Hidden Traps in Health Insurance Claims!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube.

In today’s edition of The Daily Brief:

Why do your health insurance claims get rejected?

The RBI’s new and improved PSL norms

Why do your health insurance claims get rejected?

CNBC-TV18 recently reported that the Insurance Regulatory and Development Authority (IRDAI) — India's insurance regulator — has flagged serious lapses in how Star Health and Allied Insurance Company settles its claims. Reportedly, IRDAI could soon take action against the company once it wraps up its investigation. The report also hinted that around 8-10 other insurers might be under similar scrutiny.

Now, we looked around but couldn’t find any official document or press release from the regulator itself. Meanwhile, Star Health responded in an exchange filing, clarifying that "IRDAI conducts regular audits and thematic inspections as part of its regulatory oversight," and that the media reports appeared "speculative and motivated in nature." So, let's take this whole thing with a generous pinch of salt.

Health insurance is a nightmare

Look, we have no idea if Star Health Insurance is up to any funny business. But going by what CNBC-TV18 says, IRDAI’s unhappy about how the company responds to claims. And doesn’t that sound painfully familiar? If you’ve had the misfortune of landing up in a hospital recently, chances are, you aren’t too surprised. Whether this bit of news is true or not, claim rejection really is an issue in the health insurance industry.

At the risk of sounding overly simplistic, insurance finally boils down to one thing: settling claims. We all hope things never reach that point, but let's face it: you only realise if your insurance policy is worth it when you make a claim.

Now, in some spheres, this really works. Take life insurance, for instance. There, the claims process is pretty straightforward. If you die (heavens forbid), your family gets paid. That's why you see industry-wide claim settlement ratios easily hovering above 95%.

But as soon as you shift gears to health insurance, things start to look pretty bleak.

According to IRDAI's latest annual report, in FY 2024, only 71% of the total amount claimed was paid out. Companies declined to pay out 22% of the amount claimed, either due to the fine print in policy contracts, or because of some sort of issue at the end of the policyholder. Another 6% are still pending.

So basically, when it was time to settle claims, for every ₹10 that people asked for, ₹3 never reached them. Is there a deeper issue here? Is there something problematic about the health insurance sector as a whole that makes claim rejections so common? For regular folks like us, who are counting on our insurance plans coming through during the worst moments of our lives, this is honestly disheartening. It leaves policyholders stranded when they need support the most, and worse still, it erodes trust. And that isn’t a good thing. If people lose trust in insurance, that can have ripple effects across the industry. That's something nobody wants — not even the insurers themselves.

That’s why we decided to dig deeper into the industry's dynamics to uncover why claim rejections happen so often. Here's what we found.

Who’s who in the health insurance industry?

Let’s quickly set the stage. If you can figure out who’s involved and how they interact with everyone else, you’ll find it easier to spot exactly where the system leaks.

When you decide to buy insurance, you basically have two choices. One, you go straight to the insurance company — which is fairly straightforward. Two, you approach an insurance broker or advisor. Brokers and advisors help you figure out which policy suits you best, simplify all the complicated jargon, and guide you through the buying process. They earn their commission from insurers whenever you buy a policy through them.

Once you pick your policy, you pay your premium to the insurance company. Now, here's where it gets interesting — the insurer assigns you a ‘Third Party Administrator’ (TPA). TPAs are basically the insurance company’s helping hands. They handle claims processing, approve cashless requests, provide customer service, and manage relationships with network hospitals. Now, here’s the issue. TPAs are often paid on the basis of how many claims they can process, and how fast. They aren’t beholden to you, and don’t have a strong incentive to improve your experience.

Network hospitals, by the way, are simply hospitals that have a deal with your insurer to offer cash-less treatment to its customers.

When it's time to file a claim — whether for cashless treatment or for reimbursement — it’s the TPA who steps in and coordinates between you and the hospital. They collect your documents, verify paperwork, liaise with the hospital, and sometimes even consult medical experts. After all this, TPAs recommend whether to accept, partially accept, or reject a claim.

The final call on your claim, however — whether it’ll be accepted, and how much you’ll be paid — is made by the insurance company’s claims department. And finally, if everything checks out, the insurer pays your claim.

If you find this complicated, don’t worry. It absolutely is. And as you might have guessed, with so many parties involved, there is plenty of room at every step for things to fall between the cracks. Here’s how that happens.

Where are the problems?

Why do policyholders often feel the claim settlement system is stacked against them? Well, that’s because there are potential problems at every turn.

First, lazy advisors

You probably don’t buy a policy directly from an insurer—chances are, you'll rely on an agent or advisor. If you chose a good advisor, congratulations! But if you didn’t, you might’ve already set yourself up for future claim rejections.

Even well-meaning advisors can do a poor job explaining complex policies — often because they themselves don’t fully understand them. Worse yet, some advisors intentionally mis-sell policies just to hit their sales targets, setting unrealistic expectations for you. Finally, advisors might mess up your application — putting in inaccurate or incomplete information — leaving you vulnerable to future claim rejections on grounds of ‘misrepresentation’ or ‘concealment,’ even if you intended to be completely honest.

Second, arbitrary deductions

Many policyholders face deductions in their claims for reasons that seem unfair or poorly explained. Often these are based on internal rules or obscure conditions.

For instance, insurers often won't reimburse parts of your bill that they label “non-medical” — items like gloves, syringes, PPE kits, toiletries, and administrative fees — even though you have to pay for them if you’re getting treated. As a patient, this could feel absurd: why would insurers cover OT (Operation Theatre) charges, and then turn stingy when it comes to basic stuff like gloves? That’s like paying for your dhokla and then fighting you over the dhaniya on top!

These small deductions can quickly accumulate, leaving policyholders shocked at how much they have to pay from their own pockets.

Another infamous deduction, especially from older policies, is the ‘proportionate room-rent’ clause. If you chose a hospital room above your policy's eligible limit, insurers might only pay a proportional percentage of all other charges, resulting in significant personal expenses. Thankfully, the regulator has standardized some of these terms, but legacy issues still pop up.

Finally, the ‘Reasonable and Customary’ charges dispute

Perhaps the most controversial and confusing practice is the "Reasonable and Customary" (R&C) charges clause found in most health policies. This clause allows insurers to pay only for treatment costs deemed "reasonable, customary, and medically necessary" for a particular condition in a specific location. What does that mean? Nobody knows. Except, perhaps, the insurer themselves. 🙂

To be fair, this isn’t entirely unreasonable. It’s intended to prevent hospital overbilling. But unfortunately, insurers often apply this clause arbitrarily. What’s "reasonable" to one insurer might differ drastically from another’s view, leaving patients confused and frustrated. Here are a few examples:

Imagine you get a surgery at a leading hospital, which charges ₹2 lakh. Smaller hospitals, however, charge ₹1 lakh for it. Insurers might approve only ₹1.2 lakh out of your bill, leaving you scrambling to cover the difference.

Imagine you have a bad case of dengue. Your doctor might hospitalize you as a precaution at a platelet count of 75,000 µL. Your insurer, however, might argue that hospitalization was only justified below 50,000 µL — leaving you stuck between your doctor’s advice and insurance rules.

These aren't hypothetical scenarios, by the way. They're real experiences shared by people we talked to during our research.

These skewed practices are visible in claim statistics. In FY 2023-24, for instance, health insurers in India rejected claims worth a whopping ₹26,037 crore. While some rejections are legitimate (fraud, waiting periods), the sheer volume of rejections probably points to widespread frustration.

Interestingly, data indicates that stand-alone health insurers like Star Health pay fewer claims per premium rupee compared to public sector insurers. And the difference is quite stark too — ₹5,463 versus ₹10,122 per ₹10,000 premium collected. This stricter management might seem efficient from an insurer’s perspective, but for customers, it often means tougher scrutiny and frequent claim cuts. Naturally, such data has drawn regulatory attention.

What can you do about it?

Look, no matter how strongly IRDAI acts in one case, these conflicts here are bound to happen. When you fall sick, Insurers naturally want to minimize payouts, hospitals want bills cleared quickly, and patients understandably prefer not to pay anything extra out-of-pocket. But since insurers ultimately call the shots, a robust grievance redressal mechanism is essential.

If you ever find yourself stranded, here’s something you should know: there’s a multi-tiered grievance system that you can take things to:

Internal Claims Review: First, approach your insurer’s internal claims cell. They have 15 days to respond to your complaint.

Grievance Cell of the Company: If unsatisfied, escalate it internally to the grievance cell. Insurers must acknowledge your grievance within 3 days and provide a resolution within 15 days.

Insurance Ombudsman: If internal channels fail, you can approach the Insurance Ombudsman, provided your claim is less than ₹50 lakh. This process takes about 3 months, and although informal and free, you have to represent yourself—no lawyers allowed.

Consumer and Civil Courts: If even the Ombudsman can’t help, you can move to consumer courts or civil courts. These, while powerful, can be lengthy and cumbersome.

