Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

For all the sources mentioned in this video, don’t forget to check out our newsletter; the link is in the description.

With that out of the way, let me get started.

Is it a bubble that might build the future?

So over the past week, a lot of things have happened that together tell you where the whole AI story really is right now — and how absurd, tense, and strangely revealing it’s become.

Starting with Open AI’s CFO who recently said that they’re talking to the U.S. government about loan guarantees for their trillion-dollar data-center buildout. Basically, she was saying: this infrastructure is too big and too expensive for private markets alone and we might need you i.e. the govt to help underwrite it.

That’s quite crazy. OpenAI, the most valuable startup on the planet, and its CFO is out there saying, in public, that they may need the government to back their spending.

The logic, she said, was simple: this stuff costs too much and doesn’t last long enough. The servers, the GPUs, the data-center power — all of it depreciates fast. Government backing would make it cheaper to borrow, because the risk shifts to taxpayers.

There are more interesting things that have happened.

Michael Burry, the one who’s famous for his betting against the market in 2008. He’s The Big Short guy. He has now disclosed a $1.1 billion short bet against AI-related stocks. At the same time, Deutsche Bank, which has lent billions to the data-center industry, started looking for ways to hedge its exposure — basically, insure itself in case this AI infrastructure boom goes wrong.

And, the best one out of this week was when Sam Altman went on a podcast with Brad Gerstner, who’s an investor in OpenAI and Satya Nadella. Brad asked him the blunt question that everyone has been talking about for the longest time:

“How can OpenAI, with around $13 billion in revenue, commit to $1.4 trillion in spending?”

And, the reply was just bold. He said, first of all, that the $13 billion figure is wrong — “we’re doing well more revenue than that.” Then he said, “If you want to sell your shares, I’ll find you a buyer.”

That’s WILD.

But here’s where things took another turn. Because right after all this noise, Sam Altman put out a long clarification post.

He said: OpenAI does not have or want government guarantees for its data centers. We believe governments shouldn’t pick winners or losers, and taxpayers shouldn’t bail out companies that make bad decisions,

But what came right after matters more. He said there’s a version of government involvement that does make sense - not backing private companies, but governments building their own AI infrastructure. A strategic national reserve of computing power, like an energy reserve but for compute. The government builds it, the government decides how to use it.

The only place OpenAI has even discussed loan guarantees was for semiconductor fabs - helping secure domestic chip supply. That’s not about bailouts, that’s industrial policy. Same logic as the CHIPS Act.

So he wasn’t just walking back the CFO’s comments. He was reframing the whole conversation - away from “OpenAI needs government help” toward “the government should think about compute like it thinks about oil or energy.”

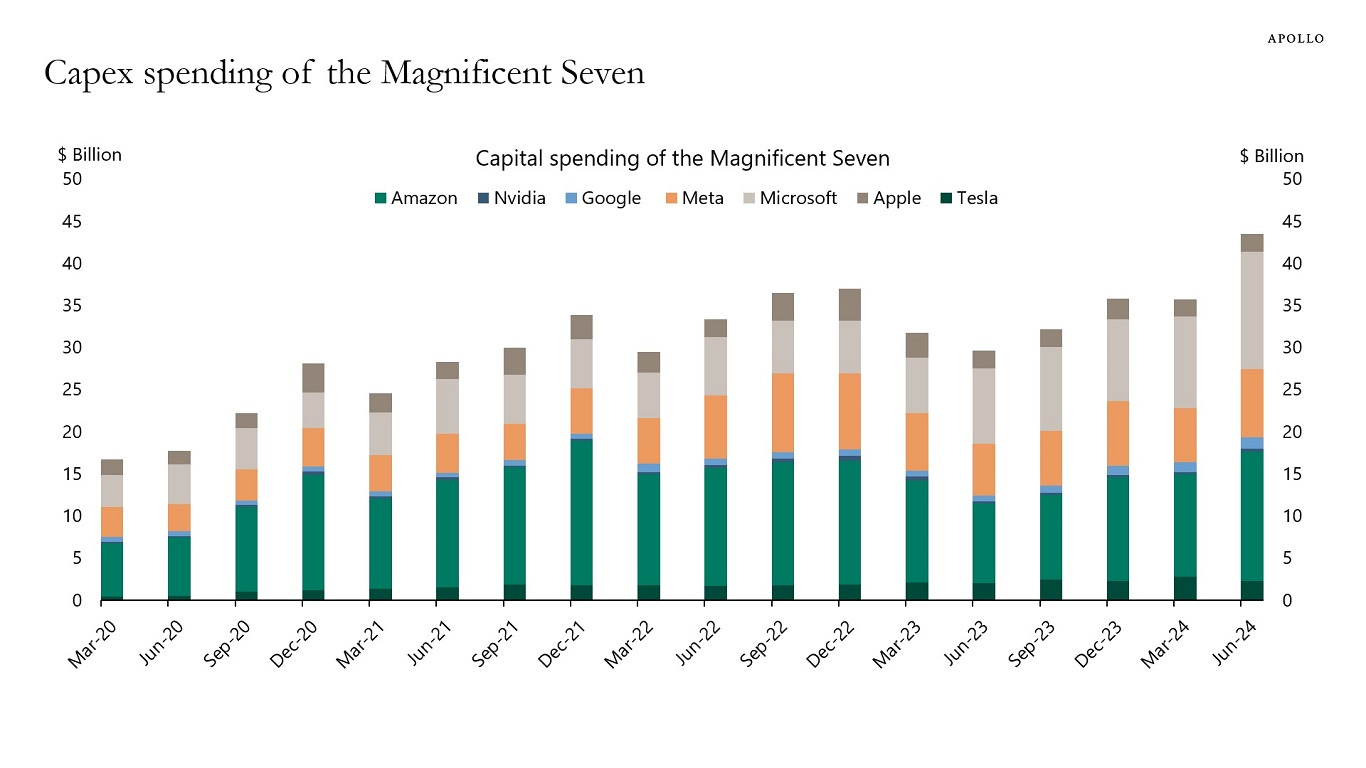

See, the reason all this is such a big deal is that these are not small numbers. A trillion dollars of spending is closer to the scale of national infrastructure.

And this is where Ben Thompson’s piece on Stratechery really helps make sense of it. He says yes — this is a bubble. But not all bubbles are bad.

Every big technological leap — from railroads to the Internet — starts with wild overspending. That’s what builds the foundation for the next era. The dot-com bubble gave us too many bankrupt startups, sure, but it also gave us the fiber-optic cables that power the modern Internet.

Thompson calls this kind of thing an “inflection bubble” — the good kind. One where too much money chasing the future ends up creating real, lasting capacity: roads, power plants, data infrastructure.

And he says AI could go either way. On the one hand, it’s scary because so much money is going into GPUs — short-lived assets that age fast. But on the other hand, all this spending is already forcing real-world buildouts: new chip fabs, power generation, and a whole layer of physical capacity that will outlast the hype.

He points out that Microsoft and Amazon have both said their biggest bottleneck isn’t chips — it’s power. They’re building 15- to 20-year assets just to keep up. If AI ends up forcing the world to generate more clean, abundant energy, then even if the bubble pops, it will have left something real behind.

That’s the hopeful version of this story. That what looks like reckless spending might actually be a kind of accidental industrial policy — a moment where ambition and mania accidentally build the future together.

Maruti Suzuki is finally happy again

“We see a lot of helmets coming into our showrooms, which is a good sign because people who had never considered buying a car before, they are now actively considering.”

That line came from Maruti Suzuki’s latest earnings call. On the surface it sounds almost trivial, but for a company that has spent the past two years lamenting the slow death of the small car, it’s a quiet turning point. Helmets in the showroom mean something deeper: the two-wheeler customer, long frozen out by price inflation and EMIs, is finally crossing over.

To understand why that matters, it helps to remember where Maruti was just a few quarters ago.

A while back, RC Bhargava, the Chairman of Maruti Suzuki, had said that “88% of the country is not participating in the car growth story. That’s because entry-level cars are just not growing.” The problem wasn’t supply. It was affordability.

The same tone carried into the first quarter of this year.

Rahul Bharti had said,“The affordability issues in the entry segment cars continue to affect the growth of the industry,”

For a company whose identity was built on first-time buyers, it was an admission that its own base was eroding. The mood in those calls was defensive, cautious, and tired.

And then came the latest quarter.

The numbers tell the story of a sharp turn. In the festive period — starting 22nd September, the same day the GST cut kicked in — Maruti recorded about 500,000 bookings, compared to 350,000 the previous year. Retail sales nearly doubled, from 211,000 units a year ago to around 400,000 this time. Of those, roughly 250,000 units came from small cars, a growth of almost 100%.

For a company built on small cars, it almost felt like Maruti had stopped believing in them. For a while, they’d been saying the same thing — that affordability had collapsed, that the middle class had stalled, that first-time buyers weren’t coming back. So when small cars suddenly started moving again, it wasn’t just demand reviving. It was Maruti rediscovering its own audience. The GST cut in September helped, of course. It made the numbers line up again for people who’d been priced out. But the bigger shift was emotional: the company that had written off the bottom of the market was now seeing it come back to life right in front of them

There’s still caution in the air. Even Maruti admits some of this demand could be deferred or festive in nature. But sentiment has flipped. The company’s narrative has moved from helplessness to momentum, about pent-up demand finally finding release.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.