.

This change in the intellectual atmosphere should affect how governments behave over time. So should the humbling of a second protectionist president in a row. After the electoral flop of Bidenomics, it is Trump’s turn to misread the working class as people pining to do the manual jobs of their forebears. It takes a college degree to believe this patronising foolery, which the comedian Dave Chappelle has countered better than most. (“I want to wear Nikes, not make them.”) What is a “worker” in 2025? A sales rep with a sideline as a gig driver, probably, whose main exposure to trade is the purchase of cheap products. While 80 per cent of Americans want more factories, 25 per cent aspire to work in them. Physical labour for thee, but not for me.

Stating the obvious

Whether you like the famous economist Ha-Joon Chang or hate him, I think he's always worth listening to. He recently gave an Interview to Jacobin on the stupid trade war and I want to share a few things that stood out to me:

The decline of American manufacturing is "self-inflicted" because the capitalist class chose to outsource and offshore manufacturing rather than invest at home. Instead of investing the profits the US corporations generate, they chose to return the money to shareholders in the forms of buybacks.

One of the stated objectives of Trump's tariffs is reindustrialization. Countries like Sweden, Finland, and Singapore successfully reindustrialized but they didn't do it through protectionism alone. They used a wide array of policies ranging from retraining people who lost jobs in traditional manufacturing to industrial policies to develop other industries.

Even though the US policy of protectionism starting in the late 1800s lasted until World War II, it worked because American companies invested and caught up to the British and Europeans. Alexander Hamilton advocated for tariffs but there was more to his suggestion including investing in infrastructure, developing banks, bond markets and targeted industrial policies.

On the stupidity of looking at bilateral deficits and the hypocrisy of the Americans:

Developing countries have huge trade deficits, but you cannot say that deficits and surpluses reflect unfair competition. No one forced the Americans to buy Korean cars or Chinese solar panels. They bought them because they wanted them.

This logic is bizarre. Why is the United States not looking at imbalances in services, which usually work in favor to the Americans? In the last few decades, the US economy has been restructured into becoming an exporter of oil, gas, agriculture, and services. Why are the Americans not looking at imbalances in agriculture? The United States has a huge trade surplus with South Korea in terms of agriculture. Is it okay for the Korean government to accuse the Americans of unfair practices in the agricultural sector because the United States gives huge subsidies to its farmers? America might have a deficit in terms of manufacturing trade with Mexico, but it has a surplus in terms of service export with Mexico. Just looking at our manufacturing and saying that all this is due to unfair competition by other countries is bizarre.

The world is one giant supply chain

For over 3 decades, companies around the world, especially US companies made significant investments in building "optimized" and "efficient" supply chains that crisscross the globe. I don't think most people understand how truly global the manufacturing processes of large companies are. Take the US itself, it's deeply reliant on China for a whole range of goods.

Decoupling from China, bringing production to the U.S., and supply chain diversification are U.S. strategic priorities. Yet global supply chains can’t be rewired quickly without major disruption – an economic rule. China is a key supplier of critical minerals, semiconductors, industrial parts and auto parts, U.S. Census data show. How intertwined are the economies? U.S. imports of computer and electronics are bigger than total U.S. production of these items. See the chart. Tariffs could up costs, cut access to key inputs and halt production. A cooling U.S. stance would point to growing awareness of the risks tied to a supply shock.

Big questions remain about the damage tariffs could cause, even if the binding effect of economic rules means it will take time to uproot current trade relationships. We see more cause for concern on the supply side, as disruptions could lower productivity and the growth trajectory – like the pandemic shock. Long-term capital spending could also be hurt by uncertainty as happened after the 2016 Brexit vote. — BlackRock

From toys, headache tablets, toasters to critical electronic equipment and pillows, the US is reliant on China. Think of the US as an experienced veteran drug addict and China as the only drug dealer. What happens to the addict if the only drug peddler in town were to suddenly close shop?

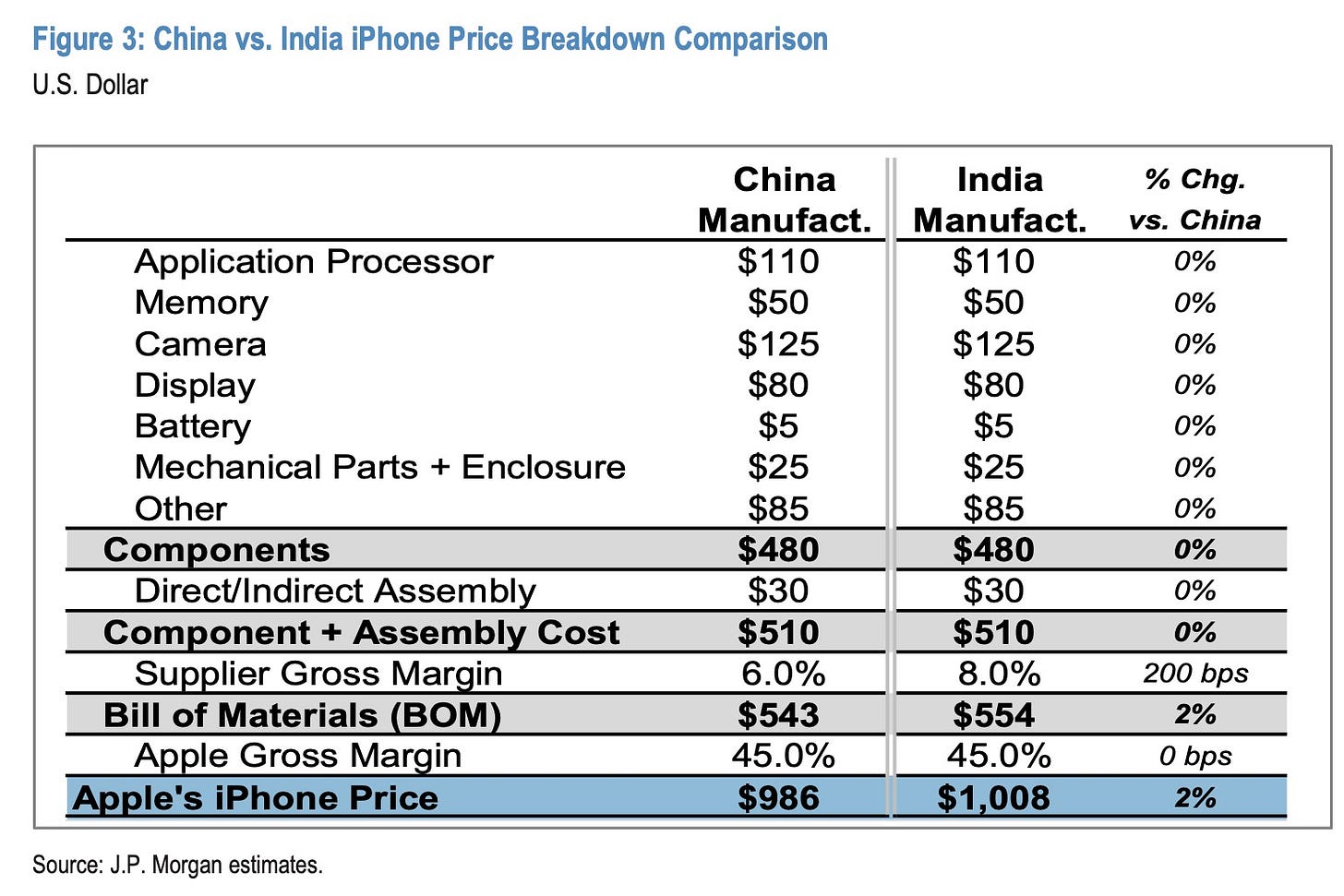

The Financial Times recently published a brilliant article on why it’s hard to make iPhones in the US. Here are some stunning stats:

New models are a sophisticated jigsaw of around 2,700 different parts. Apple uses 187 suppliers in 28 countries.

Less than 5 per cent of iPhone components are currently made in the US, according to the International Data Corporation, including the glass casing, the lasers that enable Face ID and the chips, which include the processor and 5G modem.

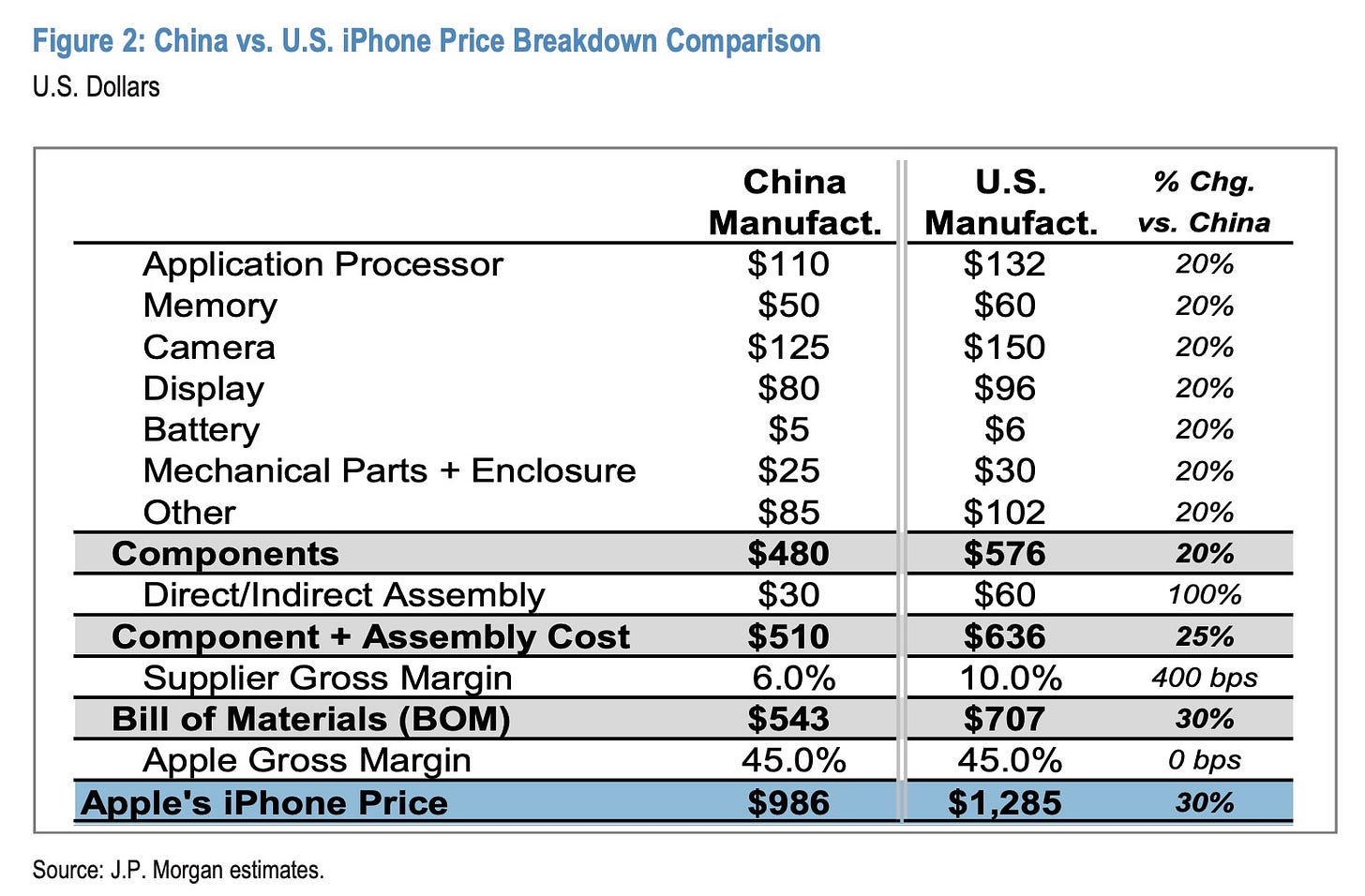

To make it more concrete, if the final assembly of the iPhone was moved from China to India, the price of the phone would increase by 2% according to J.P. Morgan. If they were to be moved to the US from China, the cost would increase by 30%. TLDR: Imposing tariffs is easier than untangling and relocating supply chains that have taken 2-3 decades to establish.

But, to paraphrase Upton Sinclair, it's hard to make a man understand the nuances of global trade when his favorite word in the dictionary is "tariff."

Here’s an index tracking disruptions in the flow of critical products. I wish this was tradeable so that I could go long:

A big beautiful decoupling

Perhaps the most stunning development that isn't being discussed nearly enough is that Trump's global trade war is now pretty much a US-China trade war.

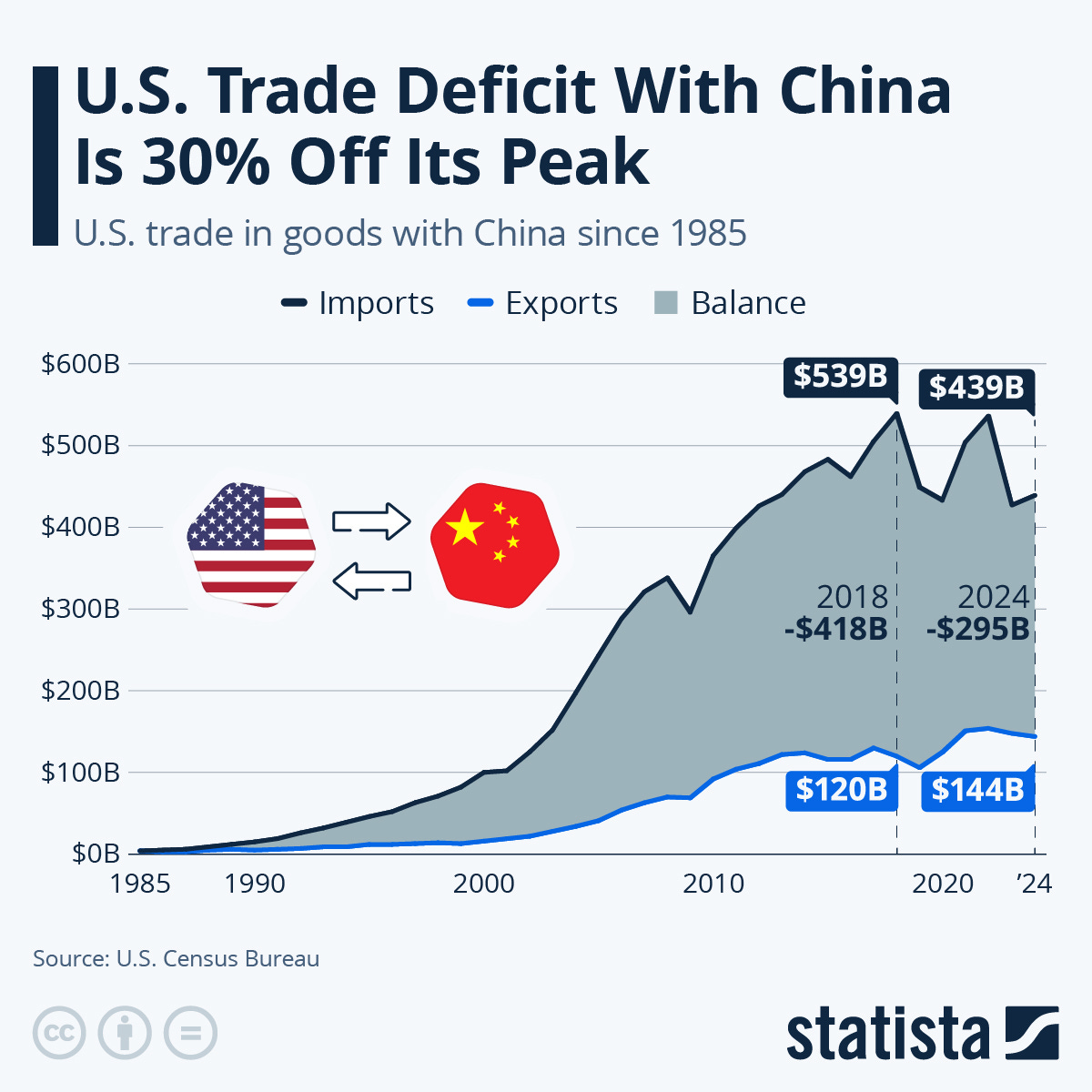

These are two countries with nearly $600 billion of trade in goods.

Right now, this relationship is slowly but surely breaking apart. Trump is slowly but surely engineering a slow and “beautiful” decoupling.

A beautiful shot in the foot!

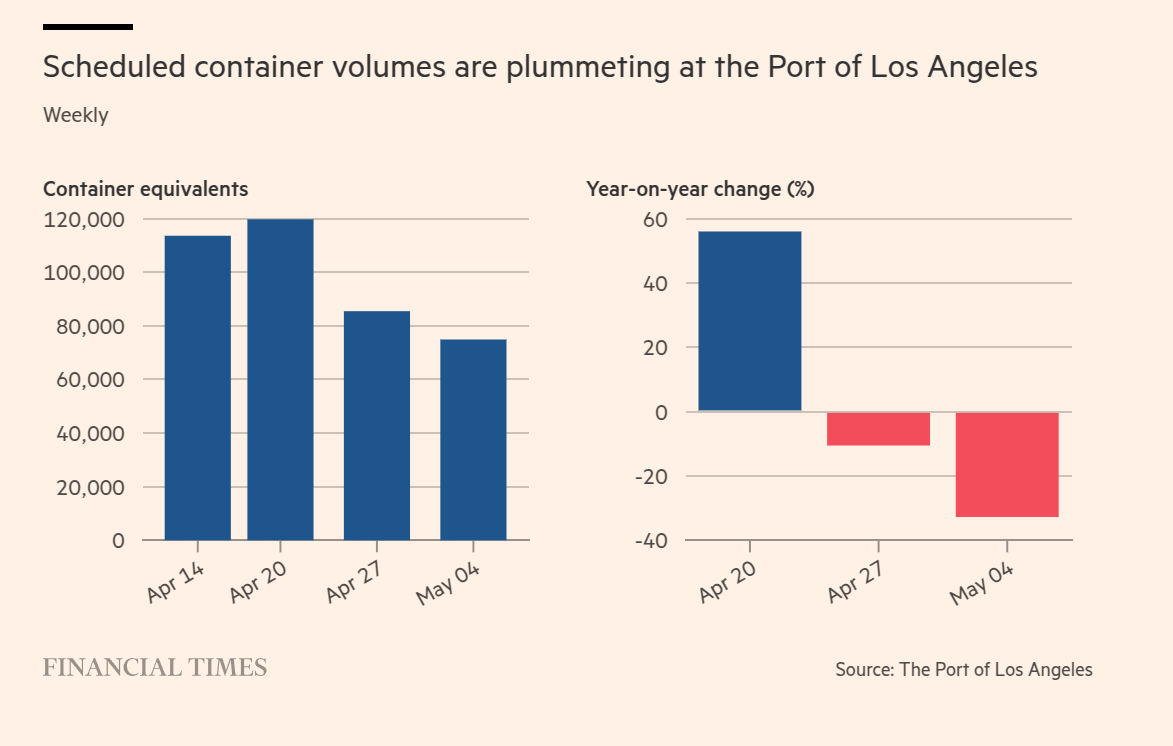

We are already seeing signs of the flow of goods from China to US being affected:

For the week ending May 3, the number of freight vessels leaving China and headed to the Southern California ports, the main U.S. ports receiving Chinese freight and other Asian trade, is down 29% week-over-week, according to Port Optimizer, a tracking system for ships. Year-over-year, the data shows a 44% drop in vessels scheduled to arrive the week of May 4-May 10. — CNBC

At the Port of Los Angeles, one of America’s biggest gateways for imports from China, executive director Gene Seroka told port officials Thursday that he expects a 35% drop in import volumes in two weeks “as essentially all shipments out of China for major retailers and manufacturers has ceased.” — WSJ

With tariffs at 145%, many small businesses will have to shut down or declare bankruptcy.

In a Toy Association survey of 410 toy manufacturers with annual sales of less than $100 million, more than 60 percent said they had canceled orders, and around 50 percent said they would go out of business within weeks or months if the tariffs remained.

In many cases, the tariffs are more than the cost of goods itself:

"I have an oral care company and all of our empty containers such as tubes, bottles and tins, as well as dental floss come from China. Currently, I have an order of 5,000 bamboo lip gloss tubes at port. The order cost me $5000. The tariff I have to pay is $9,983. Obviously, this triples the COG for this item, cutting into our profit in a huge way. I will have to take out a loan to pay this extra expense. ... Something has to be done because this is unfairly punishing small business owners. It is also important to note that none of these items are made here in the U.S., so it’s not like I can buy Made In The USA even if I wanted to!"

Trade will steadily grind to a halt:

Many companies say that tariffs above 50 percent on Chinese imports are enough to stop trade entirely. With tariffs now at a minimum of 145 percent, and in some cases much higher, that would mean that the Trump administration may have to drop its China tariffs by at least 100 percentage points to meaningfully restart the flow of goods.

This decoupling is starting show up in the number of ships making their way from China to US:

However, I want to add a few caveats to this chart. Many companies had started stocking up on goods in anticipation of the tariffs so a dip in China to US shipping volumes was bound to happen. The other reasons that are contributing to this drop in trade volume are more industry specific such as excess capacity and regulatory changes. That doesn't mean trade hasn't been affected.

How does Trump feel about prices increasing because of the “beautiful” tariffs on China?

“You know, somebody said, ‘Oh, the shelves are going to be open,’” Mr. Trump said from the White House. “Well, maybe the children will have two dolls instead of 30 dolls, you know? And maybe the two dolls will cost a couple of bucks more than they would normally.”

He’s cool with it!

Good cop, bad cop

After Trump unleashed his stupid trade war, reports emerged that both the US and China were forcing countries to pick sides. While the US was trying to arm twist countries to reduce trade with China in return for lower tariffs, China has been threatening export restrictions.

Despite American bluster, it isn't immediately clear to me why countries would choose to alienate China and side with the US. Here's Christopher Wood of Jefferies in his latest letter:

If this pressure means Japan and India may be able to negotiate better deals with the US than might otherwise have been the case, they are unlikely to agree terms that threaten their trading relationship with China. Remember that China specifically warned last week that it will retaliate against any country that negotiates trade deals with America “at the expense of China’s interests”. In this respect, it is a reality that for many countries China is now a more important trade partner than the US. To be precise, a total of 143 or 71% of countries traded more with China than with the US in 2024, while 107 or 53% of countries traded more than twice the amount with China that they trade with the US, based on IMF’s data on international trade in goods by partner countries (formerly Direction of Trade Statistics). This compares with 22% and 11% respectively back in 2001 when China joined WTO (see Exhibit 1).

China is simply too important for most countries to alienate:

China’s rapid ascent as a global trade superpower can be traced back to 2001, the year it acceded to the World Trade Organisation (WTO). At the time, more than 80 per cent of economies had more two-way trade with America than with China. By 2018, the last time we did this exercise, that figure was down to just above 30 per cent — with 139 out of 202 economies with available data trading more with China than with the United States. That pattern has held with the latest data, which covers the full year for 2023 for 205 economies. About 70 per cent of the world, or 145 economies, now trade more with China than with America.

China was the largest bilateral trading partner for 60 economies in 2023, almost twice as many as for the United States, which was the largest bilateral trading partner for 33 economies.

One of the funniest things in all this is that Trump being Trump, expected Xi to come begging. In the days and weeks after Liberation Day (Retardation day), there were reports that the Americans asked the Chinese to call them first so that they could cut a deal and save face. The Chinese told the Americans to bugger off. Despite Trump's false claims that the Chinese were seeking a deal, it turns out they weren't and were prepared to go all out. Think about that for a second. The leaders of the world's two most powerful nations have reduced geopolitics to a teenage staring contest over who picks up the phone first.

However, given that the serious backlash Trump is facing, it looks like the US has made the first move offered to make a “deal.”

From Art of The Deal to Art of the Kneel!

What does this mean for India?

Both Peter Navarro, Donald Trump's trade advisor, and Scott Bessent, the Treasury Secretary, have said publicly that a trade deal with India is imminent. This begs the question, is this good for India? Anupam Manur, professor of economics at Takshashila Institution wrote a thoughtful article recently:

Thus, whatever trade concessions India is contemplating with the US, it should look at expanding these provisions to our other important trading partners as well. One of the important lessons from this episode is that the US is no longer an all-season reliable trading partner and to mitigate random policy shifts from the US in the future, it is imperative for India to hedge its bets. In fact, a strong trade deal with another major economy in this period would have given India more leverage in its negotiations with the US.

With the EU, the UK, Japan and most other major economies reeling under the effect of Trump’s tariffs and searching for diversification options, the time has been ripe for India to seal the deal with these countries. In a fractured and non-rules-based world order (with the WTO becoming irrelevant), it is in India’s interest to get into as many bilateral trade treaties as it can and be part of regional trading blocs. This is also the time when most countries would be willing to compromise on the minor issues in favour of larger market access and India should adopt a similar approach.

Pair this article with these two articles by the super thoughtful Pranay Kotasthane, again from Takshashila:

Global Policy Watch: Pause And Effect

Psychoanalyzing of Trump

In the last few months, I've been obsessed with the second and third order effects of Trump. Going down this rabbit hole to understand the fallout from Trump's actions was akin to becoming an amateur psychoanalyst and I wrote a little about what I learned. Having said that, is there a simple explanation about what drives Trump to do the things he does? Here’s Francis Fukuyama:

Rather than cataloguing this list of abuses, it may be more useful to consider what motives lie behind them. Since the early days of the first Trump term, a minor industry has grown up trying to put his thoughts and actions into something like a coherent intellectual framework: he is a nationalist, a populist, an isolationist, an imperialist, a postliberal, a nativist, and so on. I think most of these characterizations are inadequate because he has been several contradictory things simultaneously: for example, he both eschews “forever wars” and yet wants to expand the land area of the United States, or reduce prices while raising taxes and stoking inflation. Least convincing of all are ponderous books like Patrick Deneen’s Why Liberalism Failed or Regime Change which try to put Trumpism into a coherent philosophical framework.

Ever since Trump’s first term, I’ve felt that the phenomenon he represents could best be explained not in terms of ideas or ideology, nor could it be easily explained as a matter of economic interest, social groups, class, or other familiar concepts. It is not that such factors are irrelevant, but rather that they fail to capture the full phenomenon. The most useful framework in my opinion is psychology, both personal and social. Trumpism is basically a mentality drenched in what Nietzsche labeled ressentiment, that is, acute resentment of others based on wounded pride, perceived disregard, fears of inadequacy, and a desire to exact revenge on those who had earlier failed to pay adequate respect.

Misreading China

A peculiar thing about the discussions of the rivalry between America and China is that they swing between extremes. One moment China is kicking America's sorry butt like a teenage bully on the playground and the next, it's an old age nursing home cosplaying as a world-class superpower. These wild swings are then reflected in the rhetoric of US politicians and the strategic outlook of the US defence establishment.

Kurt Campbell and Rush Doshi, two ex-officials in the Biden national security team start their analysis of the strategic capabilities of America and China with this framing in Foreign Affairs. They begin by saying that small states can become world-class powers as history has shown from Britain, Spain, Netherlands and Germany. But when large powers run the same playbook, "they can remake the world." That is to say, small countries can become powerful, but big countries with scale can become superpowers.

The stunning assertion they make is that the US, on its own is behind China in many key areas like manufacturing capacity, electric vehicles, nuclear technology, active patents, scientific publications, stock of missiles, hypersonic defence capabilities and more. If it retreats, it further risks losing ground in whatever areas the US is ahead of China like technology, for example.

The reason why it's stunning is that Rush Doshi, one of the authors of the article, was a top official in the Biden security apparatus and has seen the power dynamics up close. The authors make the case that the only way the US can keep up with China is reimagining alliances. But it has to shed its Cold War era frame of thinking about alliances as managed relationships:

To achieve scale, Washington must transform its alliance architecture from a collection of managed relationships to a platform for integrated and pooled capacity building across the military, economic, and technological domains.

The other key argument they make is that many of the challenges that China has to face like aging populations, high youth unemployment, and high debt levels don't matter to the strategic calculus in the timelines that people expect. Issues like demographic challenges play out over decades and do not materially affect Chinese superiority vs US on an immediate time frame.

It's an interesting article and the reason why I am writing about it is because Rush Doshi gave a lecture based on the article at the Harvard Kennedy School and I found it insightful:

At the risk of being repetitive, the sheer scale that China has built across a variety of strategic domains compared to the US is nuts:

Look at that sense of scale people had about America, that now applies to China in manufacturing. China's manufacturing power is unmatched. It's two times the share of American manufacturing, four times our share by 2030 according to the U.N. Two times our power generation, 13 times our steel production, 20 times our cement production, and 200 times American shipbuilding capacity.

Forget about America, look at the world. China produces half the world's chemicals, half the world's ships, 67% of electric vehicles, 75% of the world's batteries, 90% of the world's solar panels, more than 90% -- if you take all the industrial robots installed in the world in 2023, one in every two was installed in China, a factor seven times greater than the amount installed in the United States.

That powers the next industrial revolution. But actually also powers the next industrial revolution, and China right now is leading in fourth generation nuclear technology and plans to build 100 nuclear reactors and on a per capita basis could outstrip U.S. power production. And it's translating that scale to military advantage. We're seeing, you know, 1.35 times the number of U.S. naval vessels by 2030. China will build 65 in the next five years, taking its fleet to 435. The U.S. will be at 300. It's leading in quantum communication. It's digitizing jet engines and so on.

China has weaknesses. I think these weaknesses are very important, but they're not important on the timeframe that matters for strategic competition. Let's talk about them very quickly, China's economy is smaller than the U.S. economy, and in some terms it's shrinking. The dollar is very valuable. If you adjust for purchasing power, infrastructure, military personnel, et cetera, then China's economy surpassed the U.S.'s economy ten years ago.

Take demographics, China is aging. The problems don't have strategic potential until maybe 5 years, 25 years from now. There's a [population] below the age of 14 in China that actually increased in relative terms and in absolute terms. So that buys them a little bit of time. And of course, their dependency ratio will not be the Japanese dependency ratio today until 2050. And if you take A.I., another productivity enhancement, under consideration, China has a good chance of remaining quite competitive.

Take debt, people talk about Chinese debt. It is high, it's a problem, especially for local governments. We're seeing a change in the way China handles debt. Take those three same sectors, look at the U.S., the same percentage. Take the housing sector, it's going bust, but they're redirecting the capital into their companies to outcompete U.S. companies and western companies at marginal cost.

America's companies are the biggest, the most profitable, but they have a problem, which is that they may not be able to sustain market share. The Chinese companies aren't as worried about profits. Part of our stratospheric valuation is a product of the desire for people to hold dollars -- so if you take it all into consideration, China has significant weaknesses, but I don't think they manifest on a timeframe that people are expecting. The biggest weakness they have is political. Who knows what happens after President Xi. The whole system could fall apart. That's the biggest wild card.

From the article:

This is an era in which strategic advantage will once again accrue to those who can operate at scale. China possesses scale, and the United States does not—at least not by itself. Because its only viable path lies in coalition with others, Washington would be particularly unwise to go it alone in a complex global competition. By retreating to a sphere of influence in the Western Hemisphere, the United States would cede the rest of the world to a globally engaged China.

Big, "beautiful" unintended consequences

The subtext of much of what I have written so far is the second order effects of Trump's stupid trade war. While these effects are obvious when you look at the financial markets and the broader economy, Trump is proving to be a blessing in disguise for many political parties.

First, the liberals led by Mark Carney, the former governor of the central banks of Canada and England, staged a remarkable comeback to win the recent Canadian elections. The defining factor, of course, was Trump's horrible treatment of Canada with tariffs and the juvenile threats to make it the 51st state of America.

The Liberals have fallen just shy of the 172 seats needed for a clear majority, but they will be the party of government. The victory represents an astonishing flip of political fortune. Mr Carney is a political rookie who had never sought office before becoming Liberal leader on March 9th. The Liberals entered 2025 led by an unpopular prime minister, Justin Trudeau, scraping all-time lows in public opinion polls. Mr Trudeau resigned on January 6th. Mr Carney entered the race to succeed him ten days later and immediately ditched many of his party’s least popular policies such as the consumer-facing portion of Canada’s carbon tax. Mr Trump suggested repeatedly that Canada should cease to exist as a sovereign country and become the 51st member of the United States (including on the day of the vote, April 28th). These four events shocked support for the Liberal Party back to life. — The Economist

It now looks like a similar political shift is underway in Australia:

Australia’s election appeared to be heading towards a conservative coalition earlier this year. But since President Donald Trump returned to the White House, Australians have watched in horror as Mr Trump abandoned Ukraine, started a global trade war and purged tens of thousands of federal employees. This has given the incumbent social-democrat government, run by the Labor Party, a boost ahead of the election on May 3rd (see chart).

It is a remarkable reversal. Two-thirds of Australians now say America cannot be trusted as a security partner and want a more independent defence policy, up from 39% in June. That survey also shows that Australians trust the prime minister, Anthony Albanese, more than the opposition leader, Peter Dutton, to manage Mr Trump. Meanwhile another poll finds that 64% of Australians have little or no trust in America to “act responsibly”.

Back home, Trump’s approval rating is crashing faster than the price of one of Chamath’s SPACs.

AI, oh no!

Regardless of whether you are an AI booster or a doomer, you got to admit that these tools like ChatGPT etc that we've all started using seem magical, creepy and eerie at the same time. They might be stochastic bullshitters that vomit the median mediocrity, but even if you are deeply cynical about AI, you've gotta admit they're pretty good.

You can't think about AI and not think about where all this is going. It's simply not possible. But the future is entirely unknowable, which means we're left with making random guesses using the mental crutches of movies, sci-fi novels, listening to the people building AI and plain old linear extrapolation. I don't know about you, but my default mental model of thinking about AI is to assume disruption by default. That means these things will poke holes in the fabric of reality ever so gently, expand the hole by tearing the fabric slowly along the holes, and then either enslave us, kill us all or…

I deliberately end at "or" as a coping mechanism to stop myself from imagining more horror-filled dystopias. I hope it's a sunshine and roses utopia, but would that be a bet you wanna take? I'm not sure at this point.

Anyway, Mark "masculine energy" Zuckerberg was on Dwarkesh Patel's podcast and he said something that I am not sure how to think about:

Mark Zuckerberg: I do think people are going to use AI for a lot of these social tasks. Already, one of the main things we see people using Meta AI for is talking through difficult conversations they need to have with people in their lives. "I'm having this issue with my girlfriend. Help me have this conversation." Or, "I need to have a hard conversation with my boss at work. How do I have that conversation?" That's pretty helpful.

As the personalization loop kicks in and the AI starts to get to know you better and better, that will just be really compelling. Here's one stat from working on social media for a long time that I always think is crazy. The average American has fewer than three friends, fewer than three people they would consider friends. And the average person has demand for meaningfully more. I think it's something like 15 friends or something. At some point you're like, "All right, I'm just too busy, I can't deal with more people."

But the average person wants more connection than they have. There's a lot of concern people raise like, "Is this going to replace real-world, in-person connections?" And my default is that the answer to that is probably not. There are all these things that are better about physical connections when you can have them. But the reality is that people just don't have as much connection as they want. They feel more alone a lot of the time than they would like.

So I think a lot of these things — things that today might have a little bit of stigma around them — over time, we'll find the vocabulary as a society to articulate why they are valuable, why the people who are doing them are rational for doing it, and how it is actually adding value to their lives. But also the field is very early. There are a handful of companies doing virtual therapists, virtual girlfriend-type stuff. But it's very early. The embodiment in those things is still pretty weak. You open it up and it's just an image of the therapist or the person you're talking to. Sometimes there's some very rough animation, but it's not an embodiment.

The cynic in me is screaming, this is another shitty ploy by the silicon valley overlords to get us hooked onto their products.

The tiny part of my brain that's still capable of coherent thought tells me he's got a point. People are more lonely, disenchanted and alienated than ever and it's only normal they turn to AI rather than Arnab Goswami on Republic TV.

The realist movie-addled giga-genius in me tells me that we've seen this in movies like Her, The Matrix, I, Robot, Transcendence and Iron Man and sooner or later, fiction leaks into reality. Isn't this more likely than a Butlerian Jihad?

Thoughts?

That's it for this edition. I still had a ton of things to cover but in the interest of keeping this only bloody long instead of really bloody long, I'll end here. Please do let us know if this is only bad, instead of downright horrible and we'll keep this going.

Loved it. Keep up the snarky edge too, it gives a nice rhythm to the reading!

A great longggg read! The facts & the whole narration was on point. These articles not only deepen our understanding of the arguments, but also demonstrate the importance of building fair, data-driven discussions rather than relying solely on opinions. Each new segment feels like an added blessing, please keep it rolling!