100+ tonnes of Indian gold finally comes home

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

We are trying something new; join us in our chat group here.

Today on The Daily Brief:

Ghar wapsi for gold

Temporary bullishness for oil

Indian corporate earnings are seriously disappointing

Ghar wapsi for gold

The Reserve Bank of India has quietly moved a huge amount of gold—about 102 tonnes—from overseas vaults in London to India. That’s a massive load, not just physically, but also in terms of national significance. To put it in perspective, that’s roughly the weight of 17 African elephants or about 20,000 gold bars. This isn't just about bringing gold closer to home; it’s a strategic move to secure our nation’s wealth within our own borders.

Right now, India holds a total of 855 tonnes of gold in its reserves. Of that, 510 tonnes are now stored in vaults within the country, while the rest remains with the Bank of England in London and the Bank for International Settlements in Switzerland.

So why does the RBI care where its gold is stored, and what does this move really mean? Let’s break it down.

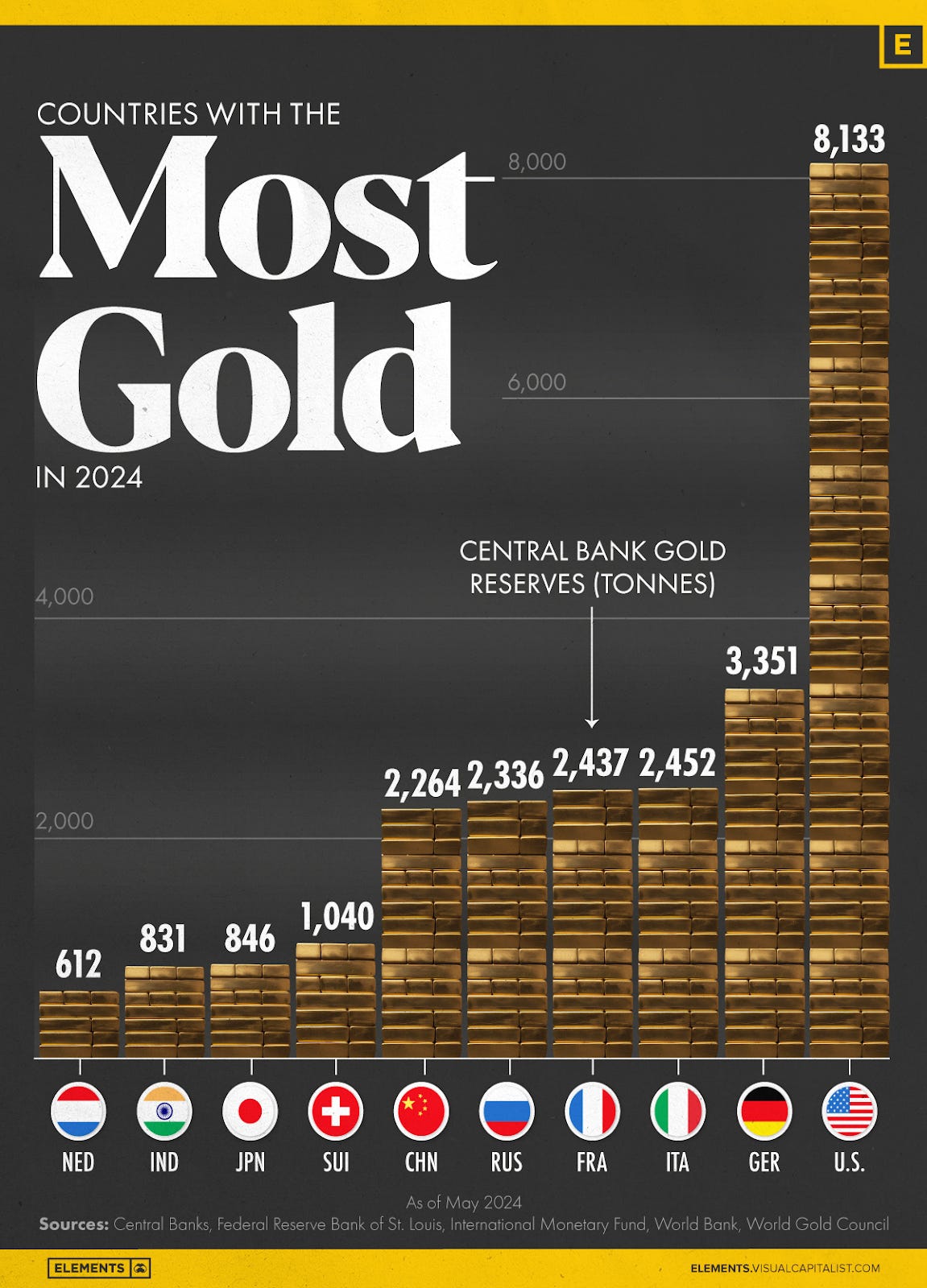

For central banks worldwide, gold is like an insurance policy against risks like geopolitical tensions and inflation. Because central banks hold gold in physical form, it's protected from being frozen or seized by foreign governments or financial institutions. Unlike digital reserves held in other countries—which could be blocked or restricted—physical gold is entirely under the control of the country that owns it. That’s why major players like the U.S., Germany, China, and even the International Monetary Fund hold large amounts of gold. In fact, the U.S. tops the list with a massive 8,000 tonnes!

India’s 855 tonnes might seem small in comparison, but this latest move by the RBI shows it’s not just about the quantity—it’s also about where this gold is stored. Bringing a significant portion of gold back home is a step toward protecting these assets from potential international risks.

Now, you might be wondering: if there was a risk, why did India keep gold in London for so long in the first place?

To understand that, we need to take a quick look at history. In 1991, India faced a severe economic crisis, known as the balance of payments crisis. Things were so dire that the government had to pledge some of its gold to secure a $405 million loan from the Bank of England. Although India later bought that gold back, some remained in London for logistical reasons, giving India an early lesson on the risks of storing its wealth abroad.

For years after 1991, the RBI continued to store a large part of its gold in London’s Bank of England vaults. London is the center of the global gold market, known for its liquidity, transparency, and security. With the London Bullion Market Association (LBMA) setting standards, holding gold in London meant the RBI had quick access to trading or other financial arrangements like currency swaps. In short, London has been a strategic location for central banks around the world to store gold, allowing easy management of reserves.

But times have changed. Today, the global financial landscape is shifting, fueled by rising geopolitical tensions. Recently, in response to Russia’s invasion of Ukraine, western countries led by the U.S. and Europe froze $300 billion of Russia’s central bank reserves. What if something similar happened to our assets stored abroad?

Historically, London and Switzerland have been seen as safe havens for gold storage, but this freeze highlighted the risks of keeping wealth in foreign jurisdictions. India’s recent decision to bring more of its gold home reflects this concern. By doing so, the RBI is taking a cautious approach, reducing reliance on foreign storage and safeguarding India’s wealth from potential geopolitical pressures.

Temporary bullishness for oil

In the next story, let’s talk about crude oil—a topic that keeps coming up on this daily brief show. This is especially important for us because India relies heavily on imported oil, with about 80-90% of our oil needs met by other countries.

As a result, we feel the impact whenever global oil prices rise. From what we pay at the pump to the overall health of our economy, it all gets affected. Recently, oil prices have been a concern due to ongoing geopolitical tensions in the Middle East. This is where global politics and oil dynamics intersect—something crucial for us as investors and market watchers to understand.

There’s an alliance of oil-producing countries called OPEC+ that has significant control over oil supply. It includes the 13 members of OPEC (the Organization of the Petroleum Exporting Countries) along with 10 additional countries, including some of the world’s largest oil exporters like Russia.

Since late 2022, this group has been cutting oil production, meaning they decided to produce less oil each day. The goal was to keep prices from falling too low by controlling the amount of oil available in the market.

From 2022 to 2023, these cuts added up to 5.86 million barrels of oil per day—almost 6% of global demand. Simply put, that’s a massive reduction in oil supply, big enough to impact prices worldwide.

Recently, a major update came in from OPEC+. Over the weekend, eight countries in this group announced a change in strategy. Initially, they had planned to reduce their supply cuts by releasing an additional 2.2 million barrels into the market next month. However, they’ve now decided to delay this move. This means the oil supply will remain tighter than originally anticipated!

According to an analysis by ING, there are several reasons for the delay. Saudi Arabia, for example, is concerned that easing the cuts could result in a loss of market share to other producers. Additionally, there are worries that some countries aren’t fully sticking to their quotas, meaning they may not be cutting production as much as initially agreed.

But here’s where things get puzzling: despite these production cuts, oil prices haven’t surged. Brent crude, a key benchmark for global oil prices, is currently trading around $74-75 per barrel—about 10% lower than its peak in October.

So, this brings us to the question—why aren’t oil prices rising despite the production cuts and tensions in the Middle East? A few factors are keeping prices down. Let’s break it down:

Global Economic Slowdown: Economic growth, especially in major markets like China and Europe, has been weaker than expected. A slower economy means lower demand for oil, as factories produce less and there’s less movement of people and goods.

High Oil Production in the U.S.: The U.S. has been producing oil at record levels, adding more supply to the global market, which helps keep prices in check.

High Interest Rates: High interest rates, especially in the U.S., tend to slow economic growth. This slowdown means businesses and consumers use less oil, which softens demand.

Russia’s Steady Production: Despite facing sanctions due to geopolitical tensions, Russia has managed to keep its oil production and exports steady, adding to the global supply.

We’re also seeing some signs of weaker demand for oil, especially in Asia, one of the world’s largest oil consumers. For instance, Asia’s crude oil imports were lower in October than in September.

Despite all these factors, one of the biggest influences here is China. As a major driver of global oil demand, China has accounted for over 60% of the growth in global demand over the past decade. In response, the International Energy Agency (IEA) has lowered its forecast for global oil demand growth in 2024.

Looking ahead, oil prices could take two very different paths:

The Bullish Case: Tensions in the Middle East could escalate, potentially disrupting oil supplies. For example, if Iran were to retaliate in response to recent regional events, it could impact vital oil supply routes. A similar situation occurred in 2019 when attacks on a major Saudi oil facility took out about 5 million barrels of production in a single day. Such disruptions could lead to a sharp increase in oil prices.

The Bearish Case: Analysts predict that by 2025, the oil market could see an oversupply of around 800,000 barrels per day. This surplus would mainly come from increased production in non-OPEC countries like the U.S., Brazil, Guyana, and Canada. If China’s demand remains weak and OPEC+ fully reverses its supply cuts by 2025, Brent crude prices could fall to the low $60s per barrel, and in the case of a recession, prices might even drop into the $50s.

Adding another layer to this already complex picture is the upcoming U.S. presidential election, which could have a big impact on the oil markets. Here are two possible scenarios:

If Trump Wins: Trump has indicated he would apply “maximum pressure” on Iran, which could reduce the Iranian oil supply. He’s also committed to ramping up U.S. oil production by streamlining permits for drilling and pipeline projects.

If Harris Wins: We can expect her to continue the current administration’s balanced approach to managing the oil supply while focusing on reducing emissions. This would mean maintaining current sanctions policies while prioritizing environmental goals.

Now, let’s get to the most important question—what does all of this mean for people like you and me?

In the short term, oil prices are likely to remain unpredictable, with swings influenced by both economic and geopolitical factors. For India, this uncertainty is especially significant. If oil prices spike, our import costs will rise, potentially impacting the economy in multiple ways. On the other hand, if prices drop due to oversupply and weaker demand, we might see some relief at the fuel pump.

Ultimately, keeping an eye on these factors will be key to understanding where oil prices—and our economy—are headed.

Indian corporate earnings are seriously disappointing

Today, we’re diving into what’s shaping up to be a bit of a tug-of-war in India’s financial markets. On one side, there’s strong domestic momentum, but on the other, global uncertainties and high valuations are contributing to a correction in the broader market.

Before we get into earnings, let’s look at the bigger picture. The Indian markets have had an incredible run this year, with both the Nifty and Sensex hitting record highs in September, driven by strong domestic inflows, especially from retail investors. Even as foreign investors pulled back, retail and domestic institutional investors, like mutual funds, have been net buyers.

However, there’s some nervousness in the market. Geopolitical tensions—such as the recent Israel-Iran conflict—upcoming U.S. elections, a stronger dollar, and rising U.S. bond yields are creating uncertainty on the global front. So, while the domestic outlook remains strong, the market is absorbing these uncertainties.

The September quarter is shaping up to be another weak period for corporate profitability, adding to the market’s concerns. The Nifty 50 is down about 10% from its peak. With most large companies having reported their earnings, overall corporate revenues have grown only 8% year-on-year, marking the sixth consecutive quarter of single-digit revenue growth. More notably, aggregate profits have declined by 3.5% year-on-year, making this the first quarter of profit decline since Q3 FY23.

All eyes are on big companies, and so far, the results have been disappointing. According to an analysis by Bernstein, over 65% of NSE100 companies have reported earnings, with 48% of them missing expectations by more than 4%. This is the highest rate of earnings misses since March 2020, highlighting the market’s concerns this earnings season.

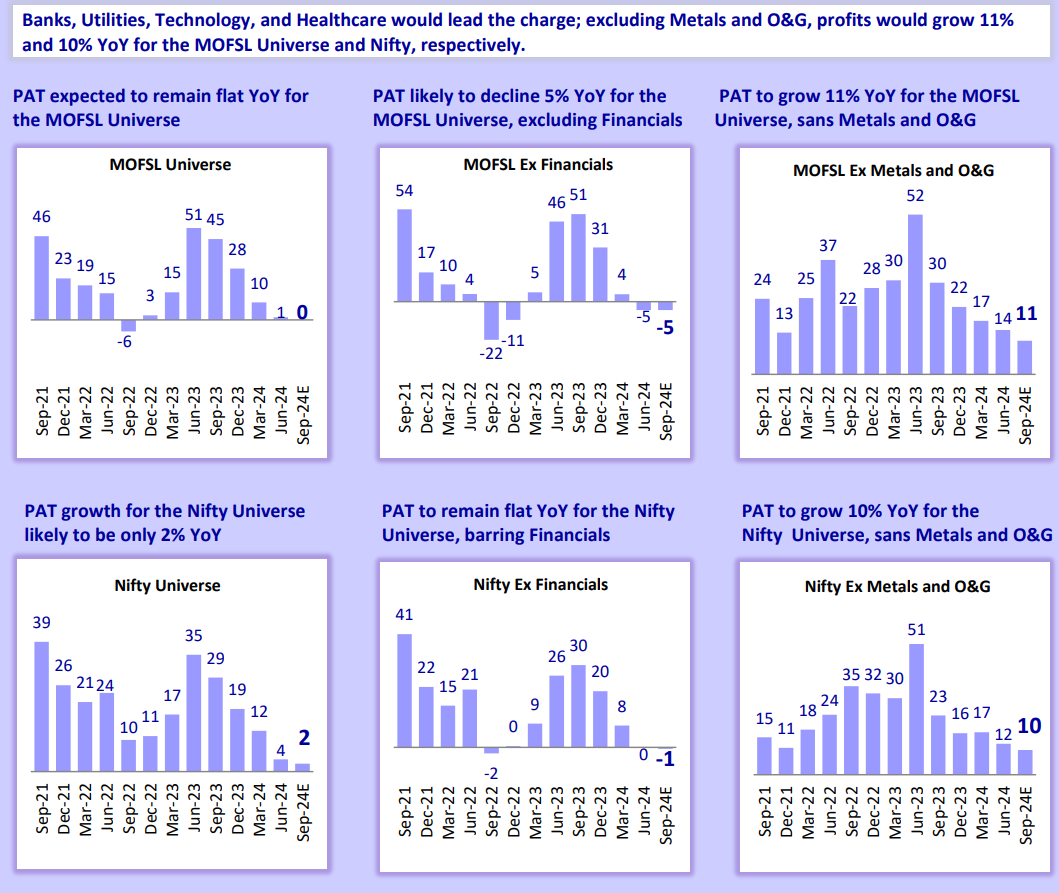

Recently, Motilal Oswal published a report on this quarter’s earnings expectations, and the outlook isn’t much brighter. For 2QFY25, they project Nifty earnings to grow just 2% year-over-year, marking the slowest pace since mid-2020. Excluding Oil Marketing Companies, the growth estimate improves to about 5% year-over-year. While there’s still growth, it has clearly slowed down.

Let’s look at which sectors are expected to perform well and which might lag behind.

The standout this quarter, according to Motilal, is the financial sector, particularly BFSI (Banking, Financial Services, and Insurance), with projected earnings growth of 11% year-over-year. Public sector banks are expected to lead with a 17% increase, while private banks may see a more modest 5% growth. Lending-focused NBFCs (Non-Banking Financial Companies) are also expected to benefit from stable credit conditions and rising demand.

Another strong sector in Motilal’s outlook is healthcare, with anticipated earnings growth of 15%. This is largely due to strong domestic demand and strategic launches in the U.S. generics market. For hospitals, factors like adding more beds, higher occupancy rates, and other revenue optimizations are expected to boost profitability.

Utilities, according to Motilal’s estimates, are enjoying a moment in the spotlight, with projected earnings up 24% year-over-year. This growth is expected to come from new capacity and strong demand across industrial and urban sectors. Companies like NTPC and Power Grid are likely to benefit from these favorable conditions.

On the other hand, some sectors are expected to face more challenges.

In metals, Motilal Oswal projects only a 2% year-over-year increase, essentially flat due to a high base from last year. Declining metal prices and competition from cheaper imports, especially from China, are weighing on this sector’s outlook.

The oil and gas sector is looking at an even steeper drop, with profitability expected to decline by 33% year-over-year. This sector is feeling the impact of weak global oil prices and shrinking refinery margins, affected by lower international demand and increased competition. For major players like Reliance and BPCL, this means reduced revenue and slimmer profit margins, making it a tough environment to navigate.

Finally, the cement sector is projected to see a significant earnings decline of 41% compared to last year. Cement producers are struggling with pricing pressure due to market oversupply, while high input costs—especially for coal and transportation—are further squeezing their margins. This combination of lower prices and rising expenses underscores how challenging it is for commodity-driven industries like cement to maintain momentum.

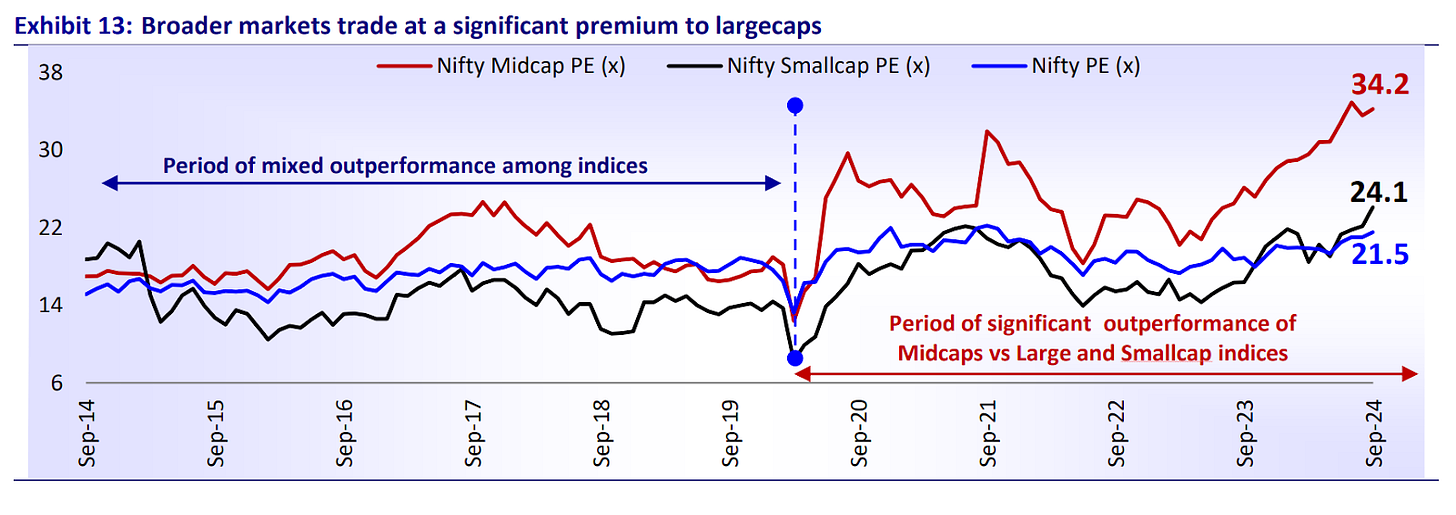

To wrap up, Motilal Oswal’s overall market outlook is cautiously optimistic. They highlight strong domestic inflows and early signs of recovery in rural consumption. However, they also point to some risks. Valuations are high, with the Nifty currently trading at around 21.5 times its forward earnings—about 5% above the long-term average. The market cap-to-GDP ratio is at 146%, well above the historical average of 85%, which could signal potential volatility if expectations aren’t met.

In Motilal’s view, the broader market is even more stretched. Midcap and small-cap indices have outpaced large caps significantly over the past year. The Nifty Midcap 100 is up by 48%, and the Nifty Smallcap 100 has climbed 50%, pushing their valuations to a substantial 60% premium over the Nifty 50. While these smaller stocks offer growth potential, they also carry added risk at such high valuation levels.

Looking at interest rate policy, the global shift toward easing could also play a role. The U.S. Fed has already started cutting rates, and historically, periods of monetary easing have encouraged foreign investors to turn positive on Indian equities. We saw this back in 2007-2008 and again in 2019-2020. With the RBI expected to join this easing trend next year, it could create a supportive environment for Indian stocks, provided inflation and other domestic factors stay in check.

Lastly, there’s the strength of retail participation. Domestic retail investors have become a key support for the market, with local inflows outpacing foreign ones by a 5.5-to-1 margin in recent years. This steady local backing has helped the Indian market weather global uncertainties better than some of its peers. However, if sentiment shifts among domestic investors, it could have a ripple effect on the broader market.

So, while the festive season and potential for lower rates bring some optimism, it’s also a time for caution, especially with midcap and small-cap valuations running high. In the coming months, we’re likely to see a balancing act where global challenges meet local strengths, making it more important than ever to stay informed.

Tidbits

Rajeev Thakkar sees fixed income as an appealing alternative to equities amid high valuations. He notes that while private banks have strong long-term growth potential, their short-term returns may be limited due to foreign portfolio investor (FPI) outflows.

Maruti is increasing utility vehicle production by 33% to meet rising consumer demand. This shift marks a strategic move away from compact cars, aligning with broader market trends.

October’s GST collections reached Rs 1.87 lakh crore, reflecting 9% growth and signaling economic resilience. This trend could support further government investment in infrastructure and boost confidence in growth.

India’s global share in exports like petroleum, gemstones, and sugar has surged, solidifying its position in key markets and showcasing its expanding export strength.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments