Can India Beat China in Electronics Manufacturing?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

Can India's electronics journey go from importer to exporter?

Can India break China's critical minerals monopoly?

Inside ITC's latest quarter

Can India's electronics journey go from importer to exporter?

In our first story, let’s discuss Dixon Technologies' latest quarterly results. The interesting twist here is that, despite the company reporting a massive 263% jump in its consolidated net profit, its stock surprisingly dropped nearly 7.5% in a single day!

Now, you might think that strong profits would make investors happy, so why the drop? Here’s the catch: sometimes, markets have sky-high expectations, especially in booming sectors like electronics manufacturing. Investors may have hoped for even more impressive results, or they could be cautious, thinking other companies in this sector might soon post even stronger numbers, making Dixon’s achievements seem ordinary in comparison. So, while the numbers are solid, this market reaction reflects the high expectations in the electronics manufacturing industry.

Let’s take a step back and look at the bigger picture. The electronics industry has become essential to our daily lives. Think about it—smartphones, laptops, smart TVs, wearables, electric vehicles—all of these are powered by electronics. Without them, it would be tough to get through our day! However, there’s a critical point we often overlook: while we rely heavily on these gadgets, India produces only about 2% of the world’s electronics but consumes 5%. This gap is largely filled by imports.

To put this into perspective, in 2023, India’s electronics imports reached $76 billion, making it our second-biggest import category after crude oil!

This reliance on imports means that whenever there’s a global supply chain disruption as we saw during the pandemic, India is significantly impacted. However, the good news is that India is taking steps to change this, aiming not only to reduce imports but also to become a global exporter of electronics.

Here’s the current situation: around 27% of the electronics we use are imported. Key components like semiconductors, printed circuit boards (PCBs), and displays are primarily sourced from abroad, with China supplying about 44% of these imports. In financial terms, this translates to ₹3 lakh crore worth of electronics imports in FY22. This heavy dependence doesn’t just affect our trade balance; it also makes us vulnerable to external risks like geopolitical tensions and supply chain disruptions.

But things are looking up. By FY28, India’s dependence on imports is expected to drop to around 16%, with the total import value predicted to decrease to about ₹2 lakh crore. Meanwhile, exports are set to grow substantially. Currently, exports make up only 1% of our electronics production, but this figure is projected to grow at an impressive 44% compounded annual growth rate (CAGR), reaching ₹11 lakh crore by FY28 and accounting for 39% of our total electronics production.

This shift indicates a major transformation—from being a country that primarily buys electronics to one that manufactures and exports them. So, what’s driving this change? Let’s dive into the factors behind India’s journey to becoming a global electronics player.

The government has rolled out several initiatives in recent years to boost domestic production and attract global investment in electronics. Let’s go through the major ones:

Make in India (2014): This initiative aims to turn India into a global manufacturing hub by encouraging both domestic and international companies to set up factories here. Special funds support mobile phone and component manufacturing.

Phased Manufacturing Program (PMP): Through import duties and tax breaks, this program incentivizes local electronics production. Initially focused on mobile phones, it’s now expanding to include other electronics as well.

Production Linked Incentive (PLI) Scheme: With a budget of ₹1.95 lakh crore, this scheme encourages investment across 14 sectors, boosting production and making India globally competitive.

Source: HDFC Securities SPECS Scheme (2020): This program offers a 25% capital incentive for local manufacturing of electronic components and semiconductors, making it more financially attractive to set up production facilities.

Electronics Manufacturing Clusters (EMCs): These clusters provide an infrastructure where multiple manufacturers and suppliers can collaborate, creating efficient and productive manufacturing hubs.

Semiconductors and Display Fab Program: With ₹76,000 crore in funding, this program aims to create a local ecosystem for manufacturing semiconductors and displays, essential components in most electronics.

Merchandise Exports from India Scheme (MEIS): MEIS rewards exporters with incentives they can use for customs duties, helping Indian electronics manufacturers compete on the global stage.

India isn’t just attracting manufacturers due to these policies. There are other advantages too:

Lower Labor Costs: India’s labor costs are slightly lower than China’s, making it cost-effective for companies to set up labor-intensive operations like electronics assembly here.

Source: HDFC Securities Ease of Doing Business: India’s ease of doing business ranking improved significantly from 142nd in 2015 to 63rd in 2020, making it easier for companies to start operations and draw foreign investors.

Source: HDFC Securities Young Workforce: India has a large pool of young, skilled workers, essential for the manufacturing sector. With millions entering the workforce each year, companies find it easier to meet their talent needs.

These changes are already attracting some big names:

Apple is currently making about 5% of its iPhones in India but plans to increase that to 25% over the next few years.

Foxconn, one of the world’s largest electronics manufacturers, plans to expand its investments in India fivefold by 2026.

Micron is setting up semiconductor plants in Gujarat, a significant step toward India’s ambition to produce its own chips.

Samsung is producing 5G equipment here and expanding into laptop manufacturing.

Google plans to manufacture Pixel phones in India to diversify its production.

These moves highlight that India is quickly becoming a key part of the global supply chain. This shift isn’t only about reducing dependence on China; it’s also about building India as a global electronics manufacturing hub.

However, challenges remain. Currently, value addition within India is relatively low, at around 15-20%. This means that while we’re assembling products, critical components like semiconductors and PCBs are still mostly imported. The goal is to increase local value addition to 35-40% by FY30. To achieve this, India needs a stronger local supply chain, more investment in R&D, and advanced manufacturing facilities. Additionally, there’s a need to upskill our workforce to manage complex processes in semiconductor and high-tech manufacturing.

So, can India truly become a net exporter of electronics? The answer is yes, but it’s a long-term goal. Achieving it will require ongoing policy support, large-scale investments, and a skilled workforce. But the momentum is here. Production is growing, exports are increasing, and big names are setting up shop.

In the coming years, we may find ourselves using gadgets that are not only “Made in India” for local use but also proudly exported worldwide. That’s the future we’re working toward—a future where India plays a leading role in electronics manufacturing, creating jobs, boosting exports, and transforming into a global manufacturing powerhouse.

Can India break China's critical minerals monopoly?

In our next story, let’s dive into a topic that’s vital to the future of the global economy: critical minerals. These are specific minerals and metals that power essential technologies, from electric vehicles and renewable energy to advanced electronics and defense systems.

So, what exactly are these minerals, why are they so valuable, and how is India positioning itself in this competitive space?

Let’s start by defining critical minerals. These include lithium, cobalt, nickel, and a group of rare earth elements like neodymium and dysprosium. These minerals are essential for producing high-tech, energy-efficient devices that are now part of daily life.

Here are a few examples:

Lithium and cobalt are crucial for making rechargeable batteries, like those used in electric vehicles.

Rare earth elements are key to converting energy efficiently, powering devices like wind turbines and smartphone speakers.

Nickel is used to create corrosion-resistant materials for industries like aerospace and energy storage.

These minerals are fundamental to the shift toward a green economy. As nations set ambitious carbon-reduction goals, demand for these minerals is skyrocketing. But here’s the challenge: these minerals aren’t distributed evenly across the globe, with a few countries dominating their supply.

Globally, certain countries play significant roles due to their reserves and processing capabilities:

China processes about 85% of the world’s rare earth elements, making it a major player in the supply chain.

The Democratic Republic of Congo (DRC) provides about 70% of the world’s cobalt.

Australia, Chile, and Argentina have substantial lithium reserves, which are essential for the battery industry.

This concentration poses a supply risk: if tensions rise or a trade route is blocked, it could disrupt global access to these minerals, impacting industries worldwide. This supply risk has driven countries, including India, to seek out diverse sources and secure their own supplies.

India recently joined the Mineral Security Partnership (MSP), a coalition focused on building a more resilient global supply chain for critical minerals, making it the first developing country to do so. This move signals India’s commitment to reduce its reliance on imports and build self-sufficiency in critical minerals.

Geoffrey R. Pyatt, the U.S. Assistant Secretary of State for Energy Resources, highlighted India’s potential as a major player in critical minerals, given its large population and growing market. Although India has untapped reserves, MSP membership provides a platform to develop these resources in collaboration with international partners. India’s vision is to go beyond mining and become a leader in refining and manufacturing, creating a “mine-to-market” model to boost the economy and reduce dependence on imports.

The Indian government is encouraging major companies like Tata, Reliance, and Adani to explore opportunities in critical minerals, especially as they already have experience in clean energy and battery technology. While large-scale projects are still in their early stages, this involvement could position India as a significant player in the global market.

India’s membership in the MSP was highlighted during Prime Minister Modi’s recent state visit to Washington, underscoring the growing collaboration between the U.S. and India on critical minerals. With substantial rare earth reserves, India is seen as a promising partner in the push to diversify away from China’s dominance in this area.

India and the U.S. are also working together under the iCET (U.S.-India Initiative on Critical and Emerging Technology) framework, which aims to strengthen their partnership in areas like critical minerals, semiconductors, biotechnology, and defense. Although it’s still early, iCET is helping India build resilient supply chains, enhancing its manufacturing capabilities and independence in critical technologies.

India’s move to join MSP and its partnerships with the U.S. is about strategic independence as much as economic growth. China’s control over critical mineral supply chains poses a risk, especially given India’s security concerns and the sometimes-tense relationship between China, India, and the U.S. By building partnerships and strengthening its own capabilities, India aims to reduce its reliance on Chinese supply chains, protect its interests, and ensure a stable supply of these essential resources.

The U.S. sees India as a key ally in reducing its reliance on China, aligning the two countries’ goals in critical minerals and emerging technology. This shared interest strengthens India’s role in global supply chains while enhancing its strategic resilience.

Ultimately, the focus on critical minerals comes down to energy security and resilience. As India pursues ambitious renewable energy goals, relying solely on imports is risky. Any disruption in the supply of critical minerals could set back these plans, making it crucial for India to develop domestic capabilities.

India’s involvement in the MSP brings a unique perspective. As a developing nation with significant growth potential, India offers a relatable approach to partnerships across Asia, Africa, and Latin America. This makes India a valuable partner in regions where Western influence may face resistance, positioning it as a bridge-builder and reliable collaborator.

In summary, India’s focus on critical minerals is about securing our future economic stability and reducing vulnerability to global supply chain shocks. By joining the MSP and strengthening ties with the U.S., India is positioning itself as a key player in the critical minerals space, aiming to create a complete, self-sustaining industry to support everything from electric vehicles to advanced defense systems.

Inside ITC's latest quarter

ITC, one of India’s biggest business groups, recently announced its quarterly results for the period ending September 2024. This isn’t just financial news for shareholders; ITC’s size means its results give us a sense of what’s happening across India’s economy.

To give some context, ITC operates in a variety of sectors, including cigarettes, FMCG, agriculture, hotels, and paper products. So, by examining ITC’s performance, we can get a better picture of trends in these important parts of the economy.

For this quarter, ITC reported total revenue of ₹20,360 crore, a 16% increase compared to the same period last year and a 12.6% rise from the previous quarter. On the profit side, ITC recorded a Profit After Tax of ₹5,078 crore, slightly up from last year’s ₹4,927 crore and the previous quarter’s ₹4,917 crore.

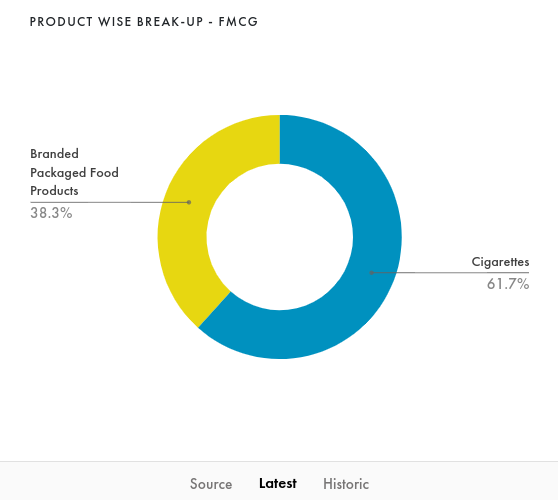

To understand what’s driving these numbers, let’s break it down by sector. We’ll start with the company’s biggest revenue generator—cigarettes—and then look at FMCG, agriculture, hotels, and paper.

ITC’s cigarette business remains its most profitable. Despite facing rising costs for leaf tobacco, this segment has shown strong resilience. This quarter, cigarette revenue climbed to over ₹8,000 crore, a 7.3% increase from the same time last year.

So, why are costs rising? Here are three main reasons:

Unseasonal Rains: Excessive rain during key growing periods has reduced the quality and quantity of leaf tobacco, a crucial ingredient in cigarettes.

Supply Chain Delays: Delays in processing and transportation have pushed up prices for high-quality tobacco.

Rising Export Demand: Indian tobacco is in high demand overseas, making it less available for domestic companies like ITC.

By looking at these details, we can better understand how ITC’s performance reflects larger trends in India’s economy across multiple sectors.

Despite these challenges, ITC is maintaining its market leadership. They’re adjusting their prices to manage these rising costs and focusing on premium offerings, which continue to perform well for them.

Moving on, let’s look at ITC’s FMCG segment—the part of the business that includes everyday items like food, personal care products, and more. This segment brought in ₹5,578 crore in revenue, a 5.4% increase from last year.

But here’s an interesting point: ITC’s notebook sales spiked last year when schools reopened post-COVID. This surge created an unusually “high base” for comparison, which makes this year’s growth appear lower, even though it remains steady.

To break down the “high base effect” in simple terms: when sales in a previous period are unusually high, it can make the current period seem weaker by comparison, even if business is actually stable. Last year’s rush for notebooks created this high base effect.

Excluding the impact of notebooks, ITC’s FMCG segment actually grew by about 7%, driven by products like Aashirvaad Atta (wheat flour), Sunfeast biscuits, and Bingo! snacks. A significant part of their strategy involves “quick commerce”—where customers order essentials through apps like Blinkit and Swiggy Instamart. ITC has adjusted its product lineup for these platforms, and while specific numbers aren’t available, this is a growing area for them.

Now, let’s move on to ITC’s agri-business segment, a major revenue driver that contributes around 28% of its total revenue. This quarter, the segment brought in ₹5,781 crore, marking a massive 47.1% growth compared to last year.

So, what does ITC’s agri-business actually do?

Unlike companies that only buy and sell raw agricultural products, ITC is involved in every step of the process. Here’s how:

Leaf Tobacco Exports: ITC is a key player in exporting Indian tobacco, and supplying high-quality tobacco to international markets, making this a profitable segment globally.

Value-Added Products: ITC processes and packages agricultural products like coffee, spices, fruits, and vegetables. These aren’t just raw exports; they’re tailored to meet global standards.

Farm-Level Partnerships: ITC works directly with over 7.5 lakh farmers across India, training them in “climate-smart” farming practices. This approach helps farmers grow more resilient, higher-quality crops, benefiting both the farmers and ITC.

By investing in climate-smart agriculture, ITC ensures a reliable supply of quality products, secures long-term relationships with farmers, and strengthens its position in both domestic and international markets.

Let’s move on to ITC’s hotel segment, which reported ₹728 crore in revenue this quarter, showcasing a 12.1% growth compared to last year. This growth is particularly impressive given it follows a strong year with a boost from major events like the G20.

Several factors are driving this growth:

Better Occupancy and Revenue: Higher room occupancy and improved room rates have boosted the revenue.

Asset-Light Model: Instead of owning hotels, ITC focuses on managing them. This approach, called an asset-light model, has enabled ITC to expand rapidly. Over the last two years, ITC has added 30 properties to its portfolio.

International Expansion: ITC recently opened its first international hotel, ITC Ratnadipa, in Colombo, Sri Lanka, which has already received positive feedback.

ITC is also in the process of spinning off its hotel business. This move allows ITC to focus more on its core businesses, like cigarettes and FMCG, while giving shareholders the potential for growth in the hospitality sector.

Lastly, there’s ITC’s paper and packaging business, which earned ₹2,114 crore this quarter. This segment saw just a 2.1% growth from last year, facing a couple of notable challenges:

Cheap Chinese Imports: Low-cost paper products from China are flooding the Indian market, making it harder for ITC to maintain profitable pricing.

Rising Wood Costs: Unseasonal rains and stricter environmental regulations have driven up wood prices, which is a key material for paper products.

These factors are putting pressure on profit margins, so growth in this segment has been slower. However, ITC is responding by increasing exports and improving cost management to help offset these challenges.

Key Takeaways

In summary, ITC’s latest results provide a strong view of the state of multiple sectors in India.

- Cigarettes, its oldest and most profitable segment, continues to perform well, even with rising input costs.

- FMCG and agriculture are expanding, showing the benefits of ITC’s approach of mixing staple products with quick commerce and value-added agricultural exports.

- The hotel segment is strategically growing, and the planned demerger will allow ITC to sharpen its focus on its main businesses.

- The paper segment faces challenges from both international competition and rising costs, but ITC is working to mitigate these pressures.

Across all segments, ITC is adapting—whether by focusing on premium products, building strong farmer partnerships, or expanding internationally. This resilience and adaptability keep ITC as a key indicator of economic trends in India.

Tidbits

India plans to build 50 new airports to strengthen connectivity and meet rising air travel demand. With air passenger traffic set to double in five years, this expansion targets job creation and long-term economic growth.

Swiggy has reduced its IPO valuation target to $12.5-13.5 billion, adjusting to market volatility. The IPO, aiming to raise $1.4 billion, reflects strong interest but cautious investor sentiment in India’s IPO market.

Jabil, an Apple supplier, plans to invest up to $275 million for two new facilities in India, expanding production of components like AirPods and iPhone casings. This highlights India’s growing role in global electronics manufacturing.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments