Government vs Government on EVs

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts or wherever you get your podcasts and video on YouTube.

Today on The Daily Brief:

No subsidy for EVs?

SEBI tells RBI to do the math right for household savings!

Steel market is chaotic!

No subsidy for EVs?

Let’s talk about the electric vehicle (EV) market in India because there are some exciting developments, but also a bit of mixed messaging from the government.

To give you some background, India launched the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme back in 2015, with a budget of Rs 895 crores. The goal? To encourage the adoption and production of electric vehicles in the country.

Then came FAME II in 2019, with a much bigger budget of Rs 10,000 crores. It aimed to boost sales of about 15 lakh electric two-wheelers, three-wheelers, cars, and buses. Now that FAME II is nearing its end, the government introduced a temporary scheme called the Electric Mobility Promotion Scheme (EMPS), which is set to expire on September 30th.

Let’s look at the numbers.

EV adoption in India is growing but still in the single digits, accounting for about 2% of total vehicle sales. It’s a decent start, but there’s plenty of room to grow.

In 2023, electric car registrations jumped 70% compared to the previous year, while overall car sales grew by less than 10%. This shows that EV growth is picking up as the market matures.

What’s also interesting is how fuel preferences are changing. According to CareEdge Ratings, the share of petrol vehicles in total sales dropped from 86% in 2020 to 76% in 2023.

One of the biggest reasons people are switching to EVs is the overall cost savings. CareEdge's analysis shows that, over a vehicle's lifetime, EVs are the cheapest to own, followed by CNG vehicles. This includes not just the purchase price, but also fuel, maintenance, and government incentives.

For example, they estimate that owning a petrol car costs around Rs 28.38 lakh over its lifetime, while an equivalent EV would cost just Rs 16.70 lakh. That’s a huge difference!

But here’s where things get a bit confusing. Two senior government officials seem to have different views about the future of EV subsidies.

On one side, we have Union Heavy Industries Minister H.D. Kumaraswamy saying that FAME III is on the way. He recently mentioned that the government could finalize the third phase of the FAME scheme in the next month or two. An inter-ministerial group is apparently working on it, addressing issues from the earlier phases.

On the other side, we have Union Road Transport Minister Nitin Gadkari, who suggests that EV subsidies might be coming to an end. He believes that with increasing demand and production, costs are dropping, which could reduce the need for government support.

Gadkari also highlighted that the GST on electric vehicles is just 5%, compared to 28% for petrol and diesel vehicles, which he sees as a major advantage for EVs.

So, what’s going on?

It seems like there’s an ongoing debate about the future of India’s EV policy. While Kumaraswamy’s comments suggest that government support is still needed, Gadkari believes the industry is ready to stand on its own.

This uncertainty is causing some worry in the EV industry, especially with the festive season around the corner. October is a huge month for vehicle sales in India, with Navratri and Diwali both taking place. EV manufacturers are concerned that if EMPS ends and FAME III isn’t ready, there might be a gap in subsidies.

Some industry players are calling for either an extension of EMPS or a quick rollout of FAME III to keep the momentum going. A sudden stop in incentives could slow down sales, especially during this key sales period.

However, Gadkari remains optimistic. He’s confident that India can become a global hub for EV manufacturing, with support from initiatives like the Production Linked Incentive (PLI) scheme, which aims to boost local production.

In short, the Indian EV market is at a critical point. The government’s next move will be crucial in shaping the industry’s future. Will subsidies continue with FAME III, or will Gadkari’s vision of a self-sufficient industry take over?

Gadkari also emphasized the potential of alternative fuels like CNG, LNG, ethanol, methanol, and green hydrogen. He stressed the need to cut costs while maintaining quality to make Indian EVs competitive on the global stage.

Another big hurdle for EV adoption is the lack of charging stations. Gadkari believes market forces will drive the development of charging infrastructure, saying there are plenty of opportunities for people to take advantage of.

One thing’s for sure: with the global shift toward cleaner transportation and India’s ambitious climate goals, the EV sector will remain one to watch. The government’s decision on subsidies could have a big impact on the entire auto industry. So, we’ll be keeping an eye on what happens next!

SEBI tells RBI to do the math right for household savings!

A couple of days ago, we talked about how Indians are spending less. Many of you asked how this is measured, and lucky for you, SEBI just published a new research paper on the topic. So, we thought it would be a great idea to explain how Indian household savings are actually calculated.

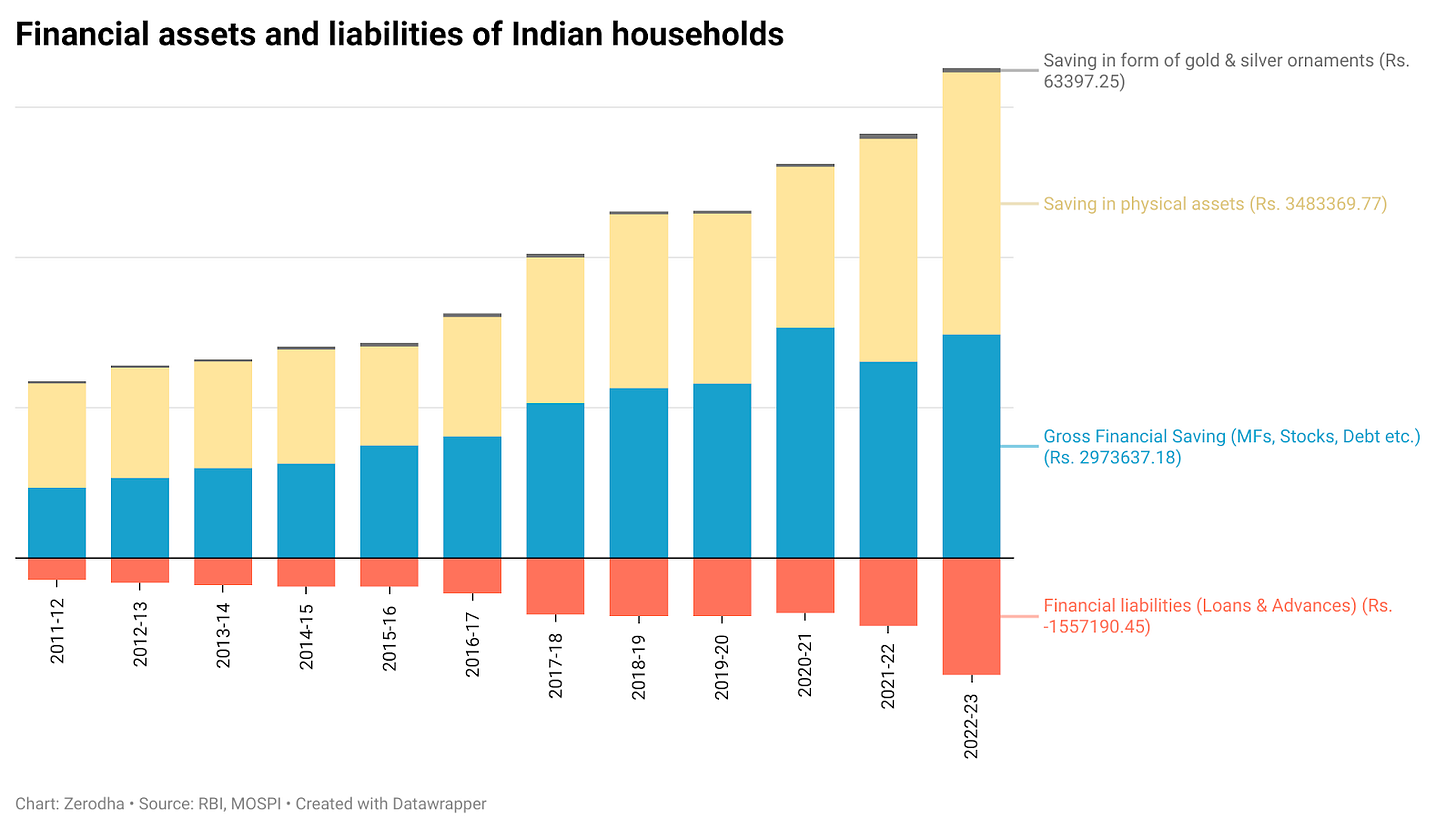

The formula for Household Savings is pretty simple: Household Savings = Gross Financial Savings - Financial Liabilities + Physical Savings.

Gross Financial Savings includes things like deposits, investments in mutual funds, stocks, bonds, and other financial products.

Physical Savings refers to investments in physical assets like real estate or gold.

Financial Liabilities are household debt, like loans or advances.

These numbers matter because they tell us how much savings are available in the country. Businesses can tap into these savings to grow, and the government can borrow from this pool for development projects.

Both the RBI and the Ministry of Statistics and Programme Implementation (MoSPI) regularly publish data on household savings and investments. Let us give you an idea of what the numbers looked like for India in FY23:

Gross Household Savings doubled from ₹23.55 lakh crore in FY12 to ₹65.2 lakh crore in FY23. That’s an annual growth rate of 9.72% over the last decade.

Physical assets, like real estate and gold, make up over 70% of total household savings.

Net financial savings (savings minus debt) dropped by 40% between FY21 and FY23.

One interesting trend is that more and more of these savings are being invested in the stock market. That’s a good thing because it means people are shifting away from traditional options like savings accounts, fixed deposits, and gold, and are choosing market-linked investments instead.

But SEBI isn’t too happy with how the RBI and MoSPI calculate total household savings. Last week, they released a working paper suggesting a new, more detailed way to measure household savings. SEBI raised three main issues with the current method:

The RBI’s current method only looks at certain groups, like retail investors and high-net-worth individuals (HNIs). SEBI suggests including all individual investors, as well as non-profits like NGOs, which are currently left out.

The current method only tracks a limited range of financial products, like equities and mutual funds, and often focuses on just the primary market (IPOs of stocks and bonds). SEBI wants to include secondary market transactions and newer instruments like REITs, InvITs, and ETFs for a more accurate picture.

Important savings data, like investments in alternative investment funds (AIFs), private placements, and other newer financial products, aren’t being captured. SEBI thinks these should be included to better reflect household savings.

Because of these gaps, household investments in the stock market have been undercounted, and SEBI wants to change that. According to SEBI’s calculations, Indians are saving more than we previously thought.

Also, the current RBI data shows that physical savings made up more than 71% of household savings in FY23, the highest it’s been since 1970. But based on SEBI’s new calculations, Indian households might actually be less dependent on physical assets and more invested in financial assets than we realized. So yeah, this is good news.

Steel market is chaotic

The world produces about 1.8 billion metric tons of steel every year, which, just for fun, is the weight of roughly 180 million elephants!

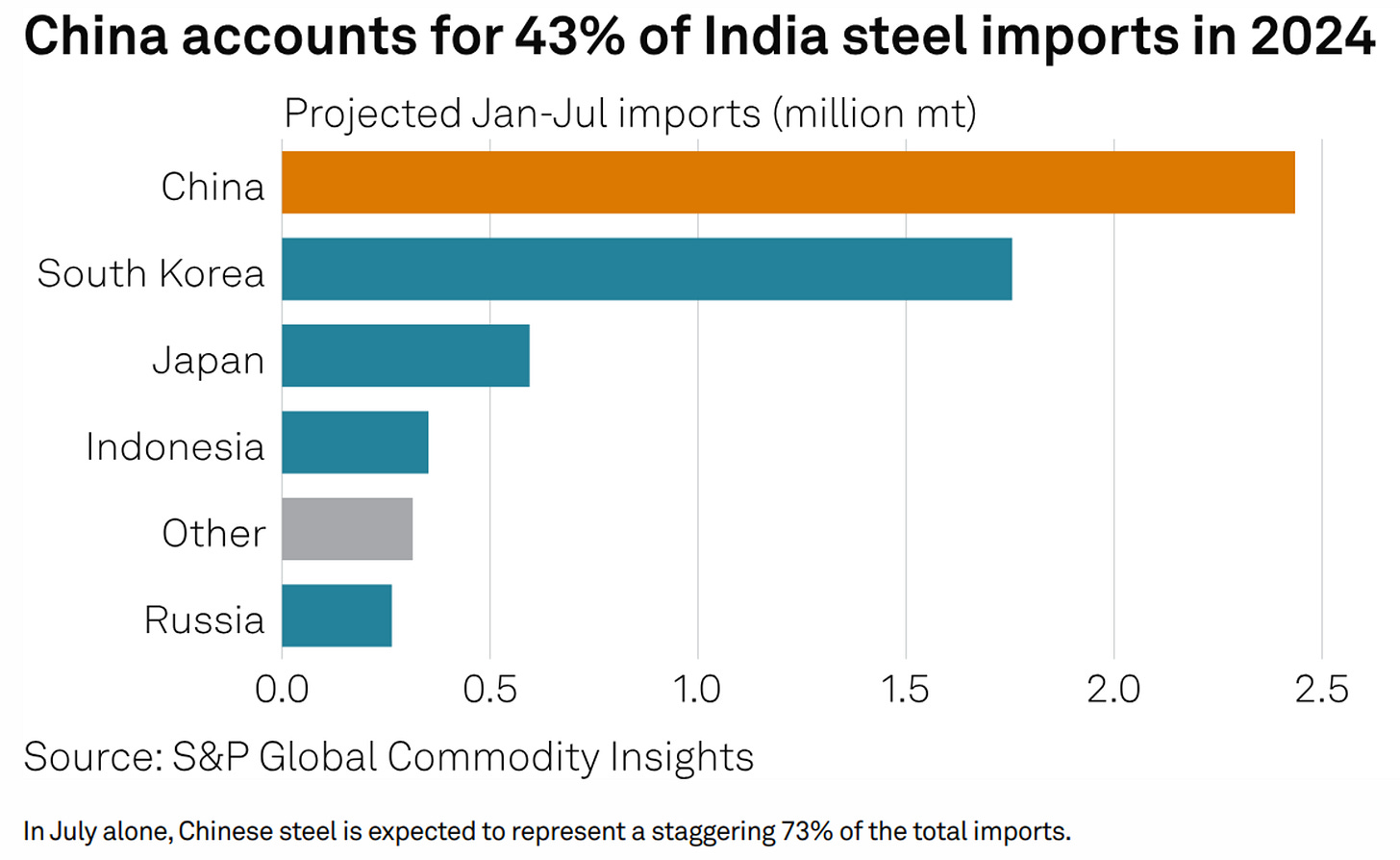

China is by far the biggest player, with over 50% of the global market share. India, in comparison, has a market share of around 6-7%. But lately, the steel industry has been facing some serious challenges, and it’s worth diving into what’s going on.

One of the biggest problems right now is China dumping cheap steel into markets like India, often selling it at prices below the cost of production. This is happening because China built way too many steel factories in the last decade, thanks to massive spending on infrastructure and manufacturing. But over the past five years, China’s economy has slowed down, largely due to the collapse of its real estate and construction sectors, which together account for over 30% of its GDP.

Because of the trillions of dollars China invested in building its physical infrastructure and industrial base, its factories are now making way more steel than they need. And since domestic demand has dropped significantly, they’re selling this extra steel to other countries at rock-bottom prices.

To put this in perspective, recent prices for Chinese steel were about Rs 48,000 per metric ton, compared to India’s Rs 51,000 per metric ton. While that difference might sound small, it’s huge in the steel industry, where margins are thin and every rupee counts for buyers.

As a result of these low prices, Chinese steel made up 73% of India’s total steel imports in July 2024, the highest level in the last seven years. This flood of cheap steel is hitting domestic producers hard because they just can’t compete with such low costs.

By the way, Japan is also exporting steel to India at prices similar to China’s. But the reason is different. Japan’s low prices aren’t due to dumping but because of a Free Trade Agreement (FTA) with India. This FTA cuts down tariffs and trade barriers, allowing Japanese steel to enter the Indian market more easily and cheaply. But given that these pieces are still lower than India’s prices, it’s hurting Indian steel makers.

Here in India, there’s a lot of talk about how to protect local steelmakers from these cheap imports. Steel Minister H.D. Kumaraswamy is pushing to raise import duties from 7.5% to 10-12% to deal with Chinese steel. Meanwhile, Commerce Minister Piyush Goyal is suggesting a Border Adjustment Tax (BAT) to balance out the taxes paid by Indian producers.

The issue, though, is that there are doubts about whether a BAT would really make much of a difference, as it might only slightly raise import prices. The lack of a clear and unified plan is leaving the steel industry in a bit of a tough spot.

Overall, the global steel market is in chaos, especially for emerging countries like India. China’s aggressive strategy of exporting its domestic problems is putting a lot of pressure on India’s steel industry, which is feeling the squeeze from all sides. It’ll be interesting to see how things play out in the coming months.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments