Aditya Birla is getting into the jewellery business

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

In today’s episode, we look at 3 big stories:

Aditya Birla is getting into the jewellery business

Will insurance become cheaper?

Will crude prices go back above $100?

Aditya Birla is getting into the jewellery business

Aditya Birla Group’s ambitious plans to enter the jewellery market, a sector worth a whopping Rs. 6,40,000 crores! Before we get into the specifics, let’s set the stage with some background on the jewellery industry:

Back in the 2000s, unorganised players dominated 95% of the market. Today, that number has shrunk to 64%.

Organised players have made significant strides, largely by expanding through franchises, driven by evolving consumer preferences. Titan's Tanishq played a crucial role here, introducing the Karatmeter to verify gold purity, which was a game changer that encouraged consumers to shift towards organised retailers.

Motilal Oswal Financial Services recently published an insightful report on the sector. Here are some key takeaways:

India imports 60-70% of its gold, mainly for jewellery.

About 20% of gold consumption comes from recycled gold.

Bridal jewellery accounts for 55% of the total demand.

Demand peaks during wedding seasons and festivals. Agricultural output and monsoon patterns also significantly influence rural demand, with rural areas accounting for 58% of total jewellery demand.

The top-10 organised players hold over 30% market share, and margins in this business are around 20-25%.

Kumar Mangalam Birla, Chairman of the Aditya Birla Group, recently announced an investment of Rs. 5,000 crores in the jewellery market over the next few years. Their goal? To grow at a 50% CAGR and become one of the top three national jewellery retailers within the next five

“Our conviction about the size of the opportunity here is matched by the size of our bet. We're investing 5,000 crores over the next few years in this business to ramp up nationally. This represents an unmatched equity inclusion in this space. We will be among the top three national jewelry retailers over the next five years and will continue to grow at a CAGR of 50%”

Their timing appears strategic, especially with the recent budget cutting customs duty on gold from 15% to 6%, plus the upcoming festive and wedding seasons. If the economy remains strong and monsoons are favorable, gold demand should be robust.

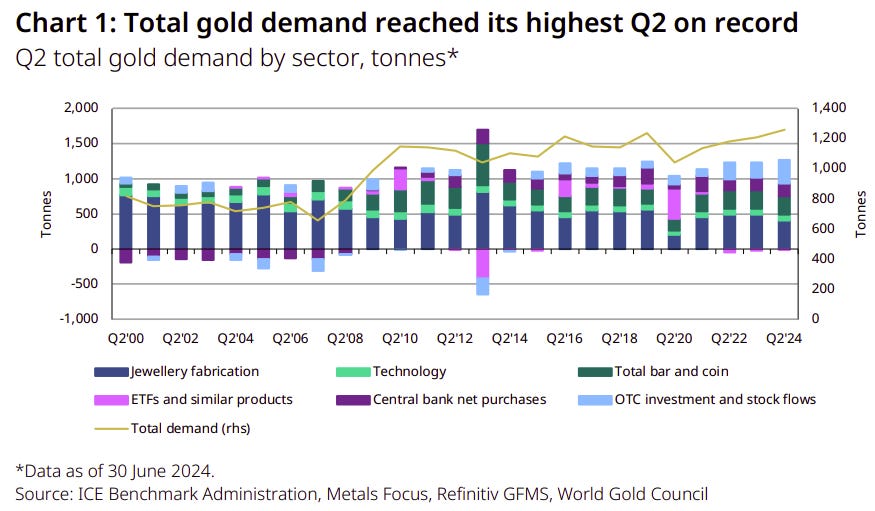

While we’re on the topic, let’s also touch on some global gold trends from the World Gold Council:

Recycled gold supply hit a Q2 high, the highest since 2012, up 4% year-on-year.

Indian gold jewellery demand fell 17% year-on-year due to high prices.

Despite record prices, Gold ETF outflows continued.

Central banks continued to buy gold, up 6% from last year but 39% lower than Q1 2024. This has been a major driver of rising gold prices as they diversify and protect reserves against economic instability, inflation, and currency risks.

Will insurance become cheaper?

Nitin Gadkari, the Minister for Road Transport & Highways, recently wrote to the Finance Minister with a significant request: he asked for a reduction in the GST on health and term insurance premiums.

Currently, we’re paying an 18% GST on these insurance policies, and Gadkari believes this rate is unfair for something so essential.

Here’s some context:

Insurance penetration in India is already quite low. The two main reasons behind this are a lack of awareness and high premiums. The additional 18% GST on top of these premiums makes it even harder for people to afford insurance, which is precisely what Mr. Gadkari aims to address.

So, what happens if the GST is reduced?

Health and term insurance would become more affordable, leading to significant savings for policyholders, especially since these policies need to be renewed regularly. A reduction in GST could also encourage more people to buy health and life insurance over time, potentially increasing insurance coverage across the country.

Lowering the GST could be a game changer, making essential health and life coverage accessible to a broader section of the population.

Will crude prices go back above $100?

With the ongoing global conflicts we keep hearing about, the world seems to be getting more dangerous by the day. It all started with Russia invading Ukraine, followed by numerous conflicts in Africa, and now the Israel-Palestine situation looks like it’s about to go off the rails.

Recently, Ismail Haniyeh, a top Hamas leader, was assassinated in Tehran, Iran's capital. While some signs point to Israel, they haven't officially claimed responsibility yet. This assassination could push the region into all-out war, especially since there was hope for a cease-fire between Israel and Hamas just a few weeks ago. But after this incident, it remains to be seen how Hamas and Iran will react. For context, in April 2024, Iran launched hundreds of missiles and drones at Israel after an Iranian commander was killed.

Now, the reason why this matters so much is because of one major commodity: oil. The Middle East accounts for 30% of global crude production, and the surrounding seas are crucial for shipping crude. If this region blows up, oil production will take a significant hit. This is bad news for everyone, but especially for India because we import more than 80% of our oil.

Let’s look at some numbers: In June 2022, after Russia invaded Ukraine, crude oil hit $120 per barrel. As of today, it's around $76 per barrel. But if war breaks out in the Middle East and crude production is disrupted, things might not be as bad as you’d imagine.

Over the last 50 years, the global economy has become much less reliant on oil than it used to be. Oil intensity, which is the amount of oil required to produce one unit of GDP, has declined. According to Columbia University estimates, the world used about one barrel of oil to produce $1,000 worth of GDP. By 2019, global oil intensity was 0.43 barrels per $1,000 of global GDP, a 56% decline. Additionally, oil production is now more diverse. The US, Russia, and Canada are big players, not just OPEC countries like Saudi Arabia.

The World Bank ran some scenarios last year, assuming a baseline price of $90 per barrel:

In case of a small disruption, oil could hit $93-$102 per barrel.

For a medium disruption, oil could hit $109-$121 per barrel.

And for large disruptions, it could hit $140-$157 per barrel.

Higher oil prices mean people spend more on energy, which is already a big part of household budgets. But that’s just the start. Higher oil prices also mean higher production costs for everything, including food, transportation, and clothing. Companies will naturally pass these costs on to consumers. Higher crude prices lead to higher inflation, which means central banks would keep interest rates high. And if people expect inflation to stay high, it affects spending and investment decisions, rippling through the economy.

In summary, let’s hope that the situation in the Middle East doesn’t spiral out of control, or we might be headed for some big trouble.

A good initiative by Zerodha. Highlighting and filtering more useful market news for readers.

Hi team,

I am loving with your content you daily bring.

You guys took a very good step to know about what is going on in capital markets daily.

Just a piece of advice or a small suggestion from myself is that,

The content is too big to grasp and to keep in mind.

Will be great if content is at the point and small conclusion at the end of every topic

I really love your content just a small suggestion