Tata’s take on the future of jewellery

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

You can also listen to The Daily Brief in Hindi.

Today on The Daily Brief:

Zudio-fication of jewellery

All that glitters... is gold!

India’s forex win

Zudio-fication of jewellery

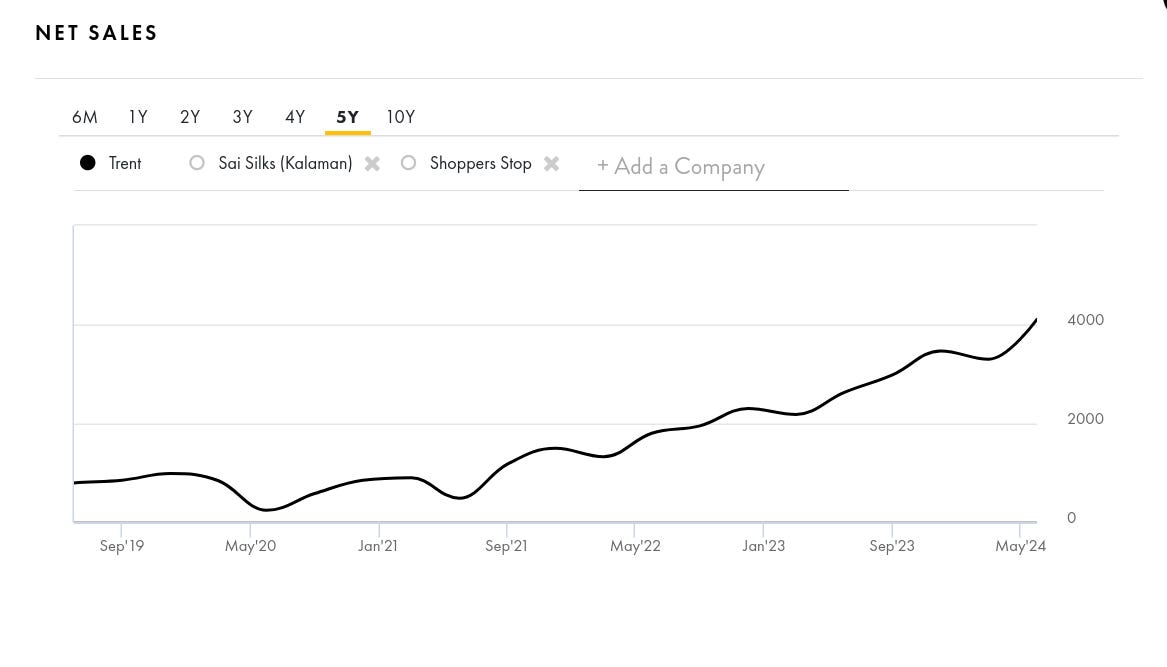

Trent, part of the Tata Group and known for its popular retail brands like Westside and Zudio, has made an interesting move into the jewellery market by launching its own lab-grown diamond brand called Pome. At first, Pome will be available in select Westside stores, offering a range of jewellery, including earrings, rings, necklaces, and bracelets.

If you’ve been keeping an eye on Trent or have shopped at Zudio or Westside, you’ve probably noticed how fast they’ve been expanding, especially with Zudio. So, this step into lab-grown diamonds seems like another smart move, considering how much buzz lab-grown diamonds are generating right now.

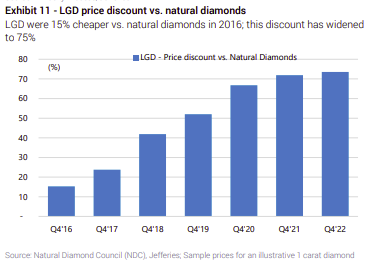

By the way, if you’re new to the idea of lab-grown diamonds, they’re diamonds created in a lab that look and feel almost exactly like natural diamonds but come at a fraction of the cost. For example, while a 1-carat natural diamond might cost upwards of ₹2.5 lakh, a lab-grown diamond of the same size would be around ₹25,000–₹30,000!

Now, back to Trent’s entry into this space—here’s why it’s so intriguing.

First off, it positions Trent to tap into a growing group of consumers who want diamonds but don’t want to pay the steep prices for natural ones. But what’s even more interesting is how this move might affect Tanishq, India’s largest jewellery brand, which is also part of the Tata Group!

Tanishq has been cautious about entering the lab-grown diamond market. Their CEO, Ajoy Chawla, recently mentioned that while some customers are curious about lab-grown diamonds, the majority still prefer natural ones. So, it’s fascinating that while one Tata company is unsure about lab-grown diamonds, another is betting on it!

And Tanishq isn’t the only brand taking a cautious approach—other big players like Kalyan Jewellers and Malabar Gold have also been slow to embrace lab-grown diamonds. However, some companies, like Senco, are starting small, running pilot programs, and seeing lab-grown diamonds as a small but growing part of their business.

What makes Trent’s approach different is its aggressive pricing and growth mindset. By offering lab-grown diamonds at prices 70-85% lower than natural diamonds of similar quality, they’re looking to shake things up, much like how Zudio disrupted the fashion retail market.

Given India’s love for diamonds, it’ll be fascinating to see which Tata company’s strategy wins out. Will Pome succeed with lab-grown diamonds, or will Tanishq’s bet that the market isn’t big enough prove to be right? Only time will tell, but it’s definitely going to be interesting to watch!

All that glitters... is gold!

In our next story, we’re going to talk about gold and why it’s become one of the hottest assets this year.

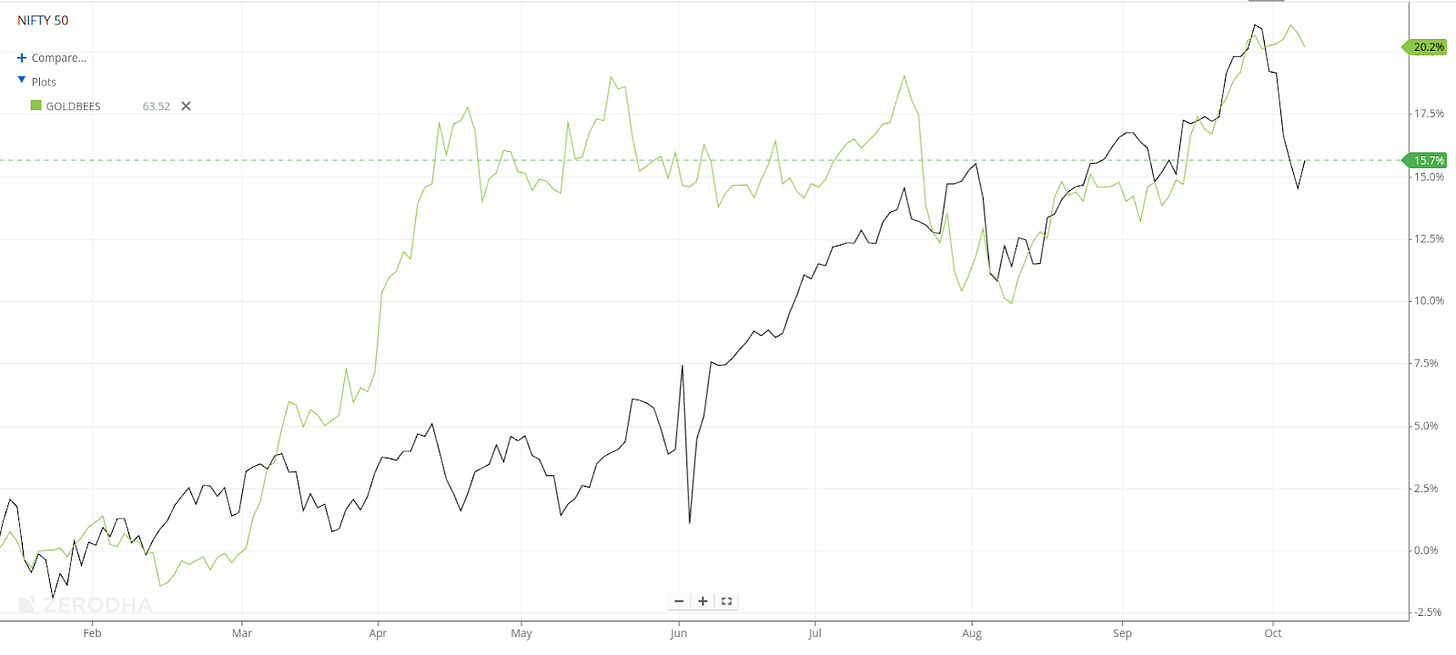

For some quick context, gold is up 18% this year, outpacing the Nifty, which has risen by 15%. Just yesterday, gold hit an all-time high in India, reaching ₹7,870 per gram!

So, what’s behind this sudden surge? Let’s break it down in simple terms.

First, let’s talk about interest rates in the U.S. The Federal Reserve has been signaling more rate cuts after lowering them by 50 basis points in September. Now, why does that matter for gold? Well, gold doesn’t pay interest like bonds or savings accounts do.

When interest rates are high, holding gold feels like you’re missing out on earning interest elsewhere. But when rates drop, that gap closes, making gold more appealing. Here’s a quick example: If bond yields drop from 5% to 2%, gold starts looking like a better deal because you weren’t relying on interest returns in the first place!

That’s exactly what’s happening right now—lower rates are making gold more attractive to investors.

But interest rates aren’t the only reason for the rise in gold prices. Central banks around the world have been buying a lot of gold recently. They’re trying to reduce their reliance on the U.S. dollar, and gold is a key part of that strategy.

To put things into perspective, central banks now account for about a quarter of global gold demand, with countries like China and India leading the charge. This steady demand from central banks has created a strong foundation under gold prices, boosting investor confidence.

The third factor driving gold’s rise is consumer demand, especially in India and China. In India, the government recently cut import duties on gold, leading to a surge in buying, particularly in the jewellery market. In China, more people are investing in gold, either through local ETFs or by buying it outright. And we can’t forget the cultural importance of gold in both these countries—it’s seen as a safe way to store wealth, so when people are unsure about the future, they turn to gold to protect their savings.

The fourth reason is the geopolitical tension around the world. With the war in Ukraine, unrest in the Middle East, and other global uncertainties, the world feels pretty unpredictable right now. When things get shaky, gold tends to shine as a safe-haven asset—somewhere people park their money when other investments start to look risky.

Now that we’ve covered why gold is surging, let’s talk about how investors are reacting.

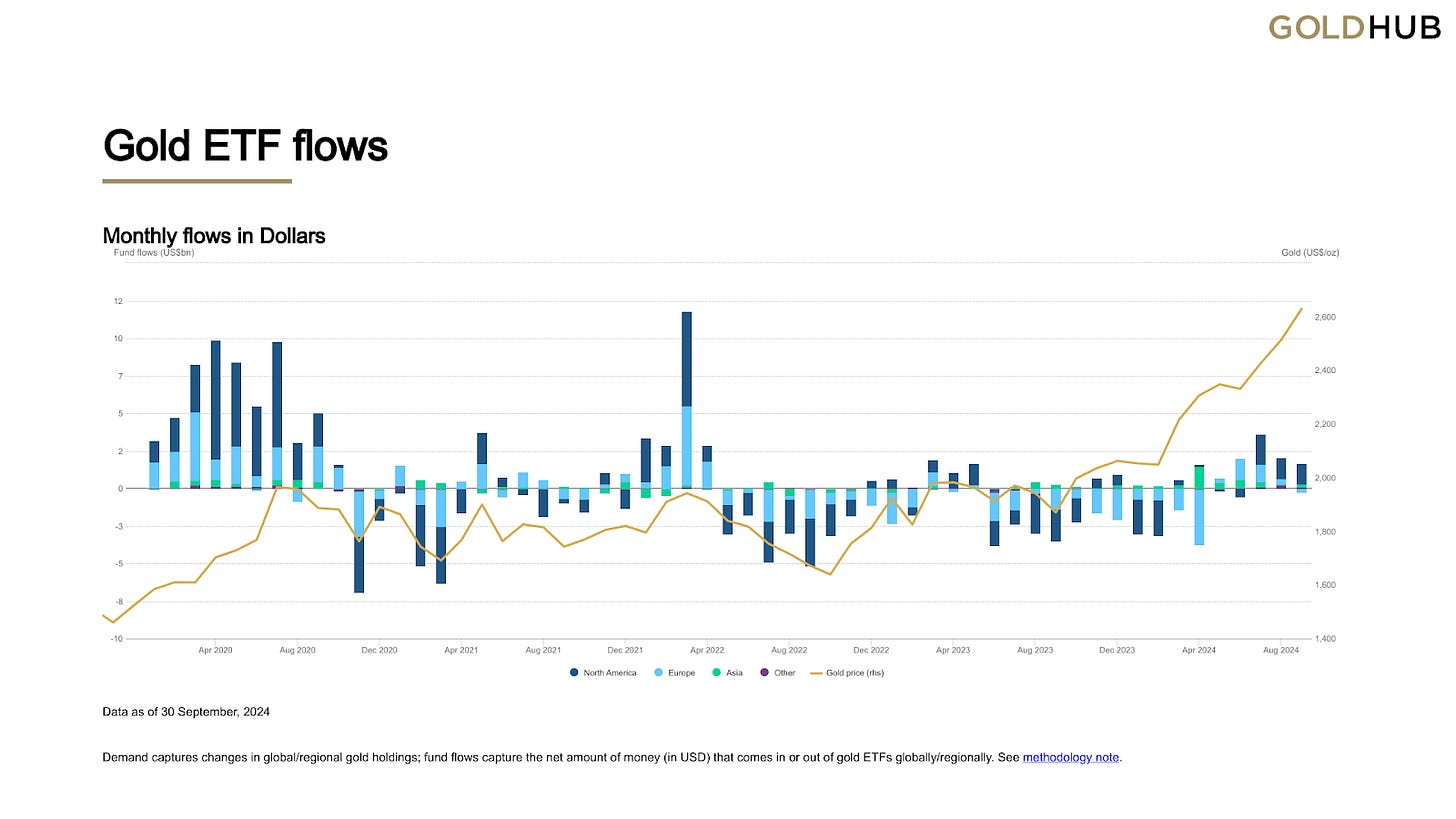

Gold ETFs have seen steady inflows over the last four months, after experiencing outflows earlier in the year. Investors, especially in the West, are starting to bring gold back into their portfolios as the economic outlook becomes more uncertain. With more rate cuts on the horizon, gold is becoming an increasingly attractive option.

So, where could gold go from here?

Right now, gold is trading around $2,650 an ounce. Goldman Sachs predicts it could reach $2,700 by early next year, assuming the Fed continues cutting rates and geopolitical risks remain high. UBS has a similar view—they’re expecting $2,700 by mid-2025, especially if central banks keep buying and the Fed keeps easing.

Looking ahead, there are a few key things we’ll need to keep an eye on:

What the Fed does with interest rates

How much gold central banks continue to buy

Changes in the geopolitical landscape.

If the Fed cuts rates more aggressively or if economic conditions worsen, gold could keep climbing. But if the Fed holds off on rate cuts or global tensions ease, we might see gold’s momentum slow down.

India’s forex win

India has recently crossed a major milestone—our foreign exchange reserves have surpassed $700 billion! This puts India among only four countries worldwide to hit this mark. To put it into perspective, in the 1990s, our reserves covered just 4.8 weeks of imports. Now, they’re enough to cover nine months of imports!

This is a big deal, but it raises a few questions:

How did we get here? Where is all this forex coming from? And why are we holding on to so much of it? Let’s break it down.

First, let’s clarify what foreign exchange reserves (or forex reserves) are. These are assets held by a country's central bank, like the Reserve Bank of India (RBI), in foreign currencies such as the US dollar, Euro, Pound, and Yen. As of September 27, 2024, 87% of India’s reserves are in foreign currency assets like bonds and treasury bills, 9% are in gold, and the rest are in Special Drawing Rights (SDRs) and positions with the IMF.

So, how do these reserves go up or down? It all depends on the flow of foreign money into and out of India. If more foreign currency comes in than goes out, our reserves rise. If more leaves, our reserves fall.

What drives this inflow or outflow? Trade is a big factor—imports reduce our reserves, while exports increase them. Then there’s income from abroad, like dividends, interest, and remittances sent home by Indians living overseas. These are part of what’s called the "current account balance." For India, the current account has often been negative because we import more than we export. Even though we receive a lot of remittances, our imports usually outweigh that income. So, the rise in forex reserves isn’t really coming from the current account.

The real boost comes from the "capital account balance," which includes investments and loans, particularly Foreign Direct Investments (FDI) and Foreign Portfolio Investments (FPI). These have played a major role in building up our forex reserves. For example, in Q2FY24, India had a positive capital account balance of $15 billion, while the current account was negative by $9.8 billion.

Another factor influencing reserves is something called "Valuation Change." This isn’t actual money flowing in or out but changes in the value of the reserves we hold, driven by exchange rates or asset prices. For example, if the US dollar strengthens, the value of our dollar-denominated assets goes up, which is reflected in our reserves. The same applies to gold when its price rises.

So, why do we need so much in forex reserves?

Think of it as a financial safety net. Reserves help protect India from economic instability, especially during global financial uncertainty. When capital flows out suddenly, it can cause the rupee to depreciate sharply, making imports more expensive and pushing up inflation. This is where forex reserves come in handy. The RBI can use them to stabilise the rupee, manage exchange rate volatility, and ensure there’s enough liquidity to deal with external shocks.

For a developing country like India, which is closely tied to the global economy, these reserves are crucial. They reduce financial vulnerability and give confidence to international investors that India can handle global turbulence.

A great example is the Global Financial Crisis of 2008-09. When foreign investors pulled $24.4 billion out of India, the rupee was at risk of a sharp drop, which could have caused serious economic trouble. But thanks to India’s forex reserves, which stood at around $312 billion at the time, the RBI was able to step in, stabilise the currency, and prevent a bigger crisis.

In short, India’s large forex reserves act as a buffer, helping to keep our economy steady during uncertain times. They’re a sign of financial resilience, giving both domestic and international investors confidence that India can handle whatever comes its way.

Tidbits

The UAE is set to significantly increase its investment in India, raising its commitment to $100 billion, up from the $75 billion pledged in 2018. This was announced by Piyush Goyal, and the additional investment is expected to boost key sectors like infrastructure and technology.

In another major development, Hitachi Energy plans to invest ₹2,000 crore in India over the next five years. This investment will focus on greener power transmission and smart mobility solutions, helping to support India’s sustainability goals and the development of electric vehicle (EV) infrastructure.

On the other hand, Hero Motors has decided to withdraw its ₹900 crore IPO, which was initially planned to reduce debt and expand its facilities. Despite receiving SEBI approval, the company hasn’t shared the reasons behind this decision.

Meanwhile, SEBI has given the green light for the IPO of NSDL (National Securities Depository Limited), which will allow major banks to reduce their stakes in India’s largest depository. This move is expected to increase liquidity for financial institutions.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments