Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

Everyone’s throwing money at AI — what if it’s a bubble?

Just over the past two years, we’ve witnessed artificial intelligence explode into our daily lives in

ways that seemed impossible just a short time ago. But there’s a darker side to this AI revolution.

A lot of money is pouring into AI right now, but no one really knows what the returns will be. That’s normal for investing, but some experts are warning that this might actually turn into one of the biggest bubbles we’ve ever seen.

The warning

David Einhorn, the hedge fund manager famous for his bet against Lehman Brothers before the 2008 crash, recently warned about the frenzy of money going into AI.

“The numbers that are being thrown around are so extreme that it’s really, really hard to understand them.”

He further said:

“...there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”

While he expects AI will ultimately surpass today’s bullish forecasts, he questioned whether “spending a trillion dollars a year or 500 billion a year” will deliver good outcomes for the firms making those investments.

The numbers are wild

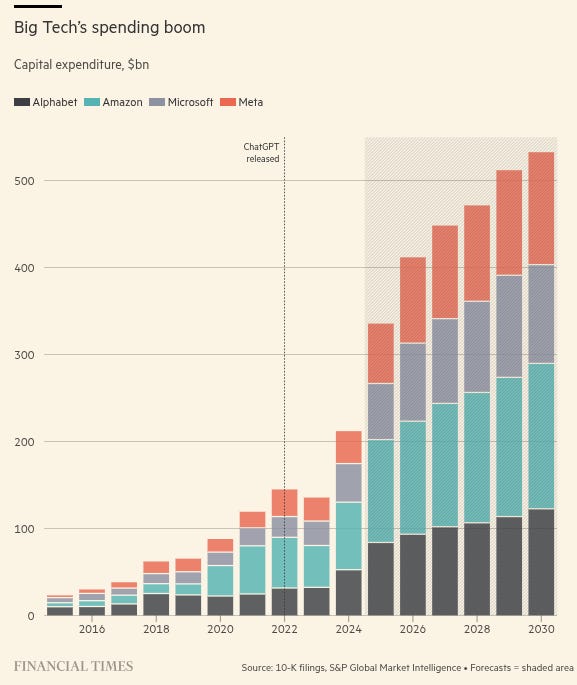

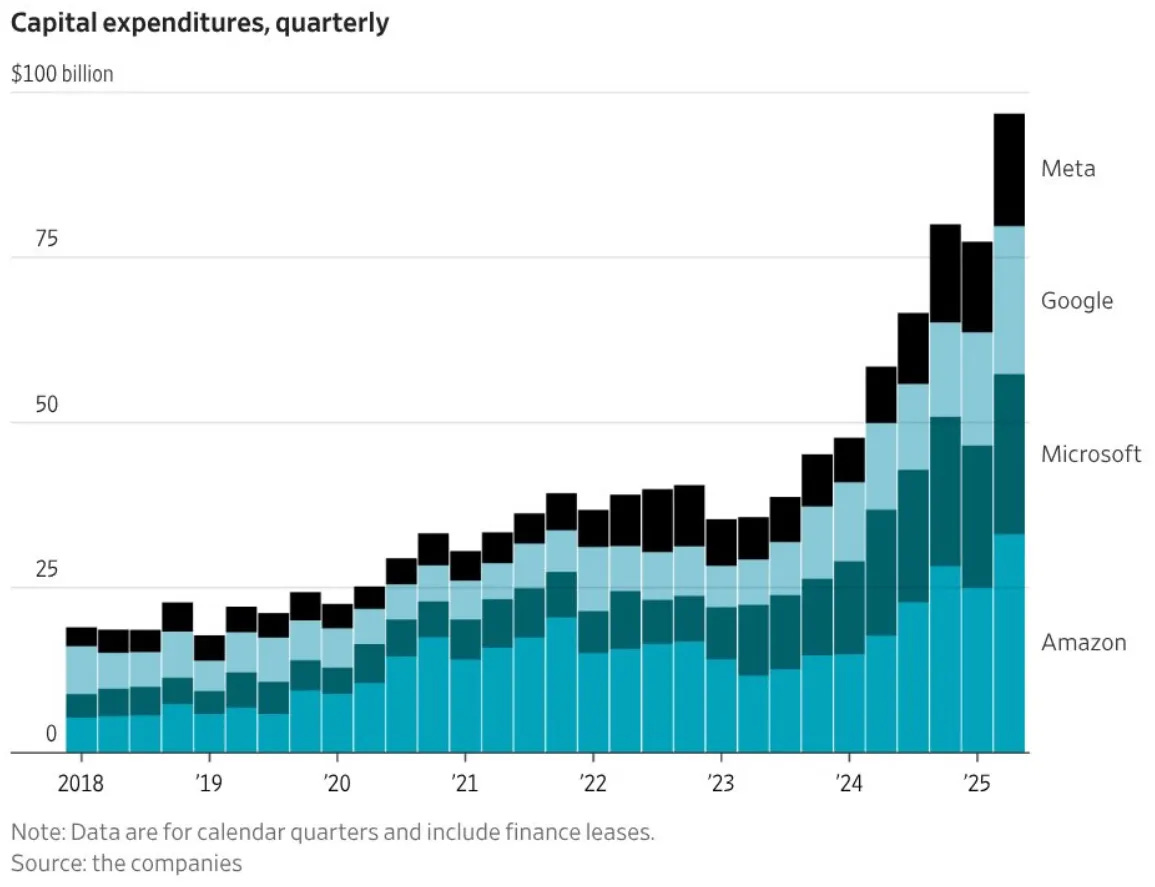

To see why Einhorn is worried, just look at the numbers. In the past six months alone, Meta, Google, Microsoft, and Amazon have poured $100–200 billion into chips, data centers, and other infrastructure. That’s on a scale we haven’t seen since the computer boom of the 1960s or even the railroad rush of the 1880s.

AI spending is already reshaping the US economy. Last quarter, money going into AI grew faster than consumer spending. Without it, overall economic growth would look pretty weak. Economist Paul Kedrosky points out that AI investment, as a share of GDP, is now bigger than the dot-com boom and is closing in on levels last seen during the railroad build-out of the Gilded Age.

About 60% of the stock market’s gains over the past two years have also come from AI-linked companies. Take that away, and returns would look bleak.

More people warning about this

