Coal: The Energy Source That Refused to Retire

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube.

In today’s edition of The Daily Brief:

Coal’s Surprising Comeback: Why the World Isn’t Ready to Say Goodbye Just Yet

How Greed Fooled Investors

Coal’s Surprising Comeback: Why the World Isn’t Ready to Say Goodbye Just Yet

When we talk about coal, most of us think of it as an old-school energy source, something that the world is gradually moving away from. For years, the story has been about renewables like solar and wind taking over, pushing coal into the shadows. But the International Energy Agency’s (IEA) latest report, Coal 2024, tells a very different story. It’s a wake-up call for anyone who assumed that coal’s decline was inevitable.

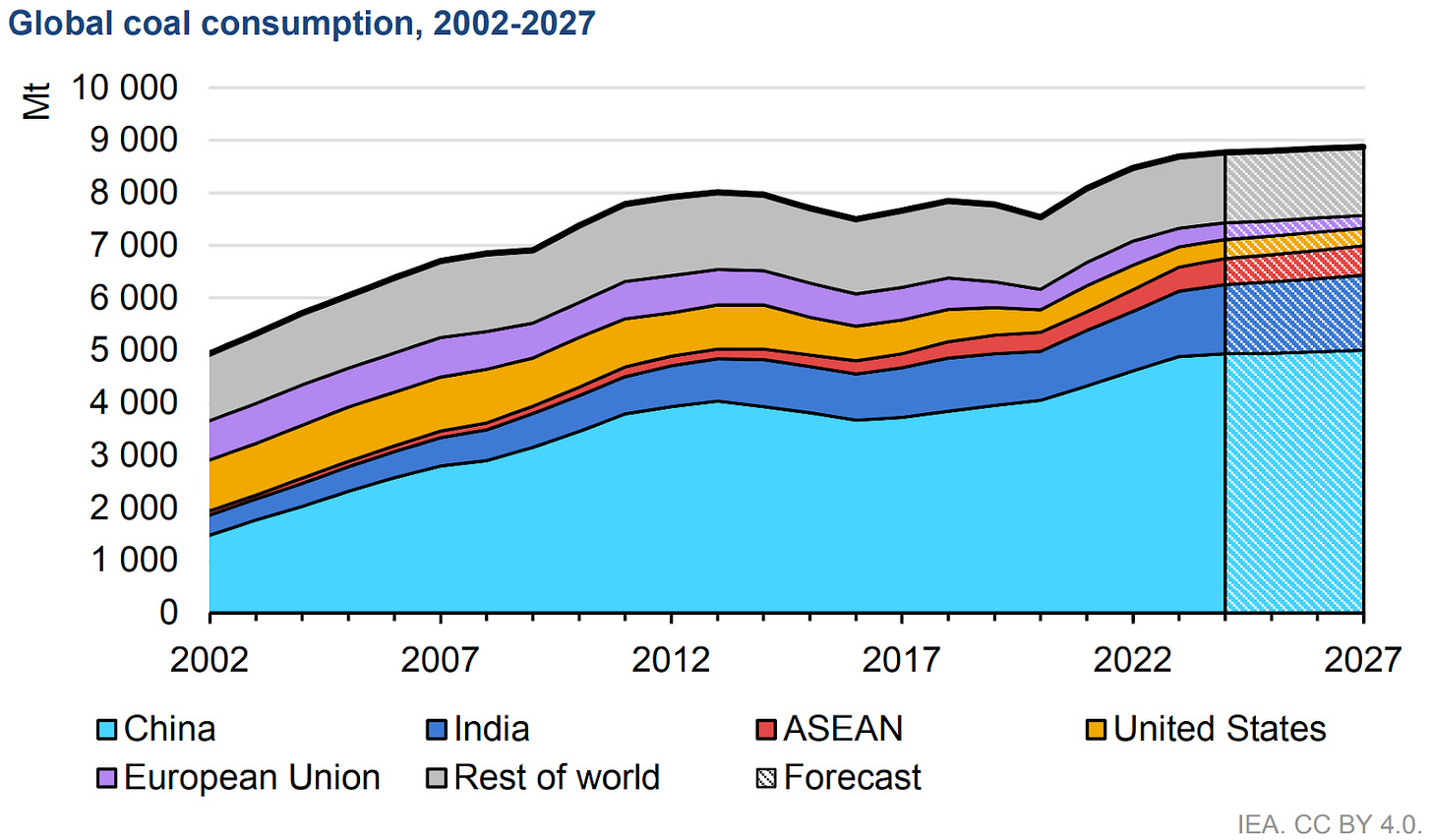

In 2024, global coal demand hit 8.77 billion tonnes, the highest level ever recorded. And the IEA, which just last year was predicting that coal demand had peaked in 2023, now says that coal use is likely to keep growing until at least 2027. The shift in their narrative is striking. What changed? And why is coal refusing to fade away?

The growth in coal use is largely being driven by emerging economies, especially China and India. Let’s break it down:

1. China’s Role: A Heavyweight in Coal Use

China, the world’s largest coal consumer, uses 30% more coal than the rest of the world combined. That alone is staggering. But what’s even more interesting is how and why China’s coal consumption is changing.

Electricity Demand Surges Beyond GDP Growth

Usually, a country’s electricity demand grows in line with its economy (measured as GDP). But in China’s case, electricity demand is growing faster than GDP. Why? New industries like artificial intelligence (AI), data centers, and electric vehicle (EV) manufacturing are guzzling electricity at unprecedented rates. Even renewable energy production in China relies heavily on coal-powered grids for stability.

Source: IEA Lower-Quality Coal Means Higher Consumption

China has ramped up coal production to avoid energy shortages, but the quality of coal being mined has gone down. Think of it like making coffee with weaker beans—you need more to get the same strength. This means China is burning more coal just to generate the same amount of energy, driving up both consumption and emissions.

2. India’s Balancing Act

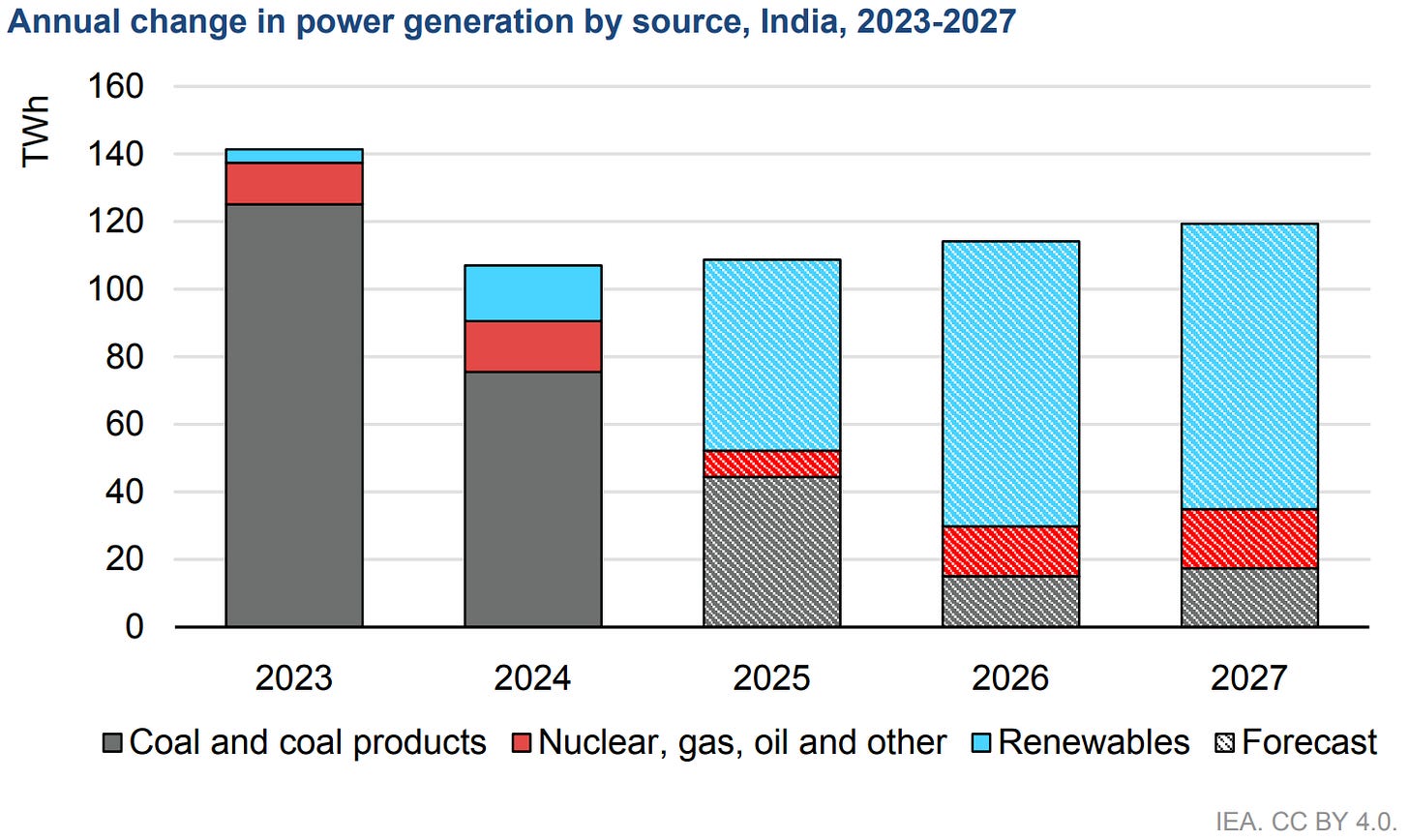

India’s coal demand grew by 8% in 2024, making it one of the fastest-growing coal markets. But here’s where things get interesting: India is also pursuing one of the world’s most ambitious renewable energy programs.

Renewables and Coal: Hedging Bets

India aims to install 500 GW of renewable energy capacity by 2030, a target that would place it among the global leaders in clean energy. At the same time, India is building 50 GW of new coal power plants. It’s like they’re preparing for two very different futures—one powered by renewables and the other by coal.

Source: Ember Energy Improving Coal Logistics

One of India’s biggest challenges is that coal mines are concentrated in a few areas, but demand is spread across the country. To solve this, they’re expanding coal transport by rail from 64% to 75% by 2030, with 38 priority rail projects in the works. This will make coal transportation faster, cheaper, and more reliable.

Source: IEA Battery Storage: The Game-Changer?

On the renewable side, India is betting big on battery storage. The cost of batteries has dropped from $450/kWh in 2021 to just $200/kWh today, making it more affordable to store renewable energy for later use. India has already tendered 16 GWh of grid-scale battery projects, and some are already operational. This could help manage the ups and downs of renewable energy, reducing reliance on coal in the long run.

Global Trends: A Complex Picture

1. Coal’s Pivot to Asia

The geography of the coal trade is shifting dramatically. After Russia’s invasion of Ukraine, many Western countries cut ties with Russian coal. In response, 84% of Russia’s coal exports now go to Asia, compared to two-thirds just a couple of years ago. But this pivot isn’t seamless—Russia is struggling with infrastructure bottlenecks, as it’s not easy to suddenly reroute massive coal shipments from Europe to Asia.

2. Emerging Asia Drives Growth

While coal use in regions like the EU and the US is declining (by 12% and 5%, respectively, in 2024), emerging economies in Asia are seeing the opposite trend. ASEAN countries like Indonesia and Vietnam could see coal demand grow by 5% annually through 2027, driven by rising energy needs and limited alternatives.

3. Production at Record Levels

The three largest coal producers—China, India, and Indonesia—all reached record production levels in 2024. Indonesia, in particular, has become a major player, expected to export nearly 500 million tonnes of coal this year, a feat no country has achieved before.

What Does the Future Look Like?

The IEA predicts that global coal demand will plateau at 8.87 billion tonnes by 2027, but there’s a big wildcard: weather in China. Extreme weather events like heatwaves or cold spells could swing coal demand by up to 282 million tonnes in a single year. That’s equivalent to the entire annual coal consumption of major countries like Germany and South Korea combined.

The Messy Reality of Energy Transitions

The big takeaway here is that the shift to clean energy isn’t as straightforward as many hoped. While OECD countries (like those in North America and Europe) have halved their coal consumption since its peak, emerging economies face tougher choices. They need to balance economic growth, energy security, and environmental concerns—and that’s no easy task.

China, for example, is building 220 GW of new coal-fired power plants, even as it leads the world in renewable energy deployment. India is doubling down on both coal and renewables at the same time. These are contradictions, but they also reflect the complexity of real-world energy transitions.

In short, coal isn’t disappearing anytime soon. Its role in the global energy mix is evolving, and shaped by economic realities, technological progress, and political decisions. And while the path to cleaner energy is still the goal, it’s clear that the journey will be anything but smooth.

How Greed Fooled Investors

Today, we’re diving into one of the boldest market manipulation cases of 2024 – the Bharat Global Developers saga.

Let’s break it down. Picture this: a little-known company, trading at just ₹16 in November 2023, suddenly skyrockets to ₹1,700 in less than a year. That’s a jaw-dropping 105x jump! But here’s where things get really interesting.

First, a bit of context. The company started as Perfact Weavers Private Limited back in 1992 and went through several name changes before becoming Bharat Global Developers. Then, in December 2023, something unusual happened. The entire management team was replaced. On December 4th, the auditor (who’d been with the company since 2011), the director, and the CFO all stepped down on the same day. Immediately after, five new directors were brought in.

What happened next was like a playbook on market manipulation. The company made two major preferential allotments of shares. The first, in April 2024, involved 9.72 crore shares issued at just ₹10 each to 31 people. Then, in August, they issued another 35 lakh shares at ₹210 each to 10 more people. Together, these 41 individuals ended up controlling 99.5% of the company.

Here’s the kicker: while the number of public shareholders in the company jumped from 10,129 in September 2024 to 44,976 by December, nearly all the shares were still held by those 41 people. In a listed company, that’s a shocking level of control.

The financials tell an equally suspicious story. Before FY 2023-24, the company had almost no revenue to speak of. Suddenly, revenue shot up from just ₹0.04 crore in FY 2022-23 to ₹25.78 crore in FY 2023-24. Then, in just six months from April to September 2024, it skyrocketed to ₹283.54 crore – all without significant fixed assets!

But here’s where things get even more intriguing. Starting in October 2024, as the lock-in period for the first batch of shares was about to expire, the company began making some bold claims. They announced they had set up six new subsidiaries in industries ranging from aerospace to mining. They also reported securing massive orders: ₹300 crore from McCain, ₹120 crore from Reliance Industries, ₹650 crore from Tata, and a ₹251 crore deal through a supposed subsidiary in Dubai.

When SEBI investigated, they found most of these announcements were completely fabricated. Many of the companies BGDL claimed to have deals with either didn’t exist or outright denied any such agreements. For instance, while BGDL claimed they were building a high-tech refinery unit for Reliance Industries, Reliance clarified they’d only purchased some basic construction materials worth about ₹155 crore.

The most shocking part? Thirteen of these preferential shareholders used the manipulated stock prices to sell about 21.17 lakh shares, raking in profits of around ₹272 crore. One individual, Mahadev Manubhai Makvana, made over ₹70 crore alone. What makes Makvana’s involvement even more interesting is that he was also an authorized signatory for two of the company’s bank accounts.

Now, let’s talk about SEBI’s response. On December 23rd, they issued a sweeping order. Trading in the stock has been suspended indefinitely. The company, its management, and the thirteen shareholders who sold shares have been barred from accessing the capital markets. Their bank accounts have been frozen, and the ₹272 crore in illegal profits have been seized.

SEBI has also given all 47 people involved just 15 working days to provide a full inventory of their assets. This includes everything—properties, mutual funds, and details of any companies where they hold significant or controlling interests.

And here’s one of the most cunning moves in the entire scheme: the bonus issue and stock split. BGDL announced an 18-for-1 bonus issue, where shareholders would receive 18 shares for everyone they held, with a record date set for December 26, 2024. At first glance, it looked like an incredibly generous offer. But in reality, it was nothing more than a carefully crafted strategy to draw in more retail investors.

By dangling the promise of “free shares,” the company aimed to drive up trading activity and inflate its shareholder count, all while insiders prepared to cash out. SEBI’s timely intervention prevented this from becoming an even bigger disaster for unsuspecting investors.

This case is a stark reminder of why doing your due diligence is so important. When a company with almost no business suddenly claims massive orders and its stock price jumps 105 times in a year, that’s not just a red flag—it’s an entire parade of them.

Tidbits:

IndiGo, India's largest airline with 427 aircraft, is wet-leasing six Boeing 787 planes to address surging international travel demand. This follows its April order of 30 Airbus A350 aircraft, with deliveries starting in 2027.

The Cotton Association of India (CAI) has requested ₹500 crore in the 2025-26 Budget to promote drip irrigation. This initiative aims to boost yields in rain-fed regions, which contribute 67% of India’s cotton production but face water scarcity.

Prepaid wallets saw a 20.4% decline in 2024, dropping from 144 crore in January to 114 crore in November, with a 16.7% YoY fall. Regulatory action led to a 42% decline in Paytm Payments Bank wallets, while Airtel Payments Bank saw a 48.5% YoY drop.

-This edition of the newsletter was written by Bhuvan

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Information about the calorific value of the coal consumed by China in the last few years should have been provided to bring more concreteness and drive the message home about the quality of the coal.