From ‘Men Will Be Men’ to ‘Money Will Be Made'

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

More blues for Pernod Ricard

Behind Reliance's record profit

More blues for Pernod Ricard

Do you remember those old “Men Will Be Men” ads that were on TV all the time?

Well, those ads must have done their job very well, because the whisky brand they promoted — ‘Seagram’s Imperial Blue’ — is India’s third-largest whisky brand by volume. Last year alone, the brand sold 22 million cases, making its owner, the French liquor giant Pernod Ricard, a lot of money.

However, Pernod Ricard just sold Imperial Blue for a mammoth ~₹4,150 crore to Tilaknagar Industries, one of India’s largest alcohol distillers. This is the largest hard-liquor (excludes beer and wine) acquisition deal India has seen in more than a decade.

But why would Pernod Ricard sell such a popular brand to a competitor? Behind this sale is a story of shifts in how (and what) India drinks, and how our largest alcohol companies are trying to anticipate this change.

Curious? Let’s cork open this story. Feel free to pour yourself a drink as you read this. 🙂

India, on the rocks

We Indians absolutely love our whisky.

This one drink alone forms two-thirds of our alcohol market. Think Royal Stag, McDowell’s No 1, Johnnie Walker, Jack Daniel’s — brands that dominate alcohol shops and weddings. India drinks more whiskey than any other country in the world, in fact, chugging 260 million cases of it last year.

But within India’s whisky market — and alcohol more broadly — two major trends are currently playing out.

The biggest trend is that of premiumization. As Indians get richer, we increasingly want our whisky to feel luxurious, and therefore more valuable. The alcohol market is also changing, and India’s new liquor customers — young men and, increasingly, women — are experimenting with newer, more aspirational drinks. International Wine & Spirits Research (IWSR) predicts that premium-and-above whisky will record double-digit growth every single year, at least until 2027.

On the other hand, mass-market whiskies have been slumping in sales. There’s no better example of that than Imperial Blue itself. Its volumes have been flat over the last few years. In fact, between 2019-24, it actually fell by 4%.

In other words, value, not volume, reigns supreme.

This may be because the government has not made it easy for alcohol companies to charge premiums. Low-end brands face price caps which differ significantly across states — and because they sell to people with low income, governments tend to keep these prices low. With low margins, it’s hard to market those brands. Premium brands, however, cater to richer audiences, who are more willing to tolerate price increases.

Secondly, premiumization has coincided with the rise of homegrown brands. Whisky is having its own “Make in India” moment. India’s uniquely humid climate helps age our single-malts much faster than those from, say, Europe. And aging improves how good it tastes. That makes them highly sought after.

In the latest year we saw data for — 2021-22 — Indian single-malts soared an eye-popping 144% by volume. In 2023, the Indian brand ‘Indri’ became the fastest-growing single-malt in the world, selling a lakh units within 2 years of its launch. Although made in India, these brands command hefty premiums, costing anywhere between ₹3,000 to ₹10 lakh for ultra-rare editions.

In fact, this trend has received a big stamp of validation from global liquor giants as well. Both Pernod Ricard and Diageo — the world’s top two alcohol companies — launched their own Indian single-malts (Longitude77 and Godawan) just last year.

These trends are key to understanding how companies like Pernod Ricard are thinking about their next moves.

What’s Pernod Ricard up to?

India, for Pernod Ricard, is the next big goldmine. Their India business has eclipsed China to become their second-largest market in the world.

They’re now doubling down. They recently committed more than $230 million to build Asia’s largest distillery in Nagpur. Pernod Ricard’s MD, Jean Touboul, believes that premium local brands are its way ahead. The launch of Longitude77 is only the start.

There’s simply no place for mass-market brands with falling growth — like Imperial Blue — in this blueprint.

In the short-term, selling Imperial Blue could lead to a drop in Pernod Ricard’s sales. After all, it was the third-largest Indian whisky brand. However, their operating margin will improve immediately upon the sale, since Imperial Blue was dragging its margins down.

In the long-term, these better margins will unlock resources for them to fuel into their premium brands — Longitude77, Glenlivet, Blenders’ Pride, and so on. They’ll sell less, but earn more.

Here’s the thing, though: India is only one part of a global puzzle. Pernod Ricard’s worldwide sales fell by 4% in the first half of FY25. Their profit growth is slowing. In the face of this decline, they’re attempting a global makeover to centralize operations and remove bloat in the company. This project — titled “Tomorrow 2” —- could save them more than $1 billion over 4 years.

A big step in this project is removing all their non-core brands. Imperial Blue isn’t the only one on the chopping block. Last year, they also sold most of their global wine portfolio — worth 4% of revenue. And right after finalizing the Imperial Blue deal, Pernod Ricard also sold off two of their international Irish whisky brands.

The rest of their business will be streamlined from five divisions to just two. One will be called Gold, and will house their premium brands. The other, Crystal, will represent their affordable portfolio.

Pernod Ricard isn’t alone in these rebalancing efforts. Its rivals have similar plans, too. Diageo, for instance, plans to invest $100 million over the next three years in India, focusing on premium brands. They, too, are cleaning house, selling 32 mass-market brands, and almost all of their global wine slate. And just like Pernod Ricard, they’re pursuing a global makeover to cut costs by $500 million.

Plug-and-play for Tilaknagar

But what’s in it for the other party in this transaction — Tilaknagar Industries?

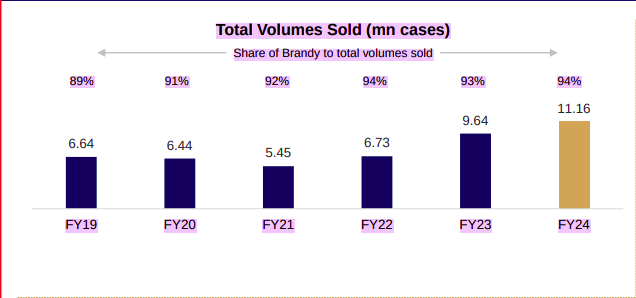

Tilaknagar is India’s largest (and world’s 2nd-largest) maker of brandy — a grape-based alcohol, which makes up 94% of their business. You might know its most popular brand, Mansion House (which, by the way, has its own problems).

Tilaknagar is India’s fifth-largest alco-bev company by market cap. They are, in essence, a strong homegrown distiller.

Whisky wasn’t a large part of their business until recently. However, off late, they have been doubling down on whisky, launching their own brands. By 2030, Tilaknagar aims to increase its share of revenues from whisky to 20%. Acquiring Imperial Blue is their biggest move to-date towards that goal.

Buying Imperial Blue doesn’t just boost their product diversity; it also expands their geographical coverage. More than 85% of Tilaknagar’s business comes from South India. They are one of the biggest liquor players in Telangana. Imperial Blue, however, is one of India’s strongest pan-Indian brands, with a lot of strong brand value already.

Much like everyone else — Tilaknagar too is looking to add more premium products to its roster. Last year, it launched Monarch Legacy brandy, priced at ₹6,750 for a 750ml bottle. It also entered a royalty-based arrangement to distribute the Indian craft gin, Samsara. It’s investing in cocktail mixers as well, primarily those best suited to brandy. Buying Imperial Blue, then, could be a stepping stone towards a more premium whisky portfolio.

Where does it get ₹4,000 crores from, though?

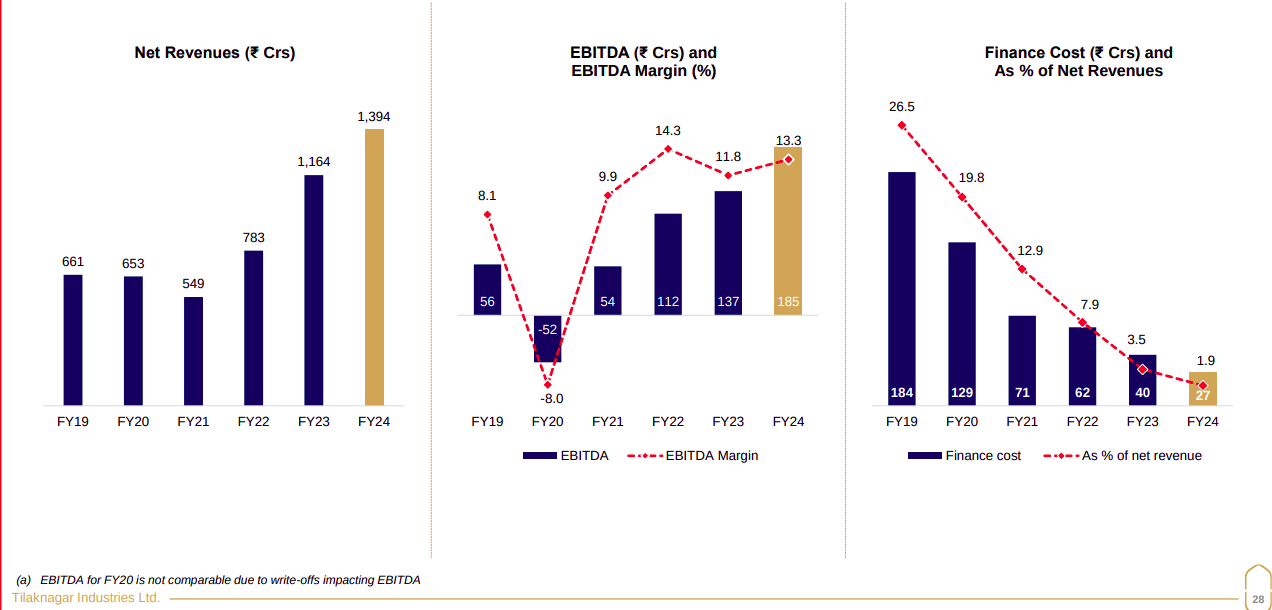

Not very long ago, Tilaknagar was sinking in debt. But it pulled off a remarkable turnaround, and is now in solid financial health. From FY19 to FY24, their net revenues have more than doubled to ₹1,394 crores. Their EBITDA margins, too, have improved from 8.1% to 13.3%. And where over a quarter of their revenue would previously go into paying debt, that number has dropped to 2%. It will raise debt to finance this deal, but it now has enough fire-power to sustain that debt burden.

With the worst behind it, Tilaknagar is preparing itself for a massive spurt of growth, and their pivot to whisky is key to that.

Shaken and stirred

The larger trends of premiumization and homegrown brands are creating a huge shuffle in the Indian alcohol industry.

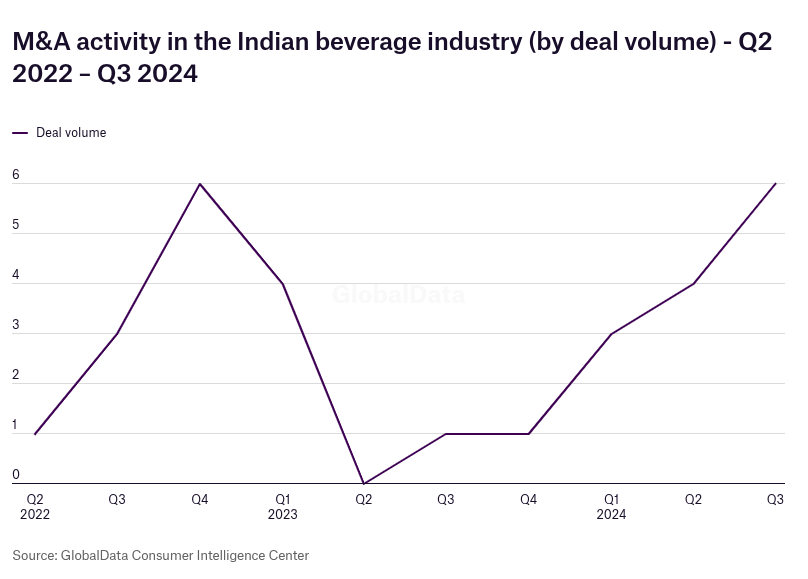

The sheer volume of mergers and acquisitions has increased significantly in the last year. Even globally, alcohol of all kinds dominated M&A deals in the first half of 2025. From conglomerates to private equity groups, everyone is jumping into buying alcohol brands.

And given how this industry is changing, our bet is that this shuffling won’t decrease anytime soon.

Between all of this, bidding wars aren’t uncommon, and Imperial Blue captures this frenzy very well. Pernod Ricard officially put Imperial Blue up for grabs in September 2024. Since then, Tilaknagar, Suntory, Inbrew and private equity group TPG have all tried to buy it.

How does this shuffle change the market? Which new winners shall emerge? We don’t know. But it is certainly an exciting time for alcohol companies.

Behind Reliance's record profit

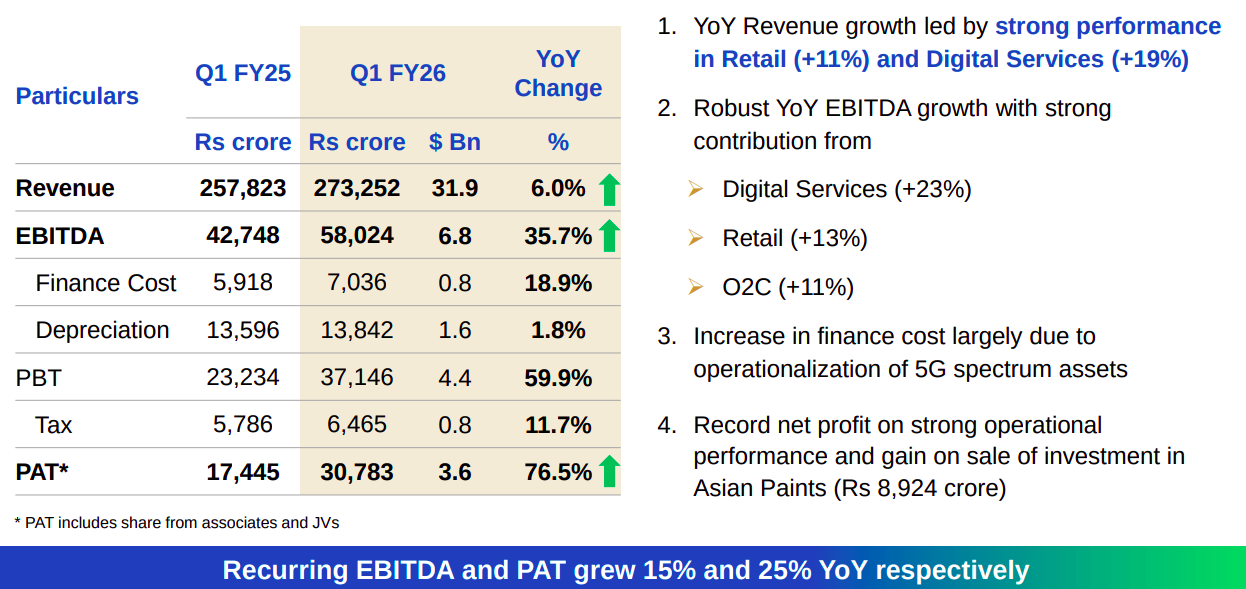

Reliance Industries' first quarter results for FY26, announced on July 18, delivered headlines that seemed almost too good to be true: a whopping 76.5% jump in net profit, to ₹30,783 crore — an all-time high. That is, India’s largest company by market cap just posted its highest ever quarterly profit. Not something you hear everyday.

But you’re probably also wondering: how in the world is that possible? That’s the sort of profit growth that a start-up would be proud of. How can a lumbering giant like Reliance make such a leap?

As with most financial stories, the devil lies in the details.

Much of that profit came from a one-time event that has nothing to do with Reliance's business. During the quarter, Reliance sold a huge stake in Asian Paints — booking a gain of ₹8,924 crore. It booked all those gains without spending anything this quarter. That is, it looks like pure profit on its books.

The company’s gross revenue, with these earnings included, grew just 6% year-on-year to ₹2,73,252 crore. There, its nearly ₹9,000 crore gains from Asian Paints look like a minor footnote. But as that denominator shrinks, the effect of the divestment feels magnified. The same amount pushed the company’s EBITDA up by 36% year-on-year to ₹58,024 crore — again, a quarterly record. And it made almost one-third of its quarterly profit.

You won’t see such gains every quarter, though.

That said, even once you ignore the Asian Paints sidenote, Reliance delivered a solid quarter. Without it, it still delivered a solid 15% EBITDA growth, with 25% PAT growth – respectable numbers that reflect genuine business momentum.

So what’s Reliance doing right?

Jio's Digital Dominance

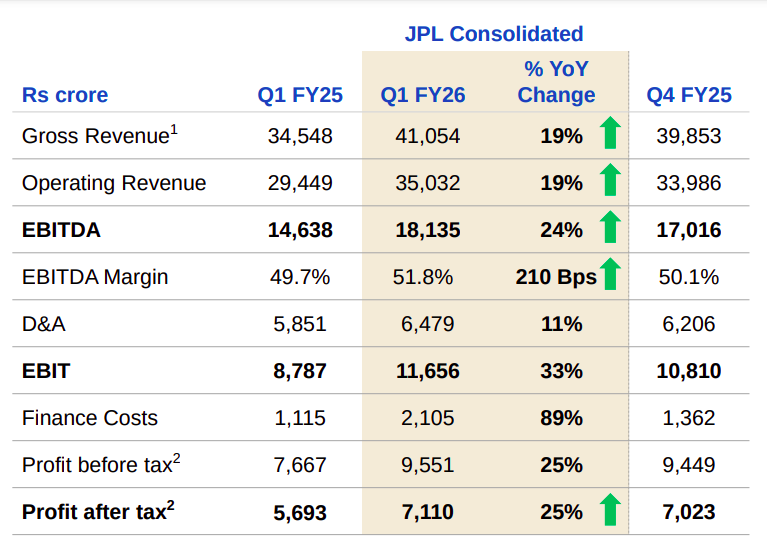

Jio was a star performer last quarter. It grew its revenues by 19% year-on-year, while its PAT jumped 25%. With a net profit of ₹7,110 crore, Jio was Reliance’s single largest profit engine for the quarter. It also broke past an EBITDA margin of 50% — that is, it spends less than 50 paisa for every Rupee it earns in revenue.

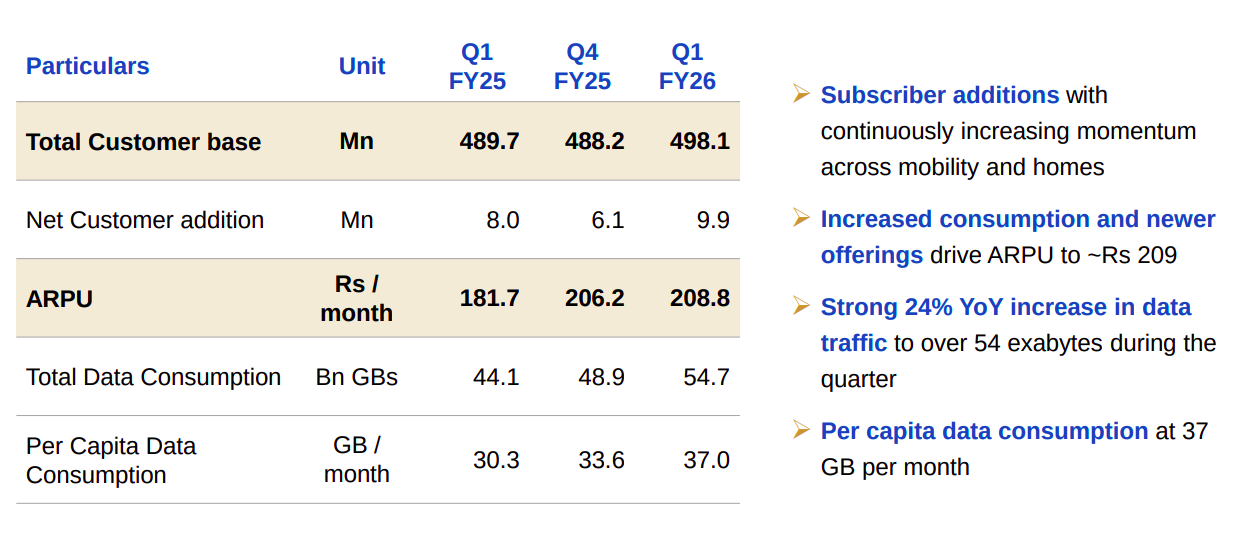

What’s more — the company is still adding new users at a breakneck pace. It added 9.9 million net new customers over the quarter. By the end of the quarter, it was just short of half a billion subscribers.

It also broke through another psychological barrier this quarter — amassing 200 million 5G subscribers. That is, an entire Brazil-sized population now uses Jio’s fastest mobile offering. That’s an enviable position to be in. India is the world's second-largest market for 5G smartphones, second only to China, and Jio has captured the poll position for itself.

Volumes aren’t all that’s driving higher revenue, though. People are also paying more for Jio services than before. Just one year ago, customers paid Jio an average of ₹181.7 per month. They now pay ₹208.8 per month — a difference of 15%.

In a nutshell, Jio is massively popular, and very profitable. Both are fantastic news for the company.

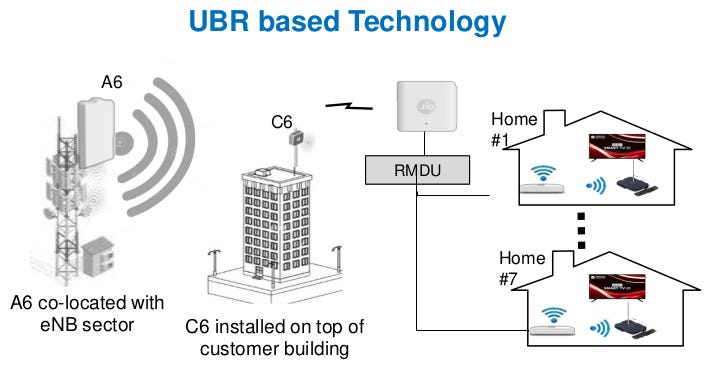

Beyond mobiles, a big part of Reliance’s telecom business has to do with getting routers into people’s homes. And there, it’s making an interesting play: focusing on fixed wireless — what it calls ‘JioAirFiber’.

See, setting up traditional, wired broadband connections is a difficult task. You need to dig up roads, seek right-of-way clearances, deal with municipal inspections, and lay miles of wire — spending thousands of Rupees per customer.

JioAirFiber flips that math. It simply mounts a small radio unit on your nearest rooftop, which beams internet to your house. That’s much easier to scale. It does so using what’s called ‘UBR’ or ‘Unlicensed Band Radio’ — unlicensed frequencies of the sort that are used for Wi-Fi.

In all, Jio hit 20 million home connections this quarter. They added 2.6 million home connections in the quarter — a run rate of almost 1 million new connections a month. Equally impressively, 7.4 million of these were fixed wireless connections — making it the world’s largest fixed wireless player, with an 82% market share in India.

This is already an impressive roll-out. And Jio seems to be doubling down on wireless internet. Not only have they partnered with SpaceX to distribute Starlink's high speed internet services in India, they’re also racking up 6G patents. Here’s what they’ve said in their concall:

Reliance Retail

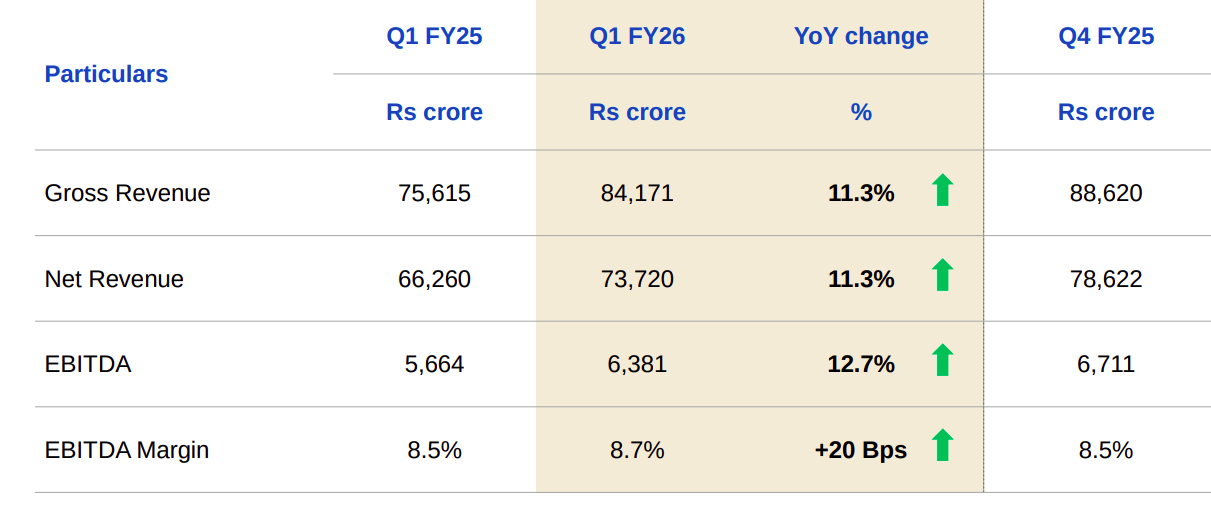

There's another business that exemplifies Reliance's diversification away from its traditional oil and petrochemical backbone: retail. The retail arm, too, saw healthy growth over the quarter — revenues rose 11.3% year-on-year to ₹84,171. Its EBITDA, too, grew at a healthy 12.7%.

Reliance Retail has two things going for them:

First, more people are shopping at Reliance stores — with registered customers up 13% from a year ago.

Second, those customers are buying more often — with the quarter’s transactions going up 16% year-on-year.

Behind this broad push are two segments where the company claims “market-leading performance”: groceries and fashion.

Groceries are the bedrock of Reliance’s retail engine. It has a range of groceries businesses — from neighbourhood supermarkets like Reliance Fresh, to brands like Freshpik that serve a premium crowd. This is Reliance’s largest retail segment, and the most stable one as well. Moreover, it’s growing rapidly. The company saw double-digit growth in many grocery categories over the quarter.

The most exciting part of the groceries business, though, is quick commerce.

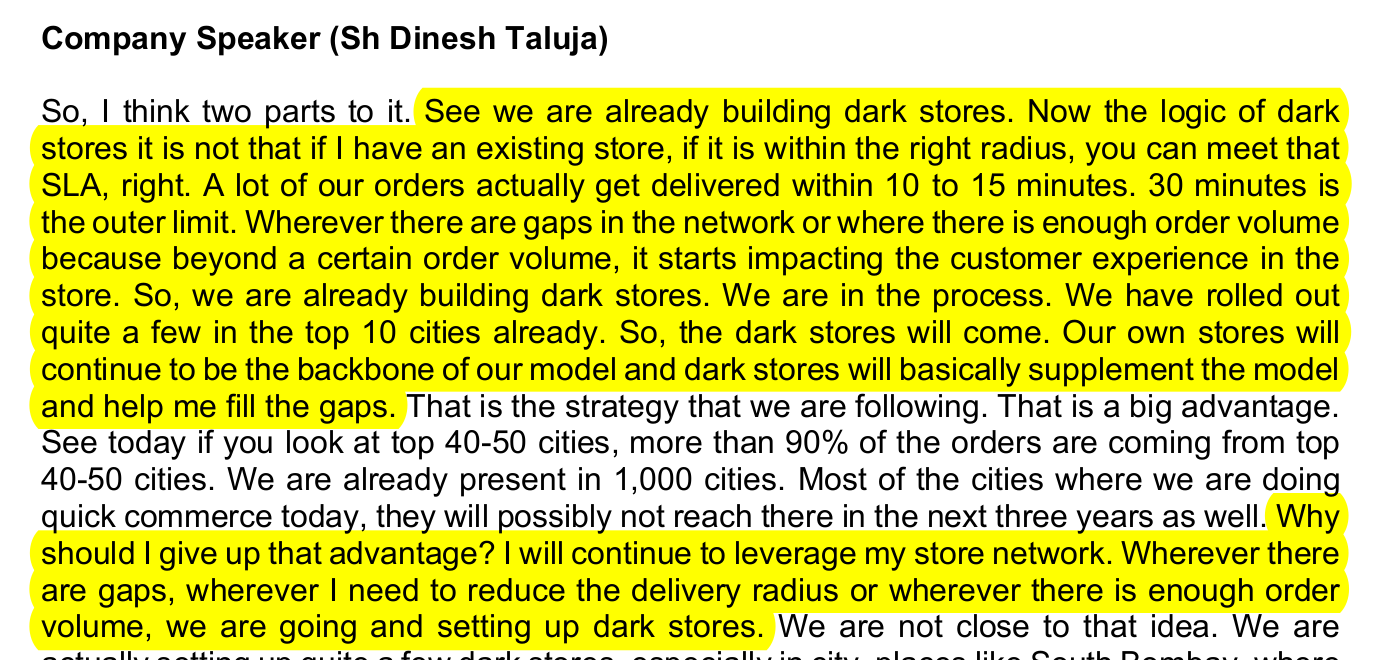

Reliance’s quick commerce business, JioMart, is one of the fastest-growing parts of the business. In a space that’s already seeing intense competition from new-age businesses like Zepto and Blinkit, they’re trying to crack a whole new approach.

Quick commerce companies usually only operate through dark stores. Reliance, though, is turning to its huge and ever-expanding network of retail stores. They’re only adding dark stores to fill gaps if their offline coverage falls short. This gives them a presence in far more cities than their competitors, and in each of those places, they get the benefit of both quick commerce and their traditional retail business.

This advantage, it seems, is trickling into their numbers. Their daily orders jumped 175% since last year, and 68% from last quarter.

Here’s what the company says:

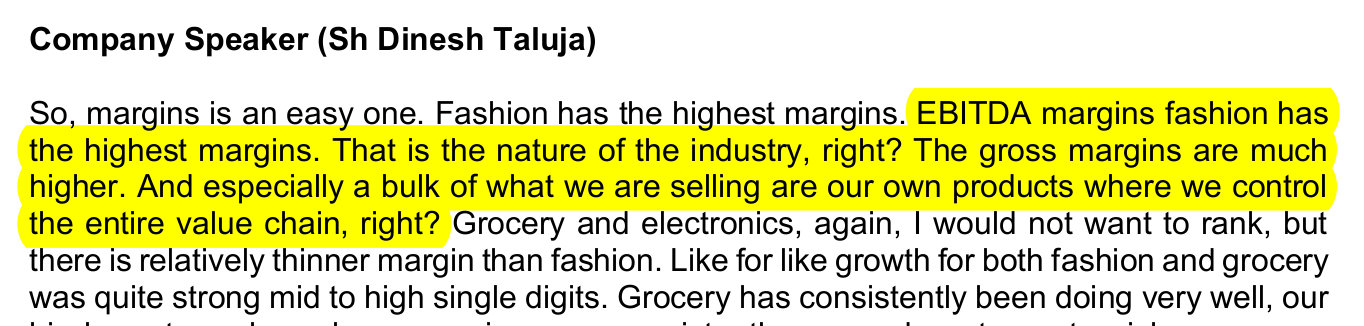

But while its groceries segment may be thriving, Reliance's fashion business is where it’s seeing the highest margins. This isn’t just because fashion in general has better margins. Reliance controls a lot of its fashion value chain. A lot of what it sells is made in-house, rather than being bought from outside suppliers. This gives it particularly high margins.

Early in its journey, Reliance’s fashion foray was synonymous with one brand — Reliance Trends. But over the last decade, the company has built out a huge constellation of brands that it either owns, or sells. Now, its empire is a lot more complex:

Many of these brands are sold online, through Ajio. Ajio is doing well for itself. It’s winning new customers — 18% of its revenue, this quarter, came from new customers. Meanwhile, each customer is slowly spending more. Last quarter, its average customer spent 17% more than they did last year. More interestingly, though, Reliance is marrying this to quick commerce. It recently launched AJIO Rush, a new 4-hour delivery service.

These successes don’t mean Reliance’s retail business is without challenges, though. Many other retail verticals didn’t do nearly as well. Take consumer electronics. As early monsoons cut the summer short, Reliance’s air conditioner sales for the year tanked.

The company, however, doesn’t see this as a problem. Management noted that the first quarter of any year is traditionally a low point. If they are to be believed, things will accelerate over the next couple of quarters.