By the way, Einhorn isn’t the only skeptic. About a year ago, Paul Singer’s Elliott Management, the infamous activist investor, said NVIDIA was in a “bubble” and AI was “overhyped.” In a letter to its clients, Elliott wrote:

A detailed analysis by Praetorian Capital reveals troubling math: AI datacenters being built in 2025 will suffer $40 billion in annual depreciation while generating only $15-20 billion in revenue. The depreciation literally exceeds revenue by 2x.

To just break even on depreciation costs, the industry would need $160 billion in revenue at 25% gross margins. But today’s AI revenue runs at only $15-20 billion. That means revenue needs to grow roughly ten-fold just to cover depreciation costs—and that’s before any profit.

For a reasonable 20% return on investment, the industry would need $480 billion in AI revenue.

The analysis concludes:

“There just isn’t enough revenue to cover the current capex spend... The world just doesn’t have the ability to pay for this much AI.”

But here’s the other side

Still, the companies building AI’s backbone aren’t slowing down. They openly admit the risks, but keep spending anyway.

OpenAI’s Sam Altman recently acknowledged the bubble concerns directly in an interview with The Verge:

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes.”

But rather than pulling back, Altman doubled down:

“You should expect OpenAI to spend trillions of dollars on infrastructure in the not very distant future. And you should expect a bunch of economists to say, ‘This is so crazy, it’s so reckless, and whatever.’ And we’ll just be like, ‘You know what? Let us do our thing.’”

Mark Zuckerberg has been equally blunt about the risks of falling behind. In a recent podcast, he admitted the AI spending might represent a bubble but argued:

“I think this administration for a number of reasons is definitely more forward-leaning on wanting to help build out infrastructure.”

When pressed about potentially “misspending a couple of hundred billion,” Zuckerberg responded that “the risk is higher on the other side”—meaning the risk of not investing enough and losing the AI race.

Meta announced it would invest “at least $600 billion through 2028” in US infrastructure, with Zuckerberg emphasizing that being “out of position” on AI would be worse than overspending.

Where does this leave us?

So where does this leave us? On one hand, the skeptics are right: the numbers are staggering, and history offers plenty of examples where massive infrastructure booms left behind wreckage for investors. On the other hand, the builders are chasing a once-in-a-generation platform shift, where the risk of sitting out looks even greater.

We don’t know how it ends. What do you think—are we watching the early stages of a lasting transformation, or the making of the next big bubble?

Accenture’s AI gamble

Global consulting giant Accenture is going through a massive, game-changing makeover.

Led by its maverick CEO Julie Sweet, Accenture is bracing itself for the age of AI. It recently announced that it will layoff staff that could no longer be re-trained for AI, having already laid off 11,000 people in the last 3 months already. This is probably one of the first overt instances of a company laying off a large part of its workforce explicitly because of AI.

Here’s what Sweet said on a call yesterday:

“Our number-one strategy is upskilling, given the skills we need, and we’ve had a lot of experience in upskilling, we’re trying to, in a very compressed timeline, where we don’t have a viable path for skilling, sort of exiting people so we can get more of the skills in we need.”

These cuts are part of a broader $865 million company-wide restructuring program. In fact, these cuts will allow Accenture to continue the trend of their operating margins extending by at least 0.1% every year — defying analyst expectations that an economic slowdown might hurt that trend.

Almost all of it is because of GenAI.

Under Sweet’s leadership since 2019, Accenture has been an early adopter of generative AI, even opening a separate AI services vertical for all its GenAI-related bookings. In fact, Sweet has acknowledged how companies are taking to AI faster than any other technology in history:

“It is well recognised that advanced AI has taken the mind share of CEOs, the C suite and boards faster than any technology development we’ve seen in the past few decades.”

However, she also mentioned that that hasn’t translated into numbers yet:

“At the same time, as reported widely, value realisation has been underwhelming for many and enterprise adoption at scale is slow, other than with digital natives.”

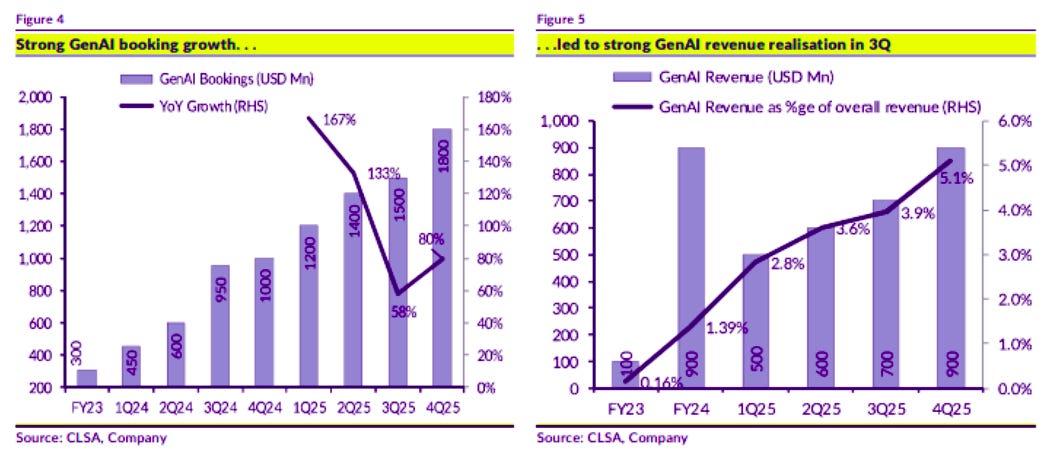

Except, Accenture is not one of those underwhelming companies. Their GenAI bookings alone made $5.9 billion in revenue in FY25. As a whole, the company grew by an impressive 7%, recording ~$70 billion in revenue and 15.1% operating margins. The thesis she’s backing on is: AI adoption at the enterprise level is actually hard. So, Accenture will help organizations make the transition first, before actually building AI products for them.

And here’s the thing: the leadership of Indian IT is feeling Accenture breathe down their neck. CLSA reports that Accenture is slowly, but surely eating into the market share of big Indian IT companies like TCS and Infosys. It is still the only IT giant present in India that has publicly reported how much of its business is directly attributable to GenAI. 44% of Accenture’s employees are in India, making us the largest base for the country. And Accenture only expects India to be one of its most important markets in the future.

The company name “Accenture” doesn’t exist in the dictionary. It was actually derived by an ex-employee as a shortening of “Accent on the future”. Turns out, in the age of AI, they seem to be living up to their name.

Are we at the turn of a cycle?

Ray Dalio thinks the world moves in slow, eighty year-long cycles. As any cycle comes to an end, existing powers fade, and new ones take their mantle. Is he correct? That’s hard to tell. History doesn’t always fit into neat patterns and narratives. But he’s certainly an extremely influential thinker — apart from running one of the world’s biggest hedge funds. While you might not trust his predictions, he certainly has an interesting and nuanced sense of how the world moves.

He recently made an appearance on The Diary of a CEO podcast.

And from the looks of it, he seems to see another turn of the eighty year cycle underway, at the moment. The English-speaking world, he thinks, is in a deeply precarious position.

The host of the podcast, Steven Bartlett, is British. Which is why, naturally, he began by asking Dalio whether he was optimistic about the future prospects of the United Kingdom. Dalio’s answer, though, was a firm “no.”

As Dalio said,:

“It has high debt, social internal conflict, it’s affected by geopolitical factors, and in terms of inventiveness, it doesn’t have the culture or capital markets that countries like the US have to support innovation at the necessary scale.”

The United States, to him, is somewhat better. Unlike Europe, which he describes as an “establishment culture,” the United States is relatively more willing to reward talent, even when it looks unconventional. As he says:

“The US has a culture of entrepreneurship and inventiveness. Europe and the UK generally have more of an establishment culture. In the US, you can be 25, have a blue streak in your hair, and if you have the talent to pull it off, you can get the resources to be an entrepreneur. This culture means more is happening here.”

Crucially, however, he is not optimistic about the United States either. To him, the country has too much debt, and its people are increasingly at each others’ throats — both of which are bad signs. As he says:

“The US has a debt–money–economy problem… It definitely has an internal conflict, in which there’s a fight between the hard left and the right, due to wealth and values gaps, and people not believing the system works for them. And so, democracy is at risk.”

It’s not like the United States has collapsed. Large parts of the United States remain extremely productive. The problem, however, is that a majority of the country has fallen off the wagon, and they’ve started resenting the system. That’s where problems arise.

To him, right now, there’s a war between the cream of American society, which is exceptionally productive, and the rest of America, which is falling behind.

“You can’t generalize about “the United States.” What you see is a small percentage — 1% — of the population is doing unbelievably well. And then, there’s the top 10%, which is the people around them. And they’re really, really doing great in that world. At the same time, the bottom 60% — 60% of Americans have below a sixth-grade reading level. What you need for a successful society is to have broad-based productivity and prosperity…. So which America are you looking at? And are you watching the war that’s happening between these?”

There are other threats on the horizon as well. A competitor — China — has announced itself on the world stage. And new technologies, like AI and robotics, threaten to replace us altogether. We might be at another turn of Dalio’s cycles.

Times of such profound change are scary. Everything you thought you knew about the world is already outdated. The old ways of doing things are dying. How do you make your way through life amidst such uncertainty?

As Dalio says:

“There’s a saying in Hong Kong — a Chinese saying — “a smart rabbit has three holes.” What that means is… can you move to a better place and get out of a terrible place? Can I successfully be an immigrant, change my location? Throughout history, that’s been important — the ability to go to good places and away from bad places.”

Apart from that flexibility, you also need the finances to cushion yourself against a shock:

“Building your financial strength matters. How you earn, spend, and save — that determines the amount. Then what you do with that amount is invest. How you invest is also important. So if you have financial ability, you can make the move, and you have knowledge about what’s happening so you can adapt — those are the things you need.”

Ultimately, you have to make peace with the cards you’ve been dealt, and have the flexibility and finances to make your way out. In a world where most playbooks are falling apart, maybe this is the only playbook you need.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.