Adani vs Birla: Who will cement the top spot?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

In today’s episode, we look at 5 big stories:

Reverse Robinhood

Adani vs Birla

SBI Cards earnings have taken a lunch break

Are more Indians flying than ever?

The govt doesn’t care about gold bonds

Reverse Robinhood

Crypto never fails to entertain, does it? Just last week, we talked about the huge hack on WazirX, an Indian crypto exchange where hackers made off with over ₹1800 crores. That's almost 45% of all the assets on the exchange!

To put it in perspective, the hackers stole over $230 million worth of crypto assets. The breach targeted one of WazirX’s wallets on the Ethereum blockchain. In response, WazirX has temporarily suspended all withdrawals to protect their users' remaining assets.

Now, you’d think since the hack wasn’t your fault, you’d get all your money back from the exchange, right? Well, that’s not exactly what WazirX is planning. Instead, they’re spreading the losses across all users, even those who weren’t directly affected. Their blog puts it this way: they’re implementing a "fair and transparent socialized loss strategy to distribute the impact across all users equitably."

It’s ironic, isn’t it? A crypto platform using the word “socialize,” especially when crypto's whole appeal is being anti-government and decentralized.

WazirX is giving users two options:

Continue trading on the platform with no withdrawals but get high priority for any recovered assets.

Continue trading but withdraw 55% of the assets while the remaining 45% is converted into stablecoin equivalent tokens that will be locked. In this option, users have a low priority for recovered assets.

So, basically, WazirX is redistributing users' savings to cover the losses from the hack. It's like a bank using your savings to pay another customer who lost their money.

Now, since this is a show about the stock market, you might be wondering: could something similar happen with stock brokers?

Here’s the thing: crypto exchanges and stock exchanges operate quite differently. When you trade on a crypto exchange, the exchange holds all your assets in what's called a hot wallet. If this gets hacked, you’re out of luck unless you move your tokens to a cold wallet (an offline wallet), which most people don’t do.

Stock exchanges, on the other hand, store your securities in a demat account, which is like a digital wallet. These accounts are maintained by two authorized depositories in India: CDSL and NSDL. The only way your demat account can be compromised is if you share your broking account password or if CDSL and NSDL themselves get hacked.

So, while crypto exchanges can be a wild ride, stock exchanges have a different setup that offers more security for your investments.

Adani vs Birla

UltraTech Cement, India's biggest cement maker and the third-largest in the world (if you don’t count China), is making some major moves. They're buying a controlling stake in India Cements, which is a big player in South India.

Here's what's going on:

UltraTech is shelling out over ₹3,900 crore to buy about a 32% stake in India Cements from the promoters. They already grabbed a 23% stake back in June. With this deal, they’ll own more than 55% of India Cements.

This is huge. It’s going to make UltraTech a dominant force in the fragmented South Indian market, boosting their market share from 12% to 23% in the region.

But this isn’t exactly a new trend. The Indian cement industry has been consolidating for over a decade. In the last 10 years, we’ve seen some big deals:

Nirma Ltd acquired Lafarge India for ₹9,400 crore.

Adani bought Ambuja Cement for over ₹80,000 crore.

Now, this latest move puts the Birlas, who own UltraTech, in direct competition with the Adanis, who own Ambuja Cement, ACC, and others. For context, Adani is currently the second-largest player in the cement market.

So, why is UltraTech making this move? There are a few reasons:

