Hidden Frauds in India’s SME Market

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

SEBI cracks down on SME frauds

Automobiles stage a comeback

SEBI cracks down on SME frauds

Over the past couple of years, SME (Small and Medium Enterprise) stocks in India have been on a wild run. The BSE SME index has almost gone up in a straight line during this period.

But behind this exuberance are many, many ridiculous stories. There are multi-baggers everywhere. SME stocks have regularly seen over 10x growth in a single year. Last August, for instance, the IPO of a company with just two automobile showrooms, was over-subscribed 400 times. And this is just one such story. There are countless similar stories when it comes to SMEs.

And because of this rapid rise, many investors—from small retail traders to large institutions—have been buying these shares in the hope of making quick profits.

In many cases, however, this enthusiasm wasn’t driven by strong earnings or genuine business growth. Instead, it stemmed from fraud.

We’ll explain.

See, there’s a lot that someone with malicious intentions can get away with if they’re running an SME. SMEs have lighter compliance requirements, get less coverage from analysts, and experience minimal institutional checks. And while this has been done to help SMEs, it also makes the perfect recipe for fraud. One can exploit these structural gaps in the SME listing ecosystem and get away with it.

SME companies sometimes spread false news to make their shares look more valuable. For instance, they could claim to have won a massive export order or to have entered a lucrative new business. If investors believe these claims, they rush to buy. And since these shares have limited float, even a little investor interest can send stock prices up.

And then, of course, insiders from within the company, like promoters and directors sell these shares to all those excited investors.

So, with the limited scrutiny they receive, it can be relatively easy to pull off such a run in an SME stock.

And that’s why we have two cautionary stories for you today. SEBI recently tightened its regulations around SMEs, and in doing so, they’ve uncovered scams involving two companies: Kalahridhaan Trendz Limited (KTL) and LS Industries Limited (LSIL).

Let us tell you what happened.

Case 1: Kalahridhaan Trendz Limited (KTL)

In September and November 2024, SEBI received a complaint from HDFC Bank. The complaint was against Kalahridhaan Trendz Limited, an NSE-listed SME firm in the textile business. HDFC Bank complained that KTL had defaulted on loans and credit card dues, and hadn’t made the necessary disclosures to the exchange.

It seemed like a simple matter, involving less than a crore. But when SEBI started digging in, it realized that the rot ran deep.

Soon after listing, KTL had made various announcements. It claimed that its profits increased by 25% and that it was making strategic expansions. Prices went up by 300%. A month later, it announced that it had received an export order worth ₹115.5 crore from a Bangladeshi textile company named Beximcorp Textiles. This was massive news for a small textile firm, so the share price jumped by 20% in just one day.

Only… there’s no proof that any of this ever happened.

When it actually looked things up, SEBI found that Beximcorp Textiles didn’t even exist. The company had faked emails and contacts to make the deal look genuine. Why? It was likely driving up the share price so that its promoters could sell their shares at a hefty profit. Incidentally, KTL’s directors resigned just before the scam came to light. They perhaps knew that things were going south.

KTL didn’t stop there, by the way. It also announced a Rights Issue — which lets existing shareholders make a further investment in a company. This new issue was as big as the company’s IPO itself. If it went ahead, investors could lose even more money to a company that, at least at the surface, seemed malicious.

For now, SEBI has frozen trading in KTL’s stock and has banned its directors from trading. It now plans to begin deeper investigations into the company.

Case 2: LS Industries Limited (LSIL)

LSIL, another textile company, was suspended from trading for 11 years starting in 2013. However, when trading resumed in July 2024, its stock price surged more than tenfold, rising from ₹22.50 to ₹267.50 in just two months. Prices fluctuated wildly for a while before finally settling around ₹68 by February 2025.

Of course, companies see their stock prices rise and fall all the time. But here’s what made the whole thing puzzling: the company had almost no revenue and consistently made losses. So, why were people so keen to buy in?

SEBI believes this was a classic pump and dump. As soon as LSIL’s shares began trading again, a small group of traders began placing regular buy orders. These orders would come in before market hours, at well above the upper circuit. As the price zoomed by 1,089%, the company began making fantastical announcements. The company claimed that it was venturing into AI and robotics. It announced plans to rename itself AI Tech Limited, bring in foreign directors, and open a Dubai subsidiary to develop robotic chefs and try hydroponic farming.

And then, within two months, the stock crashed by 84%.

The very traders that were bidding the company’s price up began selling as soon as they could. New buyers were stuck with heavily illiquid stock. Meanwhile, one of the company’s directors had sold crores of shares to a Dubai-based NRI for just $1 a share. The whole thing seemed extremely shady.

When SEBI dug in, it soon found out that none of the company’s AI plans were real. Its revenue was negligible, it had no actual products, and no real business activity. SEBI has now banned LSIL’s directors and the Dubai-based NRI from trading. It has frozen bank accounts and impounded over a crore, and has opened a detailed investigation into the matter.

What does all this tell us?

These two scams are a cautionary tale.

SME stocks can look like they’re poised for breakaway growth. But sometimes, that’s an illusion. Companies looking for a quick buck can sometimes engineer “pump and dump” schemes. After all, while it’s hard to grow your business exponentially, it’s easy to fool someone into thinking that you are. If you think you’re sitting on a once-in-a-lifetime investment, it’s important for you to ask yourself why. If someone’s hooked you in with false news, chances are they have already made their exit by the time you realize you’ve been scammed.

Of course, not every SME stock with a surging price is fraudulent. Some do well, sign major contracts, or enter lucrative new businesses.

This is why you need to understand the difference between real opportunities and empty hype. You must do your due diligence, watch for suspicious behavior, and be skeptical of news that sounds too good to be true.

With SMEs, this is especially challenging because detailed, reliable information can be hard to find. That’s why you should invest in them only if you truly understand what you’re doing.

After all, the stock market is merely a barometer of investor sentiment. It’s your job to ensure you don’t fall for nonsense.

Automobiles stage a comeback

2024 was a mixed year for India’s automobile industry. On the one hand, throughout the year, the industry delivered a fairly robust performance. The industry found answers for various old issues — from semiconductor shortages to soaring input prices — and across segments, delivered record-high sales.

Once you zoom in, however, there were plenty of pockets of concern. The market seemed to have shifted significantly, with a distinct move towards more premium vehicles. Customers lapped up utility vehicles — which made up nearly two-thirds of all passenger vehicle sales. At the same time, traditional vehicle segments, like sedans and hatchbacks, appeared to have declined in popularity. By the end of the year, manufacturers began resorting to deep discounts to get rid of their stock — particularly for older and entry-level models.

2024 was also a nightmare for commercial vehicles. Sales of buses, trucks, and tractors all suffered for large parts of the year.

January 2025, on the other, was a great month for the sector. That’s the upshot of a recent sectoral report by the incredible IndiaDataHub. That’s what we’re digging into today. Over this story, we’ll try and find answers to some key questions:

How has the automotive sector opened the year? What trends do you see across segments?

Which companies are gaining ground, and which ones are falling behind?

What can this data tell us about sustainability in the sector?

The month of January 2025 gave us some interesting answers to all of these questions. Let’s dig in.

Vehicles this January: The headline numbers

In January, overall auto sales grew by 6% compared to the same month last year. Moreover, this growth was broad-based: i.e., every single segment saw some degree of year-on-year growth over the month. For most of the industry, January marked a distinct improvement over December.

Look closely, however, and you’ll see that this recovery isn’t evenly spread. While some segments are thriving, growth is muted in others. Some companies are gaining ground, while others are struggling to keep up.

Let’s start with cars and utility vehicles. After two months of sub-par performance, the segment shook off its inertia and registered growth of 15% year-on-year. January 2024 itself had seen high growth, so this growth was over a high base as well.

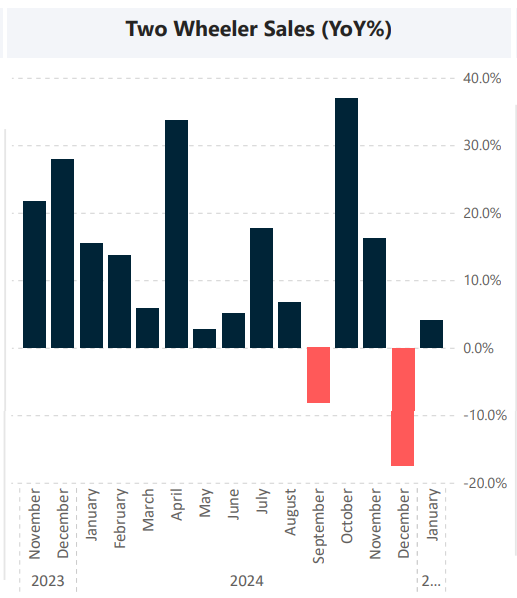

The two-wheeler market also showed signs of recovery. After a steep decline of 18% year-on-year in December, two-wheeler sales bounced back with 4% year-on-year growth in January. Nothing spectacular — but still encouraging.