Unfortunately, the process itself often feels like a punishment. Especially if you have to navigate it all alone, with limited support — and especially if you’re also dealing with some illness on the side.

IRDAI knows that these problems exist. It has introduced reforms to speed things up — shortening timelines, ensuring faster resolution, and emphasizing fairness. Yet, despite these positive steps, the claims process remains quite complicated.

Returning to CNBC TV18’s report — we still don’t know IRDAI’s final verdict on Star Health. But one thing is clear: the industry has much larger problems than the possibility of one rogue insurer.

The RBI’s new and improved PSL norms

On March 24th, the Reserve Bank of India quietly dropped a fairly sweeping update to its Priority Sector Lending (PSL) guidelines. Now, there’s a good chance ‘PSL’ sounds like one of the thousand dry banking acronyms that you instantly gloss over. Stick with us, though, because these changes are important. PSL norms control where a large chunk of Indian banks’ loans can go. And because of that, any change to these norms is a change to the heart of Indian banking itself.

The new rules come into effect from April 1, 2025, and they do a few things at once: they let banks make bigger loans under their PSL mandates, widen the scope of who gets loans on “priority,” makes life easier for many banks, and brings more financing to areas like clean energy, and to India’s small cities.

Let’s unpack what’s going on — and why this arcane-sounding change could be one of the most consequential financial tweaks of the year.

A primer on PSL

Before we get into the changes, let’s get you up to speed on what we’re talking about. Priority Sector Lending is an interesting policy lever in the RBI’s kitty. It’s meant to ensure that money doesn’t just flow to large, well-established borrowers, but also reaches underserved parts of the economy — to credit-worthy borrowers who the banking sector tends to ignore, like farmers, small businesses, affordable housing, and so on. We’ll get to some of these shortly.

How does it do that? Well, the RBI basically tells banks to direct a big chunk of their total lending to some specific sectors. For most banks, that target is 40% of their Adjusted Net Bank Credit (ANBC), while for small finance banks or regional rural banks, it’s 75%. (ANBC, to simplify things considerably, is a measure of everything the bank lends in a year, including some “loan-like” investments that are otherwise kept off their lending books.)

What if a bank doesn’t meet these targets? The bank then has to deposit the shortfall into funds like the Rural Infrastructure Development Fund (RIDF) — that’s basically a fine with a good cause.

PSL norms are a product of the Indira Gandhi era of our economic history. Before that, banks were given much more discretion in how they could lend. But when the government took over India’s major banks towards the end of the 1960s, it tried bringing more “social control” over them — pushing them to become a more active part of India’s economic planning apparatus. Over the early 1970s, PSL norms were crystallised for the first time, and banks were tasked with directing finance towards agriculture and small-scale industries.

The mandates are a well-intentioned idea, but they can have their costs. Lending to priority sectors can be a drag on the business of a bank — adding costs, cutting margins, and increasing risk of default. Small banks and foreign banks with limited reach can struggle to meet these requirements. If these mandates aren’t well designed, it can lead to inefficient credit allocation, and even contribute to their bad loans.

This is why the design of these norms is deeply important. On one hand, PSL norms remain one of the RBI’s most powerful tools for channeling finance into areas that might otherwise be left behind. On the other, this tool comes with real costs for Indian banking — both financial and operational.

This is something that even the RBI realises. Before 2015, banks constantly struggled to meet PSL norms. But in 2015, the system was overhauled completely. A variety of new sectors — such as start-ups or renewables — were brought into the fold. The RBI also gave banks that still struggled to meet these norms a new lifeline: they could now buy “Priority Sector Lending Certificates” from banks that exceeded their PSL targets, essentially outsourcing their socially-oriented functions to them. The market for these certificates has now ballooned to a massive ₹9 lakh crore, and many smaller banks see them as a separate stream of revenue.

The results, as you can see below, were dramatic. Over time, most banks managed to comply with the norms:

The new amendments overhaul these requirements yet again.

So, what do they do?

Much larger housing loans now come under PSL

Let’s start with houses. Many PSL loans go into helping people buy affordable housing, or repairing those houses. But, of course, as inflation rises, even “affordable” houses become more expensive.

So the RBI upped the largest loans that can qualify for “priority sector” lending, and allowed those loans to go to more expensive houses. It also created a new category of cities with a population of over 50 lakh — which encompass the large, metro cities of India. Here’s a summary of all the changes:

If you own an “affordable” house (by these criteria) and it gets damaged, you can also get a loan to carry out the repairs you need under PSL criteria. Now, these are exceptionally well-secured loans, given that they’re linked to people’s homes. So the tweak creates more space for banks to tap into this space, while giving home-owners more liquidity to carry out repairs. Here are the changes:

What might these changes mean, on the ground? According to SBI Research, they’re going to push banks to start taking smaller cities seriously. Ever since the pandemic, there’s been a surge of people who want their own homes in Tier IV, V and VI India. Banks and NBFCs can now chase this opportunity and tick their PSL compliance boxes.

Green energy meets green credit

Next, renewables.

A big change the RBI had made, back in 2015, was to bring renewables into the fold of its PSL norms. Suddenly, renewable energy projects had a ready source of finance. Now, this is still capped to a relatively low value. This isn’t meant for huge wind parks or solar farms that produce hundreds of Mega Watts of electricity. But if you’re putting together a small-scale project, like lining a rural road with solar-powered street lights, or setting up a small Swades-style hydel generator, this is a great source of funding. And if we hope to get anywhere close to our Net Zero targets, these small projects could end up lifting a lot of the load.

Like with affordable housing, the RBI has been stepping up the amount that a bank can give out for such projects under its PSL norms. In 2020, these had been pegged at ₹30 crore. Now, the limit has gone up to ₹35 crore.

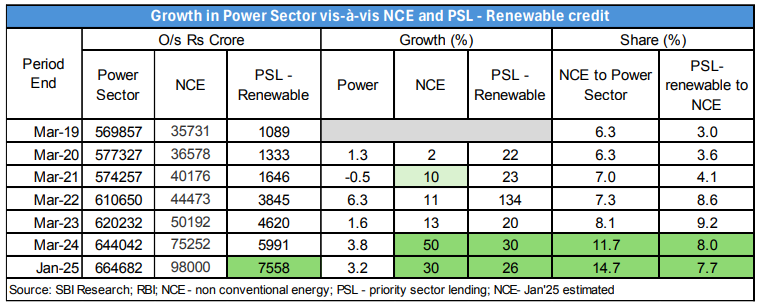

Getting banks to lend more money to renewables under PSL norms has clearly paid off. There’s data backing this up. Until January this year — with two months still to go to the close of this financial year — banks had lent out more than ₹7,500 crore to PSL-based renewables projects. This is almost six times what they lent in the entirety of FY 2020.

Of course, renewables have generally grown a lot over this time. Over the same period, overall credit to ‘non-conventional energy’ (NCE) projects had also tripled. But the fact that PSL projects in the sector grew twice as fast should tell us something. That’s what SBI Research finds as well.

Cooperative banks get a breather

If you’ve been following the news, you know that Urban Cooperative Banks (UCBs) have all sorts of problems. Here’s another: they’ve been struggling to meet their PSL goals.

See, back in 2020, the RBI tried to push UCBs further towards PSL lending. After all, these banks operate through tight local networks — and in theory, they’re the best positioned to finance the most underbanked parts of society. So, the RBI came up with a schedule — where the PSL requirements for UCBs would climb up year-after-year. By the end of FY 2024, 75% of their lending would have to go to PSL sectors.

The whole thing fell apart before it started. UCBs were absolutely not on track to meet their 75% target. So, in June 2023, the RBI gave them an extra two years — they could take till FY 2026 to get there. But that was not to be either. In fact, their PSL lending fell between FY 2023 and FY 2024.

In retrospect, those targets were perhaps a tad too ambitious. So the RBI hit pause. The revised guidelines have frozen the PSL target for UCBs at 60%. That’s still ambitious, but it’s more realistic.

Prioritising places with low credit

There are layers to credit inequity. Even if you control for who you’re giving credit to, some people are still left out. For instance, there are huge regional disparities in where credit goes — with some districts hogging a majority of PSL loans.

To get around this, the RBI has introduced a differential weight system. Simply put, if you’re giving loans in a district that doesn’t get many, your loans will go further in meeting your PSL targets. You’ll be allowed to consider 125% of the loan amount towards that end. On the flip side, districts with an abundance of loans will get only 90% weightage.

This is a clever nudge. Without actively forcing banks to do anything, it pushes them to lend in places that need it the most.

And there’s a lot more

Those are just some of the changes the RBI has made. We can’t really cover the whole thing — there are simply too many minor tweaks — but here are some highlights, to give you a flavour of what the RBI did:

A portion of PSL loans are supposed to go to “weaker sections” of society — a category that includes everyone from distressed farmers to people with disabilities. The RBI has now added transgender persons to the fold.

Since its very inception, farmers have been central to PSL norms, given the constant distress they’re under. But there’s a cap to how large these agri-loans can be, for them to fall under the PSL category. That cap has been expanded considerably.

Caps have similarly been expanded across an array of categories — from education loans, to export credits, to loans for building “social infrastructure” like toilets or schools.

A powerful tool, but one that cuts both ways

Let’s zoom out to see what’s really happening here. The RBI has a powerful tool, which, if wielded well, greatly improves the equity of Indian banking. But it also creates a big constraint for the business of banking. And, as we’ve learnt with so many laws introduced in the 1970s, if you place too many constraints on a business, you might smother it.

So the RBI’s great challenge lies in how to wield this tool well. It’s trying to get there — with small, precise changes to the incentives that banks work with. Through these, it’s trying to deepen the reach of credit while giving lenders a bit more room to breathe. Whether it succeeds, in the end, is a question of regulatory design. The better the design, the more the PSL norms feel like a surgeon’s scalpel, instead of a hammer for every nail.

Tidbits:

Bharti Airtel and its subsidiary Bharti Hexacom Ltd have prepaid ₹5,985 crore to the Department of Telecommunications for spectrum acquired in the 2024 auctions. With this, the company has now prepaid ₹25,981 crore of high-cost spectrum liabilities in FY25 alone. Airtel defined high-cost dues as those carrying interest above 8.65%. Cumulatively, Airtel has prepaid ₹66,665 crore in spectrum dues over time.

The National Highways Infra Trust (NHIT), sponsored by NHAI, has raised ₹18,380 crore in its fourth monetisation round, marking the highest-ever fundraising in India’s highway sector. The total amount raised through all four rounds has now crossed ₹46,000 crore. Of the latest funds, ₹8,340 crore came through unit capital from domestic and international investors, while ₹10,040 crore was raised as debt from Indian lenders. The monetised assets span five states and were valued at a concession price of ₹17,738 crore, including a ₹97 crore premium. For the first time, EPFO participated in the InvIT space, investing ₹2,035 crore in this round.

Wipro, India's fourth-largest IT services firm, has announced a 10-year deal worth £500 million ($645.4 million) with British insurer Phoenix Group. This marks Wipro’s second mega-deal of the financial year, following a $500 million contract signed in June 2024 with a U.S. communications service provider. The latest agreement involves Wipro managing life and pension business administration for Phoenix’s ReAssure division. As part of the deal, Wipro will expand its presence in the UK by establishing operational and technology hubs, which will include employees from both companies. The company also confirmed that some Phoenix employees will transition to Wipro, although it did not specify how many.

- This edition of the newsletter was written by Kashish and Pranav

📚Join our book club

We've recently started a book club where we meet each week in Bangalore to read and talk about books we find fascinating.

If you'd like to join us, we'd love to have you along! Join in here.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Another glitch I have observed is.. if we don't disclose any knee probelm, wait period for knee replacement coverage is 2 years. If we disclose even a minor problem, wait period is 3 years. Clearly being proactive or genuine don't go well.

We had very bad experience with Star Health insurance for covering nephrotic syndrome which triggered due to Covid vaccine.

As you mentioned in the brief, advisors role is very very critical along with customer.

This is so true especially in case of Star health. I was recently hospitalised for minor surgery and the hospital charged for OT, gloves, room rent and post surgery accessory required to heal back. As you have mentioned in the article, forget about the gloves star didn’t even paid for that compulsory accessory recommended by doctor.

Second case, couple of months back in knee replacement surgery of a relative Star didn’t paid for Pre op and post op X-rays of patient saying that it was a part of the package negotiated with the hospital and as usual the hospital said that it is not part of the package negotiated with star and charges were borne by the patient.

I am just amazed by this, is knee replacement diagnosis and then operation possible without X- rays? I think Star people are dumb and dumber are the Jupiter hospital people for not making X- rays the part of knee replacement package.

Star health insurance company is not at all worried about the charges being charged by the hospital to patient. They are blindly and half heartedly passing the bills up to the amount Pre-negotiated with the hospital as over charged amount is to be borne by the supposedly Richie rich patient.

Whole local staff of star is just busy in selling their foolish and over priced policies.

Additionally, the star empanelled hospital are not aware about the process of star health as in when hospital is supposed to ask for review of the decision for the claim amount passed by the company they have to give justification for the same. Hospital is replying with the same papers asking for review and star has a policy to not consider for review a case if no more additional documents are produced by the hospital in support of the amount being claimed by the hospital. This I came to know after I was harassed for more than 6 hours after my discharge and I was still in hospital.

Patient is not there to learn about the damn process and this is what nobody understands.