Donald Trump vs. The World

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts or wherever you get your podcasts and video on YouTube.

Today on The Daily Brief:

Trump

A decade of change on India's plate: Progress and Challenges

Antitrust case against Google

It’s India vs. China for Apple’s attention

Trump

The US election is just 55 days away, and after the recent debate between Donald Trump and Kamala Harris, things are starting to get clearer about what a win for either could mean for the US and the world.

First, let’s talk about the polls: Kamala Harris is leading by a small 2-point margin nationally, but it’s a close race in key swing states. With the margin of error, Trump could still be ahead in some important areas, especially considering the mistakes in polls during the 2016 and 2020 elections. So, it’s fair to say both are neck and neck at this point.

Now, let’s break down the possible impacts, starting with the US economy.

If Trump wins, we could see a return to aggressive fiscal and trade policies. He has said he plans to impose a universal 10% tariff on all imports and a 60% tariff on goods from China. Trump argues this will bring jobs back to the US, but according to Moody’s, it could lead to a recession by mid-2025, with inflation hitting consumers hard. The average American household might see an extra $1,700 in costs because tariffs work like a tax on imported goods. This rise in inflation could spill over to other parts of the world as well.

On the other hand, if Harris wins, she’s expected to stick with Joe Biden’s policies but make some changes to reduce economic inequality and ease the cost of living. She plans to raise corporate taxes to 28% and work on making housing more affordable.

When it comes to global impacts, Trump and Harris have very different views. Trump’s focus on tariffs could restart trade wars, not just with China but with allies in Europe and Asia too. According to an analysis by ING, Trump’s approach would likely disrupt global supply chains, slow down economic growth, and push inflation higher around the world.

Emerging economies like India, which depend heavily on exports, especially in commodities, could suffer from weaker demand. This could lead to currency pressures and slower growth.

Harris would likely continue Biden’s multilateral approach, which aims for more cooperation rather than isolation. While she will remain tough on China, her strategy might focus on balancing China’s influence instead of outright economic conflict. This could create a more stable global economy and reduce the risks of sudden shocks, which we saw during Trump’s first term.

For financial markets, the impact of a Trump presidency is mixed. ING points out that Trump’s trade disruptions might initially boost the dollar, but could eventually cause investors to seek safer assets like gold. Some sectors, like those benefiting from deregulation and tax cuts, might see gains, but overall market performance could take a hit due to trade tensions and rising consumer costs.

In contrast, Harris’s policies might lead to a slightly weaker dollar because of tighter fiscal measures, but her focus on infrastructure and social programs could be good for stocks, especially in sectors like technology and renewable energy. Bonds might also see gains as investors look for a stable fiscal path amidst these changes.

On the geopolitical front, a Trump victory could bring big shifts, especially regarding Ukraine. Trump has said he wants to reduce support for Ukraine in its fight with Russia, which could weaken US commitments to NATO and strengthen Russia’s position. Without US support, the region could become more unstable, altering the balance of power in Eastern Europe.

Harris, meanwhile, is likely to continue supporting Ukraine with sanctions on Russia and military aid, offering a more steady and consistent approach to security in Eastern Europe.

Beyond Ukraine, Trump’s ‘America First’ approach could increase global tensions, both economically and militarily. European allies, already uneasy from his first term, might find themselves in a tough spot when it comes to defense and trade partnerships.

Harris would probably take a more collaborative approach, working with allies to deal with challenges like China. This would offer a more stable global environment, though competition for technological and economic dominance would still be there.

Finally, on trade, Trump’s tariff-focused strategy is aimed at bringing manufacturing back to the US, but it’s a risky bet. In the past, tariffs have led to higher prices for consumers and haven’t shown much impact on manufacturing jobs. Trade partners in Europe and Asia could retaliate, which would further disrupt global trade and reduce cooperation.

Harris is expected to pursue a multilateral trade policy, focusing on strengthening relationships rather than isolating the US. Her approach to bringing jobs back would likely involve incentives rather than tariffs, promoting a more cooperative global trade environment without the shocks Trump’s policies might bring.

In summary, Trump’s strategy carries high risks with the potential for more market volatility, higher inflation, and disrupted global trade. Harris offers a more balanced approach, with reforms aimed at making the economy fairer. We’ll have to wait and see how it all plays out on election day.