Such a comeback in passenger vehicles is a good sign. Cars are huge purchases, and people rarely buy them when they feel insecure about their future. Strong growth in the segment indicates high consumer confidence — when people and businesses feel comfortable enough to make such big-ticket purchases, it’s likely that they nurse a positive outlook towards the economy, overall.

Commercial passenger vehicles also saw a strong month of growth. Sales of buses and other passenger vehicles (which include mini-buses, vans, and other such vehicles) jumped by a massive 30% year-on-year, suggesting that public transport and intercity travel are picking up. Notably, last January, sales in the segment had shit up by more than 50%, so this growth is over a very high base.

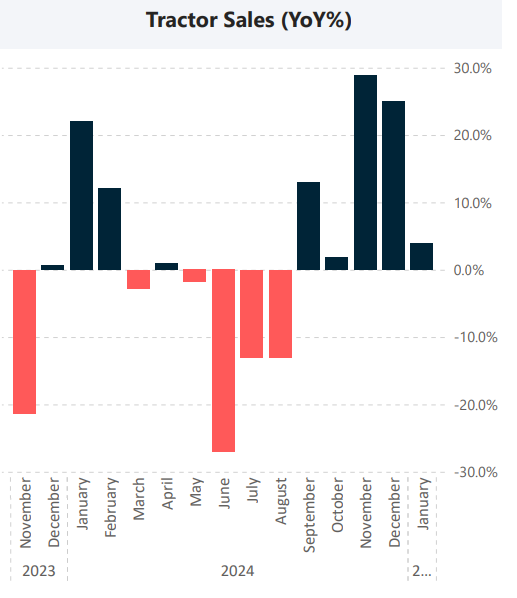

That said, not every category of vehicles had the same luck. Tractor sales had been buoyant towards the end of 2024, after a fairly rocky year, with many months of poor growth. In January, however, growth moderated again to just 4%.

There are many ways to interpret this sharp slowdown in tractor demand. On one hand, farmers often make their purchasing decisions based on agricultural cycles. It’s possible that they front-loaded their purchases earlier in the sowing season, and there’s now a natural dip. It’s also possible that we’re looking at base effects — January 2024 saw 20+% growth after a dull closing to 2023, so this year’s figures might just indicate a return to normal.

There’s also a more pessimistic reading of the situation, however. Rural markets, which had been quite strong until recently, might be showing signs of softening. This slowdown could mean that rural incomes aren’t growing as fast as before, or that farmers are holding off on big purchases.

It may be too early to come to a conclusion. Given how important rural demand is to India’s overall economy, however, this is something worth watching.

How are different companies doing?

Let’s start with two-wheelers.

The sector’s growth, this January, was led by TVS and Eicher. Both companies saw their sales rise by more than 12% compared to last year. Their growth made up for a dismal month for many other companies.

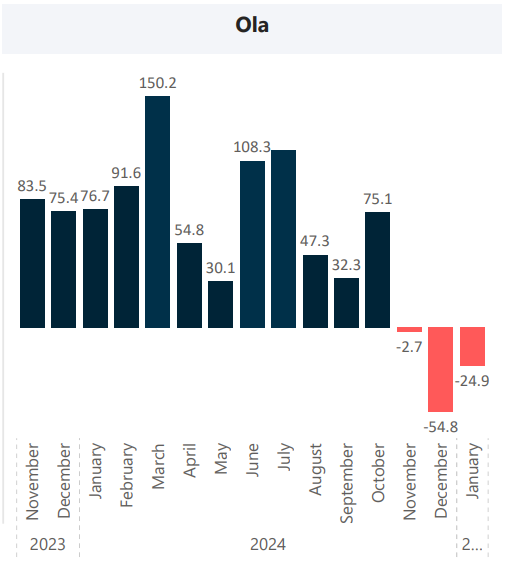

Ola Electric, which is one of the big names in India’s electric scooter market, had a disastrous January. It saw its sales drop by 25% year-on-year. This was the second straight month of falling sales for Ola. If they don’t arrest this fall, they could soon be facing some serious challenges.

Overall, Hero continues to be the biggest player in the two-wheeler market, holding about 31% of the market, followed by Honda at 25.2%. But, interestingly, TVS has been gaining ground, now holding 17.3%.

Meanwhile, Ola, which was once looked at as the future of electric scooters in India, hasn’t made much of a dent. Its market share has stagnated at ~1.3% and is on a downward trend. This is especially worrying given the sector’s wider trajectory — overall, electric two-wheelers saw ~19% growth, even as Ola’s sales declined.

Two months is a short period, and this might just be a hiccup. But if this continues, it may also suggest that established brands like TVS and Honda are doing a better job at attracting customers towards electric vehicles.

Let’s move to four-wheelers, which logged impressive growth in January.

Toyota and Mahindra were the standout performers. Toyota led the pack, with sales rising by a staggering 37% from last year. Mahindra, too, delivered an impressive figure of 20% year-on-year growth.

Even Maruti, Hyundai, and some luxury brands, which had struggled in December, saw their sales grow between 15% and 20% in January.

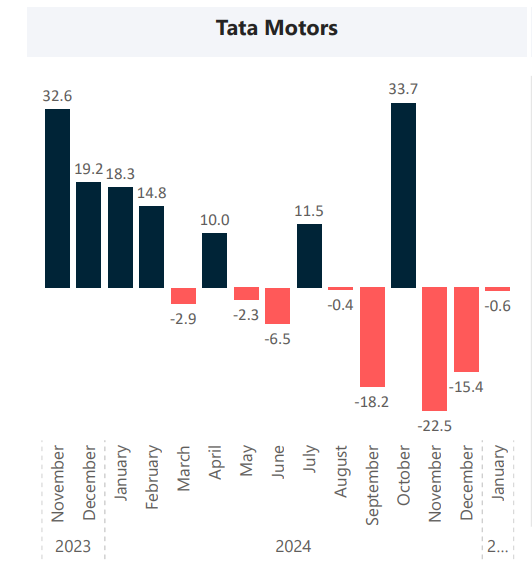

Tata Motors, however, is a study in contrast. It was the only major manufacturer to see a decline in sales, down by 0.6% compared to last year. This was Tata’s third straight month of negative growth.

Tata is evidently facing difficulties in maintaining demand for its cars. That said, this decline was much less dramatic than what it saw in November and December 2024, so this might be an early sign that the worst is behind it. We’ll have to wait and watch.

Overall, Maruti continues to dominate the four-wheeler sector, with a market share of 42.5%. Hyundai owns a quarter of the market, while the remaining market is split up among other auto majors. Toyota, perhaps because of its strong SUV offerings, has consistently done well over the last year.

Luxury brands like Audi, BMW, and Mercedes, together make up just 1% of total sales, despite a healthy 16% growth in January. Clearly, while high-end cars are growing, they remain a very small part of the Indian auto industry.

How sustainable are our purchases?

Here’s an interesting stat: across the board, customers seem to be moving towards more eco-friendly fuel sources.

Electric two-wheelers saw an impressive growth of 18.9% year-on-year, compared to a mere 4% growth for the overall segment.

The story was the same for four-wheelers. While the overall segment grew by 15%, CNG car sales went up by 50% year-on-year, while electric car sales increased by 32%.

Diesel cars, meanwhile, trailed the rest of the segment — growing at 9.8%.

That said, all in all, petrol still remains the dominant choice for most buyers in India currently.

In terms of overall market share, petrol continues to power nearly 90% of all newly purchased two-wheelers, while electric two-wheelers account for just 6-8%. Similarly, petrol cars make up over 60% of sales, while diesel holds a market share of more than 15%. CNG cars, however, make for over 20% of new car sales, up from 10% back in 2022. This suggests that buyers are increasingly looking for more fuel-efficient and cost-effective alternatives, with CNG coming out as a clear winner.

How is the sector’s overall health?

All-in-all, the automotive sector’s performance has been a bit mixed.

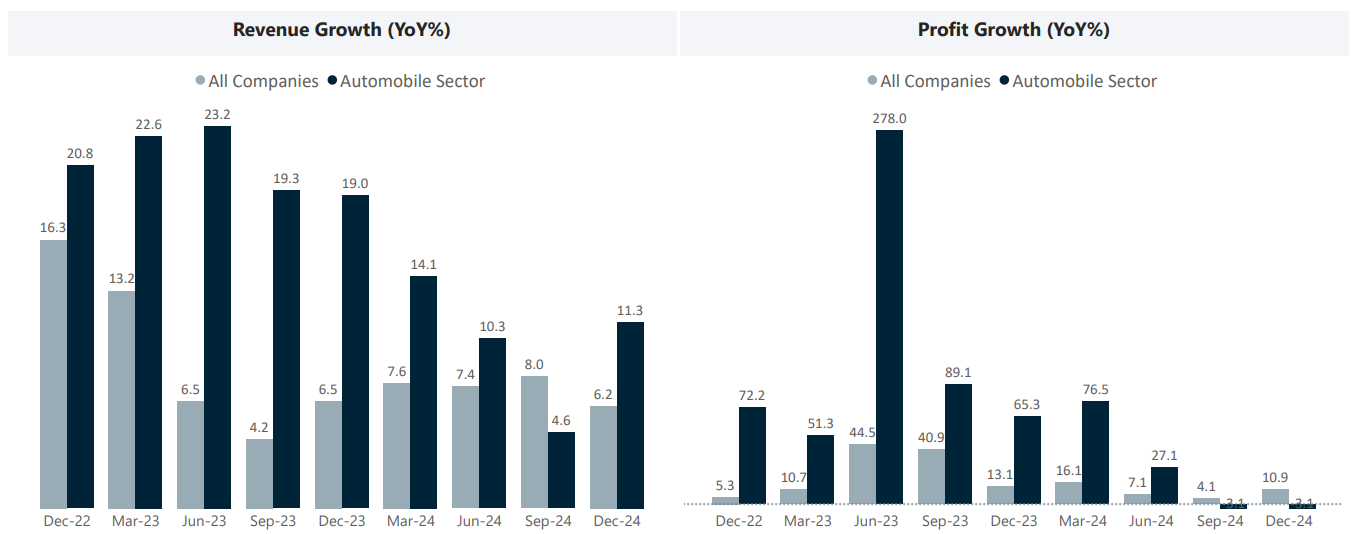

While the sector revenues have been growing — going up 11% in December, its profitability has been under pressure. In fact, in December, profits declined by 3% year-on-year, marking the second straight quarter of falling profits. As companies scrambled to offer major discounts, companies’ EBITDA margins fell, meaning companies are earning less profit on each vehicle they sell.

So with all these points and insights, the big question is — how should you think of this sector as a whole?

Zooming out, the sector shook off a muted end to 2024, beginning 2025 on the front foot. Electric vehicles are becoming increasingly mainstream, though the growth is not uniform. CNG cars are gaining quite some popularity. This hides under-performance by individual brands, however. Ola Electric shows signs of stress. Tata Motors has had a few bad months on the trot.

Is January a return to form for the sector? Or will things regress back? And can Ola Electric and Tata stage a comeback? These are the questions we’ll be looking at closely, going ahead.

Tidbits

Bangladesh has requested full power resumption for Adani Power's 1,600 MW plant in Jharkhand, which has been operating at just 42% capacity since November 1, 2024. The shutdown of one 800 MW unit was triggered by delayed payments from Bangladesh and reduced winter demand. The Bangladesh Power Development Board (BPDB), under a 25-year contract signed in 2017, has been paying $85 million monthly to clear dues. In December, an Adani source said BPDB owed the company about $900 million, while BPDB Chairperson Md. Rezaul Karim said at the time the amount was only about $650 million.

Global hedge funds ramped up their purchases of Chinese stocks, with the week of February 3-7 marking the strongest buying spree in over four months, according to Goldman Sachs. Chinese equities are now the most net-bought market on Goldman’s prime brokerage book worldwide, with 95% of the purchases in single stocks across sectors like consumer discretionary, IT, industrials, and communication services. The MSCI China Index rose for four consecutive weeks since mid-January, gaining over 6% in February and outperforming major global markets.

Oil and Natural Gas Corporation (ONGC) has signed an MoU with BP to collaborate on exploration and production, energy trading, and other business areas both in India and globally. This comes a month after BP was appointed as a technical service provider for the Mumbai High field. The partnership focuses on bidding for offshore blocks under the Open Acreage Licensing Program and sharing deepwater exploration practices.

- This edition of the newsletter was written by Pranav and Anurag

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.