Can India become the next major oil refining hub?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

India wants to use fossil fuels but also wants to go green

Is India's inflation rate too high?

How do changes in commodity prices affect our daily lives

India wants to use fossil fuels but also wants to go green

Let's start the day by diving into India’s energy strategy—a topic that might seem straightforward but actually comes with unique challenges and ambitious goals. While many countries are pushing hard towards renewables like wind and solar, India’s approach stands out. Recently, India’s Oil Minister laid out an interesting strategy: instead of stepping back from fossil fuels, we’re planning to strengthen our reliance on them. The aim? To become a "regional refining hub" until at least 2040.

So, what does this really mean? In simple terms, India doesn’t just want to refine oil for its own needs; we want to supply our neighbors too. There are plans in the works to build more refineries for oil, gas, and petrochemicals. What makes this stand out is that, while the world is shifting toward green energy, India is doubling down on oil.

But this isn’t about resisting change. India’s energy demand is enormous, driven by a fast-growing and urbanizing population. Right now, we’re refining around 5 million barrels of oil a day—about 249 million metric tonnes a year. Even that isn’t enough to meet our rising needs. The goal is to hit 450 million metric tonnes a year!

Driving this goal are state-owned giants like Bharat Petroleum (BPCL), Indian Oil Corporation (IOC), and Hindustan Petroleum (HPCL), each with its own plan to expand refining capacity.

Bharat Petroleum (BPCL) is working on a major expansion in Maharashtra and Kerala over the next 5 to 7 years. They’re not just focused on refining crude oil but also on producing petrochemicals. Why? Because petrochemicals play a big role in industries like automotive, construction, and consumer goods—think plastics and synthetic fabrics. By producing more locally, BPCL hopes to meet rising demand and cut down on imports.

Indian Oil (IOC), the largest refiner in India, is expanding its Panipat, Gujarat, and Barauni refineries. Panipat, for example, will grow from handling 15 million metric tonnes per year to 25 million. But IOC isn’t just making more fuel; it’s also adding petrochemicals to its mix, turning out everything from gasoline and diesel to industrial plastics—all from one site.

Hindustan Petroleum (HPCL) has a different focus—diesel self-sufficiency. HPCL is expanding its refineries in Barmer, Mumbai, and Visakhapatnam. By 2025, it aims to meet all its diesel needs with local production, cutting down reliance on outside suppliers and making India’s energy network more resilient.

Why all this expansion? The answer lies in India’s rapid urbanization and industrial growth. According to the International Energy Agency (IEA), India is expected to become the largest source of global oil demand growth by 2030, with demand increasing by about 1.2 million barrels per day. This growth isn’t just for vehicle fuel but also for petrochemicals like naphtha and LPG, which are used in everything from plastics to industrial chemicals.

While India is doubling down on fossil fuels, some companies are making quieter moves into renewables. Take Reliance Industries, for example—a major player in India’s oil sector. Reliance is investing heavily in biogas, with plans to build 500 compressed biogas (CBG) plants and invest ₹65,000 crore in the process. The idea is to produce biogas from organic waste, like crop leftovers and food scraps. This project ties into India’s SATAT initiative, which aims to integrate biogas into our natural gas supply, offering a cleaner, locally-made alternative to imported liquefied natural gas (LNG).

This shift isn’t just about going green; it’s practical too. Compressed biogas is renewable and can be made right here, helping to cut our reliance on imported LNG. So, even as Reliance continues to play a big role in oil, it’s taking steps towards a more sustainable future.

Beyond refining, India is also moving carefully to diversify its energy mix with biofuels. The government has set ambitious targets, like blending 20% ethanol into gasoline by 2025-26 and adding 5% biodiesel to diesel by 2030. Ethanol and biodiesel come from crops and offer renewable, less harmful alternatives for the environment. Reliance’s investment in CBG fits in well with this plan, as SATAT looks to create a “gas-based economy” that reduces our reliance on imports.

To reduce our heavy reliance on imported oil—which currently makes up 87% of our supply—India is pushing for more domestic exploration. There are 26 sedimentary basins in the country (geographical zones where oil and gas reserves are likely found), but we’re only actively exploring 10% of that area. Recently, India opened up 1 million square kilometers of previously restricted zones for oil exploration. The Petroleum Minister, Hardeep Singh Puri, has set ambitious goals to tap into around 22 billion barrels of untapped oil. To attract both local and foreign companies, the government has rolled out incentives, simpler rules, and safeguards against sudden tax changes.

India’s energy strategy might seem like a contradiction, but it’s actually a careful balancing act. On one side, we’re committed to fossil fuels. BPCL, IOC, and HPCL are leading major refinery expansions to meet immediate energy demand, cut down fuel imports, and support key industries.

On the flip side, our renewable energy investments are slowly but steadily growing. Biofuels like compressed biogas (CBG) and ethanol-blended fuels offer homegrown energy alternatives. While they won’t replace fossil fuels overnight, they do help diversify our energy mix and provide some protection against global oil price swings and supply risks.

Even though we’re deeply invested in fossil fuels, we haven’t lost sight of our climate goals. As the third-largest emitter of greenhouse gases, India has committed to reaching net-zero carbon emissions by 2070 and plans to generate 500 gigawatts of renewable energy by 2030, mainly through wind and solar projects. Still, we’re taking a more gradual approach when it comes to cutting down on fossil fuels. Efforts in biofuels and biogas represent small but deliberate steps toward a cleaner energy future.

So, what’s the takeaway? India’s energy strategy is all about balance. We’re meeting immediate energy needs through refinery expansions, while carefully building a base for renewable energy. Focusing on domestic oil refining helps reduce dependency on imports and stabilizes energy costs for a fast-growing population. At the same time, investments in biofuels and biogas show we’re taking cautious steps toward cleaner energy, blending the urgency of today’s needs with a vision for a sustainable tomorrow.

In short, while India’s energy mix might seem heavily reliant on fossil fuels today, a slow but steady shift is underway, laying the groundwork for a more diverse and resilient energy future.

Is India's inflation rate too high?

India is facing a sharp rise in inflation, and it’s having a ripple effect on everything—from household budgets to central bank decisions. Consumer Price Index (CPI) inflation has climbed to 6.2%, the highest level in over a year, pushing past the Reserve Bank of India’s (RBI) upper tolerance limit of 6%.

This rise in inflation impacts all of us. It changes how much we spend on everyday essentials and influences the choices policymakers have to make to keep the economy stable. With inflation this high, it’s likely that the RBI will need to reconsider plans to lower interest rates, which many hoped would help boost economic growth.

So, let’s break down what’s happening, why it matters, and what’s behind these price increases in India. For anyone new to how markets work, a bit of inflation is actually normal and even healthy. It shows that people are spending and that the economy is growing. But problems arise when inflation jumps too quickly, which is exactly what’s happening now. A sudden spike in inflation means that our purchasing power drops, so the money in our pockets doesn’t go as far as it used to.

For a country like India, where essentials like food and transportation make up a large part of household spending, this can put a real strain on people’s daily lives.

Central banks, like the RBI, have a big job to do—keeping inflation under control. When inflation rises too quickly, it limits the RBI’s ability to support economic growth. If inflation stays high, the RBI may have no choice but to keep interest rates high. This makes borrowing more expensive and can slow down spending and investment for both people and businesses.

So, what’s behind this latest inflation spike?

In October, food prices were the biggest driver of inflation. But it’s not just about food—there are local issues and global trends at play. Let’s dive into where prices rose the most and why.

Food prices saw a year-on-year increase of 10.8% in October, marking the sharpest rise in about four years. This wasn’t limited to a few items; it affected a wide range of essentials.

Vegetable prices saw a massive jump of 42.2%, up from an already high 36% in September. Staple items like tomatoes, onions, and potatoes were hit the hardest due to unseasonal rains and a prolonged monsoon, which hurt crop yields and disrupted harvesting.

Interestingly, if we take vegetables out of the Consumer Price Index (CPI) basket, inflation is much lower, at about 3.6%. This shows just how much of an impact rising vegetable prices are having on the overall numbers.

Edible oil prices also rose by 9.5%, marking the highest increase in over two years. This was mainly due to a 27% surge in global oil prices, driven by poor weather in major oil-producing countries. Since India imports most of its edible oils, these global price hikes hit home directly. Adding to the pressure, the government raised import duties on some oils in September to support local farmers.

Fruit prices climbed by 8.4%, while cereal prices increased by about 6.9%. These hikes were mainly due to supply challenges and high demand.

Interestingly, not everything saw a price increase. Spices, for example, dropped by about 7% year-on-year, offering a rare area of relief.

Beyond food, the cost of some essential services, such as personal care items, rose significantly, with prices jumping by as much as 11% in October!

While this might seem secondary, these rising service costs put extra pressure on household budgets. Businesses are also feeling the squeeze, with higher costs for things like rent and wages, which often end up raising prices for consumers.

Core Inflation Reflects Price Pressure Beyond Food and Fuel

Core inflation—which excludes more volatile items like food and fuel—climbed to 3.7% in October, up from 3.5% in September. While it’s still below the 4% mark, this rise shows that inflation is slowly spreading into other areas beyond food and energy.

Core inflation is an important measure because it gives us a clearer view of long-term price trends. For example, categories such as housing, education, and personal care reflect deeper issues like rising urban demand and supply constraints.

But it’s important to note that inflation in India right now isn’t just about local issues. As we mentioned earlier, international factors are also playing a big role.

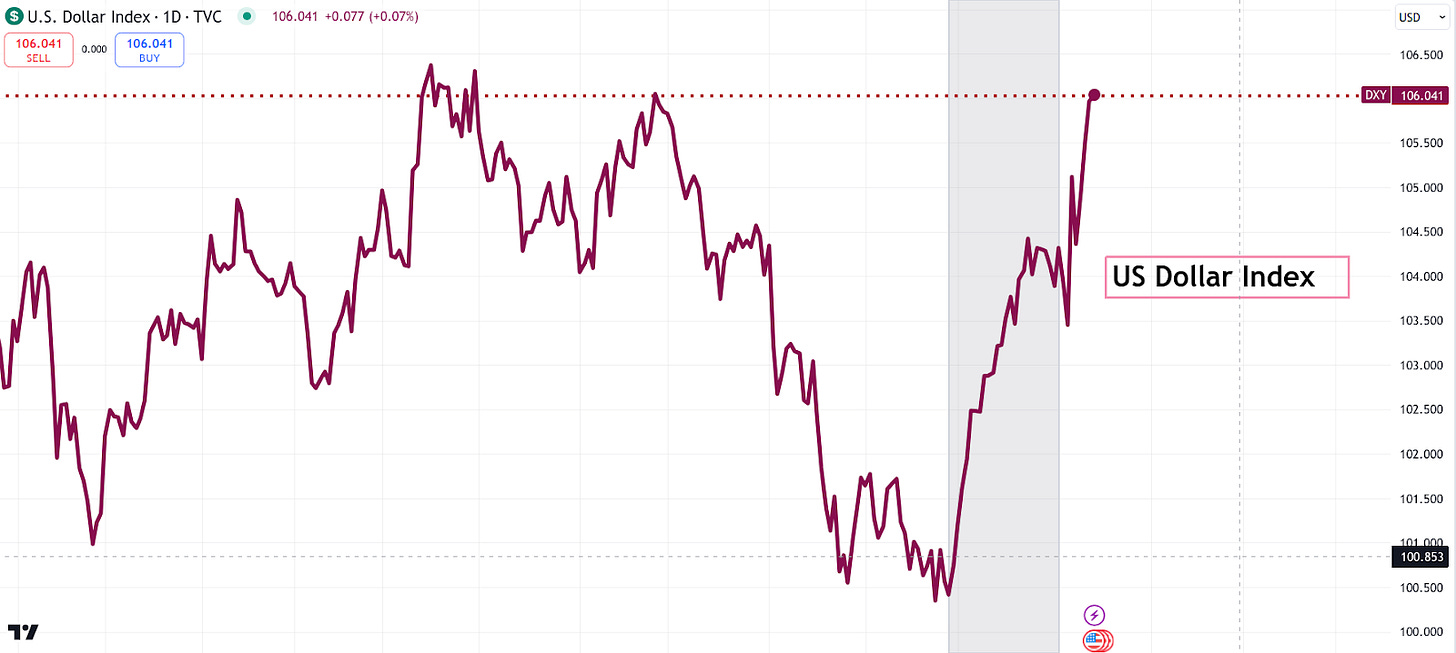

One critical factor adding to the pressure is the rising USD Index, which is now at 106. This means the US dollar has strengthened by 6% relative to its base.

When the dollar gets stronger against major currencies, including the Indian rupee, it makes imports—like oil and other essentials—more expensive in rupee terms. This “imported inflation” pushes up domestic prices, making the RBI’s job even tougher. If the RBI cuts rates, it risks weakening the rupee further, driving up import costs and adding to inflation. In other words, a strong dollar leaves the RBI in a tough spot because lowering rates could lead to even higher inflation through a weaker rupee.

As a result, the cost of imported goods for India has gone up by 4.6%, the highest level in 20 months. Meanwhile, within India, inflation has risen to 6.4%, mainly due to higher food production and distribution costs. So, we’re dealing with both imported and domestic inflation, making India especially sensitive to changes at home and abroad.

With inflation now above 6%, the RBI faces a difficult choice. Many had hoped that the RBI would cut interest rates early next year to help boost economic growth. But with inflation this high, that seems unlikely. Cutting rates in a high-inflation environment could make borrowing cheaper, increasing spending and potentially driving prices even higher. The RBI had assumed inflation would cool down in the second half of the financial year, but October’s numbers tell a different story. If inflation doesn’t get closer to 5% by the end of this fiscal year, the RBI may hold off on any rate cuts, which could slow down economic recovery further.

There is, however, some hope that inflation could cool down.

A possible bright spot is the upcoming rabi (or winter) crop harvest. Despite delayed monsoons, water levels in reservoirs in states like Punjab and Himachal Pradesh are above average, which could support a strong winter crop season. If the harvest is good, food prices could come down, provided the supply chain operates smoothly.

Global events, such as conflicts in the Middle East, could impact the price of key commodities like oil. Since oil costs affect almost every industry, stable global conditions will be crucial to avoid further price spikes.

The Indian government might also step in with measures such as increasing import quotas for essential goods or releasing buffer food stocks to temporarily ease prices.

While these steps could bring some relief, they come with their own costs and could impact the government’s budget.

So, what does this mean for us? India’s inflation spike isn’t driven by just one factor—it’s a mix of local disruptions, global pressures, and ongoing cost issues. With rising prices for both essentials and services, households are feeling the strain, and the RBI has to carefully balance controlling inflation with supporting economic growth. Research teams at CareEdge and Motilal Oswal now suggest that the RBI might hold off on rate cuts until February 2025, and that makes sense. The RBI has been clear that it wants to see inflation consistently below 4% before considering any rate cuts.

How do changes in commodity prices affect our daily lives?

The World Bank recently released its latest Commodity Markets Outlook. Now, this might sound like something only economists or traders would care about, but here’s why it matters to all of us: commodities like oil, coal, crops, and metals are the building blocks of our daily lives. Whether it’s the price of fuel for your commute or the cost of food on your plate, these commodity prices shape our everyday expenses, influencing everything from monthly bills to the wider economy.

In this story, we’ll take a closer look at how global events are shaping the prices of key commodities—and why that matters to all of us. To make it easier to follow, we’ll break it down into smaller segments: oil, coal, agriculture, metals, the ripple effects across the economy, and how all this ties back to inflation.

Segment 1: Crude Oil

Let’s start with oil, the fuel that keeps much of the world moving. Oil prices impact more than just what we pay at the pump; they influence the entire economy, affecting everything from transportation costs to the prices of goods. According to the World Bank’s projections, the price of Brent crude oil—a key benchmark for oil pricing—is expected to decrease to $73 a barrel by 2025.

This gradual decline in oil prices isn’t random—it’s driven by supply and demand finding a balance. Right now, major oil producers in the OPEC+ group (a coalition of oil-exporting countries) have agreed to limit their production, cutting back by 3.65 million barrels per day. This strategy, which will continue into 2024, aims to keep prices stable despite a slower-growing global economy.

But that’s just part of the story. Countries outside of OPEC+, such as the U.S., Brazil, and Guyana, are increasing their oil production, adding a balancing act to the market. Guyana, for example, is a new and rapidly growing player, tapping into its offshore oil reserves and bringing fresh competition to the scene.

On the demand side, the growth in how much oil the world uses is slowing. The International Energy Agency (IEA) expects a modest increase of 900,000 barrels per day in 2024—less than in previous years. This is mainly due to China pulling back. Traditionally a major driver of oil demand, China’s industrial growth is slowing, and electric vehicles (EVs) are becoming more popular. In 2023 alone, China added around 3.5 million EVs, reducing its reliance on traditional fuel.

Looking further ahead, global demand for oil is expected to peak around 2030 as more countries push toward cleaner energy. For nations that depend heavily on oil revenue, this shift presents a challenge—they’ll need to balance today’s earnings with investments in renewable energy for the future.

Policy changes are also nudging the world away from oil. In Europe, initiatives like carbon pricing make oil relatively more expensive than renewables. Meanwhile, in the U.S., the Inflation Reduction Act is pumping billions into green energy projects, speeding up the transition to sustainable sources. This doesn’t mean oil will disappear, but its role in our energy mix is gradually shrinking.

So, why does oil matter to us? Oil prices affect nearly every sector—transportation, manufacturing, and even food. Higher prices often lead to increased costs for transportation and production, pushing up inflation, while lower prices can create challenges for economies that depend on oil revenue. It’s a delicate balance.

Segment 2: Coal

Coal, which was once the backbone of global energy, is now seeing a sharp drop in demand as cleaner energy sources become more competitive. In 2022, coal prices hit $344 per ton, but by 2023, they fell to $147, and the World Bank expects this downward trend to continue into 2024.

So, why the decline? Developed economies are moving away from coal due to environmental concerns and because renewables have become more cost-effective. However, coal is still critical in certain regions. For example, more than 70% of India’s electricity comes from coal, powering its rapid industrial growth and expanding electrification. Southeast Asian countries like Vietnam and Indonesia also rely heavily on coal for energy and industry. And while China is reducing its use of coal for power generation, it remains essential for steel production, which is vital for the country’s infrastructure development.

Still, coal’s future doesn’t look bright. Renewable energy is increasingly cheaper than coal, even without subsidies, making coal a less attractive option. Governments are also discouraging coal through policies like carbon taxes, and financial institutions are pulling back from funding coal projects, choosing to invest in renewables instead. For example, organizations like the Asian Development Bank are reducing investments in coal to focus on cleaner energy options.

So, why does coal matter? Coal prices act as a sign of how quickly the world is shifting toward sustainable energy. A drop in coal demand points to a stronger move towards renewables, though for some countries, this transition will be complex and take time.

Segment 3: Agriculture

Now, let’s talk about agriculture—the sector that directly affects what we eat and how much we spend on food. While the World Bank’s food price index has dropped by 4% this year, some crops remain unpredictable.

Maize and wheat prices are lower, thanks to good harvests in key regions like the U.S. and Eastern Europe. However, rice prices have surged, climbing by more than 20% this year, mainly due to India’s export bans. As one of the world’s largest rice producers, India stopped exporting rice to control food inflation at home. This move had ripple effects on countries that depend on Indian rice, like the Philippines and several African nations.

Another example is cocoa, which has seen its price double. Climate issues and pest infestations in West Africa, where over 60% of the world’s cocoa is produced, have hurt yields and pushed prices up. Meanwhile, although the price of fertilizers has fallen by 23% from last year, it is still above pre-pandemic levels due to high energy costs in Europe, a major producer.

Looking ahead, agriculture faces tough challenges. Climate change is causing more extreme weather events like droughts and floods, threatening food security in vulnerable regions.

Why does agriculture matter? Food prices have a direct impact on our wallets, especially in low-income countries where people spend more of their income on basic staples. Balancing affordability with sustainability is essential for feeding the world.

Segment 4: Metals and Minerals

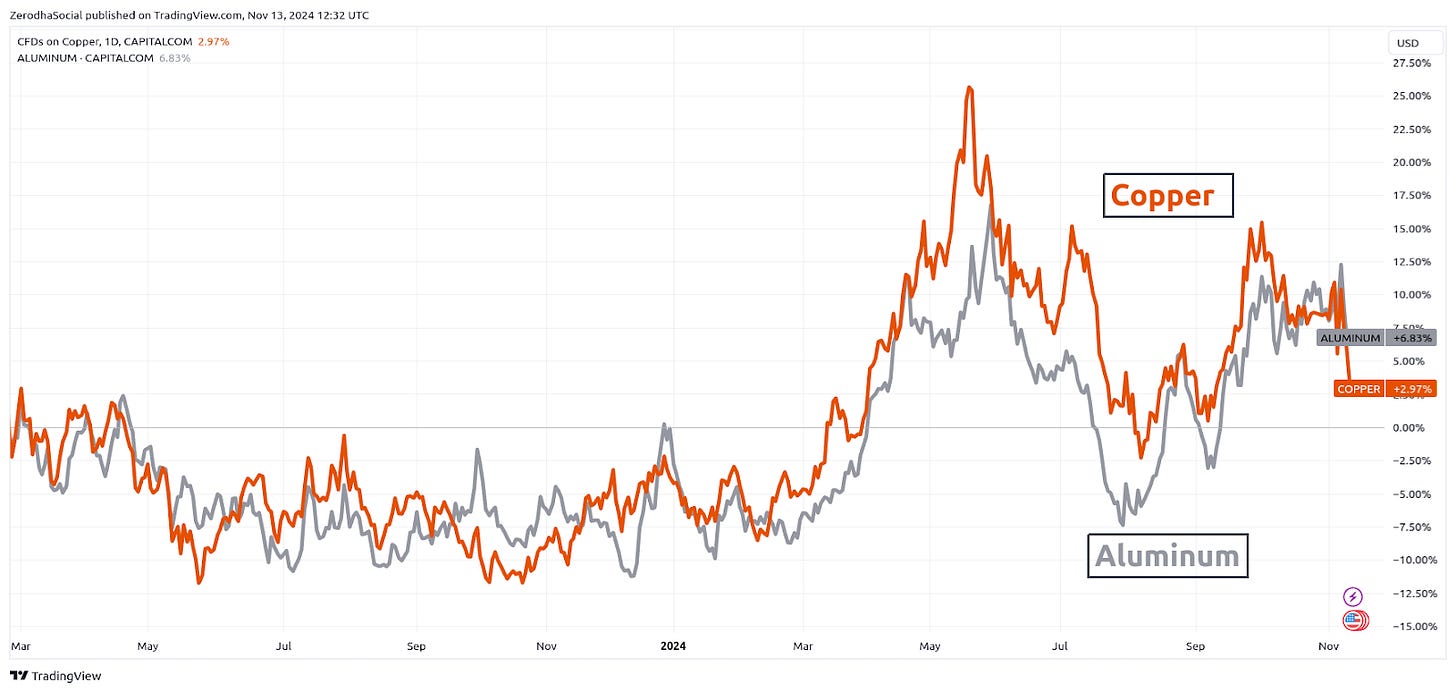

Metals and minerals are the backbone of modern economies, playing a vital role in everything from construction to technology. Copper and aluminum, for example, are in high demand due to their use in electric vehicles (EVs) and renewable energy systems. Gold prices have climbed by 27% this year, with central banks increasing their reserves as a safeguard against global uncertainties.

On the other hand, iron ore is facing weaker demand due to a slowdown in China’s property sector. Since China accounts for over half of the world’s steel production, less demand for construction materials there greatly impacts global markets.

The shift to green energy is also shaking up the metals market. Minerals like lithium, cobalt, and nickel, which are essential for EV batteries, are in high demand but come with supply chain challenges. For instance, 70% of the world’s cobalt is produced in the Democratic Republic of Congo, where political instability can threaten a steady supply.

Countries are taking steps to secure access to these critical minerals. China, for example, has restricted exports of rare earth elements to maintain its advantage in clean technology. Meanwhile, the U.S. and Australia are working to boost their own mineral production and recycling efforts to cut down on imports.

Why do metals matter? The prices of these materials show the balance between industrial demand and the push for sustainability, highlighting how we’re moving toward greener technologies.

Segment 5: Ripple Effects of Commodity Prices

Commodity prices don’t just impact their specific sectors—they have a ripple effect across the entire economy. For instance, when oil prices rise, transportation and fertilizer costs increase, which can drive up food prices. Higher coal prices can lead to increased demand for natural gas, affecting the broader energy market.

The metals market is closely tied to the shift toward green energy. Shortages of minerals like lithium or cobalt can slow down electric vehicle (EV) production, delaying progress toward lower emissions. Similarly, disruptions such as rice export bans or political issues in mining regions can affect global markets, impacting food security and industrial output.

Why this matters: Understanding these connections helps us see the bigger picture and allows businesses and governments to better plan for economic changes.

Segment 6: Commodities and Inflation

Finally, let’s connect commodities to inflation. Inflation impacts everything from our wages to our savings, and commodities play a big role in driving it. Falling energy and food prices have helped ease inflation in 2023, but there are still risks. Geopolitical tensions, like those in the Middle East, could disrupt oil supplies and cause energy costs to spike. Similarly, climate events could lead to soaring food prices, reigniting inflationary pressures.

Long-term challenges such as climate change and fragile supply chains mean that inflation risks won’t disappear anytime soon. Policymakers will need to find a careful balance between controlling inflation and supporting economic growth.

So, in summary: From oil and coal to agriculture and metals, each of these markets affects our lives in countless ways. Understanding these dynamics helps us make sense of the world and shows how commodities shape not just the economy but our everyday lives.

Tidbits

The FSSAI has mandated that all food delivered through e-commerce must have at least 30% of its shelf life remaining. This move is aimed at improving quality control in the quick commerce sector.

Nazara Technologies has launched “gCommerce,” which brings e-commerce into gaming. This integration allows for in-game purchases, boosting revenue opportunities for game developers.

Samsung’s stock has hit a four-year low due to concerns about potential U.S. tariffs and challenges in the AI chip market.

Global net inflows into ETFs have reached $1.4 trillion, surpassing the previous record set in 2021. This growth is driven by market reactions to global economic changes.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Reliance Industries in it's later quarterly results hinted that the 5% decline in profit YoY was due to decline in the oil-to-chemical (O2C) segment of the company facing some challenges due to slowing global demand and low gas realizations leading to revenue dropping 6% from this segment.

I expected Reliance Industries to do have good EBIDTA margins since oil prices have been consistently lower.

My question is since the oil and gas refining companies are ramping up production of petrochemicals., is there a shift in these companies strategy from exports to meeting local industrial needs and the impact of the EBIDTA margin impact due to change in approach?

bye