GIFT City: India’s high-stakes gamble

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

Just a quick heads-up before we dive in. The LG IPO is open now. We wrote about it earlier — you can read the full story on LG here.

In today’s edition of The Daily Brief:

GIFT City’s Ambitious Gamble

The renewable energy revolution is moving too fast

GIFT City’s Ambitious Gamble

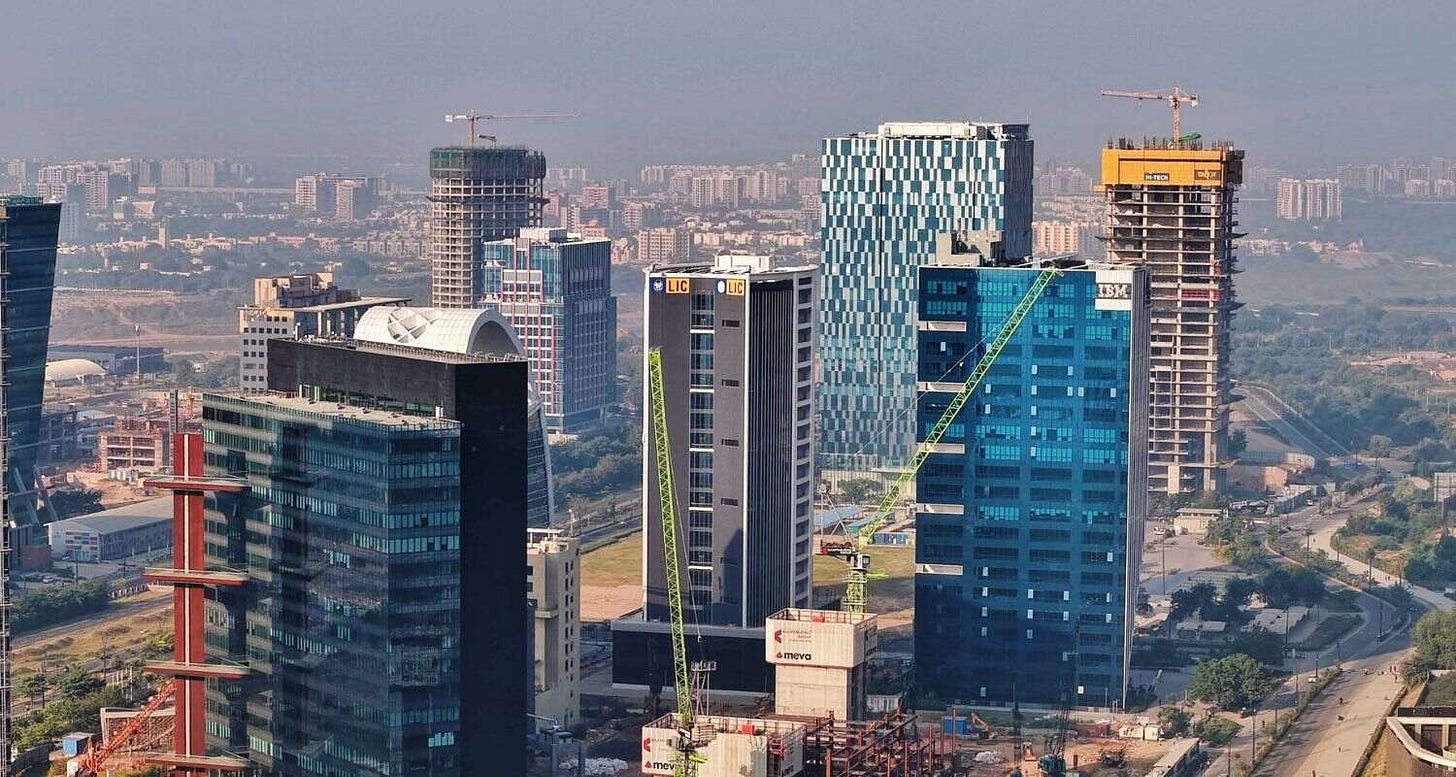

Earlier this week, Finance Minister Nirmala Sitharaman launched a new Foreign Currency Settlement System at GIFT City. The system allows real-time clearing of dollar transactions without routing through overseas banks.

It’s a milestone for GIFT City — a project launched almost wholly from scratch to rival global financial hubs like Singapore and Dubai. In 2015, Saurabhbhai Patel, Gujarat’s then-finance minister boldly claimed that:

“GIFT City will be one of the five major financial centres of the world over the next five years.”

However, the gap between vision and reality remains stark. Even after 10 years, GIFT City is far from that goal. By evening, the city empties out of the ~28,000 people who work here. GIFT City can’t attract full-time residents who want to stay here. And that puts a limit on its ambitions.

So, where does GIFT City actually stand? The story boils down to just how extraordinarily difficult it is to build a thriving financial center through top-down policies. GIFT City also stands in contradiction with how India’s existing institutions work.

Let’s dive in.

Can you build a financial hub from scratch?

We’re all familiar with cities like London, New York, Hong Kong, Singapore, Dubai, that are considered global financial hubs. Their capital markets enjoy high trust, immense liquidity, and extreme ease of business. At any given time, billions of dollars pass through them.

Many countries have tried to launch their own versions of these financial hubs. Most of them, however, failed. Moscow, for instance, was a disaster, with most of their international financial district being vacant. Kazakhstan’s attempt to build an international financial centre in its capital, Astana, remains a small player despite having generous incentives and special courts. South Korea’s Songdo couldn’t attract enough investors.

Why do top-down attempts to create a financial hub fail so often, even if they theoretically have many of the ingredients needed to make one?

Turns out, it’s really hard to predict what makes a financial hub tick. A successful financial hub is one that has built network effects. But that’s where attempts to build one struggle with a classic chicken-and-egg problem. Banks won’t move without talent, talent won’t move without banks, and neither will move without market liquidity, which needs banks and talent. A new hub must bootstrap this whole cycle from zero—an uncertain and long process.

Hard to make, easier to break

Even when it seems like you get every ingredient necessary, there are always some things that go wrong. To see how, let’s see what these factors are.

Firstly, infrastructure. Financial hubs are known to be lined with tall, fancy buildings backed up with reliable power, high-speed connectivity, and proximity to important areas. And every attempt to make a hub, from Moscow to GIFT City, has included this. But if infrastructure alone made a financial hub, there wouldn’t be so many failures. If history is any indication, successful centers have often emerged at natural trading crossroads or ports—like Dubai, New York, Singapore and Hong Kong.

Secondly, the legal framework. A global financial hub like Dubai will have a new set of laws that’s quite separate from the host country’s laws. Think of it as an international duty-free zone within a domestic airport. For a global financial hub to work, these two sets of laws can’t overlap too much, else investors won’t have enough confidence.

Dubai, for instance, is a success here. It has independent courts separate from its own judiciary that built trust among international investors. On the other hand, the Moscow hub remained subject to Russia’s own centralized, onerous judiciary. Additionally, Russia’s geopolitical stature spooked investors further, massively reducing their trust in Russia’s rule of law.

Third, sequencing is crucial. A global financial hub doesn’t do all kinds of finance, but rather specializes based on strengths. Dubai, for instance, built credibility in niche areas like Islamic finance and private banking, before expanding to popular areas like equity trading. But trying to launch a full-fledged stock exchange without enough issuers or investors, for instance, will lead to low volumes.

Fourth, you need people who want to live in these hubs. Skilled professionals are drawn to cities offering not just good jobs, but good schools for their kids, a nightlife, and a solid standard of living. You need these hubs to feel like real, vibrant cities. That’s where urban planning comes in — building dense neighborhoods, ensuring good drainage facilities, and so on. Singapore is a model case when it comes to this.

You can’t get all these factors right all at once. Things like schools and malls will only be built when there’s demand, and demand comes if the hub is useful. Where these establishments are situated must also be taken into account in urban planning. Plus, building a financial hub requires a lot of resources that not every country can afford. A failure would strain finances massively.

Building a global financial hub, therefore, needs a lot of money, effort, patience, and maybe some luck.

Why India Wants GIFT City

So, why is India pursuing such a difficult path? The answer is simple: onshoring offshore activity related to Indian assets.

For decades, a huge volume of India-related financial activity has happened outside India due to domestic regulatory constraints. The most visible example was Nifty futures. For years, foreign investors traded derivatives on India’s benchmark stock index on the Singapore Exchange (SGX Nifty). At its peak, volumes on SGX were five times larger than onshore, benefiting Singapore’s markets instead of ours.

Additionally, many Indian VC or private equity funds, as well as Indian startups register themselves in tax havens like Mauritius, Singapore, or Luxembourg. Domestic startups find it hard to raise capital from abroad while being publicly-listed in India.

GIFT City was envisioned as a solution to both these issues. In 2023, SGX and NSE struck a deal in 2023 to shift Nifty futures to GIFT. On July 3, 2023, SGX Nifty was rebranded “GIFT Nifty,” with $7.5 billion in derivative contracts migrating overnight. GIFT Nifty now trades nearly 21 hours a day, giving global investors round-the-clock access to Indian markets.

For investment funds, GIFT offers an alternative to other tax havens: tax holidays, no GST on management fees, and no capital gains tax for non-residents. That’s why entities registered in GIFT are also treated as “non-resident” under Indian law, giving them proximity to Indian deals without India’s tax burden.

GIFT City has also been trying to expand into other areas. Aircraft leasing, for instance, is one of them. Despite our huge aviation market, India has generally imported 100% of leased aircraft from foreign lessors in Ireland and Singapore. GIFT wants to get aircraft lessors to set up shop in India instead.

Now, these are huge ambitions. But we couldn’t help but ask ourselves a question: why can’t Mumbai — India’s largest existing financial hub — do all of this? Why do we need a whole new city from scratch? Well, it’s because Mumbai operates under India’s domestic rules for capital markets. These rules include strict controls on capital flows, rupee-only transactions, and regulatory oversight from multiple agencies (like SEBI, RBI, Finance Ministry).

However, to be a truly international financial hub that deals in foreign currencies freely, GIFT can’t have those rules. For that reason, it is overseen not by SEBI or RBI, but by a whole new unified regulator called the IFSCA. Ideally, this should prevent regulatory overlap and confusion that may be more common when many agencies oversee the same thing. But as we shall see, reality is more complicated than that.

Early wins

Within a decade of being created, GIFT City has certainly achieved a few big wins.

The primary aim of migrating all activity around Nifty futures from SGX to India has largely been achieved. In May this year, GIFT Nifty recorded its highest-ever monthly turnover of $102.35 billion.

The fund industry has also scaled quickly. By the end of 2024, over 200 funds were registered with the IFSCA, collectively raising over $15 billion in commitments. The absolute scale is still modest compared to Singapore, but the start has been promising.

Banking activity is also growing, as by the end of 2024, 28 international banking units (IBUs) of JP Morgan, HSBC, Citi, and so on) have opened branches, processing $508 billion in transactions by July 2023. Domestic banks like Axis and HDFC have also set up their IBUs in GIFT City.

The Reality Check

However, there is still not enough evidence that GIFT City is a force to be reckoned with. It suffers from three challenges that are inherent to the context in which it is built.

The most important challenge is incomplete liberalization. GIFT City can’t fully escape Indian broader policy constraints, which tend to be protectionist — meaning capital flows in and out of India are far more controlled than what a Singapore or Dubai allows. The IFSCA isn’t truly an independent body that can operate unilaterally, with its autonomy often being second-guessed by the SEBI and RBI.

For instance, last year, based on the RBI’s feedback, GIFT City briefly put a stop to new family office registrations. RBI’s concern was that if capital controls get too loose, GIFT City could be used to exploit tax loopholes, just like in Mauritius and Cayman Islands. Stockbrokers in GIFT are usually subject to strict SEBI rules.

Moreover, disputes in GIFT City will be heard only in existing Indian courts, which are already slow. The hubs of Dubai and Singapore, on the other hand, have separate courts that can resolve disputes far faster.

In other words, GIFT City is trying hard to be an international duty-free zone within Indian borders. But India’s current institutions and economic structure limit it from being one. This is a fundamental contradiction that we are yet to resolve. Neither the UAE nor Singapore face this issue, as it largely fits within their broader economic strategy of being fully open to capital.

The second issue is that GIFT City’s capital markets remain very nascent. GIFT aimed to get Indian startups to list domestically instead of abroad. However, as of today, not a single company has completed an IPO in GIFT City. Until major listings happen and attract investor interest, GIFT’s exchanges will be dominated by GIFT Nifty and niche derivatives. Trading volumes outside these products are extremely low.

Third, GIFT City finds it hard to attract talent. While freshers are willing to relocate, senior professionals with families are reluctant to move. The reasons are obvious: unlike Mumbai, Delhi or Bangalore, GIFT City doesn’t have a vibrant social life. Only a few thousand people actually reside in GIFT, and many of the 28,000 people who work there actually commute from well-established cities like Ahmedabad and Gandhinagar. In fact, it has often been called a “ghost town” because of how empty it feels.

What has hampered the dream of making GIFT City a talent attractor is the collapse of the infrastructure lender IL&FS, which was one of the key founding partners of GIFT City. It had an important say in the planning of the city. But its financial troubles slowed down momentum and dampened trust in any project it was associated with, including GIFT City.

Lastly, global competition is fierce. Competing with established, high-trust cities like Singapore and Dubai for regional business, plus niche hubs like Ireland for aircraft leasing, is going to be hard. It doesn’t offer enough incentives for investors to move out of these hubs yet.

The Path Forward

Global financial hubs take a long time to mature. Both Singapore and Dubai took at least 2 decades to work out. GIFT is still adolescent, and even then, it has achieved some promising results.

However, GIFT City certainly operates at odds with how the rest of India is run. With high import tariffs and capital controls, India has a tendency to protect its domestic industry over everything else. This has created lots of regulatory uncertainty.

We haven’t even addressed whether, right now, India really needs to fuel resources into building a global financial hub. While our fast-growing economy can benefit from access to foreign capital, we have other pressing economic problems that may need to be tended to first. As the RBI has hinted before, there is also a possibility that GIFT might end up being a tax haven more than a real source of investment.

Only time will tell if or how GIFT City works out.

The renewable energy revolution is moving too fast

We keep talking about renewable energy on this show again and again. And for good reason — it’s one of those topics that keeps shifting beneath our feet. Every few months, there’s a new record in solar installations somewhere, or a new subsidy program.

The International Energy Agency (IEA) just released this year’s edition of its Renewables report. It’s a humongous report that tries to capture the past, present, and future of renewable energy.

So, we figured we’d do what we always do: go through it, pick out the things that matter most, and explain them in simple terms. These are the ideas that shape where the energy transition is really heading.

For a deeper dive, of course, you should check out the full report — but here’s what it’s really saying.

Keeping up with supply

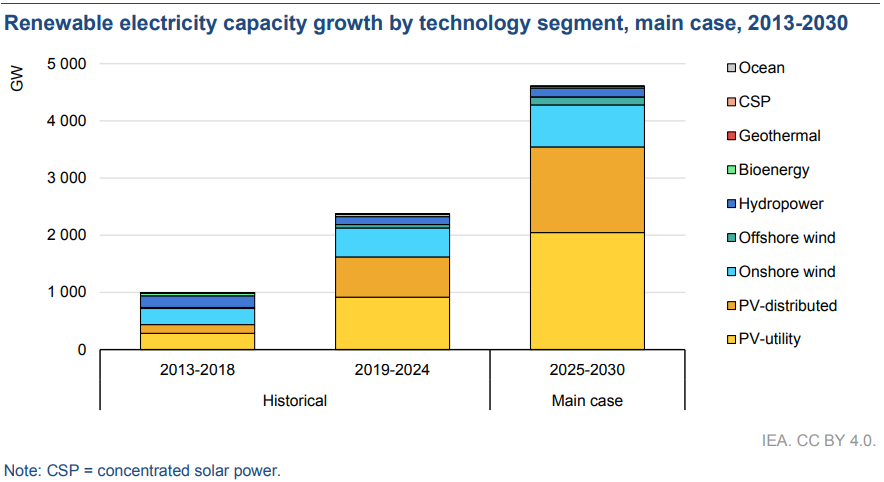

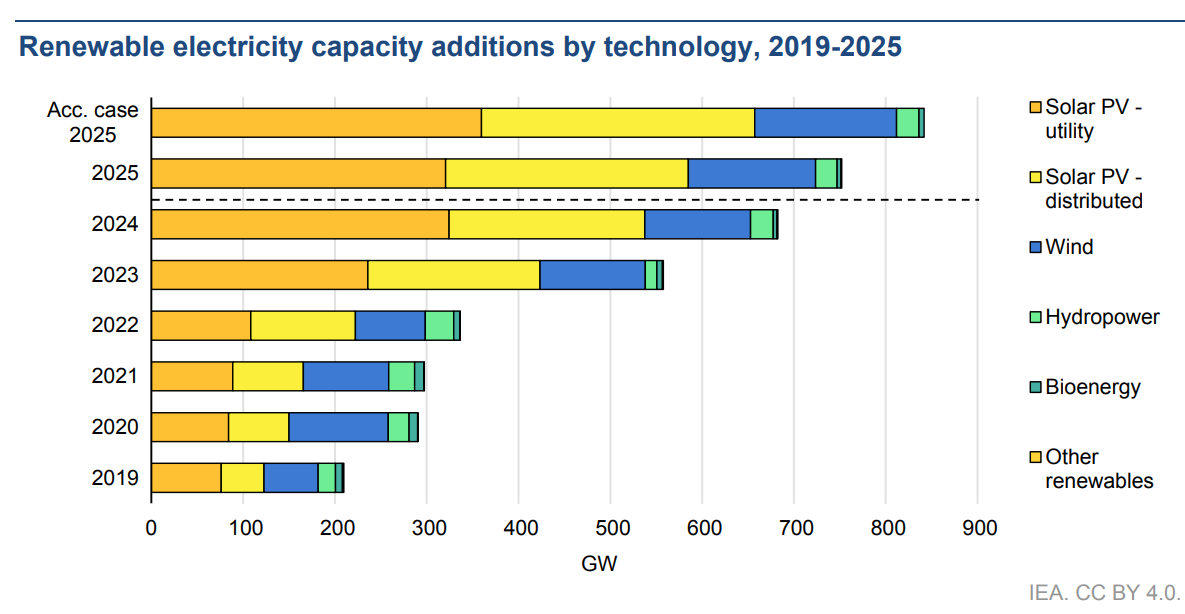

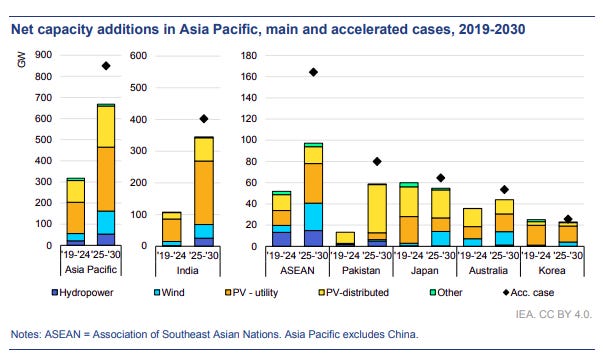

The big headline is simple but important: the world is building renewables faster than ever before. Between now and 2030, the total global renewable power capacity is expected to double, increasing by 4,600 gigawatts (GW).

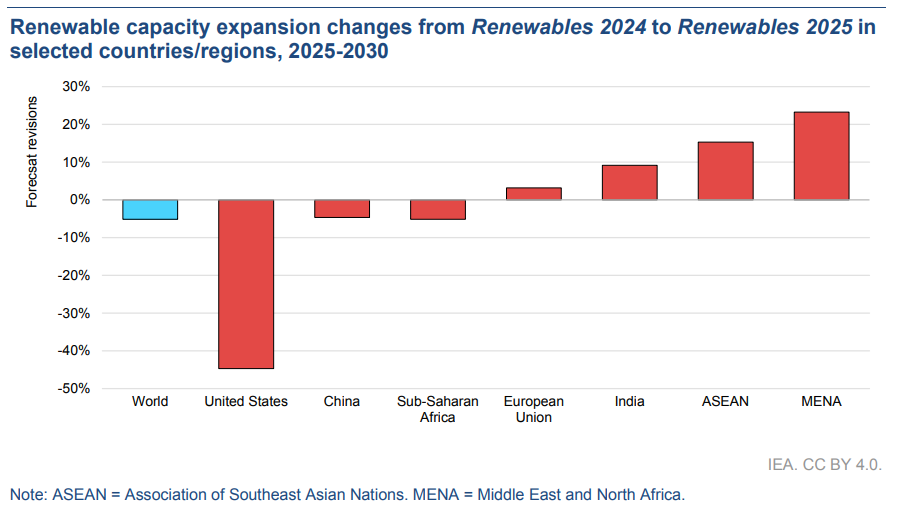

But the new forecast is 5% lower than last year’s outlook, and that cut tells its own story. Because even though renewables have become cheaper, faster, and more mainstream, the systems around them — policies, grids, supply chains, and finance — are now slowing down.

The takeaway is simple: renewable energy works, but now we have to prove that the systems built around it can keep up. What we haven’t figured out yet is how to connect, store, and move that power once it’s made.

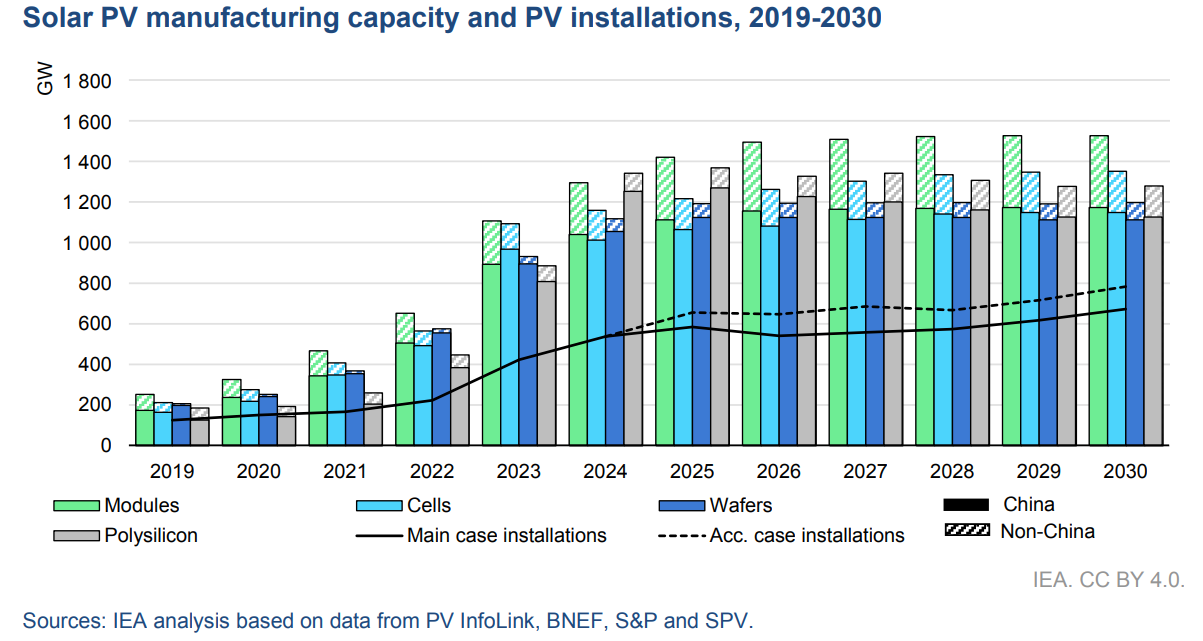

Take solar, for instance. It continues to dominate — accounting for almost 80% of all new renewable capacity. In most parts of the world, solar is now the cheapest source of new electricity, often undercutting coal and gas by a wide margin. However, panels are being deployed faster than grids can connect them.

And this source of friction is true no matter where you look. In India and China, huge solar parks now produce more electricity at midday than transmission lines can handle, forcing operators to simply switch panels off. In Europe, projects wait years for grid connections even after construction is complete.

The IEA says global investment in grids needs to double by 2030 just to keep up. Without that, curtailment — which is clean energy that’s wasted — will rise sharply. The world spent a decade figuring out how to make green power cheap, but now it’s tripping over the plumbing that moves it.

The next race may not be about who can build the most renewables, but who can actually use the power they produce.

What it says about India

If there’s one country the IEA singles out this year for solid performance in renewables, it’s India.

As we’ve covered before, India’s renewable buildout has a very different character from China’s or Europe’s. China’s model is state-led, fully financed, and industrial in scale. Europe, on the other hand, is corporate and fragmented. India sits somewhere in between: policy-driven, cost-conscious, and deeply intertwined with domestic demand.

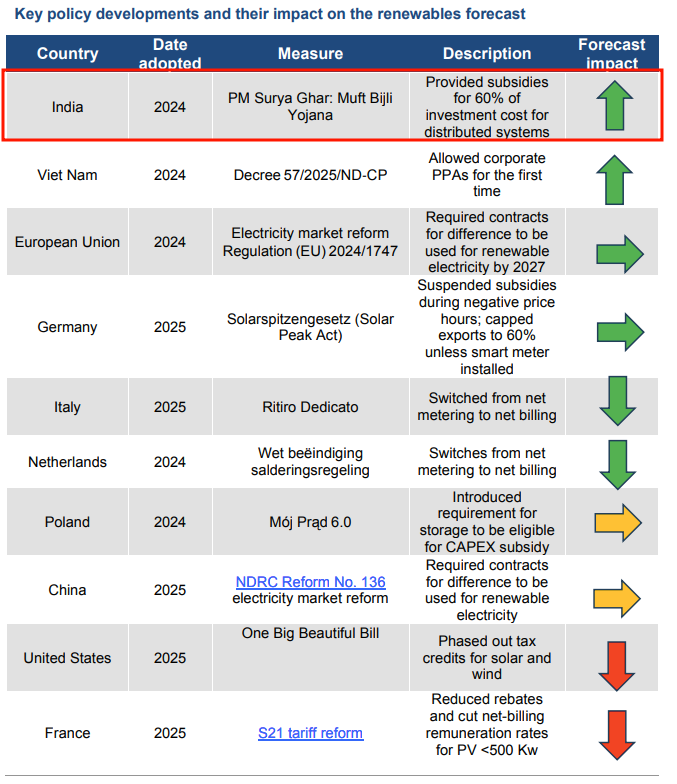

The clearest sign of progress is rooftop solar, which has finally crossed from policy to practice. The PM Surya Ghar scheme changed the game by paying installers directly, cutting paperwork, and covering up to 60% of installation costs (we have covered this before). For the first time, small towns — not just cities — are seeing applications surge. In effect, this decentralizes generation: power is being produced closer to where it’s used.

At the utility scale, the momentum is just as strong. India’s renewable auctions have become some of the most competitive and transparent in the world. Developers bid for long-term contracts with state distribution companies, locking in predictable prices for decades. That certainty has drawn big capital — Adani Green, JSW Energy, Tata Power and so on.

On the supply side, hydropower is back from the sidelines. For years, it got stuck in environmental and land disputes. Now, it’s being revived as the missing balancing tool in India’s grid. Pumped storage projects — which store energy by pumping water into reservoirs — are gaining traction. These can play the same role as large-scale batteries, stabilising supply when the sun sets or the wind dies.

Manufacturing is also making inroads. India’s Production Linked Incentive (PLI) scheme is pushing up the making of modules and cells fast. However, for upstream materials like wafers and polysilicon, we still depend on Chinese imports. India’s next big test will be closing that loop domestically. If it does, it’ll be the only country besides China with a near-complete solar supply chain.

But two big constraints still loom.

The grid is still the weakest link. India’s transmission network isn’t expanding fast enough to move power from where it’s generated to where it’s needed. The sunniest and windiest states — Gujarat, Rajasthan, Tamil Nadu — are far from the industrial load centres in Maharashtra or the north. Without more expansive grids, renewable power will get stranded and investors will hesitate.

The other constraint is financing. India’s renewable growth is being driven by large, well-capitalised companies. Smaller developers and community projects still face borrowing costs that make returns hard to get. Access to low-cost green finance could make or break the next phase.

Put together, the report’s tone on India is quite optimistic. It points out that we are one of the few countries where policy, prices, and demand are pulling in the same direction — a rare alignment in a world where energy transitions often tend to stall midway.

What’s happening internationally

Now, stepping back from India, here are the 4 broad international trends that stood out to us:

1. China is still the backbone — but caveats apply

For more than a decade, China’s renewable boom was built on state certainty. The government guaranteed grid connections while state banks provided cheap credit. That setup lets developers build at industrial speed without worrying about prices or buyers. The result was stunning: China added more solar capacity last year than the rest of the world combined and drove global panel prices down by a lot.

But that system became too expensive to maintain for state finances. So Beijing began phasing out those subsidies and moved to a market-based model — one where new projects have to compete in auctions, sell power into wholesale markets, and survive on razor-thin margins.

That’s when the cracks began to show. Developers who once built knowing they’d get paid now have to guess what prices will be. Factories that expanded to meet subsidised demand are suddenly oversupplied, deflating the prices of solar panels further. Excessive competition creating oversupply — or involution — is a very well-known phenomenon in the Chinese solar industry.

At the same time, domestic electricity demand has stopped rising as fast, meaning the grid can’t absorb everything being built. Surplus panels are flooding the export market just as the U.S. and Europe are throwing up trade barriers to protect their own industries.

The IEA’s view is that China remains the single biggest driver of global renewable growth — its scale still keeps costs low everywhere — but it’s entering a tougher phase. The old model of build first, sell later no longer works when the state isn’t footing most of the bill. The challenge now is to make renewables sustainably profitable — a harder task than making them cheap.

2. The U.S. boom is losing clarity

The US raised its solar hope with the passage of the Inflation Reduction Act (IRA) in 2022. It offered hundreds of billions in tax credits for renewables, batteries, and manufacturing. And for a while, it worked: developers rushed to announce projects, and global investors treated the U.S. as the new growth engine of the transition.

But the follow-through has been messier. The IRA’s incentives are generous, but tangled in national security; every project has to prove it meets the criteria for local, American sourcing — as opposed to being reliant on Chinese products. The combination of high interest rates and rising material costs is also making US projects far less cost-efficient than China or India.

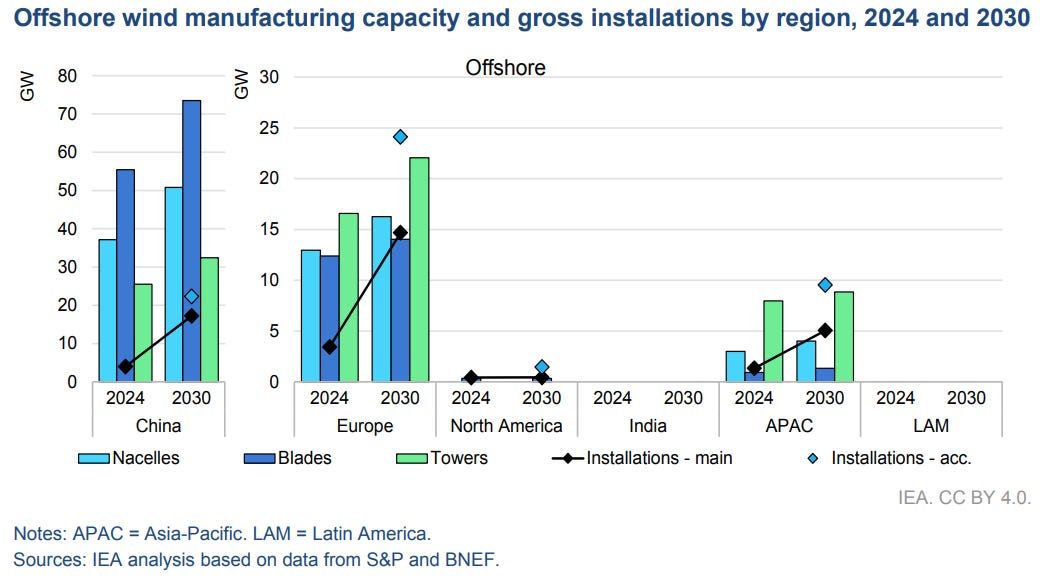

Nowhere is this problem more evident than in offshore wind. It was meant to be the country’s showpiece, but costs for turbines, steel, and vessels have exploded. Contracts that didn’t account for the inflation they now face are unviable, forcing developers to walk away.

The deeper issue is structural. The U.S. can mobilise capital faster than anyone, but it still can’t build fast. Every new transmission line or wind project must clear a maze of permits and lawsuits that can stretch a decade.

3. Europe is messy, but resilient

Europe’s bottleneck is neither money nor demand, but permits. The IEA says half of all European renewable projects are stuck in approval backlogs. In some countries, getting a wind farm cleared can take longer than building it. Environmental reviews, local opposition, and overlapping EU and national rules all slow things down.

However, in the wake of Russia cutting its oil supplies, Europe has been forced to consider renewables far more seriously after a period of slow growth. However, instead of governments, private firms are playing a bigger role here, signing long-term agreements directly with renewable producers. These deals lock in stable electricity prices and allow projects to move ahead without waiting for government tenders.

Germany, Spain, and Poland are leading Europe’s shift. The EU’s new electricity market reform will make it easier by mandating “contracts for difference” — a mechanism that guarantees developers a fixed price for their power, providing revenue predictability to high-risk projects.

4. The solar map is shifting east

Clean energy’s centre of gravity has shifted east. The IEA shows that Asia now controls almost every part of the renewable supply chain — not just China, but increasingly India, Vietnam, and Malaysia too.

Meanwhile, the West is trying to claw some of that back through industrial policy — the U.S. with its domestic-content rules, Europe with “Made in EU” subsidies. But these make projects costlier and slower. The more they try to localise, the more they lose the very price advantage that makes renewables competitive.

For India, though, this is an opening. The regional supply chain that once ended in China is starting to branch out. India is in a good position to climb the value chain.

Conclusion

The Renewables 2025 report is a cautiously optimistic story. It’s a temperature check on an industry that’s both thriving and straining.

We’ve reached a point where renewable energy is no longer just a lab experiment — people are convinced that it works. China remains the anchor, while India is emerging as the next growth engine. But we do need to prove that our grids, our politics, and our finance systems can keep up with it.

The energy transition isn’t slowing down as much as it’s getting complicated. And that might be the surest sign yet that it’s real.

Tidbits

Google is set to invest $10 billion to build a 1-gigawatt data-centre cluster near Visakhapatnam, its largest-ever direct investment in India. The project, expected to be approved by Andhra CM N. Chandrababu Naidu, will include three campuses (Adavivaram, Tarluvada, Rambilli) and supporting submarine cables and fibre infrastructure, forming part of India’s first international AI infrastructure hub. (Source: Business Standard)

This news ties into two pieces that we recommend reading: 1) India’s data-centre boom, and 2) Andhra Pradesh’s rise as India’s next industrial hub.Anthropic is setting up an office in Bengaluru and exploring a partnership with Mukesh Ambani’s Reliance Industries to expand access to its Claude AI in India — its second-largest market after the U.S. CEO Dario Amodei is visiting India to meet Reliance executives and government officials, including PM Modi. (Source: TechCrunch)

TCS has cancelled its Q2FY26 press conference scheduled for October 9 as the date coincides with Ratan Tata’s death anniversary, though the analyst call will still go ahead. The results come amid US visa fee hikes, new tariffs, and TCS’s massive job cuts, making them closely watched. (Source: Business Standard)

- This edition of the newsletter was written by Manie and Krishna

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Gift city:-

As Part of my College Industrial Visit I got an opportunity to visit the GIFT city … truly, as a 2nd year PGDM finance student who is Passionate about fintech and who has heard a lot about the GIFT city and its future projects, I was excited and its truly as u said a “ghost city”… the entry is like entering into some developed part of Gandhinagar … it was too far from the city the buildings are still work in progress … there were many well designed buildings … As you mentioned in the article everything was just like that. The host said that the GIFT city has a SEZ with an IFSC.

One of the amazing things which I saw there and is not mentioned in this Article is the “Utility Tunnel” . When explained by the host there, it felt like just an idea of “No digging zone” but in reality they are implementing the same and it’s amazing.

What is it ? It’s basically a tunnel which is three floors underground like we walked two floors down and then the utility tunnel was there below the pipes I saw some more space underneath maybe another floor for drainage. The tunnel has different pipes: one for the water supply , one for drainage, one for the AC water ,and also the city waste would be collected in this tunnel also the wires and cables which looks ugly hanging on the top of the buildings would be connected through this tunnel ..

So for the water supply if in future they want to change or repair or as they said sometimes during constructions in Mumbai the roads are dug to correct the water supply pipes and then there is this huge traffic because it might be in the middle of the road and then again poor material used can lead to Poth holes so to avoid all these problems the solution is utility tunnel. Even if there is some leak the problem would be solved without any destruction and nobody would be in trouble.

AC water pipeline they mentioned that we live in cities where in summers its impossible to live without the AC . So a separate AC pipeline where in the cool water will be passed and used in the AC cooling the used water will be passed through different pipes and the water will be filter and passed through the same pipe again like a cooling system.

Cables which are hanging in the cities looks unpleasant and can sometimes be a barrier for huge vehicles to pass also the broken wire problems during the monsoon season which could be dangerous. So utility tunnels will solve that problem connections will be passed within that tunnel.

Garbage collection they explained that the buildings waste is usually collected by the vehicle so they are trying to replace that with the hole in the buildings which are connected to the utility tunnel so that the person will throw the dry and waste garbage as if they are throwing in the dustbin but it is actually being thrown in the tunnel and then the segregation and waste management will be done in the tunnel.

When I heard all this I thought this might be just an idea which Is about to get implemented but then the host said that this is work in progress and whole GIFT city will have this utility tunnel as of now it is been constructed in small space. In the article the photo of the gift city has the LIC and SBI building just opposite to the same is this small office kind of space named as “GIFT District cooling Plant-1” where there are stairs to go underground towards the utility tunnel pipes. I saw the pipes being colored in different colors each representing the different work for the same.

When touched they were steel pipes and I was wondering … at that time that this would get corroded and … also it was just a small part which they have covered they have a plan to make a utility tunnel for whole GIFT city… which makes me wonder the pipes being used in this whole process and how this will increase huge demand for the pipes .... Towards the end of the visit a key question remained … why Gujarat and not Mumbai ? and I would say I got my answer by reading this wonderful article today so thank you so much for such an insightful article.

Hello, I read somewhere that you were going to make a book community. How do I access that book community?