Did inflation really fall?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

Spotify:

Apple Podcasts:

And the video is here:

Today, we look at 3 big stories:

Inflation is not inflating

Indian consumers are feeling the blues

Gold hits lifetime highs

Inflation is not inflating

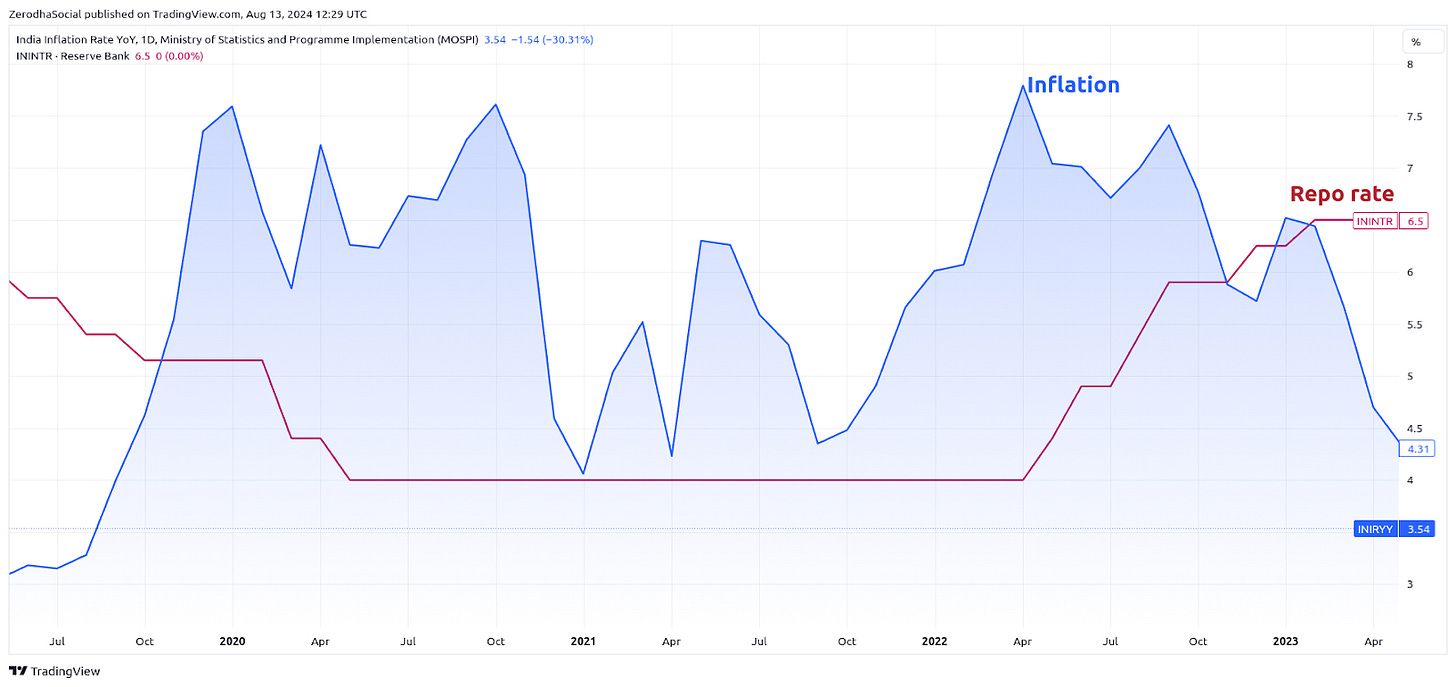

After the pandemic, when things started reopening, inflation spiked and has been stubbornly above the RBI’s target of 4%. To tackle this, the RBI raised interest rates from 4% to 6.5%. Since then, despite the high interest rates, inflation has remained sticky.

But here’s the headline: July's CPI inflation fell to a 5-year low of 3.5%. Just a year ago, in July 2023, it was sitting at a steep 7.44%.

That’s a huge drop, and it might seem like great news at first glance—perhaps even making you hopeful that the RBI might start cutting interest rates soon.

But hold on, it’s not as straightforward as it seems.

The sharp drop in inflation is largely due to something called the “base effect.” Now, I know that term might sound like economic jargon, but it’s important to understand. Inflation is usually measured as the year-over-year percentage change. So, if the inflation rate was unusually high or low last year, it creates a “base” that can make this year’s changes look more dramatic than they actually are.

For instance, last year’s inflation rate in July was a whopping 7.44%—a significant outlier compared to historical averages. This year, because prices are increasing at a slower pace, it appears that inflation has dropped to 3.5%.

But this drop is almost entirely due to the high base from last year. In simpler terms, the comparison point (last year’s inflation) was so high that it makes this year’s inflation look lower than it actually is. This means that the fall in inflation might not last; once the base effect wears off, inflation could bounce back to its usual trend.

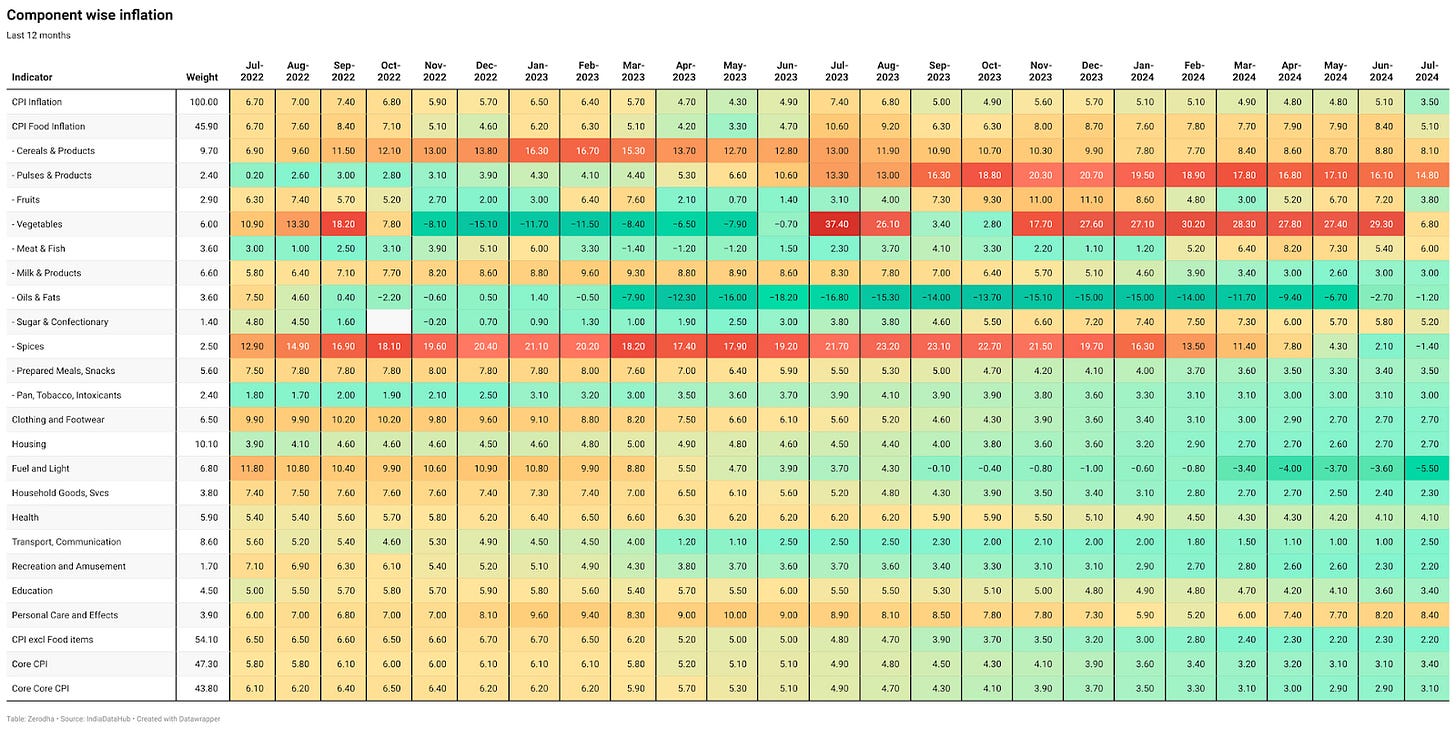

Let’s dig a bit deeper into the July numbers. Headline inflation, or CPI inflation, dropped from 5% to 3.5%, largely because of the base effect. However, if we look at food prices, they’re still climbing—just not as quickly as before.

Core inflation, which strips out food and energy prices, actually rose slightly from 3.1% to 3.4%, primarily due to higher telecom tariffs, something we’ve touched on in previous discussions.

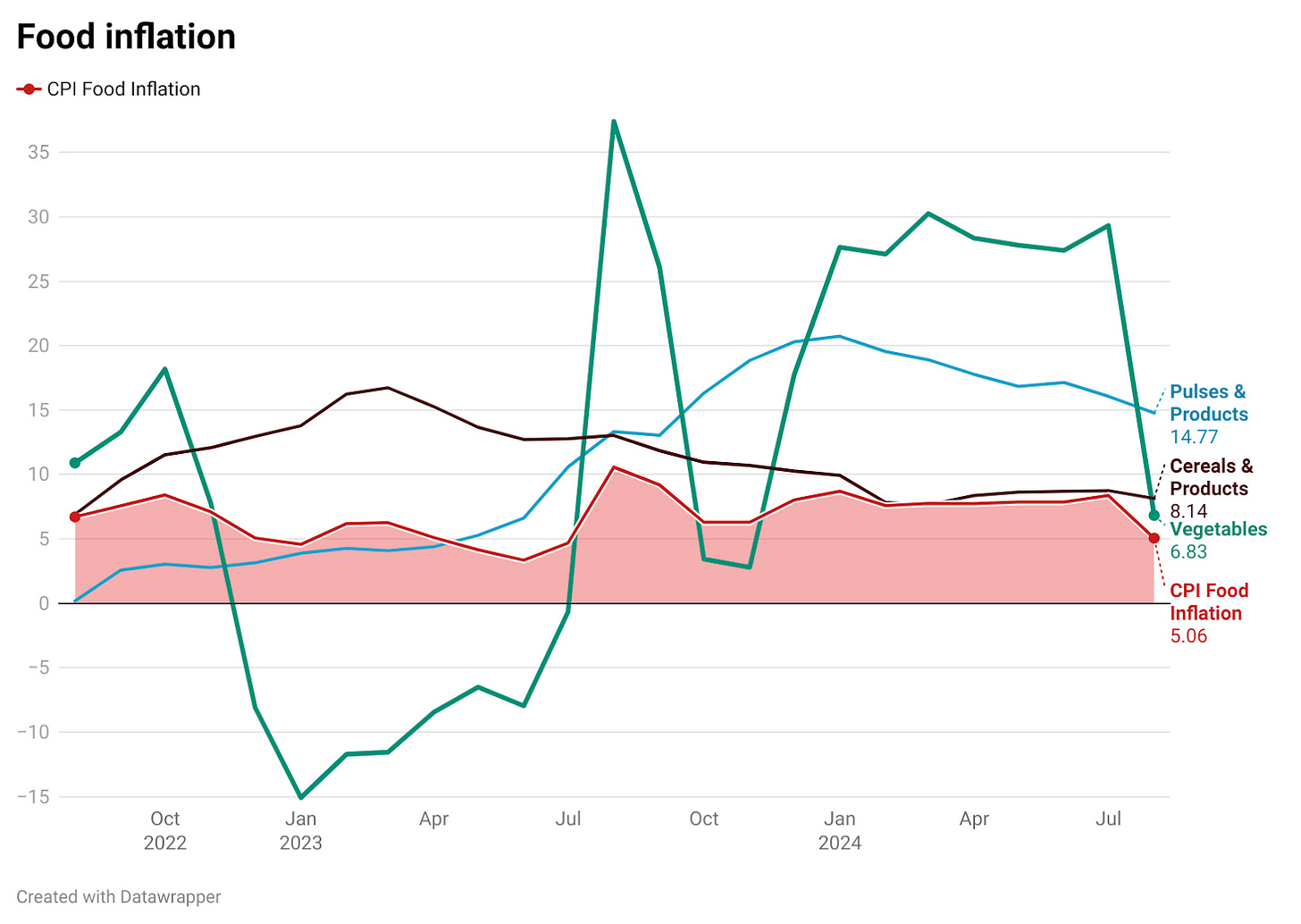

Over the last year, and even in recent months, food inflation was high, driven by supply chain disruptions and unfavorable weather conditions. These factors created the base effect that’s making this year’s inflation rate appear lower. The hope now is that this year’s expected good monsoon will materialize and help bring food inflation down. So far, the monsoon seems to be on track, and let’s hope it stays that way.

In some genuinely positive news, energy inflation has dropped for 11 consecutive months. In July, it fell by -5.5%, a steeper decline than June’s -3.6%. This decrease is mainly due to the continued fall in LPG prices. Additionally, the stabilization of global crude oil prices has significantly reduced fuel inflation. Despite ongoing geopolitical tensions, oil prices have remained relatively stable, thanks to increased global supply and subdued demand, particularly from China.

So while the drop in headline inflation might seem like good news, the underlying factors tell a more complex story. The RBI is likely to keep a close eye on these developments before making any moves on interest rates.

Indian consumers are feeling the blues

One way to think about the economy is that it’s a sum of how people earn and spend. All of this is captured in a single number called GDP. Now, GDP gives us a broad picture of how the economy is doing, but it doesn’t necessarily tell us how people are feeling about the economy—or about their own financial situations.

To really understand that, you need to ask people how they’re feeling. That’s exactly what the RBI does every two months. They conduct surveys to gauge people’s sentiments about the economy, their expectations for inflation, and more.

Let’s start with the consumer confidence survey. In this survey, the RBI asks people how they feel about the general economic situation, the employment scenario, the overall price situation, and their own income. This survey gives us a good sense of how people are feeling about the current state of the economy.

As you might expect, consumer confidence took a nosedive in 2020 during the pandemic. But since then, it’s been on a steady rise as life gradually returned to normal. However, that upward trend has recently hit a snag. Consumer confidence has now declined for two consecutive surveys. Aside from spending, people’s sentiments have turned negative about almost everything—the current economic situation, employment prospects, prices, and even their own income.

The survey also asks people about their expectations for the next year regarding these same factors. While people still feel relatively positive about the future, their confidence has started to wane, reflecting their current concerns.

So, what does this all mean? Despite all the talk about India’s high economic growth rate, people are starting to feel a bit uneasy about it. They’re less optimistic about their job prospects, prices, and income growth compared to the previous survey. This could be a reflection of the tough job market, rising layoffs, and stagnant wage growth. As we’ve discussed before, India is grappling with a massive unemployment crisis, especially among young people.

But here’s the thing—people’s sentiments can be volatile, so it’s important not to blow this out of proportion. However, it’s definitely something to keep an eye on.

In yesterday’s episode, I touched on inflation expectations. Here’s what I said: The RBI is worried because rising food prices hit everyone hard. Imagine going to buy your favorite snacks and realizing they cost more than they did last month—not exactly fun, right? The RBI knows that high food prices can really squeeze our wallets, so they’re keeping a close watch to make sure things don’t get out of control. Until they’re confident that inflation will stay under 4%, interest rates aren’t likely to budge.

In his recent policy meeting, RBI Governor Shaktikanta Das made this point clear. He said that high food inflation has impacted household inflation expectations. In other words, if inflation stays high, people will continue to expect it to remain high. This expectation can lead to higher wages and an increased cost of living, which in turn can push companies to raise prices, fueling even more inflation.

There’s solid evidence showing that people’s expectations about future inflation can influence their spending decisions, which then ripple through the entire economy. This is why the RBI also conducts a bimonthly survey asking people about their inflation expectations across 19 major cities. They ask how people feel about current inflation, as well as what they expect three months and one year down the line. On all three metrics, inflation expectations rose compared to May, when the last survey was conducted.

This means people not only believe the current inflation rate is high, but they also think it will stay high in the coming months and even a year from now. Here’s the interesting part: In the survey, the RBI noted that people’s one-year-ahead inflation expectations closely matched rising food prices, housing costs, and service costs.

This makes sense, considering that food and housing are two of the biggest expenses for most households. We buy food multiple times a month, so if prices are high, it sticks with us. This is also reflected in how CPI inflation is calculated—food and housing together account for 50% of the weight in the CPI basket.

We’ve talked about food inflation many times on this show. It has remained stubbornly high due to heatwaves, poor monsoons, and pest infestations. Food inflation fell last month on a year-over-year basis, but that’s mostly because of the base effect—remember, inflation was really high in July 2023, so even though prices increased again in July 2024, they did so at a slower rate, making it look like inflation fell. But when you look at it month-over-month, prices of vegetables and pulses still went up, just at a slower pace.

So, while the numbers might seem to suggest that things are getting better, the reality on the ground—how people are actually feeling—tells a more nuanced story.

Gold hits lifetime highs

We talk about gold a lot, but we have to bring it up again because it just hit a new lifetime high. You might be wondering why this is happening.

Recently, the US released the Producer Price Index (PPI) data, which measures inflation based on the selling prices of domestic producers. The PPI rose, but less than expected. This is another sign that inflation in the US is cooling down, which suggests that the Federal Reserve might be able to start cutting interest rates as early as September.

Now, speaking of the Fed, traders are currently betting that the Fed will cut interest rates at least once in September. Why is this important? Lower interest rates generally make gold more attractive. Gold doesn’t pay any interest itself, so when rates are low, holding gold becomes more appealing compared to bonds and other interest-bearing assets.

Because of this, the SPDR Gold Trust, which is the world’s largest gold-backed ETF, hit a lifetime high. If you’re wondering why Indian gold ETFs aren’t also at lifetime highs, it’s important to remember that the Indian government reduced import duty on gold in the recent budget, which caused domestic gold prices to drop a bit. That said, Indian gold ETFs did rise by half a percent today.

Beyond this, gold prices have stayed high due to ongoing geopolitical tensions in the Middle East. Iran has vowed to retaliate against Israel in response to the assassination of Hamas leader Ismail, and the US is moving more troops and weapons into the region in anticipation of Iran’s response. This situation is definitely something to keep an eye on.

And if you’re curious to learn everything about gold, from where it comes from to what drives its price, Bhuvan from the team did an in-depth episode with experts from the World Gold Council.

Check it out here: