Reliance vs Blinkit heats up, IT’s future in danger?, Trump on NVIDIA | Who said What?S2E4

Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

Who will win: Reliance or Blinkit?

Quick commerce in India is no longer a question of whether it’ll scale—it’s a question of who’ll own it or atleats a significant chunk of it. In one corner, you’ve got Blinkit, the market leader, moving fast and building for speed. In the other, the mammoth Reliance, armed with a 19,000-store+ strong offline network and a balance sheet big enough to swallow entire categories. One has operational finesse; the other, overwhelming might.

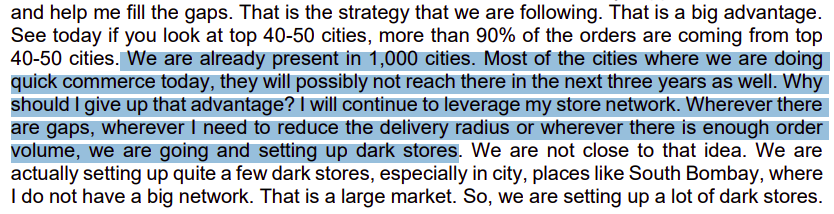

Let’s start with Reliance. In ione of their recent earnings call, the company made a forceful case that it’s uniquely positioned to win this game—not because it’s nailed the 10-minute model, but because it has the widest and deepest physical footprint in the country.

Here’s the most telling quote from that call:

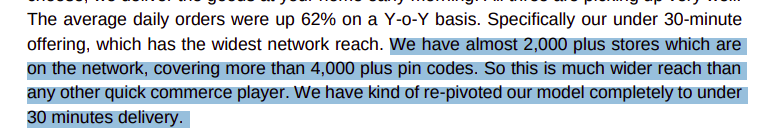

That’s Reliance telling the market: you may win Delhi or Bangalore, but we already own India. And they’re backing it up with numbers: 2,000 of their 19,000 stores are now tied into their quick commerce network, reaching over 4,000 pin codes. This is what they said in the recent earnings call:

There’s a tone of inevitability in the way Reliance speaks about this market—like it's already theirs. As if scale alone is a moat. But what if scale isn’t the moat they think it is?

Here’s where things start to break. The quick commerce model isn’t just about physical proximity, it’s about operational choreography. It’s about how quickly a picker can locate, grab, and hand over an order. It’s about store design, product packaging, and SKU layout. It’s not retail. It’s fulfillment.

Reliance is trying to do quick commerce by bending its existing store network into shape. But, as someone closely tracking this space pointed out to me, this might just be structurally flawed. Their store layout is fundamentally different from a dark store.

That difference is everything. Blinkit is built to pick, pack, and dispatch in 60–90 seconds. Reliance, at the moment, isn’t.

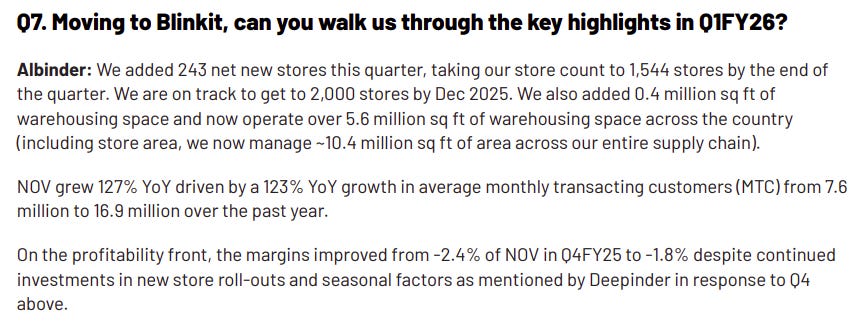

If Reliance is leaning on scale and cash, Blinkit is leaning into precision. They added 243 net new stores in the June quarter alone, taking their total to 1,544. They’re on track to hit 2,000 by the end of the year.

Albinder Dhindsa, the CEO of Blinkit, said this in their recent shareholders’ letter:

“The opportunity in front of us is massive, which means that the competition in this space is also very high… Under no circumstances will we let go of our market position here.”

Blinkit’s confidence comes from its operating system. This isn’t a company simply rolling out stores—it’s building a tightly integrated logistics, warehousing, inventory, and retail stack, all engineered for one thing: speed.

At its core, this is the real contrast: Reliance has money, Blinkit has mastery. Reliance has more capital, more locations, and more corporate heft. Blinkit has faster iteration, better design, and a single obsession: get to your door in under 10 minutes.

Reliance wants to take quick commerce to the masses. Blinkit is trying to perfect it for the top 50 million.Reliance is repurposing its stores to do more. Blinkit is building from scratch to do one thing well.

Who wins? We’ll find this out soon enough :)

Samir Arora says the IT sector is dead

Earlier this week in an interview, Samir Arora, the fund manager of Helios Capital had some very, very harsh things to say about a sector which has been India’s shining light for a long time — IT. He has just one IT company in his portfolio.

“What to say…IT sector itself is disrupted right now. People don’t want to believe it’s been disrupted black-and-white. You can see it in every result, every company.”

It’s a bold statement — almost as if to say that IT companies are well into the process of being rendered obsolete, forever, unless they change themselves. It wasn’t that long ago when, in the pandemic, IT stocks made lots of people wealthier. What changed in 4 years?

Well, let’s look at what hasn’t changed first. We’ve covered this extensively in two stories on Indian IT, here and here.

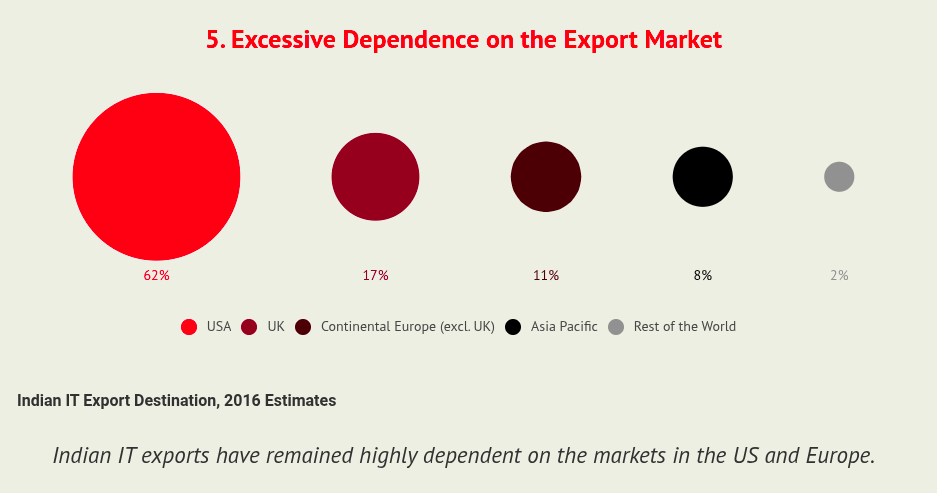

The dominant business model of our large IT companies is exporting low-end technology services to developed nations, based on lower labor costs. It has been excessively dependent on all 3 elements: the type of service, specific regions, and low wages.

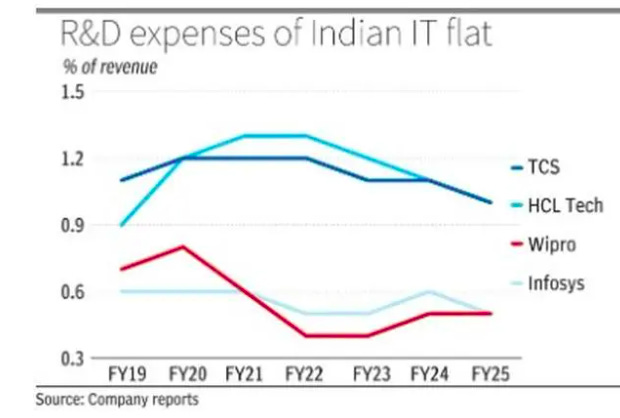

Between 1999-2013, IT’s share of patents compared to other sectors was at a dismal 2%. They have been spending a miniscule share of their revenue on R&D to move to higher-value activities, while getting strong cash flows from its rich clients. That extra cash goes mostly either as dividends, or saved up for a rainy day as retained earnings.

This staticness is under multiple threats today.

Firstly, AI. While Indian IT companies are working to bridge this gap, most of their AI experiments are still in their proof-of-concept stage. Their AI services businesses haven’t taken off yet. They will also need to upskill most of their workforce on GenAI — a humongous task by any measure. On the other hand, startups and mid-sized firms are shifting their focus to AI faster.

Secondly, the rise of global capability centres (GCCs) in India – that we have also covered here. GCCs are hubs set up by foreign firms for outsourcing certain tasks to India, and our IT firms were key to welcoming them. Today, however, GCCs are eating into Indian IT’s lunch by poaching their employees with better wages. More importantly, GCCs offer more than low-end services, which translates to better work and better pay. Meanwhile, attrition is really high in our IT firms.

Lastly, US tariffs. When the country that we’ve sold the most to starts putting a tariff on our services, we will cease to be cost-competitive. While this hasn’t happened yet, it is changing how our clients think, creating lots of uncertainty in the supply chain.

IT continues to be one of our strongest exports today, and is expected to grow in the near future. But the growth rate is slowing. Our large-cap companies need a makeover, and they know it too.

This is also an effective teaser for The Daily Brief’s round-up of the IT sector’s latest results, coming soon 🙂

Trump said something about NVIDIA

Someone that we know loves throwing quotables is, of course, US President Donald Trump.

And yet again, he has said something almost unbelievable. At a national AI summit, he revealed that he had considered breaking up what is probably the most powerful American company today — NVIDIA. But he figured that it would be extremely hard to do so:

“I figured we could go in and we could sort of break them up a little bit, get them a little competition, and I found out it’s not easy in that business.”

Now, it’s true that NVIDIA virtually owns the market for high-end AI chips, estimated to have more than 70% market share. That has attracted anti-monopoly investigations on it, not just in the US but also China and Europe. The main allegation is that NVIDIA is cutting out competition and reducing choices for customers through unfair means, which include:

Making its products not intero perable — only NVIDIA chips (and no other) can work with NVIDIA’s software (CUDA), therefore making it very hard to switch for customers.

Pressurizing customers to buy bundles — “you’ll only get X at a steep discount if you buy Y” deals, or offering different prices to those who use competitors’ products

Startup acquisitions

But some of these things aren’t black-and-white — meaning that this may not be a result of a deliberate attempt by NVIDIA to discourage competition. So, it’s hard to prove that they were ill-intentioned.

For example, was CUDA really built with the intention to exclude competitors? Maybe, it was a function of design and compatibility. In fact, NVIDIA chips also work with AMD’s software, OpenCL, though not as efficiently. The court has to prove if NVIDIA is externally penalizing the use of competitors’ cards.

With bundles — many companies give discounts when you buy their products in bulk. What needs to be shown is if the discounts were excessively discriminatory, along with customer complaints about product quality.

Acquisitions are also not inherently bad by themselves, especially if they improve a product. Are these acquisitions simply done to later shut them down? After the acquisition, did their compatibility with competitors’ products worsen, and how?

One fact makes all of this harder to prove: NVIDIA’s AI chips are better than the rest. NVIDIA’s Blackwell GPU has outperformed every other when it comes to benchmarking AI performance. They also work far better with CUDA in comparison to any other software.

NVIDIA’s strength hasn’t been written in stone. In the 2000s, for non-AI consumer-use GPUs, it has often been neck-and-neck with AMD — sometimes even being behind. All PlayStations and XBOX-es run on AMD chips.

But AI chips look to be a different ballgame. And it will be difficult to differentiate between how much of NVIDIA’s dominance in this sector is due to being unfair, and how much due to being smart, early, and better than everyone else.If you’ve made it this far, please let me know if you have any feedback for me 🙂

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

The Daily Brief by Zerodha is an outlier which brings to me and ordinary investors,the points that I probably don’t notice in the pink papers and the business channels that are filled with stock analysis. The instant Brief picks —“Reliance vs Blinkit heats up, IT’s future in danger?, Trump on NVIDIA | Who said What?” —are the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them,which but for The Brief, I wouldn’t have even come to know. Many thanks for giving me a wide and useful perspective.

The contents are really good. It becomes with tiring reading the long articles. It will be good if we have some option to hear the contents rather than reading them.