A decade of change on India's plate: Progress and Challenges

Ten years ago, the typical Indian meal looked quite different from today. Back then, cereals made up a big chunk of both the plate and the household budget. Fast forward to now, and we’re seeing a remarkable shift in what India eats.

For the first time in modern history, Indian families are spending less than half their income on food. It’s not because they’re eating less – quite the opposite. It’s a sign of economic progress, with rural food spending up by 164% and urban by 146% in the last decade.

The share of cereals in household food spending has dropped significantly – from 10.7% to 4.9% in rural areas and from 6.6% to 3.6% in urban ones. But this doesn’t mean Indians are cutting down drastically on cereals. One major reason for this decline is government food security programs.

Schemes like the Public Distribution System (PDS) have provided free or subsidized grains to millions of low-income households, especially helping the poorest. This has reduced how much families need to spend on cereals, freeing up their budgets for other foods.

For example, the bottom 20% of households saw the biggest drop in cereal spending. In rural areas, it fell from 22% to 14.5% of their food budget. With the money saved, these families are now able to add more variety to their diets.

Fruits, vegetables, milk, eggs, and meat are becoming more common on plates across the country. Fresh fruit, once a rarity for low-income families, is now more widely consumed. Milk, which used to be a luxury for many, has also become more accessible.

This shift shows how government policies and rising incomes are not only helping people meet basic nutritional needs but are also allowing them to enjoy more diverse diets.

Improved infrastructure has played a huge role in this change. Better roads, storage, and transport have made it possible for fresh food to be available year-round, even in the most remote areas. The idea of eating only seasonally is slowly fading.

This change in diet isn’t just altering what’s on the plate – it’s also improving health. More diverse diets are linked to a 14% lower rate of anemia in children and women.

But this nutritional shift comes with challenges. As traditional staples give way to a more varied diet, overall cereal consumption is declining. While this opens the door to more nutrient-rich foods, it also calls for a rethink of agricultural policies that have long focused on cereals.

There’s also the rise of processed and packaged foods, which often contain too much sugar, salt, and unhealthy fats. This trend, especially in urban areas, is worrisome. At the same time, there’s been a slight dip in vegetable consumption.

What’s even more concerning is the increase in spending on tobacco and alcohol. In rural areas, households are now spending more on pan, tobacco, and intoxicants than on fresh fruits. Urban households show a similar trend.

So, while we’re seeing positive changes toward more diverse and nutritious diets, particularly among lower-income groups, the rise in processed foods, alcohol, and tobacco is troubling.

The shifts in what India eats have far-reaching effects. They’re reshaping agriculture, influencing public health policies, and reflecting the broader economic changes in the country. As India continues to grow and evolve, so too does its relationship with food.

This past decade tells a story of progress, with diets becoming more varied and nutritious across society. But it also highlights new challenges that need creative solutions. From policymakers to farmers, food manufacturers to consumers, everyone has a part to play in shaping India’s food future.

Antitrust case against Google

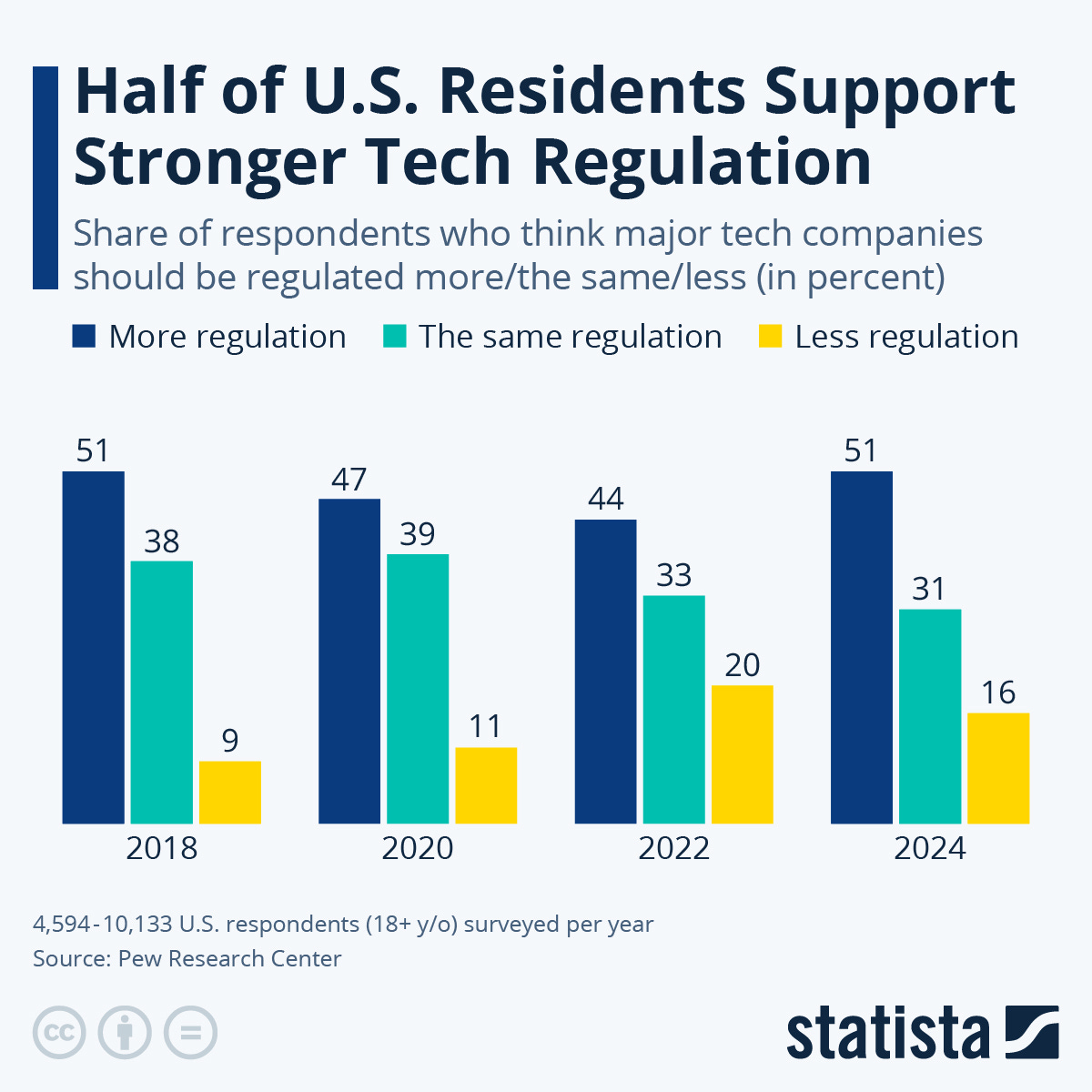

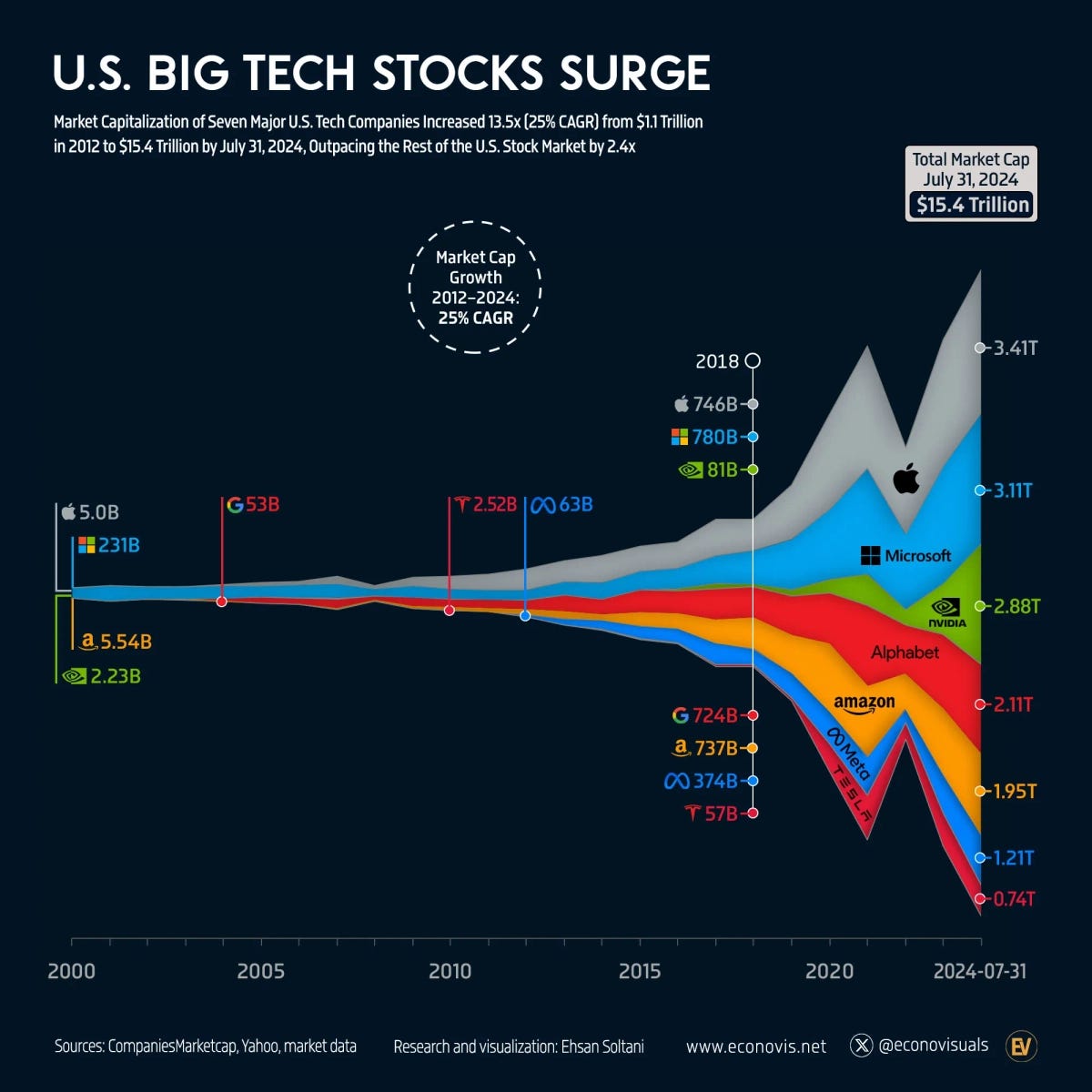

Over the past two decades, we’ve seen the rise of tech giants that now dominate not just their industries but also our daily lives. To put their size in perspective: when Facebook went public in May 2012, the total market value of Facebook, Apple, Google, Amazon, and Microsoft was $1.3 trillion. Today, it's a staggering $11 trillion. For comparison, the total value of the entire Indian stock market is about $5 trillion.

These companies have reached their heights through innovative products, network effects, and smart acquisitions. They’ve reshaped industries, created new ones, and now control vast areas of the digital economy.

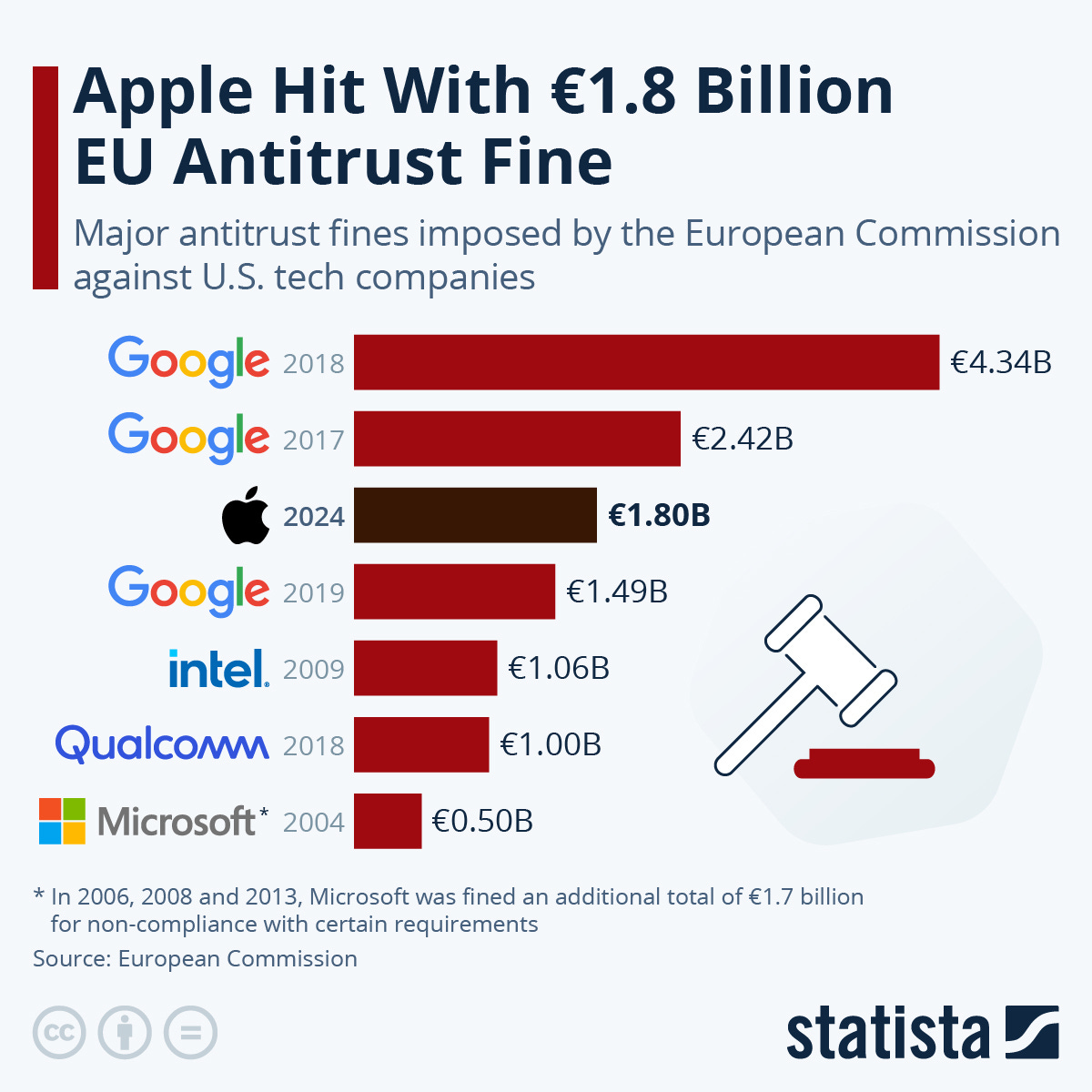

But with all this power comes growing scrutiny. These tech giants are facing significant challenges from regulators and lawmakers worldwide. The latest challenge is the antitrust case against Google, which started on September 9th.

Before diving into the details, let’s look at why this matters. The dominance of these tech companies has far-reaching effects:

Small businesses rely on them: Many small businesses and startups depend on platforms like Google and Facebook for advertising. If these platforms have too much power, they could raise fees, making it harder for smaller companies to compete.

Less competition, fewer choices: When just a few companies control the market, consumers may have fewer options, and there’s less pressure on companies to innovate or improve their services.

Privacy concerns: These companies gather vast amounts of personal data, and having so much information in the hands of a few raises major privacy concerns.

Impact on information: Social media platforms are now major sources of news. Their algorithms decide what information people see, which can affect public opinion and even elections.

Wealth and power concentration: With so much wealth and power in a handful of companies, there’s a risk of increasing economic inequality and less competition across the economy.

Now, let’s focus on the Google case. The US Department of Justice (DOJ) claims that Google has created a monopoly in the digital advertising market. They argue that Google has built a “trifecta of monopolies,” dominating the tools used by website publishers to sell ads, the tools advertisers use to buy ads, and the advertising exchange where these transactions happen.

It’s like if one company owned the stock exchange, the biggest brokerage firms, and the software investors use to trade. The DOJ says this gives Google an unfair advantage, allowing them to manipulate the digital ad market at every stage.

DOJ lawyer Julia Tarver Wood didn’t hold back in her opening statement, accusing Google of using its dominance to “control all sides of the market,” leading to higher ad prices, less money for publishers, and harm to consumers.

A key part of the case is Google’s past acquisitions, like the purchase of DoubleClick in 2008. The DOJ says Google used these acquisitions to eliminate competition.

They also argue that Google has limited the interoperability of its tools with rivals, making it hard for advertisers and publishers to use anything but Google’s products. This “walled garden” strategy, the DOJ says, is illegal monopolistic behavior.

Perhaps most controversially, the DOJ accuses Google of rigging ad auctions to favor its own exchange.

Google, of course, sees things differently. The company argues that the digital ad market is highly competitive, with rivals like Amazon and Meta gaining ground. They claim Google’s success comes from offering better products, not from blocking competition.

Google’s defense team will likely argue that the DOJ’s view of the market is outdated, missing newer sectors like connected TV ads and retail media that show just how competitive the space is now.

This case comes after another legal blow to Google. Last month, U.S. District Judge Amit Mehta ruled that Google had illegally monopolized the online search market. The judge found that Google’s practice of paying billions to be the default search engine on devices broke antitrust laws.

Judge Mehta called Google a “monopolist” and said it used its power to maintain that monopoly. This was a big win for the DOJ and could lead to major changes in how Google runs its search business.

These cases are part of a larger trend of increasing scrutiny on Big Tech. Just a few years ago, companies like Google, Amazon, Apple, and Meta were seen as innovative disruptors. Now, they’re often viewed as powerful incumbents using their dominance to hold on to power.

This isn’t just happening in the US. Globally, countries are taking different approaches to rein in Big Tech. The European Union has been particularly active, with regulations like the Digital Markets Act and the General Data Protection Regulation (GDPR), aiming to limit tech companies’ power and improve privacy.

In the US, the focus has been more on antitrust enforcement, going after individual companies rather than passing new broad regulations. This aligns with the country’s traditionally market-oriented approach.

Meanwhile, in China, the government has taken a more direct route, cracking down on its tech sector. In 2023, China’s actions against companies like Alibaba and Tencent showed how forcefully it’s willing to step in.

Looking at history might give us some clues about how these cases will play out. The situation with Big Tech is often compared to the famous antitrust case against Standard Oil in the early 20th century. Standard Oil, owned by John D. Rockefeller, controlled about 90% of the US oil market. The company was broken up into 34 smaller companies, which later became giants like Exxon and Chevron.

A more recent example is the Microsoft antitrust case of the 1990s. Microsoft was accused of using its dominance in the operating system market to squeeze out competition in the browser market. The company was eventually forced to share its APIs with other companies and stop deals that exclusively promoted its Internet Explorer browser.

So, what could happen if Google loses? We might see significant changes in online advertising and search. This could open the door to more competition and innovation. For example, we could see new search engines emerge or more diversity in ad platforms.

The effects might not be immediate for consumers, but they could be far-reaching. More competition could mean better services and possibly lower costs for advertisers, which could indirectly benefit users. On the flip side, breaking up Google’s integrated services could make some things less seamless.

It’s important to note, though, that these cases are extremely complex and could take years to resolve fully.

