₹82,000 Crore Gone! Why Foreign Investors Are Ditching Indian Markets

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

Foreign investors have been on a selling spree

Is rural India powering India's economic growth?

Can TVS lead India's electric two-wheeler race?

Foreign investors have been on a selling spree

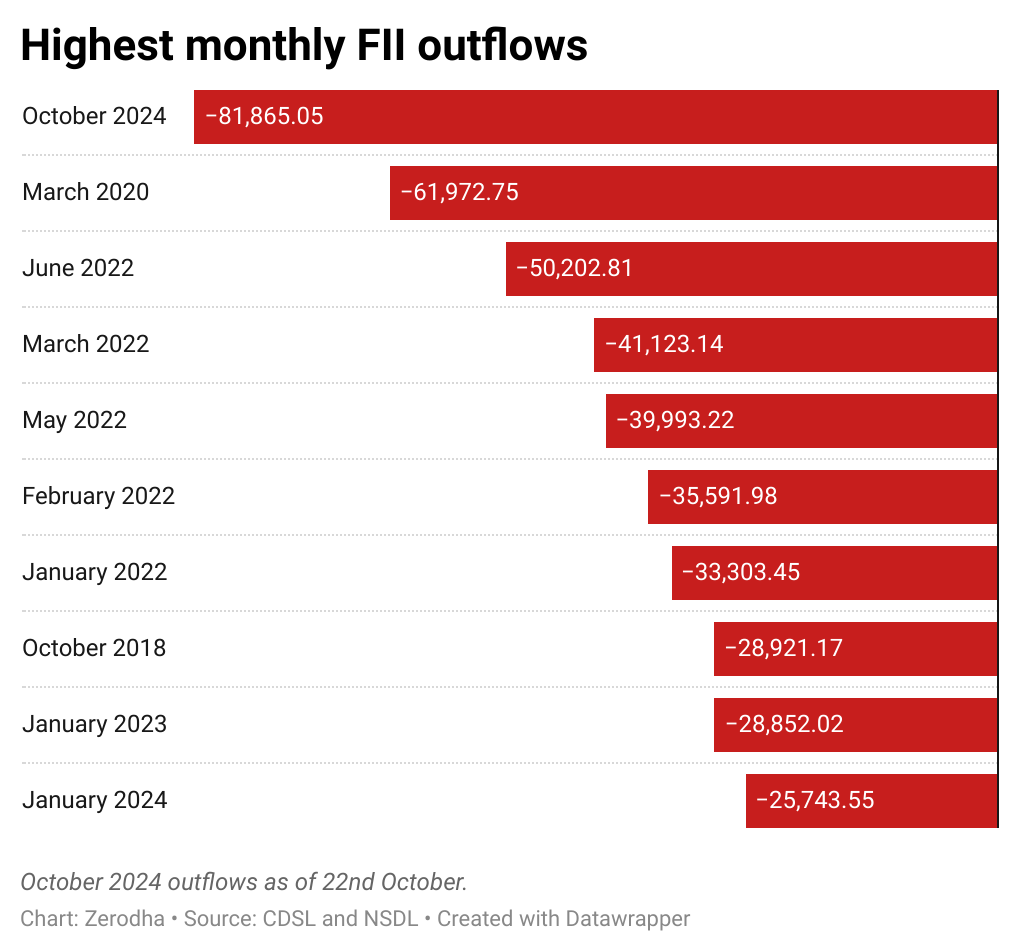

In October 2024, the Indian stock market saw one of the largest sell-offs by foreign institutional investors (FIIs) in recent history. FIIs sold a massive ₹82,000 crore (about $10 billion) in just a single month. This outflow of foreign money has even surpassed the previous record of around ₹62,000 crore that FIIs withdrew during the COVID-19 pandemic in March 2020.

So, in this story today, let’s understand why this happened and what it means for us as investors and those who keep an eye on the markets.

But before diving into the details, let’s first clarify who FIIs are, for those who may not be familiar. Simply put, FIIs, or Foreign Institutional Investors, are large financial institutions from other countries. These include hedge funds, pension funds, or asset management companies that invest significant amounts of money in countries like India. They move their money across global markets, looking for the best returns. When FIIs buy stocks in a country, they can have a big impact on the market. There's also a sentiment aspect to this. When FIIs buy or sell in large quantities, other investors often see it as a signal, influencing their own decisions. We believe this is what happened in October 2024.

The reason this sell-off is such a hot topic is that it comes as a bit of a surprise. Earlier this year, FIIs were buying Indian stocks, helping drive a market rally, but now they seem to be doing the opposite.

Of course, no one can say for sure why FIIs are selling or why the markets are falling, but we can make a reasonable guess. Most analysts attribute this FII sell-off to four main reasons:

Valuation Concerns: Indian stocks have become quite expensive compared to other markets. For example, the Nifty 50 has a price-to-earnings (PE) ratio of 23x. In simple terms, this means investors are paying 23 times the earnings of these companies, which is higher than what we’ve seen in recent years. Valuations in midcaps and smallcaps are also on the higher side. Meanwhile, markets like China are currently offering stocks at much cheaper valuations, making India less attractive to foreign investors looking for better returns.

Shift to China: China has introduced significant stimulus measures to boost its economy, making it an appealing option for global investors. This has led to a "Sell India, Buy China" trend as investors move their funds where they see more opportunities.

Global Economic Factors : Despite the recent 0.5% rate cut by the Federal Reserve and expectations of more cuts, the yield on the 10-year US Treasury bond has increased from about 3.6% to 4.2%. Why? One reason could be that traders were too optimistic about aggressive future rate cuts by the Fed and are now adjusting their expectations. Or it could be that the market believes we’re unlikely to return to the pre-pandemic world of zero interest rates, making this a shallow rate cut cycle.

Bonds and stocks often compete for investment dollars. As bond yields rise, the appeal of investing in equities decreases, as investors can achieve better returns with lower risk by choosing bonds. This shift might be causing FIIs to move their money out of Indian markets and reallocate it to the US. A stronger dollar is also a factor. After a period of decline, the US dollar has been rising alongside US bond yields.

Disappointing Corporate Earnings: Some key sectors in India, like consumer finance and energy, have reported weaker-than-expected earnings this time. This may have dampened investor confidence, adding to the reasons why FIIs are withdrawing their funds. Many brokerages have been lowering their earnings growth estimates for the Nifty, expecting growth between 4-7%, which is a multi-year low.

This wave of selling has had a noticeable impact on the Indian stock market. The BSE 500 index, which tracks the performance of 500 top companies in India, has dropped by about 7% from its peak.

Sectors like consumer finance, FMCG (Fast-Moving Consumer Goods), and energy have been hit the hardest since these are areas where FIIs had significant investments. But despite the heavy selling by foreign investors, the Indian market hasn’t collapsed.

If you’re wondering why, it’s because Domestic Institutional Investors (DIIs)—which include mutual funds, insurance companies, and pension funds—have stepped in to buy shares. In October 2024, DIIs purchased stocks worth ₹83,271 crore, more than covering the amount sold by FIIs. This strong domestic buying has helped stabilize the market and prevent a major downturn.

Retail investors, who invest through SIPs (Systematic Investment Plans), have also played a key role. SIPs have been steadily growing, averaging around ₹22,321 crore per month. This shows that domestic investors still believe in the long-term potential of the Indian market, even as FIIs pull out.

Despite the current sell-off, many analysts remain optimistic about India’s long-term growth story. The fact that domestic investors are buying during this period of foreign selling reflects strong confidence in India’s future. Government initiatives like the Production Linked Incentive (PLI) scheme are expected to further boost the economy, potentially making India an attractive destination for investments over time.

Looking back at history, the Indian stock market has bounced back from large FII sell-offs before. For example, after the Global Financial Crisis in 2008, the market fell sharply but recovered by over 127% within just 12 months. Similarly, after the COVID-19 crash in 2020, the market rallied significantly.

So, while the Indian market may remain volatile in the short term, the outlook for the long term is more hopeful, with expectations for a recovery down the line.

We discussed what’s driving foreign investment flows out of India with Sahil Kapoor, Head of Products and Market Strategist at DSP Mutual Fund, in this episode of The Big Perspective. Watch it here:

Is rural India powering India's economic growth?

In the next story, let’s talk about how rural India is contributing to the growth of the Indian economy.

The Indian economy relies heavily on consumption—essentially, how much people spend on various things in both rural and urban areas. In fact, about 60% of the Indian economy, or GDP, comes from people spending on goods and services. So, understanding where and how this spending is happening is key to getting a sense of where the economy might be heading.

When we look at the spending trends, the picture is mixed. In rural India, things are starting to look up—people are spending more, especially with a strong agricultural season. But in urban areas, the recovery hasn’t been as strong as we’d hoped. It’s a story of two Indias, with the countryside showing promise while the cities remain cautious.

Let’s break this down step-by-step, starting with the good news from rural India.

Rural India is showing signs of recovery, and the data supports this positive trend.

Good Monsoons and Kharif Sowing

Agriculture plays a huge role in rural prosperity, and it all starts with the rains. This year, rainfall has been especially beneficial for farming. A key measure here is the production-weighted rainfall Index (PRN), which tells us how effective the rains have been for agriculture. The PRN stood at 107% of the long-term average, meaning the rainfall has been better than usual. This is great news because good rainfall helps crops grow well.

For example, this year’s Kharif season—one of the main cropping seasons in India—saw 1108.6 lakh hectares of land sown, a 1.9% increase compared to last year. While this might sound like a small number, in a country where millions rely on farming, it’s a meaningful rise. Additionally, water reservoir levels are at 87% of capacity, well above the 10-year average. This means farmers will have enough water for the upcoming Rabi season, ensuring that crops can continue to thrive.

Falling MGNREGA Demand

Another positive sign comes from the falling demand for jobs under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). At first glance, a drop in job demand might seem concerning, but here it’s a good thing. Fewer people are seeking government-backed work because they are finding other employment, especially in agriculture, where there’s been a lot of work this season. The demand for MGNREGA jobs fell by 16.6% in the last quarter, showing that rural people are finding other sources of income.

Rising Two-Wheeler and Fertilizer Sales

One way to gauge rural prosperity is by looking at what people are buying. Two-wheeler sales, mostly motorcycles, are up by 10.7%. In rural areas, these vehicles are essential for getting around. So, when bike sales go up, it shows that people are more willing to spend on transportation, which indicates better financial conditions.

Fertilizer sales have also increased, which is important because it means that farmers are investing in their crops. Fertilizers are crucial for farming, and more sales usually signal that farmers are preparing for a good season ahead.

FMCG Sales Show Rural Strength

Another key indicator of rural spending is the sale of fast-moving consumer goods (FMCG)—everyday items like soap, food, and household products. Companies that sell these products are seeing stronger sales in rural areas compared to cities. For example, Suresh Narayanan, CMD of Nestlé India, highlighted that demand in rural India has remained stable, even as demand in big cities has slowed down. This is another clear sign that rural consumption is holding steady.

Now, let’s talk about the urban side of things. Unlike rural India, where the recovery looks promising, urban India is moving at a slower pace.

Air Travel is Recovering, But Not Fully

Air travel is a good indicator of urban spending. More people flying means more are willing to spend on things like vacations and business trips. While domestic air passenger traffic grew by 7.6% in July and 6.7% in August, it’s still not back to pre-pandemic levels. This means that while people are flying more than before, they haven’t returned to their pre-pandemic travel habits, which suggests some caution in spending.

E-Way Bills Are Rising, But the Impact is Mixed

E-way bills are generated whenever goods are moved across the country. In September, the number of these bills increased by 18.5%, showing that trade is happening. Goods are moving across the country, but it’s unclear if this has led to a significant rise in spending. Trade is up, but actual consumption still seems to be lagging.

Cement and Steel Consumption: A Mixed Story

Cement and steel are important indicators of construction and infrastructure activity, which drive urban growth. Steel consumption grew by 10% in August 2024, suggesting that infrastructure projects are moving forward. But cement consumption tells a different story—it dropped by 3% in August compared to last year. While the numbers for the entire year are slightly up (0.7%), it’s clear that momentum is lacking. This suggests that private construction, especially in cities, is still facing some challenges.

Consumer Durables: Cautious Spending on Big Purchases

When it comes to buying big-ticket items like refrigerators, TVs, or washing machines, urban consumers are holding back. Sales of consumer durables have grown by 8.2%, which is decent, but not the kind of growth we’d expect in a strong recovery. People seem to be waiting for more economic stability before making these larger purchases.

Passenger Vehicle Sales Are Dropping

Another sign of cautious spending is the decline in passenger vehicle sales. For two months in a row, car sales have dropped. This suggests that urban households are cutting back on bigger purchases, possibly waiting for more certainty before investing in new cars.

Rural India seems to be recovering faster than urban India. Thanks to good rains, strong sowing numbers, and improving farm incomes, the rural economy is gaining momentum. People in rural areas are spending more on things like bikes, fertilizers, and everyday products.

But in urban India, the recovery is slower. Air travel and trade are picking up, but not as quickly as we’d hoped. Construction is sluggish, and people aren’t rushing to buy big-ticket items like cars or appliances. It seems that urban consumers are still playing it safe, waiting for more stable times.

The takeaway here is that if rural India keeps up its momentum, it could give the entire economy a much-needed boost. But for a full recovery, we also need urban India to start spending more freely. Until both rural and urban consumption pick up, the economy’s recovery will likely remain uneven.

Can TVS lead India's electric two-wheeler race?

TVS Motor Company, one of India’s top players in the two-wheeler market, recently released its financial results for the second quarter of FY 2025. For those unfamiliar, TVS is the third-largest motorcycle maker in India by revenue and the second-largest exporter of two-wheelers in the country. Its results give us a good look at the overall demand for two-wheelers, both in India and globally.

To give you an idea of what's happening with TVS, the company is moving beyond traditional motorcycles and scooters and expanding into electric vehicles (EVs). At the same time, it's growing its presence in rural areas, where two-wheelers are a primary means of transportation. But, like any large company, TVS is also facing challenges, especially in international markets, where economic issues are affecting sales.

Let’s take a closer look at the numbers. TVS reported revenue of ₹9,228 crore for the latest quarter, reflecting a 13.3% growth compared to the same quarter last year and a 10.2% increase compared to the first quarter of FY 2025. Its EBITDA margin, which measures profitability, improved to 11.7%, up from 11% last year and 11.5% last quarter. Profit after taxes also saw a 23% rise year-on-year, with a 14.9% increase over the previous quarter.

A big part of this growth comes from TVS’s EV business. Right now, electric vehicles make up about 6% of the company’s total two-wheeler sales, and this segment is expected to grow even more.

Interestingly, even though all of TVS’s electric vehicles qualify for government incentives under the Production-Linked Incentive (PLI) scheme, the company hasn't yet factored these benefits into its financial reports. This could mean more gains in the future, as TVS continues to perform better than the industry, thanks to its strong product lineup and customer support.

In India’s electric two-wheeler market, TVS holds about 20% of the market share, ranking just behind Ola Electric. To strengthen its position, TVS plans to launch new electric models in the second half of this financial year and enter the electric three-wheeler market for both domestic and export markets.

Recently, TVS has also started exporting EVs to the ASEAN region, marking its first steps toward becoming a global player in the EV market. CEO K. Radhakrishnan is optimistic about India becoming a major export hub for EVs, with TVS playing a key role.

Government support is expected to further boost TVS’s EV push, especially with the launch of the PM e-Drive scheme, which offers subsidies and tax benefits for electric vehicle buyers. Although this scheme began after the last quarter, the management is hopeful it will drive future demand.

On the rural front, TVS has benefited from a 9% year-on-year increase in rural demand for two-wheelers, outpacing the 7% growth in urban areas. A good monsoon season has boosted agricultural output and incomes, leading to higher disposable income. The company’s strong dealership network in rural regions helps it reach these customers effectively.

While TVS is expanding its export business, it faces challenges in Africa, its largest export market, where currency depreciation and inflation have hurt sales. However, growth in Latin America and Asia has helped offset the slower sales in Africa, and the company expects improvements in African markets in the coming months.

Another important part of TVS’s business is its financial services arm, TVS Credit Services. This division helps provide financing solutions, especially in semi-urban and rural areas, making two-wheeler purchases more accessible. TVS Credit’s total book size grew by 13% year-on-year to ₹26,600 crore, while profit before tax rose by 20% to ₹220 crore.

Looking ahead, TVS has set aside ₹1,200-1,400 crore for capital expenditure and investments in FY25, with a strong focus on research and development in the EV space. CEO Radhakrishnan emphasized the importance of investing in new battery technologies and expanding the EV lineup to compete with newer players like Ola Electric and Ather Energy.

So, the big question is: Can TVS overtake Ola Electric and become the leader in the EV space? It’s tough to predict, but with its diverse product lineup, growing rural demand, international expansion, and solid financial backing, TVS is positioning itself as a strong contender in both the electric and traditional two-wheeler markets.

Tidbits:

Nvidia and Reliance have partnered to build AI infrastructure in India, as announced by Nvidia CEO Jensen Huang at the Nvidia AI Summit 2024. This collaboration aligns with India’s push for localized AI development, avoiding the need to export data for intelligence. The partnership also highlights India's strong digital connectivity infrastructure, setting the stage for significant AI advancements.

Dalmia Cement is investing ₹3,000 crore in Madhya Pradesh to build India’s first fully renewable energy-powered 4 million tonne cement plant, marking a significant move towards greener industrial practices.

Twitter India’s FY24 net profit plunged 90% due to a collapse in advertising revenue following Elon Musk’s takeover and the dismissal of the global ad sales team.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

I feel that the time has come for domestic investors to come and show their strength.

Dear Team, I have a feedback to share.

Often, the charts are trimmed, removing key information (units, explanations, etc.). For example, the chart under "Shift to China" point does not have any indication what the chart is about, even as the source chart clearly includes that information.

This happens in 3-4 charts every week.

It would be good if this can be considered going forward.

Thank you.