How India gets high!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here: Spotify and Apple Podcasts

And the video is here:

Today, we look at 5 big stories:

1) Jerome Powell gives some slightly good news

2) Uttar Pradesh makes hybrid cars more attractive

3) Indians welcome desi daaru

4) Chocolates become a luxury

5) China stupidly bans short-selling

Jerome Powell gives some slightly good news

In our previous episodes, we've talked a lot about the US and whether it will cut interest rates. Jerome Powell, the Federal Reserve Chairman, made some interesting comments recently while testifying before the US government. He said:

"The most recent inflation readings have shown some modest progress. More good data would strengthen our confidence that inflation is moving sustainably towards 2%."

And more importantly, he also said:

"You don't want to wait until inflation gets all the way down to 2% because it has a certain momentum. If you wait that long, you'll probably wait too long, and inflation will go well below 2%, which we don't want."

Now that's pretty encouraging. By the time you are listening to this, the US would have released the latest inflation data. If inflation continues to fall, the chances of a US rate cut this year will increase.

This is good news for both the Indian and the US markets. If rates the continue to fall, guess what? The bull market party might continue.

Uttar Pradesh makes hybrid cars more attractive

The Uttar Pradesh government has made a significant move to encourage the adoption of eco-friendly vehicles by waiving the road tax on strong hybrid electric vehicles until October 2025. This policy aims to make hybrid cars more affordable and attractive to consumers, aligning with India's broader goal of reducing pollution and combating climate change.

With EV penetration in India is barely 5%, such initiatives are crucial for sustainable growth and the gradual shift away from internal combustion vehicles.

UP typically charges an 8-10% road tax on petrol and diesel cars. The waiver could make hybrid cars up to 10% cheaper, potentially saving buyers up to 3.5 lakhs.

This reduction in cost is likely to make hybrid vehicles much more appealing to consumers.

RC Bhargava, Chairman of Maruti Suzuki, emphasized the need for alternative technologies beyond electric cars to achieve zero emissions and reduce oil dependence. He highlighted the role of CNG, hybrids, biogas, and ethanol.

In FY24, around 90,000 hybrid vehicles were sold in India, making up about 2% of total car sales. Major manufacturers include Maruti, Toyota, and Honda.

The tax waiver is expected to significantly boost hybrid car sales in UP and could inspire similar policies in other states.

Indians welcome desi daaru

In a remarkable turn of events, Indians are increasingly opting for local liquor, or "desi daaru," over imported alcohol. This shift is part of a broader trend where consumers are becoming more patriotic and supporting local brands.

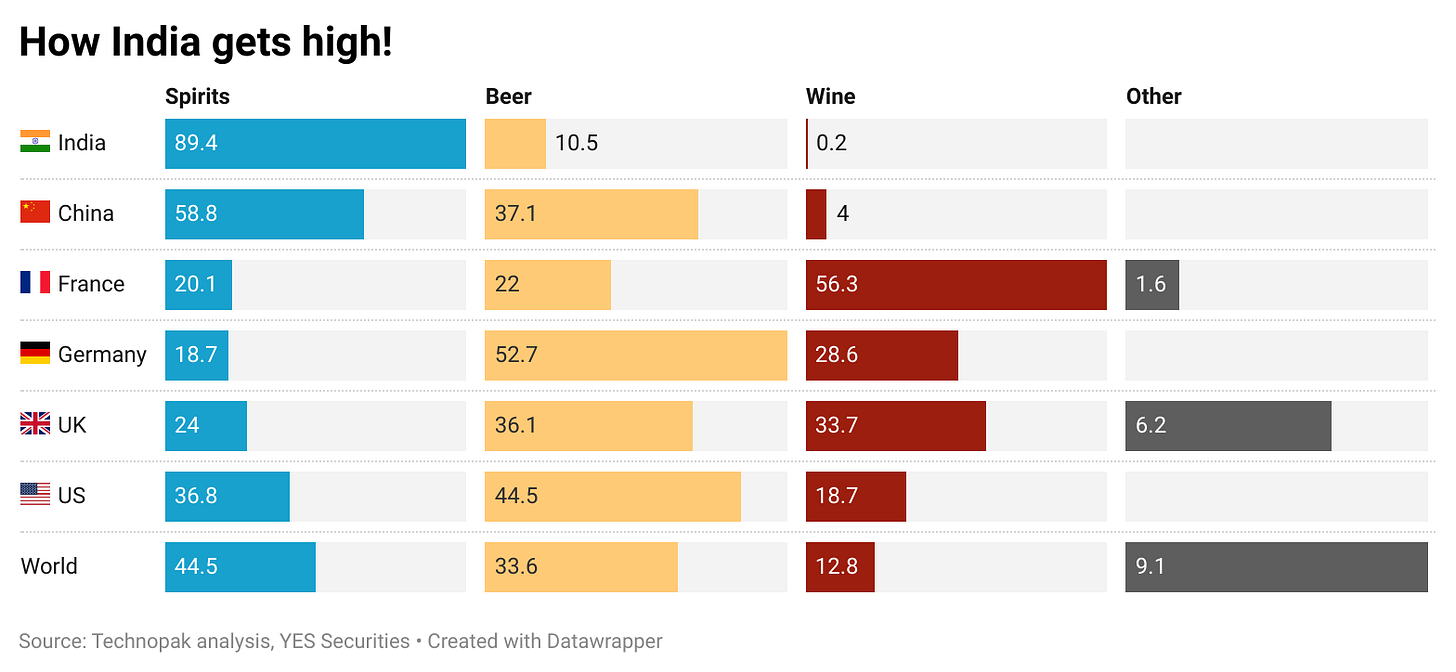

The impact has been significant, with sales of imported whisky, particularly Scotch from the US, Japan, and other countries, falling by 20-40%. Spirits like brandy, whisky, gin, and rum dominate the Indian alcohol market, making up almost 90% of sales.

There's been a growing preference for local alcohol brands since the COVID-19 pandemic.

The cost-of-living crisis due to inflation has altered consumption patterns, especially among low-income Indians.

Many Indians have experienced little to no wage growth, affecting their spending habits.

Among those with rising incomes, there's a growing preference for premium local brands, driven by better marketing and aspirational positioning.

Market Dynamics:

Indian whisky brands have become aspirational compared to their US and European counterparts due to effective marketing strategies.

Analysts are bullish on Indian alcohol companies, predicting that as incomes rise, so will the consumption of local spirits, positively impacting share prices.

Potential Industry Changes:

A potential FTA between India and the UK, discussed since January 2021, could reduce the current 150% duty on imported Scotch whisky, possibly boosting its sales. Currently, Scotch whisky accounts for less than 3% of the total whisky market in India, with the majority being locally bottled.

Alcohol in India is heavily regulated by both central and state governments, each with distinct policies and licensing regimes.

Chocolates become a luxury

If you have a sweet tooth, brace yourself for higher chocolate prices. Over the past couple of years, the price of cocoa beans, the main ingredient in chocolate, has surged dramatically. In January 2022, one tonne of cocoa was around $2,500. By April 2024, it had skyrocketed to nearly $12,000—a rise of over 250%, outpacing even Bitcoin's gains.

Reasons for the Surge in Cocoa Prices:

Africa, particularly Ghana and Ivory Coast, produces over 70% of the world’s cocoa. Extreme weather patterns, such as intense heatwaves and sudden downpours, have reduced yields and spread diseases among crops.

The Russian invasion of Ukraine has driven up fertilizer prices, further straining cocoa production.

Issues such as the Red Sea crisis have disrupted the supply chain, complicating the distribution of cocoa.

Despite the price surge, cocoa farmers in countries like Ghana and Ivory Coast still struggle financially due to government price controls, leading to underinvestment in farms and reduced yields from aging trees.

Impact on Chocolate Manufacturers:

Companies like Nestle and Cadbury hedge cocoa prices through long-term contracts to manage costs.

If high prices persist, manufacturers may reduce cocoa content or increase product prices.

Companies are exploring cocoa alternatives and selectively raising prices to cope with the increased costs.

China stupidly bans short selling

Just a few years ago, China appeared to be on a strong economic trajectory. However, recent developments have made it a tricky place to invest. Several issues have contributed to this downturn, including overinvestment, low domestic consumption, and a heavy reliance on real estate. As the Chinese economy grapples with these challenges, the government has taken steps that may not address the root causes, such as targeting short-sellers in the stock market.

Key Issues in China's Economy:

China has invested excessively to maintain high growth rates, even when investments were unproductive.

Suppressed wages and minimal spending on social welfare have prevented China from becoming a consumer-driven economy like the US, leading to a heavy reliance on exports.

Significant investments in real estate created a bubble, which burst, causing people to lose their savings and leaving construction companies in debt, spreading economic gloom.

Chinese companies have seen no earnings growth, and the stock market has lagged behind global markets over the past five years.

Government Interventions and Their Impact:

To prop up the stock market, state-owned companies have been ordered to buy stocks. A state fund supposedly bought $41 billion worth of blue-chip stocks in Q1 2024, yet the market continues to decline.

The Chinese CSI 300 index posted its seventh straight week of decline, wiping out a trillion dollars in value, while the Hong Kong stock exchange also saw significant drops.

In an attempt to manage the market downturn, China reduced the leverage for short-sellers and prevented the state-owned China Securities Finance Corp. from lending shares to them. This move is seen as a PR stunt since short-sellers constitute only 0.05% of the market's value but play a crucial role in market stability by addressing overvaluations and fraudulent practices.

Looking Ahead:

Investors are closely watching the Third Plenum meeting, starting Monday, where top Chinese policymakers will convene to make significant decisions. This meeting could indicate whether China will address its fundamental economic issues.

China's approach mirrors recent actions by South Korea, which made short-selling punishable by life imprisonment. Research indicates that such measures can be dangerous, potentially leading to market crashes when bad news finally emerges due to a lack of downward pressure from short-sellers.

Listen to the full episode to be smarter than you are after reading these bullet points.