It’s India vs. China for Apple’s attention

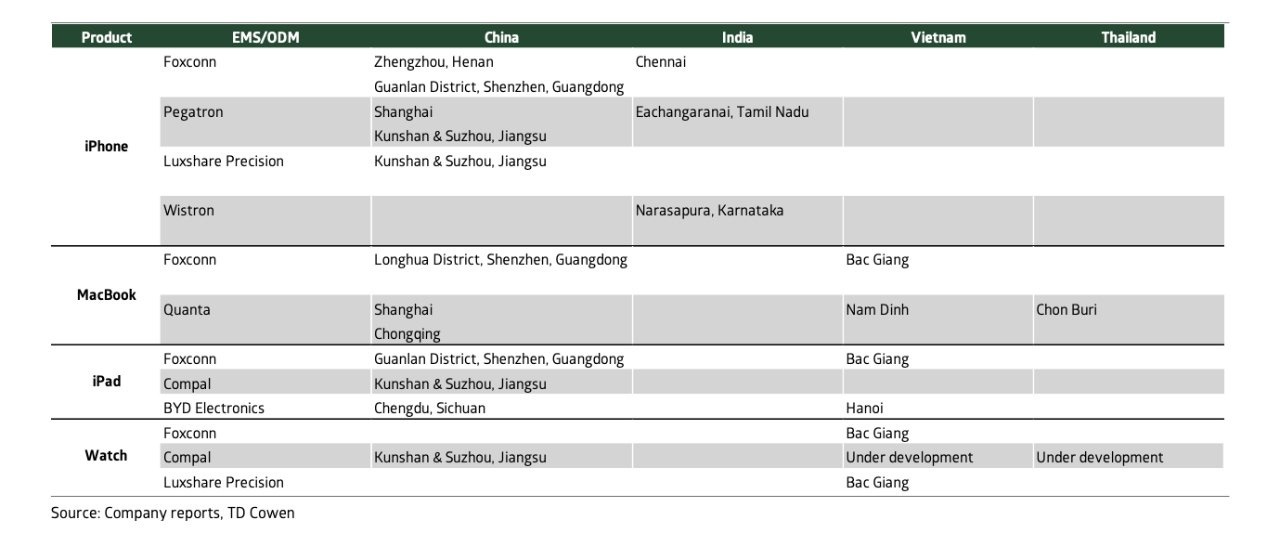

Apple just launched the iPhone 16, but the real story isn’t about the phone itself—it's about where it's being made. For years, China has been Apple's go-to manufacturing hub for its latest models, but things are changing fast.

Foxconn, one of Apple’s main manufacturers, has been assembling the iPhone 16 in India, and soon, these "Assembled in India" iPhones will be hitting global shelves. This is a big deal because manufacturing has always been a key driver of job creation and economic growth for developing nations.

We’ve seen it happen before. Between the 1960s and 1990s, the "Asian Tigers"—Hong Kong, Singapore, South Korea, and Taiwan—poured resources into manufacturing and became global export powerhouses.

So, more manufacturing in India sounds great, but what exactly is Apple doing there? Let's break it down: 14% of all iPhones are now assembled in India, double the 7% from last year. Commerce Minister Piyush Goyal even predicts this could reach 25% by 2025. Bold claim, but given how quickly things are moving, it doesn’t seem impossible.

Apple’s journey in India started in 2017 when it began producing older iPhone models. The newer models were still coming from China. Why? Because Apple had a clear goal: diversify away from China, and they had two big reasons.

Politics first

U.S.-China relations have soured since 2016, when Trump took office. His trade war with China forced Apple to rethink its supply chain and look beyond China for production. Since 2018, Apple’s suppliers have spent about $16 billion on shifting production to places like India, Mexico, the US, and Vietnam.

But it's mostly about economics

The pandemic exposed the risks of relying too heavily on China. When COVID hit, one of Apple’s key factories in China shut down, causing major delays and leaving customers waiting for weeks. Apple wanted to make sure that didn’t happen again.

By 2021, Apple was producing newer models in India, though with some delays. The iPhone 13, for instance, was six to nine months late. But by 2022, the iPhone 14 was being made in India just two weeks after its global launch.

Why the delays? Well, India had a long way to go. Manufacturing high-end electronics is no easy task—it requires expertise, a skilled workforce, and massive investments. India didn’t have much of a manufacturing base, so this was all happening for the first time.

Foxconn, Apple’s manufacturing partner, had to bring in Chinese engineers to train Indian workers. It wasn’t smooth sailing—there were cultural differences, communication gaps, and learning curves that slowed things down. But year by year, they made real progress.

Last year, for the first time, the iPhone 15 was launched simultaneously from both India and China, although India-made units were initially sold locally and hit global markets a few days later.

Now, with the iPhone 16, things are different. India-made iPhones will be available globally just days after the launch. And for the first time, India will also produce the Pro and Pro Max models—Apple’s premium phones that require more advanced manufacturing.

This is a huge win for India, which had limited manufacturing capabilities just a few years ago. With Indian-made iPhones now set for global export, it sends a strong signal to other companies to consider moving their production to India.

The ripple effect on India’s ecosystem

But the most exciting part? What this means for the local ecosystem. As India proves itself to be a reliable manufacturer, Apple may also push its component suppliers to set up shop in India.

According to Bloomberg, 14 out of 17 Chinese iPhone component suppliers have received initial approval to operate in India. But there’s a catch—they need to partner with Indian companies to form joint ventures, as they can’t operate independently.

If foreign suppliers hesitate, Apple might turn to Indian companies to fill the gap, which could speed up the growth of local businesses. In fact, The Financial Express recently reported that Apple is already in talks with Tata Group and other semiconductor manufacturers about deals worth $12 billion for iPhone components made in India.

And who knows—if things go well, Apple could start manufacturing Macs, AirPods, or even Apple Watches in India, bringing even more business to the country and its companies.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments