Here's how Indian spending has changed in the last decade

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Analysing India's consumption patterns

Adani Ports withdraws from $553 million US loan deal

Google launched Willow

Analysing India's consumption patterns

Do you remember how your family spent money 10 years ago? And how different it is now? Chances are, your expenses have changed a lot. Maybe you’re spending on things that didn’t even exist back then, or your lifestyle and priorities have shifted because you’re better off financially now.

This isn’t unique to your household—it’s true for everyone. But we wanted more than just guesses or memories. We wanted numbers. As the saying goes, “In God we trust. All others must bring data.”

So, we dug into household expenditure data from the Ministry of Statistics and Program Implementation (MoSPI), covering 2012 to 2023, to see how the average Indian family’s spending patterns have changed. Here’s what we found.

The first thing we wanted to check was whether Indians are spending less on food as their incomes have grown. That seems like a fair assumption, especially with rising per capita GDP. There’s even an economic principle called Engel’s Law that backs this idea. It says:

"As household income increases, the proportion of income spent on food declines, even if the total amount spent on food goes up."

Makes sense, right? As people earn more, the share of their income spent on necessities like food should shrink, even if they’re spending more in absolute terms.

But here’s the twist: according to MoSPI data, that’s not what’s happening in India.

Over the past 10 years, Indians have consistently spent about 28-32% of their household budgets on food, with no significant change. Compare this to countries like the UK or the US, where Engel’s Law has played out clearly over the years. As incomes rose, the share of spending on food steadily dropped. So, why is India different?

There could be a few reasons:

It’s too early to tell. A decade might not be long enough for Engel’s Law to fully play out in a country like India. Economic changes of this scale often take much longer.

Uneven income growth. While India’s per capita GDP has risen sharply, this doesn’t show how wealth is actually distributed. If the top 10% of earners are pulling up the average while a large portion of the population hasn’t seen much income growth, many households would still be spending a big chunk of their income on food.

For example, according to the Periodic Labour Force Survey (PLFS), from 2017-18 to 2022-23, the average nominal income for workers grew by just 2.2% annually. With real earnings shrinking, households had to adjust by having more family members join the workforce—an increase of 3.4%. Even then, overall household incomes grew by just 5.7%, barely keeping pace with rising costs of living. This doesn’t align with the core idea of Engel’s Law, which assumes growing income levels.

When we dug deeper into the subcategories of food and beverages, some interesting trends stood out. These patterns suggest that Indians might be becoming more health-conscious—though there are reasons to question this as well.

Spending on meat, fish, and seafood has increased while spending on dairy and poultry products has stayed about the same. This suggests that Indians are choosing more protein-rich foods, while traditional staples like bread, cereals, and pulses are taking a backseat. These staples, though filling and calorie-dense, don’t have the same nutrient profile as protein-rich options.

One possible reason for this shift could be India’s Public Distribution System (PDS). By providing staples like cereals at very low or negligible costs, the PDS might have freed up household budgets to focus on other nutritional priorities.

Another positive trend is the drop in spending on sugary foods. While sugar is hard to cut out completely, it’s good to see some change. The share of household spending on sugar, jams, honey, chocolate, and other sweets has dropped from 4.95% to 3.05%. That said, this hasn’t stopped India from being the “Diabetes Capital” of the world. One reason could be that this data doesn’t include all the processed and junk food we eat outside our homes—in restaurants, cafes, or as quick snacks on the go.

Interestingly, even spending on alcohol and tobacco—categories people often indulge in steadily—hasn’t grown much. Alcohol spending increased by just 7% per year, and tobacco by 5.5%, while overall household expenses grew faster at 11.5%. This suggests that people are cutting back on these indulgences compared to before.

The real twist comes when we compare spending habits before and after COVID. Before the pandemic, tobacco spending was growing faster than alcohol. But post-COVID, the tables turned—spending on alcohol shot up, while tobacco actually saw a decline.

So, why the sudden shift? It seems COVID changed how people think. Alcohol may have become more socially acceptable, with home consumption and social drinking becoming common during lockdowns. On the other hand, tobacco might have been villainized, likely due to heightened health concerns during the pandemic. Still, it’s hard to pinpoint the exact reasons for these changes.

But spending habits don’t stop at food and indulgences. Let’s look at other areas where the data shows some surprising trends.

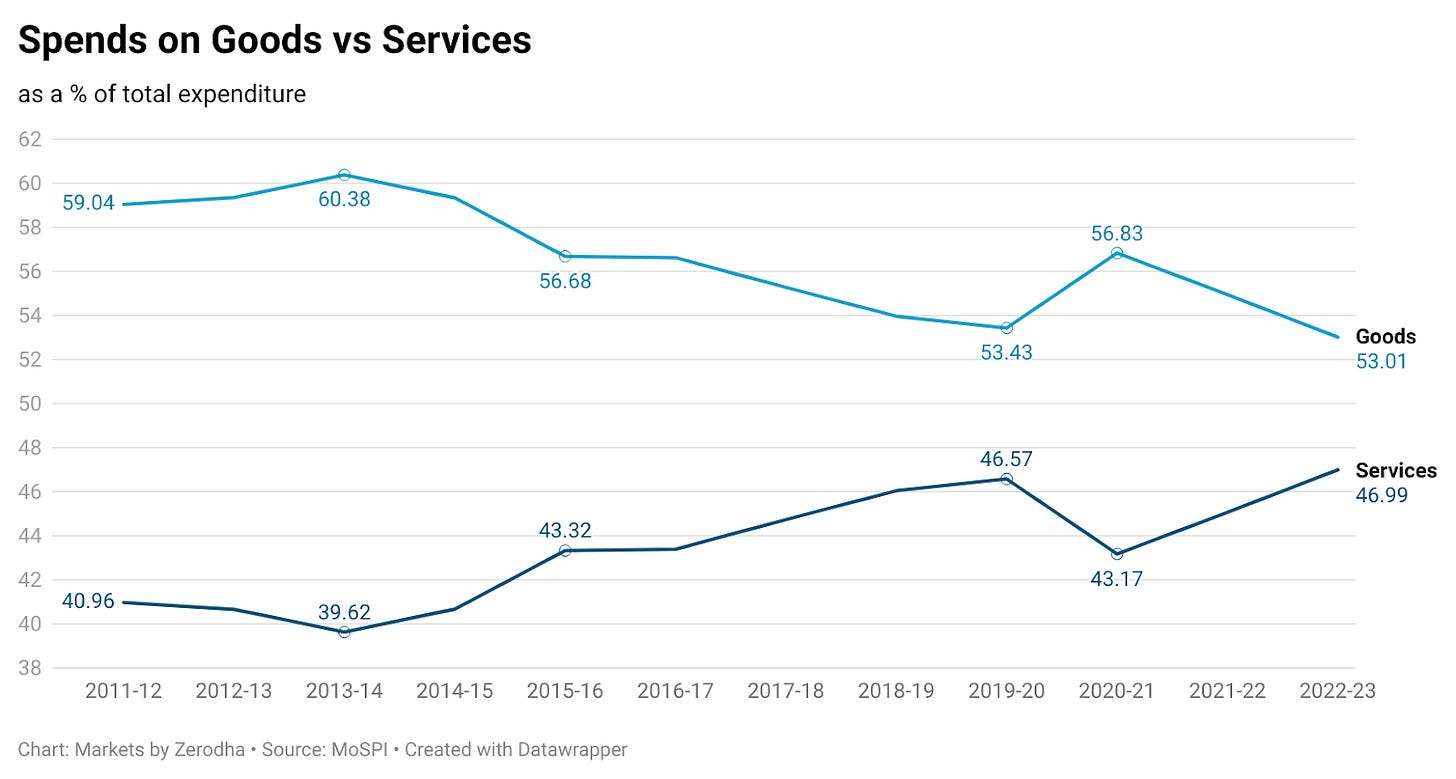

Have you noticed how people are spending less on manufactured goods and more on services? Things like healthcare, education, transport, communication, and recreation are taking up a bigger share of household budgets. Meanwhile, spending on items like clothing, home goods, and consumer products is starting to shrink. These shifts reflect changing priorities as lifestyles evolve.

It makes sense, doesn’t it? People now see services like education and healthcare as investments, prioritizing experiences over simply buying more stuff. It’s a refreshing shift that says a lot about how our lifestyles are evolving.

Now, let’s dive into some micro-level insights from the data—because the small details often tell the biggest stories.

1. Footwear took a big hit during the pandemic. With everyone stuck indoors, demand for shoes plummeted, and even after COVID, growth has been close to zero. But that’s starting to change. In 2024, footwear companies are focusing on trends like premiumization and athleisure—something we explored in a previous edition of The Daily Brief.

2. People are ditching old-school fuels. Traditional fuels like kerosene and firewood are on their way out, while LPG is quickly becoming the go-to choice for kitchens across the country. This shift highlights the success of initiatives like the Pradhan Mantri Ujjwala Yojana, which subsidizes LPG and promotes its use. The result? A clear move toward cleaner, more efficient cooking fuels.

3. Vehicle sales are booming. After years of sluggish growth, vehicle sales bounced back post-COVID, hitting all-time highs. This surge reflects pent-up demand from lockdowns, with people finally making those delayed purchases.

4. Insurance spending has doubled since COVID-19. It’s not hard to see why. The pandemic was a wake-up call, shifting how people view insurance. What used to be seen as just a tax-saving tool or pseudo-investment is now viewed as essential for financial security. The data shows households are making insurance a key part of their budgets.

Before we wrap up, here’s a quick disclaimer. If you’ve been following the news, you might have noticed that the observations from the MoSPI data differ quite a bit from the findings in the Household Consumption Expenditure Survey (HCES), which made headlines in September.

Why the discrepancies? There are a few reasons. It could come down to differences in definitions, methodologies, or even how the data was approached. For example, how a “household” is defined or how expenses are calculated can vary significantly.

It’s also worth noting that the HCES surveyed 2.5 lakh households, while the RBI data from the National Accounts Statistics 2024 is based on modeled, estimated figures. Naturally, these differences can lead to varying outcomes.

So, while the data we’ve shared is full of insights, it’s always good to take it with a pinch of salt and keep these differences in mind.

And there you have it—a snapshot of how our spending habits have shifted over the years. But this is just the big picture. What about you? Have you noticed any changes in your own spending habits over the last decade? Are you spending more on experiences instead of things? Or maybe cutting back on something you once thought was essential?

We’d love to hear your thoughts! Drop a comment and let us know how your priorities have changed over time. After all, it’s these personal stories that make the bigger trends so meaningful.

Adani Ports withdraws from $553 million US loan deal

Adani Group has decided to back out of a $553 million loan deal with the U.S. International Development Finance Corporation (DFC). This money was meant to help fund the construction of the Colombo West International Terminal (CWIT) in Sri Lanka, a project seen as an important move to counter China’s growing influence in the Indian Ocean.

Instead of using the U.S. loan, Adani now plans to finance the project entirely with its own funds. This decision comes as Gautam Adani, the group’s founder, faces allegations of bribery in the U.S., creating uncertainty around the company’s international projects.

Here’s why this port project was so important.

The Colombo port is one of the busiest in the Indian Ocean and handles a big chunk of India’s transshipment cargo—some estimates say as much as 45%. Transshipment is when large container ships offload goods at deep-water ports like Colombo, and smaller ships then distribute them to ports that can’t handle the bigger vessels. Colombo’s ability to handle these massive ships makes it a key hub, especially since many Indian ports don’t have this capability.

The CWIT project is being developed by a joint venture, where Adani Ports holds 51%. The remaining 49% is shared between John Keells Holdings, one of Sri Lanka’s largest companies, and the Sri Lanka Ports Authority. The U.S. initially offered $553 million in funding for the project—its largest-ever infrastructure investment in Asia—as part of a strategy to reduce China’s influence in the region. China already controls significant stakes in other Sri Lankan ports, like Hambantota.

But the deal seems to have fallen apart, largely because of the allegations against Adani.

In November, Gautam Adani and some top executives were accused of paying $250 million in bribes to win solar energy contracts in India. While this isn’t directly tied to the Colombo project, it has made the U.S. cautious. The DFC said it was still reviewing the project and hadn’t finalized the loan, but the process slowed down significantly.

The U.S. pulling back raises some big questions. The DFC loan wasn’t just about the money—it was a statement of U.S. support for reducing China’s control in the region. Without that backing, the project loses some of its strategic importance.

This isn’t just about one port—it’s about who shapes the future of the Indian Ocean.

Google's quantum leap with Willow

Google just announced a groundbreaking new quantum chip called Willow, and Sundar Pichai described it as a huge step forward in computing. He said, “Willow is paving the way for solving humanity’s toughest challenges by harnessing the power of quantum mechanics.”

That sounds impressive, right? But honestly, we had no clue what that actually means. So, we did what anyone would do—we asked ChatGPT to break it down for us and even write this script. If you like how this story turned out, it’s because we did a great job asking the right questions. If it doesn’t make sense, well… blame ChatGPT for not explaining it well enough!

So, here’s the deal.

Willow is a super-advanced computer chip made for a type of machine called a quantum computer. Unlike your laptop or smartphone, a quantum computer is built to tackle insanely complicated problems that regular computers just can’t solve. Imagine it as the brain of a next-level machine—a machine so powerful it could someday help us discover new medicines, create better renewable energy systems, or even find solutions to climate change.

Pretty amazing, right? But here’s the catch: quantum computers don’t work like regular computers at all. And that’s what makes them so fascinating—and so confusing.

Why are quantum computers so different? Let’s start with regular computers, like the one you’re using right now. They use “bits,” the smallest units of information. A bit is really simple—it’s either ON (1) or OFF (0), like flipping a light switch. All the amazing things your computer does are built on these 1s and 0s.

Quantum computers, on the other hand, use something called qubits, or quantum bits. A qubit is like a magical light switch that can be ON, OFF, or somehow both at the same time. This strange behavior is called superposition, and it lets quantum computers process a ton of possibilities all at once, making them super powerful.

But there’s a catch: qubits are very delicate. Even the tiniest thing—like a bit of heat or a small vibration—can mess them up and cause errors.

That’s been the biggest challenge with quantum computers so far. And this is where Willow comes in. Willow is like the superhero of quantum chips because it’s really good at handling those tricky errors. It uses a clever way to keep qubits stable and reduce mistakes, called quantum error correction.

What’s even cooler is that Willow doesn’t just fix errors—it actually gets better at fixing them as you add more qubits. It’s like building a team where every new member makes the whole group stronger and faster. That’s Willow for you.

And the speed? Willow performed a calculation in just five minutes that would take today’s fastest supercomputers 10 septillion years to complete. For some perspective, the universe itself is only about 13.8 billion years old. Yeah, it’s that fast.

So, what’s the point?

This was our next big question. Okay, Willow is fast and great at avoiding errors, but how does that actually help us, or anyone else, in the real world? Turns out, the possibilities are pretty huge:

Discovering New Medicines: Quantum computers can simulate how molecules interact, speeding up drug discovery by years—maybe even decades.

Better Batteries: They could help design batteries that last longer for electric cars or store renewable energy more efficiently.

Fighting Climate Change: By simulating complex weather and climate patterns, quantum computers could help us predict and tackle environmental changes.

Supercharging Artificial Intelligence: Training AI takes a ton of computing power. Quantum computers could make AI smarter, faster, and more efficient.

Finance and Business: Banks could use quantum computers to better analyze risks and predict market trends with incredible accuracy.

Willow isn’t going to show up on your next smartphone or laptop. It’s more like a proof of concept, showing what’s possible in the future. Think of it like the Wright brothers’ first flight—it didn’t carry passengers, but it proved flight was possible.

In the same way, Willow is showing us that quantum computers can actually work on a big scale and tackle problems we once thought were impossible. We’re not quite there yet, but Willow is a big step toward making that future real.

If Sundar Pichai’s announcement felt overwhelming with all the technical details, we hope this explanation makes things clearer!

Disclaimer: This is what ChatGPT taught us about Willow, so any mistakes are on the AI. We’re just here learning like everyone else.

Tidbits

Amazon is set to disrupt India’s quick commerce market with 15-minute deliveries in Bengaluru, challenging Swiggy Instamart and Flipkart. Leveraging its infrastructure, Amazon aims to redefine delivery standards in the $3.3 billion market.

Tesla is reviving plans to enter India, exploring showrooms as the EV market is projected to grow to 30% by 2030. With reduced import taxes and rising EV demand, Tesla’s entry could redefine India’s luxury EV segment and real estate opportunities.

China's exports grew by just 6.7% in November, down from October's 12.7%, while imports fell 3.9%, the worst in nine months. Weak global demand and internal challenges prompt Beijing to plan aggressive fiscal measures for 2025.

- This edition of the newsletter was written by Kashish and Krishna

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Only newschannel (if I may) where I don't have to chatgpt to dumb it down for me💯

As an econ grad student, I deeply appreciate the borderline academic approach to data in this newsletter—it's always an insightful read! That said, I’m a bit skeptical about the MoSPI data used here. Couldn't find an email id so asking about it down here.

India measures household consumption through the Household Consumption Expenditure Surveys (HCES), with the most recent one being conducted for 2022-23 and the one before that in 2011-12. This leaves a significant gap in the data timeline. So, I’m curious—how did you construct a continuous graph of expenditure on different items with such discontinuous data?

It seems like projections might have been used to fill in the gaps. If so, it would be incredibly valuable (and transparent!) to disclose the assumptions, weights, or models used for those projections in the newsletter. This would help readers, especially data nerds like me, better understand and trust the story behind the numbers.

Keep up the great work—love what you’re doing here!