Are the telecom wars over?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

You can watch the full video here:

In today’s episode, we look at 6 big stories:

F&Oh No!

Are the telecom wars over?

Will Blackstone eat Haldiram’s Bhujia?

Being a PMS manager just became harder

Ola is taking a cab to court

Love hate relationship between India and China

F&Oh No!

SEBI has been getting pretty concerned about the number of people losing money trading futures and options (F&O). Last fiscal year, a staggering 92.50 lakh unique investors traded in index derivatives, and a whopping 85% of them ended up with net trading losses. That's a huge chunk of people not doing so well in this space.

In response, SEBI formed a committee to come up with recommendations on how to reduce this speculative trading. The committee's suggestions led to SEBI publishing a consultation paper just yesterday. Here’s what they’re proposing:

Limiting Weekly Options Contracts:

Currently, you can trade six weekly options contracts on multiple indices, like Bank Nifty (expires on Wednesday), Nifty (Thursday), and Sensex (Friday).

SEBI wants to restrict these weekly options to only major benchmark indexes per exchange. So, for example, only Nifty and Sensex might have weekly options, while the rest will switch to monthly expiries.

Calendar Spread Benefit Changes:

If you hold two options on the same index but with different expiry dates, you currently get a margin benefit, known as a calendar spread.

SEBI proposes that on the expiry day, the margin required will increase by 1-3% of the contract value. This could mean higher costs for traders on that day.

Increasing Contract Sizes:

The last review of contract sizes was in 2015. Since then, markets have grown a lot.

SEBI suggests increasing contract sizes by about three times. So, the value of an index derivatives contract, currently between 5-10 lakhs, might be bumped up to 15-20 lakhs initially, and then to 20-30 lakhs after six months.

These changes are significant and aim to make F&O trading a bit less attractive for retail investors who might not fully grasp the risks involved. SEBI’s goal here is to reduce the number of people losing money by curbing speculation and making sure those who do trade are better prepared for the potential pitfalls.

Are the telecom wars over?

Before 2010, telecom was one of the hottest sectors in India. Everyone, including the biggest industrialists, wanted a piece of the action. But soon, it became clear that telecom is a capital-hungry industry, and over the next decade, we saw a lot of players fall by the wayside.

Remember Uninor, Tata-DOCOMO, RComm, and Aircel? They all either got acquired or shut down. Today, the telecom industry is dominated by just Bharti Airtel and Reliance Jio. There are a few other players like Vodafone-Idea, BSNL, and MTNL, but they’re struggling with all sorts of problems.

Interestingly, telecom stocks were some of the worst-performing investments over the last decade. But things are slowly starting to change now.

The last big shakeup in the sector was when Reliance Jio entered the market with its free plans. Thanks to its aggressive pricing, Jio quickly gained market share, mainly at the expense of Vodafone and BSNL. Today, Jio and Airtel are the only dominant players left.

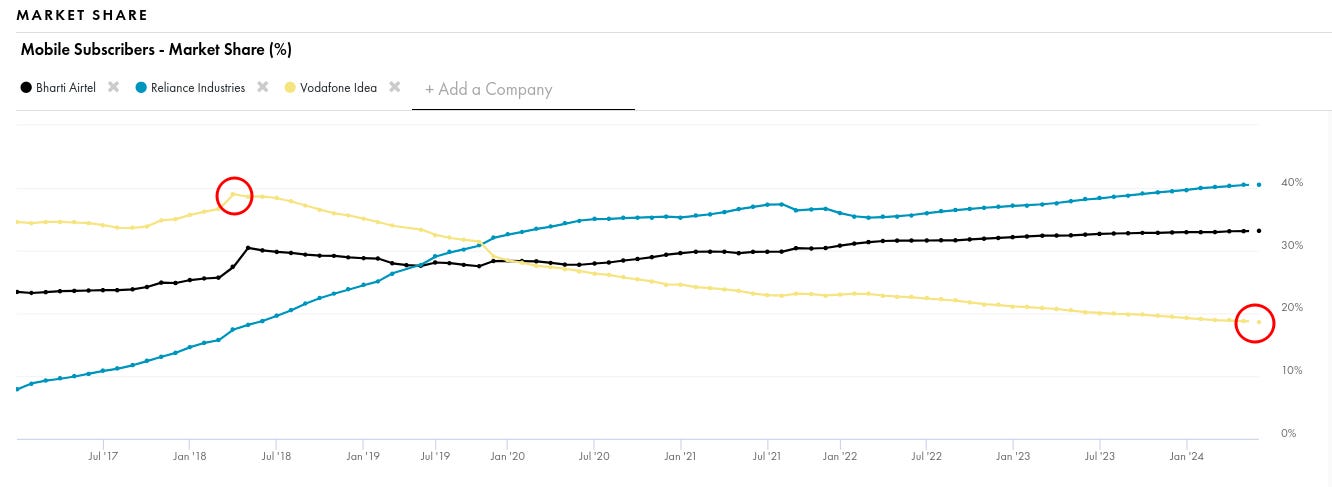

Can you guess who was the market leader back in 2018? Believe it or not, it was Vodafone! They had a market share of close to 35%-40% of mobile subscribers. But due to the rise of Jio and Airtel, Vodafone’s share has now fallen to less than 20%.

Vodafone-Idea could never get its act together. With massive investments in spectrum and the pricing wars initiated by Jio, they accumulated a ton of debt and couldn’t keep up with Airtel and Jio. They were saved by a bailout from the Indian government. Things got so bad that they started paying their suppliers with shares instead of cash!

Recently, S&P published a report on the telecom sector with some interesting insights. Now that Jio and Airtel are the main players left, they can focus on improving their financials instead of constantly fighting price wars.

Telecom is a capital-heavy sector, and both companies have already invested heavily in rolling out 4G and 5G services. Any increase in tariffs will now directly improve their profitability. Jio took the first step and announced a tariff hike, soon followed by Airtel and Vodafone-Idea, with prices going up by 10% to 25%. This is the first significant across-the-board price hike since November 2021. Now, their focus is on generating more revenue per user.

Sunil Bharti Mittal, the Chairperson of Airtel, said in an interview with ET: “We have spent nearly Rs 80,000 crore on 5G spectrum and rollout. Our competition has spent more than Rs 100,000 crore and there are no additional revenues as you know. So, the time has come now to start to rationalize and repair tariffs.”

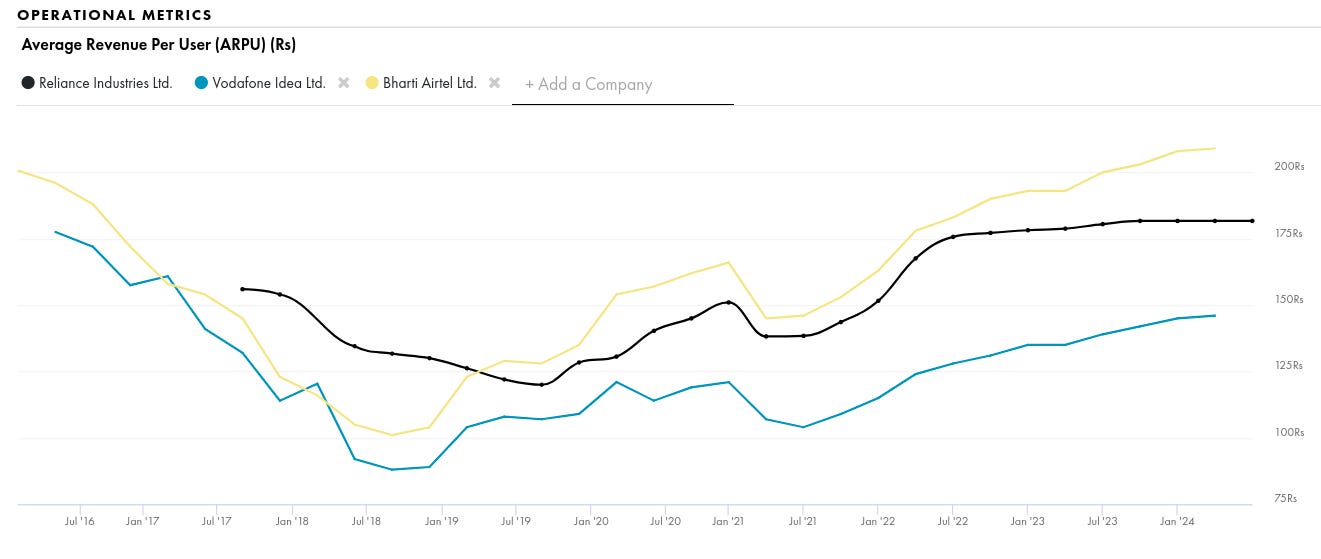

He also said: “I think we are heading towards an ARPU of Rs 300, and I hope it happens within the coming financial year, which we are entering from April 1. We need more investments into fibers, infrastructure, and rural areas.”

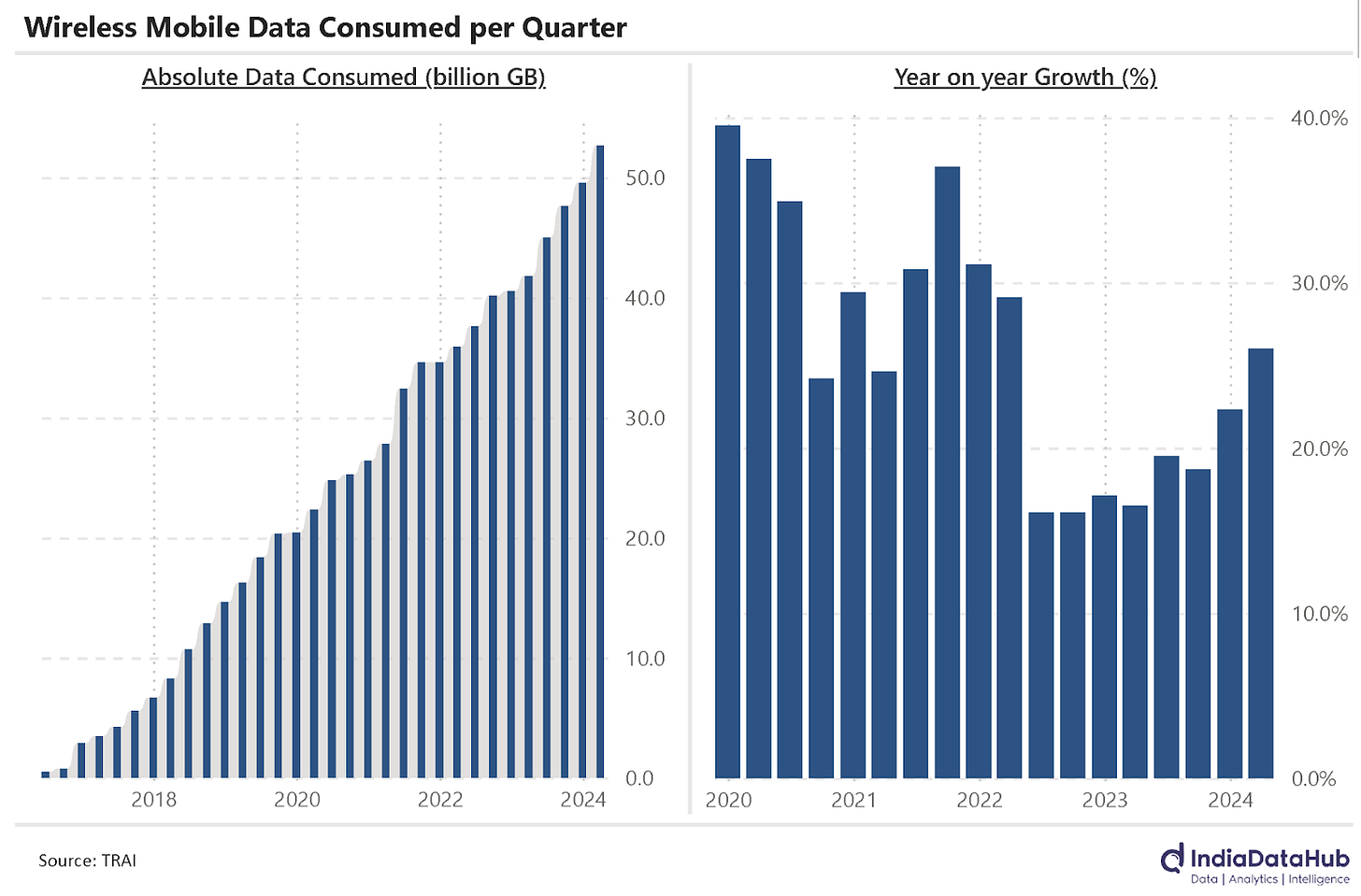

While price hikes can lead to some customers dropping their plans or switching to cheaper options, data consumption habits are generally sticky. Once a customer gets used to certain data usage levels, they are likely to continue using similar amounts of data even if prices go up.

Just to put it in numbers: During the March quarter, people used over 5,000 crore GB of mobile data. That’s almost double the amount of data used three years ago!

One interesting insight about the telecom sector is that every Rs. 10 increase in ARPU will translate into an annual EBITDA boost of over Rs. 2,500 crores for Bharti Airtel and over Rs. 3,000 crores for Reliance Jio. The telecom companies expect ARPU to keep rising as they implement more tariff hikes. These higher ARPUs will help them recover their investments in network infrastructure, including the recent rollouts of 5G services.

Interestingly, the government has been forced to help the smaller telecom players to keep them afloat. MTNL, another struggling company, was about to default on bond interest payments a few weeks ago, and the government had to step in to cover it because of a guarantee.

Last year, the government approved a massive rescue package worth more than Rs. 80,000 crores to boost BSNL's 4G and 5G capabilities. They’re doing everything they can to keep these smaller players from going under.

Will Blackstone eat Haldiram’s Bhujia?

Moving on to the next story for the day, there’s some big news brewing with Blackstone, one of the world's biggest private equity firms. They’re looking to buy a 51% stake in Haldiram's. This story has been developing for a while now, but it looks like things are finally moving forward. Let me break it down for you:

Blackstone, along with Abu Dhabi Investment Authority and Singapore's GIC, is bidding around ₹40,000 crore to buy this stake in Haldiram’s. If this deal goes through, Haldiram’s will be valued somewhere between ₹70,000 and ₹78,000 crore. That would make it one of the largest private equity buyouts in India—a huge deal!

Now, you might have heard about this before, as the Haldiram’s story has been making rounds for quite some time. The holdup has been around issues of who would own Haldiram's restaurants and the brand license after the deal. But according to anonymous sources reported by MoneyControl, these issues have been resolved. Here’s the scoop:

Blackstone’s Role: If the deal goes through, Blackstone will control Haldiram's product business and get a permanent license to use the Haldiram brand.

Haldiram Family’s Role: The Haldiram family will keep control of the restaurant operations and receive an annual royalty fee for the use of the brand.

We might get official confirmation in the next 6-8 weeks, but interestingly, Blackstone is denying any truth to this story for now. However, it seems like Haldiram’s is already restructuring in preparation for the deal.

The Delhi and Nagpur branches of the Haldiram’s family have merged their businesses into a new entity called Haldiram Snack Foods Private Limited. The Delhi branch owns 56% of this new company, while the Nagpur branch owns 44%. This merger has even gotten approval from the Competition Commission of India.

Now, all this got me curious about two questions: Why is Blackstone so interested in Haldiram’s? And what will a private equity firm do with Haldiram’s after buying it?

Here’s what I found out:

Why is Blackstone Interested?

Blackstone has been investing in India for over 16 years. Their strategy is to bet big on the growing middle class and the young population of the country. For them, Haldiram’s is a perfect way to reach this audience.

What Will Blackstone Do with Haldiram’s?

When a private equity firm like Blackstone buys a company like Haldiram’s, it’s not entirely with their own money. They use a mix of their own funds and borrowed capital from banks. Interestingly, the debt is not on Blackstone’s balance sheet but on Haldiram’s.

The original owners or promoters get their money and move out of the picture. The PE firm then sets up a new management team to run the company, aiming to grow it significantly. The goal is to either take it public (IPO) or sell it at a higher price for a profit.

If this Haldiram’s deal goes through, it’ll be quite a turnaround because PE investments in India were at a six-year low in FY24. This deal could signal a revival.

Globally, PE and VC firms have a record $2.62 trillion of uncommitted capital, meaning they have a lot of money but not many places to invest it. So, they’re turning their attention to growing markets like India. The world’s biggest PE firms, like KKR and Blackstone, are very bullish on India and have already announced significant investment plans for the coming years.

Being a PMS manager just became harder

So, most of us know by now that the Finance Minister increased the long-term capital gains tax (LTCG) from 10% to 12.5% and the short-term capital gains tax (STCG) from 15% to 20% in the latest budget. This move is aimed at controlling market activity, but it’s going to make life tough for certain types of investments.

Let me break it down for you:

When you invest in a mutual fund, you pay either LTCG or STCG depending on how long you hold it. The beauty of mutual funds is that you don't pay taxes on the trades happening inside the fund. So if a fund manager buys and sells a stock within 6 months, you don't pay any taxes on that. You only pay based on your holding period of the fund.

But this isn’t the case for portfolio management services (PMS) and alternative investment funds (AIFs). With a PMS, your investments aren't pooled like in a mutual fund. They happen in a demat account in your name, so you're taxed as if you invested on your own. The same goes for Category 1 and Category 2 AIFs.

Now, because of this capital gains tax hike, both PMS and AIFs will need to generate about 2-4% more returns just to match the post-tax returns of an average mutual fund. That’s a big deal!

And if you think 2-4% isn’t much, let me tell you that most active mutual funds don’t even beat their benchmarks. So, imagine a PMS trying to do this with the added tax disadvantage. It’s a tall order!

Ola is taking a cab to court

MapMyIndia, one of India's biggest digital mapping companies, has sued Ola Electric, the country's largest electric two-wheeler manufacturer. Here’s what’s going on:

MapMyIndia claims that Ola copied their data to build their own Ola Maps. They allege that Ola cached and saved their data and reverse-engineered a licensed product. This all stems from an agreement that Ola Electric and MapMyIndia signed back in June 2021. According to this agreement, Ola was prohibited from co-mingling, mixing, or reverse-engineering MapMyIndia’s data to create their own map service.

But according to MapMyIndia, that’s exactly what Ola Electric has done with Ola Maps. This is a big deal because Ola, MapMyIndia, and Google Maps are currently in a fierce competition to capture the Indian mapping market.

MapMyIndia has shown impressive growth over the last few years, but they're now facing threats from both Ola and Google. Ola recently announced their own map service, and Google decided to reduce its map prices by 70% in India.

Ola claims that their maps will address India-specific challenges that Western mapping apps struggle with. They’re using AI algorithms and real-time data from millions of vehicles, which is something that MapMyIndia could be worried about.

For now, Ola Electric is denying MapMyIndia's allegations. They say the claims are false, malicious, and misleading.

This legal battle could have significant implications for India's mapping industry, especially since Ola Electric is preparing for its IPO soon! It’ll be interesting to see how this story unfolds.

Love hate relationship between India and China

Last week, I talked about how India wants to be friends with China again.

India and China have had a pretty rocky relationship since their border clash in 2020. But it looks like things are starting to improve. While India still wants China to sort out the border issues, it also needs Chinese technology and investments to boost its industries. Despite all the push for “Make in India,” the reality is we can’t manufacture everything at home. Whether we like it or not, we will have to rely on China for some things.

But here’s the twist—yesterday, Piyush Goyal, India’s Commerce and Industry Minister, poured some cold water on this by saying there’s no plan to support Chinese investments, despite what the Economic Survey suggested.

Even though Chinese investments in India are tiny—just 0.37% of total FDI since 2000—our trade with China is massive. China is our biggest trading partner, with trade worth more than ₹9,70,000 crore last year. We sell them iron ore, cotton, spices, and veggies and buy a lot of electronics and machinery from them.

The political tensions remain high, but there are some selective areas where things seem to be getting better. There’s a growing recognition in the government that they can’t ban everything from China. Like it or not, we need to work with China.

For example, Indian solar companies like Tata Power Solar, ReNew Photovoltaic, and Avaada Electro need Chinese experts to help them scale up their operations and meet our renewable energy goals. They are asking for visas for Chinese engineers and technicians who are crucial for their projects. Tata Power, for instance, is investing Rs 3,000 crore in a new solar manufacturing plant in Tamil Nadu and needs these experts to get it done. Without their help, projects could be delayed.

Interestingly, the Economic Survey suggested that partnerships between Indian and Chinese companies could be a good idea. These joint ventures (JVs) would let Chinese firms get around US restrictions by making goods in India and then exporting them to the US, taking advantage of India's better relationship with the West.

But setting up these partnerships isn’t without its problems. Manufacturing in India is more expensive than in China. We also lack the necessary technical skills, infrastructure, and extended ecosystem. Plus, we have visa and import restrictions that don’t help.

To make these joint ventures work better, India needs to lower tariffs, improve the Production Linked Incentive (PLI) scheme, and make it easier for businesses to operate. By doing this, we can make these partnerships more attractive and boost our manufacturing capabilities.

So, even though there’s tension on the political front, economic needs are pushing for cooperation. Let’s see how this story unfolds in the coming weeks.