Hi folks, welcome to another episode of Who Said What? I’m Krishna. For those of you who are new here, let me quickly set the context for what this newsletter is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

It looks like protein is everywhere now.

You must have noticed it by now that protein is everywhere. Every FMCG ad, every supermarket shelf, every delivery app — protein, protein, protein.

Five years ago? This wasnt the case at all. Back then protein was just a big whey tub. Today it’s high-protein paneer, high-protein curd, yogurt, high-protein milk. Infact, ITC just launched a protein atta, McDonald’s is doing protein cheese slices. And Amul? They’ve gone as far as a protein kulfi. A kulfi. Clearly, the protein wave is here.

Now, we came across an interview with NDTV Profit, Amul MD Dr. Jayen Mehta said this:

“So by March doubling the capacity for almost for manufacturing of high quality whey protein products double almost every alternate month and by March our capacity this year will be actually six to seven times more than what was in the beginning of the year”

And he didn’t stop there:

“...this is again just the beginning because in terms of demand we just uh uh at the tip of the iceberg though there are more than 2 million active users for our app and we are selling right now only online through our own direct to consumer channel but the market is much much bigger and everyone we believe is a high protein consume”

Six to seven times more capacity. Two million app users already. This is massive.

Why now though? Two threads tie together here.

One is supply. After the monsoon, milk supply in India shoots up. Farmers and cooperatives like Amul end up collecting far more milk than households can drink fresh. Traditionally, that extra was parked in storable products like butter, ghee, skimmed milk powder.

But here’s where it gets interesting. When you turn milk into cheese, you don’t just get cheese. You also get a watery liquid called whey. It’s basically what’s left after the solid curds separate. For decades in India, this whey was considered waste so it was drained off or used as cattle feed. The irony is, whey is loaded with protein.

With new processing technology, that protein can be filtered and concentrated. Think of it like straining out the water to catch the good stuff. The result is whey protein concentrate.

Once you have that base, you can plug it back into everyday foods. Add it to buttermilk, curd, or paneer, and suddenly you’ve got a “high protein” version of something people already eat. Blend it into ice creams, kulfis, or flavoured milk, and the same indulgence doubles up as nutrition.

Amul, for instance, generates nearly 3 million litres of whey every day just from its cheese operations. Until recently, that would’ve gone down the drain. Now it’s being transformed into high-protein milk, yoghurts, paneer, and yes even protein kulfi.

The other thread is demand. See, India is badly protein-deficient. Studies show that nearly three out of four Indians consume less protein than they should, averaging only about 0.6 grams per kilo of body weight per day when the requirement is closer to 0.8–1 gram.

In plain terms, most adults are falling short by at least 10–15 grams of protein a day. And the protein we do eat mostly comes from cereals, which don’t give you the complete amino acid profile. But there’s also a shift happening. Awareness about protein deficiency has slowly started to become mainstream. FMCG brands talk about it in ads, social media feeds are full of them, and the younger generation like me are beginning to look at protein not just as a supplement but as part of everyday food.

That rising awareness may be what’s driving the surge in demand for protein.

Which is why Amul doubling capacity every other month isn’t just expansion. It’s the clearest signal that protein has started slowly entering the Indian grocery basket.

Bessent makes his case against the Fed

One of the biggest questions in global finance, today, is around whether the Trump government shall try and undermine the independence of the United States Federal Reserve.

A few months ago, this may have seemed like a matter of idle speculation. But it’s becoming an active concern. Trump officials’ criticism of the central bank is reaching a fever pitch. There are regular demands from the administration for rate cuts, often accompanying demands for the resignation of various officials. The ugliest of these has been around attempts to oust Lisa Cook, who was sworn in to the Federal Reserve’s Board of Governors, but has been hounded by administration officials ever since.

But the US executive can’t simply interfere with the functioning of the US Fed by creating a public spectacle — or it’ll be soundly thrashed by the markets. It needs more groundwork than that. It has to offer a theory to justify intervention; a case that the markets would be governed better if the US government had more control over the Fed.

That work has started. Recently, Treasury Secretary Scott Bessent wrote an article — cheekily titled “The Fed’s New “Gain-of-Function” Monetary Policy” — which lays the foundation for more government intervention. The title is an attack in itself; it likens the Fed’s policy choices over the last two decades to labs in China that allegedly caused the COVID-19 virus to leak out into the open, creating the world-wide pandemic.

That comparison is clear from the very opening:

“As we saw during the Covid pandemic, when lab-created experiments escape their confines, they can wreak havoc in the real world. Once released, they can’t easily be put back into the containment zone. The “extraordinary” monetary-policy tools unleashed after the 2008 financial crisis have similarly transformed the Federal Reserve’s policy regime, with unpredictable consequences.”

What is so “extraordinary”? Bessent points to “quantitative easing,” which he portrays as the original sin that sent the US economy off the wheels.

Quantitative easing is, at its heart, a way for the government to flood an economy with money, with the help of its central bank. How? See, all governments borrow money by issuing bonds. Usually, the amount they can borrow depends on how much appetite investors have for those bonds. But with quantitative easing, central banks themselves create new money, and then use it to lap up whatever bonds they can from the market. In essence, they become an unlimited source of demand for those bonds. This is a bottomless pit of money for governments, who can suddenly spend a lot more money than they would otherwise have the ability to.

The US Fed had kicked this practice into hyper-drive during the 2008 financial crisis, in the face of much criticism, as all its other tools of stimulating the economy dried up. That’s what Bessent has a problem with. As he says,“...the Fed extended its liquidity tools into uncharted territory, repurposing asset purchase programs as instruments of stimulative monetary policy… These tools were designed to stimulate the economy through various channels, none of which are well understood.”

This, Bessent alleges, unleashed a long list of ills. It caused rampant inflation at various points, while failing to spur the growth the Fed hoped for.

So far, though, this is a policy disagreement. But Bessent then gives it a distinctly political character. As he says, “Economic models… are based on certain beliefs about how the economy works, which may in turn be correlated with various political views. The FOMC has consistently overestimated its own power in stimulating real growth and in controlling inflation. It has overestimated the efficacy of spending-based fiscal policy and underestimated the efficacy of tax cuts and deregulation. In sum, the biases in its model have the same political tilt that has plagued most of Washington for decades: we know better than the market.”

That’s where this piece turns interesting. It flips the Fed into a political opponent to Trump. If Bessent is to be believed, Trump wants to give more control to businesses, while the Fed’s opposed to this idea. Its tools — controlling inflation and controlling money supply — are presented as a market-denying alternative: a belief that governments know better than companies.

From here, while Bessent criticises the Fed’s policies — from the suppression of market signals, to promoting inequality — it reads as the takedown of a political opponent. All of which culminates with questions on whether the Fed should be independent at all:

“The Fed’s growing footprint also has profound implications for the political economy, placing its valuable independence in a precarious position. By extending its remit into areas traditionally reserved for fiscal authorities, the Fed has blurred the lines between monetary and fiscal policy.”

Read that carefully, and you’ll notice how he twists the knife. The way he tells it, the problem isn’t that the executive is trying to interfere with the independence of the US Fed at all; it’s that the US Fed has been trying to enter the US government’s fiscal space!

This attempt to over-step its boundaries is, to him, is why the government ought to override the Fed’s independence. “The Fed’s missteps and policymaking arrogance have placed its credibility at risk, jeopardizing its independence on its core responsibility of monetary policy… The Fed alleges that it needs to be independent. But is it? Or is it captive to the ghosts of its past and of its own ego?”

Is there some concrete change Bessent is pushing for? Most immediately, it’s this:

“The Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency have decades-long expertise in examiner-led, rules-based bank supervision. Day-to-day safety and soundness exams, consumer protection enforcement, and prompt corrective action powers should reside with those agencies, leaving the Fed to focus on macro prudential surveillance, lender-of-last-resort liquidity, and the traditional tasks of monetary policy.”

What does that mean, in simple terms? Well, currently, the Fed performs a lot of oversight over banks and major non-banks, as well as other key parts of the American financial system. Those powers, Bessent suggests, should be rolled back, and given to entities that are more under the government’s control.

But that’s just the beginning. His wider goal is a more comprehensive re-look at everything to do with the Fed.

“It also likely requires an honest, independent, and nonpartisan review of the entire institution and all of its activities, including monetary policy, regulatory policy, communications, staffing, and research.”

We can’t cover everything he says in detail — we recommend you check out the original. But this marks a major chapter in what could be a long, ugly fight, and one of the most consequential of our time.

In 2 minutes, you could make Maggi, but you can’t save a company.

Just last month, Nestle, the global company, hired a new CEO named Philipp Navratil. But he might have one of the most thankless jobs in the world right now — to save one of the world’s largest food companies….ever.

Earlier this week, Navratil held an “All Hands” meeting. Right after, he made his first public comments since being CEO:

“What can each of us do to make Nestle better, smarter and faster? Together, we are...moving fast, open to fresh ideas on how we deliver the future of tasty, healthy, affordable food.”

Well, that sounds nice. Maybe too nice. What it actually is, is an attempt to paper over the carnage that the Swiss giant has been going through over the past few years.

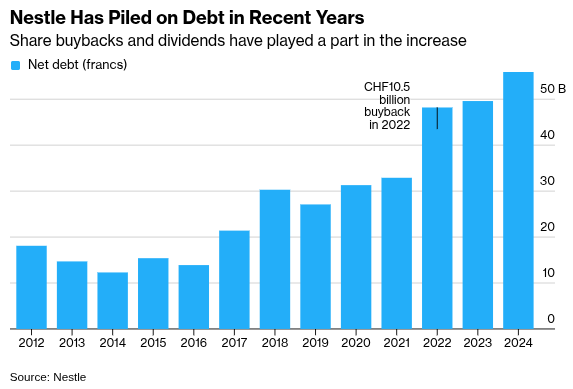

For one, Nestle is bloated with debt. The company borrowed a lot of money to make big acquisitions, particularly in the health and wellness space. This was a strategy led by their ex-CEO from 2016 to 2023, Mark Schneider, who succeeded Paul Bulcke.

But most of them either underperformed, or downright failed. For instance, they had to write-down billions of dollars on their acquisition of peanut allergy treatment company Palforzia. Additionally, huge share buybacks did not help.

Bloomberg covered what investors had to say about Nestle. And they’ve quoted Pierre-Olivier Essig, head of research at AIR Capital, who said bluntly:

“Nestlé has been sleeping — not only the board. Basically they were sold to the idea of Schneider doing health science with Nestlé, and execution was bad. Every company that Nestlé bought since Bulcke was chairman is not bringing results.”

It doesn’t help that lately, Nestle has been rocked by a few scandals. For one, it was recently discovered that the French government helped cover up a mineral water scandal whose main perpetrator was Nestle. Last year, researchers found that Nestle deliberately added more sugar to baby formula sold primarily in developing and poor countries — so that it sells more. It has been accused of having child labour in its supply chains.

Moreover, in the last 2 years, Nestle has been graced by 3 different CEOs — including Navratil. Schneider was let go in 2024 because of his failed acquisitions. He was succeeded by Laurent Freixe, who was fired within a year because of misbehavior with a junior employee. And now, Navratil, who has spent more than 2 decades at the company, is taking the helm. Meanwhile, Paul Bulcke is also stepping down as chairman earlier than scheduled. That’s a lot of management instability.

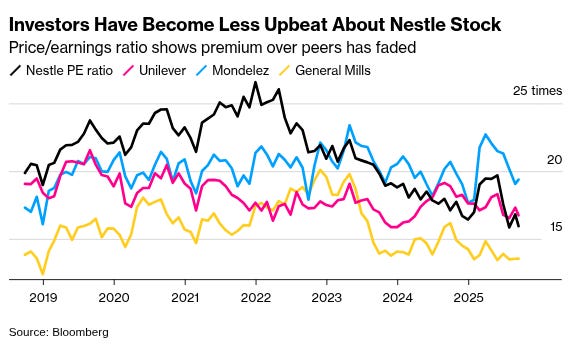

Nestle’s stock has been dangerously tanking, and they need to make important decisions really fast. It doesn’t have many new sources of growth right now, and its brand value has been tanking. And for the most part, it has only itself to blame for where it is.

This is an existential crisis for one of the biggest, most historic food companies in the world. Maybe, Nestle needs to, well, take a break.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Really interesting stuff!!!! High protein dose😄…