E&P, O2C and New Energy

Of course, we can’t write about Reliance and ignore its backbone: energy.

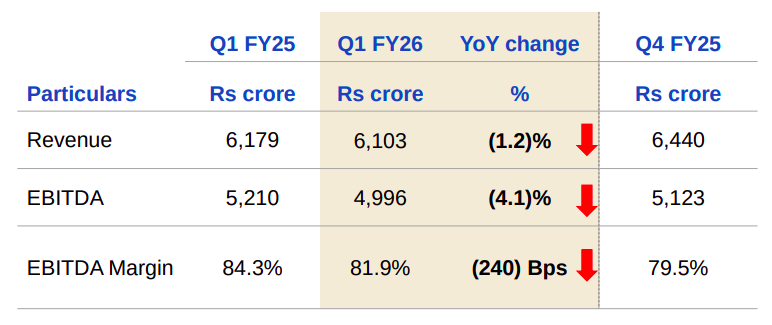

That is a less pretty picture. Reliance's oil and gas exploration and production (E&P) business is facing hard realities — its fields are growing older and less abundant. Its revenue from this vertical fell 1.2% from the previous year, while EBITDA fell more sharply — by 4.1%.

A big culprit for this fall is its share of the KG-D6 gas field, Reliance's flagship offshore asset. Last quarter, Reliance pumped out 8% less gas from the field than it did a year ago. This is natural — oil and gas fields don’t remain abundant forever. As you pump gas out, they slowly run out, and whatever is left becomes harder to extract.

That doesn’t mean Reliance’s E&P business is running in losses. It remains highly profitable — with 81.9% EBITDA margins. But those margins are falling. Reliance is trying to arrest this decline by drilling 40 new wells, but there’s only so much it’ll get out of them.

Reliance’s oldest business, though, isn’t extraction but refining — turning crude oil into fuels and petrochemicals. This business remains stable. Unlike the E&P business, as long as its refineries can source crude oil globally, they’ll stay alive.

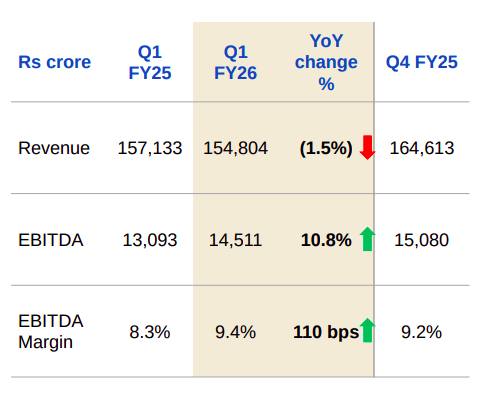

Last quarter, the company shut down many units of its Jamnagar refinery for three weeks, for maintenance. That pulled its refining revenues down 1.5% year-on-year — to ₹154,804 crore. The pain of that decline, however, was off-set by better profitability. With crude oil prices falling last quarter, the company saw better margins, and its refining EBITDA grew by 10.8%, to ₹14,511.

The days of these legacy business lines, however, are numbered. As the world moves to greener sources of energy, any oil-based business will see declining fortunes.

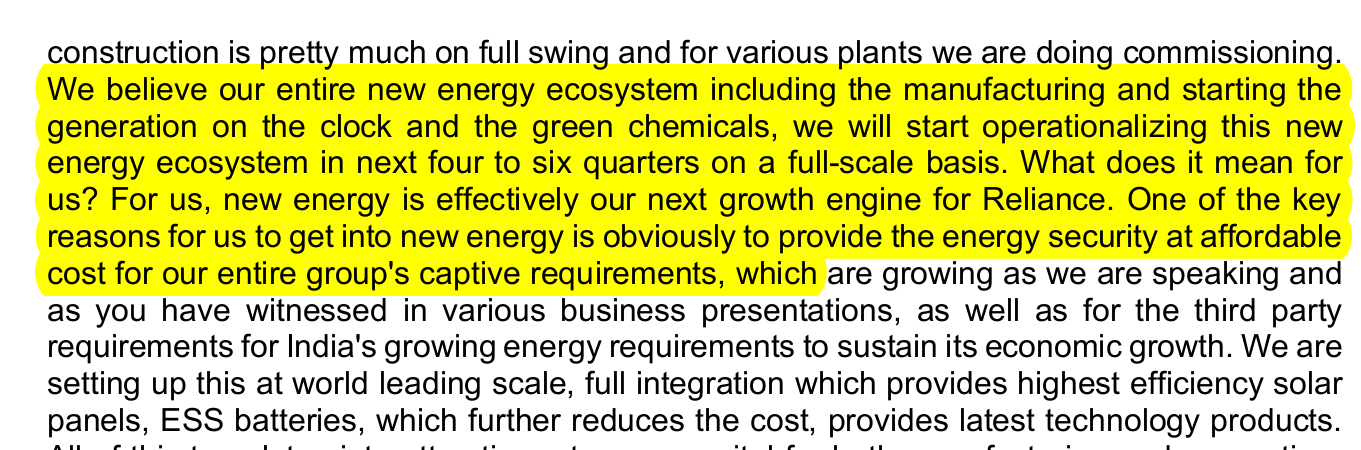

That’s perhaps why the company is investing heavily in what it calls its "New Energy" ecosystem. It’s constructing what it calls the “world's largest integrated renewable energy manufacturing facility”. Spread across 44 million square feet, the complex will house 10 separate manufacturing units covering the entire solar value chain — from polysilicon to modules — as well as battery manufacturing and green hydrogen. Some day, this might come to replace the Jamnagar refinery as the soul of Reliance’s business.

Here’s what the management is saying:

The Road Ahead

Reliance may well be India’s largest company, but it’s a company that’s going through a metamorphosis. Its record profits this quarter were a one-off windfall. But if you’re trying to understand the company, that’s not what you should focus on.

The real story is one of how it’s moving from an energy and petrochemicals giant to a diversified technology and consumer powerhouse. While most of its revenues may come from legacy oil and gas businesses, that isn’t where its future lies. To keep growing, it’ll have to pull off a complex, decade-long pivot — the largest India has ever seen. That pivot is well underway. Five years ago, ~70% of the company’s revenues came from its oil-to-chemicals business. This quarter, it was down to 57%. It’ll probably decline further.

Wireless internet, quick commerce, fast fashion, green energy; all these experiments are bound by a single thread — the need to bring Reliance to a new era.

An update on Jio-Allianz story

On Friday, we explored India’s reinsurance sector after Jio and Allianz announced their joint venture. It was our first time diving into this industry, and we were wondering why GIC Re, India’s public sector reinsurance giant, was losing market share to foreign players.

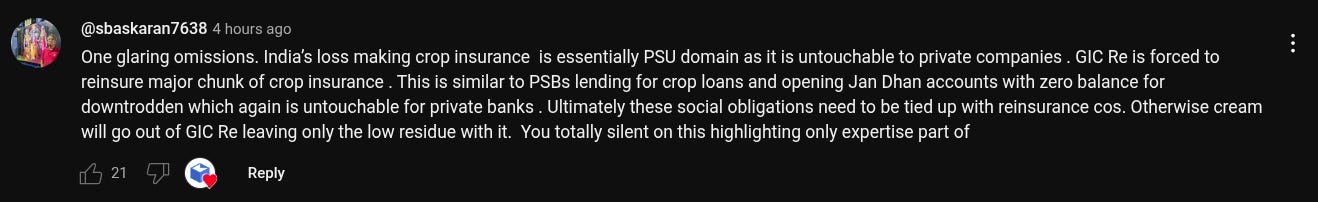

Turns out, we missed a very important piece of context. One of our YouTube subscribers, @sbaskaran7638, made an insightful comment about an important drag on GIC Re’s business — crop insurance.

Government companies aren’t always pure profit-making entities; they often carry social responsibilities. Crop insurance under government schemes like the Pradhan Mantri Fasal Bima Yojana (PMFBY) is a prime example. These schemes insure crops at subsidized rates, and much of this risk ends up reinsured by GIC. Private players typically avoid it because it’s not profitable, leaving GIC to absorb these risks—a responsibility GIC itself has repeatedly flagged as a burden.

Honestly, this angle completely slipped past us during our research. But this comment helped us better understand the industry's nuances. Thanks again, @sbaskaran7638!

We're genuinely thankful for our viewers, who engage actively and contribute insights that improve our work, keep us honest and ultimately benefit our entire audience. We are just trying to understand the world — we aren’t experts — and whenever we miss something, we hope that you fill us in.

Which is why we hope you keep writing in with comments like these, and look forward to many more interactions!

Tidbits

India, and the whole world, has a tight supply of copper. Maybe this next move will help.

Adani Group has partnered with Mettube, a leading copper tubes manufacturer, to expand its footprint in the copper industry. This collaboration will enable the two firms to tap into the growing demand for copper tubes in industries like air conditioning, refrigeration, and construction.

Source: ReutersElectric vehicles are getting popular all around the world.

VinFast India has secured advance electric vehicle orders from Nepal, Sri Lanka, West Asia, and Africa, even before inaugurating its $2 billion Thoothukudi plant in Tamil Nadu. The facility is expected to commence operations by the end of July 2025, with vehicle deliveries slated for the upcoming festive season.

Source: Business StandardIndia & UK finally signed the deal.

After 14 rounds and 3 British PMs, India and the UK have sealed their biggest trade agreement yet — the Comprehensive Economic and Trade Agreement (CETA). The deal gives 99% of Indian exports duty-free access to the UK, and slashes Indian tariffs on 90% of UK goods.

Source: Business StandardJust months after lifting curbs on ethanol production from sugarcane and paddy, India is now gearing up to introduce E27 — petrol blended with 27% ethanol — by the end of August. Having already achieved the E20 target ahead of schedule, this move takes India closer to Brazil-style ethanol blending, with Union Minister Nitin Gadkari confirming that standards for E27 fuel are being finalised.

Source: Business Standard

- This edition of the newsletter was written by Manie and Prerana

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

🧑🏻💻Have you checked out The Chatter?

Every week we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

As always, a refreshing read. What stood out to me was Reliance’s 6G rollout vision. I assume they’ve built this moat by steadily investing in tech R&D over the years, staying at the forefront of India’s telecom evolution.

Globally, China leads with around 40.5% of 6G patents, followed by the US (35.2%), Japan (9%), Europe (8.9%), and India with a relatively small share—just about 265 patents as of 2023–2024.

Still, despite the gap, I’m encouraged to see serious R&D finally happening in the backyards of our largest companies. I’ve always judged a company’s long-term health by the strength of its research division. Without it, most Indian firms remain anchored in traditional business models. The real excitement lies at the bleeding edge.

The Daily Brief today simplifies the biggest stories of sale of Imperial Blue even by a mighty corporate and helps me understand how Reliance—India’s largest company by market cap posted its highest ever quarterly profit.And,it does it by delving deep, because with most financial stories, the devil lies in the details.