A cruise through the shipbuilding industry

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

How shipbuilding works — a 101

The Fall of Man (Industries)

How shipbuilding works — a 101

We often talk about global trade, China’s manufacturing dominance, and India’s aspirations to become a bigger player in the global supply chain. These themes usually appear in isolation, but today they intersect in a fascinating way—through the shipbuilding industry.

90% of the world’s goods move by sea. Naturally, this level of global trade needs ships, which, while not often talked about, are arguably the most important plumbers of global commerce.

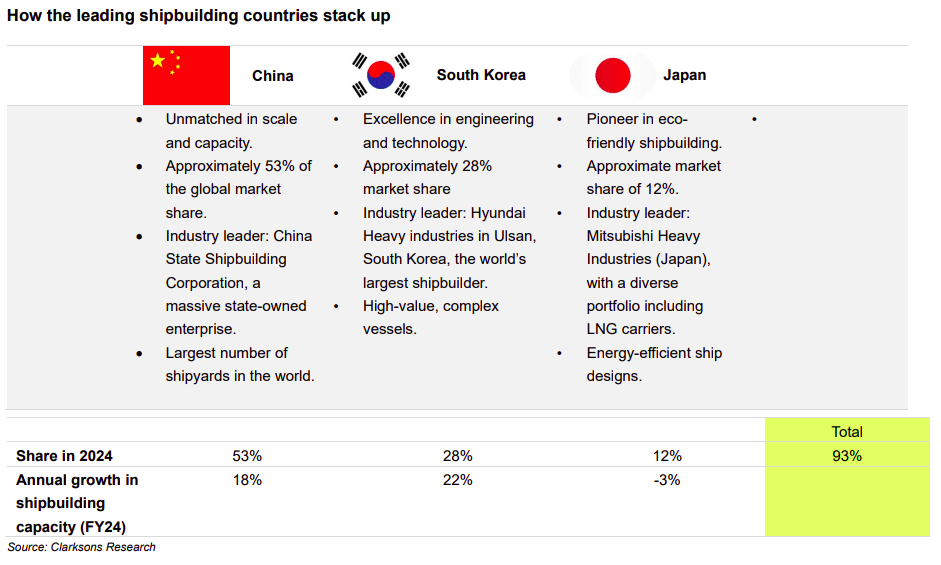

As with many other industries, China holds the crown here too. It has captured an extraordinary 53% share of global shipbuilding, rising from third place to first in just over a decade. India, meanwhile, is starting to smell the opportunity. The government recently approved a ₹69,725 crore package to revitalize India’s shipbuilding and maritime sector. That’s a large push in a sector that doesn’t often make headlines.

That’s what led us to nerd down the rabbit hole of shipbuilding, and create a primer on how the industry works. With no pun intended, let’s dive into it.

What do we mean by “the shipbuilding industry”?

The key fact you should know about shipbuilding is that it’s not just about constructing shiny new vessels. Fundamentally, it’s three businesses rolled into one.

The first is building, which involves taking an order, designing, and assembling a ship from scratch. The second is repair and maintenance: keeping ships seaworthy through their 20–30 year lives, including mandatory surveys, overhauls, and retrofits. And the third is recycling: what the industry politely calls “breaking,” where old ships are dismantled and their steel is sold back into the market. Think of it as a life cycle: build, operate, repair, recycle.

As one would expect, the demand for ships largely matches with global trade cycles. Without ships, iron ore doesn’t reach steel mills, oil doesn’t reach refineries, and those electronics you ordered don’t reach your doorstep. Energy flows also matter hugely — when LNG exports boom, orders for ships that carry LNG surge. Ships have other large use cases, too, like tourism, or even as warships for national defence. Clearly, many different economic engines feed into this one industry.

Ship demand comes in two forms: either new ships are made to accommodate more trade demand, or older vessels with a 20–30 year lifespan are replaced with new ones.

A striking feature of the industry is that it’s incredibly concentrated, with 3 countries making up over 90% of the world’s ships. China makes up ~53% of the market, South Korea follows with 28%, and Japan holds ~12%. Everyone else combined—including the U.S., Europe (outside of cruise ships), and India—hardly have any share. And it wasn’t always this way; 20 years ago, Japan was on top. But with aggressive state policy, patient capital, and a relentless push for scale, China leapfrogged to #1.

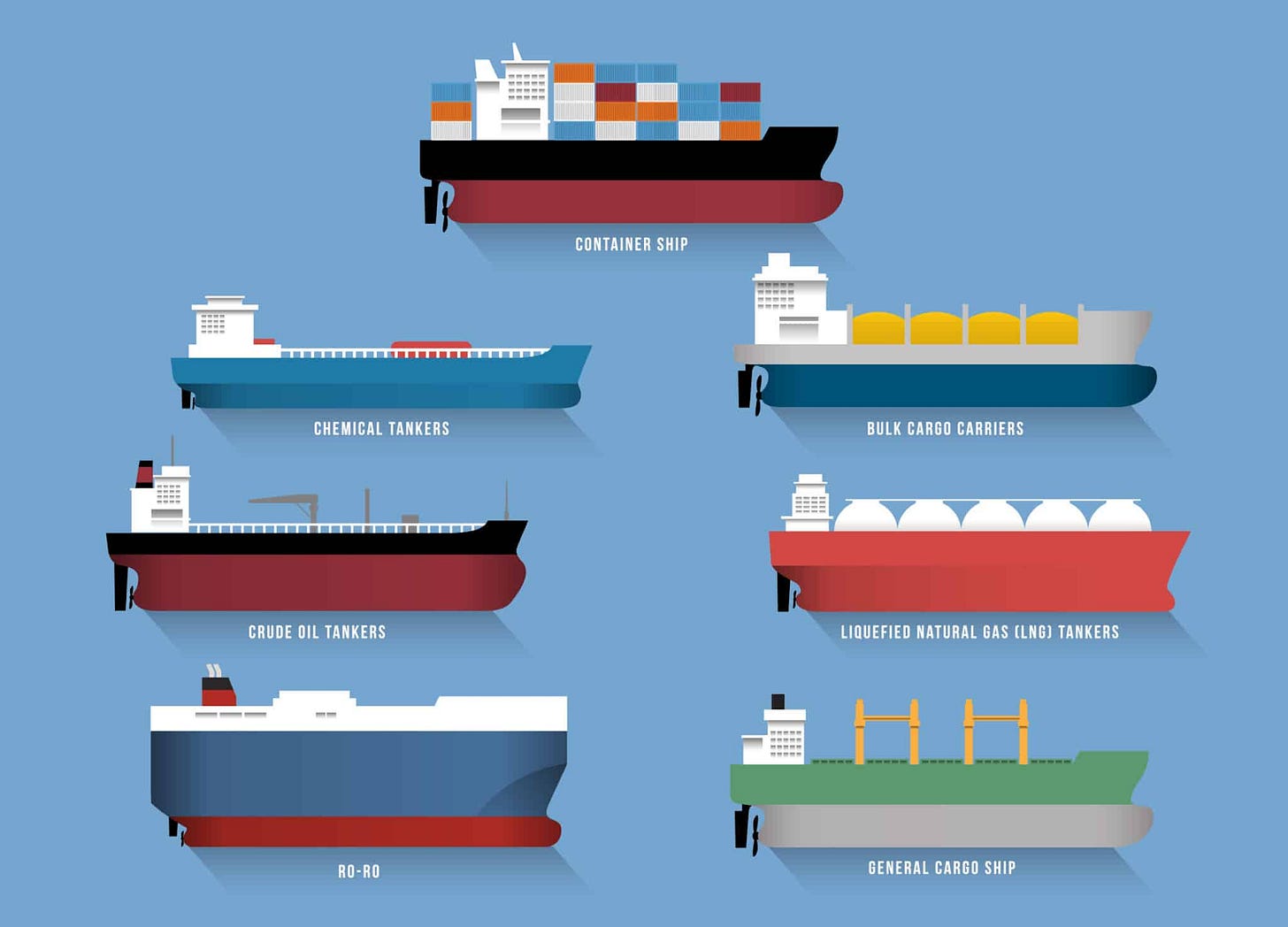

Ships come in many flavours, each tailored to a very specific use case.

It could be bulk carriers, carrying low-value, high-volume cargo like grains, coal, and iron ore. Then there are crude oil or chemical tankers that transport crude oil and refined products. Container ships—the most visible to the public—move everything from furniture to electronics in those huge multicolored containers. Then there are LNG and LPG carriers, highly specialized with insulated tanks to carry gas at sub-zero temperatures. Roll-on Roll-off (RO-RO) ships are specialized cargo vessels designed to transport wheeled cargo like cars, trucks, and trailers.

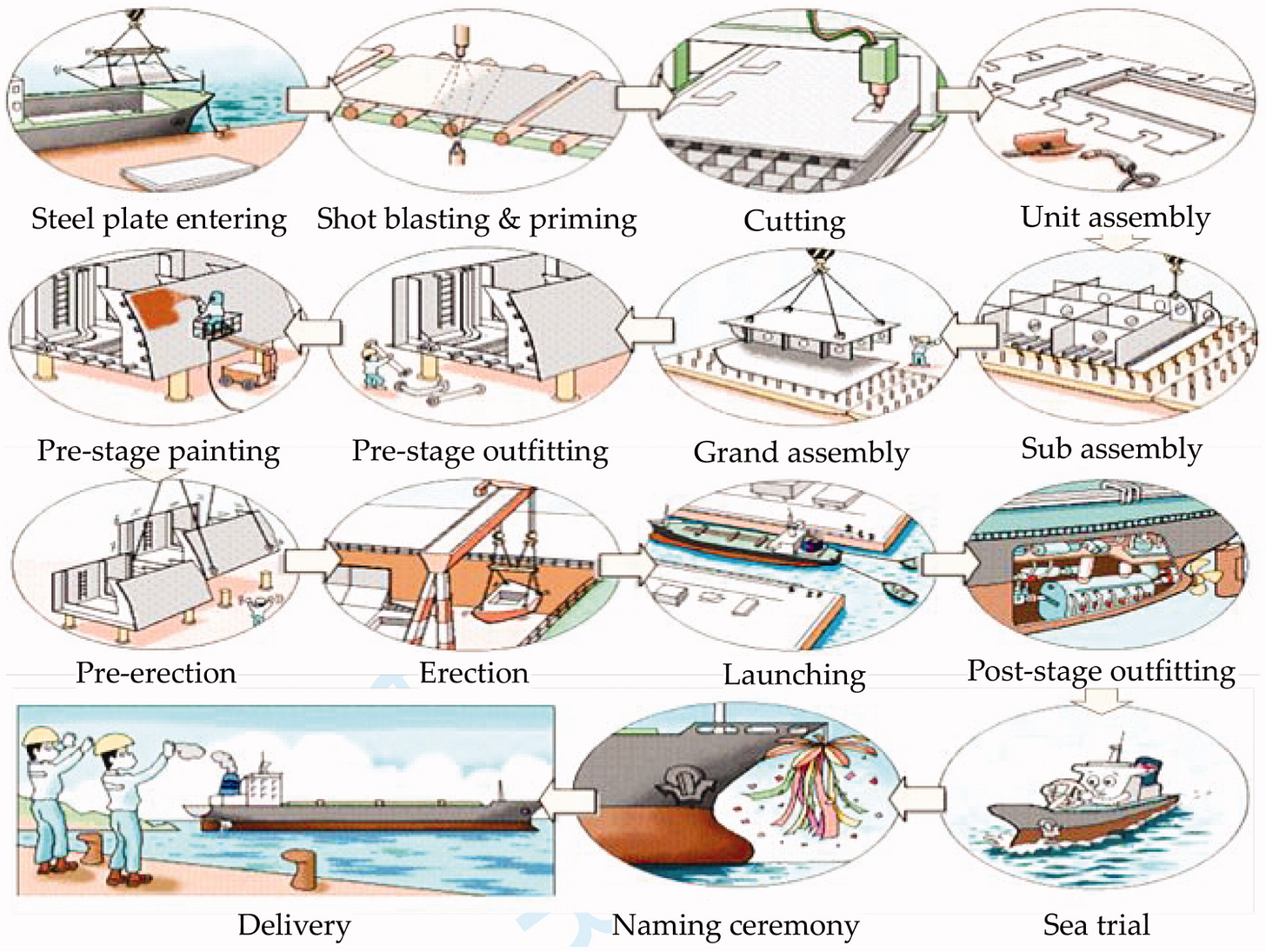

The process of shipbuilding

The question you might have next is: how do shipbuilders even build ships?

Well, here’s the thing: ship factories (or shipyards) don’t work like car factories. In fact, it may be more useful to think of them as construction (or EPC) contractors for heavy industries.

Let’s break it down. Shipbuilders don’t stock up ships as inventory, waiting for someone to buy. What they sell a contract to build for the specific need of a customer at a specific delivery slot. A ship obviously takes a long time to build. For that reason, the customer is allowed to pay in milestones instead of all at once: an advance when the deal is signed, then tranches at steps, and the balance at delivery.

Now that the contract is signed, let’s look into a shipyard. It works like a project manager: taking care of a complex supply chain, welding steel, and integrating thousands of systems into a single huge asset that can comfortably float at sea. As a result, the build process is complex—and fascinating.

Shipbuilding starts with design—ship concept drawings that must be approved. Once that’s done, the first piece of steel is cut. Next comes block fabrication, where massive sections of the ship body are built separately. These blocks are pre-fitted with as much piping, wiring, and cabling as possible — just like in construction projects. The more you can pre-fit, the faster and cheaper the full assembly ends up being. The blocks are then welded together to form the full hull (or ship body).

In Korean and Japanese yards, more than 80% of outfitting is completed before final assembly. In India, that share is much lower, which is why ships here take longer to build and end up costing more.

After that comes the launch or float-out, when the hull touches water for the first time, the first of many tests for any ship. At the berth, workers install engines, cabins, electronics, and safety gear, which are procured from various vendors and put together so that the ship starts taking its final shape.

Then come proper trials, when full-scale performance and safety tests are done. If the ship passes, it’s delivered to the owner. This can take anywhere between 2-10 years, based on the size and complexity of the ship.

Now that we know the basics of how ships are built, let’s look at how East Asian countries aced each step of the process, overtaking Western countries.

Firstly, you need access to relatively lower-cost skilled labor. Welding, cabling, piping, and outfitting are all labor-intensive processes. Even in the most high-tech yards, thousands of workers are needed on the shop floor. Countries like China, South Korea and Japan had an edge in this labour cost arbitrage.

Second, you need dense supplier clusters. A modern ship has thousands of parts — engines, thrusters, navigation systems, pumps, valves, coatings, and so on. No single yard makes all of this in-house, and ideally, you’ll need the suppliers of these parts to be close to a shipyard. The best shipbuilding nations have built ecosystems where dozens of specialized vendors sit around the yard, feeding parts just-in-time. Without that ecosystem, every order adds more cost and time.

However, the most important ingredient of all is cheap long-term capital.

Think about it. A ship order is a multi-year project. Shipbuilding obviously requires high capex. But it also needs lots of working capital to pay suppliers and manage long lead times — and this amounts to 35-40% of the shipbuilding cost. If capital is expensive, the math doesn’t work.

This is precisely where China pulled ahead of everyone else. Its state banks are well known to provide patient and low-cost funding to priority sectors — and shipbuilding is one of them. But they also provided refund guarantees (RGs), giving buyers confidence that their advances were safe. Otherwise, many international buyers won’t even consider a yard.

The India Lens

Now, where does India stand in all this?

Unfortunately, India hardly builds 2% of the world’s ships. That’s tiny for a country that depends on shipping for ~95% of its trade — which really represents a massive opportunity. However, we end up using foreign made ships to transport most of our trade, and haven’t yet capitalized on it.

Why? Well, it’s for the opposite of the exact reasons China, Japan and South Korea are dominating.

Firstly, working capital is expensive in India. In India, interest rates are often 10–10.5%, far higher than global competitors. That makes every ship order less competitive. Add to that the difficulty of getting refund guarantees and insurance, and it’s easy to see why most orders slip away.

That isn’t the end of our financing issues, though. Because of our regulations, Indian ships aren’t classified as mortgageable assets under the SARFAESI Act, nor do they legally count as “infrastructure”. That means banks can’t lend against them, and long-term loans at competitive rates are rare. Even public institutions dedicated to infrastructure financing, like NIIF or IIFCL, can’t fund shipbuilding because of a legal barrier. That shuts off the cheap institutional capital that shipbuilding needs.

Secondly, we depend on imports of the ship parts themselves, such as propellers, engines, high-capacity diesel generators, and control systems. These aren’t produced domestically at scale, which not just means higher costs through imports, but also a lack of supplier clusters that are necessary to optimize shipyards. Hence, Indian shipbuilders face delays and cost overruns.

Then, there’s the technology itself. Many Indian shipyards still use outdated production methods with low levels of automation. As we mentioned before, in comparison to China and Japan, India does far less pre-fitting of parts, which drags out timelines and raises costs. Productivity per worker is also much lower.

The government steps in

The government understands this, which is why this September, it stepped in with a monster ₹69,725 crore package. It’s designed as a four-pillar push to give Indian shipyards the support they’ve never really had.

A large part of the package is dedicated to making the most important ingredient — cheaper capital — easier to access. The Shipbuilding Financial Assistance Scheme (SBFAS), for instance, has been extended all the way to 2036, along with a ₹24,736 crore kitty.

Additionally, the package contains a new Maritime Development Fund (MDF) worth ₹25,000 crore for long-term financing. Of this MDF, ₹20,000 crore is dedicated to investment where the government personally buys a stake for nearly half the capital needs. The remaining ₹5,000 crore is meant to reduce interest rates for shipyard loans. All of this should subsidize Indian yards so that they can quote more competitive prices when bidding against foreign rivals.

Meanwhile, the government is also doubling down on more shipyard capacity. The Shipbuilding Development Scheme (SbDS), worth ~₹20,000 crore, is aimed at scaling India’s shipbuilding capacity to 4.5 million gross tonnage. That means new mega-yard clusters, better infrastructure, dedicated technology centers, and even risk insurance for shipbuilding projects. In other words: building an ecosystem and strong supplier clusters, not just a yard here and there.

To tie all the ingredients together, the government is setting up a National Shipbuilding Mission, making it a priority sector. This is supposed to oversee all the money flows, keep regulations aligned, and make sure the big vision doesn’t get lost in bureaucracy.

Conclusion

This piece is mostly an attempt to map out the basics of how the shipbuilding industry works and where India stands. There’s a lot more to dig into that we hope to do in a sequel to this.

The green transition, for instance, is already reshaping demand, with new ships being ordered to run on LNG or methanol instead of oil. Then there’s the story of actual companies in India—like Cochin Shipyard and others—that are slowly making moves in this space.

And of course, the bigger, harder question: will India’s latest ₹69,725 crore push actually change the game, or will it end up as another ambitious industrial policy that falls short in execution?

But, if these reforms actually deliver, Indian shipyards could finally scale up, attract global partners, and maybe—just maybe—move from being a fringe player to a serious contender.

The Fall of Man (Industries)

One of the complications of trying to understand a listed company’s business is that, so often, much of its actual business is happening through a list of different companies that it has interests in — subsidiaries, joint ventures, associates, and more. To really judge a company’s performance, then, its “standalone” financial statements aren’t enough. You need to figure out what’s happening across all those layers.

That’s why SEBI asks listed companies to come out with what are called “consolidated financial statements”. Companies have to report the combined financial performance of all these companies, cutting through the technicalities of their corporate structure, as though they were all a single business.

What happens if you don’t do so? Well, that gives you room to hide away all sorts of secrets. That’s the thing you should take away from SEBI’s recent order against Man Industries.

Man Industry’s simple accounting lie

Man Industries India Limited (or “Man Industries‘) makes and exports massive carbon steel pipes. Those pipes are used in several important industries — from oil and gas, to fertilisers, to water suppliers.

The company counts some giants among its clients — from global majors like Shell and Sinopec, to massive Indian companies — from Indian Oil to L&T. And they’ve brought the company healthy earnings. Last financial year, for instance, the company saw revenues of over ₹3,500 crore, which translated into a net profit of ₹105 crore.

Behind all this success, however, was a small problem. For many years, the company quietly kept a subsidiary off its books.

In 2013, Man Industries merged with another company, Man Infraprojects. The Bombay High Court gave the merger its blessing in 2015, and under the law, the two companies had become one since April 2013. As part of the merger, the company had gained a wholly-owned subsidiary, Merino Shelters. But for many years afterwards, it didn’t seem to acknowledge the company in its books — even as it kept routing money through it.

In fact, for one year — FY 2014-15 — the company dutifully consolidated Merino Shelters’ results with their own. But then, they stopped. And they didn’t do so for another six years. Year after year, for every financial year until FY 2021, the company’s financials pretended as though Merino Shelters just didn’t exist.

Now, for the record, the company’s promoters claimed that there were legitimate reasons not to fold Merino Shelters into its financials. There was, supposedly, a major fight over the company’s control within the promoter’s own family; including a pending case before the Bombay High Court. If they had gone ahead and consolidated those results into their financials, they could even be hauled up for contempt.

SEBI, however, didn’t think this was much of a reason. After all, the Bombay High Court hadn’t really said anything stopping them from doing so. There was no real reason for them to fear the court’s wrath.

Why tell such a lie?

If they weren’t really trying to heed the Bombay High Court’s orders, though, why else would they hide a whole subsidiary? Why shy away from reporting the performance of a whole company?

Well because if you’re so inclined, a hidden subsidiary can help you hide away a lot else — anything you don’t want your investors to see.

Profit inflation

One benefit of having this subsidiary hidden — though a relatively small one — was that Man Industries profits looked bigger than they were.

Over those six years, Merino Shelters consistently made losses. Rightfully, all those losses were losses of Man Industries as a whole, and should have been shown as such. If consolidated, they would have depressed its results.

Now, to be fair, these losses weren’t too large. Through those six years, it made a cumulative ₹4.73 crore in losses. Compared to the relatively huge revenues of Man Industries, these would have been a drop in the bucket. This non-consolidation barely moved the company’s profits up by 1-4%.

But eventually, to SEBI, that didn’t matter. They did distort the picture that Man Industries’ investors saw, even if that distortion was small. Once a company starts flouting disclosure norms, it doesn’t matter how much that benefited the company. There are some accounting malpractices that you’re simply not permitted to commit. Period.

Shady loans

There was a bigger benefit of keeping Merino Shelters off the books. Because the company was about to use it to funnel money to a range of entities, performing many little bits of financial jugglery. If it were consolidated, many disclosure requirements would have kicked in, making those transfers easier to spot. But by keeping it off its books, Man Industries found it easier to dress things up.

Merino Shelter became a key conduit through which Man Industries pushed out hundreds of crores from the company. On paper, these looked like standard loans and advances. From there, that money would be routed to other related companies — such as Man Realty, another part of the larger group.

This was a part of a larger trend, where huge sums of money was being routed to entities connected to the company’s promoter family. In FY 2019, for instance, over ₹48 crore were loaned to Limitless Contracting — which was owned by the daughter of the company’s promoter. In FY 2018, ₹40 crore was advanced to six related companies, only to be written off.

What were these loans for? We don’t know. The company didn’t mention that, nor did they follow the procedures they had to in order to give those loans.

Sometimes, that money just disappeared. Sometimes, it was paid back. Sometimes, it was “re-paid” on paper, only to be loaned once again.

In an ideal case, if Merino Shelters’ results were consolidated with those of Man Industries, a lot of this would leave a paper trail. But because it was hidden away, there was only a single number investors could look at to understand what was happening: the amount that the company was due to “receive”. In its books, these loans would look like cash that had gone out, and “receivables” that were yet to come in.

And that single number could be dressed up.

See, a company’s financials don’t give investors a year-round sense of how its balance sheet moves. They simply get a single snapshot: what was happening in the company on March 31? As long as the company looks healthy on that one day, its activity over the rest of the year remains invisible.

That is what Man Industries consistently took advantage of.

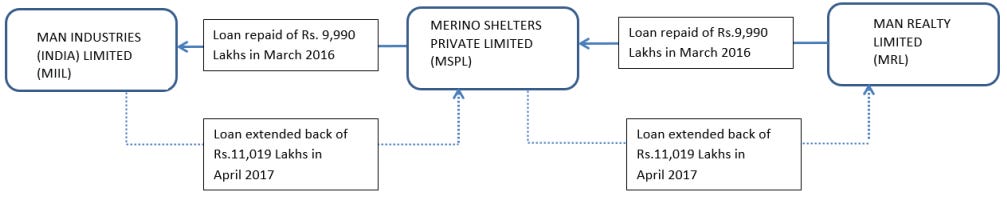

Every March 31, a lot of the money the company had loaned would suddenly reappear in its accounts. Its related entities would take large overdrafts, usually using Man Industries’ own fixed deposits with the bank as security. The liens on those fixed deposits wouldn’t be disclosed. Meanwhile, this money would be routed — often via Merino Shelters — onwards to Man Industries. For that one day, the amount it had “receivable” from those companies would come down by tens of crores. The books it prepared that day would look much cleaner.

By April, though, it would give out fresh loans to this cabal of group companies once again.

In FY 2017, for instance, Man Industries had given a loan of over ₹110 crore to Man Realty, through Merino Shelters. On March 31, 2017, a large part of that loan came back to it — and for that one day, its receivables went down by ₹53 crore. In April 2017, though, new loans had been pushed down the chain.

Sometimes, they would get even more creative.

In 2020, for instance, Man Industries reported having a “check-in-hand” from Merino Shelters worth ~₹11.5 crore, supposedly to repay part of the loans it had been made. That check was treated as cash, and that allowed the company to show a smaller amount of receivables. Only, that check was never encashed, and was cancelled in June that year.

That said, Merino Shelter later repaid the amount through a bank transfer. But the point stands: at the end of FY 2020, the company held a check that may or may not have been honoured, and called it cash in the bank.

To an investor, the company didn’t have much that was “receivable”. Nor did it show much in the way of related party transactions — it simply “netted out” any money it had supposedly received. From the outside, there was no way of knowing the company’s true exposure to related entities. Things looked under control, even when they weren’t.

What you should take away

SEBI has handed Man Industries’ promoters, and some of its key officials, two year bans from the securities markets. It has also handed out ₹25 lakh penalties to all of them — amounting to ₹1 crore in total. Meanwhile, the company’s shares had fallen by 16% when trading opened yesterday:

But our point, in covering these stories, isn’t to bad-mouth specific companies or people. It’s to help you understand ways in which companies that look healthy might be hiding skeletons in their closet, so you know what to look for when you’re doing your due diligence.

There are times when this feels hard, and the game seems rigged against you. A motivated insider can hide a lot more than you would even consider digging out from its financial reporting alone. As Warren Buffet once wrote, “the deck is stacked in favor of the deal that’s coveted by the CEO and his/her obliging staff.” This case is a clear demonstration of that fact.

What you can do, however, is look at the quality of a company’s corporate governance. You can look at how independent a company’s board seems, or how comfortable auditors are with making qualifications. You can look at how often the company transacts with related parties, and how transparent those dealings seem.

Good governance can sometimes feel like a “nice to have,” especially in India, where most businesses — even large ones — are the fief of a single family. But it isn’t a luxury — it’s often the only real line of defence between you and the risks hidden in plain sight.

Tidbits

The Sahara Group has petitioned the Supreme Court for permission to sell over 88 prime properties—including Aamby Valley and Sahara City, Lucknow—to Adani Properties Pvt Ltd. The proceeds, part of which already amount to ₹16,000 crore, will go into the SEBI-Sahara Refund Account to repay investors, with a hearing on the plea set for October 14.

(Source: The Hindu)Reliance Power has signed a share purchase agreement to sell its entire stake in five Indonesian coal subsidiaries to Singapore-based Biotruster Pte Ltd for about $12 million. The deal, routed through its Netherlands and Singapore arms, will be completed subject to conditions, with proceeds payable on closure.

(Source: The Hindu Business Line)From October 13, 2025, NSE International Exchange (NSE IFSC) will start trading zero-day-to-expiry (0DTE) options on the Nifty 50 index. These contracts will end the same day at 3:30 PM IST, and at any time there will always be five weekly expiry contracts available to trade.

(Source: NDTV Profit)

- This edition of the newsletter was written by Kashish and Pranav

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Great article...