Are we headed for the greatest oil shock ever?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

You can also listen to The Daily Brief in Hindi.

Today on The Daily Brief:

Are we headed for the greatest oil shock ever?

China is pumping money. Again!

Smartphones are now India’s largest export to US

Are we headed for the greatest oil shock ever?

A huge development recently took place—Hassan Nasrallah, the leader of Hezbollah, was killed in a targeted strike by Israel. If you’re not familiar, Hezbollah is a militant group and political party based in Lebanon, heavily backed by Iran.

So, why does this matter? Well, Nasrallah has been the face of Hezbollah for decades. Taking him out is part of Israel’s broader strategy to weaken Iran’s influence in the region. Over the past few months, Israel has been ramping up its fight against Hezbollah, targeting and eliminating over a dozen top commanders.

This isn’t just a random event—it’s a major escalation, and it brings the real risk of sparking something bigger, especially if Iran chooses to retaliate. And that’s where things get complicated.

You see, Hezbollah is tightly connected to Iran, and any response from Iran could push the entire region closer to a full-scale war. This comes on top of the ongoing conflict between Israel and Hamas, which has already heightened tensions in the Middle East. So now, the big question is: what happens if Iran steps in? How would that affect the rest of the world, especially global markets and oil prices?

If Iran gets involved directly, we could be looking at a potential full-blown war across the Middle East. This wouldn’t stay just a regional conflict—it could pull in global powers. The US is Israel’s closest ally, while Iran has support from countries like Russia and, sometimes, China. If things escalate, it’s not just the Middle East that’s affected—it could spread to places like Iraq, Syria, and Lebanon, and from there, things could spiral out of control.

But the real concern for us as investors is how this could impact the global economy, especially energy markets. The Middle East supplies around 30% of the world’s oil, and if something major disrupts that, oil prices could skyrocket.

According to Bloomberg and the World Bank, here are a few scenarios we could be facing:

If the conflict stays somewhat contained, oil prices could jump to between $93 and $102 per barrel, similar to what happened during the Iraq war in 2003.

If things escalate to a bigger conflict, oil prices could spike to $109-$121 per barrel.

In the worst-case scenario, a full-scale regional war could push prices as high as $157 per barrel—which would be catastrophic.

And it’s not just about oil. When oil prices go up, so does the cost of pretty much everything—shipping, food, raw materials—you name it. So, no matter where you are in the world, this will hit your wallet.

Let’s zoom out for a moment and look at how much of what we consume depends on global shipping routes. A major conflict in the Middle East would disrupt these routes, driving up the cost of transporting goods—from raw materials to finished products. This could mean shortages, higher prices, and more inflation.

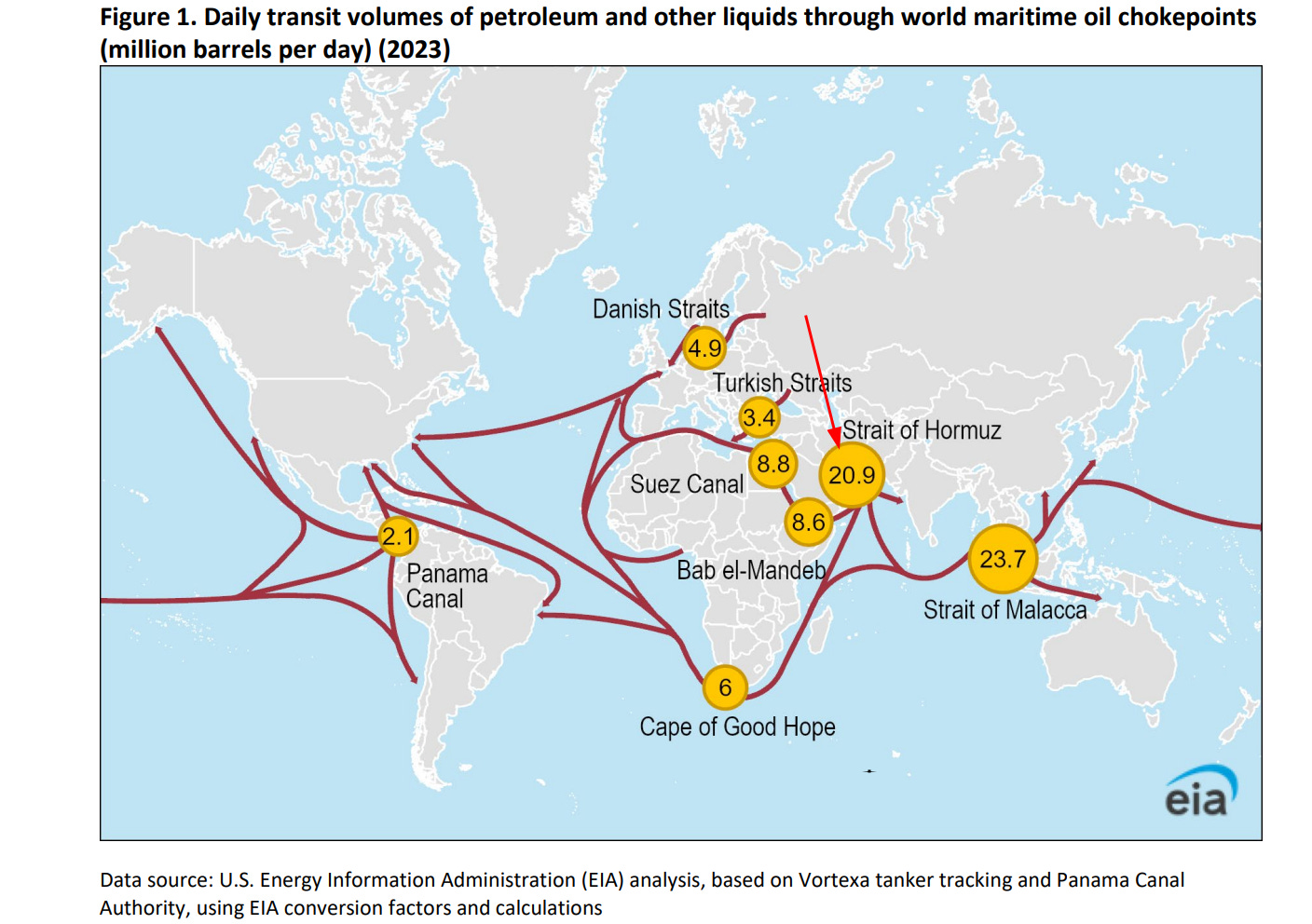

A key factor here is the Strait of Hormuz. If you’re not familiar, it’s a narrow waterway that connects the Persian Gulf to the Arabian Sea and is the main route for about 20% of the world’s oil and 25% of its liquefied natural gas (LNG).

If the Strait of Hormuz gets blocked, even temporarily, oil prices could skyrocket overnight. There are a few alternative routes, like pipelines in Saudi Arabia and the UAE, but they don’t have enough capacity to make up for a full shutdown of the Strait. In short, there aren’t any real alternatives to prevent a massive disruption.

This would hit Asia the hardest, especially countries like China, Japan, India, and South Korea, which are the largest importers of Middle Eastern oil. Europe and the US would also feel the impact, although the US has been reducing its reliance on Middle Eastern oil. Still, wherever you are, this would be bad news.

Now, you might wonder—could Iran really close the Strait of Hormuz? Historically, Iran has made threats to do so, but they’ve never followed through. That’s because Iran itself relies on the Strait for 90% of its oil exports. Shutting it down would hurt them as much as anyone else, maybe even more. Plus, the US has a strong military presence in the region specifically to keep these shipping lanes open.

So, while Iran could cause temporary disruptions or harass ships, a full closure of the Strait would likely lead to a major military response from the US. While it’s possible, it’s not the most likely scenario.

China is pumping money. Again!

Moving on to the next story, let’s talk about what’s happening with China’s economy and why experts are calling the country’s latest stimulus package a "bazooka." If you’re curious about why China needs this stimulus in the first place, there’s some interesting economic history behind it. We covered this over the weekend in the weekend edition—Around the World.

Recently, Chinese policymakers introduced a set of measures to boost the economy and stabilize financial markets. These include interest rate cuts, support for the struggling property sector, stock market interventions, and fiscal stimulus through bond issuances. The People’s Bank of China is also offering around $100 billion in loans to encourage stock purchases and buybacks.

However, the details of these measures are still a bit vague. What we have now is more like a framework or a signal of intent rather than a fully fleshed-out plan.

So, why is China doing this, and why should we care?

China is currently facing several big challenges:

Property Sector Crisis: Home prices have been falling for four years straight, which is a big deal because real estate makes up about 30% of China’s GDP. Since the peak in 2021, home prices have dropped by 20-40%. Given that 70-80% of household savings in China are tied to real estate, this is a huge problem.

Weak Consumer Confidence: People aren’t spending as much as they used to, and consumer confidence has hit record lows.

Local Government Debt: Local governments are drowning in debt. The IMF estimates that China’s total government debt, including local financing, will hit 110% of GDP in 2023.

Slowing Economic Growth: Official numbers show GDP growth at 5.2% for 2023, but many economists believe it was actually lower, around 3-5%.

Low Inflation, Even Deflation: Inflation has been so low that China has occasionally dipped into deflation. In August 2024, inflation was just 0.6%.

Now, can this new push really turn things around? Let’s break it down problem by problem:

The Property Sector: The real estate crisis is a deep-rooted issue that won’t be fixed overnight. There’s an oversupply of housing in many cities, and future demand will likely come from people upgrading their homes, not new construction. But right now, people have stopped buying altogether.

The Financial System: China’s financial system, which used to drive growth, is now holding it back. Banks are struggling with low profits, and even though interest rates are at record lows, credit growth has slowed.

Shrinking Fiscal Capacity: China’s ability to spend its way out of problems is shrinking. Government revenues (both tax and non-tax) have dropped from 22% of GDP in 2015 to just over 16% recently.

Demographic Decline: China’s working-age population has been shrinking since 2013. Historically, it’s rare for an economy with a declining workforce to grow faster than 3% over the long term.

To give you some perspective, back in 2008 during the global financial crisis, China launched a massive 4 trillion yuan ($580 billion) stimulus package. This new package is significant, but much smaller and more targeted. It’s aimed at solving specific problems rather than just flooding the economy with cash. Still, it shows that China is taking things seriously, and we could see more actions soon.

Despite these challenges, some big investors are optimistic. Billionaire hedge fund manager David Tepper recently said he’s buying "everything" related to China, believing that Chinese stocks are undervalued. Many companies in China are trading at low price-to-earnings ratios, with solid growth potential, especially when compared to more expensive U.S. stocks.

In fact, Chinese stocks have already started to bounce back. By the end of September 2024, the CSI 300 Index, which tracks large Chinese companies, had its biggest weekly gain since 2008.

But let’s not get too excited just yet. As of August 2024, the MSCI China Index was trading at a forward P/E ratio of just 8.9. That’s much lower than the broader emerging markets index at 11.75, and the MSCI All-Country World Index at 17.72. So while Chinese stocks may offer value, they also come with significant risks. Fun fact: since its launch in 1992, the MSCI China Index has delivered a total return of… zero. So, China is a good example of how the economy and the stock market don’t always move in sync.

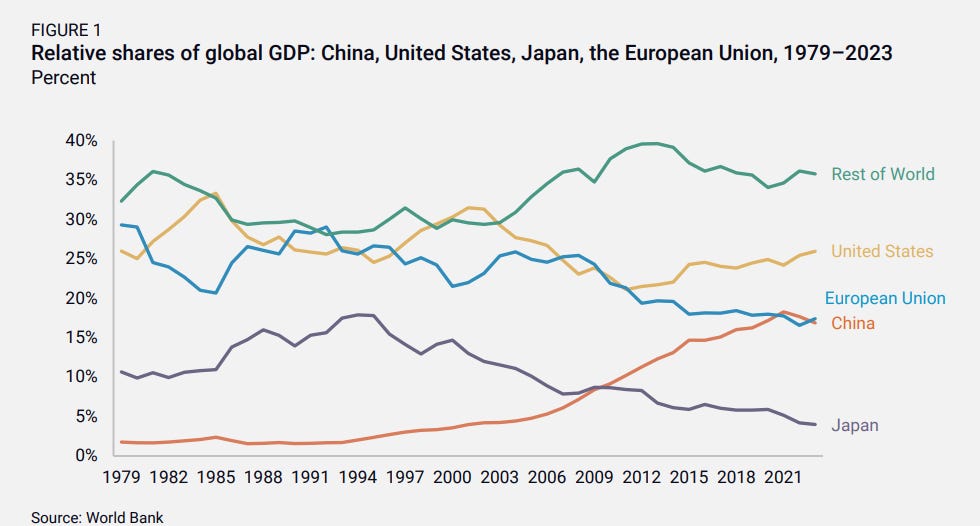

While this stimulus might boost the stock market in the short term, it’s less likely to solve China’s deeper economic problems. Some economists believe China’s economy may have already peaked as a share of the global economy. It reached its highest point at 18.3% of global GDP in 2021, and it’s been declining since.

China’s long-term challenges are structural:

China needs to shift from an investment-driven economy to one led by consumer spending. But household income is just 61% of GDP, which is low compared to global standards.

The banking system needs reform. Many banks are struggling with low capital, and they’ll need to write off bad loans and stop lending to failing businesses.

With a shrinking working-age population, it’s tough for any economy to grow faster than 3% over a five-year period.

The global environment has changed. Many countries are diversifying their supply chains away from China, making it harder for China to rely on export-driven growth.

Some analysts are comparing this moment to Europe’s “Draghi moment,” referring to Mario Draghi’s famous 2012 pledge to do "whatever it takes" to save the euro. But China isn’t quite in the same position, and here’s why:

In the short term, the government is signaling a “buy” for Chinese stocks by providing support, but this is more about stopping things from getting worse than driving aggressive growth.

The stimulus is meant to prevent a downward spiral in confidence, not to push for major economic expansion.

It doesn’t address long-term issues like demographic decline, high debt, or the need to shift from an investment-led economy to one driven by consumer spending.

So, in short, while China’s latest measures have sparked some optimism in the stock market, their impact on the real economy is still uncertain. China’s bigger challenges are structural, and short-term fixes won’t be enough to solve them. For now, we’ll have to wait and see how things play out.

Smartphones are now India’s largest export to US

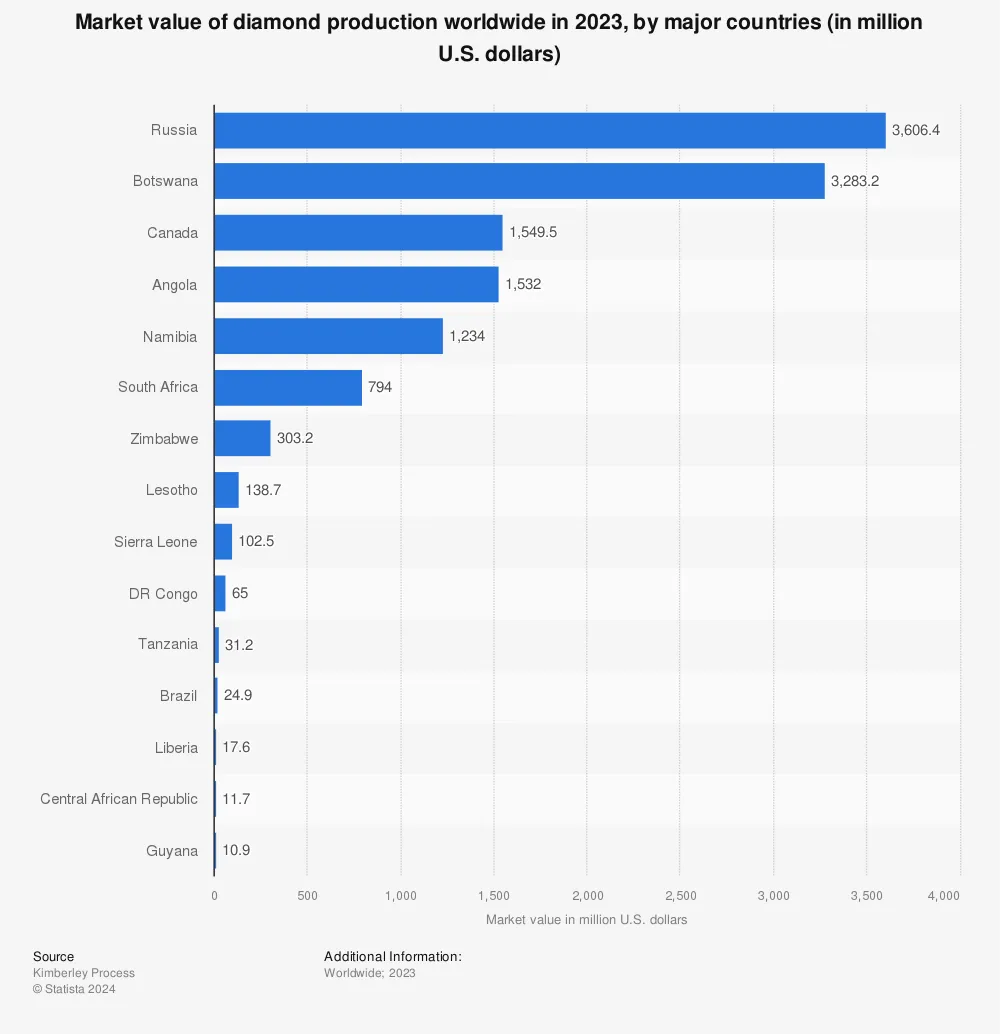

For a long time, India was known as the largest exporter of non-industrial diamonds to the US. This reputation came from India’s long-standing leadership in the global gem and jewellery market.

But recently, something surprising has happened—smartphones, led by Apple’s iPhones, have overtaken diamonds as India’s largest export to the United States!

In the June quarter of FY25, India exported $2 billion worth of smartphones to the US, while diamond exports fell to $1.44 billion. And this isn’t a one-time thing. The shift started to become noticeable in the December quarter of FY24, and the gap has only widened since. Smartphone exports have surged by 43%, while diamond exports have dropped by almost 5%.

So why is this happening? Let’s break it down:

First, the diamond industry. India’s diamond sector has been a global export leader for a long time. But lately, it’s facing serious challenges. In fact, overall diamond exports have dropped by about 30% compared to last year, which is a huge decline. On top of that, the price of rough diamonds has been falling steadily for the past 18 months.

Dinesh Navadiya, chair of the Indian Diamond Institute, even said the industry is at a “breaking point.”

Here are the main reasons why:

G7 Ban on Russian Diamonds: In December 2023, the G7 countries imposed sanctions on Russian diamonds. This was a major setback for India because 30% of our rough diamonds used to come from Russia. The sanctions also apply to diamonds processed in other countries, including India. This adds compliance costs, making it harder for our industry to stay competitive.

Declining US Demand: The US is India’s largest diamond market, but demand there has dropped significantly. High interest rates have led people to spend less on luxury goods, and lab-grown diamonds are becoming more popular, especially for engagement rings. As a result, natural diamonds are losing some of their shine in the market.

China’s Economic Slowdown: China is another big player in the diamond market, and their economic troubles are impacting India’s exports. Chinese demand for diamonds has dropped by nearly 30%.

When two of your biggest markets slow down, it’s a tough spot to be in. Factories in Surat, the heart of India’s diamond industry, are now operating only two days a week—a clear sign of the pressure the industry is under.

On the flip side, India’s smartphone industry—especially Apple’s iPhones—is booming. So, what’s driving this surge in exports?

It’s a combination of global supply chain shifts and smart government policies.

First, Apple has been diversifying its supply chain away from China. We’ve all heard about the “China+1” strategy, where countries are trying to reduce their reliance on Chinese goods and services. India is a big winner here. Apple has invested heavily in manufacturing in India, and now 14% of Apple’s global iPhone production happens in India. That means 1 in every 7 iPhones worldwide is made here!

A major factor behind India’s success is the government’s Production Linked Incentive (PLI) scheme. This policy has played a key role in attracting foreign investment and boosting local manufacturing. Thanks to the PLI scheme, Apple’s exports from India hit $12.1 billion in FY24. And with the ongoing trade tensions between the US and China, more companies are looking at India as an alternative manufacturing hub.

So, what does this mean for India’s economy? For years, we relied heavily on labor-intensive industries like diamond cutting. But now, we’re seeing a shift toward high-tech manufacturing, and that’s a big deal.

This shift goes beyond smartphones. As the world becomes more tech-dependent, India is positioning itself as a key player in high-tech manufacturing. Policies like the PLI scheme are helping us attract the investment needed to compete on a global scale.

However, with this shift come new challenges. High-tech manufacturing requires a more skilled workforce compared to industries like diamond cutting. India will need to invest heavily in workforce development to meet the demand for specialized skills.

But if the growth in smartphone exports is any sign, India is on its way to becoming a global manufacturing powerhouse.

Tidbits

Zydus Lifesciences just got the green light from the USFDA to sell Enzalutamide capsules, a treatment for prostate cancer. With the drug pulling in $870 million annually in the U.S., this approval is a big deal for Zydus as it strengthens its presence in the U.S. market.

Starting from October 1, the NSE and BSE are rolling out a new fee structure for equity and derivatives trading. This change comes in line with SEBI’s efforts to make trading fees equal for everyone.

Kalyan Jewellers’ promoter secured a ₹1,300 crore loan from Oaktree Capital to buy Warburg Pincus’ stake in the company. The loan is backed by 8.51 crore pledged shares, helping the promoter increase their stake in Kalyan Jewellers.

OpenAI is now raking in $300 million a month in revenue, with annual sales expected to hit $3.7 billion. However, the company is facing steep losses, with projections showing it could lose $5 billion in 2023 due to its rapid growth.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

In a few places in the article, ‘2023’ is used. Does that refer to 2024?