Europe wants to cut ties with Elon Musk

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Europe wants to build Starlink's rival

What will happen with commodities next year

Europe wants to build Starlink's rival

Imagine this: there’s a war, a natural disaster, or even just a power outage in a small village in the middle of nowhere. The local internet is down—fiber cables, cell towers, everything. But somehow, people still get online. They check the news, call for help, and send messages. How? A signal from space.

This is what Starlink makes possible. Thousands of small satellites orbiting the Earth send fast internet down to anyone with a dish about the size of a pizza box. No cables, no big infrastructure—just a clear view of the sky and an internet connection that works almost anywhere.

You already know the person behind this—Elon Musk. And the people who aren’t so happy about it anymore? Europe’s leaders.

Last week, the European Union signed a €10.6 billion deal to build its own satellite internet system called Iris². If that sounds like a big, expensive move, that’s because it is. Iris² isn’t just about launching satellites—it’s about not being dependent on Elon Musk. Through Starlink, Musk controls something far more valuable than rockets or electric cars: he controls the internet in places no one else can reach. And Europe isn’t comfortable with that.

To understand why Europe is spending billions, let’s talk about Starlink.

In the past, satellite internet was a joke. It was slow, expensive, and the delay was so bad you’d click a link and have time to grab a snack before the page loaded. That’s because old satellites orbit way up in geostationary orbit, 36,000 kilometers above Earth. They’re so far away that signals take forever to travel back and forth.

Starlink changed the game by putting satellites much closer—in low Earth orbit, just 350 to 1,200 kilometers above us. Being closer makes the internet faster and cuts delays to almost nothing. It’s not as fast as fiber broadband, but it works. And more importantly, it works anywhere: deserts, forests, war zones, oceans—places where regular internet doesn’t exist.

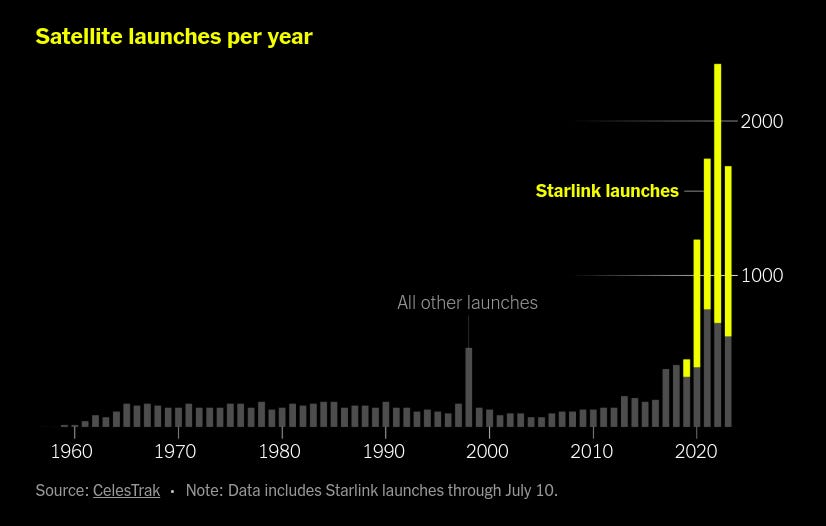

But to pull this off, you need a lot of satellites. Thousands of them. Each satellite covers a small area of Earth as it orbits, so to give global coverage, you need a whole swarm of satellites constantly moving around the planet. Musk, through SpaceX, has already launched over 6,000 Starlink satellites, with plans for tens of thousands more.

By now, you’ve probably guessed that this isn’t cheap. Users pay around $599 for the dish and about $120 a month for the internet service.

But this changes everything. Suddenly, someone living in a remote village in Africa can have better internet than someone in a city stuck with a bad broadband connection. Ships at sea, planes in the sky, people in disaster zones—all of them can stay online, thanks to Starlink.

Sounds amazing, right? And it is. Starlink is one of the most impressive technologies of the last decade. But there’s a catch: it’s entirely controlled by Elon Musk.

Here’s an example. In 2022, when Russia invaded Ukraine, Musk turned Starlink into a wartime communication network overnight. Ukrainian forces used it to coordinate drone strikes and stay connected after Russia bombed traditional internet infrastructure. Without Starlink, Ukraine’s military operations would have collapsed.

But then Ukraine asked Musk for something more: to expand Starlink coverage over Russian-occupied Crimea, where they needed it most. Musk said no. He worried it might escalate the war, so he simply refused. One man decided where Ukraine could and couldn’t fight.

This alarmed a lot of people. It showed that Starlink isn’t just a tool—it’s power. Musk has total control over who gets access and who doesn’t. If Starlink becomes the backbone of global internet, Musk becomes the switch. He could turn it on or off for an entire country at any time.

It’s easy to imagine Europe looking at this and thinking: What if we’re next?

This fear wasn’t new. Mario Draghi, the former head of the European Central Bank, recently delivered a report that spelled it out. The report was commissioned to evaluate Europe’s competitiveness in a changing world, and the findings were blunt.

Draghi pointed to Starlink as a clear example of Europe being left behind. Musk’s satellites are faster, cheaper, and better. Starlink’s dominance doesn’t just threaten European space companies like Airbus and Thales—it makes Europe strategically dependent on a U.S. billionaire.

The report made one thing clear: Europe has no equivalent to Starlink. If Musk decided to cut off Starlink access tomorrow—whether because of politics, business interests, or even just a bad mood—Europe would be left stranded. And while Musk’s loyalty is unpredictable, his influence is impossible to ignore.

Draghi’s message was straightforward: Europe needs to act. Without its own infrastructure, it risks falling behind economically and becoming vulnerable on a global scale.

Maybe that’s why Europe is building Iris². The name stands for “Infrastructure for Resilience, Interconnectivity, and Security,” but really, it’s Europe’s way of saying, “We’re not leaving something this important in Musk’s hands.”

Iris² will launch 290 satellites into orbit by 2030. It’s designed to do two things:

Provide secure, encrypted communications for European governments and militaries.

Offer broadband internet to citizens, businesses, and industries across Europe and beyond.

The problem? Iris² won’t be ready until 2030. By then, Starlink will likely have tens of thousands of satellites blanketing the Earth, locking in its global dominance. Musk’s network already operates in over 100 countries, and SpaceX is launching satellites every week. Starlink is fast, reliable, and people are signing up in droves.

Iris² is Europe’s attempt to catch up, but it won’t be easy.

What will happen with commodities next year

Let’s start with the most traded commodity in the world—oil. According to ING, oil prices are expected to average between $71 and $73 per barrel in 2025. Why? The ongoing drama with OPEC+ countries.

The group, led by Saudi Arabia, faces a tough choice: keep production low to prop up prices or increase output and risk prices dropping below $70 per barrel.

At the same time, non-OPEC supply—especially from the U.S.—is expected to grow by 1.4 million barrels per day, while global demand is only set to grow by just under 1 million barrels per day. This means 2025 is likely to see an oil surplus, which will put more pressure on prices.

Geopolitical tensions are another wildcard. Ongoing conflicts like Russia-Ukraine and unrest in the Middle East could disrupt supplies, keeping oil markets unpredictable. That said, OPEC has a safety net: with over 5 million barrels per day of spare capacity, they can step in to stabilize supply if needed.

But the energy market isn’t just about oil, so let’s talk about a few others.

First, coal. Coal use is expected to peak in 2025. Why? While countries like India and China still rely heavily on it, cleaner energy sources like solar, wind, and natural gas are becoming more affordable and widely adopted. Governments worldwide are pushing for decarbonization, and coal is losing its place as the go-to energy source. Still, coal’s role in emerging economies means its decline will be slow, not sudden.

Next, nuclear power. It’s quietly making a comeback. Rising energy demand, especially from AI-powered data centers, is driving renewed interest in small modular reactors and nuclear projects.

Now let’s talk about gasoline. Global demand is also expected to peak soon. Why? Electric vehicle adoption and better fuel efficiency in traditional cars are starting to balance out the rising demand from growing populations and economies, particularly in countries like India.

But here’s the twist. Even as demand slows, new refining capacity is coming online. The standout is the Dangote refinery in Nigeria, Africa’s largest, which is set to run at full capacity next year. This massive plant will produce a significant amount of gasoline and could reshape the global gasoline trade. It’s not alone—new refineries in Mexico and the Middle East are also adding to the mix.

The problem? Too much refining capacity and not enough demand will put refining margins—what refineries earn—under pressure. This could lead to refinery closures, especially in regions like the Eastern U.S., Europe, and China, where plants are already struggling to stay profitable.

Gold

Let’s move on to something Indians hold close to their hearts—gold. Whether it’s for weddings, festivals, or just a safe investment during uncertain times, gold is a big deal. And the good news? Gold is expected to stay strong in 2025, with prices likely to remain high, hovering around $2,650 per ounce, according to the World Gold Council.

Before we look ahead, let’s not forget how gold performed in 2024. It was one of the best-performing assets of the year, jumping 28%—its strongest run in over a decade. Gold outshined stocks, bonds, and other major investments as people turned to it for safety and solid returns.

Why is gold doing so well, and why is it likely to stay strong in 2025? It’s a mix of factors:

Central Banks Are Buying Like Never Before

Emerging market central banks are stocking up on gold to reduce their dependence on the US dollar. Countries like China, India, and Turkey are leading the way. These purchases are expected to continue, keeping gold prices supported.

Falling Interest Rates

The US Federal Reserve and other central banks are expected to cut interest rates in 2025. Lower rates make gold more appealing since it doesn’t pay interest, and the opportunity cost of holding it drops. This is likely to boost investment demand, especially through gold ETFs. Historically, gold has gained an average of 6% in the first six months of a rate-cut cycle. Its performance after that depends on how long and deep the cycle goes.

Geopolitical Tensions and Market Risks

Uncertainty always works in gold’s favor. Whether it’s ongoing conflicts, trade wars, or a new US administration creating waves, investors see gold as a safe place to park their money during volatile times.

Asia’s Role

Asia will remain crucial, with China and India as the world’s biggest gold markets. Together, Asia accounts for more than 60% of annual demand (excluding central banks). While Chinese consumers have been cautious lately, strong investment demand from the region has helped keep prices high. If economic stimulus picks up in China, its gold appetite could grow even more. In India, demand has already been boosted due to the recent reduction in import duties.

What About Silver and Platinum?

While gold grabs most of the attention, silver and platinum are also worth keeping an eye on.

Silver:

Silver prices hit a 12-year high in 2024, driven by strong demand from industries like solar panel manufacturing and other applications. This momentum is expected to continue in 2025, with prices projected to rise by 7% next year.

Platinum:

Platinum is facing some challenges. Weak demand from the automotive sector—where it’s used in catalytic converters—has slowed its growth. Even so, tighter mine supply from major producers could still provide some support, with prices expected to increase by 5% in 2025. However, overall demand for platinum is likely to shrink next year.

Summarizing the Outlook on Precious Metals

Gold’s incredible performance in 2024 wasn’t a fluke. In 2025, key factors like central bank buying, lower interest rates, and geopolitical risks will keep gold in the spotlight. Silver will benefit from the clean energy boom, while platinum will face challenges but find some support from limited supply.

Looking at all the forecasts, one common investment theme seems to stand out: something like “long gold, short oil.” That’s the signal experts are sending.

And for us Indians, this is good news. We love gold—whether it’s for weddings, festivals, or just as a safe investment. If gold prices go up, those investments will shine even brighter.

On the other hand, we import a lot of oil, so stable or cheaper oil prices work in our favor. Lower oil prices mean lower transportation costs, steady fuel prices, and, most importantly, less inflation.

As we step into 2025, this combination—rising gold prices and manageable oil costs—could be the perfect balance for both your wallet and the economy.

Tidbits

India's trade deficit surged to a record $37.8 billion in November as gold imports spiked 4.3x to $14.9 billion, comprising 20% of total imports. Meanwhile, exports fell 4.8%, driven by a 49.6% drop in petroleum and a 26% fall in gems and jewellery.

Dixon Technologies partnered with Vivo to exclusively assemble phones, potentially doubling Dixon's production to meet Vivo’s 30 million unit demand. This move aligns with India’s PLI scheme and strengthens Dixon’s market leadership, positioning India as a mobile manufacturing hub.

Vedanta announced its fourth interim dividend of ₹8.5 per share, totaling ₹3,324 crore for FY25. With strong cash flows and consistent payouts, Vedanta’s market cap crossed ₹2 trillion, reflecting investor confidence amid a metals sector rally.

- This edition of the newsletter was written by Krishna and Kashish

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

nice article. so what happens to telecom operators like bharti, jio and also telecom cable cos in india?