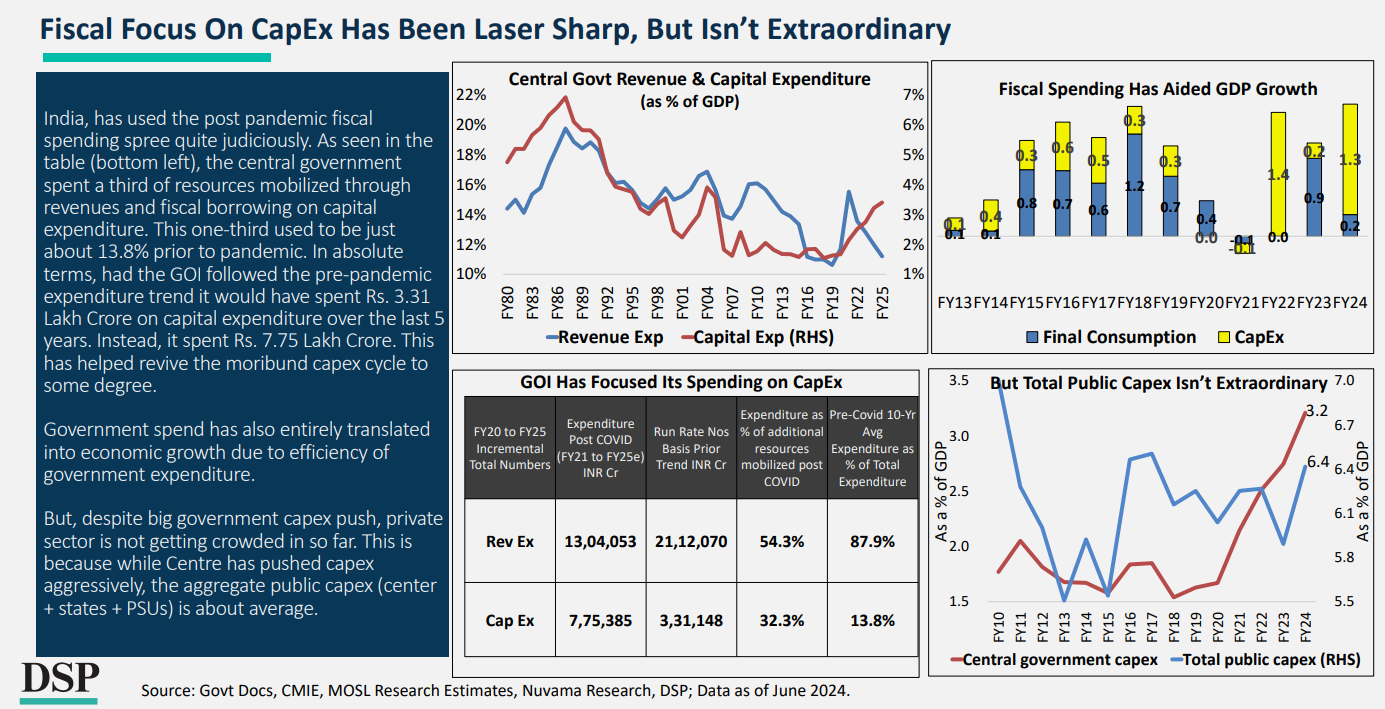

India’s Development: The country is still developing, and we need massive investments in infrastructure—roads, bridges, houses, industries. And all of that needs cement.

Economic Growth: This infrastructure push is one of the big reasons why India has been one of the fastest-growing economies in the world. In fact, India’s GDP growth over the last 4-5 years has been driven largely by government investments.

Government Plans: The recent budget includes plans to invest ₹10 lakh crore to provide housing for one crore urban poor and middle-class families under the PM Awas Yojana Urban 2.0.

Industry Competition: The cement industry is highly competitive and fragmented, with many smaller firms. By consolidating, UltraTech can improve its operational efficiencies.

So, UltraTech’s move is strategic. They’re positioning themselves to capitalize on India’s growth and infrastructure development while improving their own operational efficiencies in a competitive market.

SBI Cards earnings have taken a lunch break

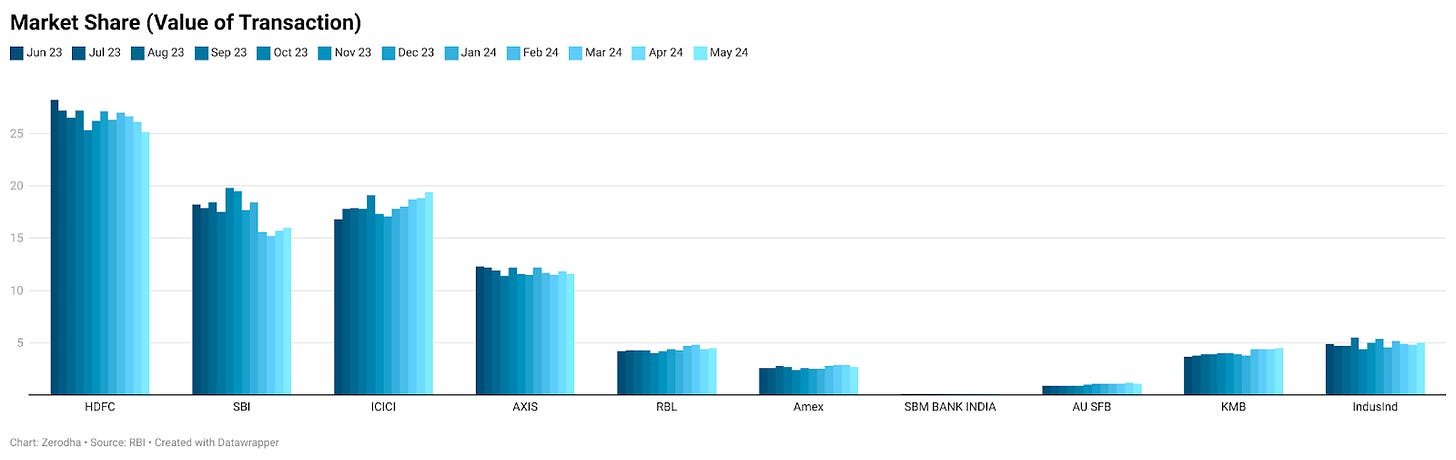

SBI Cards, India's second-largest credit card issuer after HDFC Bank, just announced their latest results, and let's just say, they were a bit of a letdown. But there are some interesting trends worth noting.

First off, profits are flat—no growth quarter-on-quarter or year-on-year. Plus, they've been steadily losing market share over the last couple of years. That's definitely not great news.

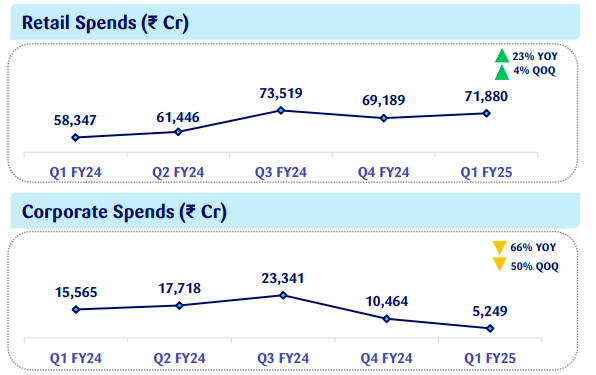

Corporate spending has taken a hit, thanks to the RBI's regulatory crackdown. They've banned certain types of credit card spends in the B2B space. But there's a silver lining—retail spending is growing at a healthy pace.

Now, onto the not-so-good news. Non-performing assets, or NPAs, are on the rise. Both stage 2 and stage 3 loans are increasing. Here’s a quick breakdown:

Stage 1: Loans overdue by up to 30 days

Stage 2: Loans overdue by 31-89 days

Stage 3: Loans overdue by more than 90 days

This means people aren't just missing their credit card payments; many seem to have borrowed more than they can handle. In response, SBI Cards is taking action. They've reduced limits on 5 lakh credit cards this quarter after cutting limits on 15 lakh cards in the previous quarter.

But here's the thing—this rising bad loan trend isn't just an SBI Cards problem. It's happening across the industry, especially in unsecured retail lending.

Now, let me share some interesting tidbits from a Kotak Research report:

Out of all the money people owe SBI Cards, 62% is earning interest. That's good news for SBI Cards because they're making money off those outstanding balances.

The share of new accounts from salaried individuals dropped from 79% in 2021 to 68% in 2025. Meanwhile, the share of self-employed individuals has gone up from 21% to 32%.

The share of cards in Tier 3 cities has exploded. It was around 10% at the end of 2021, and now it's about 30%. That’s a pretty significant jump.

So, while there are definitely some challenges, there are also some bright spots and shifting trends worth keeping an eye on.

Are more Indians flying than ever?

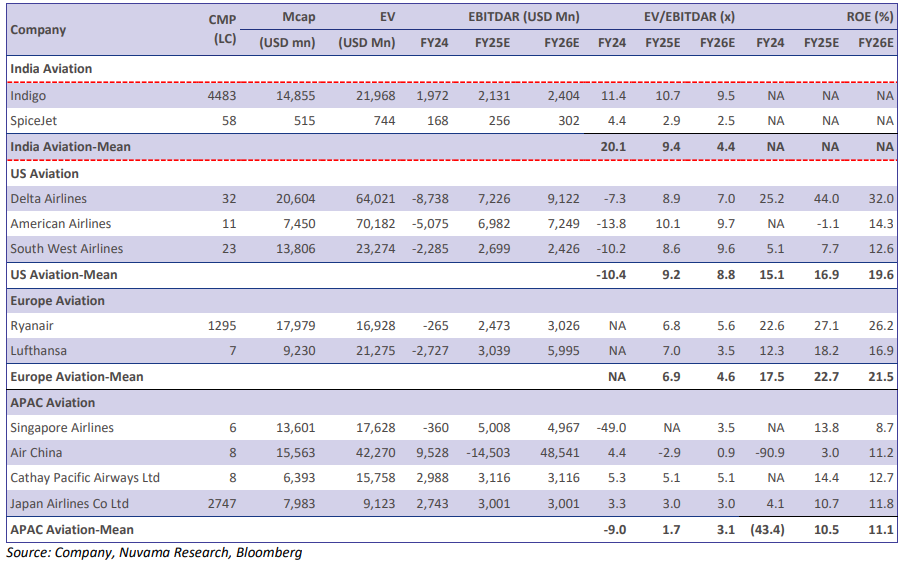

Interglobe Aviation, or Indigo, just announced its quarterly results. Why is this important? Well, Indigo controls more than 60% of India’s domestic aviation market, so their results give us a pretty good idea of what's happening in the overall aviation industry in the country.

According to this quarter’s results, Indigo’s revenues went up by 18%, but profits fell by 12%! But let's not get bogged down by just the numbers. The real interest lies in the deeper insights about the industry.

First, it's important to know that the airline industry uses a metric called “Passenger Revenue per Available Seat Kilometer,” or PRASK, to measure efficiency. This is calculated by combining the total revenue from passengers, the number of seats, and the total kilometers traveled.

Indigo's PRASK this quarter was 4.54 rupees, about the same as last year. What's impressive is that Indigo’s PRASK is on par with or better than top domestic airlines globally—crazy, right?

Also, Indigo's earnings per kilometer and per passenger were 1.3% higher than in the previous quarter. This means Indigo, the leader in the Indian aviation market, has kept its revenues stable despite the overall market being unstable due to monsoons and other factors. They’ve also managed to make more money per ticket than the previous quarter, showing they can capitalize on their market position and operational efficiency.

But even though Indigo is huge, India’s overall aviation market is still in its early stages. Let me give you a broader perspective:

First off, our aviation market is tiny compared to our population. We have about 500 commercial planes for a massive 150 crore population! In comparison, the US has over 10,000 planes for just 35 crore people.

India has less than 150 airports, while the US has over 5000 airports for a much smaller population!

According to Aditya Ghosh, the ex-CEO of Indigo, the number of people who travel by train in one week in India is equal to the number of people who travel by air in one year in India. So, it's not that our population doesn’t travel—they just don’t travel by air!

The aviation market is still centered around India’s major cities. Delhi, Mumbai, and Bangalore, even with multiple terminals, are struggling with capacity problems, while there are still many cities without good airport connectivity.

That said, the Indian aviation industry is definitely growing. Reports suggest we’ll add 2,700 new planes in the next 20 years. If all goes well, India could be one of the top three air passenger markets in the world by 2041!

Even though India’s aviation market lags behind the US, Indigo stands toe-to-toe with US aviation companies when it comes to numbers. Indigo’s market capitalization is comparable to, or even better than, some of the top domestic airline operators worldwide. Plus, Indigo is a profitable airline company, while many other airlines globally are still losing money.

But for a country as large as India, Indigo alone can't carry all the passenger load. As India gets richer, the aviation market will definitely grow. For India to become a major aviation market, multiple airline companies will need to do well.

The govt doesn’t care about gold bonds

The government might soon make a big change to its plans for issuing Sovereign Gold Bonds, or SGBs, in FY 2025. Let me fill you in on why this matters. First, some background on why SGBs were introduced in the first place:

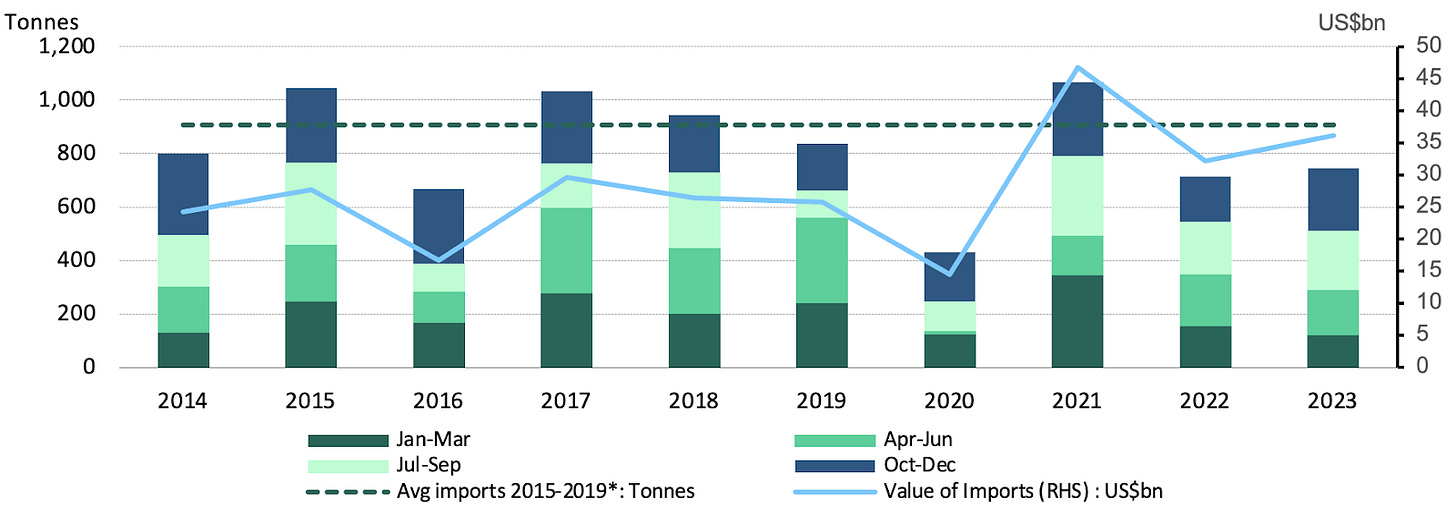

India imports a massive amount of gold. The problem with physical gold is that it doesn’t generate income or contribute to the economy. Instead, it puts pressure on the rupee and our current account deficit because we’re buying so much from outside. Estimates say Indians buy about 700 tons of physical gold bars and coins every year, and we import roughly 800-1000 tons annually.

So, in 2015, the government introduced Sovereign Gold Bonds (SGBs)—a digital form of gold—to curb the Indian obsession with physical gold. The idea was that people would stop buying as much physical gold and instead buy SGBs, reducing imports and easing the current account deficit.

The government needed to issue SGBs regularly to prevent people from going back to buying jewelry and gold bars, which would spike imports again. But times have changed. The current account deficit and inflation are looking better, and the country seems to be managing even if gold imports increase a bit. This is also why the government reduced the import duty on gold in the budget, something we talked about in our July 25th episode.

Now, there’s speculation that the government will reduce the number of SGBs issued this financial year. According to some experts:

The government might cut its target for issuing SGBs in FY25 by as much as 38%.

The new target is 18,500 crore rupees worth of gold bonds this financial year, down from ₹29,638 crore in the interim budget and ₹26,852 crore in the revised estimate for 2023-24.

For context, since 2015, the RBI, on behalf of the government, has issued over ₹70,000 crores of SGBs. Of this, ₹27,000 crores worth of SGBs were issued in FY 24 alone because gold prices have been hitting new highs recently.

Now, what does this reduction mean for the broader economy? I don’t have all the answers, but here are some questions to consider:

Will the reduction in SGB issuance increase gold imports?

Will people look for alternatives like digital gold and gold ETFs, even though they aren’t as attractive as SGBs?

Only time will tell.

Thank you for daily brief. Get to know the dynamics in economics.